Life Science Analytics Market Size & Trends

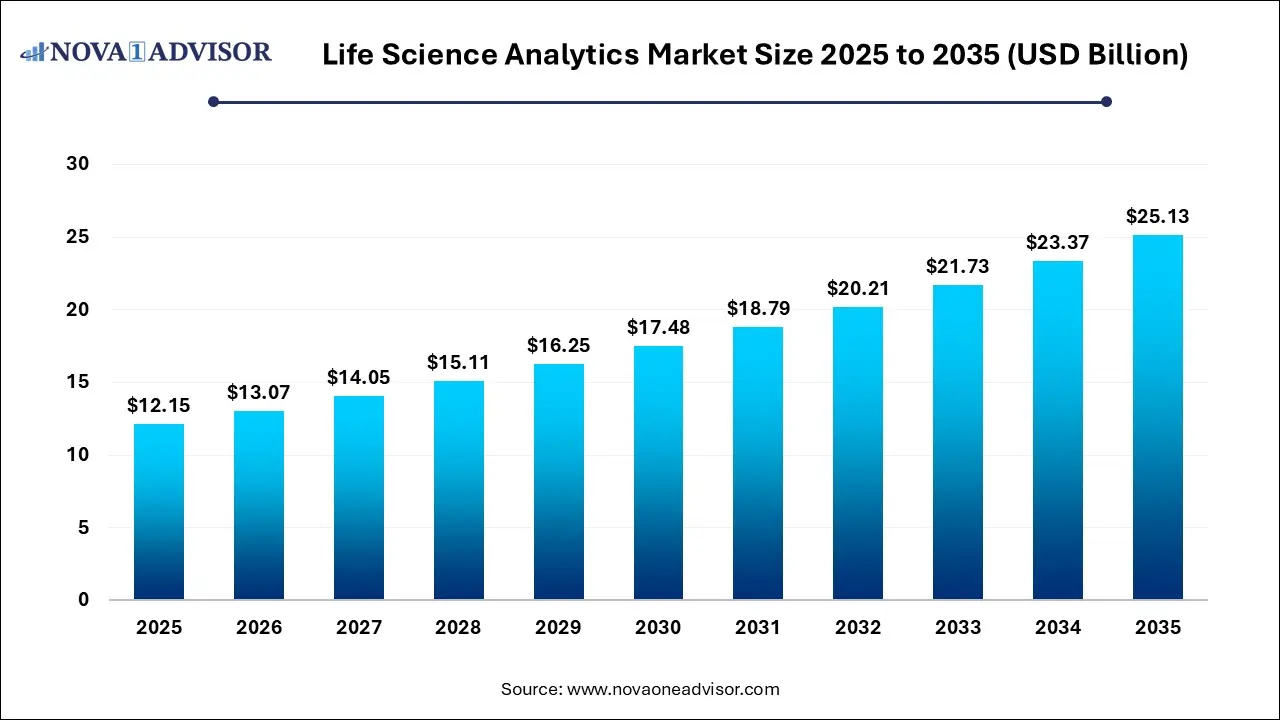

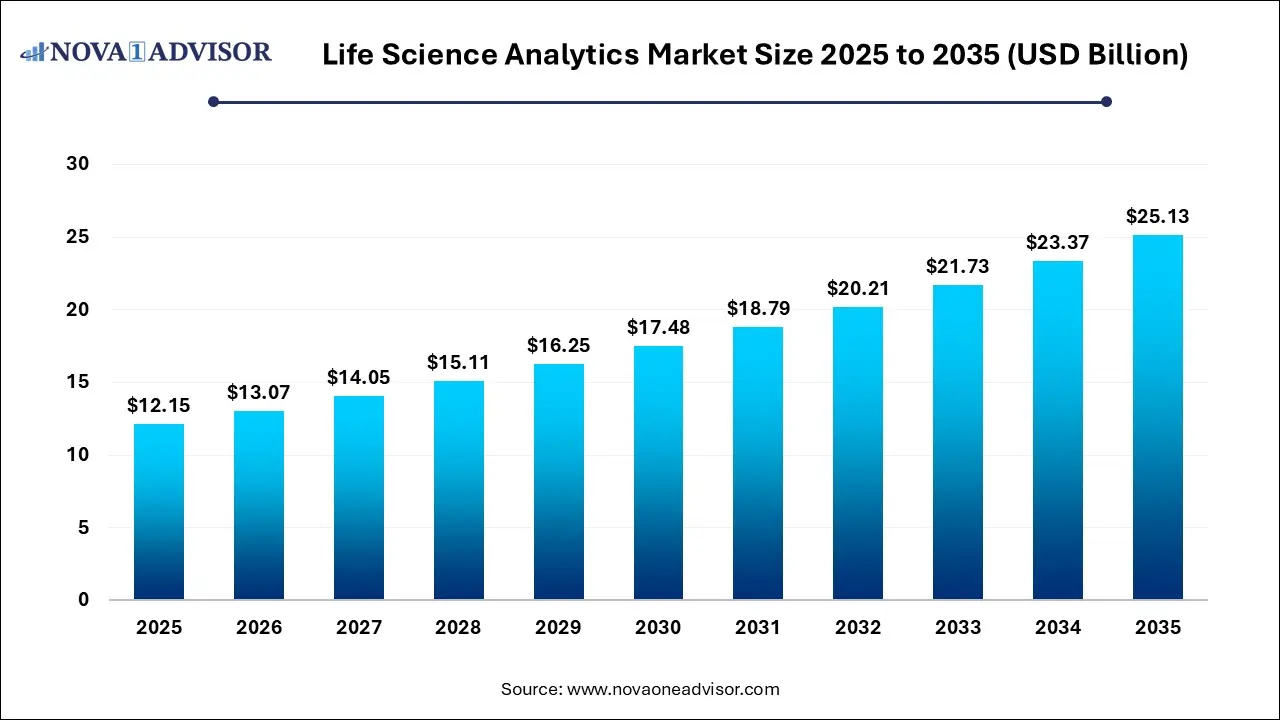

The global life science analytics market size was exhibited at USD 12.15 billion in 2025 and is projected to hit around USD 25.13 billion by 2035, growing at a CAGR of 7.54% during the forecast period 2026 to 2035.

Key Takeaways:

- The services segment held the largest revenue share of 57.66% in 2025

- The descriptive analytics segment held the largest revenue share in the market in 2025

