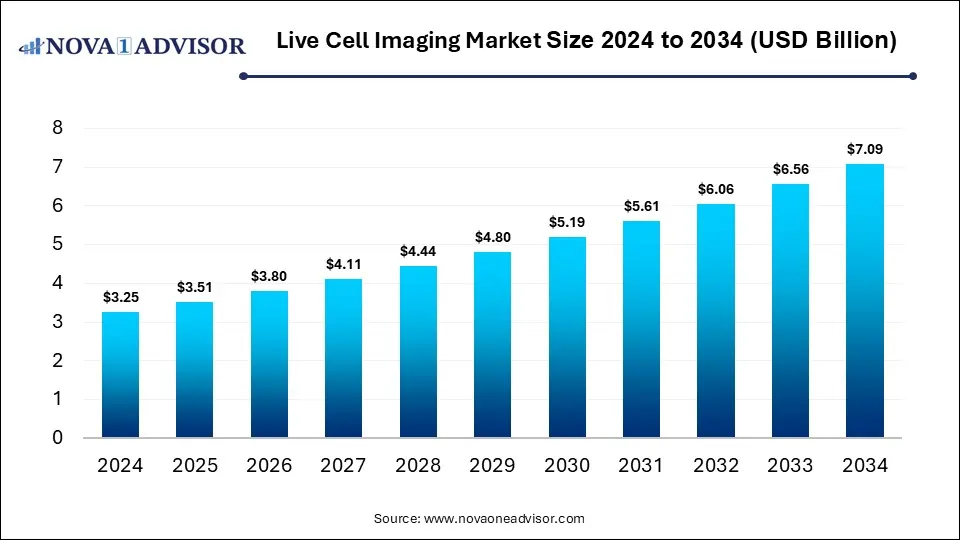

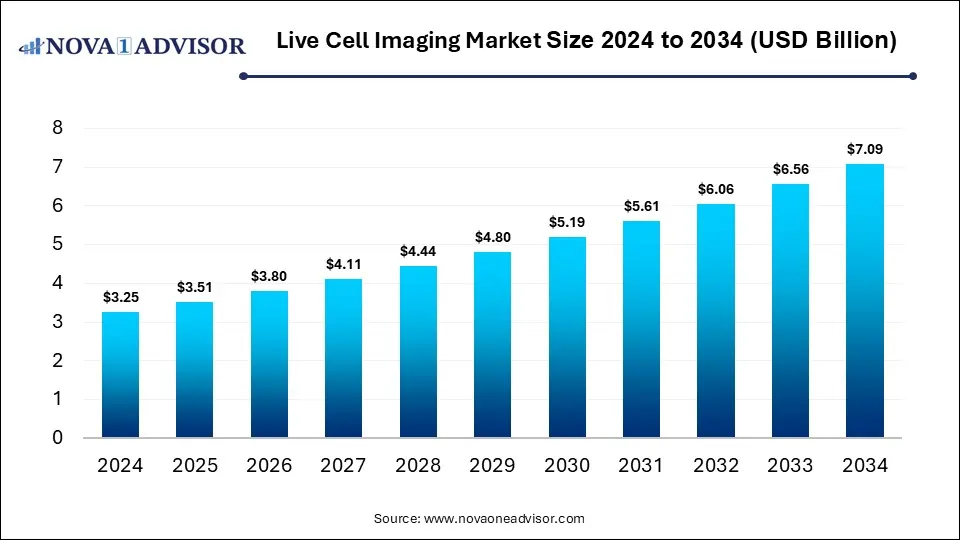

Live Cell Imaging Market Size and Forecast 2025 to 2034

The global live cell imaging market size is calculated at USD 3.25 billion in 2024, grows to USD 3.51 billion in 2025, and is projected to reach around USD 7.09 billion by 2034, growing at a CAGR of 8.11% from 2025 to 2034. The market is expanding rapidly due to the rising demand for real-time cellular analysis in drug discovery and disease research. Advancements in imaging technologies and increasing adoption in academic and clinical studies are further driving growth.

