Manufacturing Execution System in Life Sciences Market Size and Research 2026 to 2035

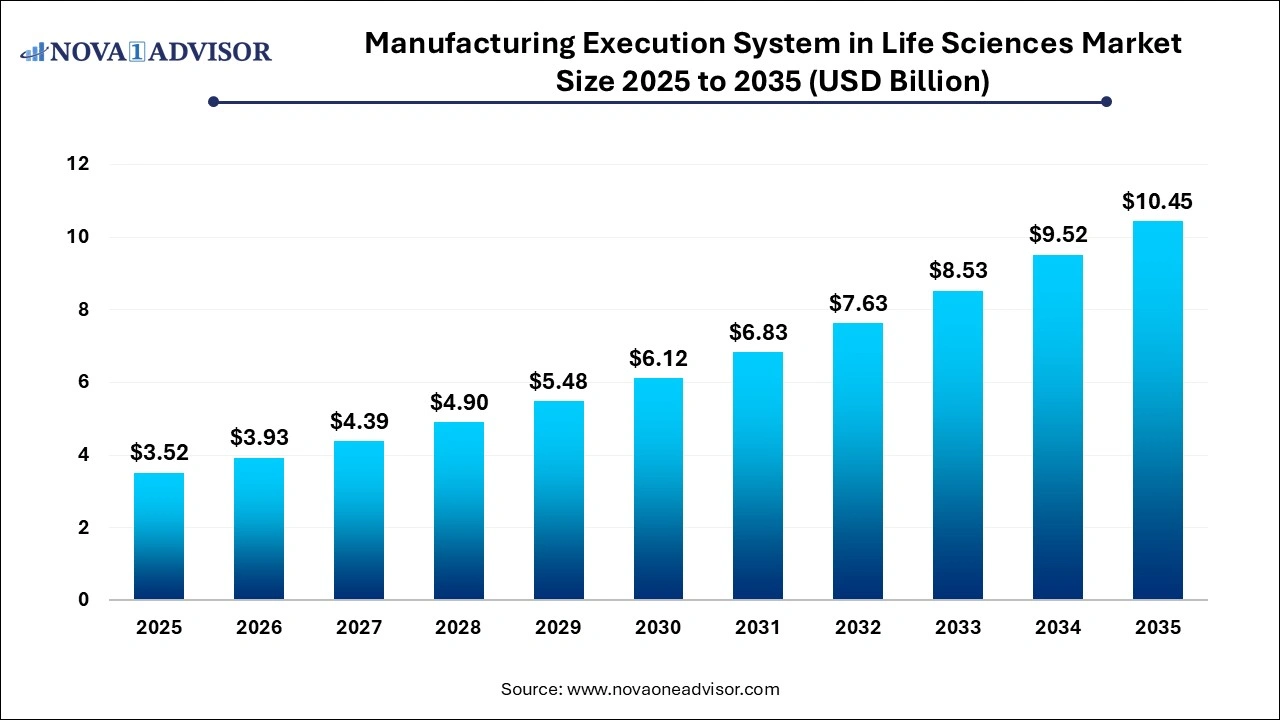

The manufacturing execution system in life sciences market size was exhibited at USD 3.52 billion in 2025 and is projected to hit around USD 10.45

billion by 2035, growing at a CAGR of 11.5% during the forecast period 2026 to 2035.

Manufacturing Execution System in Life Sciences Market Key Takeaways:

- The software segment is expected to grow at a significant CAGR of 11.1% from 2026 to 2035.

- The on-premise deployment segment held the largest market share in 2025.

