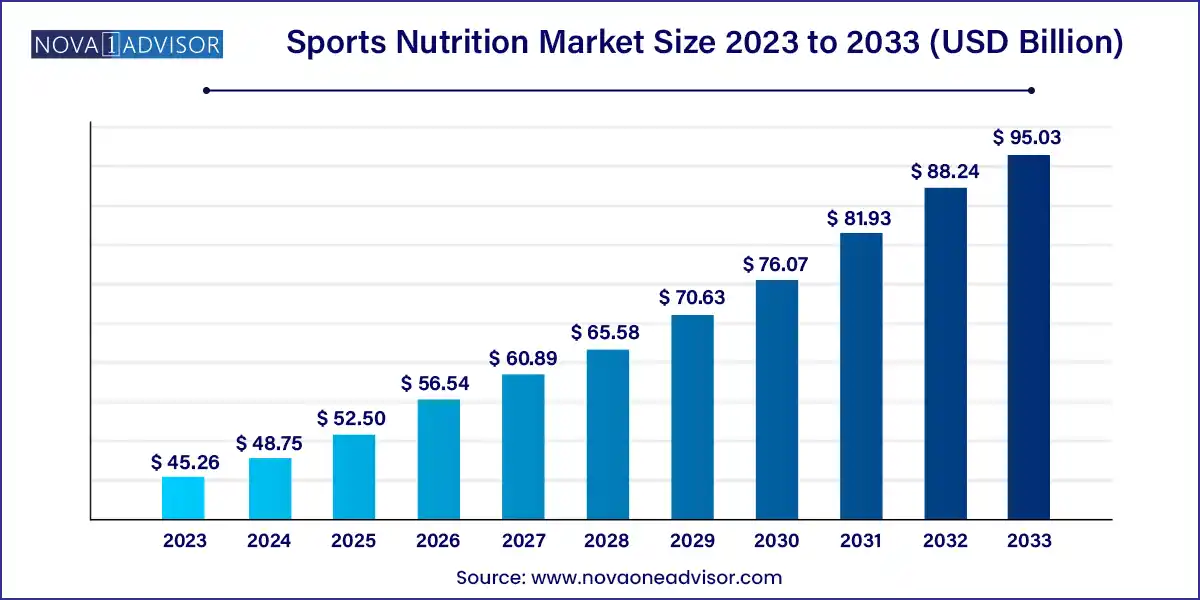

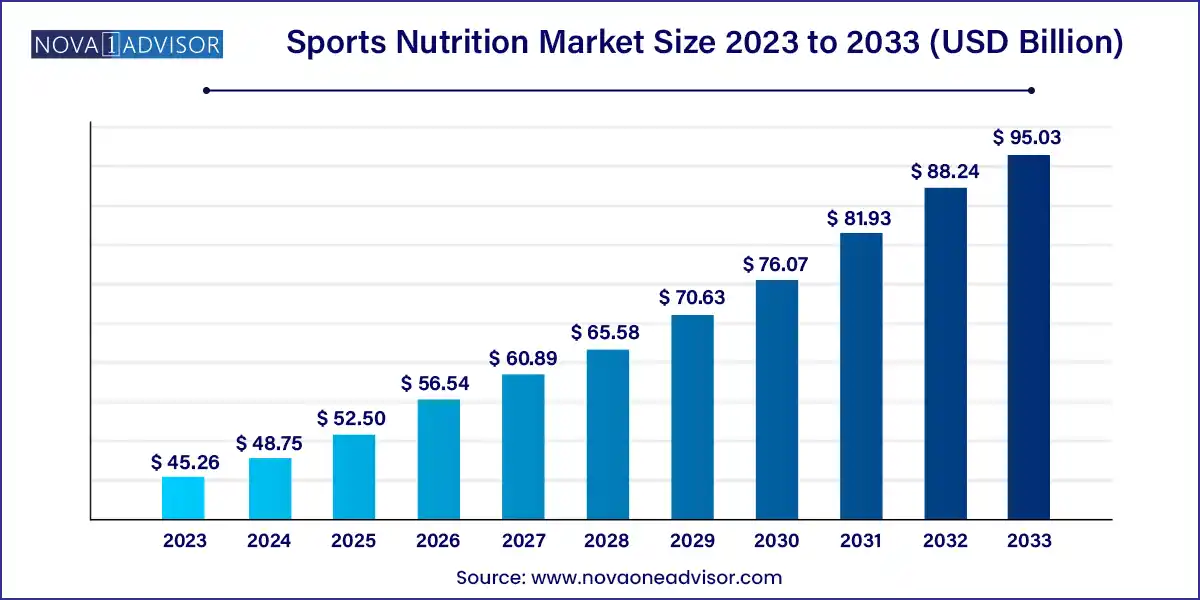

The global sports nutrition market size was exhibited at USD 45.26 billion in 2023 and is projected to hit around USD 95.03 billion by 2033, growing at a CAGR of 7.7% during the forecast period of 2024 to 2033.

Key Takeaways:

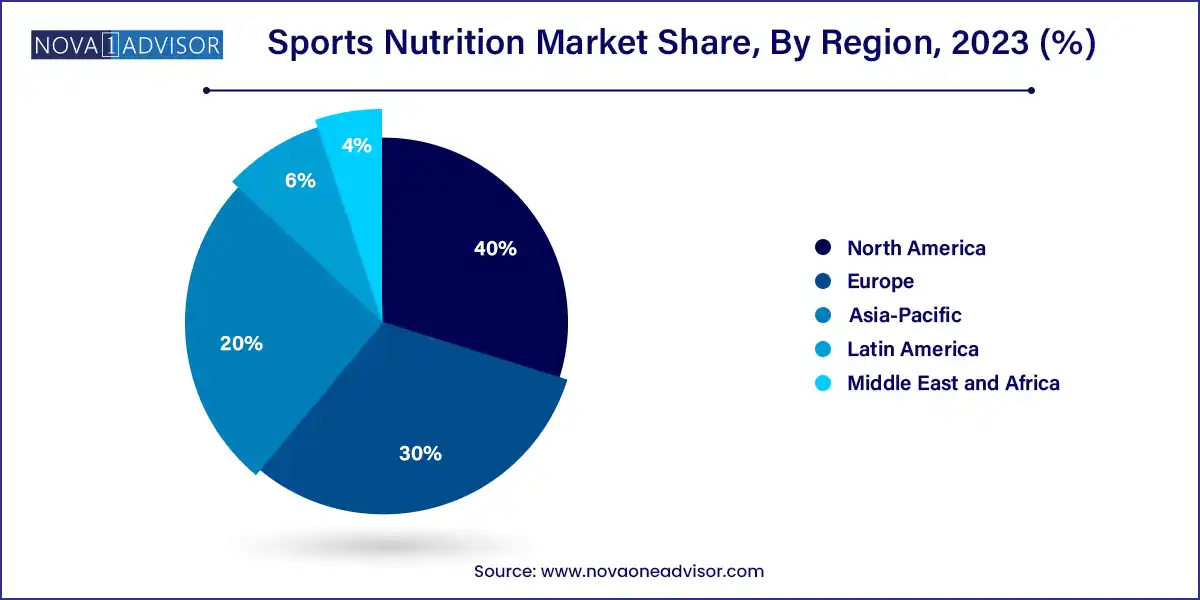

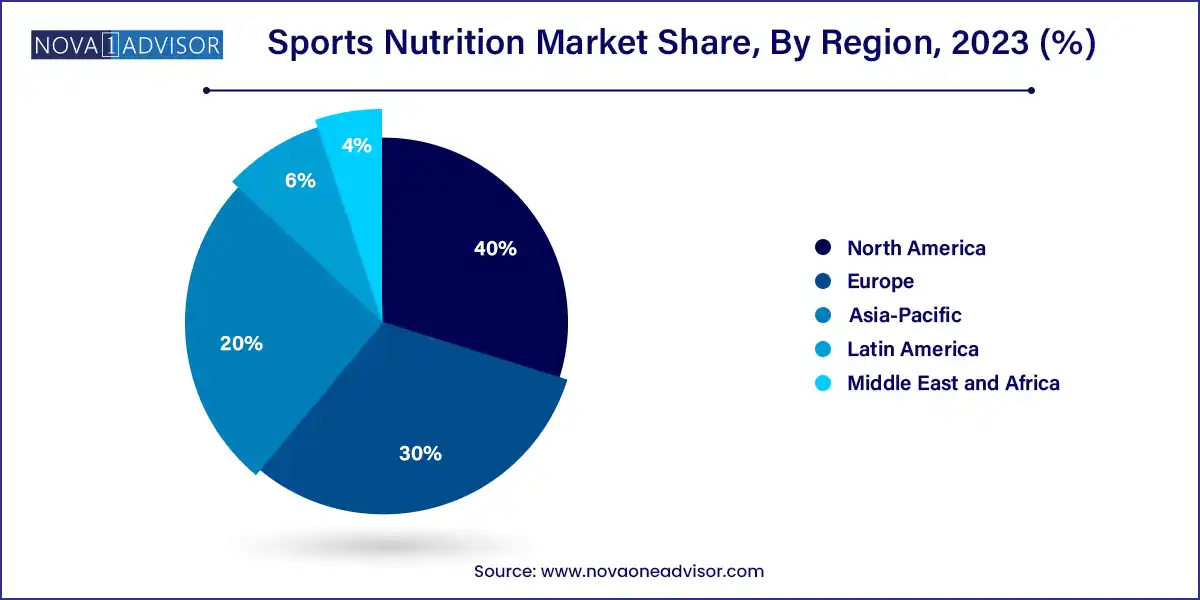

- Asia Pacific accounted for the largest revenue share of 40.0% in 2023.

