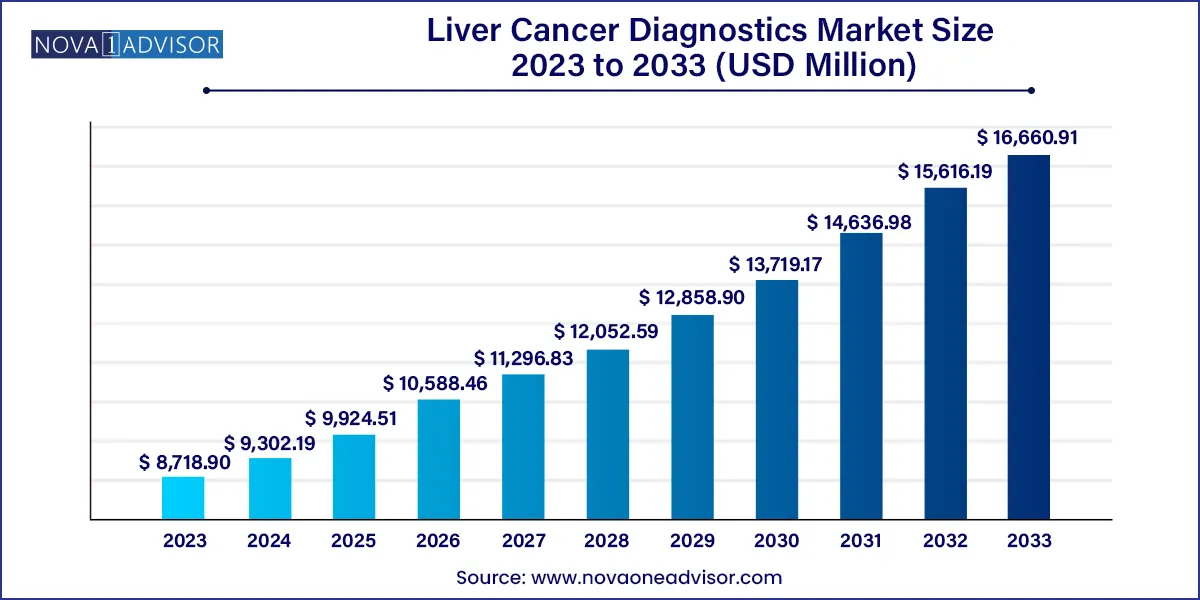

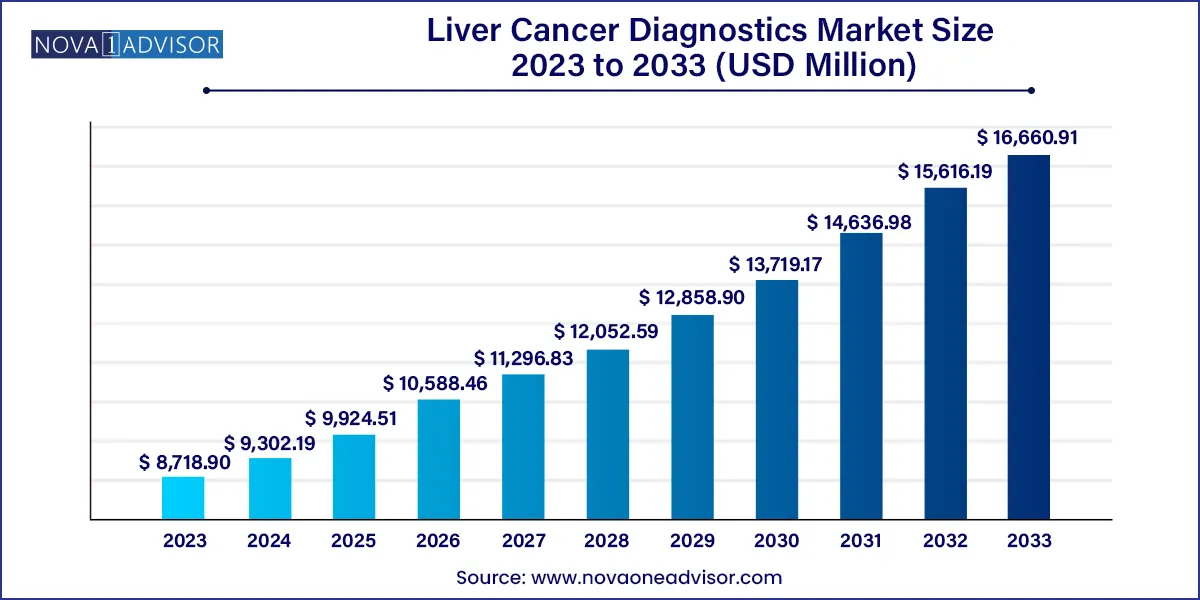

The global liver cancer diagnostics market size was estimated at USD 8,718.90 million in 2023 and is expected to surpass around USD 16,660.91 million by 2033 and poised to grow at a compound annual growth rate (CAGR) of 6.69% during the forecast period 2024 to 2033.

Key Takeaways:

