The global liver disease diagnostics market size was valued at USD 40.11 billion in 2023 and is anticipated to reach around USD 82.67 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

Market Overview

The global liver disease diagnostics market is evolving rapidly, driven by a confluence of factors such as the rising prevalence of chronic liver diseases, improvements in diagnostic modalities, and the growing focus on early disease detection. Liver diseases, including hepatitis, liver cancer, cirrhosis, and non-alcoholic fatty liver disease (NAFLD), are among the leading causes of global morbidity and mortality. Early diagnosis and effective monitoring remain critical in reducing disease burden and improving patient outcomes.

Diagnostics in this field range from traditional laboratory blood tests and liver biopsies to advanced imaging modalities and emerging non-invasive technologies. Recent advancements include elastography, high-resolution MRI, next-generation sequencing for genetic liver disorders, and blood-based biomarkers for early hepatocellular carcinoma (HCC) detection. These innovations are reshaping diagnostic pathways by enabling accurate staging, risk stratification, and therapeutic decision-making.

As healthcare systems shift toward value-based care and preventive medicine, the role of liver diagnostics has become more prominent. An increasing number of screening programs, particularly for viral hepatitis and fatty liver diseases, are being implemented in developed countries. Simultaneously, rising alcohol consumption, sedentary lifestyles, and obesity in emerging economies are contributing to growing demand for liver disease diagnostics. With biopharma companies investing in companion diagnostics and governments increasing awareness campaigns, the market is poised for strong and sustained growth.

Major Trends in the Market

-

Shift Toward Non-Invasive Diagnostics: Techniques like transient elastography and serum biomarkers are replacing traditional liver biopsies due to lower risk and patient discomfort.

-

Rising Focus on Early Cancer Detection: Companies are launching blood-based diagnostics targeting hepatocellular carcinoma (HCC) in high-risk populations.

-

Integration of AI and Imaging: Artificial intelligence is enhancing liver imaging interpretation, enabling automated fibrosis scoring and disease prediction.

-

Growing Screening for NAFLD and NASH: As metabolic liver disorders increase globally, early screening initiatives for fatty liver are expanding in both clinical and public health settings.

-

Precision Medicine and Companion Diagnostics: Targeted therapies in liver cancer and hepatitis C are driving demand for molecular diagnostics to guide treatment.

-

Point-of-Care and At-Home Testing: Decentralized testing for hepatitis and liver enzymes is gaining momentum, especially in remote and underserved areas.

-

Strategic Collaborations and M&A: Diagnostic developers are partnering with hospitals and pharmaceutical companies to broaden access and accelerate clinical validation.

Liver Disease Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 43.12 Billion |

| Market Size by 2033 |

USD 82.67 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.5% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033

|

| Segments Covered |

By Disease Type, By Technique, By End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Randox Laboratories Ltd.; Boston Scientific Corporation; Laboratory Corporation of America Holdings; Fujifilm Corporation; Horiba Medical; Siemens Healthcare GmbH |

Key Market Driver: Rising Prevalence of Chronic Liver Diseases

A primary driver propelling the liver disease diagnostics market is the escalating global burden of chronic liver diseases. According to the World Health Organization, over 2 million people die annually from liver diseases, including cirrhosis and liver cancer. Hepatitis B and C alone affect over 300 million individuals worldwide, while NAFLD is estimated to affect nearly 25% of the global population.

NAFLD, in particular, has emerged as a silent epidemic, tightly linked to the global obesity and diabetes crisis. In developed countries, it is now the most common cause of liver dysfunction, and without early diagnosis, it can progress to non-alcoholic steatohepatitis (NASH), cirrhosis, and liver failure. Consequently, diagnostic protocols are being updated to include routine liver assessments in metabolic clinics and endocrinology departments.

The increasing recognition of liver disease as a multisystemic and preventable condition has prompted health authorities to implement screening programs and integrate liver panels into routine health checks. This rising diagnostic demand across asymptomatic and at-risk populations is accelerating market expansion across imaging, laboratory, and molecular diagnostic segments.

