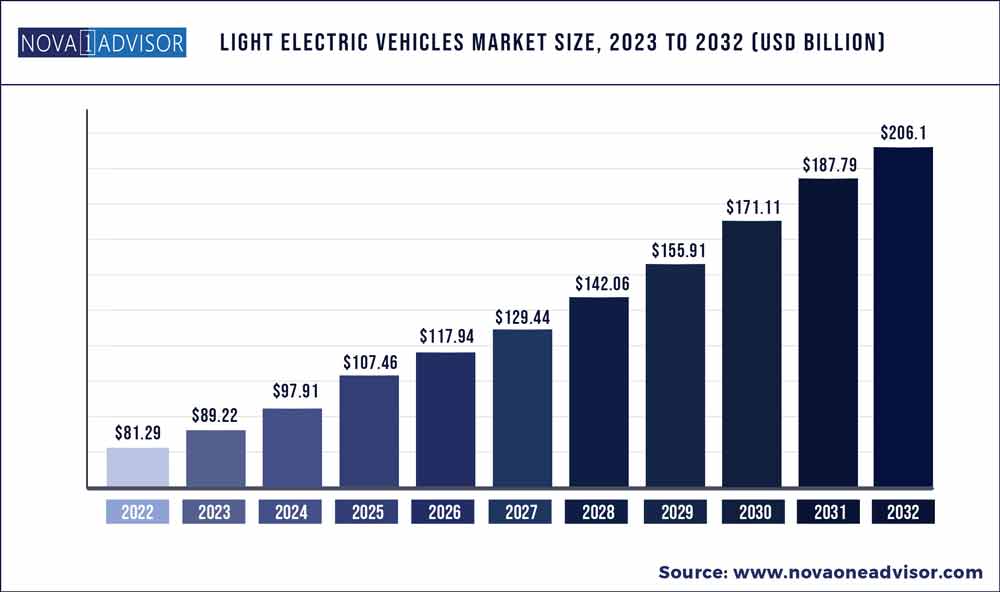

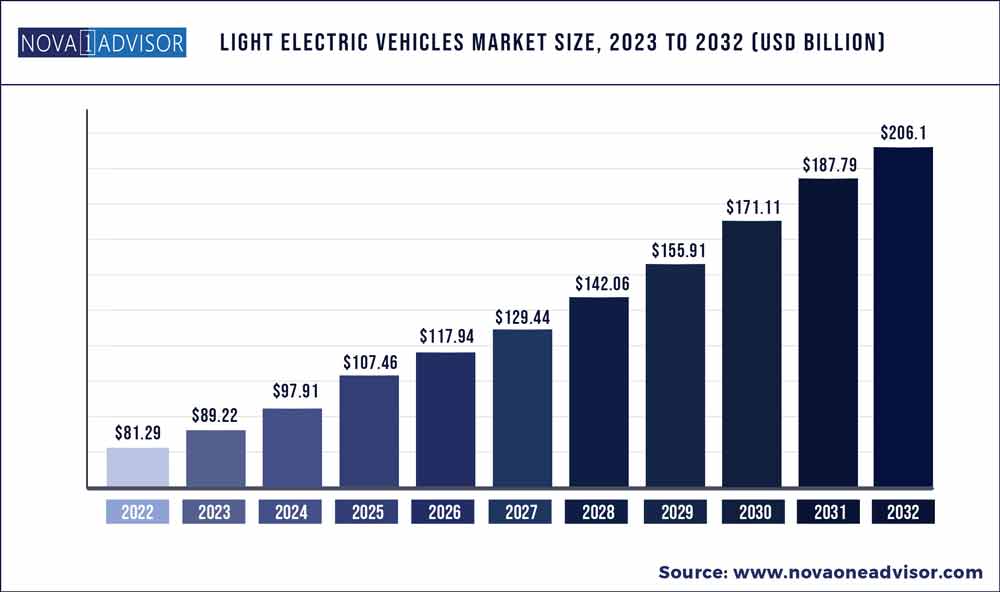

The global light electric vehicles market size was exhibited at USD 81.29 billion in 2022 and is projected to hit around USD 206.1 billion by 2032, growing at a CAGR of 9.75% during the forecast period 2023 to 2032.

Key Pointers:

- North America region dominates the global market.

- By Vehicle Category, the 2-wheeler segment captured the largest revenue share in 2022.

- By Application, the commercial segment is predicted to generate the maximum market share in 2022.

- By Power Output, the 6–9 kW segment is expected to capture the largest market share in 2022.

- By Component, the battery pack segment is projected to record the highest market share in 2022.

