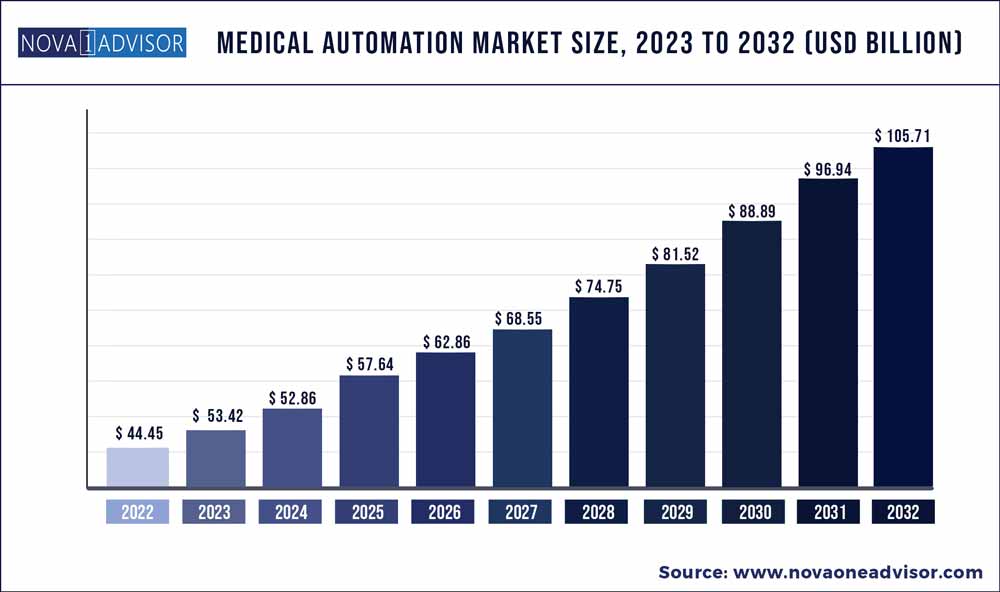

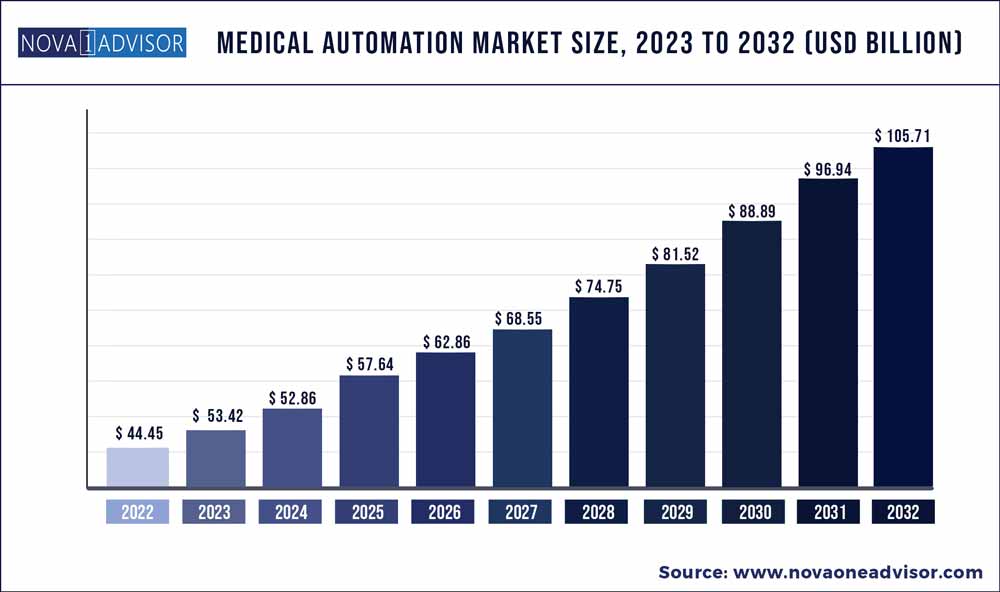

The global medical automation market size was exhibited at USD 44.45 billion in 2022 and is projected to hit around USD 105.71 billion by 2032, growing at a CAGR of 9.05% during the forecast period 2023 to 2032. A few of the key factors driving the market are the adoption of automated instruments by drug discovery departments of pharmaceutical companies, the rise in need for miniaturization, and technological advancements coupled with the rise in demand for robot-assisted surgeries.