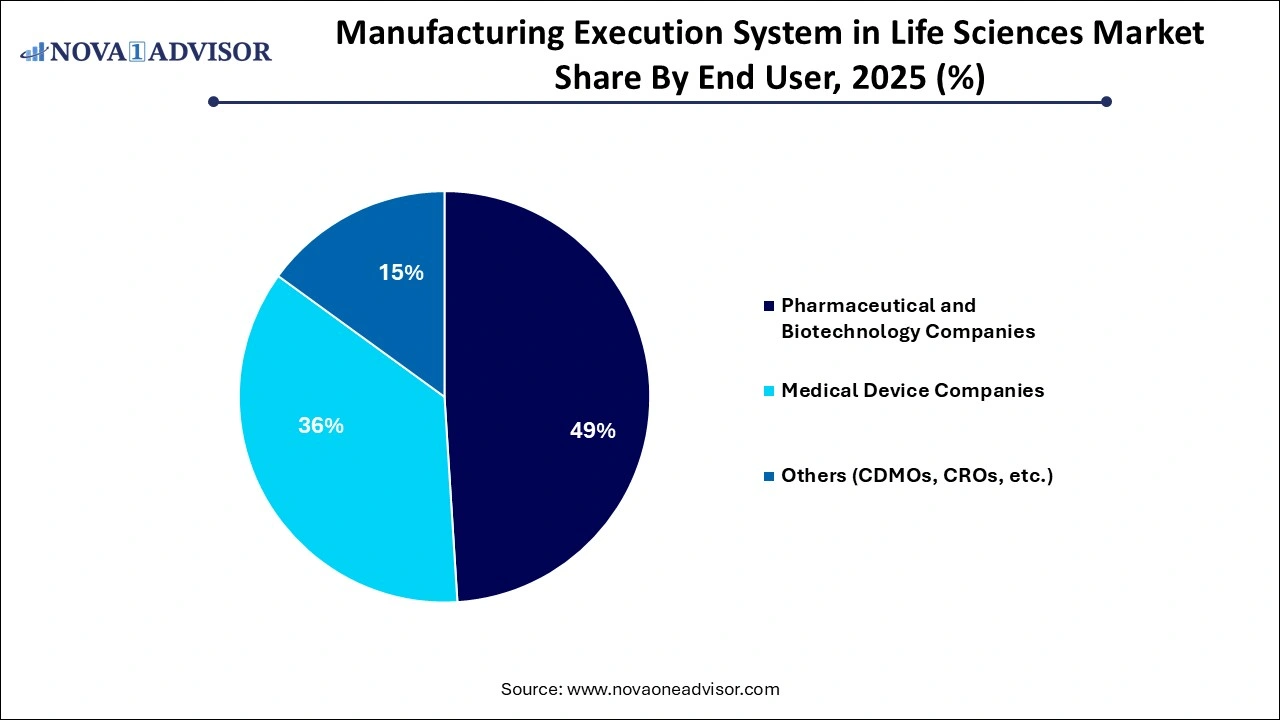

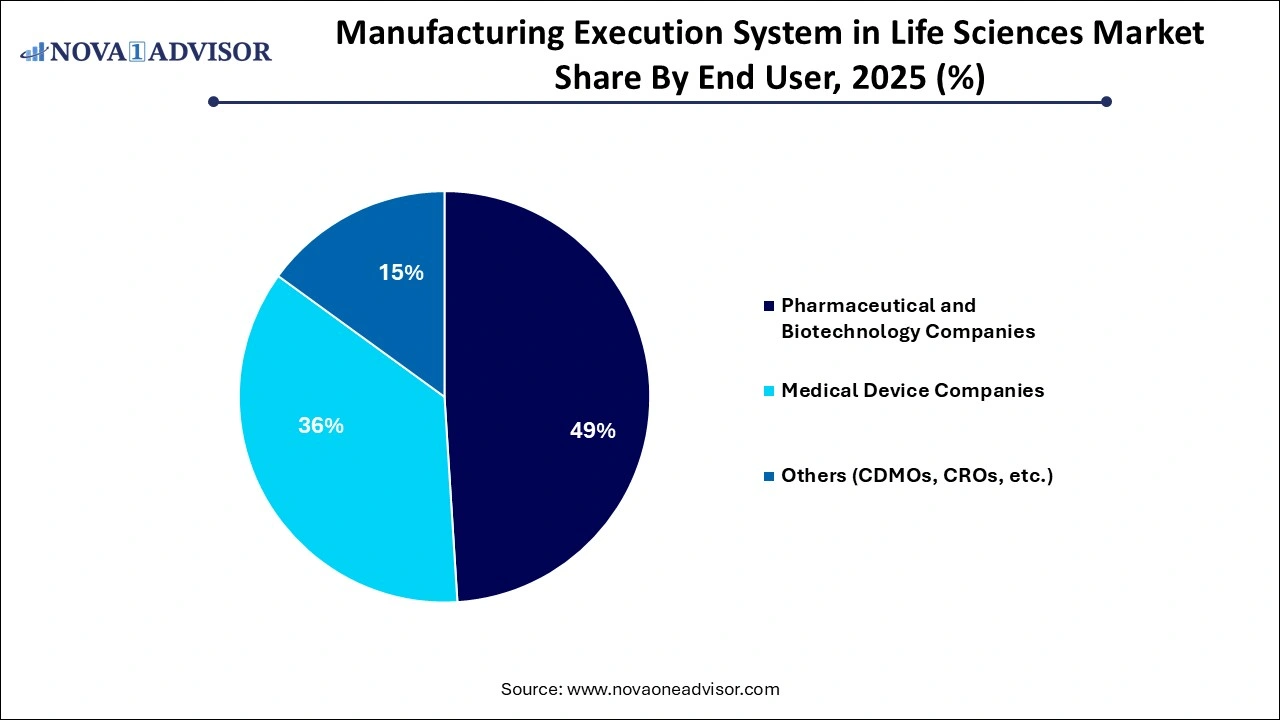

- Based on end-users, the pharmaceutical & biotechnology companies segment held the largest revenue share of 49% in 2025.