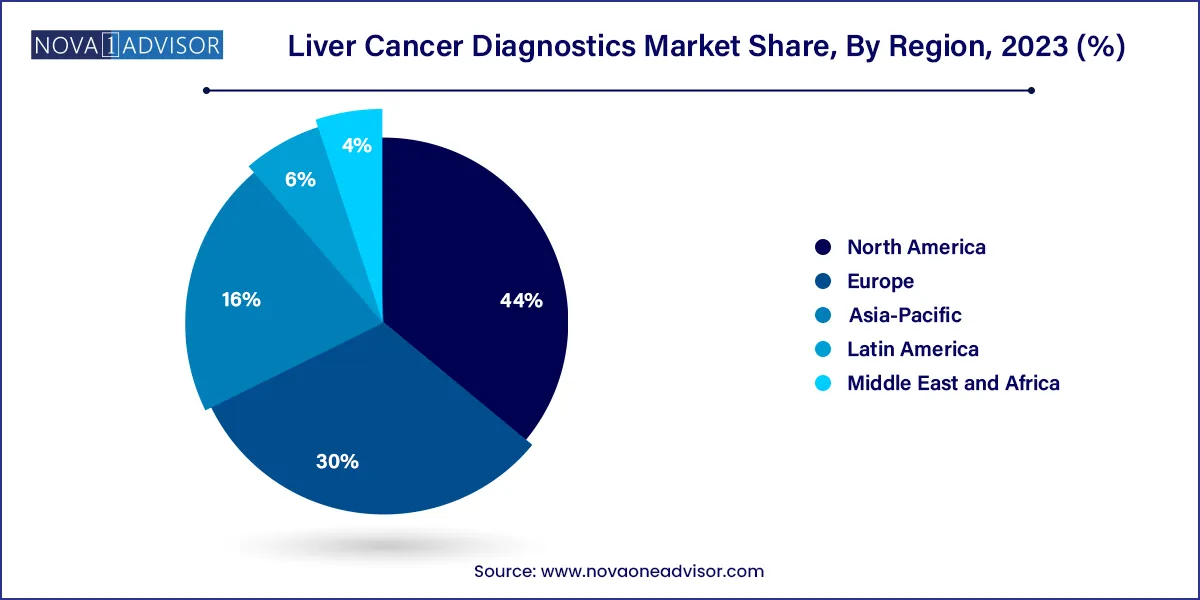

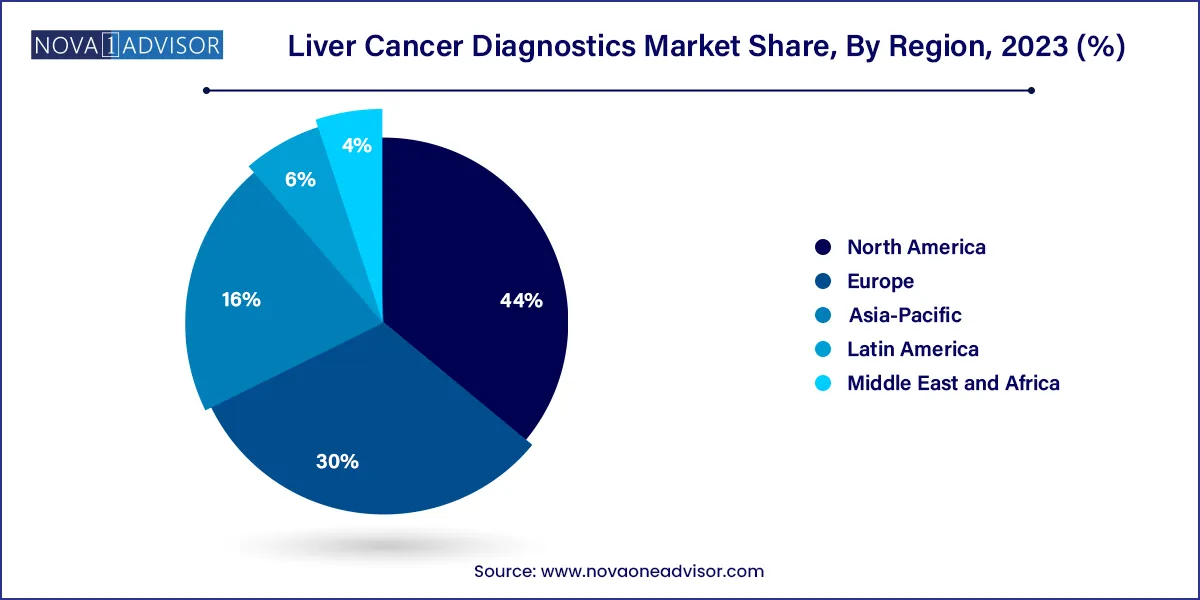

- North America dominated the liver cancer diagnostics market with a share of 44.0% in 2023 and is projected to generate the highest revenue during the forecast period.

- In terms of revenue, the laboratory tests segment dominated the market with a share of over 33.7% in 2023.