Key Takeaways:

- Therapeutic automation held the largest share of the market in 2022, accounting for more than 54% of total market revenue.

- The market is supported by the growth of the intraoperative imaging segment, which made up more than 64% of the overall imaging automation market in 2022.

- The market is supported by the expansion of the surgical automation segment, which is growing at a compound annual growth rate of over 9%.

- The overall market is expanding at the compound annual growth rate of 9.04%, supported by the growth of the logistics automation segment over the forecast period.

- The end-use segment is dominated by hospitals and diagnostic centers with over 51.0% share in 2022.

- The research laboratories & institutes segment is anticipated to grow at a positive compound annual growth rate of over 9%.

- The Europe medical automation market is expected to expand at a CAGR of 9.30% in the forecast period of 2023 to 2032.

Medical Automation Market Report Scope

Additional contributing factors include increased government initiatives, an increase in clinical trials due to greater R&D outsourcing to emerging nations, and rising expenditures for infrastructure development. For instance, due to government initiatives that place a high priority on domestic innovation in nations like South Korea and China, there are now more domestic manufacturers in the surgical automation industry that specialize in robotic-assisted surgeries. Examples include Curexo in South Korea, which even serves as the local distributor for THINK Surgical's TSolution robotic system, and TINAVI Medical Technologies in China. Over the forecast period, an increase in local companies will be key to the market's growth.

Due to shutdown restrictions and disruptions in logistics management, the COVID-19 pandemic severely impacted the medical device market. However, due to the wide range of application usage, the medical automation market experienced little to no impact and saw a noticeable increase in demand. This is in support of the micro markets covered in the report, for instance, the market for laboratory and pharmacy automation, the market for medical software, informatics, and logistics, and, to a smaller extent, the market for therapeutic automation, which all showed evidence of benefit from the COVID-19 pandemic. For instance, even if the COVID-19 pandemic had a detrimental effect on robotic system sales, most players ended 2020 with strong demand for their products. For instance, over 100 robotic systems were put in by Stryker and Zimmer Biomet in the fourth quarter of 2020 for their MAKO and ROSA systems, respectively. This indicates that robotic-assisted surgeries are likely to be strong beyond 2020.

Moreover, the complexity of regulatory approvals varies by location and is dependent on the class to which a device's system belongs, which has a limited market impact. For instance, ensuring complicated compliance systems is a time-consuming operation that could delay the launch of products, ultimately making it challenging for manufacturers to introduce automated systems in the market.

Application Insights

Based on the application type, the market is fragmented into imaging automation, therapeutic automation, laboratory and pharmacy automation, medical software, informatics, and logistics automation markets. Therapeutic automation held the largest share of the market in 2022, accounting for more than 54% of total market revenue.

Imaging Automation Market

The market is supported by the growth of the intraoperative imaging segment, which made up more than 64% of the overall imaging automation market in 2022. This is due to the increase in the usage of less invasive treatments as well as technological advancements. For instance, Philips announced major updates to its Zenition mobile C-arm platform in June 2020.

Therapeutic Automation Market

The market is supported by the expansion of the surgical automation segment, which is growing at a compound annual growth rate of over 9%. This is a combination of both technical developments and an increase in the strategic initiatives taken by the companies. For instance, organizations' strategic initiatives, such as the BPCI, CJR, and advanced value-based reimbursement models, have given manufacturers the chance to offer supplementary goods and services that will successfully broaden the continuum of care.

Medical Software, Informatics, And Logistics Automation Market

The overall market is expanding at the compound annual growth rate of 9.04%, supported by the growth of the logistics automation segment over the forecast period. Furthermore, the rising need for automated material handling solutions across healthcare manufacturing sectors and rapid urbanization expansion is driving the market expansion.

