Medical Writing Market Size and Research

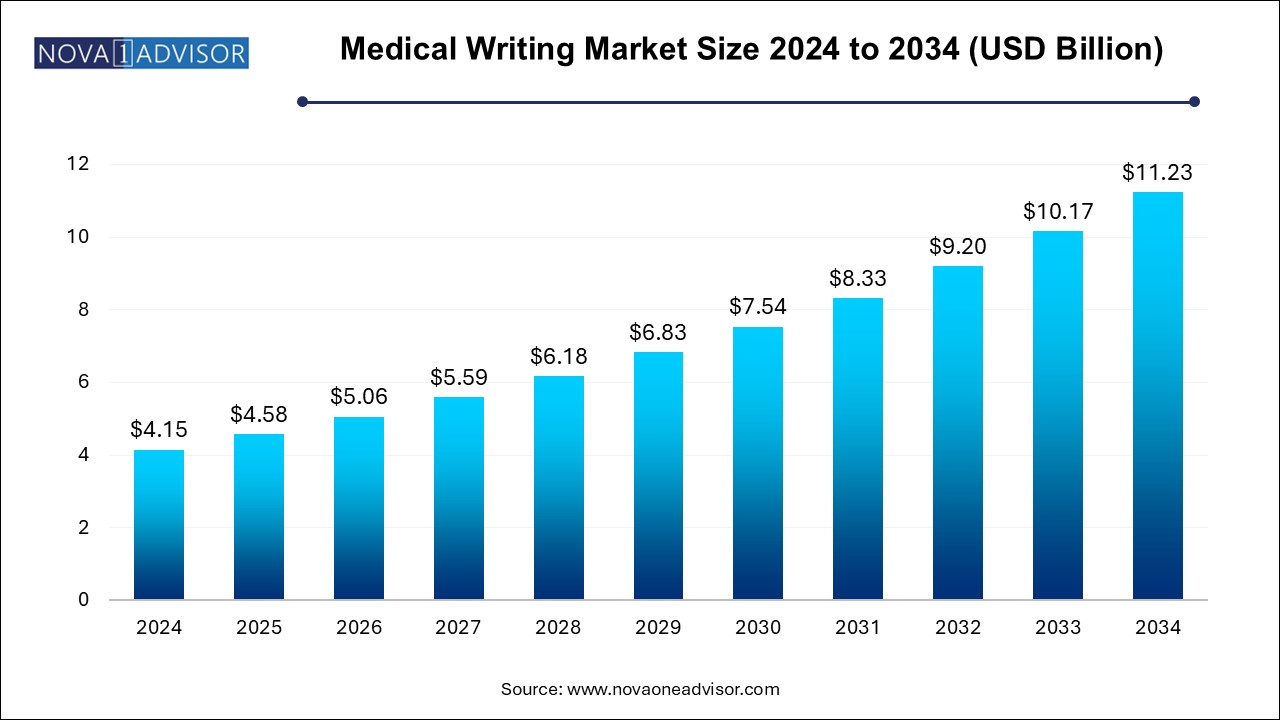

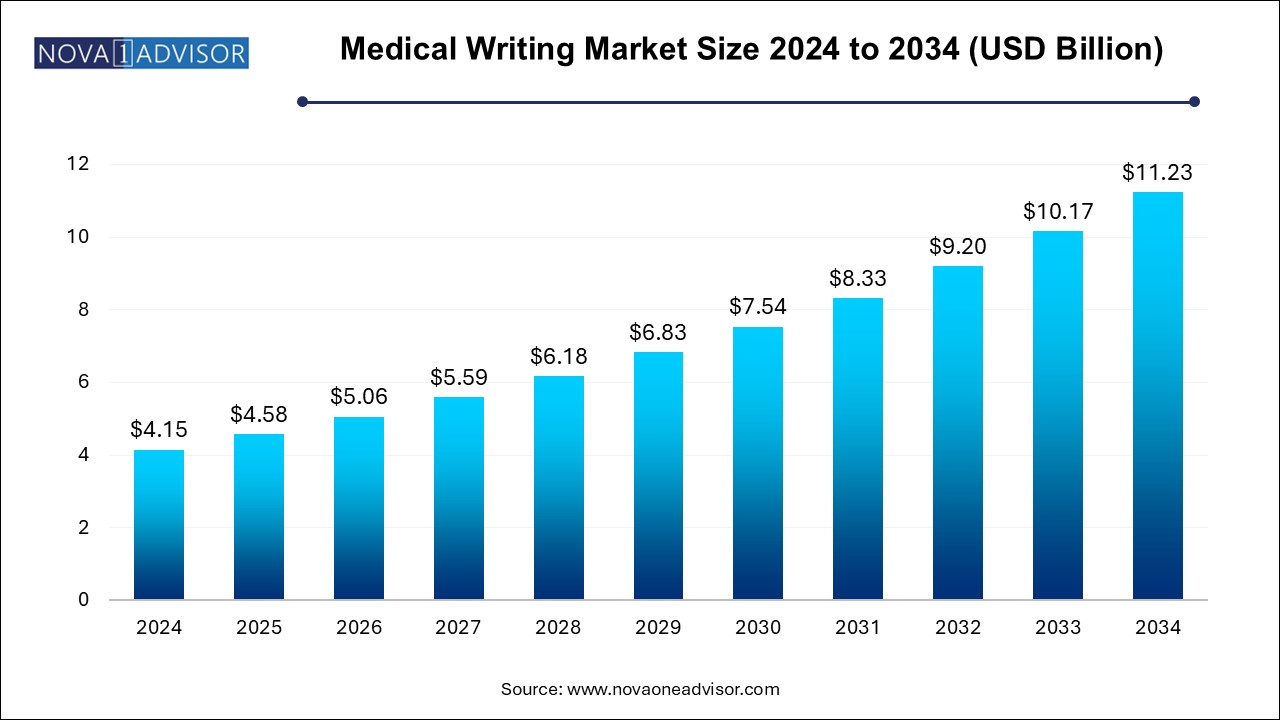

The medical writing market size was exhibited at USD 4.15 billion in 2024 and is projected to hit around USD 11.23 billion by 2034, growing at a CAGR of 10.47% during the forecast period 2024 to 2034.

Medical Writing Market Key Takeaways:

- Based on type, the clinical writing segment dominated the global medical writing market with a share of 38.1% in 2024.

- Regulatory writing is expected to be the fastest-growing segment with a CAGR of 11.30% during the forecast period.

