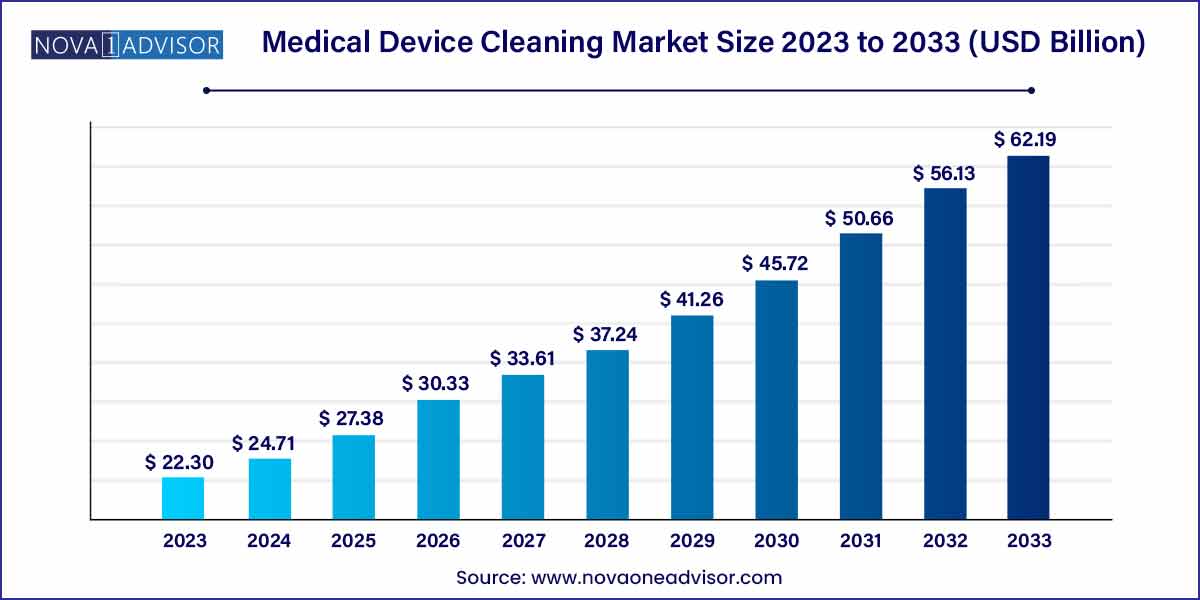

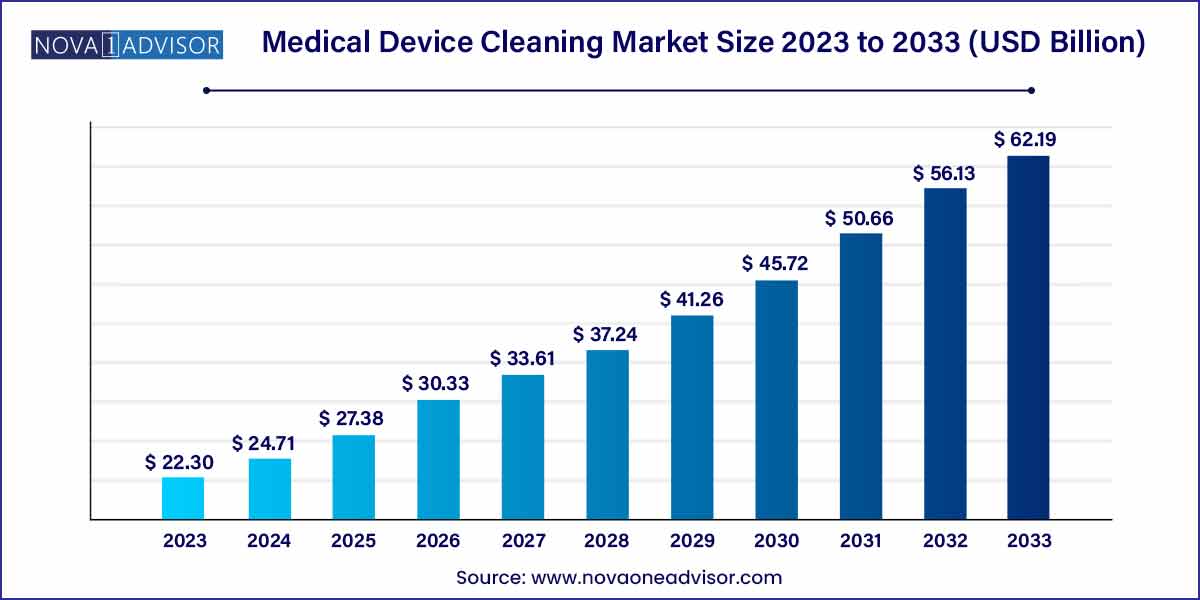

The global medical device cleaning size was estimated at USD 22.30 billion in 2023, is expected to surpass around USD 62.19 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 10.8% during the forecast period of 2024–2033.

