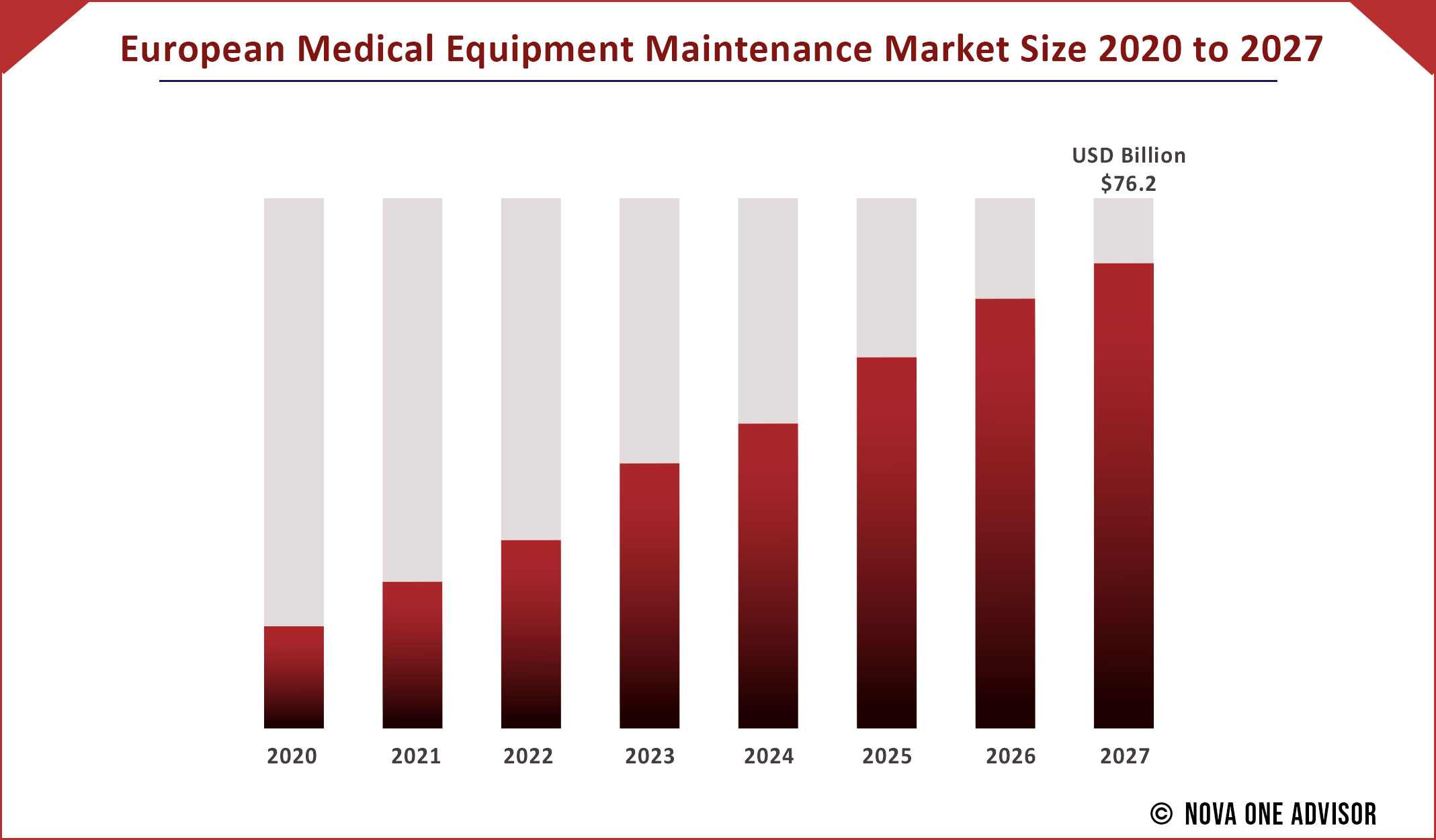

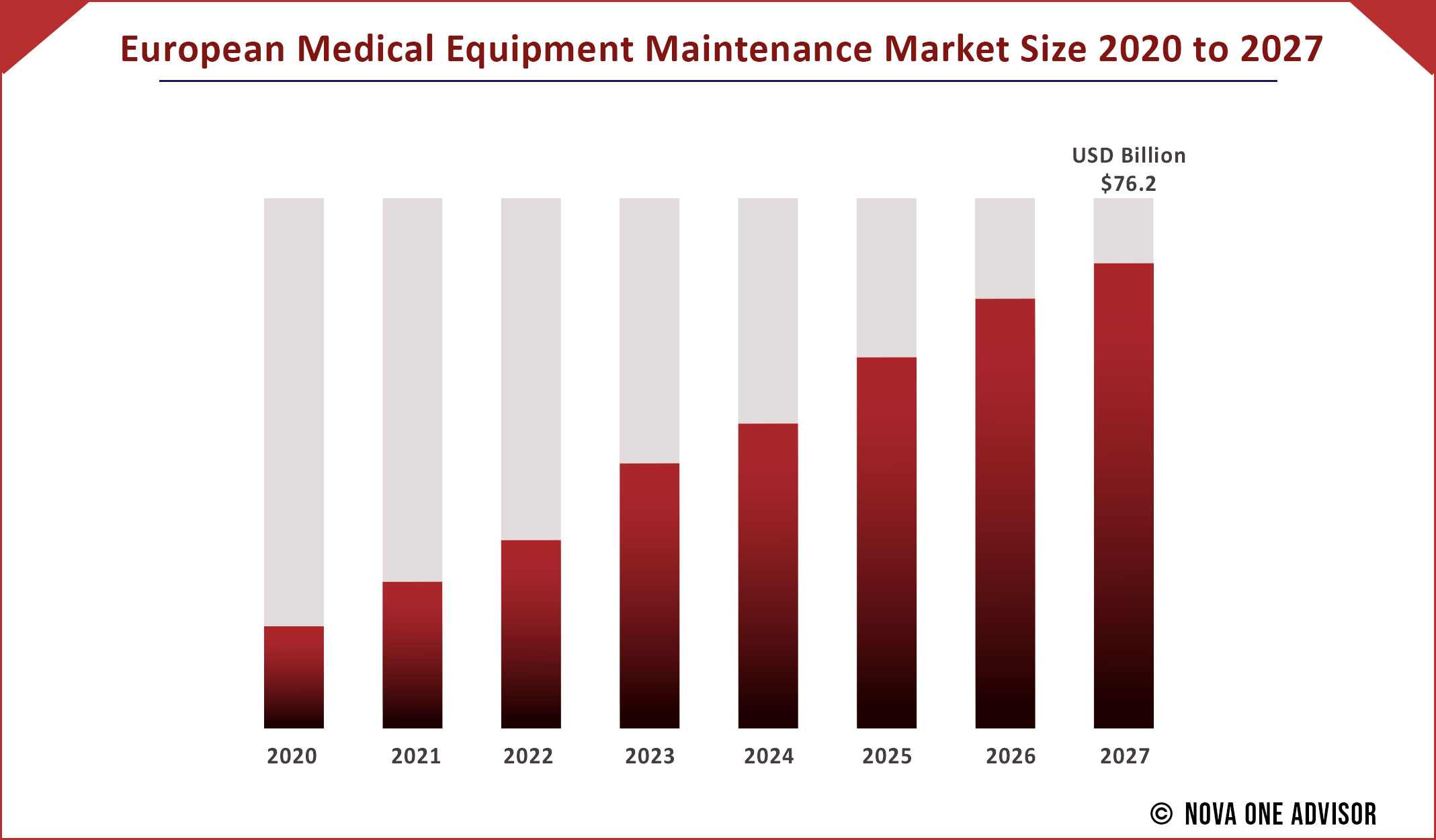

The global Medical Equipment Maintenance market gathered revenue around USD 44.9 Billion in 2020 and market is set to grow USD 76.2 Billion by the end of 2027 and is estimated to expand at a modest CAGR of 12.4% during the prediction period 2021 to 2027.

Growth Factors:

The Market Increase in health care expenses and increase in need for technologically advanced medical equipment have significant increase in the medical equipment manufacturing market. This medical equipment is used for the people’s health. They have been broadly used for the health-checks of human lives in every department of healthcare industry. For instance, calibration is an important procedure for any equipment and device, to maintain and improve its accuracy and precision.

