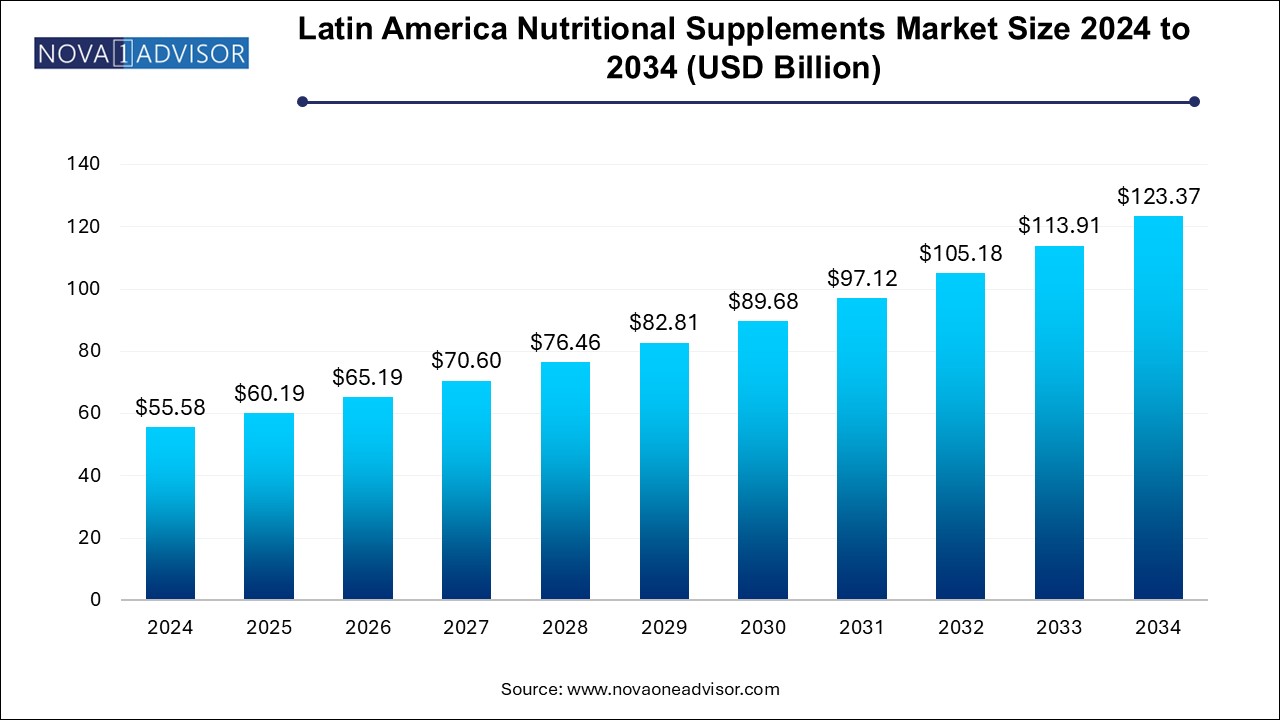

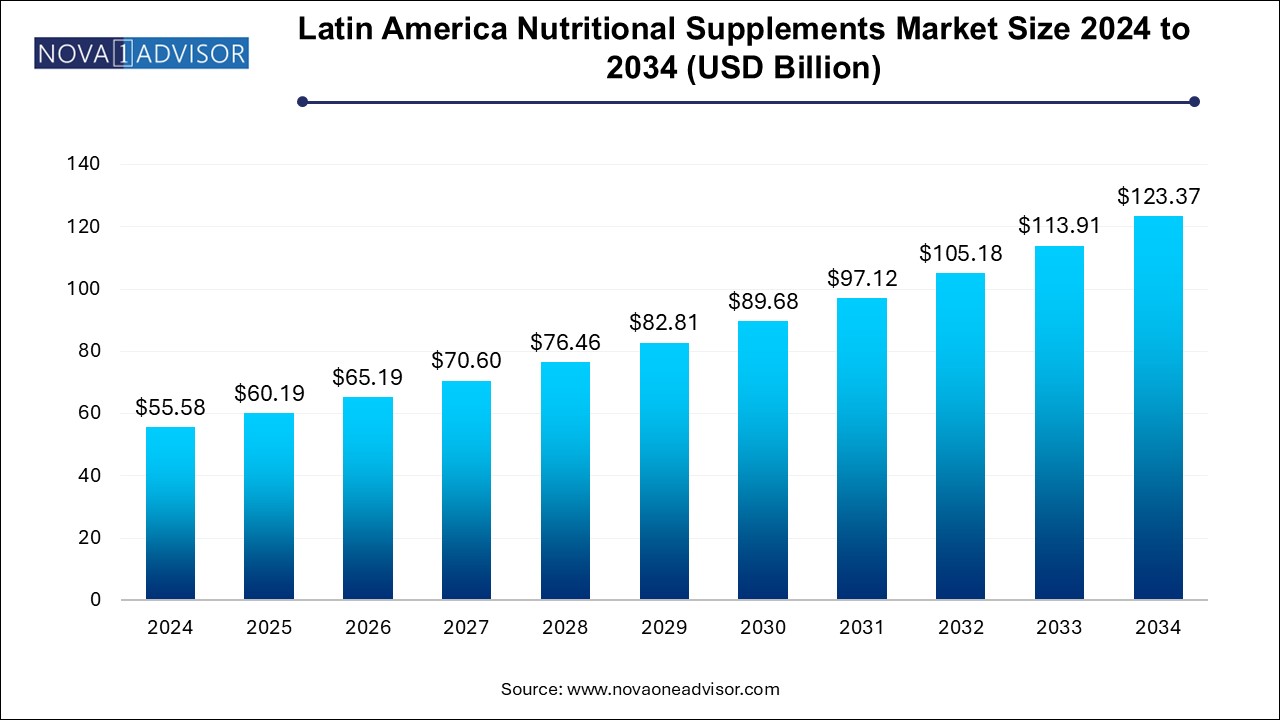

Latin America Nutritional Supplements Market Size and Growth

The Latin America nutritional supplements market size was exhibited at USD 55.58 billion in 2024 and is projected to hit around USD 123.37 billion by 2034, growing at a CAGR of 8.3% during the forecast period 2025 to 2034.

Market Overview

The Latin America nutritional supplements market is emerging as a significant player in the global wellness economy, driven by rising health consciousness, evolving dietary habits, and growing disposable income. Nutritional supplements—including vitamins, minerals, amino acids, protein powders, and functional foods—are increasingly used to support general health, manage chronic conditions, and enhance athletic performance across diverse demographic groups.

The shift towards preventive healthcare, exacerbated by the COVID-19 pandemic, has reshaped consumer behavior in Latin America. An increasing number of individuals now prioritize immune health, mental wellness, and weight management, translating into heightened demand for accessible and efficient dietary solutions. Coupled with growing sports participation and gym culture among urban populations, the consumption of sports nutrition and protein supplements is surging across Brazil, Argentina, and other regional markets.

E-commerce channels are rapidly transforming product distribution in this space, enabling direct access to a variety of global and domestic brands. Additionally, local health food stores, pharmacies, and supermarkets continue to account for a significant share of supplement sales, often providing personalized consultation and bundled offerings.

The regulatory environment, although diverse across countries, is gradually aligning with global food safety and efficacy standards. Brazil’s ANVISA, Argentina’s ANMAT, and regional trade associations are focusing on harmonizing labeling, product registration, and ingredient approval processes to facilitate cross-border trade and consumer safety. This regulatory maturation is further enhancing market credibility and driving investments by multinational players.

Major Trends in the Market

-

Rising Popularity of Plant-Based Supplements: Latin American consumers are embracing pea, lentil, soy, and hemp protein due to sustainability, allergies, and lifestyle preferences.

