The global medical affairs outsourcing market was exhibited at USD 1.90 billion in 2023 and is projected to hit around USD 3.88 billion by 2033, growing at a CAGR of 7.4% during the forecast period of 2024 to 2033.

.jpg)

Key Takeaways:

- Based on service, the medical writing and publishing segment held the largest share of 35.0% in 2023.

- The medical science liaisons (MSL) segment is expected to exhibit 14.2% CAGR growth over the forecast period.

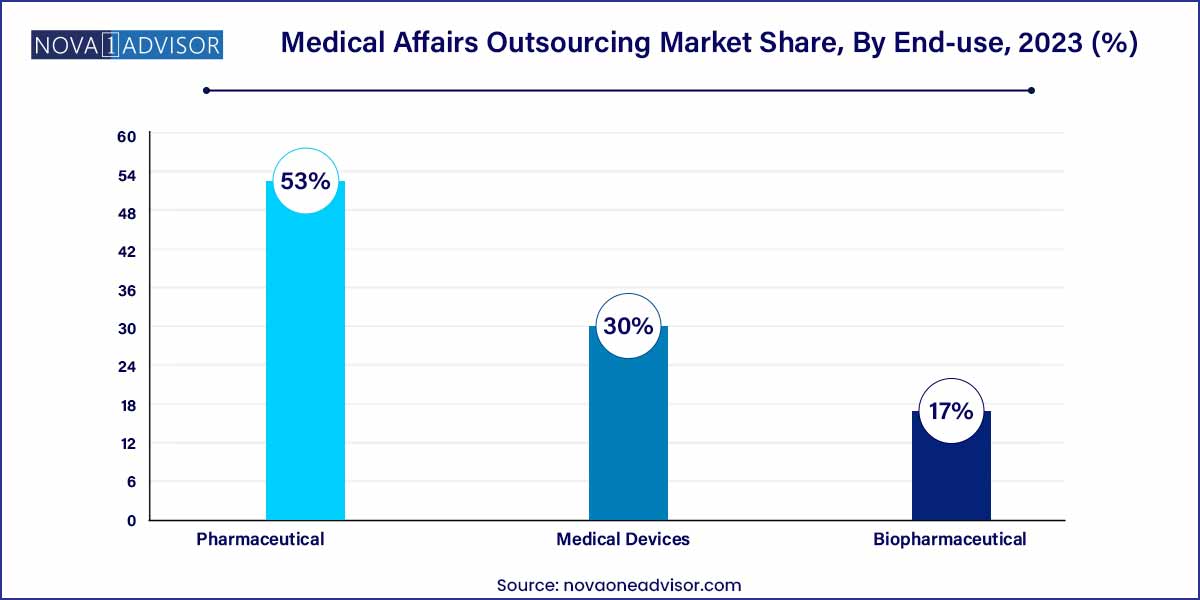

- In terms of industry, pharmaceuticals accounted for the largest revenue share of 53% in 2023.