Right operative of medical equipment is extremely essential for almost all healthcare expert for instances doctors, nurses, and others. Medical equipment and devices allow healthcare experts to precisely check health of the patient. These are utilized from diagnostic methods to surgeries, therapeutic treatments, operating table, and helping specialists in emergency hospital room.

Based on device type, the global medical equipment maintenance market is sectioned into imaging equipment, endoscopic devices, surgical instruments, and electromedical equipment. Based on service type, the market is segmented into corrective, preventive, and operational maintenance. On the basis of service provider, the medical equipment maintenance market is categorized into original equipment manufacturers (OEMs), independent service organizations (ISOs), and in-house maintenance. Based on end user, the global medical equipment maintenance market is divided into public-sector organizations and private-sector organizations.

This research report purposes at stressing the most lucrative growth prospects. The aim of the research report is to provide an inclusive valuation of the Medical Equipment Maintenance market and it encompasses thoughtful visions, actualities, industry-validated market findings, historic data, and prognoses by means of appropriate set of assumptions and practice. Global Medical Equipment Maintenance market report aids in comprehending market structure and dynamics by recognizing and scrutinizing the market sectors and predicted the global market outlook.

Report Coverage

| Report Scope |

Details |

| Market Size |

USD 76.2 Billion by 2027 |

| Growth Rate |

CAGR of 12.4% From 2021 to 2027 |

| Base Year |

2020 |

| Forecast Period |

2021 to 2027 |

| Historic Data |

2017 to 2020 |

| Report coverage |

Growth Factors, Revenue Status, Competitive Landscape, and Future Trends |

| Segments Covered |

Service Type, Service Providers, Device Type, End User Region |

| Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Companies Mentioned |

GE Healthcare; Siemens Healthineers; Koninklijke Philips N.V.; Drägerwerk AG & Co. KGaA; Medtronic; B. Braun Melsungen AG; Aramark; BC Technical, Inc.; Alliance Medical Group; Althea Group. |

COVID-19 Impact Assessment on Market Landscape

The report comprises the scrutiny of COVID-19 lock-down impact on the income of market leaders, disrupters and followers. Since lock down was instigated differently in diverse regions and nations, influence of same is also dissimilar across various industry verticals. The research report offers present short-term and long-term influence on the market to assist market participants across value chain makers to formulate the framework for short term and long-lasting tactics for recovery and by region.

Medical Equipment Maintenance market Report empowers readers with all-inclusive market intelligence and offers a granular outline of the market they are operational in. Further this research study delivers exceptional combination of tangible perceptions and qualitative scrutiny to aid companies accomplishes sustainable growth. This report employs industry-leading research practices and tools to assemble all-inclusive market studies, intermingled with pertinent data. Additionally, this report also emphases on the competitive examination of crucial players by analyzing their product portfolio, pricing, gross margins, financial position, growth approaches, and regional occurrence.

Global Medical Equipment Maintenance Market: Drivers & Restraints

The global medical equipment maintenance market is estimated to grow at a rapid pace in the forthcoming years. Quick implementations of new methods, global increase in number of life-threatening infections and disorders will drive the market. This will need cutting-edge medical devices, and increase in purchase of renewed medical systems drive the global medical equipment maintenance market.

The prime factors boosting the global medical equipment maintenance market are growing concentration on preventive medical equipment maintenance. Also, growing preference for buying of restored medical equipment as well as growing investments of major enterprises to build healthcare infrastructure is driving the market.

However, increase in cost of medical equipment and treatment, absence of health care expertise, and significant cost of maintenance of medical equipment are the restraining factors for the global medical equipment maintenance market. Nevertheless, developments for complex equipment maintenance and growing number of public-private partnerships is fueling the market.

Regional analysis:

North America accounted for the largest revenue share of 40.1% in 2020 owing to the advanced medical infrastructure, rising prevalence of chronic diseases, higher healthcare spending, and a large number of hospitals and ambulatory surgical centers in the region. In addition, higher demand for advanced medical devices in the region is anticipated to propel the market growth in the region.

Asia Pacific is expected to witness the fastest growth over the forecast period due to the growing geriatric population, government initiatives to provide better healthcare services, and rising healthcare spending in the region. For instance, the Government of India launched the Ayushman Bharat Yojana in 2019 to offer free access to healthcare for 45% of people in the country.