- The sales and marketing support segment held the largest revenue share in 2025

- The on-demand segment held the largest revenue share in 2025

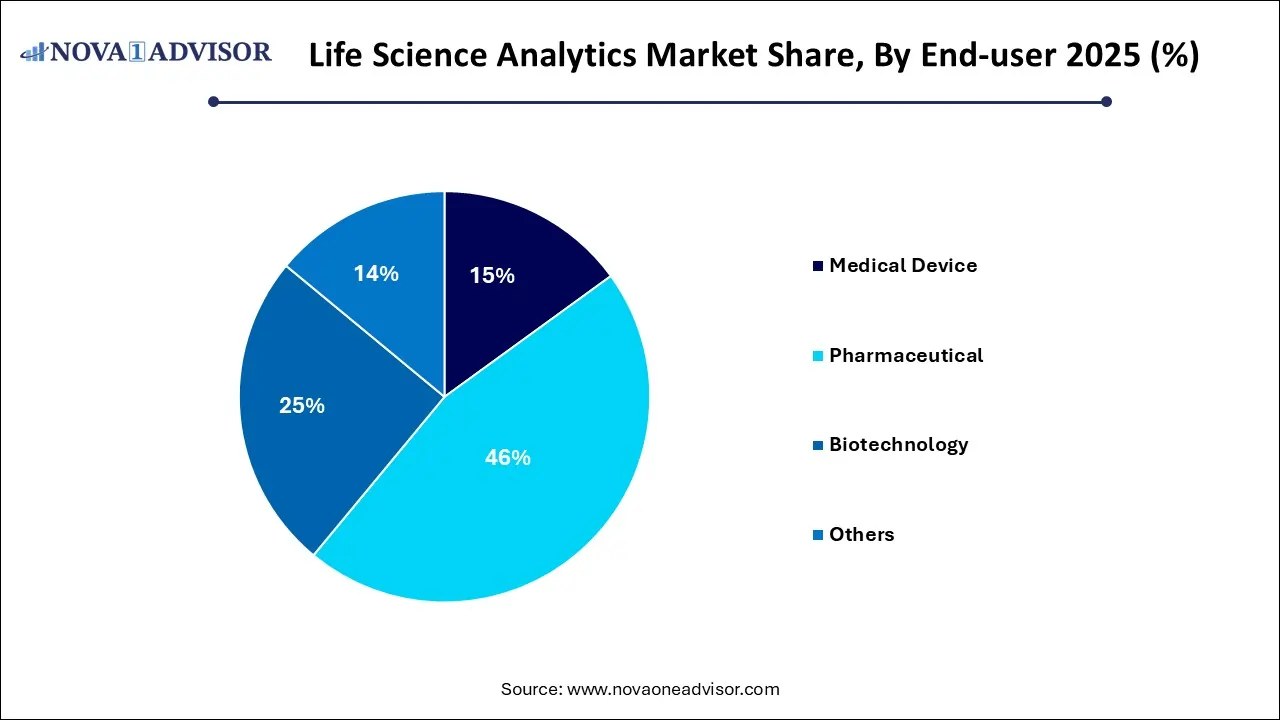

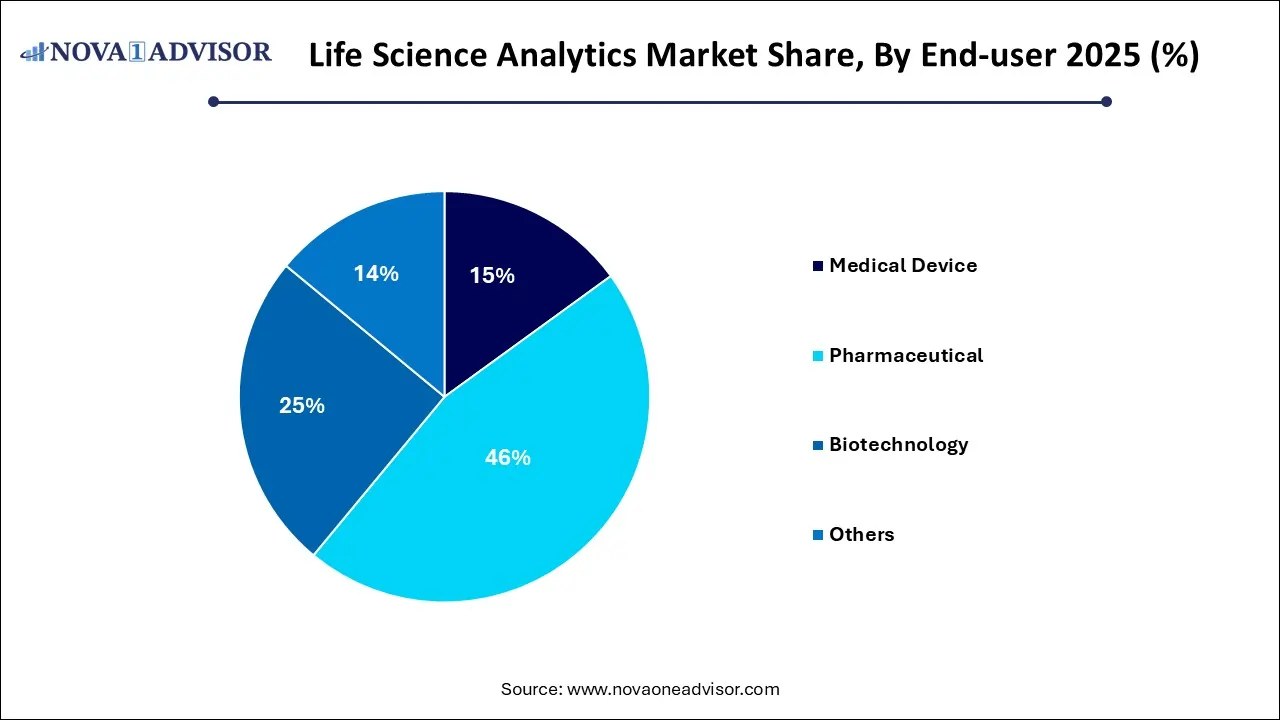

- The pharmaceutical segment held the largest revenue share in 2025

