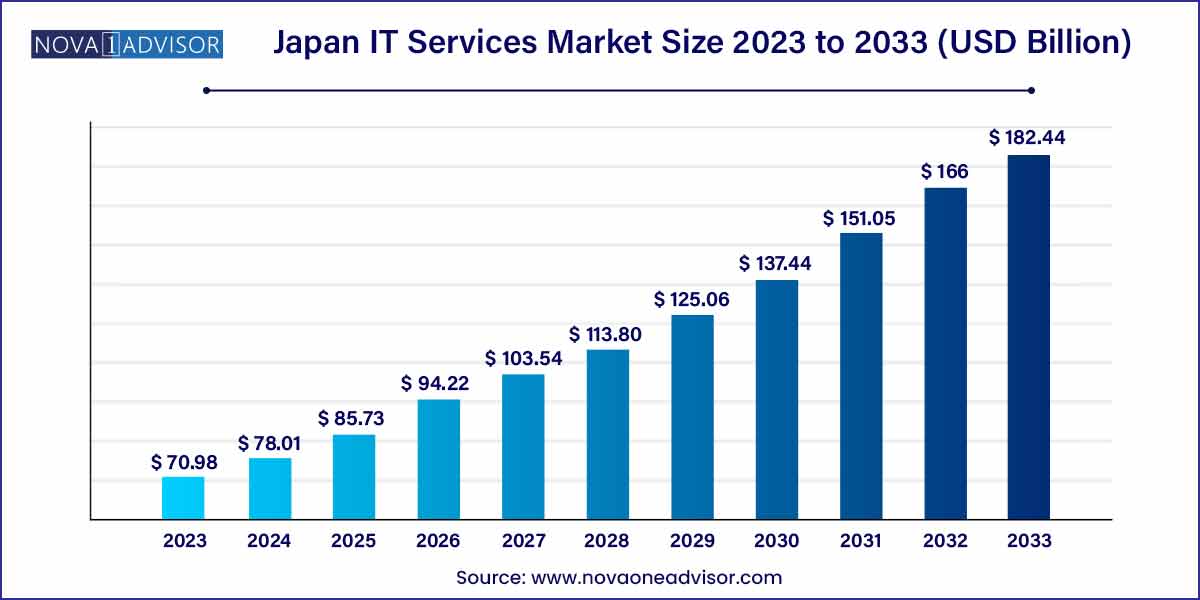

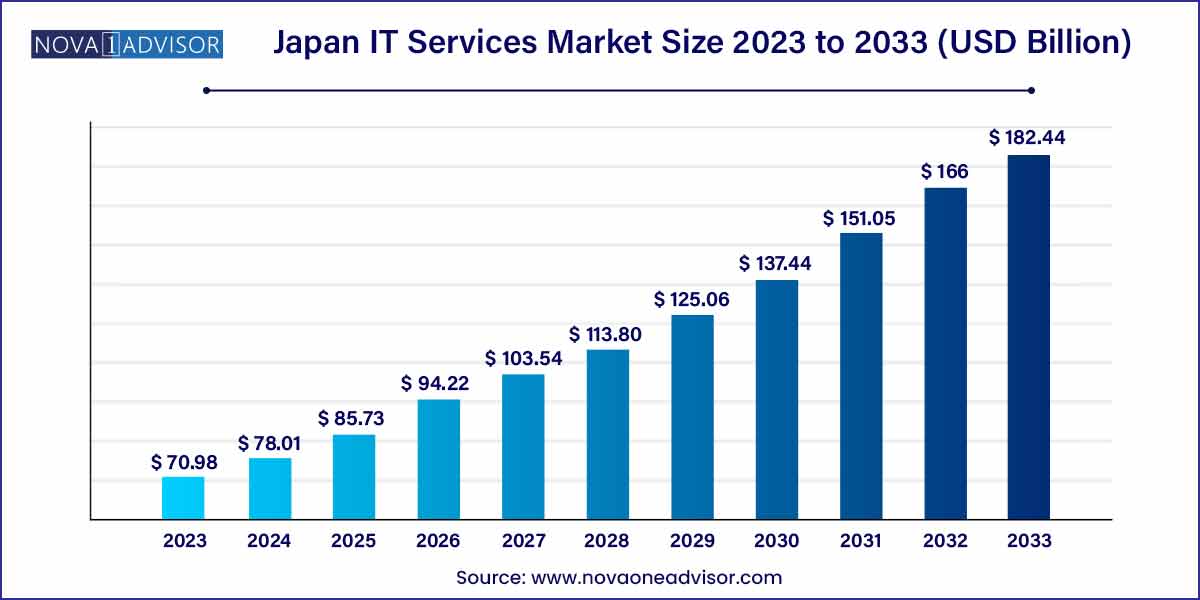

The japan IT services market size was estimated at USD 70.98 billion in 2023 and is projected to hit around USD 182.44 billion by 2033, growing at a CAGR of 9.9% during the forecast period from 2024 to 2033.

