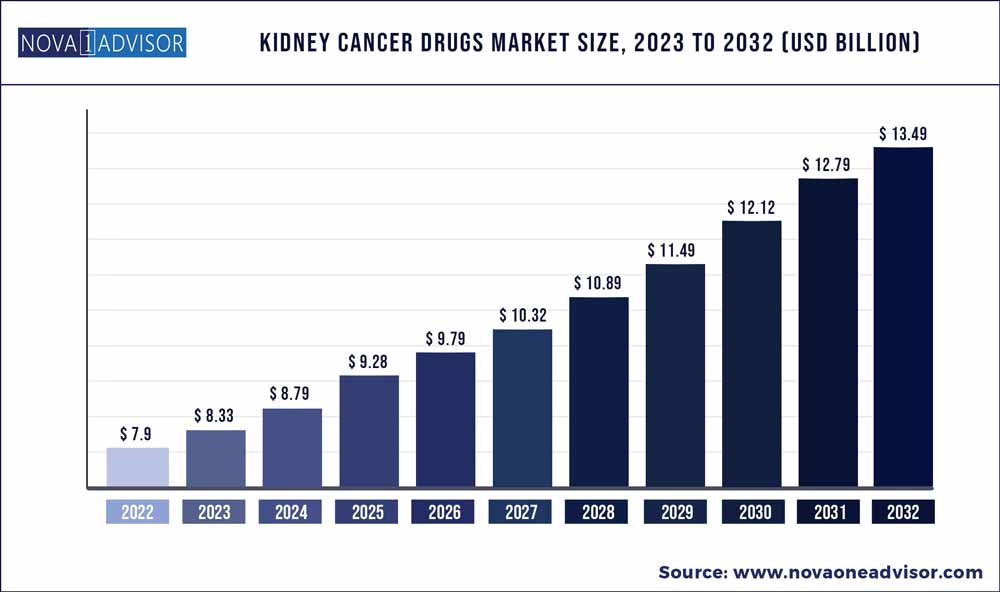

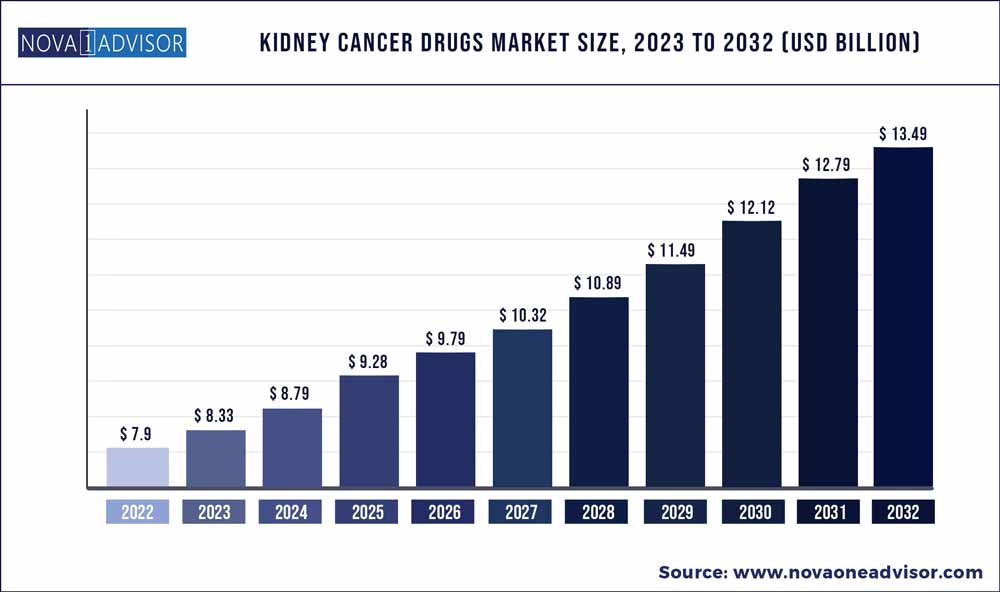

The kidney cancer drugs market size was estimated at USD 7.9 billion in 2022 and is expected to surpass around USD 13.49 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 5.5% during the forecast period 2023 to 2032.

Key Takeaways:

- Novel agents have expanded market opportunities through a larger number of patients under treatment and better treatment prospects compared to traditional therapies. The notable clinical profile of immuno-oncology drugs is reflected in their rapid uptake and expansion of indications

- The current treatment landscape in metastatic and advanced RCC will shift from TKI and mTOR inhibitors to specific immuno-oncology agents like immune checkpoint inhibitors (ICI), which have demonstrated positive results on PFS as monotherapy (Opdivo) or combination therapy (Opdivo+Yervoy)

- The U.S. accounted for more than 62.0% of the market in 2022 due to the increasing incidence of renal cell carcinoma and the presence of key manufacturers in the country. On the other hand, surge in kidney cancer screening is a key driver in markets such as EU

- Emerging markets in Asia Pacific and Middle East and Africa are fueled by increasing expenditure on healthcare, a large untapped patient population base due to rise in the elderly population, and improvement in diagnostic technologies

Kidney Cancer Drugs Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 8.33 Billion |

| Market Size by 2032 |

USD 13.49 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 5.5% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Therapeutic class, pharmacologic class, country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Bayer; Bristol-Myers Squibb; Eisai; Exelixis; Genentech (Roche); Novartis; Pfizer; Prometheus Labs. |

The U.S. dominated the scene among the seven major markets. Market growth is largely driven by factors such as availability of novel drugs, presence of strong pipeline, and rise in the incidence of renal cancer due to the growing geriatric population and more prominent smoking habits.