Key Market Restraint: High Cost and Limited Access in Low-Income Settings

Despite growing awareness, the liver disease diagnostics market faces a significant barrier in the form of cost and access limitations, especially in low- and middle-income countries (LMICs). Many of the advanced diagnostic technologies such as MRI elastography, endoscopic ultrasound (EUS), and genomic testing are not accessible in remote or resource-constrained settings due to their high infrastructure and operational costs.

Even routine liver function tests and hepatitis serology panels are underutilized in rural clinics due to lack of laboratory facilities or trained personnel. While non-invasive techniques like FibroScan are becoming more widespread, their cost and calibration requirements still limit penetration beyond urban tertiary hospitals.

This disparity not only restricts early diagnosis but also delays treatment initiation, worsening health outcomes. Bridging this gap will require multi-sectoral efforts, including portable diagnostics, digital health platforms, and subsidized testing programs backed by public-private partnerships.

Key Market Opportunity: Emergence of Liquid Biopsy and Blood-Based HCC Detection

The advent of blood-based diagnostics and liquid biopsy technologies offers one of the most promising opportunities in liver disease diagnostics, especially for liver cancer. Early-stage hepatocellular carcinoma (HCC) often presents without symptoms and is difficult to detect using conventional imaging or AFP testing.

In February 2024, Exact Sciences launched its blood-based test for liver cancer detection, expanding its early cancer detection portfolio. This test is designed for high-risk populations, including those with cirrhosis or chronic hepatitis. It leverages DNA methylation patterns and genomic biomarkers to detect early cancer signals before tumors are radiographically visible.

The shift toward blood-based HCC screening enables more frequent and cost-effective monitoring without radiation exposure or invasive procedures. As this technology matures, it is expected to significantly reduce mortality through earlier interventions and personalized treatment planning, creating immense growth potential for molecular diagnostics firms and clinical laboratories.

Segmental Analysis

By Disease Type

Hepatitis, particularly B and C, dominates the liver disease diagnostics market in terms of volume and revenue. These viral infections have long been targeted by large-scale public health initiatives and screening campaigns. Diagnostic demand stems from both new case detection and chronic monitoring. With effective antiviral treatments now available, early diagnosis has become even more critical, especially in Asia and Africa where endemic prevalence remains high. Diagnostic protocols typically include serological tests for HBsAg, HCV RNA, and viral load quantification, generating a consistent demand for laboratory-based assays.

Conversely, Non-Alcoholic Fatty Liver Disease (NAFLD) is the fastest growing disease segment, reflecting its dramatic rise in prevalence. NAFLD is closely linked to lifestyle disorders such as obesity, insulin resistance, and hypertension. As it often remains asymptomatic until late stages, demand for screening and risk stratification tools is surging. Physicians now routinely recommend liver function panels and elastography in metabolic syndrome evaluations. Non-invasive fibrosis scores like FIB-4, NFS, and FibroScan are gaining adoption for staging NAFLD, driving market growth particularly in North America, Europe, and urban centers in Asia.

By Technique

Laboratory tests represent the largest share of the diagnostics technique segment. Liver function tests (LFTs), viral serologies, and enzyme panels (ALT, AST, GGT) are fundamental components of liver disease assessment. These tests are available across most primary care and diagnostic labs and form the first line of investigation for any suspected liver abnormality. Additionally, molecular assays for hepatitis viral load and HCV genotyping are crucial in treatment planning, especially as genotype-specific drugs remain standard in some regions.

However, imaging techniques are experiencing the fastest growth, driven by advancements in elastography and AI-powered modalities. Techniques like transient elastography (FibroScan), contrast-enhanced MRI, and CT scans provide detailed insights into liver stiffness, fat infiltration, and tumor characterization. These technologies are rapidly replacing invasive biopsies in fibrosis staging and cancer monitoring. Innovations in portable imaging and integration with electronic health records further enhance the role of imaging in liver diagnostics, especially in specialty centers and hepatology clinics.

By End-use

Hospitals dominate the liver disease diagnostics market due to their access to comprehensive testing infrastructure, skilled personnel, and ability to perform multi-modal assessments (e.g., imaging, endoscopy, and biopsy). Most serious liver disease diagnoses are confirmed and managed within tertiary care hospitals that are equipped with gastroenterology and hepatology departments. Furthermore, inpatient management of cirrhosis, acute hepatitis, or liver failure requires continuous monitoring, reinforcing the hospital’s role as the primary diagnostic center.