Key Takeaways

- North America dominated the live cell imaging market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the equipment segment held the largest market share in 2024.

- By product, the consumable segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the stem cell & drug discovery segment led the market with the largest revenue share in 2024.

- By application, the development biology segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the high content screening (HCS) segment held the highest market share.

- By technology, the time-lapse microscopy segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Live Cell Imaging?

Live cell imaging is a technique that allows real-time visualization and study of living cells to observe their structure, behaviour, and biological processes without disrupting them. The live cell imaging market is expanding as researchers seek deeper insights into cellular dynamics, such as migration, signaling, and intracellular interaction. Growing focus on regenerative medicine, immunology, and neuroscience is increasing its adoption. The technology also supports reduced reliance on animal models by enabling in vitro studies. Moreover, collaboration between research institutions and imaging companies, along with the availability of advanced software for real-time data analysis, is fostering broader use across both basic and applied science.

What are the Key trends in the Live Cell Imaging Market in 2024?

- In June 2025, Ramona, a Durham-based life sciences imaging company, introduced the Vireo live-cell imaging system. The platform enhances cell analysis with higher speed and throughput, combining compact video microscopes with AI-powered real-time image processing. (Source: https://www.ncbiotech.org/)

- In April 2025, Bruker Corporation introduced the Beacon Discovery Optofluidic System during the AACR Annual Meeting. This benchtop platform provides an accessible solution for conducting live single-cell functional analysis.(Source: https://ir.bruker.com/)

How Can AI Affect the Live Cell Imaging Market?

AI is reshaping the market by enhancing real-time tracking of complex cellular events and uncovering hidden patterns that traditional methods may miss. It supports multi-dimensional data integration, linking imaging results with genomics and proteomics for deeper biological insights. AI also enables adaptive imaging, where systems adjust settings automatically based on cell responses. Additionally, its role in reducing storage needs through smart data compression and optimizing experiment design is broadening its impact across research and clinical applications.

Report Scope of Live Cell Imaging Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.51 Billion |

| Market Size by 2034 |

USD 7.09 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.11% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, Technology, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Nikon Corporation, Carl Zeiss AG, GE HealthCare., PerkinElmer, Leica Microsystems, Olympus Corporation, Biotech Instruments Inc, Thermo Fisher Scientific Inc., CYTENA GmbH, Corning Incorporated, Bruker |

Market Dynamics

Driver

Advancement in Microscopy Technology

Advancements in microscopy technology fuel the live cell imaging market by making instruments more compact, automated, and user-friendly, allowing broader access beyond expert labs. New imaging platforms also reduce phototoxicity and sample damage, enabling longer observation of living cells. Additionally, integration with digital tools, faster image acquisition, and compatibility with multiplex assays support complex experiments. These improvements not only expand research capabilities but also enhance cost-effectiveness and scalability, encouraging wider adoption in both academic and pharmaceutical sectors.

Restraint

High Cost of High-Content Screening Systems

The high cost of high-content screening systems restrains the live cell imaging market because it delays upgrade cycles and discourages frequent technology adoption. Many institutions rely on shared facilities or older equipment, which limits access to cutting-edge capabilities. Moreover, budget priorities in research often favor consumables or immediate project needs over expensive instruments. This mismatch between financial planning and capital investment slows innovation uptake, creating unequal access to advanced imaging tools across different sectors and regions.

Opportunity

Integration of Live Imaging with Organ-on-Chip and 3D Cell Culture Systems for Realistic Disease

The integration of line cell imaging with organ-on-chip and 3D cell culture systems creates future opportunities by enabling long-term monitoring of complex cellular integration in controlled environments. These platforms allow simultaneous visualization of multiple tissue types, improving understanding of cross-organ communication. They also make experiments more scalable and reproducible, supporting large-scale drug testing. Additionally, the ability to integrate imaging with microfluidics and biosensors enhances data quality, offering researchers powerful tools to advances data quality, offering researchers powerful tools to advance biomedical innovation and streamline therapeutic pipelines.