Key Takeaways:

- Based on device type, the market has been segmented into non-critical, semi-critical, and critical. The semi-critical segment held the largest market share of 45.9% in 2023.

- The disinfection segment held the largest market share of 52.2% in 2023

- The intermediate-level segment held the largest share of over 52.0% in 2023.

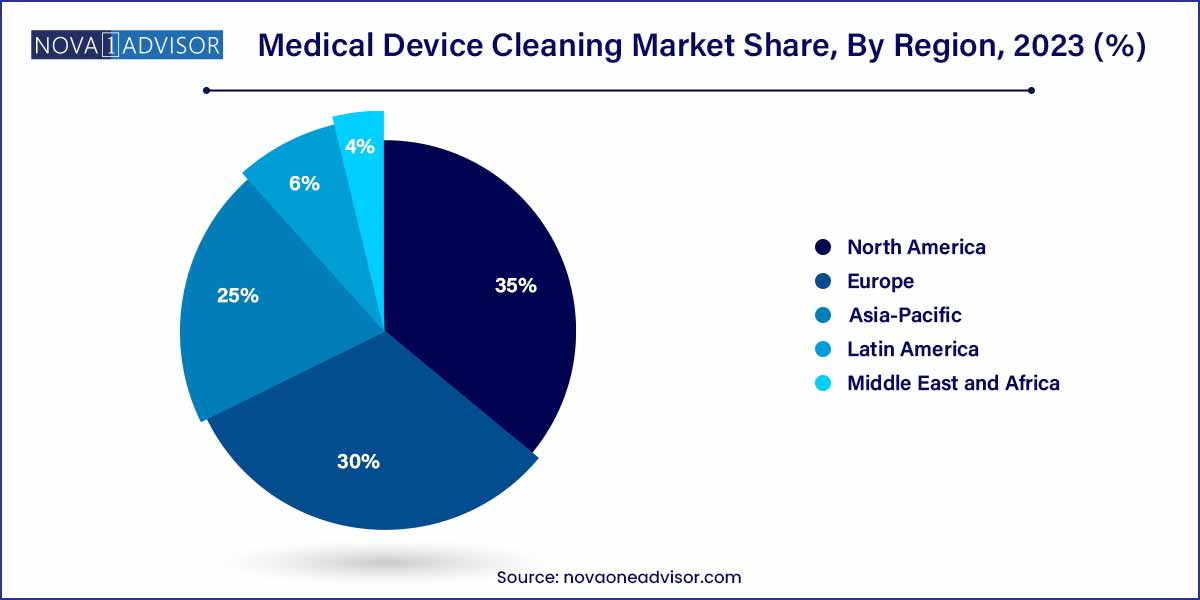

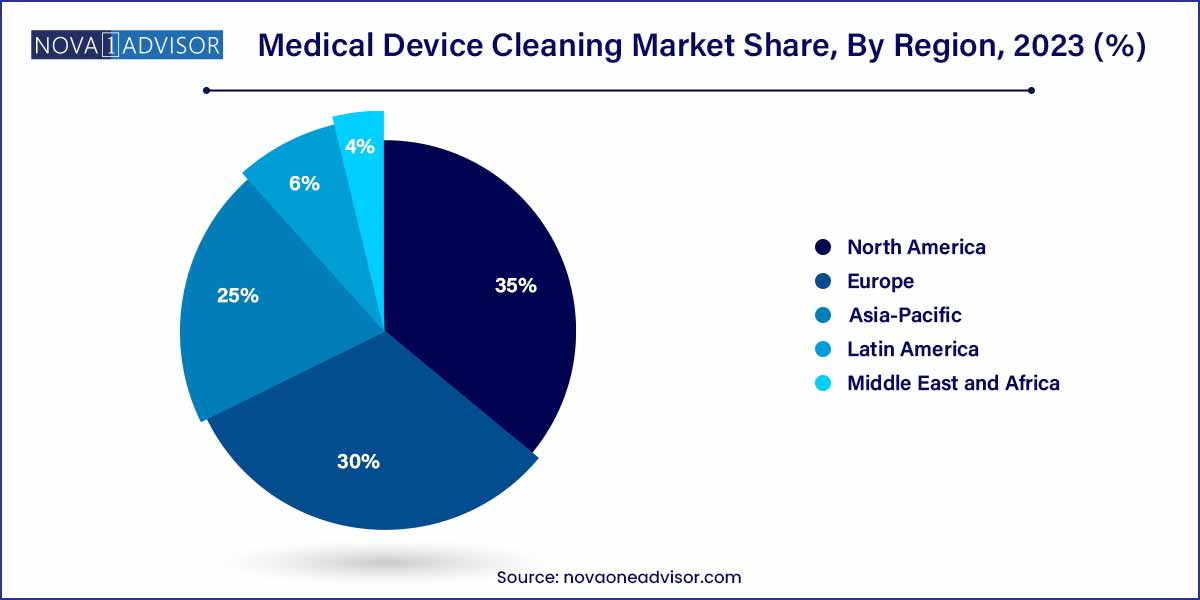

- North America dominated the medical device cleaning market in 2023 with around 35.0%.

Market Overview

The medical device cleaning market is a crucial segment of the healthcare industry that ensures patient safety, infection control, and regulatory compliance. Medical devices, whether reusable or single-use, must be thoroughly cleaned to remove contaminants such as blood, tissue, and microorganisms before they are disinfected or sterilized for reuse. Proper cleaning is the foundational step in preventing hospital-acquired infections (HAIs) and maintaining operational efficiency in healthcare facilities.

With the rising volume of surgical procedures globally, coupled with increasing awareness regarding infection prevention, the demand for efficient, standardized cleaning protocols and products has surged. Additionally, regulatory bodies like the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and World Health Organization (WHO) have emphasized stringent guidelines for medical device reprocessing, further driving the market.

The market has expanded with innovations such as enzymatic detergents, automated washers, and sterilization equipment. Furthermore, the COVID-19 pandemic heightened the focus on infection control, propelling investments in cleaning technologies across hospitals, ambulatory surgical centers, and diagnostic labs. As healthcare systems prioritize patient safety and operational excellence, the medical device cleaning market is poised for robust, sustained growth

Major Trends in the Market

-

Automation of Cleaning Processes: Rise in the adoption of automated washers and disinfection units to improve efficiency and standardization.

-

Development of Eco-friendly and Biodegradable Cleaning Agents: Focus on sustainability is driving innovations in green cleaning products.

-

Increased Outsourcing of Reprocessing Services: Healthcare facilities are outsourcing cleaning and sterilization to specialized providers.

-

Growing Demand for Single-use Devices: Yet, cleaning remains essential for certain critical and semi-critical reusable instruments.

-