Kidney cancer accounts for 2.0% of total adult malignancies globally and makes up for 3.8% of all new cancer cases in U.S. Renal cell carcinoma accounts for over 90.0% of all kidney cancers while renal pelvis cancer makes up for <10.0% of microscopically confirmed kidney carcinomas. Clear cell renal cell carcinoma is the most prevalent subtype of renal cell carcinoma, affecting 70.0% of patients with RCC.

The incidence rate of RCC is highest in North America and Western Europe. Metastatic RCC is present in around 30.0% of patients at the time of diagnosis. Globally, approximately 270,000 new cases are diagnosed every year and around 116,000 deaths per year are due to renal cell carcinoma.

Therapeutic Class Insights

Until the 1980s, treatment of kidney cancer included surgical removal of the kidneys, which later progressed to laparoscopic removal of the tumor-affected part. Drugs are usually given to advanced-stage patients with disease progression. Various forms of cancer treatment methods have been implemented among the currently approved drugs, including immune modulation therapy, cytokine therapy, mTOR inhibitor, and Vascular Endothelial Growth Factor (VEGF) inhibitor.

Rising preference for novel immunotherapies and immune-oncologic agents will push the use of targeted therapies to specific patient subpopulations or later lines of treatment. Programmed death-1 (PD-1) inhibitors are poised to displace TKIs and mTOR inhibitors as the standard of care in first-and second-line RCC settings. Combination regimens, specifically those including PD-1 inhibitors will be introduced in the first-line setting to target major unmet needs, including overcoming tumor resistance, improving progression-free survival, and maintaining the quality of life.

Pipeline Insights

As kidney cancer is not responsive to traditional cancer treatments, drug development for this disease focuses on using novel treatments. Novel agents have expanded opportunities in the kidney cancer drugs market through a larger number of patients under treatment and better treatment prospects compared to traditional therapies. Some prominent players covered in the segment are Amgen/Allergan, Argos Therapeutics, AstraZeneca, Aveo Pharmaceuticals, Bayer, Exelixis, Incyte, Merck, and Roche.

PD-1 and PD-L1 inhibitors represent a paradigm shift in kidney cancer treatment. Several PD-1 and PD-L1 agents with novel MoAs are in early development and are being evaluated both as monotherapy and in combination with already approved immuno-oncology agents. The notable clinical profile of immuno-oncology drugs is reflected in their rapid uptake and expansion of indications.

Country Insights

The U.S. led the market with a share of more than 62.0% in 2022. Increased adoption of therapeutics, established healthcare infrastructure, and the presence of key manufacturers in the country are major factors responsible for its large share. Japan is expected to experience a high growth rate owing to various factors such as multiple product launches in the region during the forecast period and the existence of a large geriatric population base susceptible to kidney cancer.

China offers strong opportunities for market expansion due to the ongoing Healthy China 2022 healthcare reform and the removal of price caps on all medicine categories. The Chinese government has initiated a supportive 12th Five-Year Plan measures targeting biotechnology as a crucial development sector. Additionally, the presence of a large target base with strong unmet clinical needs is expected to drive regional market growth.

Recent Developments

- In December 2022, Exelixis, Inc., an oncology-focused biotechnology company, announced the initiation of the STELLAR-304. It is a phase-3 pivotal trial evaluating zanzalintinib with nivolumab versus sunitinib in patients having advanced non-clear cell kidney cancer.

- In February 2022, Eisai Co., Ltd. and Merck & Co., Inc., Rahway, NJ, USA announced that the Japanese Ministry of Health, Labour and Welfare (MHLW) has approved the combination of LENVIMA by Eisai plus KEYTRUDA by Merck & Co., Inc. for radically unresectable or metastatic renal cell carcinoma, the most common type of kidney cancer.

Some of the prominent players in the Kidney Cancer Drugs Market include:

- Bayer

- Bristol-Myers Squibb

- Eisai

- Exelixis

- Genentech (Roche)

- Novartis

- Pfizer

- Prometheus Labs

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the Kidney Cancer Drugs market.

By Therapeutic Class

- Targeted Therapy

- Immunotherapy

By Pharmacologic Class

- Angiogenesis Inhibitors

- mTOR Inhibitors

- Monoclonal Antibodies

- Cytokine Immunotherapy (IL-2)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)