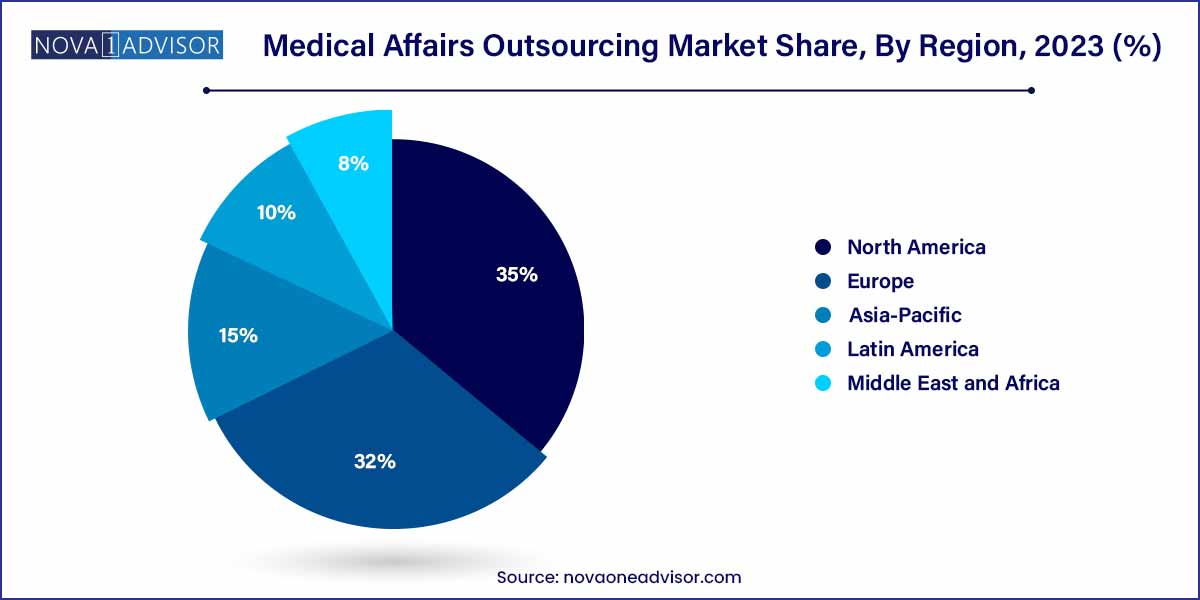

- North America dominated the market in 2022 and accounted for a revenue share of over 35%.

- The medical market in Asia Pacific is anticipated to be the fastest-growing regional market with a CAGR of 15.1% in the forecast period.

Medical Affairs Outsourcing Market: Overview

In the evolving landscape of healthcare, the role of medical affairs has become paramount. Pharmaceutical, biotechnology, and medical device companies are increasingly recognizing the need to optimize their medical affairs functions to ensure regulatory compliance, enhance stakeholder engagement, and drive evidence-based decision-making. This burgeoning demand has catalyzed the growth of the Medical Affairs Outsourcing (MAO) market, offering specialized services that enable companies to navigate complex regulatory environments while focusing on core competencies.

Medical Affairs Outsourcing Market Growth

The medical affairs outsourcing market has witnessed significant growth, driven by several key factors that underscore its importance in the healthcare landscape. Firstly, the escalating complexities of regulatory compliance within the pharmaceutical and biotechnology sectors have necessitated specialized expertise, prompting companies to seek external support. This focus on adherence to stringent regulatory guidelines not only ensures compliance but also mitigates potential risks and legal implications. Secondly, the pursuit of cost-efficiency remains a compelling driver, particularly for small to mid-sized enterprises looking to optimize resources and achieve operational excellence. Outsourcing specific medical affairs functions enables companies to redirect internal resources towards core competencies such as research & development and commercialization. Additionally, the globalization of clinical trials has intensified the demand for localized medical expertise across diverse geographies, fostering a collaborative approach to evidence-based decision-making. Moreover, the strategic alignment with outsourcing partners offers access to niche capabilities, innovation, and scalability, driving value creation and competitive differentiation in an increasingly dynamic marketplace. Collectively, these growth factors underscore the pivotal role of medical affairs outsourcing in navigating regulatory complexities, optimizing operational efficiency, and fostering innovation within the healthcare ecosystem.

Medical Affairs Outsourcing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.90 Billion |

| Market Size by 2033 |

USD 3.88 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, Industry, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

ICON plc; IQVIA Holdings, Inc.; The Medical Affairs Company; Syneos Health, Inc.; Thermo Fisher Scientific Inc. (PPD); Ashfield Healthcare Communications; Zeincro Group; Wuxi Clinical Development, Inc.; SGS S.A.; Indegene, Inc. |

Medical Affairs Outsourcing Market Dynamics

Rising Complexity in Regulatory Compliance:

The pharmaceutical and biotech sectors are increasingly navigating a complex web of regulatory guidelines and standards. As these regulations become more stringent and multifaceted, companies are turning to medical affairs outsourcing as a strategic solution. Outsourcing specific medical affairs functions, such as pharmacovigilance and regulatory affairs, allows organizations to ensure compliance, mitigate risks, and navigate the intricate regulatory landscape effectively. By partnering with specialized outsourcing providers, companies can leverage expertise in interpreting, implementing, and adhering to evolving regulatory requirements, thereby maintaining a competitive edge and safeguarding patient safety.

Focus on Core Competencies and Cost-Efficiency:

In today's competitive healthcare landscape, companies are prioritizing core competencies such as research & development, commercialization, and market expansion. Medical Affairs Outsourcing enables organizations to streamline operations, achieve significant cost savings, and optimize resource allocation. By outsourcing non-core functions like medical writing, market access support, and medical science liaison services, companies can redirect internal resources towards strategic initiatives that drive innovation and market differentiation. This focus on core competencies, coupled with cost-efficiency, empowers organizations to remain agile, responsive, and competitive in a rapidly evolving marketplace, fostering sustainable growth and value creation.