- By Vehicle Type, the e-bike segment is expected to account for the biggest market share in 2022.

This study mapped electric industrial vehicles, autonomous forklifts, delivery robots, electric bikes, electric scooters, electric motorcycles, neighbourhood electric vehicles, electric lawn mowers (robotic and manual), and automated guided vehicles. Rapid electrification of neighbourhood vehicles, scooters, and motorcycles, usage of e-bikes for multiple roles in urban commute, recreation, and sports, and increased shift to use of battery-operated material handling vehicles (e.g., forklifts, aisle trucks, tow-tractors, and others) for indoor applications have all increased demand for low-emission alternatives to off-road vehicles (e.g., ATVs and UTVs), lawnmowers, and other household items. Additionally, the demand for e-scooters and e-motorcycles is anticipated to increase more quickly than that of other LEVS due to the rapid deployment of charging stations throughout nations and initiatives and actions taken by local governments to minimise emissions and traffic on roadways.

Light Electric Vehicles Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 89.22 Billion

|

|

Market Size by 2032

|

USD 206.1 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 9.75%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

By Vehicle Category, By Application, By Power Output, By Component and By Vehicle Type

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Accelerated Systems Inc., Addax Motors, Aisin Corporation, Alke, American Landmaster, Ari Motors, Auro Robotics, Auto Rennen India, Balkancar Record, BMW AG, Borgwarner Inc., Byd Auto Co. Ltd., Cfmoto, Club Car Inc., Columbia Vehicle Group Inc., Continental AG, Crossfire Motorcycles, Crystalyte Motors and Others.

|

Market Dynamics:

Driver: Government incentives and subsidies

The With increasing concerns raised over the environmental impact of conventional vehicles, governments around the world are encouraging the adoption of vehicles using alternative sources of fuel. In developing countries like India and China, LEVs are being made a compulsory part of operational fleets for purposes such as geofenced passenger hauling, last-mile delivery, and other commercial purposes. Developed countries like the Netherlands are aiming to use only electric vehicles with zero emissions for all commercial and governmental purposes by the end of 2025. Governments like Mexico are also providing tax incentives at various stages of EV deployment, like vehicle purchase, charging, and infrastructure developments.

Restraint: Limited range and high initial ownership cost of LEVs than ICE Counterparts

The growth of the Light electric vehicle market has been restrained due to range limitations. Unlike ICE vehicles LEVs do not have fuel tanks for energy storage and quick refueling. A fully charged battery can cover a limited range, which is generally lower than the ICE counterpart. Currently, most electric two-wheelers like e-scooters, e-motorcycles, and e-bikes have a range of up to 100–120 miles and with 6-8 hours of charge time, consumers with a need to travel more than 100 miles per day are reluctant to purchase LEVs. Industrial vehicles also suffer from limited battery range and long charging times limiting their usage per day. The solution for this problem is battery swap station on which governments and private players are focusing alike. With standardization of battery type and size, the application of battery swap stations can be bought into wider general use countering the aforementioned issues.

LEVs are costlier than gasoline-powered light vehicles. The LEVs usually cost around USD 5,000-7,000 higher than their ICE counterparts in the North American region. Most of the consumers cannot afford brand-new and expensive models. The cathode price affects the price of the batteries to a great extent, because raw materials such as cobalt, nickel, lithium, and magnesium are expensive. The battery of an LEV needs frequent charging, which increases the requirement for additional equipment such as electric chargers. Recent developments in the LEV market have pressed OEMs to invest more money in the development of such products reducing their initial cost of ownership. Polaris's ICE ranger models such as Ranger 570, Ranger SP 570 and Ranger 1000 costs less than the Ranger EV Kinetic.

Opportunity: Use of battery swapping for electric utility vehicles

Battery swapping at the LEV charging stations is a new trend that eliminates the time for charging batteries for LEV users. Although level 3 EV charging can charge an electric vehicle in 30–60 minutes and ultra-fast charging can charge in 15–30 minutes, they are not compatible with LEVs. Therefore, battery swapping is a great alternative for LEVs. Companies such as NIO have installed over 300 battery swapping stations by July 2021 and plan to install around 4,000 more by 2025 in China. Its swapping stations have been used about 2.9 million times globally, with approximately 1,000 battery-swapping stations designed outside China. Shell signed an agreement with NIO in November 2021 to develop such battery-swapping EV charging stations jointly. This has created a new opportunity for battery-as-a-service in LEV charging. The battery swapping stations are expected to attract more electric utility vehicle customers as they will not have to wait for more charging time. The swap stations will also reduce the upfront cost of the electric utility vehicles as the battery ownership will be replaced by battery leasing.