End-Use Insights

The end-use segment is dominated by hospitals and diagnostic centers with over 51.0% share in 2022. The dominance is due to the rising usage of automated equipment in diagnostics, treatment, and laboratories.

The rise of this industry is being driven by automation in pharmacies and hospitals, particularly in tier 2 and tier 3 cities of the growing economies of Asia Pacific, including India. For example, institutions like Apollo and Fortis in India are working to offer computerized healthcare services that are functioning in tier 2 and tier 3 towns.

The research laboratories & institutes segment is anticipated to grow at a positive compound annual growth rate of over 9%. This is attributed to the presence of government-assisted agencies and acceptance of the new products launched into the market.

Regional Insights

North America dominated the industry in 2022 owing to high R&D investments, product launches, and government initiatives. Furthermore, the growth is attributed to the presence of a well-established healthcare infrastructure, which has increased the use of laboratory automation in the region. In addition, the supportive reimbursement framework and the local presence of major players in this region are also boosting the penetration of novel solutions in the market.

The Europe medical automation market is expected to expand at a CAGR of 9.30% in the forecast period of 2023 to 2032. The rising demand for technology-driven systems, the presence of major players, and the presence of well-established and developed healthcare infrastructure are expected to contribute to the region's market growth.

In addition, the presence of government agencies, such as the Medicines and Healthcare Products Regulatory Agency, is critical in certifying pharmacy automation systems and other devices with European standards, which is expected to give growth opportunities in the coming years for this regional market.

Furthermore, the markets in Asia Pacific are expected to exhibit the fastest compound annual growth rate (CAGR) over the forecast period owing to the developing healthcare sector, increasing cases of chronic diseases, and growing government and corporate investment in the healthcare sector, which are the major growth factors in this region.

Some of the prominent players in the Medical automation Market include:

- Accuray, Inc.

- Tecan Group Ltd.

- Medtronic Plc.

- Swisslog Holding AG

- GE Healthcare

- Intuitive Surgical, Inc.

- Stryker Corporation

- Siemens AG

- Koninklijke Philips N.V.

- Danaher Corporation

- Zimmer Biomet

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Medical automation market.

Application Outlook

- Imaging Automation Market

-

- Integrated Image Analysis software systems

- Medical Intraoperative Imaging

-

-

- iCT

- iUltrasound

- iMRI

- C-arm system

- Therapeutic Automation Market

-

- Non-Surgical Automation Market

-

-

-

- Implantable Cardioverter Defibrillators (ICD)

- Automated External (Portable) Defibrillators

- Wearable cardioverter defibrillators

-

-

- Electronic Drug Delivery Systems

-

- Surgical Automation Market

-

-

-

-

- Capital Equipment

- Consumables

- Services

-

-

-

-

- Large-Joint Replacement

- Spinal Fusion

-

-

- Intelligent Operating Rooms

- Surgical Simulators

- Laboratory and Pharmacy Automation Market

-

- Laboratory Automation Market

-

-

- Total Automation (Inclusive of Pre-analysis, Transport Mechanisms, Liquid Handling, Sample Storage, & Analysis)

- Modular Automation Systems (Inclusive of Specimen Acquisition & Identification & Labelling, Transport Mechanisms, Sample Preparation, Sample Loading & Aspiration, Reagent Handling & Storage, Sample Analysis & Measurements)

- Microplate Readers and Standalone Robots

-

- Pharmacy Automation Market

- Medical Software, Informatics, and Logistics Automation Market

-

- Software and Informatics

- Logistics Automation

-

-

- Hospital/Staff/Patient Tracking Systems Automated Liquid Handing

-

-

-

- Radiofrequency Identification

- Real-time Location Systems

-

-

- Automated Hospital Pickup and Delivery

-

-

-

- Pneumatic Tube Systems (PTS)

- Automated Guided Vehicles (AGV)

End-Use Outlook

- Hospitals & Diagnostic Centers

- Research Laboratories & Institutes

- Pharmacies

- Others (Home/Ambulatory Care Settings, etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)