Market Restraint

Quality Control and Data Security Concerns:

As companies increasingly rely on medical affairs outsourcing to navigate complex regulatory landscapes and streamline operations, concerns surrounding quality control and data security emerge as significant restraints. Entrusting critical functions such as regulatory affairs, medical writing, and pharmacovigilance to external partners necessitates stringent quality assurance frameworks and robust data protection measures. Ensuring consistency, accuracy, and confidentiality across outsourced services requires transparent communication, rigorous oversight, and adherence to industry best practices. Any lapses in quality control or data security can jeopardize regulatory compliance, compromise patient safety, and erode stakeholder trust, thereby limiting the widespread adoption and scalability of outsourcing solutions within the healthcare ecosystem.

Technological Integration and Expertise Alignment:

The rapid evolution of digital technologies, data analytics, and artificial intelligence presents both opportunities and challenges for medical affairs outsourcing. Companies seeking to leverage advanced technologies to enhance efficiency, innovation, and strategic decision-making must navigate complex integration processes and align with outsourcing partners possessing specialized expertise. Ensuring seamless integration of technological solutions, adherence to regulatory guidelines, and alignment with organizational objectives necessitates collaboration, investment, and continuous upskilling. The disparity in technological capabilities, expertise alignment, and innovation readiness across outsourcing partners can hinder operational efficiency, strategic alignment, and value creation, thereby posing challenges for companies seeking to optimize medical affairs functions through outsourcing.

Market Opportunity

Strategic Partnerships and Collaborative Innovation:

The medical affairs outsourcing landscape presents a significant opportunity for companies to establish strategic partnerships and foster collaborative innovation. By leveraging the expertise, capabilities, and resources of specialized outsourcing providers, organizations can drive synergies, enhance operational efficiency, and accelerate product development timelines. Collaborative engagements enable access to niche skills, regional insights, and innovative solutions, fostering a culture of continuous learning, adaptation, and value creation. Embracing a collaborative approach to medical affairs outsourcing facilitates knowledge exchange, best practice sharing, and the co-creation of tailored solutions that address evolving regulatory, therapeutic, and market challenges, thereby fostering sustainable growth, competitive differentiation, and stakeholder engagement within the healthcare ecosystem.

Globalization and Market Expansion:

The globalization of clinical trials, market expansion initiatives, and therapeutic innovation presents a compelling opportunity for medical affairs outsourcing. As companies seek to navigate diverse regulatory landscapes, cultural nuances, and market dynamics, outsourcing specialized functions such as regulatory affairs, market access, and medical writing enables access to regional expertise, insights, and strategic partnerships. Leveraging outsourcing solutions to facilitate global market entry, product launch optimization, and stakeholder engagement empowers organizations to capitalize on untapped opportunities, drive commercial success, and enhance patient access to innovative therapies. By embracing a global perspective, strategic partnerships, and localized expertise, Medical Affairs Outsourcing facilitates seamless expansion into new markets, fosters innovation, and positions companies for long-term success within the competitive healthcare lands

Market Challenges

Quality Control and Data Security Concerns:

One of the predominant challenges facing the medical affairs outsourcing market revolves around maintaining stringent quality control measures and ensuring robust data security protocols. Entrusting critical functions such as regulatory affairs, medical writing, and pharmacovigilance to external partners necessitates a comprehensive understanding of industry standards, regulatory compliance, and ethical considerations. Addressing inconsistencies in service quality, ensuring transparency, and safeguarding sensitive data across diverse geographies and regulatory landscapes poses significant challenges. Any lapses in quality control or data security can compromise patient safety, erode stakeholder trust, and expose organizations to legal and reputational risks, thereby limiting the widespread adoption and scalability of outsourcing solutions within the healthcare ecosystem.

Talent Acquisition and Expertise Alignment:

As the demand for specialized Medical Affairs As outsourcing services continue to grow, identifying, attracting, and retaining top talent with niche expertise poses a significant challenge for organizations. Ensuring alignment with organizational objectives, cultural fit, and regulatory knowledge requires strategic workforce planning, continuous training, and development initiatives. The evolving nature of healthcare regulations, therapeutic areas, and market dynamics necessitates a proactive approach to talent acquisition, upskilling, and knowledge transfer. Addressing skill gaps, fostering collaboration between internal teams and outsourcing partners, and maintaining a competitive edge in a talent-driven marketplace remain pivotal challenges for companies seeking to optimize medical affairs functions through outsourcing.