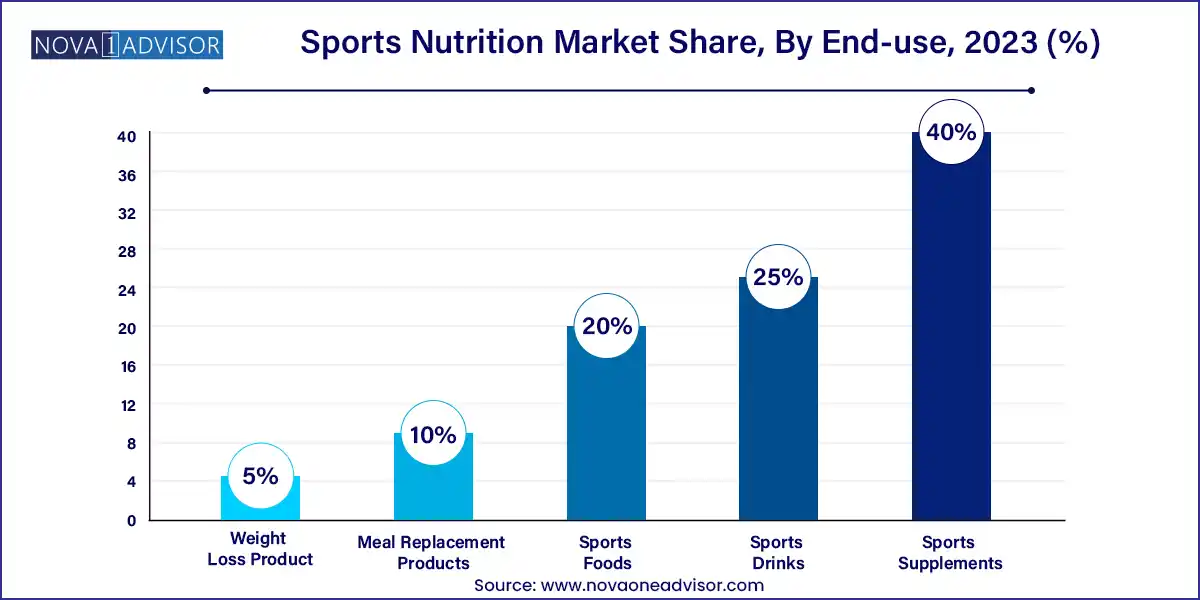

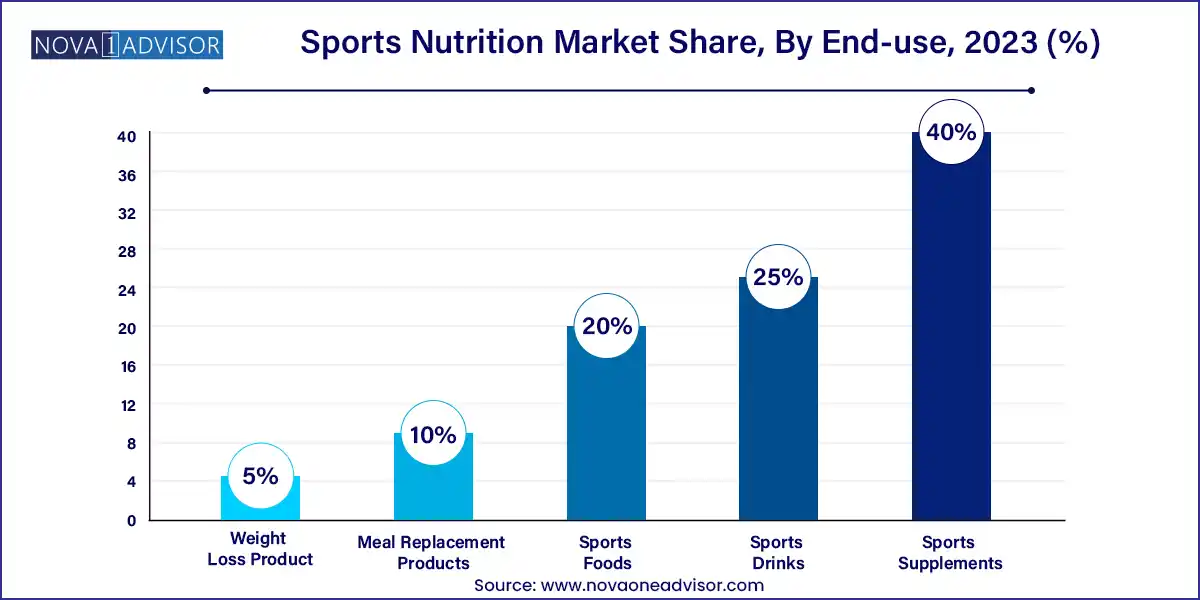

- The sports supplements segment accounted for the largest revenue share of 40.0% in 2023.

- Based on formulation, the powder segment held the largest market share in 2023.

- Based on consumer group, the adult segment dominated the market with largest market share in 2023.

- Based on sales channel, the brick-and-mortar segment dominated the market with largest market share in 2023.

Market Overview

The Sports Nutrition Market has evolved beyond its early roots of catering exclusively to elite athletes and bodybuilders. Today, it serves a vast demographic that includes recreational fitness enthusiasts, working professionals seeking wellness, and even older adults aiming to preserve muscle mass and energy. The industry encompasses a diverse array of products including sports supplements, drinks, foods, weight loss solutions, and meal replacements all designed to support athletic performance, muscle recovery, and overall physical endurance.

Valued in the billions, this global market has been propelled by factors such as increasing awareness of fitness, the rise of social media influencers promoting wellness lifestyles, and a growing base of consumers embracing preventive health through nutrition. The market has expanded in product form, ingredients, target demographics, and sales channels. Innovations in protein sources, formulation science, and digital retailing have made it more accessible and tailored.

The convergence of health, performance, and convenience has led to a dynamic market landscape where sports nutrition is no longer niche it is mainstream. As of 2025, this industry continues to experience double-digit growth in several regions, fueled by product diversification and a surge in demand post-pandemic for immunity and wellness-boosting functional nutrition.

Major Trends in the Market

-

Mainstreaming of Sports Nutrition: Broader adoption beyond athletes to include office workers, seniors, and adolescents.