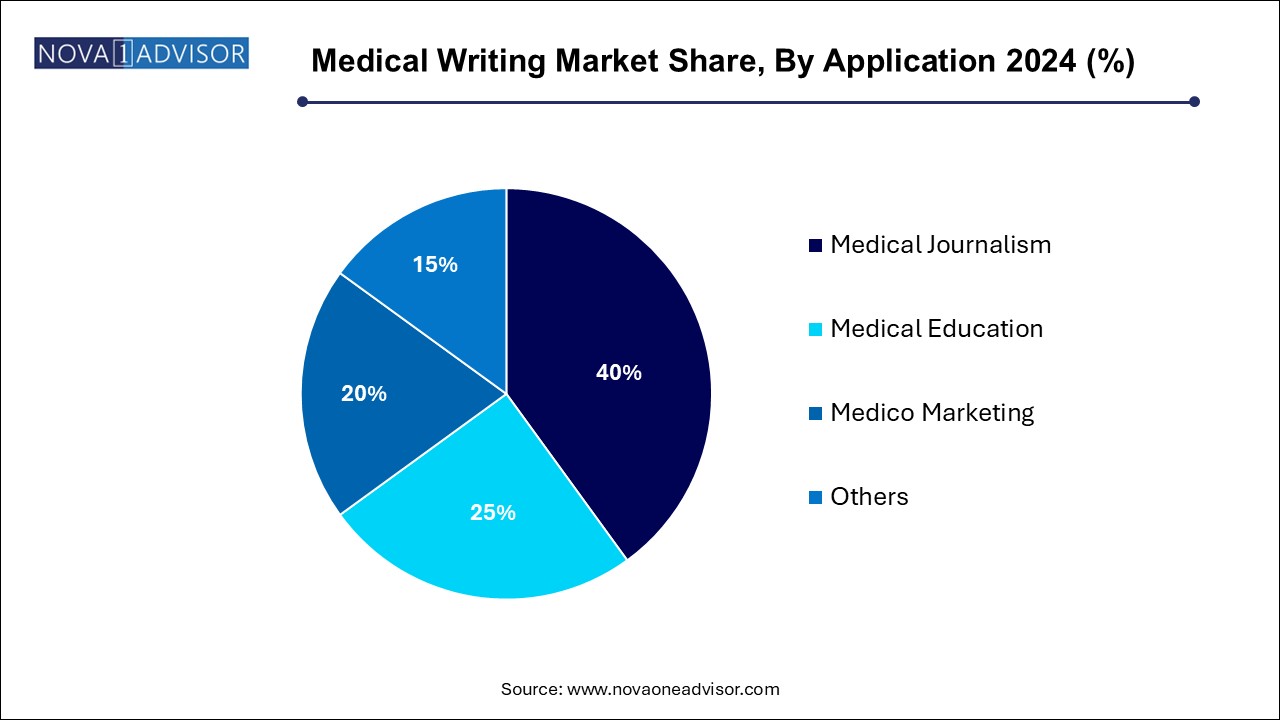

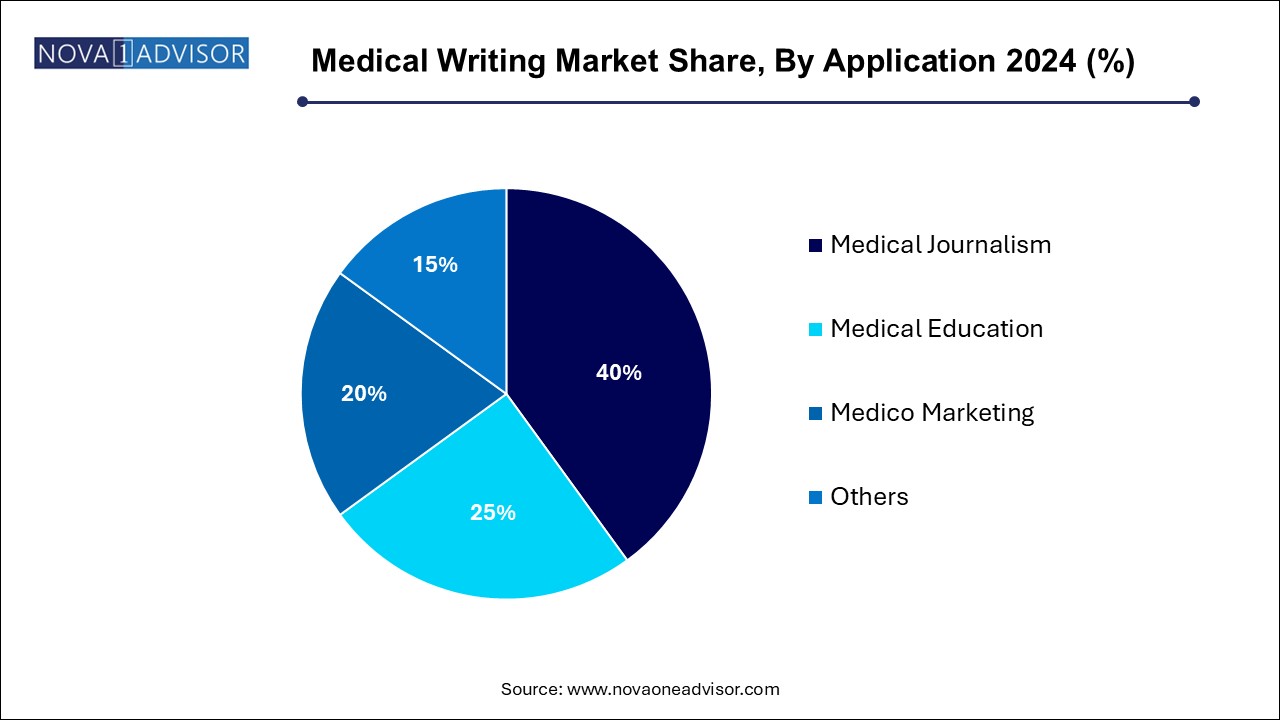

- The medical journalism segment accounted for the maximum share of the market with 40.0% in 2024.

- Based on end-use, the CROs & other segments dominated the market in 2024 due to rising R&D costs.

- North America dominated the market with a share of 35.4% in 2024.

Market Overview

The Medical Writing Market is a vital component of the global healthcare ecosystem, providing essential documentation services that span clinical research, regulatory submissions, scientific communication, medical journalism, and pharmaceutical marketing. Medical writing plays a foundational role in translating complex clinical and scientific data into structured, compliant, and easily understandable formats for regulators, healthcare professionals, payers, and patients.

With increasing research activity in pharmaceuticals, biotechnology, and medical devices, the demand for high-quality medical documentation has surged. Regulatory bodies such as the U.S. FDA, EMA, and PMDA in Japan enforce strict guidelines that require precise documentation throughout the product lifecycle—from Investigational New Drug (IND) applications and Clinical Study Reports (CSRs) to product labeling, educational content, and post-marketing surveillance reports.

