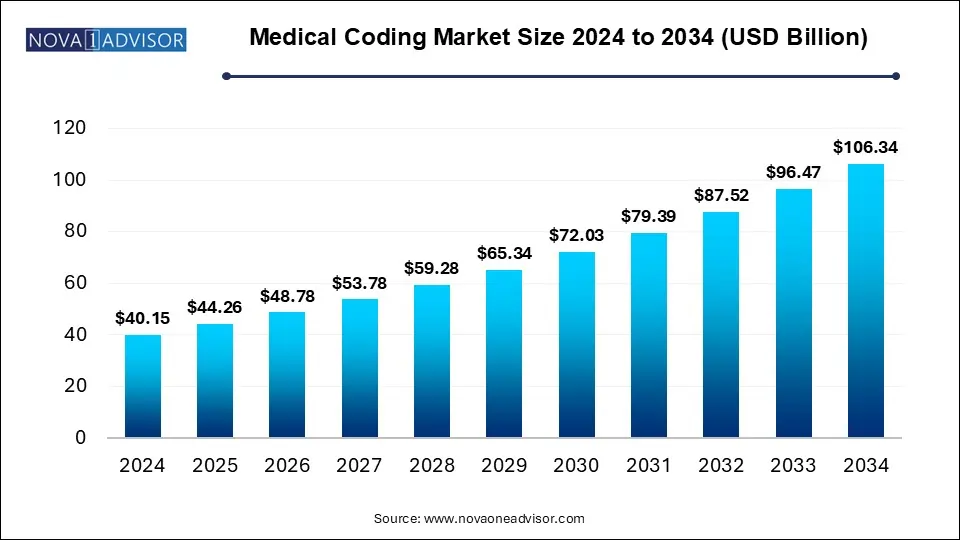

Medical Coding Market Size and Growth

The medical coding market size was exhibited at USD 40.15 billion in 2024 and is projected to hit around USD 106.34 billion by 2034, growing at a CAGR of 10.23% during the forecast period 2025 to 2034.

Medical Coding Market Key Takeaways

- Based on components, the outsourced segment accounted for the highest revenue share of 66% in 2024.

- The in-house segment is expected to witness substantial growth during the forecast period.

- In 2024, North America dominated the medical coding market, capturing a 61% share.

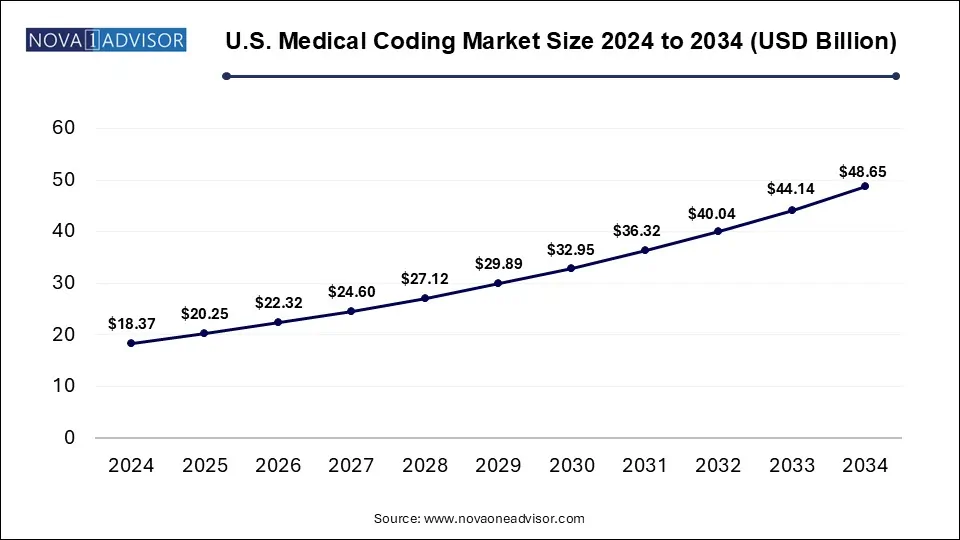

U.S. Medical Coding Market Size and Growth 2025 to 2034

The U.S. medical coding market size was valued at USD 18.37 billion in 2024 and is expected to reach around USD 48.65 billion by 2034, growing at a CAGR of 9.25% from 2025 to 2034.

North America led the medical coding market with a dominant 60% revenue share in 2024. This leadership is largely due to the growing need for a standardized coding language to minimize documentation errors and discrepancies within healthcare systems. Medical coding addresses this requirement by transforming diagnoses, procedures, services, and medical equipment details into standardized alphanumeric codes. Such practices are crucial for precise billing and effective healthcare administration. Furthermore, advancements in healthcare IT, including the application of Artificial Intelligence (AI) and Machine Learning (ML) in coding systems, are expected to further accelerate market expansion.