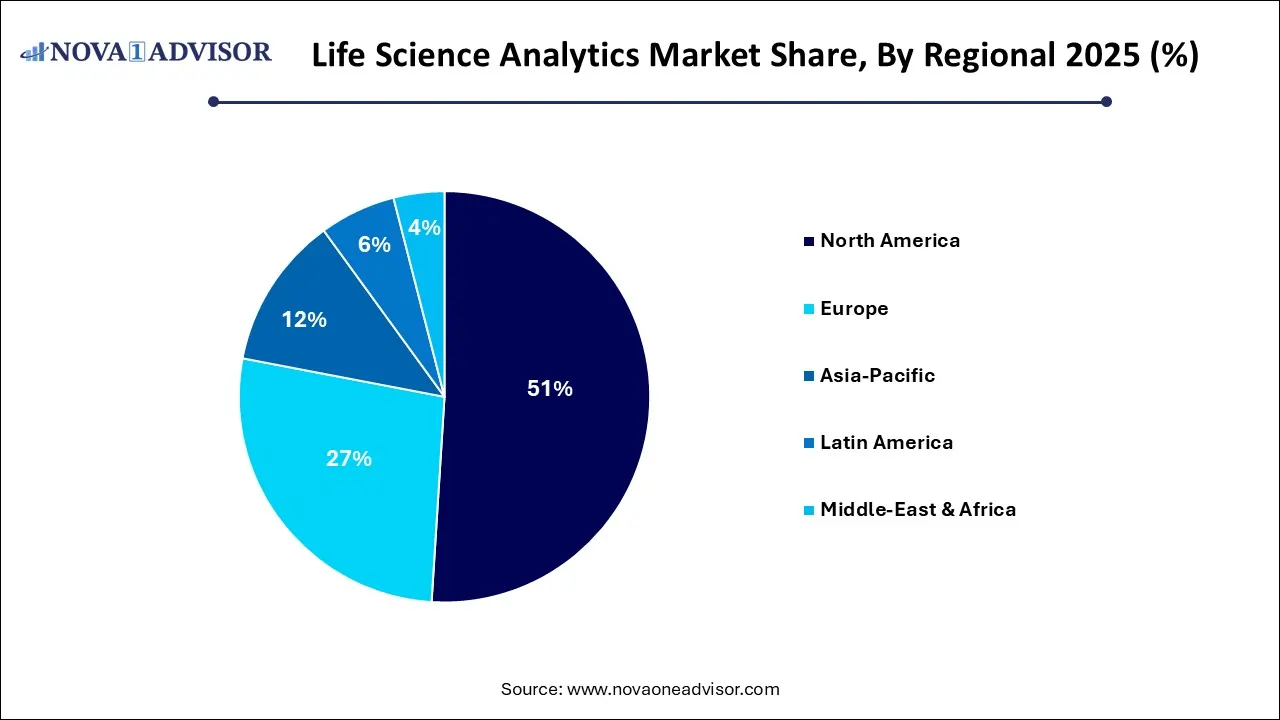

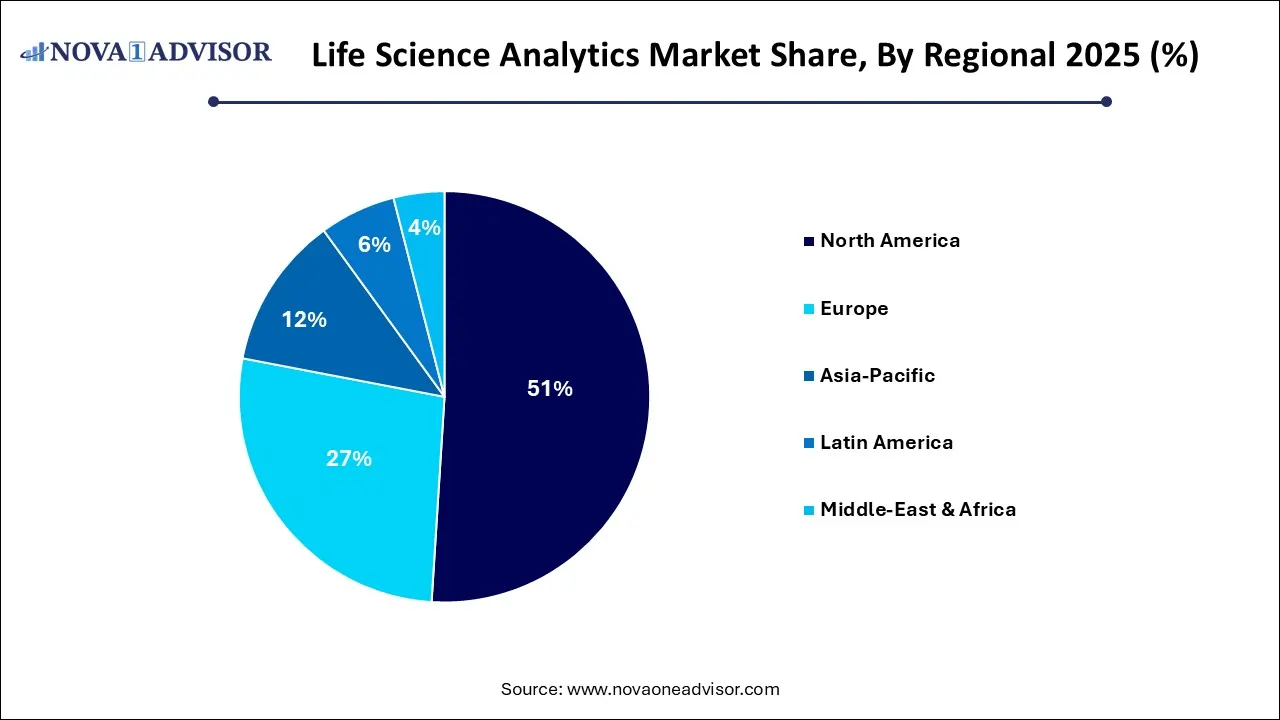

- North America life science analytics market dominated the global market and accounted for a revenue share of 51% in 2024

Market Overview

The Life Science Analytics Market is transforming the healthcare and biopharmaceutical sectors by enabling data-driven decision-making across research, development, commercialization, and regulatory processes. In a world increasingly reliant on precision medicine, personalized healthcare, and evidence-based interventions, life science analytics is emerging as a fundamental catalyst for innovation and operational excellence.

