Mechanical Ventilator Market Size and Forecast 2025 to 2034

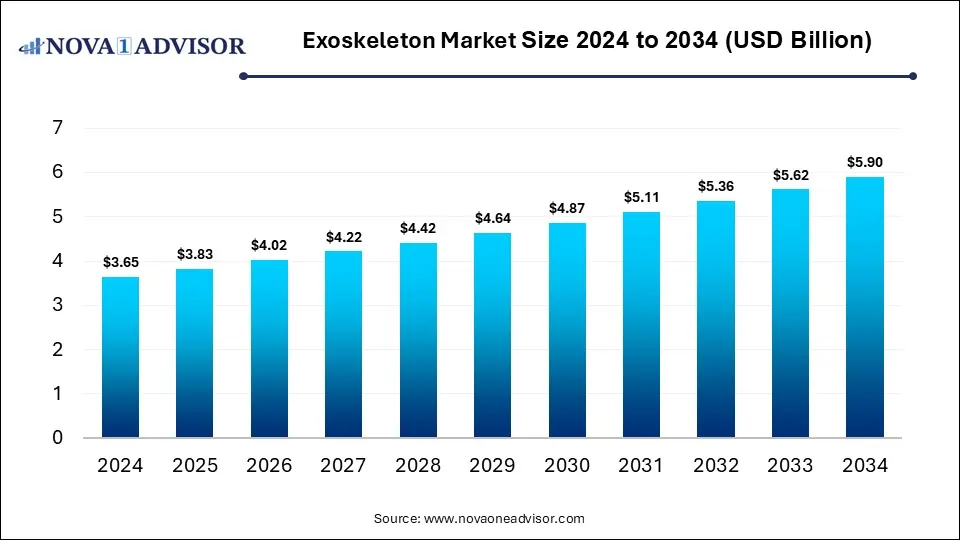

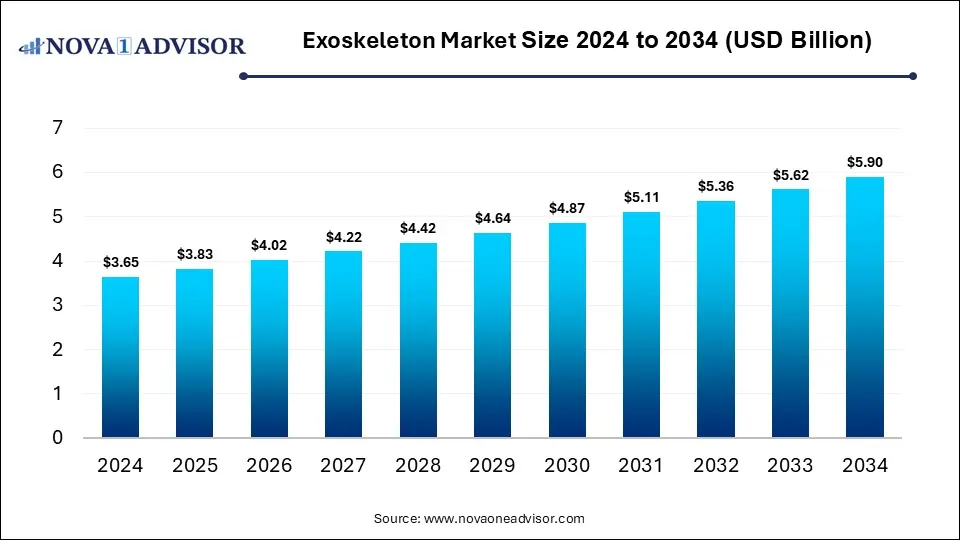

According to Nova One Advisor, the global Mechanical Ventilator market gathered revenue around USD 3.65 billion in 2024 and market is set to grow USD 5.90 billion by the end of 2034 and is estimated to expand at a modest CAGR of 4.92% during the prediction period 2025 to 2034.

Growth Factors:

The unprecedented dawn of COVID19, increasing incidence of chronic obstructive pulmonary disease (COPD), rising incidence of respiratory emergencies, and technological innovation in respiratory care devices are the major factors driving the market for mechanical ventilators.