Trends in the U.S. Medical Coding Market

The U.S. commanded the largest share of North America's medical coding market in 2024, driven by the rising number of healthcare facilities such as hospitals, specialty clinics, ambulatory surgical centers, and cancer care institutions. The demand for coding by medical professionals to maintain updated patient records is also a significant growth driver. According to the U.S. Bureau of Labor Statistics, employment for medical personnel, including coders and billing experts, is projected to grow by 13% from 2016 to 2026.

Europe Medical Coding Market Overview

In Europe, the market is gaining momentum due to the increasing need for uniform coding in healthcare records. This standardization helps reduce insurance fraud and misinterpretations during claims processing, enhancing the efficiency of hospital billing systems. Technological improvements, such as computer-assisted coding tools and stronger healthcare infrastructure in several European countries, are expected to support market growth.

The UK held the largest market share in the region in 2024, driven by the proliferation of training institutes offering medical coding certifications. Efforts by major players to raise awareness about coding benefits and career prospects are further contributing to market development.

Germany accounted for a notable portion of the European market due to the growing number of coding-related job opportunities and the increased use of digital technologies in healthcare. There is a strong demand to modernize billing systems through accurate coding, aiding in the evaluation of treatment efficacy and frequency.

Asia Pacific Medical Coding Market Trends

Asia Pacific is projected to experience the most rapid growth in the global medical coding market during the forecast period. This trend is fueled by a surge in chronic disease cases, prompting enhancements in healthcare infrastructure and service quality. Streamlined billing and insurance claim processes through efficient coding are among the key advancements in the region. Rising healthcare expenditures and government support for better medical services are also contributing factors.

In China, the expanding healthcare infrastructure and digitization of medical records are primary growth drivers. The increasing population and the need for consistent and efficient documentation are accelerating the adoption of standardized coding systems.

India’s market is benefiting from the affordability of outsourcing medical coding services compared to Western nations. The push for standardized medical documentation to ensure accurate reimbursement, along with a focus on healthcare IT and a booming domestic healthcare sector, is promoting the outsourcing trend and fueling market expansion.

Latin America Medical Coding Market Trends

Latin America’s medical coding market is growing due to healthcare reforms, favorable regulations, expanding insurance coverage, and the widespread adoption of health IT systems. The prevalence of chronic diseases is also a significant driver. In countries like Argentina, increased demand for coding is tied to the growth of private and public insurance programs, which require accurate coding for effective claims processing.

Brazil is poised for strong growth as a result of ongoing healthcare reforms and the rising volume of healthcare data. The continued improvement of the Unified Health System (SUS) necessitates precise coding for patient data management, billing, and policy compliance.

Medical Coding Market Trends in the Middle East & Africa (MEA)

The MEA region is experiencing notable market growth due to active development in healthcare infrastructure. Countries such as South Africa and the UAE are adopting global coding protocols like ICD-10 to enhance record accuracy and consistency. These regulatory changes have increased the demand for advanced coding systems and skilled professionals capable of adhering to these standards.

In Saudi Arabia, the market is expanding rapidly due to increased investments in healthcare under national development frameworks such as Vision 2034. The country’s drive to improve healthcare services has fueled the need for sophisticated coding systems for patient data handling, billing, and compliance, making them indispensable to modern healthcare operations.

Report Scope of Medical Coding Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 44.26 Billion |

| Market Size by 2034 |

USD 106.34 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.23% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Component, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

STARTEK; Oracle; Maxim Healthcare Services; Paraxel International Corporation; Aviacode Inc.; GeBBS; Nuance Communications Inc. (Microsoft); Optum, Inc.; The Coding Network, LLC.; Dolbey Systems, Inc. |

Medical Coding Market By Component Insights

The outsourced segment dominated the medical coding market in 2024, accounting for 66% of the total revenue, and is expected to maintain the fastest growth rate throughout the forecast period. This expansion is largely driven by the growing volume of healthcare data and patient information, a strong focus on cost-efficiency among healthcare providers, and the need for compliance with global coding norms and regulations. Outsourcing provides healthcare organizations with access to qualified coding professionals without the financial and logistical burden of maintaining in-house teams. It also allows medical staff to prioritize patient care by delegating complex and time-intensive coding responsibilities to external experts. Additionally, advances in communication and technology have enabled secure, seamless international collaboration, further boosting the appeal of this model.

The in-house segment is also projected to experience considerable growth in the coming years. This trend is fueled by the growing necessity for accurate billing systems, an increasing emphasis on standardized patient data, and the rising cost-consciousness of healthcare institutions. The widespread implementation of electronic health records (EHRs) and the demand for specialized coding personnel capable of managing diverse coding systems are key contributors. Many healthcare organizations are acknowledging the advantages of maintaining an internal, well-trained coding team that can ensure regulatory compliance, optimize reimbursements, and minimize billing inaccuracies.

Some of The Prominent Players in The Medical Coding Market Include:

- Aviacode, Inc.

- Dolbey Systems, Inc.

- GeBBS

- Maxim Healthcare Services

- Nuance Communications, Inc. (Microsoft)

- Optum, Inc.

- Oracle

- Paraxel International Corporation

- STARTEK

- The Coding Network, LLC

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Medical Coding Market

By Component

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)