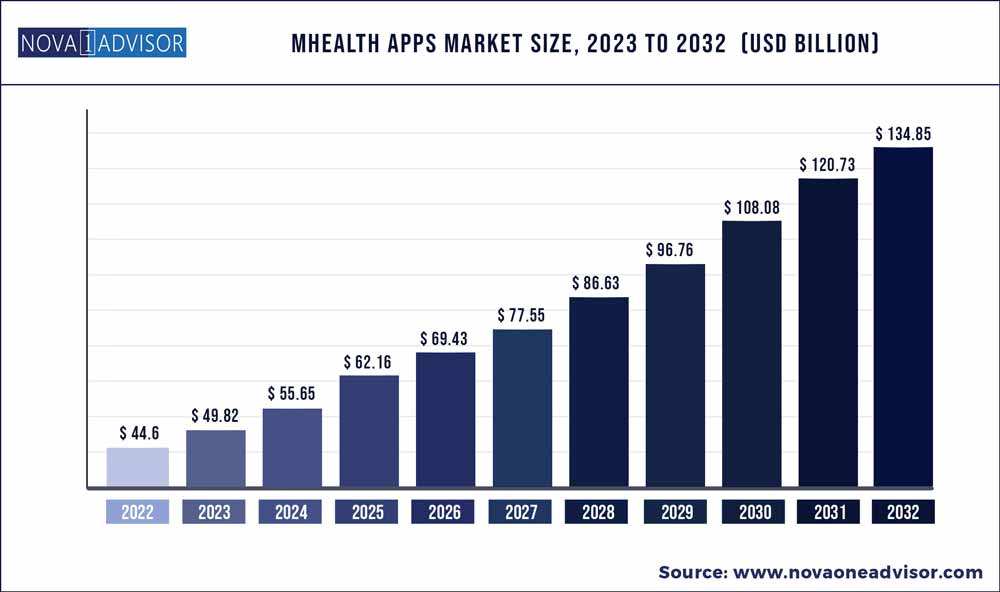

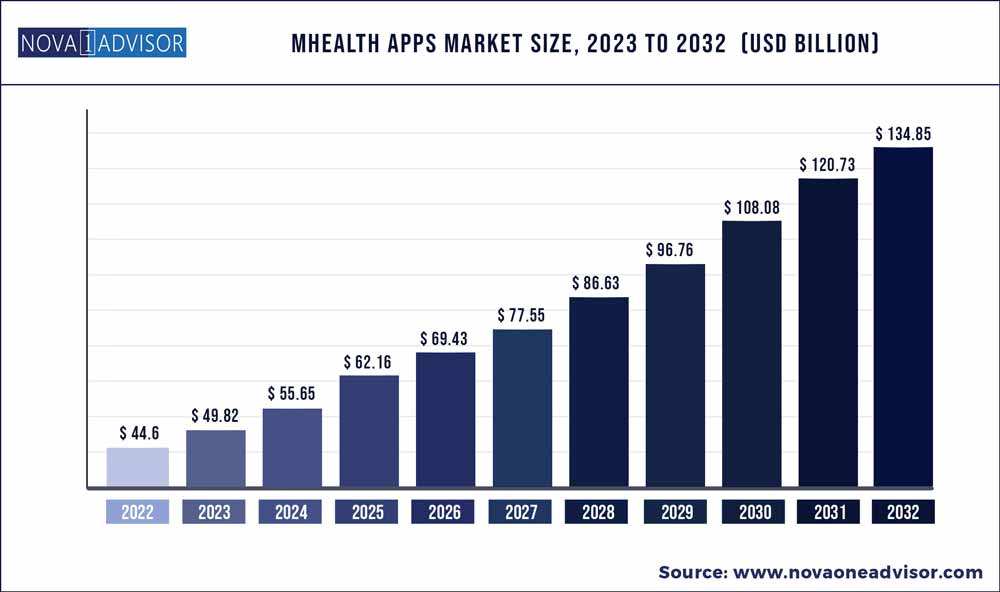

The global mHealth apps market size was estimated at USD 44.60 billion in 2022 and is expected to surpass around USD 134.85 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 11.7% during the forecast period 2023 to 2032.

Key Takeaways:

- The medical apps segment dominated the market for mHealth in 2022 and accounted for the largest revenue share of 97.6%.

- North America dominated the market for mHealth and accounted for the largest revenue share of 37.2% in 2022.

mHealth Apps Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 49.82 Billion |

| Market Size by 2032 |

USD 134.85 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 11.7% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Product type, Platform, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Teladoc Health, Inc.; Abbott Laboratories; Johnson and Johnson; AstraZeneca PLC; F. Hoffmann-La Roche Ltd.; Novartis AG; Bristol-Myers Squibb Company; GlaxoSmithKline plc; Merck and Co., Inc.; Pfizer, Inc.; Sanofi; Samsung Electronics Co. Ltd.; Qualcomm Technologies, Inc.; Orange; Google (Alphabet), Inc.; Allscripts; Airstrip Technologies, Inc.; AT&T; Apple, Inc. |

Growing adoption of fitness and medical apps to collect and track individuals' health-related data and to improve the overall health of the patients’ using smartphones are the major factors anticipated to drive the market. In addition, increasing internet and smartphone penetration and growing awareness in maintaining physical health and lifestyle improvement are also further increasing the adoption, thereby supporting market growth.

Furthermore, increasing promotion to adopt health applications by the government and private organizations due to the benefits provided by these applications in monitoring and improving health conditions and lifestyle is also expected to accelerate the app adoption over the years. In addition, the growing number of health applications and continuous improvement of the app quality by the developers is also anticipated to boost the growth of the market for mHealth. For instance, according to statistics quoted by IQVIA in an article published by Medical Device Network in 2021, are more than 350,000 digital health applications available on app stores.