Technical advancements such as rapid innovation in the field of Positive Airway Pressure (PAP) devices, portability, and improvement in battery life of transport and portable devices are the primary factors that encourage the usage of mechanical ventilators. In April 2020, InnAccel Technologies announced the introduction of a non-invasive ventilation system intended for usage in ICU with COVID-19 patients. This system was engineered and manufactured in India to treat patients with deteriorating hypoxemia. Besides, this system functions across numerous settings and clinical applications, without the necessity of continuous electricity, or a trained breathing therapist.

The WHO estimates that at present, approximately 90% of COPD deaths occur in low- and middle-income countries. Therefore, the rise in the prevalence of such diseases, new product launches, and the availability of portable, cost-contained, and easy-to-use mechanical ventilators for the treatment of respiratory conditions are expected to fuel the market growth worldwide. For instance, in August 2020, Spicejet introduced Spiceoxy, a portable, non-invasive ventilation device. The increasing awareness amongst the end users is projected to boost the demand over the forecast period.

Asia Pacific and Latin America are expected to witness lucrative growth over the forecast period. This growth is due to the presence of untapped opportunities, rising expenditure levels, and the introduction of favorable government initiatives. Market participants are constantly engaged in the development of new products in an attempt to improve presence and ensure sustainability. For instance, in April 2021, Drägerwerk AG & Co. KGaA has acquired the majority share of STIMIT AG. With this purchase, the company further increases its proficiency in the lung-protective ventilation field.

This research report purposes at stressing the most lucrative growth prospects. The aim of the research report is to provide an inclusive valuation of the Mechanical Ventilator market and it encompasses thoughtful visions, actualities, industry-validated market findings, historic data, and prognoses by means of appropriate set of assumptions and practice. Global Mechanical Ventilator market report aids in comprehending market structure and dynamics by recognizing and scrutinizing the market sectors and predicted the global market outlook.

Report Scope of Mechanical Ventilator Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.83 Billion |

| Market Size by 2034 |

USD 5.90 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 4.92% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Ventilation mode, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Getinge AB; Medtronic; Vyaire Medical Inc.; Drägerwerk AG & Co. KGaA; Koninklijke Philips N.V.; Hamilton Medical; GE Healthcare; Smiths Medical; ZOLL Medical Corporation; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.. |

COVID-19 Impact Assessment on Market Landscape

The report comprises the scrutiny of COVID-19 lock-down impact on the income of market leaders, disrupters and followers. Since lock down was instigated differently in diverse regions and nations, influence of same is also dissimilar across various industry verticals. The research report offers present short-term and long-term influence on the market to assist market participants across value chain makers to formulate the framework for short term and long-lasting tactics for recovery and by region.

Mechanical Ventilator market Report empowers readers with all-inclusive market intelligence and offers a granular outline of the market they are operational in. Further this research study delivers exceptional combination of tangible perceptions and qualitative scrutiny to aid companies accomplishes sustainable growth. This report employs industry-leading research practices and tools to assemble all-inclusive market studies, intermingled with pertinent data. Additionally, this report also emphases on the competitive examination of crucial players by analyzing their product portfolio, pricing, gross margins, financial position, growth approaches, and regional occurrence.

Regional Insights

North America dominated the market with a revenue share of over 55.2% in 2024. A soaring number of critically ill COVID-19 patients in the U.S. (4,813,647 as of 3 August 2020) and the presence of leading manufacturers implementing production boost are key factors driving the regional market. Additionally, the U.S. automotive giants like Tesla, Ford, and GM have switched their assembly lines for medical supplies such as masks, mechanical ventilators, and other medical devices to help the government with the shortage problems of these devices. This, in turn, resulted in the significant growth of the regional market.

In Asia Pacific, the market is anticipated to witness significant growth over the forecast period owing to the increasing cases of COVID 19, chronic respiratory diseases, rising healthcare expenditure, various collaborations, new product launches, and strategic agreements implemented by local players during the pandemic. For instance, in January 2021, CSIR-NAL developed a non-invasive airway pressure ventilator, Swasth Vayu.