- For Instance, In November 2024, researchers at KU Leuven developed a cutting-edge organ-on-chip device designed to accurately model human cells. This innovative platform enables real-time monitoring of cellular interactions and responses, providing valuable insights into disease mechanisms and potential therapeutic interventions. (Source: https://nanoconvergencejournal.springeropen.com/)

Segmental Insights

How does the Equipment Segment dominate the Live Cell Imaging Market in 2024?

The equipment segment dominated the market in 2024 due to the increasing adoption of integrated imaging platforms that combine multiple functionalities, such as liver-cell tracking, environmental control, and multiplex assays. Researchers prefer investing in versatile, durable systems that support long-term experiments and reduce workflow complexity. Additionally, growing collaborations between equipment manufacturers and research institutions, along with the trend towards automation and miniaturization, have boosted demand for high-end instruments, making the equipment segment the largest contributor to market revenue.

The consumables segment is projected to grow rapidly because innovation in cell scaffolds, microfluidic chips, and biosensors are expanding the range of materials required for live cell imaging. Researchers increasingly prefer customized and application-specific consumables to improve experiment accuracy and reproducibility. Additionally, the growth of academic and pharmaceutical research, coupled with the trend towards short-term. High-throughput studies, driven by frequent replacements and higher consumption of these materials, are accelerating the market growth.

Live Cell Imaging Market By Product, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Equipment |

1.46 |

1.58 |

1.71 |

1.85 |

2.01 |

2.17 |

2.35 |

2.54 |

2.75 |

2.98 |

3.22 |

| Consumable |

1.30 |

1.40 |

1.52 |

1.64 |

1.77 |

1.91 |

2.06 |

2.23 |

2.41 |

2.60 |

2.81 |

| Software |

0.49 |

0.53 |

0.57 |

0.61 |

0.66 |

0.72 |

0.77 |

0.84 |

0.90 |

0.98 |

1.05 |

Why Did the Stem Cell & Drug Discovery Segment Dominate the Market in 2024?

The stem cell and drug discovery segment generated the largest revenue in 2024 because these areas increasingly rely on live cell imaging to study complex cellular interactions and optimize therapeutic development. Advancements in regenerative medicine and biologics have heightened the need for precise visualization of cellular responses. Furthermore, pharmaceutical companies are investing heavily in preclinical screening and safety testing, which drives consistent demand for sophisticated imaging tools, securing this segment’s dominant position in the market.

The developmental biology segment is projected to grow rapidly as researchers increasingly focus on understanding genetic regulation, cell signaling, and morphogenesis in living organisms. Integration of advanced imaging techniques with organoids and microfluidic models allows detailed visualization of developmental processes over time. Rising interest in disease modeling, tissue engineering, and regenerative therapies further drives adoption. Additionally, funding for developmental studies and collaborations between academic and biotech institutions are accelerating the use of live cell imaging in this application segment.

How does the High Content Screening (HCS) Segment Dominate the Live Cell Imaging Market?

The high-content screening (HCS) segment led the market because it integrates advanced imaging with robust software for detailed cellular analysis, enabling researchers to extract complex phenotypic information efficiently. Its scalability and compatibility with automated workflows support large-scale experiments in drug discovery and functional genomics. Additionally, the growing demand for predictive in vitro models and reduced reliance on animal testing has increased the adoption of HCS systems, reinforcing their position as the dominant technology in the live cell imaging market.

The time-lapse microscopy segment is projected to grow rapidly as it allows long-term monitoring of cellular behavior under physiologically relevant conditions without disrupting the cells. Innovations in miniaturized imaging systems, integration with AI for automated analysis, and compatibility with 3D cultures and organ-on-chip models are driving adoption. Its increasing use in personalized medicine, stem cell research, and high-throughput studies further accelerates growth, positioning time-lapse microscopy as one of the fastest-growing technologies in the live cell imaging market.

