Large And Small-scale Bioprocessing Market Size and Forecast 2026 to 2035

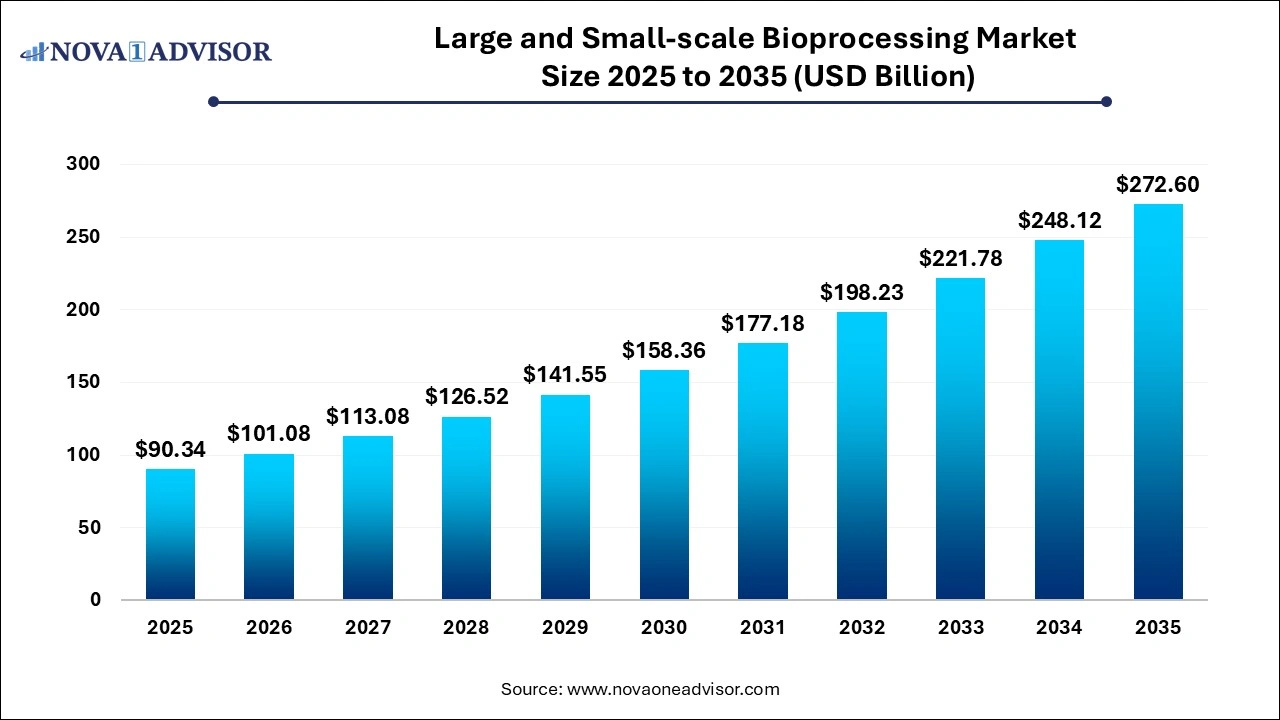

The global large and small-scale bioprocessing market size is calculated at USD 90.34 billion in 2025, grows to USD 101.08 billion in 2026, and is projected to reach around USD 272.6 billion by 2035, growing at a CAGR of 11.68% from 2026 to 2035. The large and small-scale bioprocessing market growth can be linked to the rising demand for biopharmaceuticals, emerging biotech startups, and expansion of advanced therapies.

Large and Small-scale Bioprocessing Market Key Takeaways

- North America dominated the global large and small-scale bioprocessing market accounting for the largest share in 2025.

- Asia Pacific is expected to show the fastest growth in the market over the forecast period.

- By scale, the industrial scale segment dominated the market with the largest revenue share in 2025.

- By scale, the small-scale segment is expected to show the fastest growth during the forecast period.

- By workflow, the downstream processing segment accounted for the highest market share in 2025.

- By workflow, the fermentation segment is expected to register strong growth in the market during the predicted timeframe.

- By product, the bioreactors/ fermenters segment held the biggest market share in 2025.

