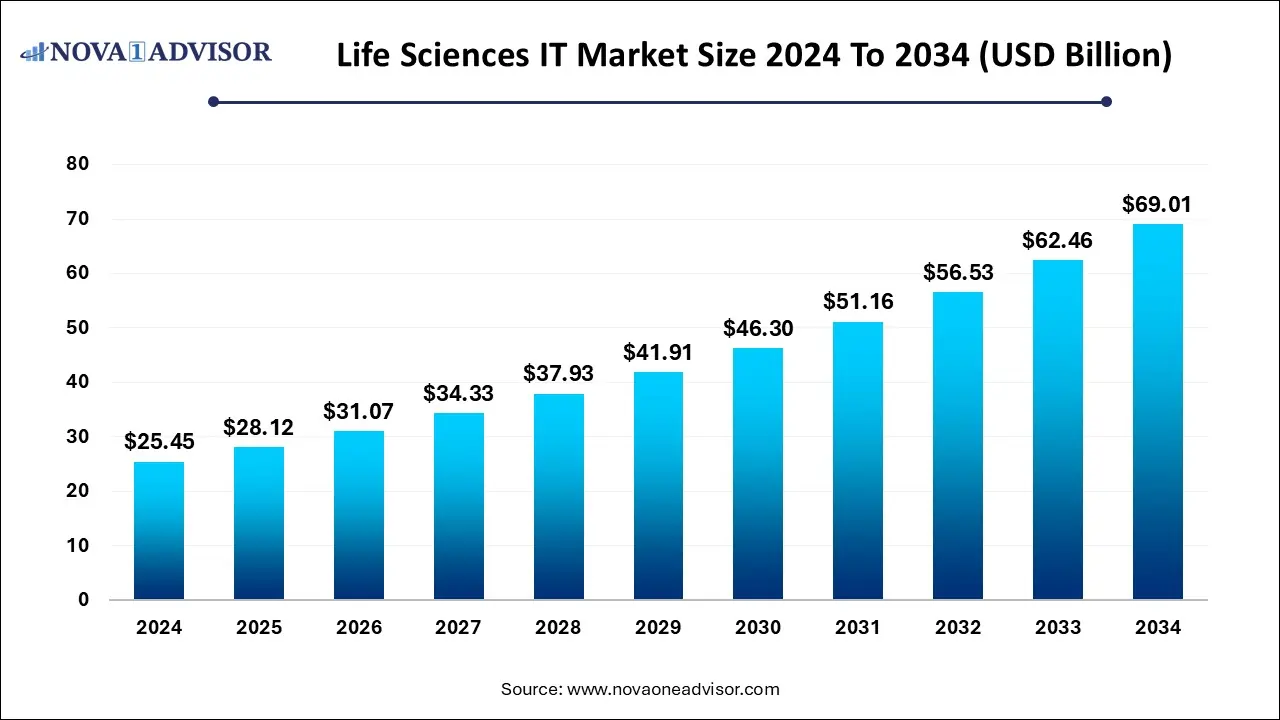

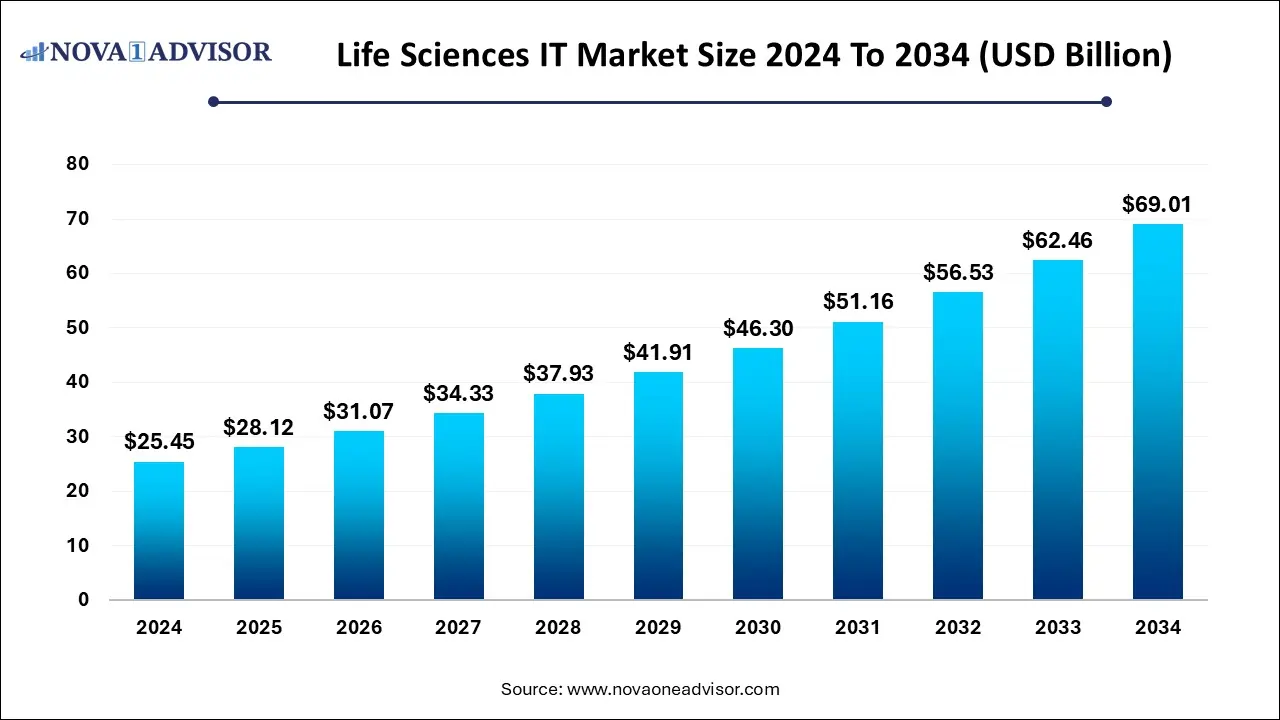

Life Sciences IT Market Size and Growth 2025 to 2034

The global life sciences IT market size was estimated at USD 25.45 billion in 2024 and is expected to hit USD 69.01 billion in 2034, expanding at a CAGR of 10.49% over the forecast period of 2025-2034. The market growth is driven by rising adoption of digital technologies, growing demand for cloud-based solutions, increased focus on data-driven drug discovery, expanding use of AI and analytics in clinical research, and stringent regulatory requirements for data management and compliance.

Key Takeaways

- By region, North America held the largest share of the life sciences IT market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By solution type, the data analytics & big data solutions segment led the market in 2024.

- By solution type, the cloud-based IT infrastructure segment is expected to expand at the highest CAGR over the projected timeframe.

- By application, the drug discovery & development segment led the market in 2024.

- By application, the genomics & personalized medicine segment is expected to expand at the highest CAGR over the projection period.

- By end user, the pharmaceutical & biotechnology companies segment led the market in 2024.

How is AI Impacting the Life Sciences IT Market?

AI is significantly influencing the life sciences IT market by enhancing efficiency, accuracy, and innovation across research, development, and clinical operations. AI-driven platforms are accelerating drug discovery by analyzing complex biological datasets and predicting potential therapeutic targets faster than traditional methods. In clinical trials, AI enables smarter patient recruitment, real-time monitoring, and predictive analytics to improve success rates and reduce costs. Additionally, AI supports personalized medicine by integrating genomic, clinical, and behavioral data to tailor treatments to individual patients.

- In June 2025, IQVIA Holdings Inc. introduced new AI agents in partnership with NVIDIA Corporation for life-science workflows, aiming to accelerate decision-making in drug development and clinical operations.

Market Overview

The market growth is driven by the increasing adoption of cloud computing, AI and big data analytics, rising R&D investments, and the growing need for digital transformation in life sciences. Collectively, these factors are positioning Life Science IT as a cornerstone for innovation, productivity, and precision-driven healthcare advancements. The life science IT market encompasses digital technologies, software solutions, and data management systems that support research, clinical trials, manufacturing, and regulatory processes in the life sciences industry. These solutions enable efficient data integration, real-time analytics, and collaboration across pharmaceutical, biotechnology, and healthcare organizations. Key benefits include accelerated drug discovery, improved clinical trial management, enhanced regulatory compliance, and better patient outcome tracking.

Report Scope of Life Sciences IT Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 28.12 Billion |

| Market Size by 2034 |

USD 69.01 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.49% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Solution Type, By Application, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

What are the Major Trends in the Life Sciences IT Market?