Life science analytics refers to the application of advanced analytical tools ranging from simple reporting dashboards to complex predictive and prescriptive analytics specifically tailored for pharmaceutical, biotechnology, and medical device industries. These tools empower organizations to uncover critical insights from vast datasets, optimize clinical trials, accelerate drug development timelines, ensure regulatory compliance, manage supply chains efficiently, and enhance sales and marketing strategies.

Key drivers of this market include the explosion of healthcare data from clinical trials, genomics, patient registries, real-world evidence (RWE) initiatives, and electronic health records (EHRs); the growing emphasis on precision medicine; and the urgent need for operational efficiency amidst rising R&D costs. Advanced technologies such as artificial intelligence (AI), machine learning (ML), natural language processing (NLP), and big data analytics are being integrated with life science analytics platforms to deliver deeper, faster, and more actionable insights.

The COVID-19 pandemic further catalyzed digital transformation in the life sciences industry, with analytics playing a crucial role in vaccine development, drug repurposing efforts, and supply chain resilience. As the healthcare ecosystem continues to evolve, life science analytics will remain at the forefront of enhancing patient outcomes, optimizing resource utilization, and driving strategic growth for life sciences companies.

Major Trends in the Market

-

Growing Adoption of Real-World Evidence (RWE) Analytics: Life science companies are increasingly leveraging real-world patient data to complement clinical trial findings and support regulatory approvals.

-

Integration of Artificial Intelligence and Machine Learning: Predictive and prescriptive analytics powered by AI/ML algorithms are revolutionizing drug discovery, patient stratification, and market forecasting.

-

Shift Toward Cloud-Based Analytics Platforms: Cloud deployments are providing scalability, real-time insights, and cost efficiencies, encouraging wider adoption among mid-sized and large enterprises.

-

Personalized and Precision Medicine Initiatives: Analytics is becoming indispensable for tailoring therapies to individual genetic profiles, enhancing treatment efficacy, and minimizing adverse events.

-

Expansion of Pharmacovigilance and Risk Management Analytics: Heightened regulatory scrutiny is driving demand for advanced analytics solutions for adverse event detection and safety reporting.

-

Growing Focus on Sales and Marketing Optimization: Life science firms are using descriptive and predictive analytics to fine-tune marketing strategies, optimize field force performance, and maximize ROI.

-

Collaborations and Partnerships Across Ecosystems: Strategic alliances between tech companies, CROs (Contract Research Organizations), and pharma firms are expanding analytics capabilities.

-

Rising Regulatory Pressure and Data Governance Requirements: Stringent compliance standards like GDPR and HIPAA are driving the need for robust analytics with strong data security and privacy controls.

Life Science Analytics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 13.07 Billion |

| Market Size by 2035 |

USD 25.13 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.54% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Component, Type, Application, Delivery, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Accenture; Cognizant; IBM; Wipro Limited; Take Solutions Limited; IQVIA; Oracle; SAS Institute, Inc. |

Key Market Driver

Rising Demand for Personalized Medicine

The growing focus on personalized medicine delivering treatments tailored to individual genetic, environmental, and lifestyle factors is a major driver of the life science analytics market. Traditional "one-size-fits-all" models of drug development are increasingly giving way to precision strategies that require detailed patient segmentation, biomarker identification, and outcome prediction.

Life science analytics platforms enable researchers and clinicians to sift through vast genomic databases, integrate clinical and molecular data, and identify patterns that inform personalized therapeutic interventions. For instance, in oncology, predictive analytics models help determine which patients are most likely to respond to targeted therapies based on tumor genetics.

Companies like Roche, through platforms like Foundation Medicine, are heavily investing in analytics-driven precision oncology solutions. As the number of personalized therapies in pipelines grows, analytics will become even more critical for optimizing clinical trial designs, selecting patient cohorts, and gaining regulatory approvals faster.

Key Market Restraint

Data Privacy and Security Concerns

Despite its transformative potential, the life science analytics market faces substantial challenges related to data privacy and security. Life sciences organizations handle highly sensitive information including patient health records, genetic data, clinical trial results, and proprietary research findings.

Data breaches, cybersecurity threats, and non-compliance with data protection regulations such as GDPR (General Data Protection Regulation) and HIPAA (Health Insurance Portability and Accountability Act) can result in severe financial penalties, reputational damage, and loss of public trust. The complexity of managing multi-source, cross-border data flows further exacerbates security challenges.