-

Plant-Based and Clean Label Movement: Demand for vegan proteins, organic certifications, and label transparency.

-

Functional Ingredient Expansion: Rise of adaptogens, probiotics, nootropics, and omega fatty acids for holistic benefits.

-

On-the-Go Nutrition: Portable formats like protein bars, gels, and drinks for convenience-led consumption.

-

Digitization of Sales Channels: E-commerce growth and personalized subscription services are replacing traditional retail dominance.

-

Customization and AI-Powered Nutrition: Personalized blends based on DNA, metabolism, or fitness goals.

-

Regulatory Tightening: Stricter regulations across Europe, APAC, and North America on supplement claims and safety.

-

Influencer-Driven Product Adoption: Celebrities and athletes launching their own nutrition brands.

Sports Nutrition Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 48.75 Billion |

| Market Size by 2033 |

USD 95.03 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Formulation, Consumer Group, Sales Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Iovate Health Sciences; Abbott; Quest Nutrition; PepsiCo; Cliff Bar; The Coca-Cola Company; MusclePharm; The Bountiful Company; Post Holdings; BA Sports Nutrition; Cardiff Sports Nutrition; Jacked Factory; Orgain |

Market Driver: Rising Consumer Focus on Preventive and Functional Health

One of the most powerful drivers of the sports nutrition market is the global pivot toward preventive health and functional wellness. Increasing cases of lifestyle-related diseases and heightened post-pandemic awareness have led consumers to proactively manage their health through nutrition.

Consumers are no longer just seeking muscle gains—they are using sports nutrition for cognitive clarity, immune support, energy stabilization, and sleep optimization. This functional shift is pushing companies to expand their portfolios beyond traditional whey proteins and BCAAs to include products fortified with botanicals, vitamins, and minerals designed for comprehensive health management.

For example, demand for immunity-supporting products featuring zinc, vitamin C, and elderberry in sports drinks surged after 2020 and remains high. This evolution from performance-only products to daily lifestyle enhancers has expanded the total addressable market considerably.

The lack of standardization and growing misinformation about product claims poses a significant restraint in the sports nutrition industry. Unlike pharmaceuticals, many regions treat sports supplements as food, subjecting them to less rigorous oversight. However, as incidents of contamination, doping concerns, and false marketing claims increase, regulators are clamping down.

For instance, the U.S. FDA, EFSA in Europe, and TGA in Australia are demanding greater transparency on sourcing, ingredient efficacy, and manufacturing practices. This tightening scrutiny increases the compliance burden, especially for smaller players. Moreover, consumer trust is fragile, and a few negative reports can dent category credibility, particularly among new or casual users.

Market Opportunity: Age-Inclusive and Gender-Specific Product Innovations

A major opportunity lies in creating targeted sports nutrition products for under-served demographics, especially geriatrics, women, and adolescents. While the traditional consumer base has skewed male and young, the fastest-growing groups today are women (interested in holistic fitness and hormonal health) and older adults seeking active aging solutions.

For instance, muscle loss due to sarcopenia in aging populations can be mitigated through high-quality protein and creatine supplementation. Female-specific products enriched with iron, calcium, or adaptogens for hormonal balance are also gaining traction. This demographic-specific segmentation opens new revenue streams and allows for higher consumer loyalty through personalization.

Segments Insights:

By Product Type Insights

Sports supplements dominate the market, particularly protein powders, amino acids, and vitamin-mineral combinations. Among proteins, whey protein especially isolate forms holds the largest share, due to its complete amino acid profile and rapid absorption. These products form the core of sports nutrition regimens for muscle growth and recovery. Creatine, BCAA, and glutamine also remain staples among performance athletes and gym-goers.

Sports foods, particularly protein bars and energy bars, are the fastest-growing subsegment, driven by convenience, portability, and expanded use cases such as snacking, meal bridging, and travel. These bars are evolving into hybrid products with added fibers, probiotics, and mood-boosting ingredients, appealing to consumers beyond gyms like students, professionals, and travelers.

