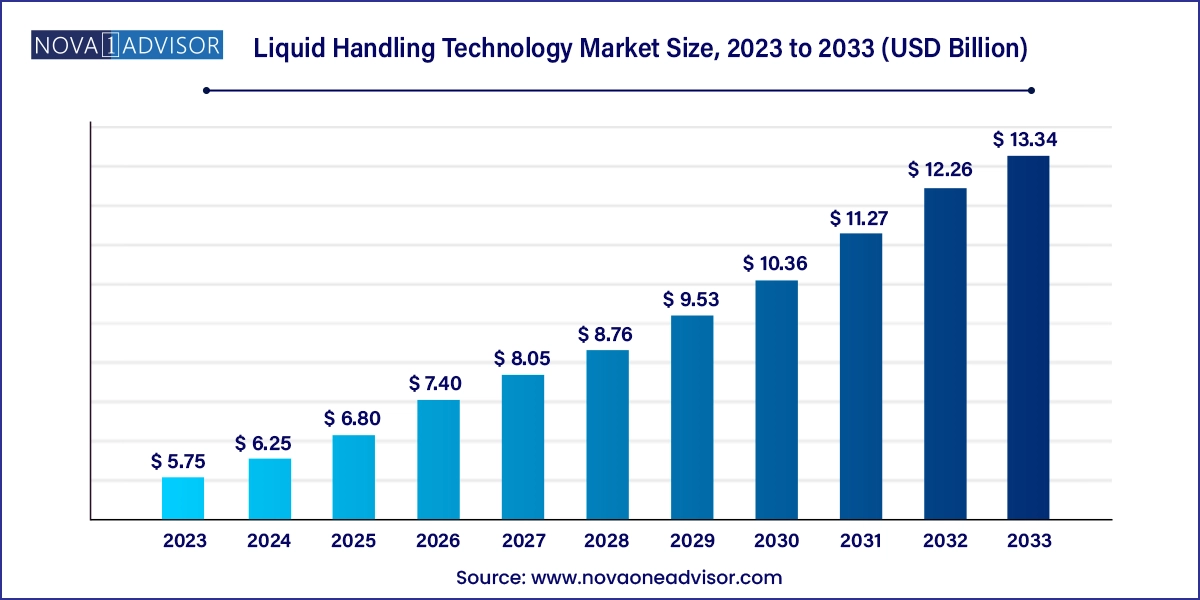

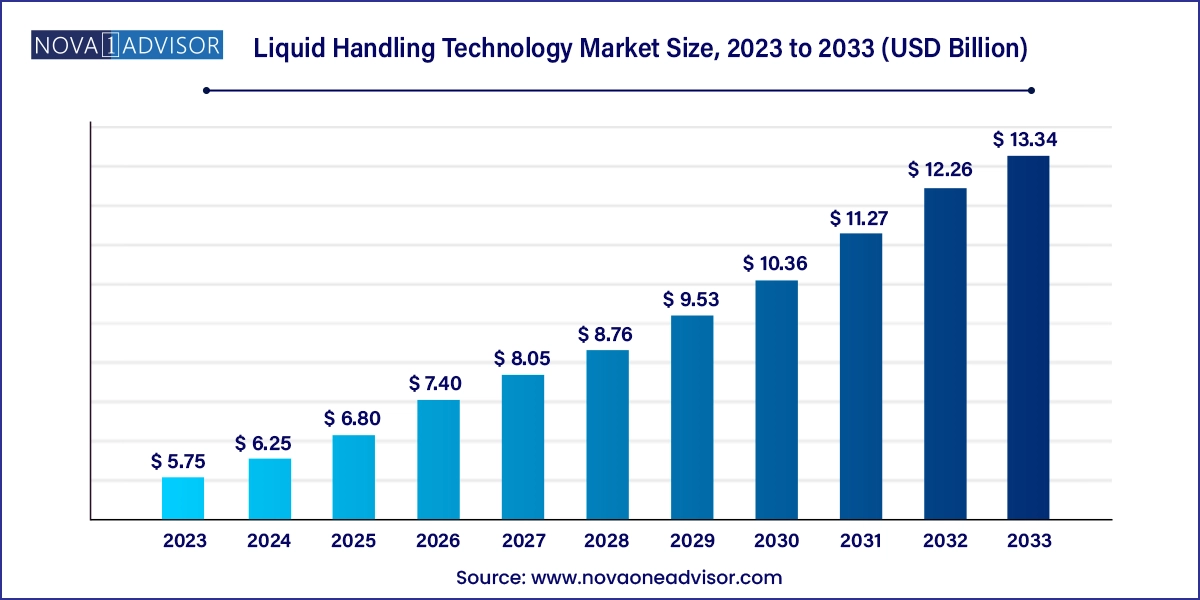

Liquid Handling Technology Market Size and Trends

The liquid handling technology market size was exhibited at USD 5.75 billion in 2023 and is projected to hit around USD 13.34 billion by 2033, growing at a CAGR of 8.78% during the forecast period 2024 to 2033.