However, diagnostic laboratories are the fastest-growing end-users, particularly as molecular diagnostics and specialized liver panels gain popularity. Centralized labs and pathology networks are processing increasing volumes of samples from both urban clinics and telehealth providers. Outsourcing of specialized tests such as HCV genotyping, liver fibrosis markers, and liquid biopsies to reference labs is becoming more common. Additionally, the rise of digital pathology and AI-assisted liver histopathology scoring is expanding the laboratory market into new frontiers of diagnostic accuracy.

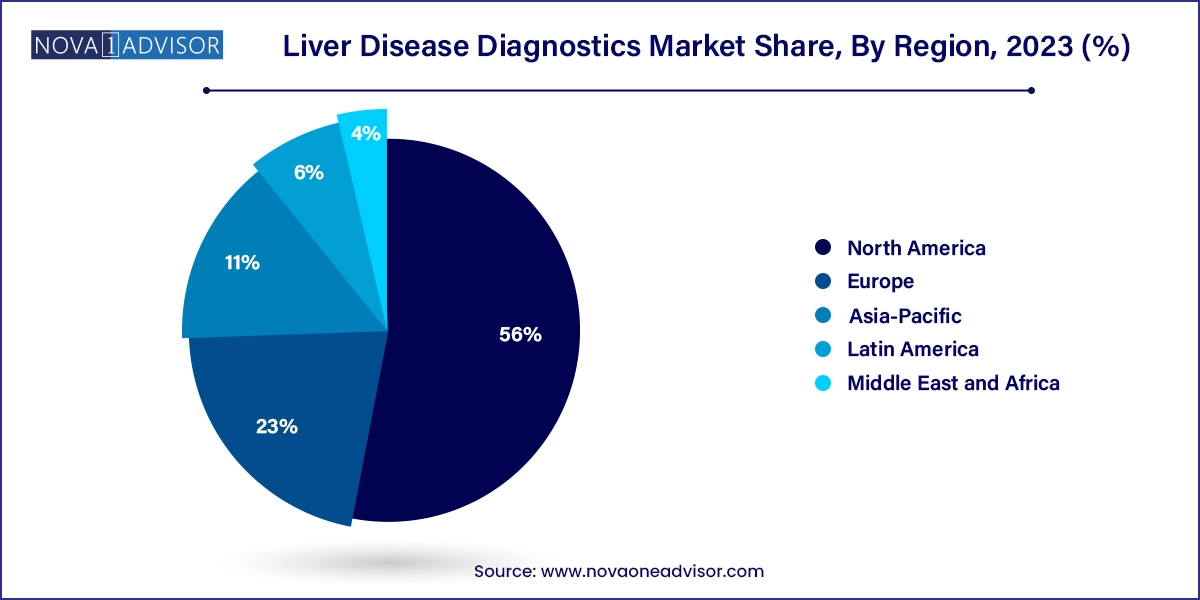

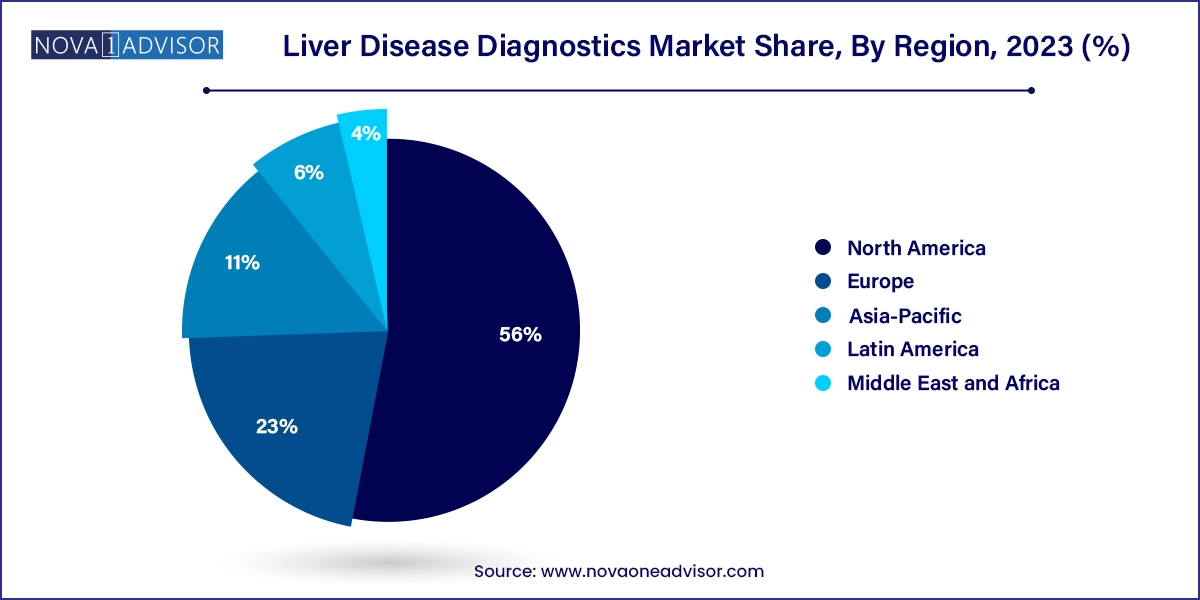

Regional Insights

North America dominates the global liver disease diagnostics market, led by the U.S., where liver diseases rank among the top 10 causes of death. The region has a mature diagnostic infrastructure, widespread health insurance coverage, and high awareness of liver health. Government-supported hepatitis screening programs, integration of NAFLD assessments in diabetes clinics, and robust adoption of advanced imaging have contributed to market leadership.

Companies like Exact Sciences, Abbott, and Siemens Healthineers maintain a strong presence, continuously innovating liver cancer diagnostics, fibrosis assessments, and at-home liver panels. Additionally, favorable reimbursement for non-invasive imaging and viral load testing has improved patient access and encouraged early intervention.

Asia-Pacific is the fastest growing regional market, driven by the high burden of hepatitis, rapidly increasing rates of NAFLD, and improving healthcare infrastructure. Countries like China, India, and Japan are investing in liver disease prevention and diagnostics through public-private partnerships. For instance, China’s national hepatitis control programs and India’s growing network of diagnostic chains are expanding access to viral screening and fibrosis testing.