Regional Insights

How is North America contributing to the Expansion of the Live Cell Imaging Market?

North America led the live cell imaging market in 2024 due to early adoption of cutting-edge imaging platforms and strong regulatory support for biomedical research. The region benefits from a high concentration of academic institutions and specialized research centers that prioritize advanced cellular studies. Additionally, availability of skilled personnel, collaborations between tech developers and research organizations, and a focus on innovative therapeutic development, including regenerative medicine and personalized therapies, have reinforced the region’s dominant market position.

How is Asia-Pacific Accelerating the Live Cell Imaging Market?

Asia-Pacific is projected to grow rapidly due to the increasing establishment of biotech startups and contract research organizations that require advanced live cell imaging solutions. Affordable labor, expanding academic research, and rising awareness of modern cellular analysis techniques are driving adoption. Additionally, growing demand for personalized medicine, regenerative therapies, and high-throughput drug screening, along with technology transfer from developed regions, is fueling market expansion, making Asia-Pacific the fastest-growing region in the live cell imaging market during the forecast period.

Live Cell Imaging Market By Regional, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

1.14 |

1.23 |

1.33 |

1.44 |

1.56 |

1.69 |

1.83 |

1.98 |

2.14 |

2.32 |

2.51 |

| Europe |

0.81 |

0.88 |

0.95 |

1.02 |

1.11 |

1.20 |

1.29 |

1.40 |

1.51 |

1.63 |

1.76 |

| Asia Pacific |

0.81 |

0.88 |

0.95 |

1.02 |

1.11 |

1.20 |

1.29 |

1.40 |

1.51 |

1.63 |

1.76 |

| Latin America |

0.26 |

0.28 |

0.30 |

0.33 |

0.35 |

0.38 |

0.41 |

0.45 |

0.48 |

0.52 |

0.56 |

| Middle East and Africa (MEA) |

0.23 |

0.25 |

0.27 |

0.29 |

0.31 |

0.33 |

0.36 |

0.39 |

0.42 |

0.46 |

0.49 |

Top Companies in the Live Cell Imaging Market

- Nikon Corporation

- Carl Zeiss AG

- GE HealthCare.

- PerkinElmer

- Leica Microsystems

- Olympus Corporation

- Biotech Instruments Inc

- Thermo Fisher Scientific Inc.

- CYTENA GmbH

- Corning Incorporated

- Bruker

Recent Developments in the Live Cell Imaging Market

- In May 2025, BD, a global medical technology leader, launched the world’s first cell analyzer combining spectral and real-time imaging technologies. This innovative system enhances flow cytometry by revealing previously undetectable cellular details, offering researchers greater insights across diverse applications with improved ease and higher throughput. (Source: https://investors.bd.com/)

- In March 2025, Nikon (Japan) launched Version 1.4 of the ECLIPSE Ui Digital Imaging Microscope, introducing Tile View and Layer View features. These enhancements allow simultaneous comparison of multiple images, improving live cell imaging and facilitating detailed analysis of dynamic cellular processes. (Source: https://www.microscope.healthcare.nikon.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the live cell imaging market.

By Product

- Equipment

- Consumable

- Software

By Application

- Cell Biology

- Developmental Biology

- Stem Cell & Drug Discovery

- Others

By Technology

- Time lapse Microscopy

- Fluorescence recovery after photobleaching (FRAP)

- Fluorescence resonance energy transfer (FRET)

- High content screening (HCS)

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: U.S. Live Cell Imaging Market, by Product