Integration of IoT and Smart Monitoring: Smart devices are being deployed to monitor cleaning efficacy in real-time.

-

Customized Cleaning Solutions for Complex Instruments: Tailored cleaning agents and protocols are developed for robotic surgical devices and endoscopes.

-

Regulatory Stringency and Audits: Greater focus on compliance is leading to structured documentation and validation of cleaning processes.

Medical Device Cleaning Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 22.30 Billion |

| Market Size by 2033 |

USD 62.19 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Device, Technique, EPA Classification, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Steris plc.; GetingeAB; Advanced Sterilization Products; The Ruhof Corp.; Sklar Surgical Instruments; Sterigenics International LLC; Biotrol; Metrex Research, LLC; Oro Clean Chemie AG; Cantel Medical Corp.; Ecolab; 3M. |

Driver: Rising Prevalence of Hospital-acquired Infections (HAIs)

One of the primary drivers for the medical device cleaning market is the alarming rise in hospital-acquired infections globally. According to the Centers for Disease Control and Prevention (CDC), approximately 1 in 31 hospital patients has at least one healthcare-associated infection on any given day. Contaminated medical devices are a major contributor to HAIs, underscoring the critical need for rigorous cleaning protocols. Effective cleaning eliminates organic and inorganic materials that could otherwise shield microorganisms from disinfection or sterilization. Consequently, healthcare providers are investing heavily in advanced cleaning technologies and solutions to mitigate infection risks, protect patients, and reduce hospital costs associated with extended stays and legal liabilities.

Restraint: High Costs Associated with Advanced Cleaning Technologies

Despite the growing awareness of its importance, the high costs associated with advanced cleaning technologies and systems act as a restraint for the medical device cleaning market. Investment in automated cleaning machines, enzymatic detergents, smart monitoring systems, and staff training programs can be financially burdensome, especially for small and mid-sized healthcare facilities. Additionally, the need for regular maintenance, validation testing, and compliance documentation adds to operational expenses. As a result, some institutions, particularly in low-income regions, continue to rely on manual, less reliable cleaning methods, thereby hampering broader market adoption.