- By product, the cell culture products segment is expected to register the fastest growth over the forecast period.

- By application, the biopharmaceuticals segment dominated the market generating the highest revenue share in 2024.

- By application, the speciality industrial chemicals segment is expected to register significant growth in the market during the predicted timeframe.

- By use-type, the multi-use segment generated the highest market revenue share in 2025.

- By use-type, the single-use segment is expected to register significant growth during the forecast period.

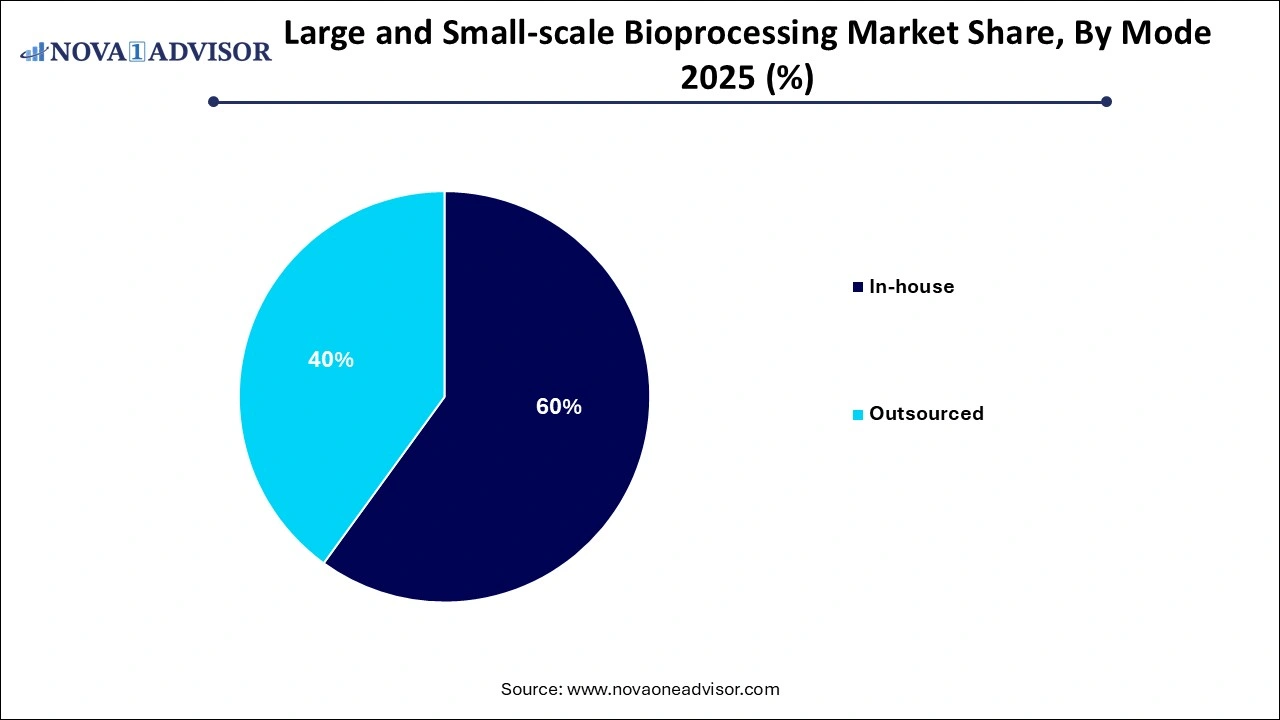

- By mode, the in-house segment captured the highest market share in 2025.

- By mode, the outsourced segment is expected to grow at a significant CAGR over the forecast period.

How is the Large and Small-scale Bioprocessing Market Expanding?

Large and small-scale bioprocessing are different but interconnected approaches for biological manufacturing. Large-scale bioprocessing refers to high-volume production of biopharmaceuticals by utilizing large bioreactors and advanced automated technologies for commercialization, whereas, small-scale bioprocessing focuses in optimization of processes and screening of several conditions in small bioreactors, often used in research and development.

