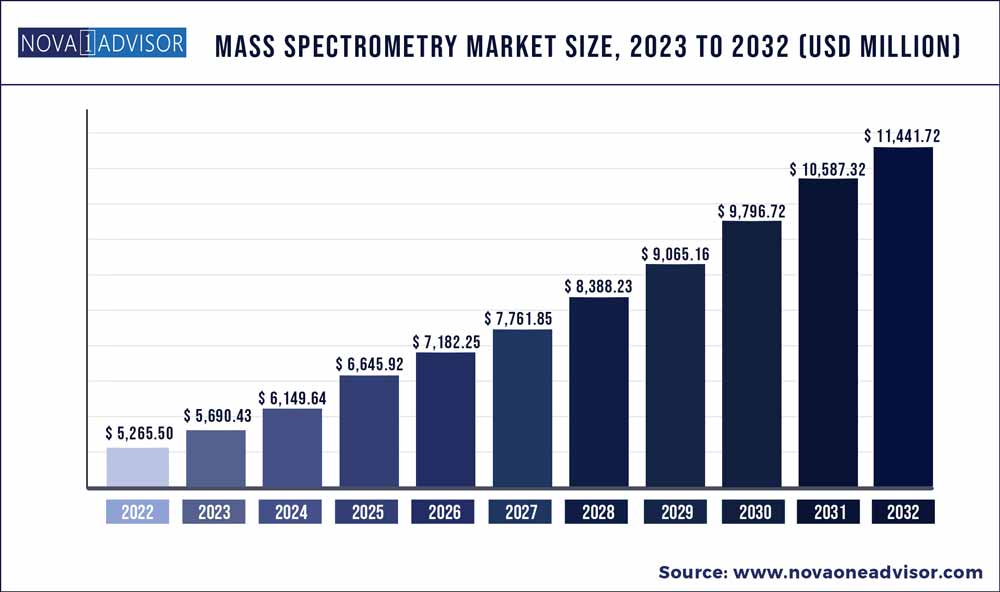

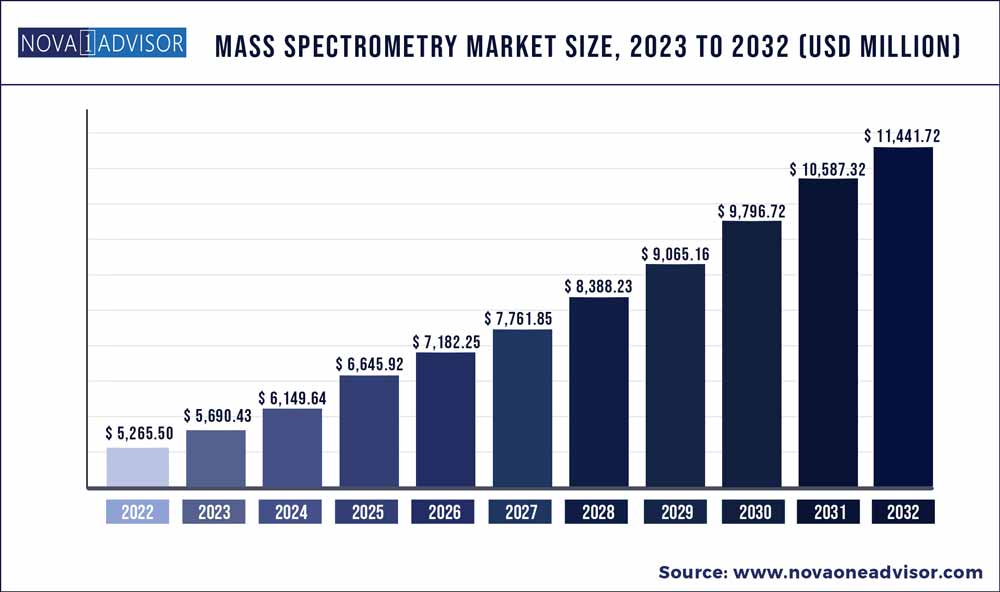

The global mass spectrometry market size was estimated at USD 5,265.50 Million in 2022 and is expected to surpass around USD 11,441.72 Million by 2032 and poised to grow at a compound annual growth rate (CAGR) of 8.07% during the forecast period 2023 to 2032.Mass spectrometry is used as an analytical method to characterize large biomolecules, such as DNA and proteins, and is widely used for omics-related studies. The primary application of mass spectrometry is in the field of drug discovery where it is used to identify structures of metabolites and drugs as well as for screening of metabolites in biological systems. Hence, with the increase in the prevalence of chronic diseases and rising R&D investments for the development of new diagnostic techniques, demand for mass spectrometry is expected to witness growth in the near future.