Similarly, in August 2024, Spicejet introduced Spiceoxy, a portable, non-invasive ventilation device. The introduction of such cost-effective products is expected to fuel the adoption in the coming years. Additionally, the growth in this region is attributed to the development of infrastructure and healthcare policies promoting better care provided to individuals. The growing trend of lifestyle habits such as smoking and genetic allergy developments expediting the number of cases of respiratory disorders further promotes market growth.

Mechanical Ventilator Market By Regional, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

1.28 |

1.34 |

1.41 |

1.48 |

1.56 |

1.63 |

1.72 |

1.80 |

1.90 |

1.99 |

2.09 |

| Europe |

0.91 |

0.96 |

1.00 |

1.05 |

1.10 |

1.16 |

1.21 |

1.27 |

1.33 |

1.40 |

1.46 |

| Asia-Pacific |

0.91 |

0.96 |

1.00 |

1.05 |

1.10 |

1.16 |

1.21 |

1.27 |

1.33 |

1.40 |

1.46 |

| Latin America |

0.29 |

0.31 |

0.32 |

0.34 |

0.35 |

0.37 |

0.39 |

0.41 |

0.43 |

0.45 |

0.47 |

| Middle East & Africa (MEA) |

0.26 |

0.27 |

0.28 |

0.29 |

0.31 |

0.32 |

0.34 |

0.36 |

0.37 |

0.39 |

0.41 |

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

- Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Some of the prominent players in the Mechanical Ventilator Market include: Getinge AB; Medtronic; Vyaire Medical Inc.; Drägerwerk AG & Co. KGaA; Koninklijke Philips N.V.; Hamilton Medical; GE Healthcare; Smiths Medical; ZOLL Medical Corporation; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for the period of 2021 to 2034 and covers subsequent region in its scope:

By Product

By Ventilation Mode

By End-use

- Hospitals

- Home Healthcare

- Others

By Geography

North America

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

List of Tables

-

Table 1: U.S. Protein Expression Market, by Expression Systems, 2024–2034

-

Table 2: U.S. Protein Expression Market, by Product, 2024–2034

-

Table 3: U.S. Protein Expression Market, by Application, 2024–2034

-

Table 4: U.S. Protein Expression Market, by End Use, 2024–2034

-

Table 5: Canada Protein Expression Market, by Expression Systems, 2024–2034

-

Table 6: Canada Protein Expression Market, by Product, 2024–2034

-

Table 7: Canada Protein Expression Market, by Application, 2024–2034

-

Table 8: Canada Protein Expression Market, by End Use, 2024–2034

-

Table 9: Mexico Protein Expression Market, by Expression Systems, 2024–2034

-

Table 10: Mexico Protein Expression Market, by Product, 2024–2034

-

Table 11: Mexico Protein Expression Market, by Application, 2024–2034

-

Table 12: Mexico Protein Expression Market, by End Use, 2024–2034

-

Table 13: Germany Protein Expression Market, by Expression Systems, 2024–2034

-

Table 14: Germany Protein Expression Market, by Product, 2024–2034

-

Table 15: Germany Protein Expression Market, by Application, 2024–2034

-

Table 16: Germany Protein Expression Market, by End Use, 2024–2034

-

Table 17: France Protein Expression Market, by Expression Systems, 2024–2034

-

Table 18: France Protein Expression Market, by Product, 2024–2034

-

Table 19: France Protein Expression Market, by Application, 2024–2034

-

Table 20: France Protein Expression Market, by End Use, 2024–2034

-

Table 21: UK Protein Expression Market, by Expression Systems, 2024–2034

-

Table 22: UK Protein Expression Market, by Product, 2024–2034

-

Table 23: UK Protein Expression Market, by Application, 2024–2034

-

Table 24: UK Protein Expression Market, by End Use, 2024–2034

-

Table 25: Italy Protein Expression Market, by Expression Systems, 2024–2034

-

Table 26: Italy Protein Expression Market, by Product, 2024–2034

-

Table 27: Italy Protein Expression Market, by Application, 2024–2034

-

Table 28: Italy Protein Expression Market, by End Use, 2024–2034

-

Table 29: Rest of Europe Protein Expression Market, by Segments, 2024–2034

-

Table 30: China Protein Expression Market, by Expression Systems, 2024–2034

-

Table 31: China Protein Expression Market, by Product, 2024–2034

-

Table 32: China Protein Expression Market, by Application, 2024–2034

-

Table 33: China Protein Expression Market, by End Use, 2024–2034

-

Table 34: Japan Protein Expression Market, by Expression Systems, 2024–2034

-

Table 35: Japan Protein Expression Market, by Product, 2024–2034

-

Table 36: Japan Protein Expression Market, by Application, 2024–2034

-

Table 37: Japan Protein Expression Market, by End Use, 2024–2034

-

Table 38: South Korea Protein Expression Market, by Expression Systems, 2024–2034

-

Table 39: South Korea Protein Expression Market, by Product, 2024–2034

-

Table 40: South Korea Protein Expression Market, by Application, 2024–2034

-

Table 41: South Korea Protein Expression Market, by End Use, 2024–2034

-

Table 42: India Protein Expression Market, by Expression Systems, 2024–2034

-

Table 43: India Protein Expression Market, by Product, 2024–2034

-

Table 44: India Protein Expression Market, by Application, 2024–2034

-

Table 45: India Protein Expression Market, by End Use, 2024–2034

-

Table 46: Southeast Asia Protein Expression Market, by Segments, 2024–2034

-

Table 47: Rest of Asia Pacific Protein Expression Market, by Segments, 2024–2034

-

Table 48: Brazil Protein Expression Market, by Expression Systems, 2024–2034

-

Table 49: Brazil Protein Expression Market, by Product, 2024–2034

-

Table 50: Brazil Protein Expression Market, by Application, 2024–2034

-

Table 51: Brazil Protein Expression Market, by End Use, 2024–2034

-

Table 52: Rest of Latin America Protein Expression Market, by Segments, 2024–2034

-

Table 53: GCC Countries Protein Expression Market, by Expression Systems, 2024–2034

-

Table 54: GCC Countries Protein Expression Market, by Product, 2024–2034

-

Table 55: GCC Countries Protein Expression Market, by Application, 2024–2034

-

Table 56: GCC Countries Protein Expression Market, by End Use, 2024–2034

-

Table 57: Turkey Protein Expression Market, by Segments, 2024–2034

-

Table 58: Africa Protein Expression Market, by Segments, 2024–2034

-

Table 59: Rest of MEA Protein Expression Market, by Segments, 2024–2034

-

Figure 1: U.S. Protein Expression Market Share, by Expression Systems, 2024–2034

-

Figure 2: U.S. Protein Expression Market Share, by Product, 2024–2034

-

Figure 3: U.S. Protein Expression Market Share, by Application, 2024–2034

-

Figure 4: U.S. Protein Expression Market Share, by End Use, 2024–2034

-

Figure 5: Canada Protein Expression Market Share, by Segments, 2024–2034

-

Figure 6: Mexico Protein Expression Market Share, by Segments, 2024–2034

-

Figure 7: Germany Protein Expression Market Share, by Expression Systems, 2024–2034

-

Figure 8: France Protein Expression Market Share, by Segments, 2024–2034

-

Figure 9: UK Protein Expression Market Share, by Segments, 2024–2034

-

Figure 10: Italy Protein Expression Market Share, by Segments, 2024–2034

-

Figure 11: China Protein Expression Market Share, by Expression Systems, 2024–2034

-

Figure 12: Japan Protein Expression Market Share, by Segments, 2024–2034

-

Figure 13: South Korea Protein Expression Market Share, by Segments, 2024–2034

-

Figure 14: India Protein Expression Market Share, by Segments, 2024–2034

-

Figure 15: Brazil Protein Expression Market Share, by Segments, 2024–2034

-

Figure 16: GCC Countries Protein Expression Market Share, by Segments, 2024–2034

-

Figure 17: Turkey Protein Expression Market Share, by Segments, 2024–2034

-

Figure 18: Africa Protein Expression Market Share, by Segments, 2024–2034