The expansion of the large and small-scale bioprocessing market is driven by the need for scalable and systematic manufacturing processes, increased research and development expenditure, outsourcing trends, and continuous improvements in bioprocessing technologies. The emergence of innovative techniques such as CRISPR gene editing and synthetic biology are expanding the bioprocessing market potential.

What Are the Key Trends in the Large and Small-scale Bioprocessing Market in 2025?

- In July 2025, Mitsui Chemicals launched its innovative InnoCell cell culture microplates, which feature exceptional oxygen permeability and will provide non-treated “N-type” cell culture microplates specifically designed for culturing non-adherent cells, organoids, and spheroids, as well as collagen-coated “C-type” plates optimized for culturing hepatocytes and other cell types frequently used in pharmaceutical assays.

- In June 2025, Univercells Technologies, a Belgium-based Donaldson Life Sciences business and a global supplier of innovative bioprocessing solutions, expanded its product offerings with the launch of scale-X nitro controller, the latest addition to its established scale-X fixed-bed bioreactor portfolio. The compact and cost-effective controller is designed for streamlining the scale-up of viral vector vaccine production from R&D to commercial manufacturing.

How is AI Impacting the Large and Small-scale Bioprocessing Market?

Artificial intelligence (AI) is transforming large and small-scale bioprocessing by enhancing the accuracy and efficiency of workflows. AI algorithms can be applied for maintaining optimal oxygen transfer rates (OTR) by optimizing bioreactor performance through the prediction of oxygen demand and automatic adjustments of aeration and agitation. Analysis of sensor data for predicting critical process parameters (CPPs) through AI algorithms can enable real-time control of bioprocesses, further improving performance. Cloud-based platforms are facilitating centralized data management and control, while edge computing is enabling real-time decision making for large-scale bioprocesses.

Furthermore, in small-scale bioprocessing, AI can be applied for optimizing cell culture conditions in microfluidic bioreactors, for workforce training on complex bioprocessing techniques through AI-powered digital training as well as for automating data management to ensure compliance with evolving regulatory standards.

- For instance, in November 2024, New Wave Biotech, a London-based start-up, launched Bioprocess Foresight, an AI-led simulation software developed for assisting alternative protein and biomanufacturing companies to design smarter and scale up faster with lowered costs for expediting their path to market.

Report Scope of Large And Small-scale Bioprocessing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 101.08 Billion |

| Market Size by 2035 |

USD 272.6 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.68% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Scale, By Workflow, By Product, By Application, By Use Type, By Mode |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Avantor, Inc, Bio-Process Group, Bio-Synthesis, Inc., BPC Instruments AB, CESCO BIOENGINEERING CO., LTD, CerCell A/S, Corning Inc., Danaher (Cytiva), Distek, Inc., Entegris, Eppendorf AG,ExcellGene SA, F. Hoffmann-La Roche Ltd, Getinge AB, KUHNER AG, Lonza, Meissner Filtration Products, Inc., Merck KGaA, PBS Biotech, Inc., Repligen Corporation, Saint-Gobain, Sartorius AG, Thermo Fisher Scientific, Inc., Univercells Technologies |

Large and Small-scale Bioprocessing Market Dynamics

Drivers

Increasing Chronic Disease Burden

There is a global rise in number of chronic diseases such as cancer, autoimmune disorders like Crohn’s disease and rheumatoid arthritis, cardiovascular diseases, diabetes, and neurological conditions like Alzheimer’s and Parkinson’s, among others which lack curative treatment, further requiring long-term management. Biologics such as recombinant proteins, monoclonal antibodies, and vaccines offering highly targeted and effective treatment options for these chronic conditions compared to small molecule drugs are gaining traction. The complexity of these biologics is creating the demand for specialized manufacturing platforms with sophisticated bioprocessing technologies.

Restraints

High Costs Associated with Infrastructure and Equipment

The high capital investments in large and small-scale bioprocessing, required for building the infrastructure and implementation of advanced instruments such as bioreactors, chromatography equipment and automated systems, especially for continuous bioprocessing. These limitations in infrastructure can potentially limit the access and adoption of bioprocessing technologies, particularly for small market players and emerging biotech startups, further impacting the market growth.