-

Growing Focus on Immune Health and Preventive Care: Post-pandemic behavior has amplified demand for vitamin C, zinc, probiotics, and adaptogenic herbs.

-

Expansion of Sports Nutrition Beyond Athletes: Recreational gym-goers and wellness-focused individuals are increasingly consuming BCAAs, creatine, and protein powders.

-

Personalized and Age-Targeted Supplements: Tailored formulations for children, women, pregnant individuals, and geriatric populations are gaining market traction.

-

E-commerce Acceleration: Online platforms, social commerce, and direct-to-consumer brands are streamlining access, driving rapid digital growth.

-

Localization and Herbal Integration: Indigenous herbs and botanicals (e.g., maca root, guarana, yerba mate) are being incorporated into functional foods and beverages.

-

Smart Packaging and Clean Labels: Consumers are demanding transparency, sustainability, and traceability in product labeling and packaging.

-

Weight Management and Digestive Health Drive Innovation: Probiotic-enriched supplements and detox formulations are growing rapidly among young consumers.

Report Scope of Latin America Nutritional Supplements Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 60.19 Billion |

| Market Size by 2034 |

USD 123.37 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Formulation, Sales Channel, Consumer Group, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Herbalife International of America, Inc; Amway Corp; Bayer AG; Sanofi; Abbott; Nestlé; Pfizer Inc.; GNC Holdings, LLC; Higher Ground Supplements; Shaklee Corporation |

A major driver fueling the Latin America nutritional supplements market is the rising awareness about health and wellness, particularly in the context of increasing lifestyle-related disorders. Urbanization, sedentary behavior, and changing dietary habits have led to a surge in obesity, diabetes, and cardiovascular ailments across the region. For instance, over 60% of the adult population in Brazil is classified as overweight or obese, leading to heightened demand for nutritional solutions that support weight loss, glucose metabolism, and cardiovascular health.

Moreover, the pandemic further accelerated this shift as consumers became more proactive about immune support and chronic disease prevention. As a result, daily supplementation with multivitamins, omega-3s, and immune-boosting nutrients has become mainstream across middle- and upper-income groups. The rise of fitness apps, wellness influencers, and health education campaigns has also played a pivotal role in expanding the consumer base and demystifying the benefits of supplements.

Market Restraint: Regulatory Fragmentation and Labeling Inconsistencies

Despite strong growth potential, the market is challenged by regulatory fragmentation and inconsistent product labeling standards across Latin American countries. While Brazil, Argentina, and Mexico have relatively developed frameworks for supplement regulation, other countries lag behind, creating a non-uniform landscape that can hinder product registration, labeling, and cross-border trade.

This lack of harmonization affects both domestic and international players. Companies often have to customize formulations, alter health claims, and undergo multiple approval processes to enter different markets in the region. Furthermore, limited consumer education regarding supplement efficacy and safety has resulted in market saturation with low-quality or misbranded products, eroding consumer trust in some cases. A unified regulatory roadmap and clearer product categorization would significantly enhance transparency and market integrity.

Market Opportunity: Expansion of Functional Foods and Personalized Nutrition

An exciting opportunity in the Latin American nutritional supplements market is the expansion of functional foods and beverages combined with personalized nutrition. Consumers increasingly prefer formats that integrate health benefits into their daily routines—such as fortified snacks, protein bars, probiotic drinks, and omega-3-enriched yogurts. These products offer the dual benefit of taste and health, bridging the gap between supplementation and regular food consumption.

Personalized nutrition is also gaining momentum, especially among urban millennials and Gen Z. Emerging brands are offering subscription-based models with questionnaires or at-home diagnostic kits to tailor supplement regimens based on genetic markers, lifestyle, and dietary preferences. As data-driven health ecosystems mature, supplement manufacturers that invest in personalization technologies, AI-backed apps, and micro-targeted marketing will likely gain a competitive edge in the region.

