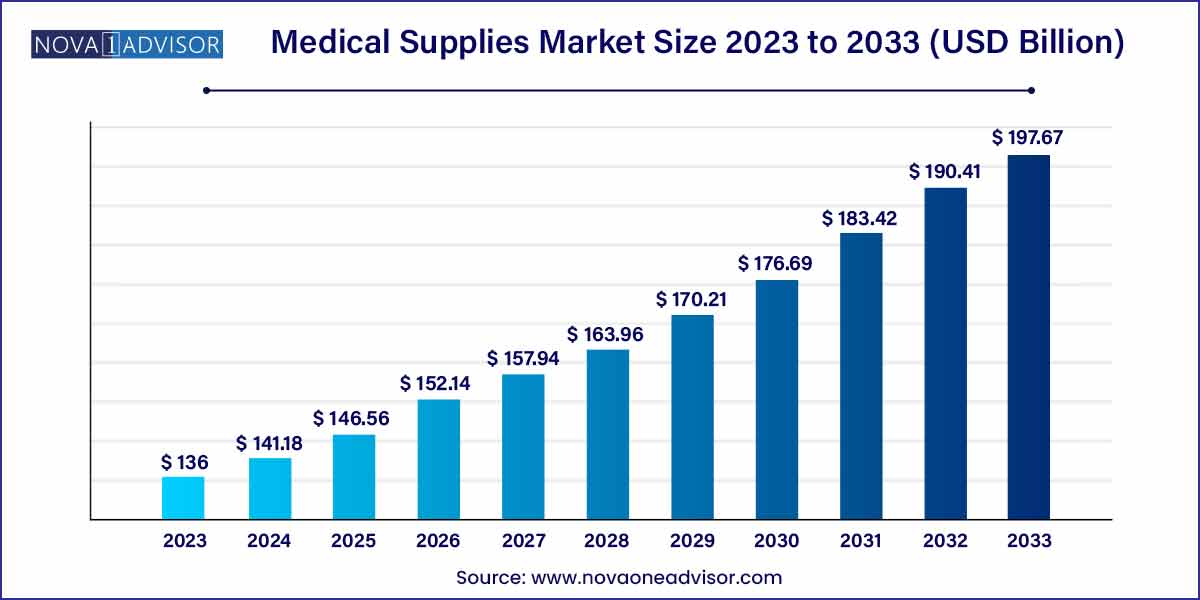

The global medical supplies market size was exhibited at USD 136.00 billion in 2023 and is projected to hit around USD 197.67 billion by 2033, growing at a CAGR of 3.81% during the forecast period of 2024 to 2033.

Key Takeaways:

- Based on region, North America dominated the global medical supplies market in 2023

- The rapid growth in the number of hospitals and clinics across the globe is estimated to foster the demand for the medical supplies in the forthcoming years.

- Based on type, the catheters segment dominated the market in 2023, in terms of revenue and is projected to witness notable CAGR during the forecast period.

- Based on application, the others segment accounted largest revenue share in 2023 and is estimated to sustain its dominance during the forecast period.

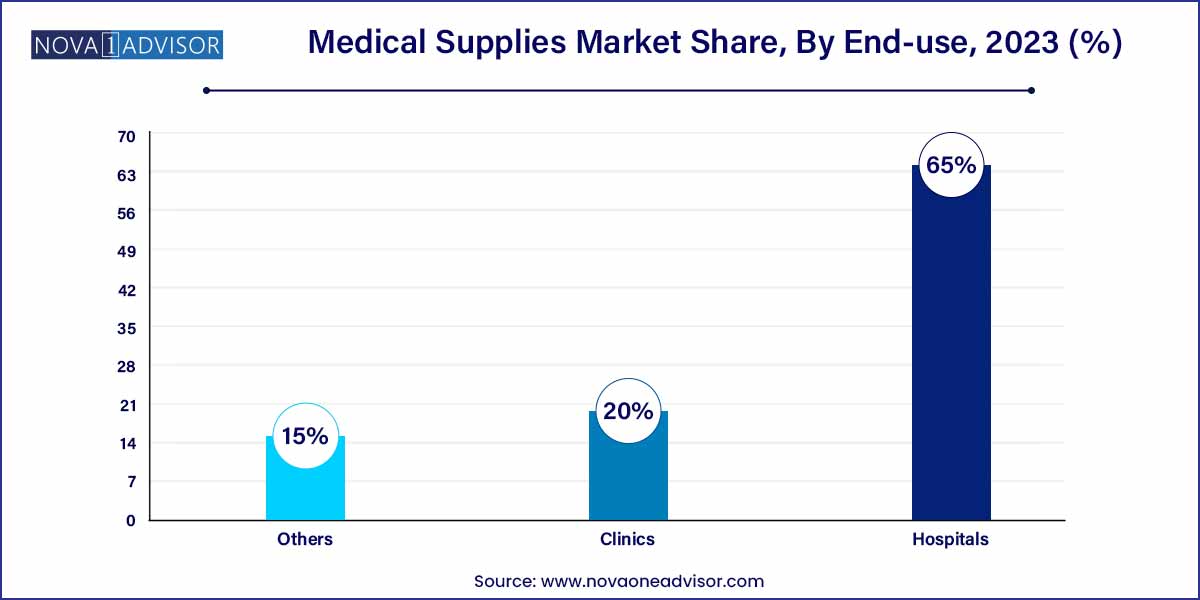

- Based on end user, the hospitals segment dominated the market in 2023, in terms of revenue.