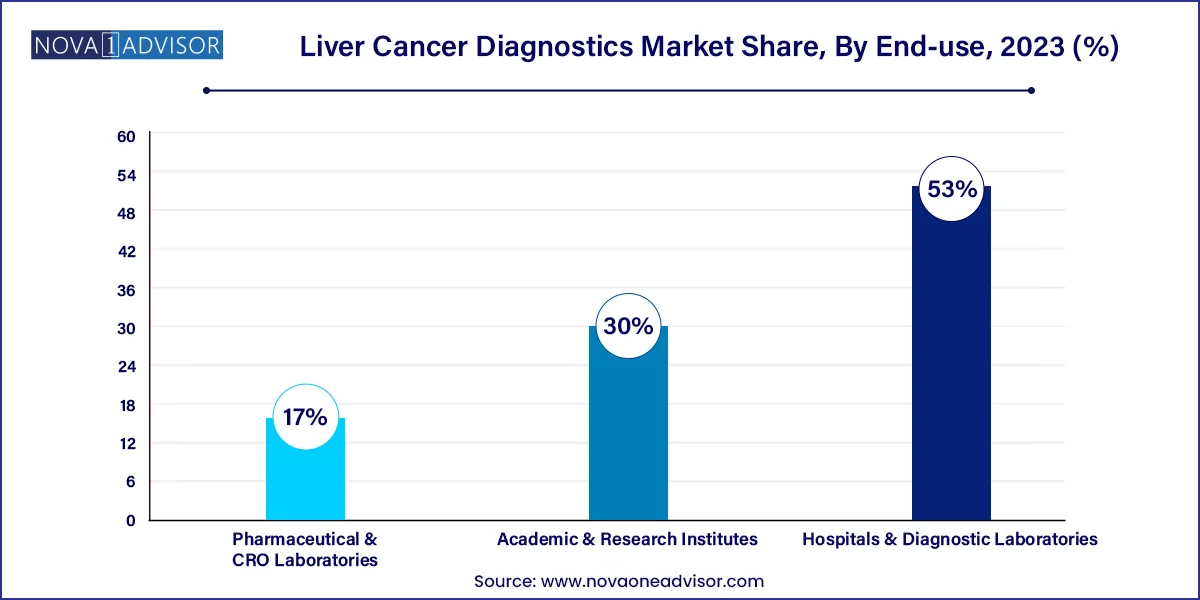

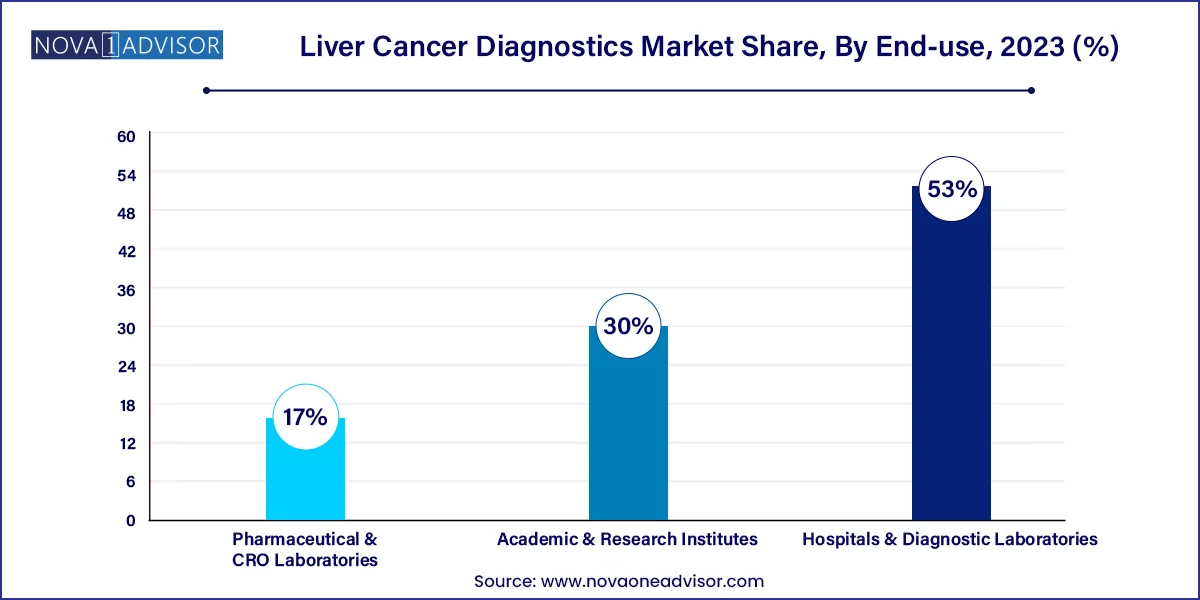

- In terms of revenue, the hospitals and diagnostic laboratories segment dominated the market with a share of over 53.0% in 2023.

Market Overview

The liver cancer diagnostics market is a vital segment of the oncology diagnostics industry, driven by the rising global burden of primary liver malignancies, predominantly hepatocellular carcinoma (HCC). Liver cancer ranks among the top causes of cancer-related mortality worldwide and has one of the fastest-growing incidence rates among all malignancies. Effective and early diagnosis is crucial for liver cancer due to its asymptomatic nature in early stages and rapid progression when left untreated.

Globally, over 900,000 new cases of liver cancer are reported annually, with hepatitis B and C infections, alcohol-related liver disease, non-alcoholic fatty liver disease (NAFLD), and cirrhosis being the leading causes. Increasing awareness among clinicians and patients, along with the evolution of diagnostic technologiesincluding molecular diagnostics, imaging modalities, and biomarker testing has significantly improved early detection, staging, and treatment planning.