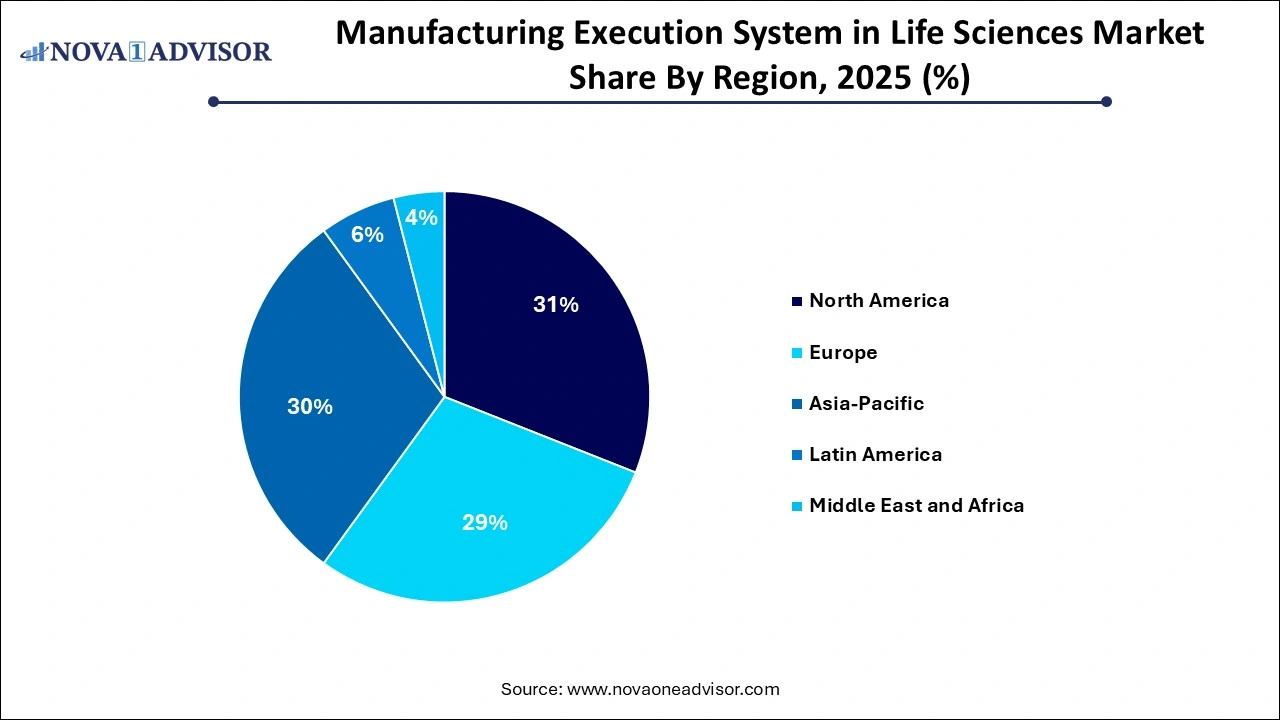

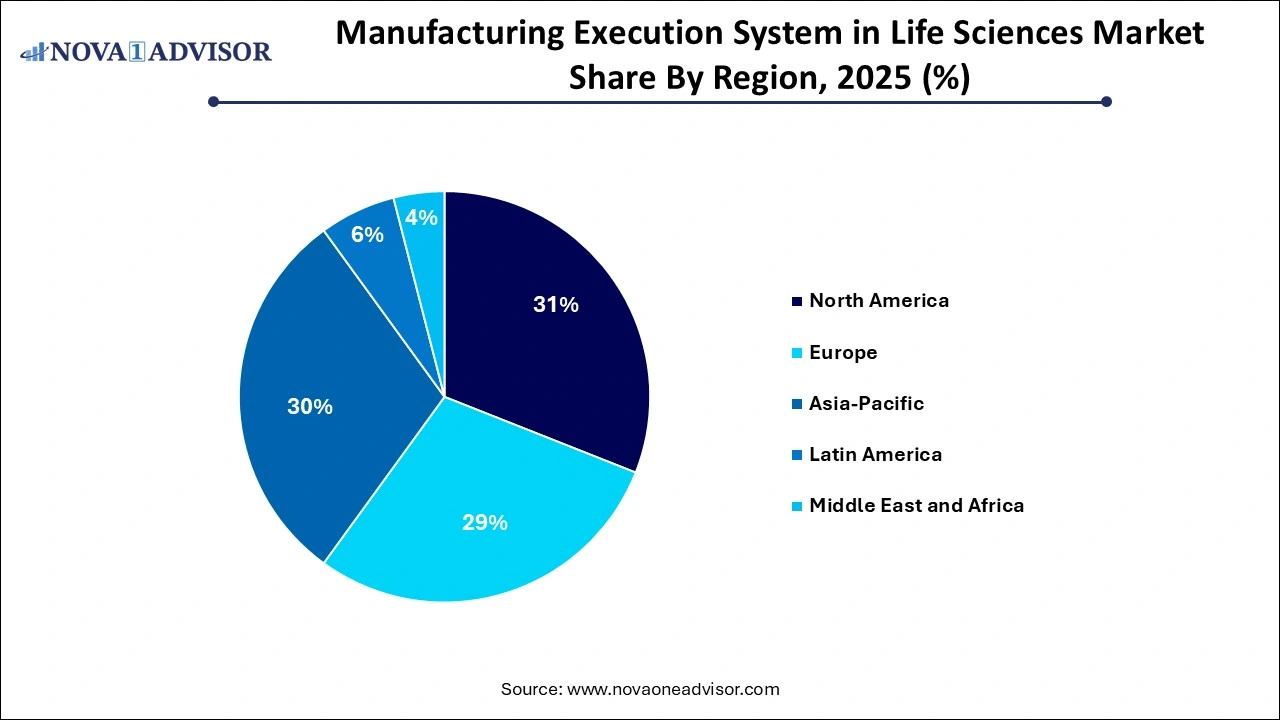

- The North America manufacturing execution system in life sciences market dominated the market and held the largest market share of 31% in 2025.