Ensuring end-to-end encryption, establishing robust access controls, investing in cybersecurity infrastructure, and adopting transparent data governance frameworks are imperative for mitigating these risks and fostering greater confidence in analytics-driven innovations.

Key Market Opportunity

Expanding Use of Advanced Analytics in Drug Discovery

A major untapped opportunity in the life science analytics market lies in the expansion of advanced analytics across early-stage drug discovery. Traditional drug discovery processes are notoriously time-consuming, expensive, and fraught with high failure rates.

By applying machine learning algorithms, natural language processing (NLP), and big data analytics, life sciences companies can rapidly analyze vast biological datasets, predict drug-target interactions, identify new molecular entities, and prioritize candidates with the highest success probabilities. Companies like BenevolentAI and Atomwise are leveraging AI-driven analytics to identify promising compounds faster than traditional methods.

With pharmaceutical R&D costs soaring and the patent cliffs looming for many blockbuster drugs, early integration of analytics into the discovery process can dramatically accelerate innovation pipelines and reduce time-to-market, offering a powerful competitive advantage.

By Component Insights

The Software segment dominated the life science analytics market, fueled by the growing demand for powerful analytics platforms capable of handling complex datasets, generating actionable insights, and supporting decision-making across research, regulatory, and commercial functions. Vendors like SAS Institute, Oracle, and IBM offer comprehensive software suites tailored for life sciences applications including clinical trial analytics, pharmacovigilance, and market performance analytics.

Software solutions provide visualization dashboards, data mining tools, predictive modeling engines, and compliance management features that streamline workflows across the entire life sciences value chain. Cloud-based, AI-enhanced, and customizable software solutions are particularly gaining traction as life science organizations seek greater flexibility and scalability.

Meanwhile, the Services segment is expected to witness the fastest growth. The increasing complexity of analytics deployment ranging from integration with legacy systems to compliance auditing drives demand for consulting, implementation, managed services, and training. Life science firms are increasingly outsourcing analytics functions to specialist service providers to leverage domain expertise, reduce costs, and focus on core R&D and commercialization activities.

By Type Insights

The Descriptive analytics segment held the largest share of the life science analytics market, primarily because it serves as the foundation for data-driven decision-making. Descriptive analytics tools aggregate historical data from clinical trials, sales channels, regulatory submissions, and supply chains, enabling life sciences companies to understand what has happened and why.

Dashboards, reports, and visual analytics tools facilitate trend analysis, performance benchmarking, and operational monitoring. For example, pharmaceutical sales teams use descriptive analytics to identify top-performing products and geographies, guiding future marketing strategies.

However, Predictive Analytics is projected to grow at the fastest rate. Fueled by machine learning, AI, and real-time data integration, predictive analytics models forecast future trends, such as disease outbreaks, patient responses to therapies, and market dynamics. By anticipating risks and opportunities, life science companies can make proactive, strategic decisions, enhancing their competitive agility.

By Application Insights

The Research and Development (R&D) segment dominated the life science analytics market, reflecting the intense focus on enhancing clinical trial efficiency, improving candidate screening, and reducing time-to-market for new therapies. Analytics tools assist in protocol design, site selection, patient recruitment, and trial monitoring, thereby addressing key R&D bottlenecks.

The incorporation of real-world data (RWD) and real-world evidence (RWE) into clinical development programs is further enhancing R&D productivity, allowing companies to design more patient-centric, adaptive trials.

On the other hand, Pharmacovigilance is expected to be the fastest-growing application area. With increasing regulatory scrutiny and the emphasis on drug safety, analytics is playing a crucial role in monitoring adverse events, detecting safety signals early, and automating risk management plans. Advanced pharmacovigilance analytics platforms help pharmaceutical firms comply with evolving global regulations while safeguarding public health.

By Delivery Insights

The On-demand (Cloud-based) delivery segment dominated the market, driven by the need for flexibility, scalability, and cost efficiency. Cloud-based analytics platforms allow life sciences companies to access powerful computing resources without the need for heavy IT infrastructure investments, accelerating data processing and collaboration across global teams.

Real-time access to analytics tools enables faster decision-making in dynamic environments such as clinical trials, pharmacovigilance monitoring, and supply chain operations.

Conversely, On-premises deployment retains significance in highly regulated environments where data privacy, security, and control are paramount. Some large pharmaceutical companies and government research institutes continue to favor on-premises solutions for mission-critical applications.

