Long Read Sequencing Market Size and Research

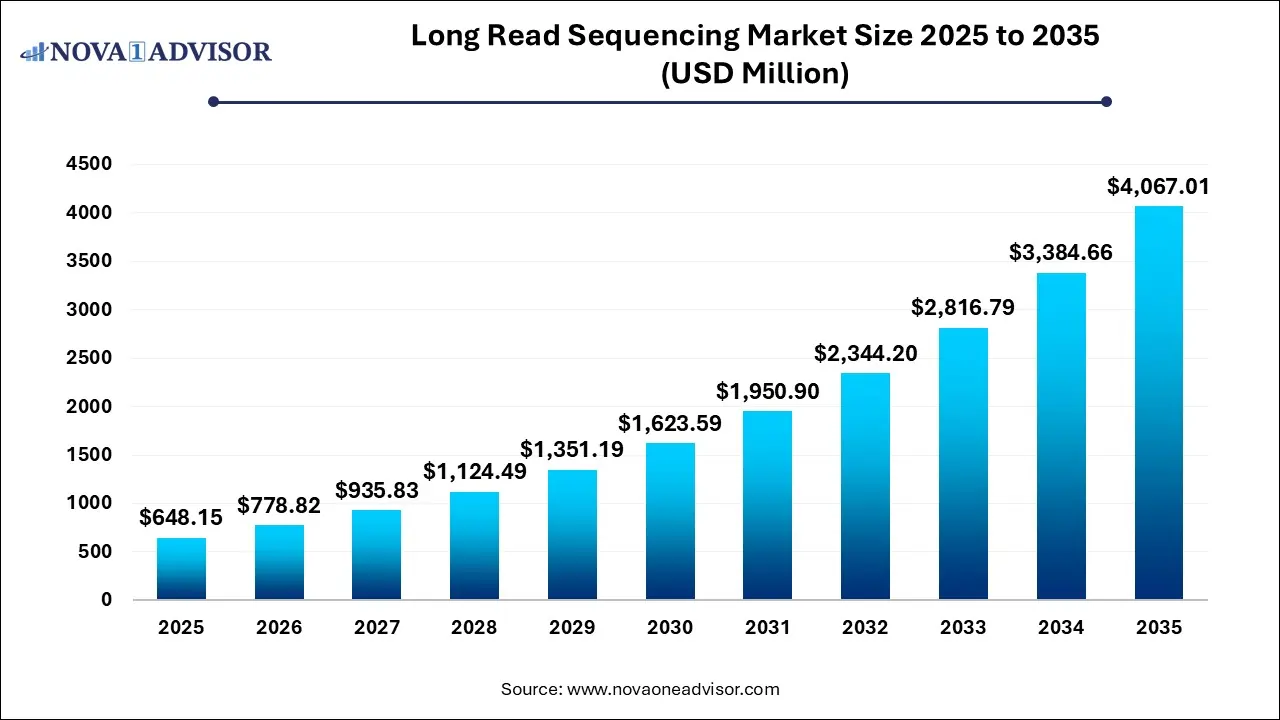

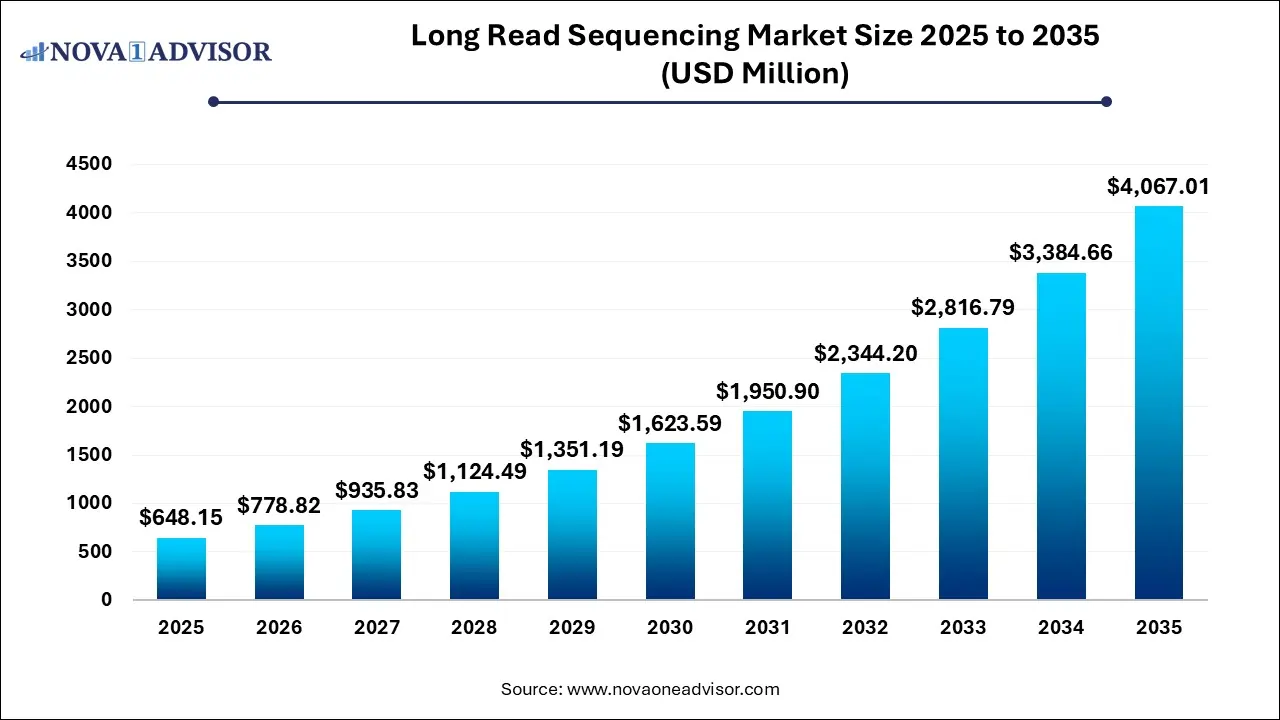

The Long read sequencing market size was exhibited at USD 648.15 million in 2025 and is projected to hit around USD 4067.01 million by 2035, growing at a CAGR of 20.16% during the forecast period 2026 to 2035.

Key Takeaways:

- In 2025, the consumables segment held the largest market share of 63%.

- The nanopore sequencing segment dominated the market in 2025 with a share of 54%.

- The sequencing segment accounted for the largest revenue share of 63% in 2025.

- The whole genome sequencing segment dominated the long read sequencing market in 2025 with a share of 30%.

- In 2025, the academic & research institutes segment captured the largest market share of 50%.

- North America dominated the regional market with a largest share of 52% in 2025

Market Overview

The global Long Read Sequencing (LRS) market has emerged as a pivotal segment of the genomics industry, offering transformative advantages in accurately identifying structural variants, resolving complex genomic regions, and enhancing de novo genome assemblies. Unlike short-read sequencing technologies, long-read sequencing enables the reading of DNA strands exceeding tens of thousands of base pairs in a single pass. This capability significantly improves the resolution and quality of genomic data, which is especially beneficial in applications such as whole genome sequencing, metagenomics, epigenetics, and rare disease detection.

The market has witnessed significant momentum in recent years, propelled by a rising interest in precision medicine, the growing adoption of sequencing technologies in clinical diagnostics, and technological innovations that reduce costs while improving throughput. With organizations such