Lyme Disease Testing Market Size and Growth Report, 2033

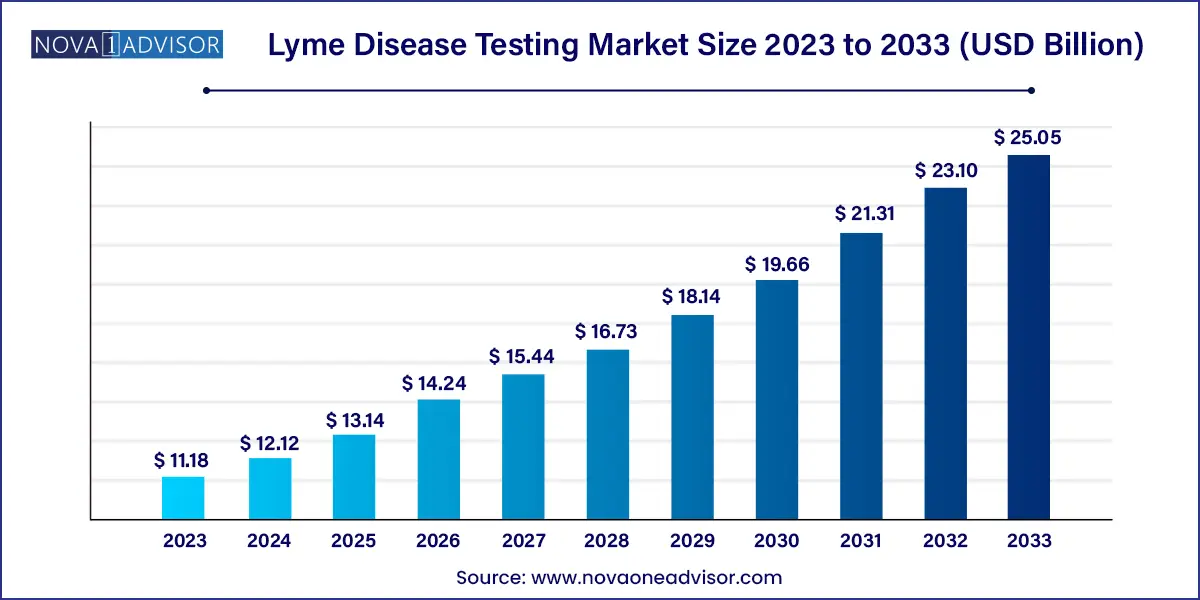

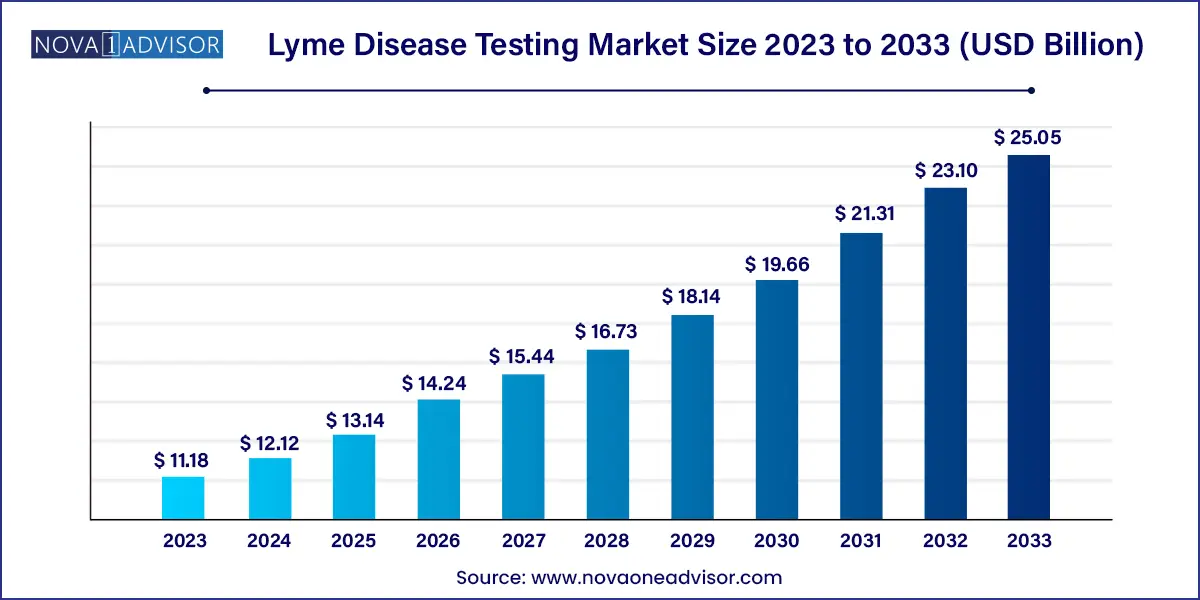

The global iyme disease testing market size was valued at USD 11.18 billion in 2023 and is anticipated to reach around USD 25.05 billion by 2033, growing at a CAGR of 8.4% from 2024 to 2033.

Lyme Disease Testing Market Key Takeaways

- Europe dominated the lyme disease testing market with the revenue share of 48.29% in 2023

- The lyme disease testing market in North America is anticipated to grow at a steady CAGR during the forecast period

- Based on technology, the other segment led the market with the largest revenue share of 88.56% in 2023.

- The Interferon-Gamma Release Assays (IGRA) testing technology segment is experiencing substantial growth due to several factors.

- Based on testing, the serological test segment led the market with the largest revenue share of 53.87% in 2023

- Based on sample, the blood segment led the market with the largest revenue share of 62.49% in 2023 and is expected to grow at the fastest CAGR over the forecast period.

- Based on sample, the blood segment led the market with the largest revenue share of 62.49% in 2023 and is expected to grow at the fastest CAGR over the forecast period.

- Based on end use, the hospital segment led the market with the largest revenue share of 58.44% in 2023.

Market Overview

Lyme disease, caused by the Borrelia burgdorferi bacterium and primarily transmitted through the bite of infected black-legged ticks, has become one of the most prevalent vector-borne diseases across North America and Europe. In recent years, there has been an alarming surge in the number of reported Lyme disease cases, with the Centers for Disease Control and Prevention (CDC) estimating approximately 476,000 people diagnosed and treated for Lyme disease annually in the United States alone. The increasing public health burden has prompted significant advancements in Lyme disease diagnostics, boosting demand for accurate, early, and cost-effective testing tools.