Market Overview

The global medical supplies market is a critical pillar supporting healthcare infrastructure worldwide. Medical supplies, ranging from simple consumables like gloves and syringes to complex diagnostic tools and PPE (Personal Protective Equipment), ensure the efficient and safe operation of healthcare services across hospitals, clinics, diagnostic laboratories, and homecare settings.

The COVID-19 pandemic underlined the strategic importance of reliable and agile medical supply chains, significantly altering purchasing patterns, regulatory landscapes, and investment priorities. Even in the post-pandemic era, demand for medical supplies remains elevated, driven by ongoing infection control needs, the rising burden of chronic diseases, expanding surgical procedures, and the global movement toward more accessible healthcare.

Moreover, the global aging population, increasing incidences of diseases such as cancer, diabetes, respiratory disorders, and kidney ailments, and heightened focus on preventive healthcare are fueling a sustained need for consumables and diagnostic supplies. Medical supply manufacturers are responding with innovation in product safety, usability, sterilization standards, and sustainability.

Amid tightening regulations and growing patient expectations, healthcare providers are increasingly prioritizing high-quality, compliant supplies to ensure optimal clinical outcomes, minimize infection risks, and improve patient satisfaction. Consequently, the global medical supplies market is positioned for robust long-term growth.

Major Trends in the Market

-

Rising Demand for Single-use, Disposable Supplies: Increased infection control requirements boosting disposable products.

-

Expansion of Home Healthcare Services: Growth in home-use medical supplies for chronic disease management.

-

Technological Advancements in Diagnostic Consumables: Integration of AI in diagnostic kits and point-of-care testing solutions.

-

Focus on Eco-friendly and Biodegradable Medical Supplies: Sustainability driving R&D in green medical consumables.

-

Globalization of Supply Chains: Outsourcing production to Asia-Pacific and Latin America for cost-effectiveness.

-

Regulatory Harmonization Efforts: Global initiatives to standardize medical supply quality and safety standards.

-

Digitalization of Inventory and Supply Chain Management: Adoption of IoT and RFID tracking systems.

-

Increased Preparedness for Future Pandemics: Strategic stockpiling and expansion of emergency medical supplies.

Medical Supplies Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 136.00 Billion |

| Market Size by 2033 |

USD 197.67 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.81% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

3M, Medtronic, Smith & Nephew, BD, Cardinal Health, Inc., Johnson & Johnson, Abbott, B. Braun Melsungen AG, Boston Scientific Corporation, Thermo Fisher Scientific, Inc., Stryker, Baxter International, Inc., Avanos Medical, Inc. |

Key Market Driver: Growing Prevalence of Chronic and Infectious Diseases

The primary driver propelling the global medical supplies market is the rising prevalence of chronic diseases and infectious conditions worldwide. Chronic diseases such as diabetes, cardiovascular diseases, respiratory ailments, and kidney disorders are becoming more common due to lifestyle factors, aging populations, and urbanization.

For instance, according to the WHO, chronic diseases account for 74% of all global deaths. Such conditions necessitate frequent diagnostic monitoring, surgical interventions, wound care, dialysis, and infection control measures, creating continuous demand for medical consumables.

Moreover, the global experience with COVID-19 heightened awareness about infection prevention, respiratory support supplies, PPE, and diagnostic testing, trends that are likely to persist. Hospitals and clinics are investing heavily in maintaining adequate stockpiles of essential medical supplies, ensuring long-term market growth.

Key Market Restraint: Supply Chain Disruptions and Raw Material Shortages

Despite strong demand, supply chain vulnerabilities and raw material shortages act as significant restraints. The COVID-19 pandemic exposed the fragility of global supply chains, leading to shortages of essential products such as masks, gloves, ventilators, and testing kits.

Furthermore, reliance on a limited number of raw material suppliers (for plastics, rubber, specialty chemicals, etc.) makes the industry susceptible to price volatility, geopolitical tensions, and environmental regulations. Transportation delays, customs bottlenecks, and export restrictions during global crises can severely impact availability and pricing, making supply chain resilience a key concern for stakeholders.

Building diversified, localized, and digitally managed supply networks is now a priority but remains a challenge for many smaller players, impacting market dynamics.

Key Market Opportunity: Expansion of Homecare and Remote Patient Monitoring

A major opportunity emerging in the medical supplies market is the rapid expansion of homecare and remote patient monitoring services. As healthcare systems worldwide shift toward cost-effective, patient-centered care models, there is growing demand for medical supplies suitable for home settings.