Opportunities

Sustainability Initiatives and Technological Progress

The rising shift in the pharmaceutical industry towards biomanufacturing over traditional chemical synthesis to adopt more sustainable and environment friendly practices is gaining traction. Increasing environmental awareness and stringent regulations are pushing industries to implement sustainable methods in bioprocessing technologies for production of biological products, biofuels, chemicals and other biodegradable materials. Furthermore, advancements in bioprocessing technologies such improved bioreactor designs, adoption of single-use systems, automation and continuous bioprocessing technologies enabled through Process Analytical Technology (PAT) are creating opportunities for market growth.

Large and Small-scale Bioprocessing Market Segmental Insights

By Scale Insights

What Drives the Industrial Scale Segment’s Dominance in the Market in 2025?

The industrial scale segment captured the largest revenue share in the market in 2025. The rising prevalence of chronic diseases, increasing demand for biopharmaceuticals, advancements in bioreactors and automation, and need for efficient, large-scale bioprocessing solutions such as stainless steel bioreactors are driving the market growth of this segment. A significant advantage of industrial scale bioprocessing systems is economies of scale, allowing production of large volumes of products at low costs for manufacturers. These lowered costs facilitate the production of large volumes of established biologics and vaccines, further catering to the global expectations.

The small-scale segment is expected to register the fastest growth over the forecast period. Small-scale bioprocessing solutions are widely used for the development and manufacturing of personalized therapies based on individual patient needs or small cohort. The emergence of several biotech startups focused on bespoke applications, including gene therapies and cell-based therapies as well as rising investments by public and private sectors in biotechnology R&D are driving the demand for smaller, cost-effective and flexible bioprocessing systems. These solutions are widely being implemented in early-stage drug development, for clinical trials, in academic research, for developing specialized therapies as well as for decentralized biomanufacturing processes, particularly for personalized therapies.

By Workflow Insights

Why Did the Downstream Processing Segment Dominate in 2025?

The downstream processing segment dominated the market with the largest revenue share in 2025. Downstream processing in bioprocessing refers to the recovery and purification of desirable products from a complex mixture, such as fermentation broth or cell culture. The segment’s market dominance is driven by the rising demand for biotherapeutic products such as monoclonal antibodies and recombinant proteins, increased adoption of single-use and disposable technologies for mitigating cross-contamination risk, innovations in purification technologies such as chromatography and filtration techniques, and rising focus on development of sustainable bioproducts such as biofuels and environment friendly materials.

- For instance, in May 2025, IonOpticks, a designer of top-notch chromatography columns for mass spectrometry research, launched its 4th Generation of Aurora Series columns, providing improved robustness, reproducibility, longevity and spray stability.

The fermentation segment is expected to register robust growth over the forecast period. Fermentation involves utilization of microorganisms for production several valuable products in bioprocessing. Small-scale fermentation is important for R&D purposes, whereas, large-scale production focuses on mass production for different commercial applications. The rising adoption of microbial and cell-based expression systems, cost-effectiveness of large-scale fermentation processes, sustainability, and the increasing demand for biologics and biosimilars are the factors boosting the market growth of this segment. Automation of fermentation processes as well as optimization of feed strategies is helping achieve consistent product quality with real-time control, along with reduced production costs.

- For instance, in March 2025, Pow.Bio, a startup focused on changing the economics of precision fermentation, launched a new 25,000 sq ft FDA-registered facility in Alameda, California and is equipped with a fleet of dual-chamber continuous fermentation systems at different scales. The facility also provides expanded downstream processing capabilities such as freeze-drying and spray drying.

By Product Insights

The bioreactors/ fermenters segment accounted for the largest market share in 2024. The segment’s market dominance is driven by the increasing demand for biologics and vaccines as well as biosimilars, growing emphasis on precision medicine, favorable government policies and streamlined regulations, further driving the demand for bioprocessing equipment, including bioreactors and fermenters. The rise in number of Contract Manufacturing Organizations (CMOs) offering bioprocessing services are contributing to the demand of bioreactors and fermenters in the market.