Liver cancer diagnostics encompass a spectrum of tests ranging from blood-based biomarker screening to high-resolution imaging, endoscopy-guided biopsy, and molecular profiling. A multidisciplinary approach that includes laboratory tests, imaging, and histopathology is often employed to improve diagnostic accuracy. The integration of artificial intelligence (AI), liquid biopsy, and multi-omics profiling is further shaping the market’s innovation trajectory.

With the growing demand for precision medicine, personalized treatment, and companion diagnostics, the liver cancer diagnostics market is poised for robust expansion. Emerging economies are witnessing improved access to diagnostics due to expanding healthcare infrastructure and public screening initiatives, making liver cancer diagnostics a global healthcare priority.

Major Trends in the Market

-

Rise of Non-Invasive and Minimally Invasive Testing: Liquid biopsies and advanced imaging techniques are reducing dependence on tissue biopsies.

-

Growth in Biomarker-Based Diagnostics: Multi-biomarker panels and next-generation sequencing (NGS) are enhancing diagnostic precision and early detection rates.

-

Artificial Intelligence in Imaging: AI-driven tools are improving image analysis, lesion detection, and interpretation consistency in liver scans.

-

Increased Use of Companion Diagnostics: Biomarker-driven diagnostics are supporting targeted therapies, especially in advanced HCC cases.

-

Expansion of Point-of-Care Testing in Low-Income Regions: Portable and cost-effective tests are being developed for early liver cancer detection in resource-limited settings.

-

Growing Role of Circulating Tumor DNA (ctDNA): ctDNA-based tests are gaining ground as dynamic biomarkers for monitoring disease progression and response.

-

Integration of Multi-Omics Data: Combining genomic, proteomic, and metabolomic data enhances biomarker discovery and diagnostic accuracy.

Liver Cancer Diagnostics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9,302.19 Million |

| Market Size by 2033 |

USD 16,660.91 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.69% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Test Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Abbott Laboratories; F. Hoffmann-La Roche Ltd.; Qiagen N.V.; Thermo Fisher Scientific, Inc.; Siemens Healthineers; Becton Dickinson & Company; Illumina, Inc.; Koninklijke Philips N.V; Epigenomics AG; Fujifilm Medical Systems U.S.A., Inc. |

Market Driver: Increasing Global Incidence of Liver Cancer

The primary driver of the liver cancer diagnostics market is the rising global incidence and mortality associated with liver cancer, particularly hepatocellular carcinoma. According to the WHO, liver cancer is the sixth most diagnosed cancer and the third leading cause of cancer death globally. The growing prevalence of chronic liver disease, including hepatitis B and C, alcohol abuse, and metabolic disorders like obesity and NAFLD, is directly contributing to the rising number of liver cancer cases.

Furthermore, populations in Asia and Africa face disproportionately high incidence rates due to endemic hepatitis virus exposure. This public health burden has increased government and private investment in screening programs, early detection campaigns, and technological innovation in diagnostics. Improved survival rates are heavily dependent on early-stage detection, intensifying the demand for advanced and sensitive diagnostic modalities.

Market Restraint: Limited Accessibility and High Diagnostic Costs

A significant barrier to market expansion is the limited accessibility and high cost of comprehensive liver cancer diagnostics, especially in low-income and middle-income countries. Sophisticated diagnostic tools such as contrast-enhanced MRI, CT scans, molecular profiling panels, and AI-supported imaging interpretation require significant capital investment, infrastructure, and trained personnel.

Additionally, invasive procedures such as liver biopsies carry procedural risks and are often underutilized due to patient discomfort and lack of availability in rural areas. Even when non-invasive methods are available, lack of reimbursement, insurance coverage variability, and economic inequality limit patient access. Inadequate national screening programs and late diagnosis remain critical challenges, particularly in developing countries where liver cancer outcomes are poorest.

Market Opportunity: Development of Non-Invasive Biomarker Panels and AI-Assisted Diagnostics

One of the most promising opportunities in the liver cancer diagnostics market lies in the development and commercialization of non-invasive, multi-analyte biomarker tests, which can be used for mass screening and routine surveillance. Innovations such as circulating tumor DNA (ctDNA) tests, exosomal RNA analysis, and AI-powered diagnostic algorithms are paving the way for affordable, early, and scalable liver cancer diagnostics.