The Lyme Disease Testing Market is experiencing steady growth, primarily driven by rising awareness, increasing tick populations due to climate change, and better surveillance. Healthcare institutions, research labs, and diagnostic companies are investing in sophisticated technologies to identify Lyme infections across multiple stages—early localized, early disseminated, and late disseminated—thus improving patient outcomes.

With diagnostics ranging from Enzyme-Linked Immunosorbent Assays (ELISA) to advanced Nucleic Acid Tests (NATs), the market is increasingly diverse. The global focus on developing rapid, point-of-care tests that can identify Lyme disease during the critical early stages is transforming the competitive landscape, while regulatory initiatives and government funding further catalyze industry expansion.

Major Trends in the Market

-

Integration of Artificial Intelligence and Machine Learning in diagnostic workflows to improve result accuracy and interpret complex Lyme disease presentations.

-

Growth in Point-of-Care Testing Devices enabling remote and real-time detection, particularly beneficial in rural or endemic regions.

-

Multi-pathogen panel development targeting co-infections like Babesiosis and Anaplasmosis, often found alongside Lyme disease.

-

Development of Novel Serological Assays with enhanced sensitivity and specificity compared to traditional ELISA and Western Blot methods.

-

Rising adoption of nucleic acid amplification tests (NAATs) as confirmatory diagnostics due to their ability to detect early-stage Lyme disease before antibody response.

-

Increasing demand for urine antigen testing as a non-invasive alternative to blood-based diagnostics, especially among pediatric and geriatric populations.

-

Collaborative public health initiatives in endemic areas like the U.S. Northeast, aimed at standardizing diagnostic criteria and surveillance.

-

Innovations in sample collection including dried blood spots and portable urine kits to enhance accessibility and comfort in testing.