- For instance, in January 2025, Biosphere introduced its breakthrough UV-sterilized bioreactor which will transform industrial fermentation workflows. Along with the launch, Biosphere raised $8.8 million in a seed funding round and also secured a $1.5 million contract with the U.S. Department of Defense for applying its technology in production of critical bioproducts.

The cell culture products segment is expected to show the fastest growth during the predicted timeframe. Cell culture products used in bioprocessing used for cultivation and manipulation of cells, particularly for manufacturing biotherapeutics and other biological products. Key cell culture products used in bioprocessing include cell culture media, cell culture supplements, growth factors, cell lines, single-use bioprocessing components, bioreactors, media filters and cell retention systems. The rising demand for biologics, advancements in cell culture technologies, shift towards animal-free and chemically defined media, as well as expanding applications such as in protein therapeutics, viral vaccines, gene therapies and cell-based therapies are the factors fuelling the market growth.

By Aplication Insights

What Made Biopharmaceuticals the Dominant Segment in the Market in 2025?

The biopharmaceuticals segment dominated the market with the highest revenue share in 2025. The growing prevalence of chronic illnesses and increasing emphasis on development of targeted and personalized therapies is creating a huge demand for biopharmaceuticals, with biologics representing a huge portion of the medications in the development pipeline. Rising investments to accelerate research and development activities across various therapeutic modalities, focus on addressing unmet medical needs, ongoing clinical trials for novel biologics requiring clinical-grade materials, expanding biomanufacturing capacities as well as enhanced efficiency and cost-effectiveness of bioprocessing technologies are the factors boosting the market growth of this segment.

The speciality industrial chemicals segment is expected to grow a significant rate over the forecast period. Speciality industrial chemicals are widely used for bioprocessing in areas such as media formulation, purification and downstream processing. Sodium hydroxide, sulphuric acid, amino acids, antibiotics and enzymes (biocatalysts) are some of the specific chemicals used in bioprocessing applications. Growing environmental awareness, shift towards sustainable practices in bioprocessing for production of biofuels and bio-based chemicals, increasing demand for eco-friendly plastics and packaging materials like biodegradable polymers, and innovations in bioprocessing technologies like recombinant DNA technology are the factors driving the market growth of this segment.

By Use Type Insights

What Made Multi-Use Segment Dominant in the Market in 2025?

The multi-use segment generated the largest market revenue share in 2025. The robustness and proven scalability of multi-use systems like stainless steel bioreactors offering a durable and reliable platform for large-scale commercial production with high predictability and consistent performance, leading to enhanced product quality and regulatory compliance are contributing to the market growth. Significant investments by pharmaceutical companies in multi-use stainless steel facilities, focus on hybrid facility models, integration with existing biomanufacturing infrastructure, and cost effectiveness for large-volume, established products are the factors driving the market growth.

The single-use segment is anticipated to register significant growth over the forecast period. The cost efficiency and reduced operational expenses in bioprocessing workflows with single-use facilities is driving their adoption. Single-use systems can eliminate the time consuming cleaning and sterilization cycles required in between batches in traditional facilities, further enabling quick changeovers and minimized contamination risks, leading to increased facility utilization and reduced downtimes. The enhanced flexibility in scaling up or down production volumes offered by single-use technologies makes them suitable for early-stage development, small-scale clinical trials and commercial production, especially for multi-product facilities, CDMOs, and for companies manufacturing multiple biopharmaceuticals.

By Mode Insights

How In-House Segment Accounted for the Highest Market Share in 2025?

The in-house segment dominated the market accounting for the highest revenue share in 2025. Manufacturers are adopting in-house operations for bioprocessing workflows as it offers real-time control of all the processes from raw material sourcing to commercialization, leading to quick decisions-making, faster turnaround times and strategic flexibility in responding to market demands. Moreover, improved intellectual property (IP) security, comprehensive data collection, direct quality control and assurance as well as long-term cost-effectiveness are the factors driving the market dominance of this segment.

The outsourced segment is expected to witness significant CAGR during the forecast period. The market growth of this segment is driven by the rising reliance of biopharmaceutical companies on Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). Factors such as reduced upfront investments, focus on core competencies, access to specialized expertise and advanced bioprocessing facilities, increased flexibility to scale production, support through all development, accelerated time-to-market, and enhanced regulatory are the market expansion.

