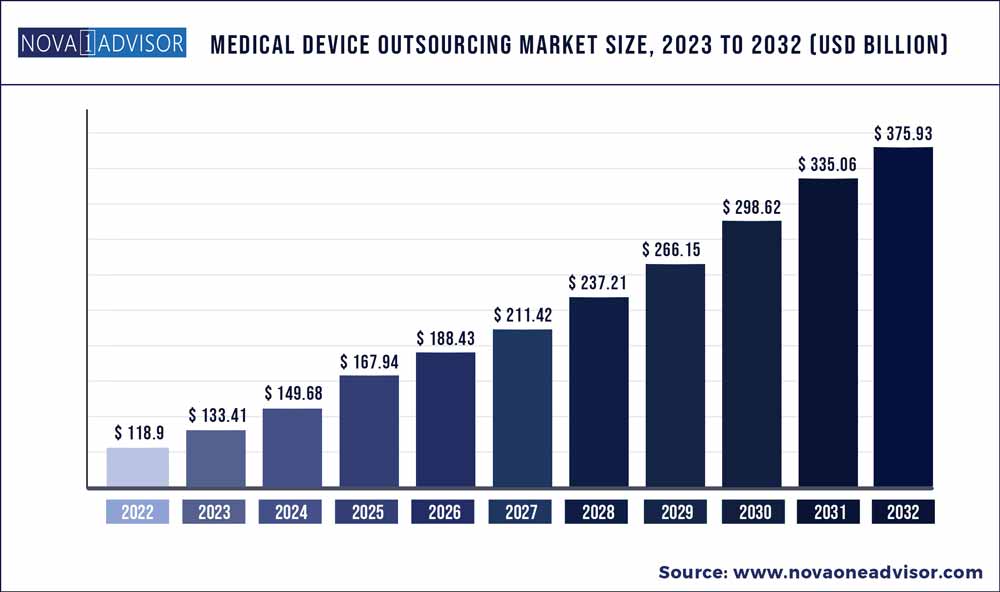

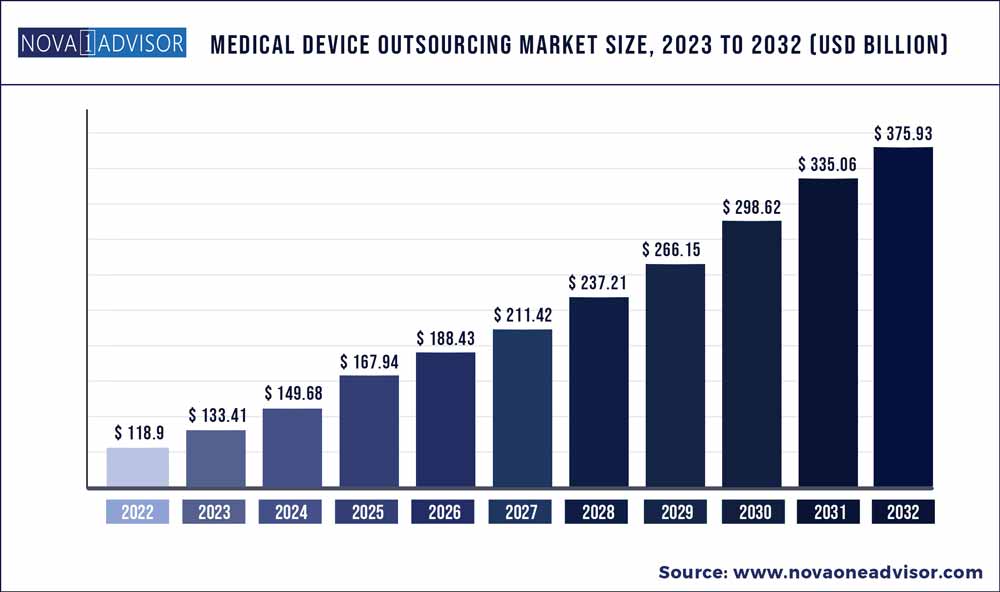

The global medical device outsourcing market size was exhibited at USD 118.9 billion in 2022 and is projected to hit around USD 375.93 billion by 2032, growing at a CAGR of 12.2% during the forecast period 2023 to 2032.

Key Pointers:

- Asia Pacific dominated the global market in 2022 with the largest revenue share of 41.11%.

- North America is also anticipated to register significant growth during the forecast period.

- The contract manufacturing segment led the market and accounted for more than 54.19% share of the global revenue in 2022.

- The quality assurance services segment is projected to attain the fastest CAGR growth of 14.5% during the forecast period.

- The cardiology segment accounted for the maximum share of 20.17% in 2022

- General and plastic surgery device outsourcing is anticipated to exhibit the fastest CAGR growth of 13.7% from 2023 to 2032.