- Adoption of Cloud-Based Platforms

Life science companies are increasingly using cloud infrastructure for data storage, scalability, and collaboration. Cloud solutions enable real-time data access, secure sharing between global research teams, and streamlined regulatory compliance.

- Growing Use of Real-World Data (RWD) and Real-World Evidence (RWE)

Organizations are leveraging real-world data from electronic health records, wearable devices, and patient registries to support clinical research and regulatory submissions. This trend improves drug safety monitoring and facilitates evidence-based decision-making.

- Expansion of Digital Clinical Trials

The rise of decentralized and hybrid clinical trials supported by digital tools and telehealth platforms is transforming trial management. These innovations increase patient engagement, reduce recruitment challenges, and speed up data collection.

- Focus on Data Security and Regulatory Compliance

With growing data volumes, cybersecurity and compliance with standards such as GDPR, HIPAA, and FDA 21 CFR Part 11 have become top priorities. Companies are investing in secure IT frameworks and blockchain technologies to ensure data integrity and patient privacy.

Market Dynamics

Rising Digital Transformation

Rising digital transformation is a major driver of growth in the life science IT market, as organizations increasingly integrate advanced technologies to enhance efficiency and innovation. Digital tools such as artificial intelligence, cloud computing, and big data analytics are streamlining research and development, enabling faster drug discovery and clinical trial management. These technologies also facilitate real-time data sharing, automation, and collaboration across global research teams, reducing operational costs and time-to-market. Moreover, digital platforms improve data accuracy and regulatory compliance, which are critical in life sciences.

Growing Volume of Biomedical Data

The growing volume of biomedical data is another key factor driving the growth of the life science IT market, as the industry increasingly relies on advanced technologies to manage and analyze complex datasets. With the expansion of genomics, proteomics, clinical trials, and real-world evidence studies, life science organizations generate massive amounts of structured and unstructured data. This surge in data volume necessitates robust IT solutions such as cloud platforms, big data analytics, and AI-based systems to extract meaningful insights. Efficient data management enables faster drug discovery, personalized medicine development, and improved decision-making in clinical research.

Restraint

High Implementation and Integration Costs

Deploying advanced technologies such as AI, big data analytics, and cloud infrastructure requires significant upfront investment in hardware, software, and skilled personnel. Additionally, ongoing expenses for system upgrades, cybersecurity, and regulatory compliance add to the total cost of ownership. These financial challenges often limit the adoption of digital solutions, especially in regions with constrained healthcare budgets. As a result, while large enterprises can embrace digital transformation, cost barriers slow down widespread adoption across the broader life sciences ecosystem.

Opportunities

Emergence of Real-World Data (RWD) and Real-World Evidence (RWE)

The emergence of real-world data (RWD) and real-world evidence (RWE) is creating immense opportunities in the life science IT market by transforming how pharmaceutical and biotechnology companies approach research, development, and regulatory processes. RWD from electronic health records, wearable devices, and patient registries provides valuable insights into treatment effectiveness and patient outcomes beyond controlled clinical settings. Life Science IT solutions enable the efficient collection, integration, and analysis of these vast datasets to generate actionable RWE for drug development and market access strategies. Regulatory agencies such as the FDA and EMA are increasingly recognizing RWE in decision-making, further driving adoption.

Expansion of Cloud-Based Platforms

Rising development and adoption of cloud-based platforms creates immense opportunities by enabling scalable, secure, and cost-effective data management across research and clinical operations. Cloud platforms allow seamless collaboration among global teams, facilitating real-time data sharing, faster analytics, and more efficient drug discovery processes. They also support integration of large, complex datasets from genomics, clinical trials, and patient records, enhancing decision-making and innovation. Moreover, cloud adoption reduces infrastructure costs and improves compliance with data security and regulatory requirements.

- In November 2025, Switzerland-based Tenthpin Management Consultants launched its Centre for Life Sciences Cloud Solutions in Pune, establishing a Global Centre of Excellence for cloud and AI-driven innovation. The center is set to develop future-ready cloud solutions for Pharma, Medtech, Biotech, Healthcare, Animal Health, and CDMOs, enabling regulatory compliance, real-time insights, and seamless global collaboration.