By Segments

Service Insights

Medical Writing & Publishing dominated the market due to its critical role in documentation, regulatory submissions, and scientific communications. With regulatory requirements becoming increasingly stringent, companies rely heavily on skilled medical writers to prepare clinical trial protocols, investigator brochures, clinical study reports, and manuscripts for publication. The demand is especially high during product launches and regulatory filing phases. Furthermore, the increase in digital publishing and open-access journals has widened the scope of medical publishing, making this segment a backbone for knowledge dissemination and regulatory communication.

Medical Science Liaisons (MSLs) are the fastest-growing service segment. Their role in engaging with KOLs, providing field-based scientific support, and driving real-world insights has gained prominence. With increased competition in therapeutic areas like oncology and immunology, companies are relying on MSLs to build strategic relationships and influence prescribing behaviors ethically. Outsourcing MSL functions allows for geographic expansion and therapeutic specialization. For instance, deploying a network of MSLs in Southeast Asia to support a rare disease launch enables localized engagement at reduced cost and with greater cultural alignment.

Industry Insights

The pharmaceutical industry leads the medical affairs outsourcing market in terms of revenue contribution. The pharmaceutical sector, with its extensive product pipelines and stringent regulatory expectations, necessitates a wide array of medical affairs services—from scientific data generation to medical information handling and strategic engagement. Large pharma companies often outsource to manage global scale and multilingual requirements. A case in point is Pfizer’s engagement with multiple CROs during its global vaccine rollout to support scientific communication and real-time monitoring.

The biopharmaceutical industry is experiencing the fastest growth. As biologics, biosimilars, and advanced therapies like gene and cell therapies dominate drug pipelines, biopharma firms increasingly need medical affairs services to support these technically complex products. These services include medical education, RWE generation, and HEOR studies. Due to limited internal infrastructure, especially among emerging biotech firms, outsourcing becomes a strategic imperative. For instance, a biotech startup developing a monoclonal antibody might depend on external partners for both medical writing and medical information dissemination throughout its Phase II and III trials.

Regional Insights

North America dominates the global medical affairs outsourcing market, accounting for the largest revenue share. The presence of major pharmaceutical and biotech companies, stringent regulatory frameworks, and mature CRO ecosystems have all contributed to this dominance. The United States, in particular, is home to some of the world’s leading MAO providers and life sciences hubs, including Boston, San Diego, and the San Francisco Bay Area. Moreover, the availability of highly trained professionals and a robust digital infrastructure supports high-quality outsourced medical services. Companies such as IQVIA and Syneos Health have deep roots in this market, offering specialized medical affairs services tailored to the U.S. FDA requirements.

Asia-Pacific is the fastest-growing region, fueled by rapid pharmaceutical market expansion, growing regulatory maturity, and increasing outsourcing from Western nations. India and China are at the forefront, offering a combination of clinical and medical writing expertise at competitive prices. Japan and South Korea, with their aging populations and high R&D investment, are also contributing to regional growth. Additionally, the rise of local CROs like Novotech (Australia) and CliniExperts (India) is fostering regional self-sufficiency while attracting international clients.

Some of the prominent players in the medical affairs outsourcing market include:

- ICON plc

- IQVIA Holdings, Inc.

- The Medical Affairs Company

- Syneos Health, Inc.

- Thermo Fisher Scientific Inc. (PPD)

- Ashfield Healthcare Communications

- Zeincro Group

- Wuxi Clinical Development, Inc.

- SGS S.A.

- Indegene, Inc.

Recent Developments

-

In February 2025, Syneos Health announced a strategic partnership with a leading Japanese pharma firm to provide medical monitoring and MSL services across Southeast Asia, aiming to expand its presence in emerging Asia-Pacific markets.

-

In December 2024, ICON plc launched a new AI-enabled medical writing platform designed to reduce turnaround times for clinical documentation by up to 40%, further reinforcing their leadership in outsourced regulatory services.

-

In October 2024, Parexel expanded its India operations by opening a new medical affairs hub in Hyderabad, aiming to support growing demand for multilingual medical information and pharmacovigilance support.

-

In August 2024, IQVIA acquired a niche medical affairs consultancy based in Germany to strengthen its EU-focused capabilities in oncology and rare diseases, reflecting the growing trend of niche specialization.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical affairs outsourcing market.

Services

- Medical Writing & Publishing

- Medical Monitoring

- Medical Science Liaisons (MSLs)

- Medical Information

- Others

Industry

- Pharmaceutical

- Biopharmaceutical

- Medical Devices

-

- Therapeutic Medical Devices

- Diagnostic Medical Devices

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)