Latin America Nutritional Supplements Market By Product Insights

The functional foods and beverages segment dominated the market with a revenue share of 53.0% in 2024, with vitamins, minerals, and omega-3s forming the foundation of consumer adoption. Multivitamin formulations continue to perform strongly due to their broad appeal across age groups and gender segments. Magnesium, iron, and vitamin D supplements are particularly popular among women, while zinc and vitamin C remain top choices for immune health. The segment’s dominance is also reinforced by their ease of formulation, low price points, and widespread distribution across pharmacies and supermarkets.

The sports nutrition segment is projected to grow at the highest CAGR of 9.4% over the forecast period, driven by increasing participation in fitness activities, rising gym memberships, and a culture of performance-oriented lifestyles. Whey protein concentrates and isolates continue to lead in terms of volume, but plant-based proteins such as pea and lentil proteins are growing rapidly due to vegan and lactose-intolerant consumer preferences. Pre-workout formulas, BCAAs, creatine, and recovery-based supplements are also witnessing double-digit growth, especially in Brazil and urban Argentina.

The powder segment dominated the market with the largest revenue share in 2024, especially within sports nutrition and protein supplementation. Powders are preferred due to their affordability, shelf life, and versatility across product lines. Flavored and mixable protein powders dominate gym and e-commerce channels, while micronutrient-enriched powders for children and seniors are gaining ground in the dietary supplement segment.

The capsules segment is projected to grow at the highest CAGR over the forecast period, owing to consumer preference for convenient dosing and enhanced bioavailability. These formulations are common in omega-3s, herbal supplements, and probiotics, often marketed for daily use. They are also easier to regulate and standardize, enhancing their trust factor among health professionals and pharmacies.

Latin America Nutritional Supplements Market By Sales Channel Insights

The Brick & mortar outlets dominate, particularly chemists, health food shops, and supermarkets that serve as trusted access points for Latin American consumers. Pharmacies are essential for the sale of multivitamins, minerals, and doctor-recommended supplements, while health food shops and gyms serve the sports nutrition demographic. These channels benefit from personal interaction, product sampling, and bundled offers.

E-commerce is the fastest-growing sales channel, fueled by the convenience of home delivery, broader product assortment, and growing digital penetration. Platforms like Mercado Libre, Netshoes, and specialized health websites are expanding their supplement portfolios, often supported by influencer marketing and personalized wellness apps. Cross-border e-commerce is also facilitating access to premium international brands that may not be available in physical stores.

Latin America Nutritional Supplements Market By Consumer Group Insights

The adults segment dominated the market with the largest revenue share in 2024, owing to their interest in sports performance, appearance, energy, and immunity. This age group is also highly responsive to digital wellness trends and is open to trying innovative supplement formats and combinations.

The geriatric segment is projected to grow at a significant CAGR over the forecast period, particularly for bone, joint, and cardiovascular support supplements. With aging populations in Brazil and Argentina, demand for calcium, magnesium, omega-3s, and multivitamins tailored to elderly health is surging. Brands targeting this demographic often emphasize bioavailability, clinical validation, and doctor endorsements.

Latin America Nutritional Supplements Market By Application Insights

The weight management segment dominated the market with the largest revenue share in 2024, especially post-pandemic. Vitamin C, zinc, probiotics, and herbal extracts like echinacea and elderberry are widely used across adult and senior segments. These products are frequently promoted through pharmacies and health professionals.

The sports & athletics segment is anticipated to grow at the highest CAGR over the forecast period, particularly among urban female consumers. Fat burners, detox drinks, and CLA supplements are gaining popularity, as are collagen-based and antioxidant-rich formulations targeting skin, hair, and nail health. This segment overlaps strongly with functional foods and beauty-from-within categories.

Country-Level Analysis

Brazil led the Latin America nutritional supplements market in 2024, accounting for the largest share in both volume and revenue. Factors such as a large population, robust urbanization, and cultural acceptance of supplements contribute to this leadership. Brazil also has a mature sports nutrition segment, driven by its vibrant fitness culture, bodybuilding community, and national policies promoting physical activity.