How Macroeconomic Variables Influence the Life Sciences IT Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. as higher national income levels enable greater investments in healthcare infrastructure, research, and digital transformation initiatives. Expanding economies allocate more resources toward advanced IT solutions such as data analytics, AI, and cloud platforms to enhance R&D efficiency and regulatory compliance. Conversely, in periods of economic slowdown, reduced public and private spending can temporarily restrain the market by delaying technology adoption and project implementation.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the life sciences IT market by forcing pharmaceutical companies to find innovative ways to reduce costs and increase operational efficiency. Faced with shrinking profit margins due to rising material and labor costs, and lower potential revenues from government price controls, companies invest in IT solutions like AI, data analytics, and cloud computing to streamline processes from R&D to supply chain management. This shift from manual processes to advanced technology is a strategic response to market volatility, pushing the adoption of IT within the life sciences sector as a critical tool for survival and growth.

Exchange Rates

Exchange rate fluctuations can negatively affect companies operating globally. Volatile currency values increase the cost of importing advanced technologies, software, and IT services, impacting project budgets and profitability. Additionally, unfavorable exchange rates can discourage foreign investments and delay international collaborations, thereby slowing market growth and digital adoption in the life sciences sector.

Segment Outlook

By Solution Type Insights

What Made Data Analytics & Big Data Solutions the Dominant Segment in the Life Sciences IT Market in 2024?

The data analytics & big data solutions segment dominated the market with the largest share in 2024. This is because of the rising need for data-driven decision-making across pharmaceutical and biotechnology research. Life science organizations are leveraging advanced analytics, artificial intelligence, and machine learning to process massive volumes of clinical, genomic, and patient data for faster, more accurate insights. These solutions enable predictive modeling, real-time monitoring, and improved clinical trial outcomes, significantly enhancing R&D efficiency. Furthermore, the integration of big data platforms supports regulatory compliance and personalized medicine initiatives, solidifying their central role in digital transformation across the life sciences industry.

The cloud-based IT infrastructure segment is expected to grow at the fastest CAGR during the projection period, owing to its scalability, flexibility, and cost-efficiency in managing vast volumes of research and clinical data. Cloud platforms enable real-time collaboration among globally distributed teams, accelerating drug discovery, clinical trials, and data sharing across organizations. Additionally, the growing adoption of hybrid and multi-cloud strategies supports secure data storage and regulatory compliance in sensitive healthcare environments. With increasing digital transformation initiatives and the integration of AI and analytics into cloud platforms, life science companies are rapidly transitioning from on-premises systems to cloud-based infrastructure to enhance innovation and operational efficiency.

By Application Insights

How Does the Drug Discovery & Development Segment Dominate the Life Sciences IT Market in 2024?

The drug discovery & development segment dominated the market with the largest share in 2024. This is due to the growing integration of digital technologies such as AI, machine learning, and bioinformatics into research processes. These tools enable faster target identification, compound screening, and molecular modeling, significantly reducing the time and cost associated with traditional R&D. Pharmaceutical companies are increasingly adopting advanced IT platforms to analyze complex biological data, simulate drug interactions, and optimize trial designs. Moreover, the need for precision medicine and the utilization of real-world data further strengthen the demand for IT solutions in drug discovery, making this segment the cornerstone of digital innovation in the life sciences industry.

The genomics & personalized medicine segment is expected to grow at the fastest CAGR over the projection period, driven by rising demand for precision therapies tailored to individual genetic profiles. Advancements in sequencing technologies, combined with AI and big data analytics, are enabling researchers to analyze vast genomic datasets for disease prediction and targeted drug development. Cloud-based bioinformatics platforms further facilitate real-time data sharing and collaboration among research institutions and healthcare providers. Additionally, increased investments in genomic research and national-level precision medicine initiatives are driving the adoption of IT solutions that support personalized treatment approaches and improve patient outcomes.

By End User Insights

Why Did the Pharmaceutical & Biotechnology Companies Segment Lead the Market in 2024?

The pharmaceutical & biotechnology companies segment led the life sciences IT market in 2024 due to their extensive reliance on digital technologies to enhance research, development, and manufacturing processes. These companies are major adopters of AI, cloud computing, and data analytics to accelerate drug discovery, improve clinical trial efficiency, and ensure regulatory compliance. The integration of IT solutions enables them to manage complex datasets, streamline operations, and reduce overall development timelines. Moreover, increasing investments in digital transformation initiatives and collaborations with IT providers further strengthen their leadership in driving innovation within the life sciences ecosystem.