Key Takeaways:

- The application management segment accounted for the largest market revenue share in 2023

- The data management segment will witness highest growth in the coming years.

- Reactive IT services segment led the market and accounted for 56.3% of the global revenue share in 2023.

- The proactive IT services segment is predicted to foresee significant growth in the forecast years.

- Operations & maintenance segment accounted for the largest market revenue share in 2023.

- The design & implementation segment is poised for significant growth.

- AI & machine learning segment accounted for the largest market revenue share in 2023.

- The big data analytics segment is predicted to foresee significant growth through 2033.

- On-premises deployment accounted for a greater market revenue share in 2023

- Large enterprises accounted for the largest market revenue share in 2023.

- The small & medium enterprise segment is poised for significant growth.

- The IT & telecom segment accounted for the largest market revenue share in 2023.

- The retail segment will witness significant growth in the coming years.

Market Overview

The Japan IT services market is a critical pillar in the country's digital transformation journey, encompassing a wide spectrum of service offerings that support enterprise, public, and infrastructure-level digitalization. From systems design and implementation to operations, cybersecurity, data governance, and cloud migration, IT services in Japan have become integral to the functioning of both traditional industries and emerging digital-first enterprises.

Japan, known for its advanced manufacturing sector and innovation-led economy, has traditionally been cautious in adopting disruptive technologies. However, in recent years, the push for digital transformation (DX) has gained momentum, supported by both corporate and government initiatives. Programs like the “Digital Agency” launched in 2021 aim to standardize digital services across the public sector and enhance the country’s overall digital resilience. This has directly impacted the IT services market, leading to increased investments in cloud computing, cybersecurity frameworks, artificial intelligence (AI), and managed services.

Japan’s IT services landscape is unique due to the dominance of large system integrators (SIs) and established vendors like NTT Data, Fujitsu, and NEC, which offer full-stack IT services, including infrastructure outsourcing, application modernization, and IT governance. These companies are deeply embedded in Japan's keiretsu model, where long-term client-vendor relationships dominate. However, this traditional model is gradually evolving as cloud-native startups and global IT service providers challenge legacy providers by offering agile, scalable, and cost-effective solutions.

With rising demand for services such as cybersecurity compliance, big data management, and AI/ML implementations, the Japanese IT services sector is positioned for sustained growth. The convergence of operational technology (OT) and IT, driven by Industry 4.0 adoption in Japan’s manufacturing core, further fuels the demand for integrated IT services.

Major Trends in the Market

-

Rapid Shift Toward Cloud-First Strategy: Businesses are migrating from legacy infrastructure to cloud-based environments, including hybrid and multi-cloud architectures.

-

Rise in Managed Security Services Demand: Cyber threats targeting Japanese firms have led to heightened demand for real-time threat monitoring, incident response, and compliance services.

-

AI & Automation-Driven IT Operations (AIOps): Companies are integrating machine learning into IT service management for predictive maintenance and automated decision-making.

-

Growth in DX Consulting Services: Enterprises, especially in BFSI and manufacturing, are hiring IT service consultants to guide large-scale digital transformation initiatives.

-

Legacy Modernization as a Strategic Priority: Organizations are focusing on updating COBOL-based systems and traditional ERPs, especially in public sector and banking.

-

Increased Adoption of IT Services in SMEs: Government subsidies and cloud adoption are enabling more small and medium enterprises to outsource IT services for growth and scalability.

-

Data Sovereignty and Local Hosting Regulations: Japanese clients prefer localized data centers and Japanese-speaking service personnel, giving local providers a competitive edge.

Japan IT Services Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 78.01 Billion |

| Market Size by 2033 |

USD 182.44 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.9% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Approach, type, application, technology, deployment, enterprise size, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Accenture PLC; DTS CORPORATION; Fujitsu Limited; Hitachi Systems, Ltd.; NEC Corporation; NTT DATA Corporation; OTSUKA CORPORATION; SCSK Corporation; TIS Inc.; TOSHIBA IT-SERVICES CORPORATION |

The leading driver of the Japan IT services market is the enterprise-wide push for digital transformation (DX) across nearly all sectors, catalyzed by the government and supported by public-private collaboration. In particular, Japan’s “Society 5.0” vision a national strategy combining digital innovation with societal goals has created momentum for companies to adopt next-gen IT infrastructure.