By End-user Insights

The Pharmaceutical sector accounted for the largest market share, as analytics tools are critical in every phase from drug discovery and clinical development to regulatory compliance and commercialization. Big pharma companies like Pfizer, Novartis, and Merck are heavily investing in analytics platforms to boost R&D productivity, optimize go-to-market strategies, and enhance patient engagement.

The growing adoption of data-driven approaches for market access, pharmacovigilance, and competitive intelligence further cements the pharmaceutical sector's dominance.

Meanwhile, the Biotechnology sector is poised to grow the fastest. The biotech industry’s focus on niche therapies, precision medicine, and cutting-edge modalities like gene therapies and cell therapies demands sophisticated analytics capabilities. Smaller biotech firms are leveraging cloud-based, AI-driven analytics to gain competitive advantages without massive infrastructure investments.

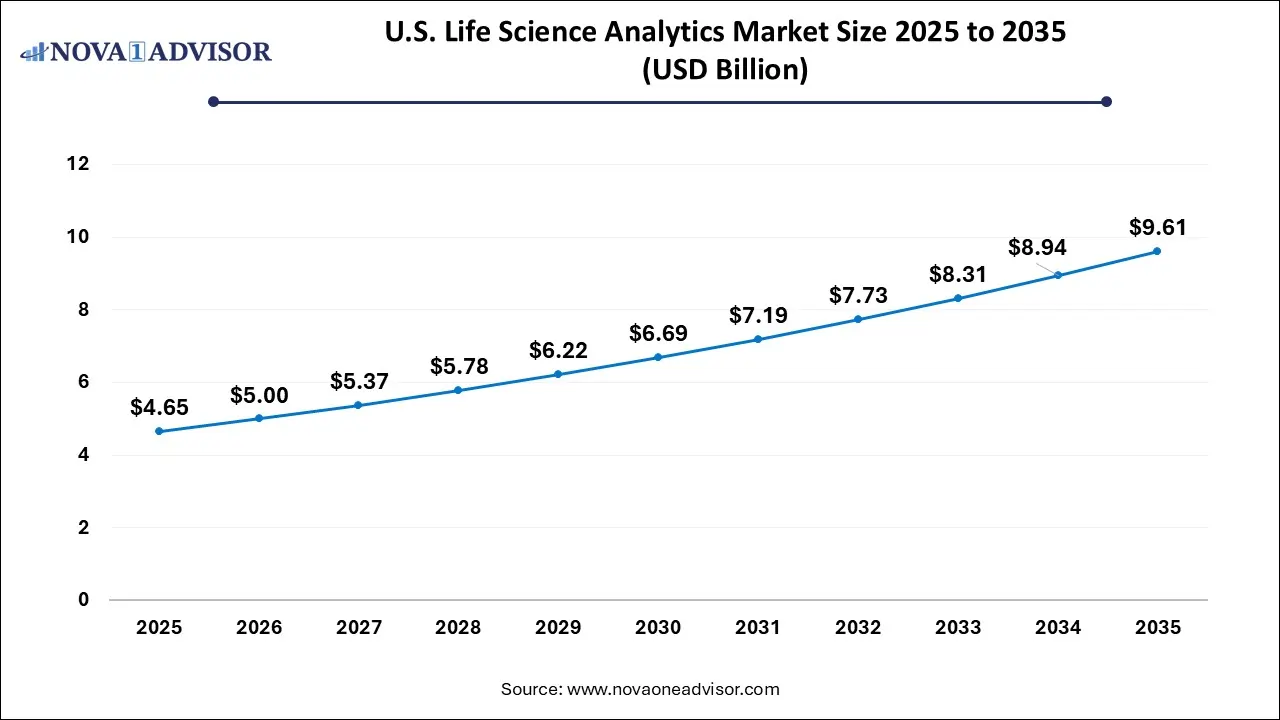

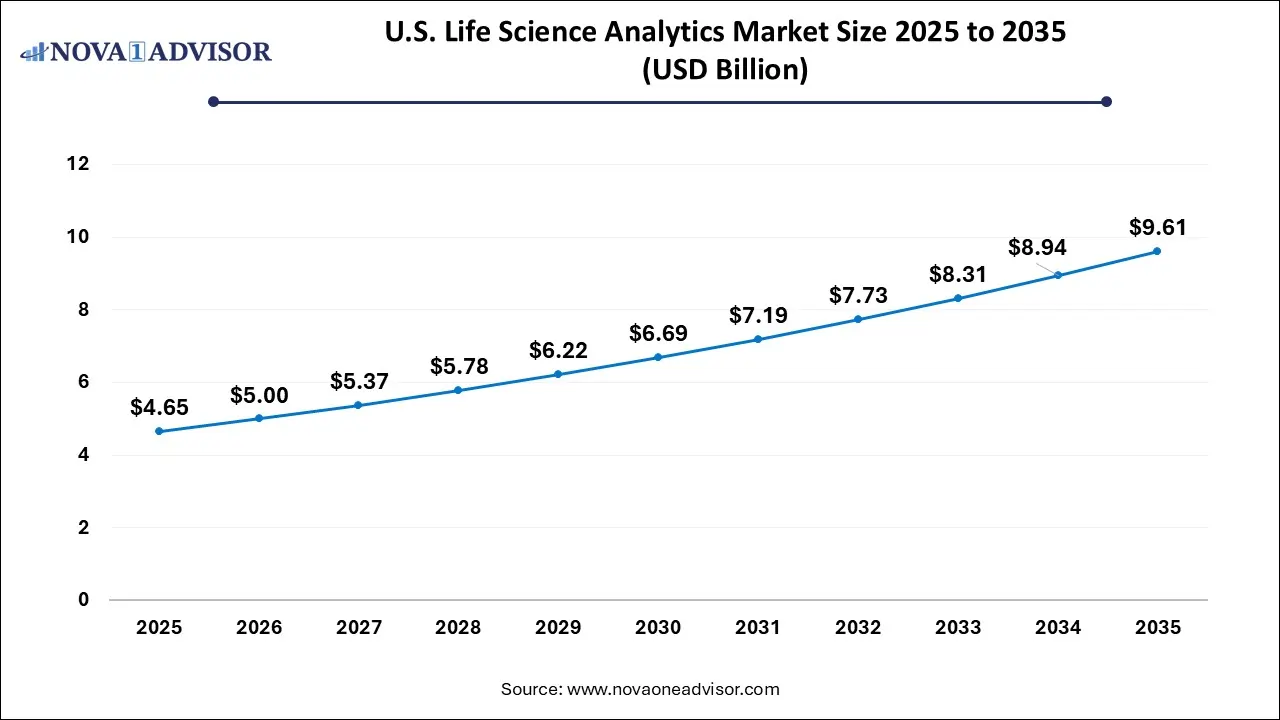

U.S. Life Science Analytics Market Size and Growth 2026 to 2035

The U.S. life science analytics market size is calculated at USD 4.65 billion in 2025 and is expected to reach nearly USD 9.61 billion in 2035, accelerating at a strong CAGR of 6.82% between 2026 and 2035.

By Regional Insights

North America dominated the life science analytics market, driven by factors such as strong healthcare infrastructure, high R&D expenditure, regulatory mandates for data transparency, and a mature digital health ecosystem. The U.S., being home to leading pharmaceutical giants, biotech innovators, CROs, and health IT companies, remains the epicenter of analytics innovation.

Government initiatives such as the U.S. 21st Century Cures Act, promoting clinical trial modernization and real-world evidence usage, are further boosting analytics adoption. Major life sciences hubs like Boston, San Francisco, and New Jersey are spearheading the integration of AI, big data, and analytics into healthcare and drug development.