The contract research organization segment is expected to expand at the highest CAGR in the coming years. This is primarily due to the increasing trend of outsourcing research and clinical trial activities by pharmaceutical and biotechnology companies. CROs are rapidly adopting advanced IT solutions such as electronic data capture (EDC), clinical trial management systems (CTMS), and AI-based analytics to enhance efficiency and ensure data integrity. These technologies enable CROs to manage multi-site trials, monitor patient outcomes in real time, and comply with stringent regulatory standards. Furthermore, the growing demand for cost-effective and faster drug development processes is driving CROs to invest in digital transformation, making them a critical growth engine for the Life Science IT market.

By Regional Analysis

What Made North America the Dominant Region in the Market?

North America maintained dominance in the life sciences IT market, accounting for the largest share in 2024. The region’s dominance is primarily attributed to its strong technological infrastructure, high healthcare expenditure, and early adoption of advanced digital solutions, such as AI, cloud computing, and big data analytics, in life sciences. The presence of leading pharmaceutical and biotechnology companies, along with established IT service providers, further strengthened the region’s market position. Supportive government initiatives promoting digital health transformation and precision medicine accelerated innovation across research and clinical operations. Additionally, a well-developed regulatory framework and extensive R&D investments from both the public and private sectors contributed to the region’s leadership in the life sciences IT market.

The U.S. is a major contributor to the North American life sciences IT market, thanks to its advanced healthcare infrastructure and the strong presence of global pharmaceutical, biotechnology, and IT companies. The country’s emphasis on digital transformation in healthcare, along with high investments in genomics, personalized medicine, and clinical research, has fueled market growth. Additionally, supportive government policies, such as funding for health IT initiatives and data-driven research programs.

- In July 2025, the U.S. government has launched initiatives like the National AI Initiative to ensure American leadership in AI, which has direct applications for life science research.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for life sciences IT. This is due to increasing investments in healthcare infrastructure, rapid digitalization, and the growing adoption of advanced technologies such as AI, cloud computing, and data analytics. Emerging economies such as China, India, and Japan are heavily investing in life science research, biotechnology, and pharmaceutical development, creating strong demand for IT solutions. Government initiatives supporting digital health and precision medicine are further accelerating the integration of technology across research and clinical operations. Additionally, the region’s expanding patient population and growing focus on cost-effective healthcare innovation are driving the need for efficient IT systems.

China is a major player in the Asia Pacific life sciences IT market due to its massive investments in biotechnology, pharmaceutical research, and digital health infrastructure. The government’s strong support for innovation through initiatives like “Made in China 2025” and its focus on AI-driven healthcare solutions have accelerated market growth. Additionally, the rapid expansion of clinical research, data analytics capabilities, and collaborations with global life science IT providers have positioned China as the region's key growth engine.

How is the Opportunistic Rise of Europe in the Life Science IT Market?

Europe is emerging as a significant market for life sciences IT. This is due to the increasing adoption of digital technologies in healthcare, strong regulatory support for data integration, and a rising focus on personalized medicine. Countries such as Germany, the U.K., and France are investing heavily in digital health initiatives and R&D to enhance pharmaceutical innovation and patient care. The region’s emphasis on interoperability, data security, and compliance with regulations like GDPR has strengthened trust in IT-based healthcare solutions. Furthermore, growing collaborations between life science companies, research institutions, and technology providers are accelerating the deployment of advanced IT systems.

Germany is a major player in the European life sciences IT market due to its strong healthcare infrastructure, advanced research capabilities, and significant investments in digital transformation. The country’s well-established pharmaceutical and biotechnology industries actively adopt IT solutions to enhance drug discovery, clinical trials, and data management. Moreover, supportive government initiatives promote digital health and precision medicine, as well as collaborations between academia and industry.