Large enterprises, especially in sectors like banking, manufacturing, and logistics, are undergoing end-to-end digital reengineering. This includes legacy system decommissioning, adoption of cloud ERP systems, rollout of AI-driven analytics, and the deployment of secure hybrid IT environments. Companies like Toyota and Mitsubishi are leveraging IT services for IoT and AI in factory automation and predictive analytics, while financial institutions are digitizing workflows and front-end interfaces.

This digital push is generating demand for comprehensive IT services from consulting and implementation to security, analytics, and long-term managed services.

Market Restraint: Talent Shortage in Advanced IT Skills

A pressing restraint for the Japan IT services market is the persistent shortage of skilled IT professionals, particularly in emerging technologies like AI, cybersecurity, and cloud architecture. Despite Japan’s technological prowess, the industry suffers from a demographic challenge: an aging workforce and a limited influx of younger digital talent.

Local firms often struggle to fill key IT positions, leading to a bottleneck in service delivery, especially for projects involving real-time data analytics, agile transformation, and DevOps. While system integrators like NTT Data and Fujitsu have internal training programs, the demand for skills often outpaces the supply. Moreover, the language barrier and strict labor regulations deter the import of foreign tech talent.

This shortage impacts project timelines, limits scalability, and increases dependency on a small pool of highly skilled professionals, particularly for advanced implementations.

Market Opportunity: Expansion of IT Services in the SME Segment

A significant opportunity lies in the expansion of IT services among Japan's vast base of small and medium enterprises (SMEs). SMEs account for over 99% of businesses in Japan but have historically underinvested in IT services due to cost concerns, limited awareness, and an overreliance on manual processes.

However, recent government initiatives and market dynamics have begun to shift this landscape. Subsidies, grants for IT adoption (e.g., the IT Introduction Subsidy), and user-friendly cloud platforms have encouraged SMEs to adopt digital tools. IT service providers now offer scaled-down, modular services tailored for SMEs ranging from managed security services to cloud-based CRM, payroll, and POS systems.

As SMEs aim to stay competitive, especially in e-commerce and customer experience, their reliance on professional IT services is expected to increase exponentially—offering service providers a long-term, high-growth segment.

Segments Insights

By Approach

Proactive IT services dominate the market, especially among large enterprises and institutions that require predictive maintenance, constant monitoring, and optimization. This approach allows organizations to identify and fix issues before they impact operations, reducing downtime and improving user satisfaction. Proactive services are increasingly powered by AI/ML tools that detect anomalies in system behavior, manage configurations automatically, and help in capacity planning.

However, reactive IT services are growing steadily, especially among SMEs and legacy industries. Many traditional businesses still operate in a break-fix model, relying on IT support only when problems arise. With increased awareness and budget flexibility, these users are transitioning to hybrid models that start with reactive support but evolve into semi-managed services, creating new entry points for IT service vendors.

By Type

Operations & Maintenance services dominate the Japan IT services market, accounting for a significant portion of recurring revenues. Given the legacy-heavy IT environment in sectors such as banking, transportation, and government, there is constant demand for monitoring, patching, upgrades, and hardware support. Managed service providers (MSPs) and IT infrastructure specialists are commonly contracted for these needs, ensuring uninterrupted business continuity.

At the same time, Design & Implementation services are the fastest growing, driven by increased demand for cloud migration, data center design, and application modernization. Clients undertaking large-scale DX projects require robust system architecture design, followed by implementation of cloud-native applications, cybersecurity frameworks, and advanced analytics platforms. This has led to multi-year contracts, often starting with consultation and followed by full-scale rollout.

By Application

Systems & Network Management is the most dominant application, owing to the criticality of keeping IT infrastructure stable and secure. With remote work, mobile devices, and hybrid environments becoming common, the need to manage endpoints, networks, and VPNs has grown sharply. Enterprises rely on IT service providers to handle complex integrations, support real-time monitoring, and ensure compliance with IT governance standards.

Security & Compliance Management is the fastest-growing segment, especially after several high-profile cybersecurity breaches involving Japanese firms. Compliance with local and global standards such as the Act on the Protection of Personal Information (APPI) and GDPR for overseas operations has compelled organizations to seek professional help. Managed Detection and Response (MDR), endpoint protection, and zero-trust network architecture are high-demand areas under this umbrella.

By Technology

Big Data Analytics dominates the technology segment, driven by Japan’s data-rich industries like manufacturing, retail, and financial services. Organizations are leveraging analytics for demand forecasting, inventory optimization, fraud detection, and customer personalization. The proliferation of IoT sensors in factories has also increased demand for predictive analytics, requiring specialized IT service providers to process and visualize data effectively.