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

- Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Some of the prominent players in the Medical Equipment Maintenance Market include: GE Healthcare; Siemens Healthineers; Koninklijke Philips N.V.; Drägerwerk AG & Co. KGaA; Medtronic; B. Braun Melsungen AG; Aramark; BC Technical, Inc.; Alliance Medical Group; Althea Group.

Unravelling the Critical Segments

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects including product type, application/end-user, and region. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for period 2017 to 2027 and covers subsequent region in its scope:

Global Medical Equipment Maintenance Market, by Device Type

- Diagnostic Imaging Equipments

- CT Scanners

- MRI Systems

- Ultrasound Systems

- X-Ray Systems

- Mammography Systems

- Angiography Systems

- Fluoroscopy Systems

- Nuclear Imaging Equipments (PET/SPECT)

- Electrosurgical Equipment

- Endoscopic Devices

- Surgical Equipment

- Medical Lasers

- Opthalmology Equipment

- Patient Monitoring & Life Support Devices

- Ventilators

- Anesthesia Monitoring Equipments

- Infusion Pumps

- Dialysis Equipment

- Other Life Supported Devices & Patient Monitoring Devices

- Dental Equipment

- Dental Radiology Equipments

- Dental Laser Devices

- Other Dental Equipment

- Laboratory Equipment

- Durable Medical Equipments

- Radiotherapy Devices

Medical Equipment Maintenance Market, by Service Type

- Preventive Maintenance

- Corrective Maintenance

- Operational Maintenance

Global Medical Equipment Maintenance Market, by Technology

- Multi-Vendor OEMs

- Single-Vendor OEMs

- Independent Service Organization

- In-House Maintenance

Global Medical Equipment Maintenance Market, by End User

- Hospital

- Diagnostic Imaging Centers

- Dialysis Centers

- Ambulatory Surgical Centers

- Dental Clinics & Speciality Clinics

- Other End Users

By Geography

North America

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Highlights of the Report:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market

- Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market

- Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

Research Methodology

In the study, a unique research methodology is utilized to conduct extensive research on the growth of the Medical Equipment Maintenance market, and reach conclusions on the future growth parameters of the market. This research methodology is a combination of primary and secondary research, which helps analysts ensure the accuracy and reliability of the conclusions.

Secondary resources referred to by analysts during the production of the Medical Equipment Maintenance market study are as follows - statistics from government organizations, trade journals, white papers, and internal and external proprietary databases. Analysts have also interviewed senior managers, product portfolio managers, CEOs, VPs, marketing/product managers, and market intelligence managers, all of whom have contributed to the development of this report as a primary resource.

Comprehensive information acquired from primary and secondary resources acts as a validation from companies in the market, and makes the projections on the growth prospects of the Medical Equipment Maintenance markets more accurate and reliable.

Secondary Research

It involves company databases such as Hoover's: This assists us recognize financial information, structure of the market participants and industry competitive landscape.

The secondary research sources referred in the process are as follows:

- Governmental bodies, and organizations creating economic policies

- National and international social welfare institutions

- Company websites, financial reports and SEC filings, broker and investor reports

- Related patent and regulatory databases

- Statistical databases and market reports

- Corporate Presentations, news, press release, and specification sheet of Manufacturers

Primary Research

Primary research includes face-to face interviews, online surveys, and telephonic interviews.

- Means of primary research: Email interactions, telephonic discussions and Questionnaire based research etc.

- In order to validate our research findings and analysis we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

- CEOs, VPs, market intelligence managers

- Procuring and national sales managers technical personnel, distributors and resellers

- Research analysts and key opinion leaders from various domains

Key Points Covered in Medical Equipment Maintenance market Study:

- Growth of Medical Equipment Maintenance in 2021

- Market Estimates and Forecasts (2017-2027)

- Brand Share and Market Share Analysis

- Key Drivers and Restraints Shaping Market Growth

- Segment-wise, Country-wise, and Region-wise Analysis

- Competition Mapping and Benchmarking

- Recommendation on Key Winning Strategies

- COVID-19 Impact on Demand for Medical Equipment Maintenance and How to Navigate

- Key Product Innovations and Regulatory Climate

- Medical Equipment Maintenance Consumption Analysis

- Medical Equipment Maintenance Production Analysis

- Medical Equipment Maintenance and Management