Liquid Handling Technology Market Key Takeaways:

- North America dominated the market with a revenue share of 40.88% in 2023.

- The U.S. accounted for the largest revenue share of the market in the North America region in 2023.

- The Asia Pacific region is expected to grow at the fastest rate during the forecast period.

- China accounted for the largest revenue share of the market in the Asia Pacific region in 2023.

- The consumables segment held the largest revenue share of over 47.1% in 2023.

- The automated workstations segment is expected to show lucrative growth during the forecast period.

- The semi-automated liquid handling segment accounted for the largest revenue share in 2023.

- The automated liquid handling segment is estimated to register the fastest CAGR over the forecast period.

- The drug discovery & ADME tox research segment dominated the market in 2023.

- The cancer & genomic research segment has been anticipated to show lucrative growth over the forecast period.

- The academic & research institutes segment dominated the market in 2023.

- The contract research organization (CRO) segment has been anticipated to show lucrative growth over the forecast period.

Market Overview

The liquid handling technology market plays a foundational role in modern laboratory automation, encompassing a diverse array of tools and platforms designed to accurately dispense, transfer, and manage liquids in laboratory settings. Whether for high-throughput drug discovery, genomic analysis, or routine diagnostic testing, liquid handling technologies are essential for maintaining precision, reproducibility, and operational efficiency.

Over recent years, the market has grown significantly in response to increasing research activities in life sciences, the expansion of pharmaceutical and biotechnology sectors, and rising demand for miniaturized, automated, and high-throughput systems. Traditional manual pipetting has been progressively replaced or augmented by semi-automated and fully automated systems, especially in labs focused on genomics, proteomics, synthetic biology, and clinical diagnostics. With growing R&D investments, the liquid handling industry is becoming increasingly dynamic, integrating features like robotic arms, cloud connectivity, and AI-based error detection to boost throughput and reduce human error.

The COVID-19 pandemic acted as a catalyst, accelerating the adoption of automated liquid handlers in diagnostic testing workflows, particularly for RT-PCR and serology testing. Additionally, the growing prominence of personalized medicine, single-cell analysis, and automated bio-sample processing is reshaping the future of liquid handling solutions.

Major Trends in the Market

-

Increasing demand for automation in high-throughput screening and genomics workflows

-

Integration of AI and machine vision systems for pipetting error detection and calibration

-

Rising adoption of cloud-connected platforms for remote control and workflow standardization

-

Shift toward miniaturized liquid handling tools to conserve reagents and reduce costs

-

Development of acoustic liquid handlers for contactless and contamination-free transfer

-

Demand for user-friendly, ergonomic manual pipettes with electronic feedback

-

Growing prevalence of single-use consumables for contamination control

-

Collaborative product development between CROs, academic labs, and equipment manufacturers

Report Scope of Liquid Handling Technology Market

Key Market Driver: Rising Demand for High-throughput and Precision-driven Drug Discovery

A significant driver of the liquid handling technology market is the increasing need for high-throughput and precision liquid handling in drug discovery and genomics research. In an era where speed and accuracy are critical to early-stage drug development, liquid handling automation allows researchers to screen thousands of compounds in microplate formats with exceptional consistency and reproducibility.

Automated systems also minimize the variability associated with manual pipetting, enabling better assay performance and reducing the risk of cross-contamination. This demand is especially evident in applications such as compound library management, ELISA, PCR, and cell-based assays. As pharmaceutical companies strive to accelerate timelines and reduce costs, investment in liquid handling automation becomes essential to achieving these goals.

Key Market Restraint: High Capital Investment and Maintenance Costs

Despite the long-term advantages, the market is constrained by the high initial investment and operational maintenance costs associated with sophisticated liquid handling systems. Small and mid-sized labs, especially academic or nonprofit research institutions, may find it challenging to allocate capital for fully automated workstations or robotic systems.

In addition to the cost of acquiring the equipment, expenses related to regular calibration, software updates, user training, and servicing can further strain budgets. Compatibility issues between devices and third-party platforms, coupled with limited flexibility in certain systems, can also hamper operational efficiency, particularly in rapidly evolving R&D environments.

Key Market Opportunity: Growth in Bioprocessing and Single-cell Research Applications

A transformative opportunity lies in the expansion of liquid handling applications in bioprocessing and single-cell biology. With biologics and cell therapies on the rise, bioprocessing workflows increasingly require automated liquid handlers for tasks such as media formulation, reagent mixing, and sample dilution. These processes demand high levels of sterility and accuracy, aligning well with modern liquid handling systems equipped with HEPA filters and enclosed workspaces.

Simultaneously, single-cell genomics is emerging as a disruptive field, requiring ultra-precise nanoliter to microliter volume transfers. Innovations such as digital microfluidics and acoustic dispensing are enabling non-contact handling of minute sample volumes, ideal for rare cell analysis, single-cell RNA-seq, and CRISPR screening. Manufacturers that offer flexible, modular systems for these applications are well-positioned to tap into new growth segments.