Manufacturing Execution System in Life Sciences Market Overview

The Manufacturing Execution System (MES) in Life Sciences Market is witnessing robust growth as pharmaceutical, biotechnology, and medical devices manufacturers seek smarter and more compliant production ecosystems. MES acts as a bridge between the enterprise resource planning (ERP) system and the shop floor, enabling real-time monitoring, control, and optimization of manufacturing processes. In the life sciences sector, where precision, compliance, and data integrity are paramount, MES solutions are critical to ensuring batch consistency, minimizing human error, accelerating time-to-market, and complying with stringent regulatory mandates such as 21 CFR Part 11, GAMP5, and EU GMP Annex 11.

The growing complexity of manufacturing environments, along with the increasing trend toward personalized medicines, cell and gene therapies, and high-mix, low-volume production, has made traditional manual systems insufficient. MES solutions, when customized for life sciences, offer a digitized framework that supports electronic batch records (EBRs), process validation, deviation management, traceability, and electronic signatures—all of which are essential for regulatory audits and operational excellence.

Major Trends in the Manufacturing Execution System in Life Sciences Market

-

Shift Toward Paperless Manufacturing and Digital Batch Records (eBRs): Companies are digitizing their batch processes to enhance compliance, minimize manual interventions, and streamline audits.

-

Integration with IoT and Automation Platforms: MES platforms are increasingly being integrated with IoT devices and automation systems to enable real-time data capture and predictive maintenance.

-

Modular and Scalable MES Architectures: Vendors are offering modular MES platforms that allow phased implementation and scalability for small and mid-sized firms.

-

Adoption of Cloud-based and Hybrid Deployments: Cloud and hybrid solutions are gaining traction due to their flexibility, scalability, and lower upfront costs.

-

Regulatory-Centric MES Design: Solutions are being designed specifically to comply with life sciences regulations like FDA’s 21 CFR Part 11 and EMA standards.

-

Growing Role of MES in Personalized and Precision Medicine Manufacturing: MES is being used to manage smaller batch sizes and patient-specific product tracking.

-

Increased MES Adoption by CDMOs and CROs: As outsourcing increases in the industry, service providers are deploying MES to ensure standardization and quality across client portfolios.

Report Scope of Manufacturing Execution System in Life Sciences Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.93 Billion |

| Market Size by 2035 |

USD 10.45 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.5% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Solution Type, By Deployment Type, By End-user |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

ABB; Körber AG; MasterControl Solutions, Inc.; AVEVA Group Ltd.; Cognizant; Rockwell, Automation; Nagarro; Siemens AG; Emerson Electric Co. |

Manufacturing Execution System in Life Sciences Market Dynamics

Driver – Rising Compliance Burden and Quality Requirements

A significant driver for MES adoption in life sciences is the increasing complexity of regulatory compliance and the critical need for quality assurance. Global regulatory agencies such as the FDA, EMA, and PMDA have intensified scrutiny on manufacturing practices, especially following product recalls, contamination incidents, and drug shortages. Compliance with Good Manufacturing Practices (GMP) now demands more than just documentation—it requires verifiable, real-time process control and data traceability.

MES platforms are uniquely positioned to support these compliance requirements by enabling real-time data recording, deviation tracking, audit trails, and secure electronic signatures. For instance, leading pharmaceutical manufacturers such as Pfizer, Novartis, and Roche have implemented MES across multiple plants to ensure global quality standardization. MES allows them to streamline batch record management, reduce batch review times, and enable faster product releases without compromising safety or compliance. In an environment where a single compliance breach can result in millions in fines or lost revenue, MES is no longer optional—it is essential.

Restraint – High Cost of Implementation and Integration

Despite its numerous benefits, a key restraint in the MES market is the high cost and complexity associated with deployment and system integration. MES implementation in life sciences requires customization to align with specific manufacturing processes, equipment configurations, validation requirements, and regulatory frameworks. These implementations can stretch over months, if not years, and require collaboration across IT, production, and quality teams.

The financial burden is particularly heavy for small and mid-sized companies, which may lack the internal expertise or infrastructure to support such transformative projects. Moreover, integrating MES with existing legacy systems like LIMS (Laboratory Information Management Systems), ERP, SCADA, and QMS (Quality Management Systems) poses technical challenges that demand significant time and expertise. The need for comprehensive validation documentation to meet regulatory guidelines further adds to the total cost of ownership. These hurdles can delay decision-making and adoption, particularly in emerging markets.