- Class II type medical devices accounted for the largest market share of 66.9% in 2022 and the segment is expected to register the fastest CAGR of 12.4% over the forecast period0

- The high cost of medical devices, and almost 43.16% of the medical devices fall under this category.

Medical Device Outsourcing Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 133.41 Billion

|

|

Market Size by 2032

|

USD 375.93 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 12.2%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Services, Application, Class

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

SGS SA; Laboratory Corporation of America Holdings; Euro fins Scientific; Pace Analytical Services, Inc.; Intertek Group plc; WuXiAppTec; North American Science Associates, LLC; TÜV SÜD; Sterigenics U.S., LLC (GTCR, LLC); Charles River Laboratories; Medical Device Testing Services; RJR Consulting, Inc.; Mandala International.; Freyr; Global Regulatory Partners; PAREXEL International Corporation (EQT Private Equity and Goldman Sachs Asset Management); Emergo (UL LLC); Bioteknica; Accell Clinical Research, LLC; Genpact.; Criterium, Inc.; ; Promedica International; Med pace; ICON plc.; IQVIA Inc.; Integer Holdings Corporation; Tecomet Inc. (Charlesbank Capital Partners, LLC); Jabil Inc.; FLEX LTD.; Celestica Inc.; Sanmina Corporation.; Plexus Corp.; Phillips Medisize (Molex, LLC); Cantel Medical Corp. (STERIS plc) and West Pharmaceutical Services, Inc.

|

Rising demand for advanced medical products and a growing trend of offshoring is fueling the medical device outsourcing market growth.

Regulatory bodies are emphasizing the quality of the healthcare devices provided to the public which is becoming burdensome to handle. To meet the regulatory scenario, various services like regulatory consulting are being utilized by the industry players. For example, the European Medical Device Regulation undertakes special spontaneous inspection of outsourced products to test the quality as well as conformity with standards.

Contract manufacturers, especially in developed countries like the U.S., EU nations, and Japan, comply with the international standard for the quality management system, which makes them a preferred option as compared with contract manufacturers in India and China. However, regulatory changes anticipated in developing countries ensure compliance by contract manufacturers. Demand for regulatory compliance is expected to boost the growth of consulting services such as remediation, compliance, and QMS, thereby contributing to the growth of the global medical device outsourcing market.

Owing to COVID-19, there was a decline in the number of diagnoses for other diseases like cancer and tuberculosis among others. The recovery from COVID-19 is expected to increase demand for the medical devices used for diagnosing these diseases. Public organizations across the globe are taking initiatives to increase the production of medical equipment to prevent a future shortage. For instance, in January 2021, U.S. president Joseph Biden in response to the pandemic preparedness emphasized improving gaps in the supply chain by augmenting domestic manufacturing of test kits, PPE, and durable medical equipment.

Service Insights

The contract manufacturing segment led the market and accounted for more than 54.19% share of the global revenue in 2022. Based on services, the market is segmented into quality assurance services, regulatory affairs services, product design & development services, product testing & sterilization services, product implementation services, product upgrade services, product maintenance services, and contract manufacturing services.

Increasing focus on decreasing the cost of production is augmenting the growth of this segment. In addition, increasing complexity in manufacturing is contributing to market growth. Manufacturing high-quality and safe devices for patient care is a major concern of medical device manufacturers. Also, the high level of inspection in developing medical devices has created layers of standards and regulations. Hence, this is creating demand for manufacturing services.

However, the quality assurance services segment is projected to attain the fastest CAGR growth of 14.5% during the forecast period. The maintenance of an effective quality management system is an integral part of the production of every medical device. One such quality management system is ISO 13485, which involves the development, implementation, and maintenance of the products intended for use by medical device manufacturers and suppliers. Medical device manufacturers are outsourcing quality management services to medical device consulting companies to ensure compliance and provide high-quality components alongside safe and effective finished medical devices.

Application Insights

The cardiology segment accounted for the maximum share of 20.17% in 2022 and is likely to remain dominant throughout the forecast period. Based on the application, the market is segmented into cardiology, diagnostic Imaging, orthopedic, IVD, ophthalmic, general & plastic surgery, drug delivery, dental, endoscopy, diabetes care, and others. According to WHO, 17.9 billion people died due to cardiovascular disease in 2019, representing 32% of all global deaths.

This is due to the high prevalence of conditions, such as angina pectoris, myocardial infarction, hypertensive heart disease, rheumatic heart disease, atrial fibrillation, and congenital heart disease. The high prevalence of CVDs globally is increasing the demand for cardiovascular devices.

Moreover, the high complexity of cardiovascular devices and the need for technical expertise, and manufacturing of these devices may also lead to the high cost to the OEMs, which is likely to result in the higher outsourcing of these devices.