as the NIH and global genomic research initiatives investing in comprehensive human genome projects, the adoption of LRS technologies is anticipated to accelerate. Leading players, including Pacific Biosciences, Oxford Nanopore Technologies, and BGI, have continued to roll out next-generation platforms with enhanced accuracy and speed, further strengthening market growth.

The increasing incidence of complex genetic disorders, cancers, and infectious diseases has underscored the demand for high-throughput and highly accurate genomic sequencing tools. Long read sequencing not only caters to these needs but also opens new frontiers in single-cell sequencing, microbiome studies, and transcriptomics, making it an indispensable tool in both research and clinical settings. The global long read sequencing market is forecasted to grow robustly through 2030, supported by continuous technological evolution and expanding applications across healthcare and life sciences.

Major Trends in the Market

-

Integration of AI and Machine Learning in Genomic Data Interpretation

The deployment of AI algorithms for sequencing data analysis is significantly reducing interpretation time and improving diagnostic accuracy.

-

Rise in Clinical Adoption for Rare Disease Diagnosis

Long read sequencing is increasingly used in hospitals and diagnostic laboratories to detect rare and undiagnosed conditions due to its high resolution and ability to identify structural variants.

-

Miniaturization and Portability of Sequencing Instruments

Companies are developing compact, portable LRS platforms suitable for point-of-care settings and field-based genomic studies.

-

Emergence of Hybrid Sequencing Techniques

Combining short-read and long-read sequencing is becoming a standard approach to optimize cost-efficiency and data quality.

