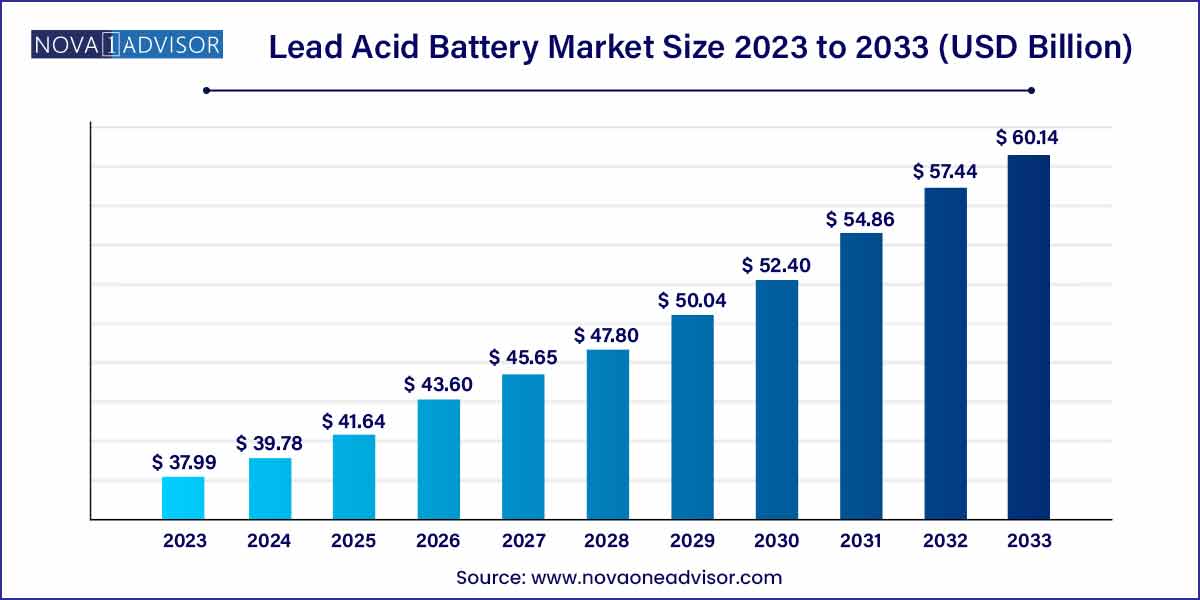

The global lead acid battery market size was exhibited at USD 37.99 billion in 2023 and is projected to hit around USD 60.14 billion by 2033, growing at a CAGR of 4.7% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific dominated the lead acid batteries industry and accounted for more than 56.0% share of the global revenue in 2023.

- In terms of value, Starting, Lighting, and Ignition (SLI) batteries emerged as the largest product segment and accounted for more than 53.0% of the market in 2023.

- In terms of value, the flooded lead acid battery segment emerged as the largest construction method segment and accounted for more than 68.0% of the market share in 2023.

- In terms of value, automotive emerged as the largest application segment and accounted for more than 58.0% of the market in 2023.

Market Overview

The lead acid battery market continues to be a cornerstone of the global energy storage sector, combining reliability, cost-effectiveness, and established technology to meet the growing power demands across industries. As one of the oldest types of rechargeable batteries, lead acid batteries have maintained their relevance amidst evolving energy solutions due to their high power output, durability, and cost advantages. They are widely used in diverse sectors including automotive, telecom, uninterruptible power supply (UPS), electric bikes, and transportation vehicles, among others.

Growing demand for energy storage solutions, a rapid increase in automotive sales, and the expansion of industrial sectors have fueled the growth of the lead acid battery market. Despite facing competition from newer technologies like lithium-ion batteries, lead acid batteries continue to dominate specific applications where cost sensitivity, robustness, and safety are paramount. Developing economies, particularly in Asia-Pacific and Africa, have provided fertile ground for market expansion due to increasing infrastructure development, telecom network expansions, and electrification projects.

The integration of renewable energy systems also promotes the use of stationary lead acid batteries for grid storage. Moreover, with technological improvements such as enhanced flooded batteries (EFB) and absorbent glass mat (AGM) technologies, the lifecycle and efficiency of lead acid batteries have significantly improved, boosting their attractiveness across industries.