AI & Machine Learning are the fastest-growing technologies, with applications ranging from conversational AI in banking to visual inspection systems in manufacturing. Japanese companies are investing in AI to automate decision-making, streamline operations, and innovate customer service models. IT service providers are playing a critical role in deploying, training, and integrating ML models into enterprise systems.

By Deployment

On-premises deployment still dominates, especially among large financial institutions, government bodies, and conservative manufacturers. These clients prioritize control, data security, and compliance, often requiring private data centers and in-house infrastructure. Many Japanese organizations prefer hybrid models where critical data remains on-premise while workloads are shifted to the cloud.

However, cloud deployment is growing at an accelerated pace, aided by hyperscalers like AWS, Microsoft Azure, and Google Cloud expanding their presence in Japan. With rising confidence in cloud security and better SLAs, even regulated industries are warming up to cloud-first strategies. IT service providers are being called upon to manage migrations, hybrid integration, and workload optimization.

By Enterprise Size

Large enterprises dominate IT services demand, with multi-million-dollar contracts spanning multiple years. These firms require full-suite offerings from infrastructure to analytics, with robust SLAs, 24/7 support, and multi-layered security. They also frequently engage in global outsourcing, co-managed IT models, and in-house-outsource hybrids.

Small and Medium Enterprises (SMEs) are the fastest-growing segment, thanks to SaaS adoption, affordable managed services, and public cloud platforms. Vendors are developing SME-focused packages offering CRM, cybersecurity, collaboration tools, and managed support all with monthly billing and easy onboarding. As SMEs digitize their operations to compete in the post-pandemic economy, their IT service investments are projected to scale significantly.

By End-Use

BFSI (Banking, Financial Services, and Insurance) is the largest end-use segment, driven by its complexity, regulatory oversight, and dependency on secure, always-on digital services. Japanese banks are undergoing legacy core system modernization, deploying AI chatbots, and investing in fintech integrations—all of which rely on extensive IT service involvement.

Healthcare and Retail are among the fastest-growing end-use sectors. Healthcare providers are digitizing patient records, implementing telemedicine platforms, and ensuring HIPAA compliance, which require strong IT service backing. Similarly, retail businesses are leveraging e-commerce, inventory automation, and customer analytics to thrive in a hybrid shopping environment, driving demand for versatile IT support.

Country-Level Analysis

Japan’s IT services market is shaped by its unique corporate culture, regulatory framework, and innovation ethos. The country’s preference for long-term partnerships with trusted vendors has historically favored domestic giants like NTT Data and NEC. However, as digital transformation becomes a competitive imperative, global IT firms and agile startups are also gaining traction.

Regulatory compliance, data privacy, and information security remain top priorities for Japanese clients. The culture emphasizes quality, meticulous planning, and operational excellence—leading to detailed scoping and longer sales cycles. Urban centers like Tokyo, Osaka, and Nagoya serve as IT service hubs, while regional governments are investing in digital public services.

Japan’s demographic challenges also play a role. With an aging population and shrinking workforce, automation and IT support systems are critical for productivity maintenance. This macroeconomic reality ensures continued demand for services that enhance operational efficiency, reduce manual dependency, and support citizen-centric digital infrastructure.

Recent Developments

-

April 2025 – Fujitsu launched an AI-driven AIOps platform in partnership with Microsoft Japan to automate IT operations for enterprise clients.

-

March 2025 – NTT Data announced a three-year DX consulting program for mid-sized manufacturers in partnership with the Ministry of Economy, Trade and Industry (METI).

-

January 2025 – IBM Japan partnered with a leading Tokyo-based hospital chain to implement a blockchain-based electronic health record system.

-

November 2024 – Hitachi Systems introduced a managed security platform targeting SMEs with integrated endpoint protection and cloud backup.

-

October 2024 – Rakuten Technology unveiled its next-gen retail IT service stack combining AI-based demand forecasting with IoT shelf monitoring.

Key Japan IT Services Companies:

- Accenture plc

- DTS CORPORATION

- Fujitsu Limited

- Hitachi Systems, Ltd.

- NEC Corporation

- NTT DATA Corporation

- OTSUKA CORPORATION

- SCSK Corporation

- TIS Inc.

- TOSHIBA IT-SERVICES CORPORATION

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Japan IT Services market.

By Approach

- Reactive IT Services

- Proactive IT Services

By Type

- Design & Implementation

- Operations & Maintenance

By Application

- Systems & Network Management

- Data Management

- Application Management

- Security & Compliance Management

- Others

By Technology

- AI & Machine Learning

- Big Data Analytics

- Threat Intelligence

- Others

By Deployment

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

By End-use

- BFSI

- Government

- Healthcare

- Manufacturing

- Media & Communications

- Retail

- IT & Telecom

- Others