-

Expansion of Metagenomic Applications

Long read sequencing is playing a pivotal role in exploring complex microbial communities in human health, agriculture, and environmental studies.

-

Open-Source Software for Long Read Data Analysis

The market is witnessing a surge in open-source computational tools specifically designed for managing and interpreting long-read data.

Report Scope of Long Read Sequencing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 778.82 Million |

| Market Size by 2035 |

USD 4,067.01 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 20.16% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Technology, Workflow, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Pacific Biosciences of California, Inc.; Oxford Nanopore Technologies Limited; Quantapore, Inc.; Element Biosciences; BGI; Eurofins Genomics; F. Hoffmann-La Roche Ltd.; MicrobesNG; Takara Bio; New England Biolabs |

Market Driver: Rising Demand for Precision Medicine

A major driver fueling the long read sequencing market is the growing demand for precision medicine, particularly in oncology, neurology, and rare genetic diseases. Precision medicine relies on understanding the genetic makeup of individuals to tailor treatments, which necessitates accurate sequencing data. Long read technologies offer superior read lengths and minimal assembly gaps, enabling the precise identification of structural variants and haplotypes critical for individualized therapy.

For instance, Pacific Biosciences' HiFi reads have demonstrated an exceptional ability to detect insertions, deletions, and repetitive regions, which are often missed by short-read platforms. This capability has made LRS an integral part of translational research and clinical genomics programs worldwide. As healthcare systems shift toward personalized therapeutics, the demand for LRS technologies will experience exponential growth.

Market Restraint: High Cost of Instruments and Sequencing

One significant barrier to market expansion is the high cost associated with long read sequencing platforms and consumables. Despite improvements in affordability, LRS systems remain significantly more expensive than their short-read counterparts. Instruments from leading vendors such as PacBio or Oxford Nanopore require substantial capital investment, and operational costs including library preparation, sequencing reagents, and data analysis add to the financial burden.

This cost challenge limits accessibility in developing countries and smaller laboratories with budget constraints. While grant funding and academic collaborations offer some relief, broader adoption in routine clinical diagnostics remains hindered unless cost-per-genome can be reduced to competitive levels.

Market Opportunity: Growing Use in Epigenetics Research

A major opportunity lies in the expanding role of long read sequencing in epigenetics. LRS can directly detect DNA modifications such as methylation without the need for chemical treatment or conversion, a capability short-read technologies lack. This makes LRS uniquely suited for epigenetic studies that explore gene regulation mechanisms, aging, and disease pathogenesis.

For example, Oxford Nanopore Technologies' platforms can distinguish modified bases during the sequencing process, enabling simultaneous analysis of genetic and epigenetic information. With growing interest in understanding the epigenomic landscape of cancer and neurological diseases, this application area is expected to generate substantial demand and open new commercialization avenues for LRS technologies.

Segmental Analysis

By Product Outlook

Consumables dominated the product segment in 2025 due to their recurring usage and vital role in every sequencing cycle. Consumables, such as flow cells, sequencing kits, and reagents, are essential across diverse workflows including sample preparation, sequencing, and analysis. The continuous requirement for replenishment of these items, combined with increased throughput in research labs and diagnostics, contributes significantly to revenue generation. Vendors often tie consumable usage to their proprietary instruments, creating long-term revenue streams post-instrument sale. This recurring demand ensures that consumables remain the largest contributor to the overall market.

Instruments are projected to be the fastest growing segment over the forecast period, fueled by innovations in sequencing accuracy and throughput. New instrument launches like PacBio’s Revio and Oxford Nanopore’s PromethION 2 Solo are driving this growth by offering real-time data output and improved cost-efficiency. These platforms cater to evolving demands from both clinical and academic sectors for higher read lengths and faster turnaround. As institutions upgrade their sequencing infrastructure, instrument sales are expected to see a significant uptick.

By Technology Outlook

Single Molecule Real Time (SMRT) Sequencing leads the technology segment due to its high accuracy, longer reads, and expanding clinical application base. Developed by Pacific Biosciences, SMRT sequencing excels in resolving complex genomic regions, making it ideal for detecting structural variants and sequencing hard-to-map regions. The technology's unique ability to sequence without amplification helps maintain data integrity, increasing its relevance in both research and diagnostics.