Region-Wise Market Outlook

| Region |

Approximate Market Size in 2024 |

Projected CAGR (2025-2034) |

Major Growth Factors |

Key Restraints / Challenges |

Growth Overview |

| North America |

USD 10.6 Billion |

5.84% |

Large pharma & biotech base, high R&D spend, early adoption of AI/cloud/big-data, strong health-IT infrastructure. |

Regulatory complexity for novel digital products and high implementation costs. |

Dominant region. |

| Asia-Pacific |

USD 7.4 Billion |

7.08% |

Rapid digitalization, large patient populations, and strong government initiatives. |

Fragmented healthcare systems. |

Region with the fastest growth. |

| Europe |

USD 5.9 Billion |

9.98% |

Strong R&D hubs (Germany/UK/France), emphasis on interoperability and data security (GDPR). |

Strict data/privacy rules (GDPR) can slow cross-border data use. |

Significant share |

| Latin America |

USD 2.1 Billion |

4.48% |

Increasing healthcare access, growing clinical trials presence. |

Limited budgets, inconsistent infrastructure. |

Emerging growth. |

| Middle East & Africa |

USD 1.3 Billion |

3.51% |

Government healthcare modernization projects. |

Infrastructure gaps, talent shortages. |

Gradual growth. |

Life Sciences IT Market Value Chain Analysis

1. Research & Development (R&D) and Data Generation

The R&D stage involves generating biological, clinical, and genomic data through laboratory instruments, sequencing platforms, and automation systems. Companies like Thermo Fisher and Illumina provide advanced analytical instruments and data-generation platforms that form the foundation of life science IT integration. These tools enable efficient data collection and ensure the accuracy of experimental results, which is essential for further analysis and digital transformation in the life sciences ecosystem.

- Key Players: Thermo Fisher Scientific, Illumina Inc., Agilent Technologies, PerkinElmer, and Bio-Rad Laboratories

2. Data Management and Storage

In this stage, large volumes of research and clinical data are stored, organized, and managed through secure IT systems and cloud platforms. Oracle and SAP offer enterprise database solutions, while IBM and Microsoft provide cloud computing and data security frameworks that enable seamless integration of life science data. Effective data management ensures compliance with regulatory standards like GDPR and HIPAA, while supporting scalable access for analysis and collaboration across research teams.

- Key Players: Oracle Corporation, SAP SE, IBM Corporation, and Microsoft Corporation

3. Data Analysis and Interpretation

This stage focuses on using analytics, artificial intelligence (AI), and machine learning (ML) tools to derive meaningful insights from raw data. SAS and Accenture specialize in developing analytics platforms and consulting services to support drug discovery, clinical trials, and patient stratification. By transforming data into actionable insights, this stage drives innovation in personalized medicine and accelerates decision-making in research and healthcare delivery.

- Key Players: SAS Institute Inc., Accenture, Cognizant, and Deloitte

4. IT Infrastructure and Integration

Here, companies provide hardware, networking, and infrastructure solutions to support life science organizations in implementing robust IT frameworks. IBM and Dell offer hybrid cloud and high-performance computing solutions, while Cisco and HPE deliver secure networking systems. This stage ensures seamless integration of IT across laboratory systems, data warehouses, and enterprise platforms to maintain operational efficiency and real-time connectivity.

- Key Players: IBM Corporation, Cisco Systems, Dell Technologies, and Hewlett Packard Enterprise (HPE)

5. Application Development and Software Solutions

This stage involves the design and deployment of specialized software applications for laboratory management, regulatory compliance, and clinical trial monitoring. Veeva Systems and Medidata Solutions provide cloud-based platforms for life sciences, enabling digital collaboration across drug development processes. These applications enhance workflow automation, streamline compliance, and facilitate data-driven decision-making throughout the product lifecycle.

- Key Players: Dassault Systèmes, Veeva Systems, PTC Inc., and Medidata Solutions (a Dassault Systèmes company)

Life Sciences IT Market Companies

- Thermo Fisher Scientific Inc.

Thermo Fisher provides advanced laboratory instruments, data management platforms, and informatics solutions that enable seamless data generation and analysis across life science research. The company’s software and IT tools enhance workflow automation, compliance, and efficiency in R&D and clinical operations.

Illumina offers genomic sequencing technologies integrated with IT platforms that enable large-scale data processing and bioinformatics analysis. Its cloud-based data solutions empower researchers to manage and interpret genomic data efficiently for personalized medicine and genetic research.

Oracle delivers cloud-based databases and enterprise IT solutions tailored for life science data management, compliance, and analytics. The company supports pharmaceutical and biotech organizations in securely handling large datasets for clinical trials and regulatory processes.

SAP provides digital transformation platforms that streamline operations, integrate data, and improve decision-making for life science companies. Its enterprise software solutions enable efficient management of R&D, supply chain, and compliance processes across global networks.