Opportunity – Expanding Role of MES in Personalized Medicine and Advanced Therapies

One of the most compelling opportunities lies in the use of MES to support the unique manufacturing workflows of personalized medicine, cell therapy, gene therapy, and mRNA-based treatments. These advanced modalities require precise control of patient-specific production steps, chain-of-identity tracking, and real-time release mechanisms. Traditional batch manufacturing models fall short in such environments, where flexibility, traceability, and scalability are vital.

MES platforms designed for life sciences can support such needs through features like dynamic batch routing, integration with patient data, and modular workflows. For instance, in autologous CAR-T therapy production, MES is used to track cells from collection through modification, testing, and reinfusion, all while maintaining compliance. Vendors that can offer **personalized manufacturing templates

Manufacturing Execution System in Life Sciences Market Segment Insights

By Solution Type Insights

The software segment dominates the solution type category of the MES in life sciences market, accounting for the majority revenue share. MES software solutions offer core functionalities such as production scheduling, electronic batch records (eBR), deviation and CAPA tracking, performance analytics, and inventory management. These features are essential in ensuring GMP compliance and real-time control over manufacturing environments. Software solutions such as Siemens Opcenter Execution Pharma, Rockwell Automation’s FactoryTalk PharmaSuite, and Werum PAS-X have gained significant traction for their ability to handle the nuances of life sciences production processes.

On the other hand, the services segment is witnessing the fastest growth, primarily due to the increasing complexity of implementation, validation, and integration requirements. Service offerings include system design, configuration, training, compliance validation, upgrades, and post-deployment support. As regulatory guidelines evolve and new therapy types enter the pipeline, life sciences companies increasingly rely on MES vendors and consulting firms for tailored support. The demand for validation-as-a-service and managed cloud services is further accelerating the growth of this segment, particularly among Contract Development and Manufacturing Organizations (CDMOs) and startups with lean IT teams.

By Deployment Insights

On-premise deployment remains the dominant model for MES in life sciences, driven by concerns over data security, control, and regulatory compliance. Large pharmaceutical and biotech firms with global manufacturing footprints often choose on-premise deployments to maintain direct oversight of operations, ensure network stability, and comply with local data residency laws. On-premise MES systems also offer the flexibility for deep customization, which is often required to meet the specific needs of legacy facilities and proprietary production models.

However, cloud/web-based deployment is the fastest-growing segment, fueled by the need for scalability, cost efficiency, and remote accessibility. Cloud MES platforms reduce the infrastructure burden, offer faster implementation timelines, and support multi-site operations without compromising data integrity. Startups, CDMOs, and regional manufacturers particularly favor cloud deployment due to budgetary and agility requirements. Additionally, cloud-based MES solutions enable continuous software updates, AI integration, and predictive analytics, making them future-ready for digital-first organizations.

By End-user Insights

Based on end-users, the pharmaceutical & biotechnology companies segment held the largest revenue share of 49.0% in 2025. As they face the highest regulatory demands and have the most to gain from digital process optimization. These companies deploy MES to digitize batch processing, improve product quality, and reduce batch release time. MES solutions are instrumental in ensuring data integrity, cross-site standardization, and real-time tracking, particularly across API manufacturing, formulation, filling, and packaging lines. Industry leaders like Pfizer, Merck, and Roche are investing heavily in MES modernization as part of broader digital transformation programs.

Simultaneously, Contract Development and Manufacturing Organizations (CDMOs), Contract Research Organizations (CROs), and others are emerging as the fastest-growing end-user group. These players face increasing pressure from biopharma clients to ensure quality, scalability, and regulatory compliance. MES offers CDMOs a competitive edge by enabling real-time collaboration, traceability, and electronic documentation, thereby reducing cycle times and audit risks. As outsourcing becomes a dominant trend in life sciences, MES vendors are tailoring their solutions to suit the unique business models of service-oriented manufacturing partners.