Opportunity: Technological Innovations in Complex Medical Device Cleaning

The increasing complexity of medical devices, particularly those used in minimally invasive surgeries and robotic procedures, presents a significant opportunity for innovation in the cleaning market. Devices like flexible endoscopes and robotic surgical instruments have intricate designs with narrow lumens and sensitive components that demand specialized cleaning protocols. Companies are investing in research to develop targeted enzymatic formulations, automated cleaning devices, and validation technologies that ensure thorough cleaning without damaging delicate equipment. This growing niche segment offers immense opportunities for manufacturers that can deliver highly effective, device-specific cleaning solutions.

Device Insights

Critical devices dominated the device segment. Critical medical devices, such as surgical instruments, implants, and cardiac catheters, are used in sterile body areas, necessitating the highest level of cleaning and sterilization. Ensuring the complete removal of bioburden and organic residues from these devices is paramount to prevent infections. As surgical volumes rise, particularly with the aging global population and advancements in complex surgical techniques, the demand for effective cleaning of critical devices continues to dominate.

Semi-critical devices are the fastest-growing device segment. Semi-critical devices, such as endoscopes and respiratory therapy equipment, which come into contact with mucous membranes but do not penetrate sterile tissues, require high-level disinfection after thorough cleaning. The increasing adoption of minimally invasive procedures and endoscopic examinations has significantly boosted the usage of semi-critical devices. Consequently, the need for specialized cleaning solutions and protocols for these devices is experiencing rapid growth.

Technique Insights

Cleaning dominated the technique segment. Cleaning is the essential first step before disinfection or sterilization, and its importance is universally recognized. It involves removing visible soil, organic, and inorganic materials, significantly reducing microbial load. Effective cleaning is critical for the success of subsequent sterilization or disinfection processes. Manual cleaning using enzymatic detergents, ultrasonic cleaning baths, and automated washer-disinfectors are common practices in hospitals and surgical centers, ensuring cleaning remains the dominant technique.

Sterilization is the fastest-growing technique segment. Although cleaning initiates the process, the importance of sterilization particularly for critical devices is growing due to heightened infection control standards. Techniques such as steam sterilization (autoclaving), ethylene oxide (ETO) sterilization, and radiation sterilization are widely employed. With the proliferation of complex surgical interventions and regulatory emphasis on device sterility assurance levels (SAL), sterilization is gaining traction at an accelerated pace.

EPA Classification Insights

High-level disinfectants dominated the EPA classification segment. High-level disinfectants are required for the treatment of critical and semi-critical devices, providing broad-spectrum antimicrobial efficacy. Agents like glutaraldehyde, hydrogen peroxide, and peracetic acid are widely utilized to achieve the necessary microbial kill rates. Their crucial role in reprocessing surgical and endoscopic instruments underpins their dominance in the market.

Intermediate-level disinfectants are the fastest-growing EPA classification segment. The use of intermediate-level disinfectants is expanding rapidly for devices that encounter non-intact skin or mucous membranes, particularly in ambulatory settings and outpatient clinics. These disinfectants offer a balance between efficacy and material compatibility, driving adoption in various healthcare environments.

Regional Insights

North America dominated the medical device cleaning market. The dominance of North America is attributed to its highly developed healthcare infrastructure, strict regulatory standards, and greater awareness regarding infection control. The U.S. is at the forefront, with organizations like the Centers for Medicare & Medicaid Services (CMS) and Association for the Advancement of Medical Instrumentation (AAMI) establishing detailed protocols for device cleaning and reprocessing. Furthermore, the presence of major market players such as Steris Corporation and Getinge AB in the region strengthens North America's leadership.

Asia-Pacific is the fastest-growing region. Asia-Pacific's rapid market growth is driven by expanding healthcare infrastructure, increasing surgical volumes, and rising awareness about infection control in countries like China, India, and Japan. Governments are investing in modernizing healthcare facilities, and regulatory agencies are introducing stricter guidelines on device reprocessing. Additionally, the rising prevalence of HAIs in emerging economies is prompting hospitals to upgrade their cleaning practices, creating robust demand for advanced cleaning products and solutions.

Some of the prominent players in the Medical device cleaning include:

- Steris plc.

- GetingeAB

- Advanced Sterilization Products

- The Ruhof Corp.

- Sklar Surgical Instruments

- Sterigenics International LLC

- Biotrol

- Metrex Research, LLC

- Oro Clean Chemie AG

- Cantel Medical Corp.

- Ecolab

- 3M

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical device cleaning.

Device

- Non-critical

- Semi-critical

- Critical

Technique

-

- Detergents

- Buffers

- Chelators

- Enzymes

- Others

-

-

- Alcohol

- Chlorine & Chorine Compounds

- Aldehydes

- Phenolics

-

- Heat Sterilization

- Ethylene Dioxide (ETO) Sterilization

- Radiation Sterilization

EPA Classification

- High Level

- Intermediate Level

- Low Level

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)