- Table 2: U.S. Live Cell Imaging Market, by Application

- Table 3: U.S. Live Cell Imaging Market, by Technology

- Table 4: Canada Live Cell Imaging Market, by Product

- Table 5: Canada Live Cell Imaging Market, by Application

- Table 6: Canada Live Cell Imaging Market, by Technology

- Table 7: Mexico Live Cell Imaging Market, by Product

- Table 8: Mexico Live Cell Imaging Market, by Application

- Table 9: Mexico Live Cell Imaging Market, by Technology

- Table 10: Germany Live Cell Imaging Market, by Product

- Table 11: Germany Live Cell Imaging Market, by Application

- Table 12: Germany Live Cell Imaging Market, by Technology

- Table 13: France Live Cell Imaging Market, by Product

- Table 14: France Live Cell Imaging Market, by Application

- Table 15: France Live Cell Imaging Market, by Technology

- Table 16: UK Live Cell Imaging Market, by Product

- Table 17: UK Live Cell Imaging Market, by Application

- Table 18: UK Live Cell Imaging Market, by Technology

- Table 19: Italy Live Cell Imaging Market, by Product

- Table 20: Italy Live Cell Imaging Market, by Application

- Table 21: Italy Live Cell Imaging Market, by Technology

- Table 22: Rest of Europe Live Cell Imaging Market, by Segments

- Table 23: China Live Cell Imaging Market, by Product

- Table 24: China Live Cell Imaging Market, by Application

- Table 25: China Live Cell Imaging Market, by Technology

- Table 26: Japan Live Cell Imaging Market, by Product

- Table 27: Japan Live Cell Imaging Market, by Application

- Table 28: Japan Live Cell Imaging Market, by Technology

- Table 29: South Korea Live Cell Imaging Market, by Product

- Table 30: South Korea Live Cell Imaging Market, by Application

- Table 31: South Korea Live Cell Imaging Market, by Technology

- Table 32: India Live Cell Imaging Market, by Product

- Table 33: India Live Cell Imaging Market, by Application

- Table 34: India Live Cell Imaging Market, by Technology

- Table 35: Southeast Asia Live Cell Imaging Market, by Segments

- Table 36: Rest of Asia Pacific Live Cell Imaging Market, by Segments

- Table 37: Brazil Live Cell Imaging Market, by Product

- Table 38: Brazil Live Cell Imaging Market, by Application

- Table 39: Brazil Live Cell Imaging Market, by Technology

- Table 40: Rest of Latin America Live Cell Imaging Market, by Segments

- Table 41: GCC Countries Live Cell Imaging Market, by Product

- Table 42: GCC Countries Live Cell Imaging Market, by Application

- Table 43: GCC Countries Live Cell Imaging Market, by Technology

- Table 44: Turkey Live Cell Imaging Market, by Segments

- Table 45: Africa Live Cell Imaging Market, by Segments

- Table 46: Rest of MEA Live Cell Imaging Market, by Segments

- Figure 1: U.S. Live Cell Imaging Market Share, by Product

- Figure 2: U.S. Live Cell Imaging Market Share, by Application

- Figure 3: U.S. Live Cell Imaging Market Share, by Technology

- Figure 4: Canada Live Cell Imaging Market Share, by Segments

- Figure 5: Mexico Live Cell Imaging Market Share, by Segments

- Figure 6: Germany Live Cell Imaging Market Share, by Product

- Figure 7: France Live Cell Imaging Market Share, by Segments

- Figure 8: UK Live Cell Imaging Market Share, by Segments

- Figure 9: Italy Live Cell Imaging Market Share, by Segments

- Figure 10: China Live Cell Imaging Market Share, by Product

- Figure 11: Japan Live Cell Imaging Market Share, by Segments

- Figure 12: South Korea Live Cell Imaging Market Share, by Segments

- Figure 13: India Live Cell Imaging Market Share, by Segments

- Figure 14: Brazil Live Cell Imaging Market Share, by Segments

- Figure 15: GCC Countries Live Cell Imaging Market Share, by Segments

- Figure 16: Turkey Live Cell Imaging Market Share, by Segments

- Figure 17: Africa Live Cell Imaging Market Share, by Segments