IBM offers AI, cloud computing, and data analytics platforms that help life science companies accelerate drug discovery and clinical research. Its Watson Health platform uses machine learning to derive actionable insights from complex biomedical and clinical data.

Microsoft supports the life science IT ecosystem through Azure cloud services and AI-based analytics tools that ensure secure data storage and collaboration. The company’s technology enables scalable infrastructure for genomics, clinical research, and digital health applications.

SAS provides advanced analytics and AI-driven data management platforms that enhance research efficiency and regulatory compliance. Its solutions are widely used for clinical trial analysis, real-world evidence generation, and healthcare data visualization.

Veeva Systems specializes in cloud-based software for the life sciences industry, focusing on clinical data management, regulatory compliance, and customer relationship management. Its solutions streamline digital workflows and improve collaboration across R&D and commercial operations.

- Dassault Systèmes (Medidata Solutions)

Dassault Systèmes, through Medidata Solutions, offers cloud-based platforms for clinical trial management, data analytics, and life cycle management. Its technologies help biopharma companies digitize clinical operations and accelerate time-to-market for new therapies.

IQVIA combines advanced analytics, technology platforms, and clinical research expertise to support digital transformation in life sciences. Its data-driven insights and AI tools optimize drug development, regulatory strategy, and real-world evidence generation.

Recent Developments

- In September 2025, Oracle Corporation recently launched a suite of AI-driven healthcare solutions at its Oracle Health & Life Sciences Summit, including generative-AI enhancements in patient portals, autonomous reimbursement systems, and a next-gen agentic electronic health record platform.

- In August 2025, EVERSANA launched a pharmaceutical marketing AI agency powered by an end-to-end Google Cloud-based AI platform. The agency, already deployed across multiple brands, is 80% AI-driven and automated, significantly cutting marketing costs and accelerating campaign execution.

Exclusive Analysis

The Life Sciences IT market is undergoing a paradigmatic transformation, driven by the convergence of cloud computing, artificial intelligence, data interoperability, and regulatory digitization. As pharmaceutical, biotech, and medtech enterprises recalibrate operating models to accommodate decentralized R&D ecosystems, digital twin technologies, and real-world evidence analytics, IT enablement has evolved from a support function to a strategic differentiator. The industry’s pivot toward data-centric innovation underscores a growing reliance on agile, compliant, and interoperable digital infrastructures capable of accelerating discovery-to-commercialization timelines.

The opportunity landscape is being reshaped by the exponential rise in biologics, cell and gene therapies, and personalized medicine, all of which demand hyper-specialized IT architectures. Solutions integrating AI/ML for predictive modeling, digital quality management, and regulatory intelligence are rapidly gaining traction, while cloud-native platforms and low-code systems are unlocking scalability across complex global supply chains. Furthermore, the adoption of data lakes and federated learning frameworks is enhancing cross-functional visibility, positioning IT as the linchpin for next-generation clinical, manufacturing, and pharmacovigilance ecosystems.

From a market expansion standpoint, strategic collaborations among technology hyperscalers, consulting firms, and life sciences enterprises are creating an unprecedented multiplier effect. The shift toward “compliance-by-design” digital ecosystems, coupled with the rising demand for secure, interoperable data pipelines, positions the Life Sciences IT market for sustained double-digit growth over the next decade. Companies that can orchestrate a seamless convergence of domain expertise, digital trust, and intelligent automation stand to capture significant value as the industry transitions toward a fully digitized, patient-centric innovation continuum.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the life sciences IT market.

By Solution Type

- Data Analytics & Big Data Solutions

- IT Infrastructure Management

- Enterprise Resource Planning (ERP) Solutions

- Clinical Trial Management Systems (CTMS)

- Laboratory Information Management Systems (LIMS)

- Electronic Data Capture (EDC) & Electronic Health Records (EHR)

- Regulatory Compliance Solutions

- Supply Chain Management (SCM) Solutions

By Application

- Drug Discovery & Development

- Clinical Trials Management

- Pharmacovigilance

- Genomics & Personalized Medicine

- Manufacturing & Quality Control

- Regulatory Compliance & Reporting

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Hospitals & Clinical Laboratories

- Academic & Research Institutes

- Medical Device Manufacturers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)