Urbanization, rising disposable income, and increased health screenings in corporate wellness programs are creating new diagnostic demand. Moreover, local companies are developing cost-effective imaging and lab solutions tailored to regional needs. With a large population base and growing health awareness, Asia-Pacific presents a major growth opportunity for diagnostics manufacturers and service providers.

Liver Disease Diagnostics Market Top Key Companies:

- Abbott

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Randox Laboratories Ltd.

- Boston Scientific Corporation

- Laboratory Corporation of America Holdings

- Fujifilm Corporation

- Horiba Medical

- Siemens Healthcare GmbH

Recent Developments

-

February 2024: Exact Sciences launched a new blood-based liver cancer test, expanding its early detection platform and targeting high-risk patients such as those with cirrhosis or chronic hepatitis. [Source: BusinessWire]

-

December 2024: GE HealthCare introduced a new ultrasound elastography solution integrated with AI algorithms for real-time liver stiffness measurement in primary care settings.

-

October 2024: Siemens Healthineers announced collaboration with a leading Asian diagnostic chain to deploy its liver fibrosis assessment solutions across 200 clinics in India and Southeast Asia.

-

June 2024: Abbott Diagnostics received CE mark for its enhanced HCV genotyping assay, capable of differentiating mixed infections and rare genotypes for improved treatment planning.

Liver Disease Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Liver Disease Diagnostics market.

By Disease Type

- Hepatitis

- Cirrhosis

- Liver cancer

- Non-alcoholic fatty liver disease (NAFLD)

- Other disease types

By Technique

- Imaging

- Liver biopsy

- Endoscopy

- Laboratory tests

By End-use

- Hospitals

- Laboratories

- Other end-users

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)