Major Trends in the Market

-

Shift Towards Enhanced Flooded Batteries (EFB): As automotive manufacturers increasingly demand better performance for start-stop systems, EFBs are witnessing rising adoption over traditional flooded batteries.

-

Growing Popularity of Renewable Energy Integration: Lead acid batteries are gaining momentum as a reliable storage solution for renewable energy projects, especially in rural and off-grid areas.

-

Expansion of Electric Bike Usage: The surge in electric bike sales, particularly in Asian countries, is driving significant demand for motive lead acid batteries.

-

Advancements in VRLA (Valve Regulated Lead Acid) Technology: Innovations aimed at making VRLA batteries maintenance-free and more resilient are helping expand their use in UPS, telecom, and critical backup systems.

-

Recycling and Environmental Sustainability Initiatives: A high recycling rate (almost 98%) for lead acid batteries compared to other battery chemistries is increasing their favor among environmentally conscious users and regulators.

-

Investment in Smart UPS Systems: Demand for compact, maintenance-free, high-capacity UPS systems in IT infrastructure and healthcare sectors is pushing the adoption of advanced VRLA batteries.

-

Increasing Demand for Cost-Effective Backup Power Solutions: In developing regions where frequent power outages are common, the affordability and reliability of lead acid batteries make them a preferred choice.

Lead Acid Battery Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 37.99 Billion |

| Market Size by 2033 |

USD 60.14 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Construction Method, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

East Penn Manufacturing Co.; Exide Technologies; Johnson Controls; ATLASBX Co. Ltd.; NorthStar; C&D Technologies, Inc.; Narada Power Source Co., Ltd.; Amara Raja Corporation; GS Yuasa Corp; Crown Battery Manufacturing; Leoch International Technology Ltd. |

Key Market Driver

Rising Demand for Energy Storage Solutions in Emerging Economies

The robust growth in industrialization and urbanization in emerging economies like India, Brazil, and several African nations is creating a heightened demand for reliable energy storage systems. Frequent electricity outages and the need for backup power solutions have significantly driven the adoption of lead acid batteries. Particularly in telecom towers, hospitals, manufacturing plants, and commercial buildings, lead acid batteries serve as a dependable backup power source.

For example, in India, government initiatives like ‘Power for All’ and the ongoing telecom expansion into rural regions necessitate resilient power storage infrastructure. Lead acid batteries, being cost-effective and capable of handling wide temperature variations, perfectly fit into these applications. Furthermore, their recyclable nature aligns with sustainability goals, promoting their usage in mass electrification programs and renewable integration projects.

Key Market Restraint

Growing Competition from Lithium-Ion Batteries

Despite their affordability, lead acid batteries face fierce competition from lithium-ion technology, which offers superior energy density, faster charging, longer lifecycle, and lower weight. Lithium-ion batteries are increasingly becoming the preferred choice in automotive (especially electric vehicles), high-end UPS systems, and portable devices.

This shift is particularly prominent in developed markets like North America and Europe where customers prioritize compactness, weight reduction, and efficiency over upfront costs. The automotive industry’s aggressive move toward electric vehicles powered by lithium-ion batteries is gradually eroding the traditional dominance of lead acid in the SLI (starting, lighting, and ignition) applications segment. This ongoing substitution poses a long-term threat to the growth of the lead acid battery market.

Key Market Opportunity

Increasing Demand in Renewable Energy Storage Applications

The renewable energy sector presents a significant growth opportunity for the lead acid battery market. As solar and wind installations grow worldwide, particularly in off-grid and hybrid systems, the need for affordable and robust storage solutions is becoming critical. Lead acid batteries are emerging as a cost-effective alternative for solar PV systems, especially in remote and rural areas where budget constraints limit the adoption of high-cost energy storage options.

For instance, in regions like sub-Saharan Africa, the rising installation of microgrids and hybrid solar-diesel systems often incorporates lead acid batteries for energy storage. These batteries offer a mature, proven technology that can provide reliable service over many years, enhancing the viability and affordability of renewable energy projects in underserved regions.