Liquid Handling Technology Market By Product Insights

Automated workstations dominate the liquid handling technology market, especially in large pharmaceutical and high-throughput screening labs. These platforms are designed to perform complex, multi-step liquid transfer protocols with minimal human intervention. Integrated systems combine plate readers, incubators, robotic arms, and software control to conduct entire experiments autonomously. Standalone workstations are popular in smaller labs that require modular automation for PCR setup, ELISA, and DNA/RNA preparation.

Integrated workstations are the fastest-growing sub-segment, owing to their ability to streamline entire workflows from sample preparation to data analysis. Their adoption is particularly strong in CROs and academic research institutes seeking to reduce processing time, labor costs, and assay variability. Integration with LIMS (Laboratory Information Management Systems) further enhances data traceability and compliance in regulated environments.

Liquid Handling Technology Market By Type Insights

Automated liquid handling holds the largest share, driven by its widespread adoption in pharmaceutical R&D, genomics, and diagnostics. These systems reduce manual errors, enhance reproducibility, and support rapid protocol scaling. Their usage has become standard in biobanks, molecular diagnostic labs, and sequencing centers.

Semi-automated systems are the fastest-growing, offering a balance between manual flexibility and automated precision. They are especially suited for labs transitioning from manual workflows or dealing with medium-throughput projects. These systems offer programmable features like aspiration/dispense cycles, yet require user supervision—ideal for education, QC, and custom research projects.

Liquid Handling Technology Market By Application Insights

Drug discovery & ADME-Tox research is the dominant application, as high-throughput screening of compounds relies heavily on precise and repeatable liquid dispensing. Liquid handlers are used for preparing assay plates, diluting drug candidates, and transferring reagents. The increasing use of cell-based assays, biochemical screens, and phenotypic profiling further fuels demand.

Cancer and genomic research is the fastest-growing application, leveraging automation for PCR setup, NGS library preparation, and CRISPR workflows. These research areas require nanoliter precision, contamination control, and throughput scalability. With the growth of personalized medicine and tumor genomics, liquid handling plays a critical role in both translational and clinical research workflows.

Liquid Handling Technology Market By End-use Insights

Pharmaceutical and biotechnology companies represent the largest end-use segment, investing heavily in automation to accelerate drug development and scale operations. These organizations utilize liquid handling platforms for target identification, assay development, and quality control.

Academic and research institutes are the fastest-growing end-users, propelled by public funding, increased student enrollment, and collaborative research in areas like synthetic biology, metagenomics, and systems biology. Modular, user-friendly liquid handling systems are especially favored in core facilities and teaching labs.

Liquid Handling Technology Market By Regional Insights

North America dominates the global liquid handling technology market, driven by strong pharmaceutical R&D expenditure, well-established biotech hubs, and early adoption of lab automation. The U.S. leads in patents, product launches, and institutional research funding. Regional companies such as Thermo Fisher Scientific, Beckman Coulter, and Hamilton Company have strong footprints, and collaborative research between academia and industry propels innovation.

Asia Pacific is the fastest-growing region, spurred by rising investments in life sciences infrastructure in China, India, South Korea, and Singapore. Government-funded genomics initiatives, biomanufacturing incentives, and growing biotech startups are creating new demand for automated lab systems. Additionally, local players are emerging with cost-effective solutions tailored for academic and medium-scale labs, accelerating technology penetration.

Liquid Handling Technology Market Recent Developments

-

March 2025: Hamilton Company launched a next-generation modular liquid handling system for scalable genomics and proteomics workflows.

-

January 2025: Tecan Group announced a strategic partnership with an AI software provider to integrate real-time error detection in liquid handling protocols.

-

December 2024: Thermo Fisher Scientific expanded its KingFisher line with automation-compatible magnetic particle processors for nucleic acid purification.

-

October 2024: Eppendorf introduced new ergonomic electronic pipettes with Bluetooth connectivity and real-time data logging features.

-

August 2024: Bio-Rad launched a compact automated workstation designed for low-throughput molecular diagnostics labs.

Some of the prominent players in the liquid handling technology market include:

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc

- Danaher Corporation

- Gilson, Inc

- PerkinElmer

- Tecan Group Ltd.

- Hamilton Company

- Eppendorf SE.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the liquid handling technology market

Products

-

- Standalone Workstations

- Integrated Workstations

-

-

- Electronic Pipettes

- Manual Pipettes

- Pipette Controllers

-

- Burettes

- Dispensers

- Others

-

- Regents

- Disposable Tips

- Tubes & Plates

- Others

Type

- Automated Liquid Handling

- Manual Liquid Handling

- Semi-automated Liquid Handling

Application

- Drug Discovery & & ADME-Tox Research

- Cancer & Genomic Research

- Bioprocessing/Biotechnology

- Others

End-use

- Pharmaceutical & Biotechnology Companies

- Contract Research Organization (CRO)

- Academic & Research Institutes

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africaa