Devices such as infusion pumps, oxygen concentrators, dialysis kits, wound dressings, and remote diagnostic tools are increasingly being adapted for home use. The pandemic accelerated this shift, and aging populations, increasing healthcare literacy, and technological innovations (like telehealth) continue to reinforce it.

Manufacturers focusing on portable, easy-to-use, and patient-friendly medical supplies stand to gain significantly by catering to the expanding homecare segment.

Segments Insights:

Type Insights

Diagnostic supplies dominate the market, accounting for the largest share owing to the essential role of diagnostics in clinical decision-making across all healthcare levels. Blood glucose test strips, COVID-19 antigen kits, pregnancy tests, and cardiac biomarkers are critical consumables used daily in hospitals, clinics, and homecare. The COVID-19 pandemic massively boosted the diagnostic consumables market, and demand for rapid, accurate, and accessible diagnostic solutions continues to expand.

PPE is the fastest-growing type segment, propelled by infection prevention needs both during and post-pandemic. PPE supplies masks, gloves, gowns, face shields have become essential not just for healthcare workers but also for the general population in many countries. Continuous waves of respiratory infections, increased workplace safety norms, and stockpiling strategies by governments and organizations are sustaining high demand.

Application Insights

Infection control dominates the application segment, reflecting heightened global awareness about preventing healthcare-associated infections (HAIs) and cross-contamination. Supplies such as sterilization consumables, disinfectants, PPE, and catheter maintenance kits are critical for infection prevention protocols in healthcare facilities.

Wound care is expanding rapidly, driven by the rising incidence of diabetic ulcers, pressure sores, and surgical wounds. Advanced wound dressings, antimicrobial wound care products, and negative pressure wound therapy kits are seeing increased adoption, particularly with the expansion of home healthcare services and aging populations.

End User Insights

Hospitals dominate the end-user segment, being the largest consumers of medical supplies due to the volume of surgeries, inpatient procedures, diagnostic tests, and infection control measures performed daily. Large hospital chains, public healthcare institutions, and specialty centers account for bulk procurement, ensuring the dominance of this segment.

Clinics are growing fastest, reflecting the global shift towards decentralized, outpatient care models. Specialized clinics for dialysis, dermatology, cardiology, and wound care are proliferating, particularly in urban and suburban areas, increasing demand for cost-effective, scalable medical supplies tailored for ambulatory care settings.

Regional Analysis

North America dominates the global medical supplies market, driven by its advanced healthcare infrastructure, high healthcare spending, early adoption of innovative medical technologies, and a strong regulatory environment ensuring product quality and safety.

The United States leads with significant investments in chronic disease management, infection control, surgical innovations, and diagnostic expansions. Major players like Cardinal Health, Thermo Fisher Scientific, and 3M are headquartered in North America, providing a strong industry backbone.

In addition, the presence of extensive home healthcare services, comprehensive insurance coverage, and robust public health programs (e.g., CDC initiatives) sustain consistent demand for a wide range of medical supplies.

Asia-Pacific is the fastest-growing region, fueled by rising healthcare access, expanding middle-class populations, aging demographics, and increasing chronic disease prevalence.

China and India are witnessing healthcare infrastructure expansions at an unprecedented scale, including hospital construction, insurance penetration, and diagnostic lab network growth. Governments are investing heavily in public health programs, infection control measures, and domestic manufacturing of medical supplies.

Moreover, Asia-Pacific serves as a key outsourcing hub for manufacturing medical consumables, attracting investments from multinational corporations seeking cost advantages and proximity to growing markets.

Some of the prominent players in the medical supplies market include:

- Medtronic

- Cardinal Health, Inc.

- BD

- Johnson & Johnson

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Thermo Fisher Scientific, Inc.

- Baxter International, Inc.

- Avanos Medical, Inc.

- 3M

- Smith & Nephew

- ConvaTec Group Plc.

- Abbott

- Teleflex Incorporated

- Fresenius Medical Care AG & Co. KGaA

- Coloplast Group

- Cook Medical

- Merit Medical Systems

- Stryker

- Terumo Corporation

Recent Developments

-

March 2025: Medline Industries announced the opening of a new state-of-the-art manufacturing facility in South Carolina to expand its PPE production capabilities.

-

February 2025: Cardinal Health launched a new range of eco-friendly surgical drapes and gowns as part of its sustainability initiative.

-

January 2025: Thermo Fisher Scientific expanded its COVID-19 diagnostic consumables manufacturing unit in California to support global testing efforts.

-

December 2024: 3M Company introduced a next-generation N95 respirator with enhanced breathability and comfort for healthcare workers.

-

November 2024: Smith & Nephew acquired a wound care startup specializing in bioengineered dressings for chronic wounds, aiming to expand its advanced wound management portfolio.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical supplies market.

By Type

- Diagnostic Supplies

- Infusion & Injectable Supplies

- Disinfectants

- PPE

- Sterilization Consumables

- Wound Care Consumables

- Dialysis Consumables

- Catheters

- Radiology Consumables

- Others

By Application

- Radiology

- Wound Care

- Cardiology

- Urology

- Respiratory

- Infection Control

- IVD

- Others

By End User

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)