Nanopore sequencing is expected to be the fastest growing segment thanks to its affordability, real-time analysis, and portability. Devices like Oxford Nanopore’s MinION allow for on-site sequencing, a game-changer in pandemic monitoring and field-based genomic research. The technology’s scalability and increasing use in point-of-care diagnostics position it as a disruptive force in the genomics industry.

By Workflow Outlook

Sequencing remained the dominant segment in workflow analysis, as it represents the core function of the LRS process. Advances in throughput, read accuracy, and data integration continue to drive demand in this phase. As LRS becomes more mainstream, sequencing workflows have expanded to support diverse applications such as microbial genome assemblies, cancer profiling, and full-length transcriptomics.

Data analysis is the fastest growing workflow segment, driven by the need to manage and interpret the vast datasets generated by long-read technologies. The complexity of long-read data necessitates advanced bioinformatics tools and pipelines. The integration of AI for automated annotation and real-time analytics is transforming data analysis into a critical growth frontier within the workflow landscape.

By Application Outlook

Whole genome sequencing leads the application segment, supported by its broad utility in understanding genetic variations, population genetics, and personalized medicine. The completeness of genome assemblies achievable through LRS makes it indispensable for de novo sequencing of plants, microbes, and complex organisms. Governments and research institutions are heavily investing in whole-genome projects, further driving demand.

Epigenetics is expected to be the fastest growing application, spurred by its critical role in oncology, developmental biology, and aging research. LRS platforms can detect base modifications in real-time, making them highly suitable for mapping methylation patterns. This direct read capability is anticipated to revolutionize how researchers study regulatory genomics.

By End-use Outlook

Academic and research institutes dominate the end-user segment, driven by strong demand from universities and genomics centers globally. These institutions frequently adopt advanced technologies for disease research, microbial studies, and genomic diversity projects. Support from government grants and international collaborations facilitates early adoption of LRS platforms.

Pharmaceutical and biotechnology companies represent the fastest growing end-use, as they increasingly incorporate LRS into drug discovery, biomarker identification, and companion diagnostics. Companies are using long read data to enhance target validation and streamline R&D workflows, making this segment a critical driver of future market expansion.

By Regional Analysis

North America holds the dominant position in the global long read sequencing market, owing to its advanced healthcare infrastructure, presence of leading LRS companies, and strong R&D investment. The U.S. in particular has seen rapid adoption in clinical genomics and biopharmaceutical development. Initiatives such as the NIH's All of Us Research Program and the Genome Canada partnership have amplified the market's momentum in the region.

Asia Pacific is expected to witness the fastest growth, led by increasing genomic research funding, improving healthcare facilities, and government-led genomics projects in countries like China, India, and Japan. Institutions across Asia are adopting LRS for cancer screening, infectious disease monitoring, and agricultural genomics, establishing a vibrant demand base for both academic and commercial applications.

Some of The Prominent Players in The Long read sequencing market Include:

- Pacific Biosciences of California, Inc.

- Oxford Nanopore Technologies Limited

- Quantapore, Inc.

- Element Biosciences

- BGI

- Eurofins Genomics

- F. Hoffmann-La Roche Ltd.

- MicrobesNG

- Takara Bio

- New England Biolabs

- Pacific Biosciences of California, Inc.

- Oxford Nanopore Technologies Limited

- Quantapore, Inc.

- Element Biosciences

- BGI

- Eurofins Genomics

- F. Hoffmann-La Roche Ltd.

- MicrobesNG

- Takara Bio

- New England Biolabs

Recent Developments

-

March 2025 – Pacific Biosciences announced the commercial availability of Revio, its latest sequencing system capable of delivering over 100x human genome coverage per day, marking a major leap in throughput and cost-efficiency.

-

January 2025 – Oxford Nanopore Technologies introduced the PromethION 2 Solo, a desktop sequencer targeting clinical and small-lab markets with improved accuracy for both genomic and epigenomic applications.

-

December 2024 – BGI Genomics partnered with a Southeast Asian university for a collaborative whole-genome sequencing project aimed at understanding population-specific genetic diseases.

-

October 2024 – Roche entered the long-read sequencing landscape through strategic partnerships and acquisitions aimed at expanding its sequencing solutions for oncology research.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Long read sequencing market

Product

- Instruments

- Consumables

- Services

Technology

- Single Molecule Real Time Sequencing

- Nanopore Sequencing

- Others

Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

Application

- Whole Genome Sequencing

- Targeted Sequencing

- Metagenomics

- RNA Sequencing

- Epigenetics

- Others

End-use

- Academic & Research Institutes

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)