Challenge: Lack of compatibility, interchangeability, and standardization

Since the Light Electric Vehicle market is at a developing stage, the competition is high along with patented designs for faster and better technologies associated to motors, batteries, ecosystems, and others, which makes it hard for OEMs to have a standardized, interchangeable and all compatible systems and vehicles. To handle this issue, in August 2022, National Institution for Transforming India (NITI) Ayog, a research and advisory organization for the Government of India drafted the Battery Swapping Policy, which has mentioned the technical aspects of standardization that would facilitate interoperability across the battery swapping ecosystem. The battery standardization would make this process easier as every EV has the same battery making it reliable to swap disregarding which company manufactured the battery.

Rising demand for LEVs in personal mobility and industrial applications to drive the less than 6 kW segment

The growing demand for LEVs with low seating capacity is further likely to augment the sales of electric scooters and electric bikes with low power (less than 6 kW) for personal commutes and shared mobility applications. Owing to their high demand, Chinese players are exporting these low-power LEVs to North America and Europe at relatively lower costs. Therefore, the growing demand for personal mobility will drive the less than 6 kW power output segment during the forecast period. Most of the electric two-wheelers have a power output of less than 6 kW. These low-power two-wheelers are used for delivery purposes and personal transportation, among others. For instance, the Yadea C1S Pro, which comes with a power output of 2.2 kW to 3.9 kW, is suitable for small applications, such as warehouse management. The Center-Steering Electric Counterbalanced Lift Truck “8FBE Series” has a power output of 4.9 kW and is used for smaller applications. Government promotions and schemes have also led to increased sales of less than 6 kW power output e-bikes over the years. Hence, the above-mentioned factors would drive the growth of the less than 6 kW segment

Battery pack segment to lead market during the forecast period

In the current scenario, lithium-ion batteries are the preferred choice for LEVs like e-ATVs/UTVs, e-scooters, e-motorcycles, e-bikes, etc. because of their higher energy density, longer life, and zero maintenance effect compared to lead-acid batteries. The only factor impacting the adoption of lithium-ion batteries is their high cost and availability of raw materials for their production. Invented in 1859, the lead-acid battery is still found in many electric utility vehicles. The lead-acid battery offers a limited capacity despite its significant bulk and weight; still, it has the advantage of being both inexpensive and easy to produce and recycle. However, due to growing environmental awareness, the hazardous nature of lead-acid batteries is now restraining their usage in LEVs.

With the growing environmental concerns, many countries have adopted eco-friendly battery types. Lead-acid batteries had a huge demand in the past couple of years, mainly in electric two-wheelers such as e-bikes and e-scooter. But with the introduction of lithium-ion batteries in LEVs, the scenario of the battery market has changed a lot. Lithium-ion batteries provide many benefits over lead-acid batteries. They are compact, have a high energy density, and exhibit fewer heating problems. Most LEVs are fitted with lithium-ion batteries. Also, advancements in technology, battery manufacturers are developing alternate solutions for lithium-ion batteries in the form of lithium-polymer batteries, graphene lithium batteries, and others. Battery manufacturers are investing to develop and expand their capacities. For instance, in April 2022, Phylion Battery Co., Ltd. (China) invested nearly USD 776 million in a 16 GWh plant for battery manufacturing. Other major LEV battery manufacturers include LG Chem (South Korea), Samsung SDI (South Korea), HK Kingbopower Technology (China), and Optimumnano Energy Co., Ltd. (China).

Some of the prominent players in the Light Electric Vehicles Market include:

- Accelerated Systems Inc.

- Addax Motors

- Aisin Corporation

- Alke, American Landmaster

- Ari Motors

- Auro Robotics

- Auto Rennen India

- Balkancar Record

- BMW AG

- Borgwarner Inc.

- Byd Auto Co. Ltd.

- Cfmoto, Club Car Inc.

- Columbia Vehicle Group Inc.

- Continental AG

- Crossfire Motorcycles

- Crystalyte Motors

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Light Electric Vehicles market.

By Vehicle Category

- 2-wheelers

- 3-wheelers

- 4-wheelers

By Application

- Personal Mobility

- Shared Mobility

- Recreation & Sports

- Commercial

By Power Output

- Less than 6 kW

- 6–9 kW

- 9–15 kW

By Component

- Battery pack

- Electric motor (Propulsion Motor)

- Motor controller

- Inverters

- Power Controller

- E-brake booster

- Power Electronics

By Vehicle Type

- e-ATV/UTV

- e-bike

- e-scooter

- e-motorcycle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)