Key Takeaways:

- The instruments segment held the largest revenue share of 77.39% in 2022.

- The consumables & services segment is projected to record a rapid CAGR of 8.93% over the forecast period

- Quadrupole liquid chromatography-mass spectrometry led with the largest share of 37.09% in 2022.

- The proteomics segment held the largest revenue share of 46.69% in 2022.

- The pharmaceutical and biotechnology companies segment dominated the market in 2022 with a share of 43.98%.

- North America accounted for the largest market share of 41.94% in 2022.

- The Asia Pacific region is expected to grow at the fastest CAGR of 8.97% over the forecast period.

Mass Spectrometry Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 5,265.50 Million |

| Market Size by 2032 |

USD 11,441.72 Million |

| Growth Rate From 2023 to 2032 |

CAGR of 8.07% |

| Base Year |

2022 |

| Forecast Period |

2023-2032 |

| Segments Covered |

Product, Technology, Application, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc; Danaher Corporation; Waters Corporation; BrU.K.er Corporation; Shimadzu Corporation; PerkinElmer, Inc.; Rigaku Corporation; LECO Corporation; JEOL Ltd. |

The COVID-19 pandemic has boosted the demand for vaccine development due to recent advancements in virology-based research. Here, mass spectrometry has applications for the study of viral structure for SARS-CoV-2. The technique can also be used to study complex protein structures and protein-protein interactions associated with the virus. Hence, various pharmaceutical and biotechnology companies involved in COVID-19 vaccine and drug development efforts are anticipated to increase the demand for mass spectrometry instruments and consumables.

Furthermore, the presence of established guidelines and recommendations by regulatory bodies and organizations for the use of mass spectrometry in the field of proteomics is another factor fueling market growth. For instance, in 2020, The Human Proteome Organization's Human Proteome Project (HPP) updated the guidelines on the data interpretation of mass spectrometry. The additional guidelines are for data-independent acquisition (DIA) workflows and the new Universal Spectrum Identifier system by the HUPO Proteomics Standards Initiative. These guidelines are set to ensure high accuracy and low false-positive protein identifications and are expected to enhance the efficiency of mass spectrometry workflows.

However, mass spectrometry systems are resource-centric and complex. These can incur high maintenance and operational costs or may require troubleshooting for maintaining optimal operating conditions. Moreover, the requirement of skilled labor for operating and maintaining such complex systems represents a key operational constraint faced by users. Such factors may limit the industry’s growth over the forecast period.

Product Insights

The instruments segment held the largest revenue share of 77.39% in 2022. Spectrometers offer a wide range of applications in the biotechnology sector and are witnessing rising awareness about the benefits of mass spectrometry workflows. These instruments can be used in clinical and preclinical testing for drug discovery as well as for biomedical research in the pharmaceutical industries.

For instance, high-resolution hybrid mass spectrometry can be used in the development of cell therapies for cancer treatment. Over the past few years, the technique has become important for proteomics-based research applications such as the determination of the molecular mass of peptides, and peptide sequences. Such advancements in mass spectrometry applications are anticipated to fuel the segment.

The consumables & services segment is projected to record a rapid CAGR of 8.93% over the forecast period due to the increasing demand for such products from various academic institutions and research centers. Such institutions offer researchers access to mass spectrometry systems in their labs at a nominal cost, and in turn, drive the demand for consumables. In addition, revenue from services such as maintenance and analytical testing is expected to grow with the increasing adoption of the technique for various academic and pharmaceutical research and development activities.

Technology Insights

Quadrupole liquid chromatography-mass spectrometry led with the largest share of 37.09% in 2022. Demand for this technology has grown significantly in the past few years due to the advantages offered by the technique. For instance, the triple quadrupole technology is one of the essential analytical techniques for clinical research analysis and can measure trace levels of biomarkers in complex matrices of biological fluids. Several key players have established offerings in this domain. For instance, Waters Corporation, a leading producer of this technology, offers mass spectrometry products used for the characterization of biomolecules for application in biotherapeutics, metabolomics, extracts, and leachable.