Asia-Pacific is witnessing the fastest growth, fueled by the rapid expansion of pharmaceutical manufacturing, rising investment in biotech research, growing digital health initiatives, and the adoption of cloud computing across emerging economies. Countries like China, India, Japan, South Korea, and Singapore are leading regional growth.

The Chinese government's "Healthy China 2030" initiative and India’s push for clinical trial modernization are creating fertile ground for life science analytics adoption. Additionally, cost-effective clinical trials, a large patient pool, and increasing cross-border collaborations are attracting global players to expand their analytics-driven operations in the region.

Key Companies & Market Share Insights

Some of the key participants in the market are developing advanced analytical solutions and systems. The companies are focusing on devising innovative product development strategies to expand their product offerings and revising their partnerships and collaborations across the market to expand their business footprint and cater to the growing demand for analytical solutions.

Life science organizations are implementing analytical solutions in delivering personalized medication and value-based care and combating the Covid-19 pandemic. For instance, in April 2021, IQVIA Connected Intelligence was launched for customers to use analytical solutions in discovering data-driven insights and support effective decision making. IQVIA integrated its expertise in healthcare analytics with innovative technologies to deliver Connected Intelligence solutions. Some prominent players in the global life science analytics market include:

- Oracle

- IQVIA

- SAS Institute Inc.

- Cognizant

- IBM

- Accenture

- Take Solutions Limited

- Wipro Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the global Life Science Analytics market.

By Component

By Type

- Reporting

- Descriptive

- Predictive

- Prescriptive

By Application

- Research and Development

- Sales and Marketing Support

- Regulatory Compliance

- Supply Chain Analytics

- Pharmacovigilance

By Delivery

By End User

- Medical Device

- Pharmaceutical

- Biotechnology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)