The growing interest of the users to use health applications for chronic disease management is expected to increase the adoption of mobile health applications. In addition, increasing recommendations of healthcare professionals to use mobile applications for better patient care is also another factor anticipated to accelerate the mHealth app adoption. For instance, according to the data published in OrthoLive stated that 93% of the healthcare professionals believed that mobile health applications can improve patients' health. This type of perspective of the healthcare professionals towards the mobile health applications is further anticipated to drive the adoption of the mHealth applications over the years.

Furthermore, an increase in the number of mobile subscriptions and growing internet penetration around the globe are further helping to boost the adoption of health applications. For instance, as per the report published in 2020 by Ericsson, the mobile subscription number exceeded six billion and this is also anticipated to increase over the forecast years. Moreover, the growing use of social media and increasing app promotions are also expected to propel the growth of the market for mHealth in the upcoming years. For instance, according to the DataReportal 2021 statistics, there are around 4.55 billion social media users by October 2021, which equates to 57.6% of the total world population.

In addition, there is an increase in the utilization of mHealth applications observed during the COVID-19 pandemic. During the pandemic, the government and non-government organizations promoted the use of mobile health applications for training, self-management of symptoms, information sharing, contact tracing, risk assessment, home monitoring, and decision making to manage the COVID-19 pandemic. For instance, as per the data published in the journal Expert Review of Pharmacoeconomics and Outcomes Research, there is a 65% growth in mobile health application download in 2020.

Moreover, data security and privacy concerns of mobile healthcare applications are the major factors expected to hamper the growth of the market for mHealth. Sensitive information accesses, hacking issues, data breaches, automatic installation of malicious programs are some of the major concerns anticipated to impede the market growth. In addition, lower regulatory approval for mHealth applications is also one of the major factors anticipated to restrain the growth of the market. For instance, as per the medical economics report, only 219 mobile health applications got FDA approval by 2018.

Type Insights

The medical apps segment dominated the market for mHealth in 2022 and accounted for the largest revenue share of 97.6%. Increasing awareness to adopt medical applications among the patients and healthcare professionals for better communication and healthcare outcomes is helping in boosting the segment share. In addition, long-term use of subscribed medical applications by the patient and physicians is also one of the major factors expected to drive the segment. In addition, increasing preference for medical applications to manage chronic disease conditions is propelling segment growth.

Moreover, the development of mobile medical applications to monitor patient health and to provide support to physicians for decision-making are other factors that are anticipated to boost segment growth in terms of revenue over the years. The fitness apps segment is anticipated to grow at the fastest rate during the forecast period owing to the rising adoption of fitness-related applications coupled with increasing awareness regarding self-health management. Growing emphasis on the adoption of a healthy lifestyle and increasing the use of wearable devices, tablets, and smartphones to access fitness apps is driving the segment. Moreover, growing awareness regarding diet-related diseases is anticipated to propel segment growth over the forecast period.

Regional Insights

North America dominated the market for mHealth and accounted for the largest revenue share of 37.2% in 2022. Several factors like increasing awareness among the individuals to adopt mobile health applications, developments in coverage networks, rapid growth in the usage of smartphones, rise in geriatric population, and increasing prevalence of chronic diseases are driving the growth of the mHealth apps market in this region. In addition, increasing promotion by the healthcare professionals to use medical health applications in the U.S. is also leading to the adoption of such applications in this region.

Furthermore, due to the large population and increasing demand for health applications the Asia Pacific region is anticipated to exhibit lucrative growth over the forecast years. Fast-growing smartphone penetration and increasing internet users are also expected to drive the market for mHealth over the forecast period in this region. In addition, government initiatives to launch and promote mobile health applications to manage COVID-19 are also expected to boost the market growth in this region over the forecast years. For instance, in April 2020, the prime minister of India launched the Arogya Setu app to track the COVID 19 cases across India.

Key Companies & Market Share Insights

Increasing acceptance and adoption of mHealth apps by healthcare professionals and patients creates a competitive environment among the market players. Furthermore, the key strategies followed by the leading players in the form of mergers, collaborations, and acquisitions are also expected to accelerate market growth and fuel the competition. For example, in October 2019, Abbott Laboratories announced its partnership with Omada Health for diabetic care management using the mhealth coaching platform. Consequently, the developments by the leading players are anticipated to boost the growth of the market for mHealth over the forecast years. The key players are looking forward to developing cost-effective healthcare mobile applications as per the consumer need to hold their strong position in the market. Some of the prominent players in the mhealth apps market include:

- Teladoc Health, Inc.

- AstraZeneca PLC

- Abbott Laboratories

- Sanofi

- Johnson and Johnson

- Bristol-Myers Squibb Company

- Novartis AG

- F. Hoffmann-La Roche Ltd.

- Merck and Co., Inc.

- Pfizer, Inc.

- GlaxoSmithKline plc

- Samsung Electronics Co. Ltd

- Orange

- Qualcomm Technologies, Inc.

- Google (Alphabet), Inc.

- Airstrip Technologies, Inc.

- Apple, Inc.

- AT&T

- Allscripts

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global mHealth Apps market.

By Product Type

- Medical Apps

- Women’s Health Apps

- Personal Health Record Apps

- Medication Management Apps

- Diagnostic Apps

- Remote Monitoring Apps

- Disease Management Apps

- Others

- Fitness Apps

- Diet & Nutrition

- Exercise & Fitness

- Lifestyle & Stress

By Platform

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)