The Fourier transform-mass spectrometry (FT-MS) is the fastest-growing segment and is expected to grow at a CAGR of 8.78% over the forecast period. This can be attributed to the high resolving power, minimal error rate, high accuracy, and ease of operations offered by the technique. The technology also has applications in forensic laboratories for the identification of drugs and contraband substances such as cocaine. Such a broad range of applications can open new avenues for the growth of the segment in the coming years.

Application Insights

The proteomics segment held the largest revenue share of 46.69% in 2022. Mass spectrometry-based proteomics research is a comprehensive technique for quantitative profiling of proteins and studying protein-protein interactions. Advancements and the widespread availability of quantitative proteomics workflows have expanded the scope for studying protein function, structure, transformation, and overall protein dynamics.

In addition, developments in mass spectrometry technology are opening opportunities in single-cell analysis and clinical applications. The technology is anticipated to establish a strong position in various applications, including detecting novel biomarkers, mapping molecular tissue, and improving disease diagnosis. Such advancements are likely to fuel the growth prospects for the mass spectrometry market.

Metabolomics is projected to be the fastest-growing segment over the forecast period due to the wide range of applications of mass spectrometry in cancer screening and diagnosis. The technique can be used to study a vast number of compounds in a single sample which enables the analysis of multiple sample constituents in a single run. As metabolomics is gaining traction as an important omics technology for diagnostic and prognostic applications in several chronic and infectious diseases, the segment is expected to witness significant growth.

End-use Insights

The pharmaceutical and biotechnology companies segment dominated the market in 2022 with a share of 43.98% due to the extensive adoption of protein sequencing using mass spectrometry in the pharmaceutical industry for drug discovery and development processes. The growing demand for biomolecule analysis and drug component analysis is expected to further drive the segment growth for the market. With increasing investments in biopharmaceutical research and growth in research and development prospects in the proteomics domain, the segment is expected to witness lucrative growth in the coming years.

Government & academic institutions segment is expected to grow at a rapid CAGR of 8.02% over the forecast period due to the rise in healthcare expenditure, global increase in government funding for research activities, and increasing role of mass spectrometry techniques for disease surveillance and epidemiological research. Similarly, growth in COVID-19 testing activities and opportunities for the development of high throughput testing methods can considerably boost the market prospects.

Regional Insights

North America accounted for the largest market share of 41.94% in 2022 due to the high extent of research and development activities and the presence of an established research and healthcare infrastructure. Similarly, demand for mass spectrometry is also driven by increasing focus on disease prevention measures in the region. Furthermore, government funding in the region is considerably strong and is likely to fuel market growth. For instance, UniProt, a free-of-cost portal for obtaining protein sequencing and functional information is supported by various government institutions, including the National Eye Institute, National Heart, Lung, and National Human Genome Research Institute.

The Asia Pacific region is expected to grow at the fastest CAGR of 8.97% over the forecast period due to the availability of a large population and rising focus on healthcare systems. Similarly, the rising attention drawn by proteomics and genomics research, as well as the increase in initiatives undertaken by academic institutions for the development of protein-based therapeutics have presented significant growth opportunities for the market in the Asia Pacific region.

Some of the prominent players in the Mass spectrometry Market include:

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Danaher Corporation

- Waters Corporation

- BrU.K.er Corporation

- Shimadzu Corporation

- PerkinElmer, Inc.

- Rigaku Corporation

- LECO Corporation

- JEOL Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Mass spectrometry market.

Product

- Instruments

- Consumables & Services

Technology

- Quadrupole Liquid Chromatography-Mass Spectrometry

- Gas Chromatography-Mass Spectrometry (GC-MS)

- Fourier Transform-Mass Spectrometry (FT-MS)

- Time-of-Flight Mass Spectrometry (TOFMS)

- Matrix-Assisted Laser Desorption/Ionization-Time-of-Flight Mass Spectrometry (MALDI-TOF)

- Magnetic Sector Mass Spectrometry

- Others

Application

- Proteomics

- Metabolomics

- Glycomics

- Others

End-use

- Government & Academic Institutions

- Pharmaceutical & Biotechnology Companies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)