General and plastic surgery device outsourcing is anticipated to exhibit the fastest CAGR growth of 13.7% from 2023 to 2032. The availability of competent outsourcing firms, which comply with the regulatory requirements, and the rising demand for cosmetic surgeries are the factors expected to contribute to the growth of this segment. The awareness and consciousness about physical appearance have significantly increased in recent years, which has increased the demand for cosmetic surgeries, globally.

Surgical devices like fixation devices, extremity splints, and epilators require specialized molding and machining processes, which increases the demand for outsourcing these devices. The introduction of minimally invasive and noninvasive surgeries has led to a rise in the number of surgeries performed in a year. This calls for innovative and procedure-specific devices.

Class Insights

Class II type medical devices accounted for the largest market share of 66.9% in 2022 and the segment is expected to register the fastest CAGR of 12.4% over the forecast period owing to the high cost of medical devices, and almost 43.0% of the medical devices fall under this category. Based on the class type, the medical device outsourcing market is segmented into Class I, Class II & Class III.

Class II includes catheters, syringes, surgical gloves, blood pressure cuffs, pregnancy test kits, contact lenses, and blood transfusion kits. These devices have a higher risk involved than Class I devices as these are to be in continuous contact with patients.

Class I type medical devices are also anticipated to register significant growth during the forecast period. These devices are noninvasive. Currently, 47.0% of the devices fall under this category and 95.0% of the devices in this category are exempt from regulatory procedures due to low-risk levels. Class I devices are the easiest and fastest to purchase from the market due to the low risk to the patient and rarely provide critical to life-sustaining care. The majority of Class I devices are exempt from FDA's premarket notification (510k) and Premarket Approval Requirements (PMA).

Regional Insights

Asia Pacific dominated the global market in 2022 with the largest revenue share of 41.11%. The presence of market players and competitive pricing are the other supporting factors that are anticipated to drive this regional market. Also, the increasing demand for medical devices owing to the growing patient population suffering from chronic and infectious diseases is fueling the market growth in this region. For instance, during the first wave of COVID-19, there was a growing demand for CT scanners in India to detect pneumonia.

North America is also anticipated to register significant growth during the forecast period. This is owing to the well-established manufacturing hubs for high-end, consistent, and complex medical devices. Also, the existence of the technologically advanced electronic sector is helping North America edge over other regions. This region is also home to numerous medical device companies, which are outsourcing part of their regulatory and consulting functions to regulatory service providers, thereby contributing to the growth of the regional market.

Some of the prominent players in the Medical Device Outsourcing Market include:

- SGS SA

- Laboratory Corporation of America Holdings

- Euro fins Scientific

- Pace Analytical Services, Inc.

- Intertek Group plc

- WuXiAppTec

- North American Science Associates, LLC

- TÜV SÜD

- Sterigenics U.S., LLC (GTCR, LLC)

- Charles River Laboratories

- Medical Device Testing Services (Element Minnetonka)

- RJR Consulting, Inc.

- Mandala International

- Freyr

- Global Regulatory Partners

- PAREXEL International Corporation (EQT Private Equity and Goldman Sachs Asset Management)

- Emergo (UL LLC)

- Bioteknica

- Accell Clinical Research, LLC

- Genpact

- Criterium, Inc.

- Promedica International

- Med pace

- ICON plc.

- IQVIA Inc.

- Integer Holdings Corporation

- Tecomet Inc. (Charles bank Capital Partners, LLC)

- Jabil Inc.

- FLEX LTD.

- Celestica Inc.

- Sanmina Corporation

- Plexus Corp.

- Phillips Medisize (Molex, LLC)

- Cantel Medical Corp. (STERIS plc)

- West Pharmaceutical Services, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Medical Device Outsourcing market.

By Service

- Quality Assurance

- Regulatory Affairs Services

- Clinical trials applications and product registrations

- Regulatory writing and publishing

- Legal representation

- Other

- Product Design and Development Services

- Designing & Engineering

- Machining

- Molding

- Packaging

- Product Testing & Sterilization Services

- Product Implementation Services

- Product Upgrade Services

- Product Maintenance Services

- Contract Manufacturing

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

By Application

- Cardiology

- Class I

- Class II

- Class III

- Diagnostic imaging

- Class I

- Class II

- Class III

- Orthopedic

- Class I

- Class II

- Class III

- IVD

- Class I

- Class II

- Class III

- Ophthalmic

- Class I

- Class II

- Class III

- General and plastic surgery

- Class I

- Class II

- Class III

- Drug delivery

- Class I

- Class II

- Class III

- Dental

- Class I

- Class II

- Class III

- Endoscopy

- Class I

- Class II

- Class III

- Diabetes care

- Class I

- Class II

- Class III

- Others

- Class I

- Class II

- Class III

By Class

- Class I

- Class II

- Class III

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)