Manufacturing Execution System in Life Sciences Market By Regional Insights

North America commands the largest share of the global MES in life sciences market, primarily due to a strong concentration of pharmaceutical companies, early adoption of digital manufacturing technologies, and a favorable regulatory environment. The U.S., in particular, has a robust ecosystem of MES providers, system integrators, and industry consortia driving innovation. Regulatory bodies such as the FDA have introduced frameworks encouraging data integrity, paperless validation, and continuous manufacturing, all of which incentivize MES deployment.

Leading organizations such as Johnson & Johnson, AbbVie, and Bristol Myers Squibb are investing in next-generation MES platforms to support personalized therapies, streamline compliance, and harmonize operations across global sites. Government initiatives supporting pharmaceutical supply chain resiliency and smart manufacturing further bolster the region’s dominance. In Canada, similar momentum is seen with public-private initiatives encouraging digital health manufacturing hubs.

Asia Pacific is expected to witness the fastest growth in the MES in life sciences market, driven by the rapid expansion of pharmaceutical manufacturing hubs in India, China, Singapore, South Korea, and Australia. The region is benefiting from government support, rising exports, increasing clinical trial activity, and the proliferation of CDMOs catering to global clients. Countries such as India and China are implementing policies to digitize production and attract multinational pharma investments.

Asia Pacific is expected to witness the fastest growth in the MES in life sciences market, driven by the rapid expansion of pharmaceutical manufacturing hubs in India, China, Singapore, South Korea, and Australia. The region is benefiting from government support, rising exports, increasing clinical trial activity, and the proliferation of CDMOs catering to global clients. Countries such as India and China are implementing policies to digitize production and attract multinational pharma investments.

MES adoption in Asia Pacific is further spurred by lower implementation costs, a growing skilled workforce, and increasing partnerships between local firms and global technology providers. Singapore’s government-backed Smart Nation initiative and Japan’s push for connected factory ecosystems exemplify the region’s digital transformation roadmap. With pharmaceutical innovation centers emerging in South Korea and precision medicine initiatives gaining ground in Australia, MES deployment is expected to scale rapidly across the continent.

Some of the prominent players in the manufacturing execution system in life sciences market include:

Manufacturing Execution System in Life Sciences Market Recent Developments

-

March 2025 – Siemens Digital Industries Software launched the latest version of Opcenter Execution Pharma, with enhanced modularity and cloud-ready architecture aimed at supporting personalized therapy manufacturing.

-

January 2025 – Rockwell Automation partnered with Cytiva to develop a next-generation MES tailored for bioprocessing facilities, focused on cell therapy production scalability.

-

December 2024 – Körber Pharma announced the acquisition of Excellis Health Solutions, aiming to expand its MES and serialization compliance capabilities for regulated markets.

-

October 2024 – ABB Ltd. unveiled its MES-as-a-service platform targeting mid-sized CDMOs and CROs, offering scalable cloud deployment with AI-based predictive tools.

-

September 2024 – Emerson Automation Solutions announced a collaboration with a major vaccine manufacturer in India to implement MES across six production facilities.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the manufacturing execution system in life sciences market

Solution Type

Deployment

- On-Premise

- Cloud/Web-Based

- Hybrid

End-user

- Pharmaceutical and Biotechnology Companies

- Medical Device Companies

- Others (CDMOs, CROs, etc.)

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Asia Pacific is expected to witness the fastest growth in the MES in life sciences market, driven by the rapid expansion of pharmaceutical manufacturing hubs in India, China, Singapore, South Korea, and Australia. The region is benefiting from government support, rising exports, increasing clinical trial activity, and the proliferation of CDMOs catering to global clients. Countries such as India and China are implementing policies to digitize production and attract multinational pharma investments.

Asia Pacific is expected to witness the fastest growth in the MES in life sciences market, driven by the rapid expansion of pharmaceutical manufacturing hubs in India, China, Singapore, South Korea, and Australia. The region is benefiting from government support, rising exports, increasing clinical trial activity, and the proliferation of CDMOs catering to global clients. Countries such as India and China are implementing policies to digitize production and attract multinational pharma investments.