Large and Small-scale Bioprocessing Market Regional Insights

How is North America Dominating the Large and Small-scale Bioprocessing Market?

North America dominated the global market with the largest revenue share in 2025.The presence of a robust biotechnology sector, huge investments in R&D operations, continuous innovation in bioprocessing technologies and applications, as well as growing biologics and focus on personalized medicine approaches are the factors driving the region’s market dominance. Advancements in bioprocessing technologies such as adoption of single-use systems, continuous bioprocessing approaches, automation and miniaturization of bioprocessing equipment and advanced filtration techniques are contributing to the market growth. Government support through substantial funding, streamlined regulatory pathways, sustainability initiatives and focus on domestic biomanufacturing are encouraging bioprocessing research and development.

- For instance, in November 2024, Sartorius Stedim Biotech inaugurated its new Center for Bioprocess Innovation in Marlborough, Massachusetts, U.S.

What Fuels Expansion of the Large and Small-scale Bioprocessing Market in Asia Pacific?

Asia Pacific is expected to register the fastest CAGR in the market over the forecast period. The market growth is driven by the increasing prevalence of chronic diseases like cancer, cardiovascular disorders and diabetes in the region’s large and aging population, further driving the demand for biopharmaceuticals and effective therapies, which require bioprocessing technologies for their production. The rising investments in advancing biomanufacturing facilities such as development of cutting-edge fermentation capabilities, expansion of bioprocessing capacities, launch of innovative bioprocessing technologies as well as biosimilar pipelines in countries like China, India and South Korea are contributing to the market expansion. Furthermore, the region’s cost-effective manufacturing capabilities, supportive government initiatives and policies, and expanding biotechnology sector are boosting the market potential.

Some of the Prominent Players in the Large and Small-scale Bioprocessing Market

- Avantor, Inc

- Bio-Process Group

- Bio-Synthesis, Inc.

- BPC Instruments AB

- CESCO BIOENGINEERING CO., LTD

- CerCell A/S

- Corning Inc.

- Danaher (Cytiva)

- Distek, Inc.

- Entegris

- Eppendorf AG

- ExcellGene SA

- F. Hoffmann-La Roche Ltd

- Getinge AB

- KUHNER AG

- Lonza

- Meissner Filtration Products, Inc.

- Merck KGaA

- PBS Biotech, Inc.

- Repligen Corporation

- Saint-Gobain

- Sartorius AG

- Thermo Fisher Scientific, Inc.

- Univercells Technologies

Large And Small-scale Bioprocessing Market Recent Developments

- In May 2025, PeptiSystems and Asahi Kasei Bioprocess America (AKBA) entered into an exclusive global partnership agreement. The collaboration will bring together PeptiSystems' flow-through instrument platform and AKBA's high-performance column technology, further offering customers a streamlined and reliable setup from the very first run.

- In December 2024, SCG Cell Therapy Pte Ltd (SCG), a clinical-stage biotechnology company, signed a Memorandum of Understanding (MoU) with A*STAR Bioprocessing Technology Institute (A*STAR BTI) and Nucleic Acid Therapeutics Initiative (NATi) for advancing ribonucleic acid (RNA)-based therapeutic manufacturing process development and clinical translation.

- In November 2024, Cellevate commercially launched the world’s first-of-a-kind Cellevat3d nanofiber-based cell culture systems for viral vector production. These cell culture systems are specifically designed for faster bioprocessing and will offer more efficient scale-up as well as up to three times more viral vector yield.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the large and small-scale bioprocessing market.

By Scale

- Industrial Scale (Over 50,000 Litres)

- Small Scale (Less Than 50,000 Litres)

By Workflow

- Downstream Processing

- Fermentation

- Upstream Processing

By Product

- Bioreactors/Fermenters

- Cell Culture Products

- Filtration Assemblies

- Bioreactors Accessories

- Bags & Containers

- Others

By Application

- Biopharmaceuticals

- Speciality Industrial Chemicals

- Environmental Aids

By Use Type

By Mode

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)