ANVISA’s stringent regulatory framework has helped formalize the market, encouraging high-quality domestic production and international brand entry. Brazilian consumers are increasingly prioritizing natural and organic supplement options, particularly in urban centers like São Paulo and Rio de Janeiro. Health food stores, online platforms, and supermarkets form an integrated ecosystem that supports wide product accessibility.

Argentina is projected to be the fastest-growing market, owing to a confluence of factors including increasing awareness, digital health penetration, and rising demand for preventive health solutions amid economic recovery. Despite regulatory and import challenges, consumer appetite for supplements is expanding rapidly, particularly in Buenos Aires and surrounding provinces.

Local companies are actively developing herbal and probiotic-rich products aligned with regional dietary patterns. Argentina's strong agricultural base also supports ingredient availability for plant-based and clean-label formulations. As e-commerce infrastructure improves, cross-border trade and international brand penetration are expected to accelerate, providing Argentine consumers with a wider array of supplement choices.

Some of the prominent players in the Latin America nutritional supplements market include:

Latin America Nutritional Supplements Market Recent Developments

-

In March 2025, Herbalife launched a localized line of plant-based protein powders in Brazil using native ingredients such as acerola and cassava for clean-label appeal.

-

In January 2025, Argentine startup NutriaLab received investment from a regional health-tech fund to expand its AI-driven personalized supplement platform across Latin America.

-

In November 2024, DSM Nutritional Products opened a new micronutrient premix facility in São Paulo to support the growing demand for customized fortification solutions in Brazil and surrounding countries.

-

In September 2024, Nestlé Health Science launched its “Vital Proteins” brand in Argentina, targeting the beauty and wellness demographic with collagen-enriched supplements.

-

In July 2024, Abbott Laboratories partnered with regional distributors to roll out its Ensure and Glucerna lines with added electrolytes and digestive enzymes to meet senior nutrition needs in urban and rural Brazil.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Latin America nutritional supplements market

By Product

-

-

-

- Egg Protein

- Soy Protein

- Pea Protein

- Lentil Protein

- Hemp Protein

- Casein

- Quinoa Protein

- Whey Protein

-

-

-

-

- Whey Protein Isolate

- Whey Protein Concentrate

-

-

-

- Calcium

- Potassium

- Magnesium

- Iron

- Zinc

-

-

-

- BCAA

- Arginine

- Aspartate

- Glutamine

- Beta Alanine

- Creatine

- L-carnitine

-

-

- Probiotics

- Omega-3 Fatty Acids

- Carbohydrates

-

-

-

- Maltodextrin

- Dextrose

- Waxy Maize

- Karbolyn

-

-

- Detox Supplements

- Electrolytes

- Others

-

-

- Isotonic

- Hypotonic

- Hypertonic

-

-

- Protein Bars

- Energy Bars

- Protein Gels

-

- Meal Replacement Products

- Weight Loss Products

-

- Green Tea

- Fiber

- Protein

- Green Coffee

- Others

-

-

- Multivitamin

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Vitamin E

-

- Minerals

- Enzymes

- Amino Acids

- Conjugated Linoleic Acids

- Others

- Functional Foods & Beverages

-

- Probiotics

- Omega-3

- Others

By Formulation

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Others

By Sales Channel

-

- Direct Selling

- Chemist/Pharmacies

- Health Food Shops

- Hyper Markets

- Super Markets

By Consumer Group

-

- Age group 21 To 30

- Age group 31 To 40

- Age group 41 to 50

- Age group 51 to 65

By Application

- Sports & Athletics

- General Health

- Bone & Joint Health

- Brain Health

- Gastrointestinal Health

- Immune Health

- Cardiovascular Health

- Skin/Hair/Nails

- Sexual Health

- Women’s Health

- Anti-aging

- Weight Management

- Others

By Country