Powder-based formulations dominate due to their cost efficiency, higher protein yield, and flexible dosage. Powders are widely used in gyms and home workouts, often blended with smoothies or water for pre- or post-workout consumption.

Softgels and liquids are the fastest-growing formats, especially for on-the-go users. These formats are increasingly used for hydration solutions, omega fatty acid supplements, and detox supplements. Innovations in microencapsulation and flavor masking are also making these formats more palatable and popular.

By Consumer Group Insights

Adults represent the primary consumer group, particularly individuals aged 18–45 who are active, image-conscious, and have disposable income. This group spans athletes, recreational gym-goers, and health-conscious professionals.

The geriatric population is the fastest-growing consumer base, as sports nutrition repositions itself as essential for active aging. Older adults are increasingly incorporating high-protein, joint-health, and cognitive-support supplements into their daily routines, not for sports but for vitality and independence.

By Sales Channel Insights

Brick-and-mortar remains the leading sales channel, particularly health food stores and pharmacies where consumers can seek expert advice. Supermarkets and hypermarkets have also increased shelf space for sports nutrition as part of their wellness offerings.

However, e-commerce is the fastest-growing channel, with direct-to-consumer brands disrupting traditional distribution models. Online platforms allow consumers to subscribe, customize, and reorder easily. They also provide access to reviews, certifications, and influencer endorsements all critical in building trust.

By Regional Insights

North America leads the global sports nutrition market, with the U.S. as the largest contributor. The presence of mature brands, a large active consumer base, a strong regulatory framework, and high disposable incomes fuel demand. North America also hosts major fitness influencers, celebrities, and athletes who frequently endorse or co-create product lines.

Asia-Pacific is the fastest-growing region, with exponential growth in countries like China, India, and Indonesia. Rising gym memberships, health-conscious youth, social media fitness trends, and a booming e-commerce infrastructure are the main growth drivers. Moreover, governments in India and China are investing heavily in sports development, further enhancing the market base.

By Recent Developments

-

Optimum Nutrition (April 2025): Launched a new plant-based isolate protein blend targeting female endurance athletes.

-

MuscleBlaze (India, March 2025): Announced a partnership with India’s Olympic Committee to supply custom hydration and amino blends to national athletes.

-

Garden of Life (February 2025): Introduced a new line of adaptogenic protein bars with ashwagandha and lion’s mane for cognitive enhancement.

-

BSN (January 2025): Released a vegan creatine supplement in gummy format, expanding into functional snacking.

-

Transparent Labs (December 2024): Unveiled a DNA-based sports nutrition app to personalize supplement stacks for users.

Some of the prominent players in the Sports nutrition market include:

- Iovate Health Sciences

- Abbott

- Quest Nutrition

- PepsiCo

- Cliff Bar

- The Coca-Cola Company

- MusclePharm

- The Bountiful Company

- Post Holdings

- BA Sports Nutrition

- Cardiff Sports Nutrition

- Jacked Factory

- Orgain

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global sports nutrition market.

Product Type

-

-

- Egg Protein

- Soy Protein

- Pea Protein

- Lentil Protein

- Hemp Protein

- Casein

- Quinoa Protein

- Whey Protein

-

-

-

- Whey Protein Isolate

- Whey Protein Concentrate

-

-

- Calcium

- Potassium

- Magnesium

- Iron

- Zinc

-

-

- BCAA

- Arginine

- Aspartate

- Glutamine

- Beta Alanine

- Creatine

- L-carnitine

-

- Probiotics

- Omega fatty Fatty Acids

- Carbohydrates

-

-

- Maltodextrin

- Dextrose

- Waxy Maize

- Karbolyn

-

- Detox Supplements

- Electrolytes

- Others

-

- Isotonic

- Hypotonic

- Hypertonic

-

- Protein Bars

- Energy Bars

- Protein Gel

- Meal Replacement Products

- Weight Loss Product

Formulation

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Others

Sales Channel

-

- Direct Selling

- Chemist/Pharmacies

- Health Food Shops

- Hyper Markets

- Super Markets

Consumer Group

- Children

- Adults

- Geriatric

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)