Lyme Disease Testing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 12.12 Billion |

| Market Size by 2033 |

USD 25.05 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.4% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Technology, testing, sample, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

DiaSorin S.p.A; BIOMÉRIEUX; Oxford Immunotec; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; T2 Biosystems; IGeneX; Gold Standard Diagnostics; ZEUS Scientific; Trinity Biotech |

Key Market Driver

One of the most compelling drivers of the Lyme disease testing market is the increased incidence of Lyme disease, particularly in North America and parts of Europe. Climate change has significantly extended tick seasons, increasing their geographic range and density. This environmental shift has created new hotspots of Lyme disease transmission, expanding the target population for diagnostic testing. Additionally, increasing human interaction with wooded and grassy areas has intensified tick exposure.

For instance, between 2010 and 2020, the CDC reported a notable increase in Lyme disease cases in northern U.S. states like Maine, Vermont, and Wisconsin. Furthermore, the European Centre for Disease Prevention and Control (ECDC) has flagged emerging concerns in central and eastern European nations. The burden of disease has pushed public health systems and private healthcare providers to invest in comprehensive testing capabilities that allow for early detection, follow-up testing, and monitoring of disease progression—fueling the overall growth of the market.

Key Market Restraint

Despite technological advancements, one of the major restraints affecting the market is the high incidence of false-negative results in the early stages of Lyme disease. Traditional two-tiered testing strategies (ELISA followed by Western Blot) often fail to detect the infection within the first few weeks post-exposure, as they rely on the patient’s antibody response, which may not be adequately developed at that point.

This diagnostic gap leads to delayed treatment, prolonged patient suffering, and, in some cases, progression to chronic Lyme disease. As a result, healthcare professionals and patients may lose confidence in the reliability of diagnostic tools. While newer tests like PCR and NAAT offer better early detection, they are often more expensive, technically demanding, and not widely available in lower-income or rural settings. This disparity in access and accuracy hinders the universal adoption of advanced Lyme disease diagnostics.

Key Market Opportunity

An exciting opportunity within the Lyme disease testing market lies in the development and distribution of point-of-care (POC) diagnostics, especially tailored for rural and underserved regions. These areas often lack access to centralized laboratories and sophisticated medical infrastructure. Deploying easy-to-use, rapid diagnostics can revolutionize early detection and treatment outcomes for thousands of people living in endemic zones.

Companies are increasingly designing lateral flow assays and microfluidic-based devices that can provide results within minutes using small blood or urine samples. For instance, the emergence of mobile diagnostic vans equipped with rapid Lyme testing tools in parts of Pennsylvania and New York demonstrates the transformative potential of POC solutions. The opportunity to reach new patient populations while reducing diagnostic turnaround time presents a valuable growth avenue for both established players and emerging innovators in the field.

Lyme Disease Testing Market By Technology Insights

IGRA (Interferon Gamma Release Assays) testing dominated the technology segment due to its robust application in diagnosing immune responses associated with tick-borne pathogens. Although traditionally more common in tuberculosis diagnostics, IGRA’s role in tick-related disease assessment is expanding, especially for complex co-infections. Its utility in high-burden clinical settings ensures repeat usage and growing demand.

On the other hand, the “Others” category, which includes cutting-edge genomic and proteomic tools, is expected to be the fastest-growing segment. Techniques such as microarrays, CRISPR-based diagnostics, and biosensor technologies are gaining traction due to their enhanced sensitivity and multiplexing capabilities. With the ongoing research into biomarkers for Lyme disease, these novel technologies are likely to redefine the diagnostic standard in the coming decade.

Lyme Disease Testing Market By Testing Insights

Serological tests, particularly ELISA and Western Blot, have long been the cornerstone of Lyme disease diagnostics and continue to dominate this segment. ELISA tests are favored for their cost-effectiveness, speed, and wide availability. Western Blot acts as the confirmatory test, although its interpretation can be complex. Together, they form the conventional two-tiered testing system recommended by most health authorities.