Startups and established diagnostics companies are exploring blood-based panels that measure alpha-fetoprotein (AFP), GPC3, DCP (Des-gamma-carboxy prothrombin), and other novel markers. These tests, particularly when used in combination, offer high sensitivity and specificity and are suitable for population-level screening in high-risk groups.

The application of machine learning models to imaging data (from ultrasound, CT, or MRI) can also standardize interpretation, assist in lesion characterization, and reduce diagnostic error, further democratizing access to expert-level diagnostic insights.

Segments Insights:

By Test Type

Laboratory tests dominated the test type segment, due to their use in early screening, ongoing surveillance, and biomarker analysis. Within laboratory testing, biomarker assays remain pivotal in monitoring patients with cirrhosis or hepatitis for progression to HCC. Blood-based biomarkers such as alpha-fetoprotein (AFP), AFP-L3, and DCP have been standard tools in liver cancer diagnostics. The increasing use of molecular and proteomic biomarkers is helping clinicians assess tumor aggressiveness, recurrence risk, and suitability for targeted therapies.

Imaging tests are the fastest-growing segment, driven by the increasing deployment of contrast-enhanced CT and MRI, along with ultrasound elastography and PET-CT scans. These techniques provide critical insights into liver lesion characterization, staging, and vascular involvement. The emergence of AI-enabled radiomics is enhancing imaging interpretation, especially in regions with a shortage of radiology experts. Imaging also plays a vital role in monitoring treatment response and post-surgical surveillance, supporting its robust growth outlook.

By End-use

Hospitals and diagnostic laboratories dominated the end-use segment, as most liver cancer diagnostics require a multidisciplinary setup, including radiology, pathology, and lab medicine. Tertiary hospitals offer comprehensive diagnostics under one roof, especially for patients undergoing liver transplantation, surgical resection, or chemotherapy. Diagnostic labs are increasingly integrating liquid biopsy tests, NGS panels, and multiplex assays to provide end-to-end molecular profiling.

Pharmaceutical and CRO laboratories are the fastest-growing end users, as biomarker-based patient stratification and companion diagnostics are essential in clinical trials of targeted liver cancer therapies. These organizations rely on advanced diagnostic techniques to ensure accurate patient enrollment, treatment response tracking, and adverse event monitoring. With rising R&D in oncology drug development, diagnostic demand from pharma and CROs is set to expand significantly.

By Regional Insights

Asia-Pacific dominates the liver cancer diagnostics market, driven by the high prevalence of hepatitis B and C, which are endemic in countries such as China, Japan, South Korea, and Vietnam. China alone accounts for more than 50% of global liver cancer cases. National screening programs, rising healthcare infrastructure investment, and expanded access to diagnostic imaging are fueling growth. Moreover, governments are funding AI-based healthcare innovations, including early liver disease detection platforms.

North America is the fastest-growing region, owing to rising cases of NASH (Non-alcoholic steatohepatitis), alcohol-induced liver disease, and growing adoption of liquid biopsies and companion diagnostics. U.S.-based companies are also leading innovation in biomarker discovery and NGS-based diagnostics. The presence of key players, favorable reimbursement models for high-risk patients, and increased clinical trial activity in liver oncology further support market acceleration.

Some of the prominent players in the Liver cancer diagnostics market include:

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Qiagen N.V.

- Siemens Healthineers

- Becton, Dickinson & Company

- Illumina, Inc.

- Epigenomics AG

- Koninklijke Philips N.V.

- Fujifilm Medical Systems U.S.A., Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global liver cancer diagnostics market.

Test Type

-

-

- Oncofetal and Glycoprotein Antigens

- Enzymes and Isoenzymes

- Growth Factors and Receptors

- Molecular Markers

- Pathological Biomarkers

- Imaging

- Endoscopy

- Biopsy

- Others

End-use

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

- Pharmaceutical & CRO Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)