Segments Insights:

Product Insights

SLI (Starting, Lighting, and Ignition) batteries have maintained a dominant position in the lead acid battery market owing to their widespread application in automotive vehicles for starting engines and powering ancillary functions. Almost every internal combustion engine (ICE) vehicle uses an SLI battery, making this segment the largest revenue generator. Furthermore, the steady production and sales of automobiles globally, including passenger cars, trucks, and motorcycles, have consistently supported this dominance. Even as the industry shifts toward electric vehicles, the massive existing fleet of ICE vehicles ensures sustained demand for SLI batteries for replacements and servicing.

Conversely, the Motive battery segment is projected to grow the fastest during the forecast period. Increasing adoption of electric bicycles, electric forklifts, and material handling equipment in manufacturing and warehousing sectors is propelling the growth of motive lead acid batteries. Countries like China and the Netherlands are witnessing a boom in e-bike sales, further strengthening demand. Additionally, efforts to decarbonize the logistics and transportation sectors are fueling investments in battery-powered transport vehicles, thereby expanding the scope for motive lead acid batteries.

Construction Method Insights

Flooded lead acid batteries dominated the construction method segment due to their cost-effectiveness, durability, and ability to handle deep discharges. These batteries are extensively used in automotive applications, industrial UPS systems, and large-scale energy storage owing to their proven reliability under a wide range of operating conditions. Industries that require rugged and economically viable solutions continue to prefer flooded batteries, particularly in developing economies.

However, Valve Regulated Lead Acid (VRLA) batteries are projected to be the fastest-growing segment. VRLA batteries, including AGM and gel technologies, offer sealed designs that eliminate the need for maintenance while providing high power densities and better performance in confined spaces. Their rising adoption in UPS, telecom towers, healthcare facilities, and other critical applications is propelling rapid growth in this segment.

Application Insights

The automotive sector captured the largest share of the lead acid battery market due to the ubiquitous use of SLI batteries in traditional vehicles. Even as hybrid and electric vehicle adoption grows, conventional vehicles still form a majority of the automotive fleet, ensuring steady demand for replacement and new batteries. Automotive manufacturers’ preference for lead acid batteries due to their affordability and established supply chains has further cemented their dominance.

Meanwhile, the Electric Bikes segment is expected to witness the fastest growth rate. The surge in personal mobility solutions, driven by environmental awareness and government incentives, has significantly boosted the popularity of electric bikes. Lead acid batteries, offering an economical power solution for entry-level e-bikes, are contributing to this segment’s accelerated expansion, particularly in cost-sensitive markets like India, Vietnam, and parts of Europe.

Regional Insights

Asia-Pacific holds the largest share in the global lead acid battery market, driven by the sheer scale of automotive manufacturing, industrial activity, and telecom expansion in countries like China, India, and Japan. China alone, being the world’s largest automobile producer and consumer, heavily utilizes lead acid batteries for both OEM and aftermarket sales. Additionally, the rapid growth of telecom networks and infrastructure projects in India and Southeast Asia ensures sustained demand for both stationary and motive batteries. The region’s focus on renewable energy adoption and the development of microgrids also provides numerous growth opportunities for lead acid battery manufacturers.

.jpg)

The Middle East & Africa (MEA) region is witnessing the fastest growth in the lead acid battery market, propelled by rapid urbanization, infrastructure development, and increasing telecom penetration. Many African countries, grappling with electricity supply challenges, are investing in backup power systems where lead acid batteries are a critical component. Initiatives like the African Union’s Agenda 2063 and various renewable energy projects in Gulf Cooperation Council (GCC) countries further underscore the growing demand. For instance, solar-powered telecom tower projects in Kenya and Nigeria predominantly use lead acid batteries, boosting market prospects across MEA.

Some of the prominent players in the lead-acid battery market include:

- East Penn Manufacturing Co.

- Exide Technologies

- Johnson Controls

- ATLASBX Co. Ltd.

- NorthStar

- C&D Technologies, Inc.

- Narada Power Source Co., Ltd.

- Amara Raja Corporation

- GS Yuasa Corp

- Crown Battery Manufacturing

- Leoch International Technology Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global lead acid battery market.

Product

Construction Method

Application

- Automotive

- UPS

- Telecom

- Electric bikes

- Transport vehicles

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)