However, the Nucleic Acid Tests (NATs) are emerging as the fastest-growing segment. Unlike serological assays, NATs can detect bacterial DNA in bodily fluids during the earliest stages of infection. The high sensitivity of PCR-based platforms offers distinct advantages in acute-phase diagnosis, allowing patients to receive timely antibiotic treatment. Their increasing integration into centralized and academic labs points to their rapid commercialization and adoption trajectory.

Lyme Disease Testing Market By Sample Insights

The blood segment dominates Lyme disease testing due to the high accuracy and ease of sample collection in both hospital and outpatient settings. Blood samples are commonly used for ELISA, Western Blot, and PCR tests. Furthermore, most advanced diagnostic platforms are optimized for blood-based analysis, making it the gold standard in Lyme diagnostics.

However, urine-based testing is witnessing rapid growth, particularly in pediatric and geriatric populations where blood collection can be challenging. Emerging urine antigen tests and lateral flow assays have significantly improved in accuracy and are gaining regulatory approval. Their non-invasive nature, convenience, and compatibility with point-of-care platforms position urine as a promising sample type for widespread future deployment.

Lyme Disease Testing Market By Regional Insights

North America, particularly the United States, holds the lion’s share of the Lyme disease testing market. This dominance can be attributed to the high prevalence of Lyme disease, strong public health infrastructure, and widespread access to advanced diagnostics. The U.S. has some of the world’s most tick-endemic regions, including the Northeast and Upper Midwest. Moreover, national awareness campaigns, CDC guidelines, and federal grants for Lyme research have created an enabling environment for diagnostic innovation.

In addition, North America boasts a mature diagnostics industry with key players such as Quest Diagnostics, Bio-Rad Laboratories, and Thermo Fisher Scientific headquartered in the region. The presence of leading universities and research centers, active clinical trial pipelines, and strong healthcare reimbursement structures all contribute to its leadership position in the global market.

Asia-Pacific Emerges as the Fastest-Growing Market

While still a relatively smaller market, the Asia-Pacific region is projected to grow at the fastest pace. Countries like China, Japan, and South Korea are witnessing increased diagnostic activity due to rising cases of Lyme-like syndromes, often underreported in the past. Improved healthcare infrastructure, greater awareness, and government-backed surveillance efforts are driving growth.

Additionally, the region’s thriving biotechnology industry is playing a pivotal role. For instance, Chinese startups are actively exploring CRISPR diagnostics, while Indian companies are developing affordable ELISA kits for rural use. The push for international collaborations and the rising incidence of tick-borne diseases across the region ensure that Asia-Pacific will be a major focal point for industry expansion over the next decade.

Lyme Disease Testing Market Top Key Companies:

The following are the leading companies in the lyme disease testing market. These companies collectively hold the largest market share and dictate industry trends.

- DiaSorin S.p.A

- BIOMÉRIEUX

- Oxford Immunotec

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- T2 Biosystems

- IGeneX

- Gold Standard Diagnostics

- ZEUS Scientific

- Trinity Biotech

Lyme Disease Testing Market Recent Developments

-

March 2025 – T2 Biosystems announced the initiation of clinical trials for a Lyme disease panel using its T2Dx® instrument, aiming to detect Borrelia DNA directly from whole blood with high accuracy.

-

February 2025 – Bio-Rad Laboratories expanded its Lyme diagnostic product line with an updated Western Blot kit featuring improved interpretation software for automated result classification.

-

January 2025 – QuidelOrtho Corporation reported that its Sofia® 2 Lyme FIA, a rapid point-of-care fluorescence immunoassay, received CE-IVD certification, boosting its commercialization in European markets.

-

November 2024 – Zoonotic Technologies, a biotech startup, unveiled a novel smartphone-based Lyme detection kit targeting pediatric applications using saliva samples.

-

October 2024 – The U.S. Department of Health and Human Services announced $8 million in new funding to accelerate the development of early Lyme diagnostics under its Tick-Borne Disease Working Group initiative.

Lyme Disease Testing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Lyme Disease Testing market.

By Technology

By Test

- Serological Test

- Lymphocytic Transformation Test

- Urine Antigen Testing

- Immunofluorescent Staining

- Nucleic Acid Test

By Sample

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)