The rise of outsourcing to Contract Research Organizations (CROs), the globalization of clinical trials, growing emphasis on real-world evidence (RWE), and expanding digital channels for medical communication are reshaping the medical writing landscape. As companies compete for faster approvals and market access, skilled medical writers are becoming indispensable for ensuring compliance, clarity, and scientific credibility.

Major Trends in the Market

-

Shift Toward Outsourcing: Pharmaceutical and biotech firms are increasingly outsourcing writing tasks to specialized vendors and CROs to reduce costs and improve turnaround.

-

Demand for Real-world Evidence (RWE): With payers and regulators demanding RWE, writers are now producing patient-centric outcomes, observational studies, and value dossiers.

-

Adoption of Artificial Intelligence (AI): AI-driven tools are being deployed to automate parts of writing tasks, such as data extraction and basic narrative generation.

-

Expansion of Medical Journalism and Patient Education: Demand for consumer-friendly healthcare content is driving growth in journalism and lay-language medical writing.

-

Compliance with Global Regulatory Frameworks: Harmonization of global regulatory documentation (e.g., CTD format) is boosting demand for specialized regulatory writing.

-

Rise in Multilingual and Regional Writing Needs: As companies go global, localized and region-specific documentation is in high demand.

-

Increased Emphasis on Publication Writing: Medical affairs teams are focusing on manuscript development for peer-reviewed journals to support brand credibility.

-

Evolving Role in Medico-marketing: Medical writing is increasingly embedded in strategic marketing campaigns targeting physicians and healthcare stakeholders.

-

Integration with Digital Health Platforms: Medical writers are now contributing to digital therapeutics, mobile health apps, and telemedicine content strategies.

-

Growth in Rare Disease and Orphan Drug Segments: Complex, niche areas require expert writing for regulatory support, evidence generation, and education.

Report Scope of Medical Writing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.58 Billion |

| Market Size by 2034 |

USD 11.23 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 10.47% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Parexel International Corporation; Trilogy Writing & Consulting GmBH; Freyr; Cactus Communications; Labcorp Drug Development; IQVIA Holdings Inc.; Omics International; Synchrogenix; Siro Clinpharm Private Limited; Quanticate; Inclin, Inc. |

Key Market Driver: Surge in Clinical Trials and Regulatory Complexity

A primary driver fueling the medical writing market is the proliferation of clinical trials and the increasing complexity of global regulatory requirements. As of 2024, more than 450,000 clinical trials are registered globally, with an increasing number spanning multiple regions and requiring harmonized documentation across regulatory agencies.

Each clinical trial generates a vast amount of data, necessitating precise translation into Clinical Study Reports (CSRs), Investigators’ Brochures (IBs), patient narratives, protocols, and submission dossiers. Regulatory expectations for transparency, ethical compliance, and risk-benefit analysis have also intensified. Agencies such as the EMA now mandate public disclosure of CSRs, and the FDA emphasizes patient-centric trial design, increasing the writing burden.

The explosion of novel therapies, including gene therapy, biologics, and personalized medicine, introduces new scientific nuances and regulatory challenges. Medical writers serve as the bridge between scientific teams, regulatory affairs, and medical affairs—ensuring that clinical insights are captured with clarity, accuracy, and compliance.

Key Market Restraint: Talent Shortage and Skill Gaps

A major restraint in the market is the limited availability of skilled, domain-specific medical writers, particularly in regions outside North America and Western Europe. Writing for regulatory, scientific, or clinical audiences demands not just excellent language skills but also deep understanding of therapeutic areas, regulatory guidelines, and clinical trial methodology.

The steep learning curve associated with regulatory documentation such as Module 2 summaries, CTD structures, and eCTD submissions poses a barrier for generalist writers. The lack of formal education and certification pathways in medical writing exacerbates this shortage. As the demand for experienced writers continues to outpace supply, especially in areas like oncology, immunology, and neurology, companies may face project delays or quality compromises.

Moreover, the burden on in-house teams often leads to burnout, making staff retention a challenge for both CROs and biopharma firms.

Key Market Opportunity: Digital Transformation and Content Personalization

A promising opportunity for the medical writing market lies in leveraging digital transformation for content automation and personalization. As digital health platforms proliferate ranging from mobile apps and wearables to EHR-integrated decision-support tools there’s growing demand for medical content that is modular, tailored, and instantly deployable.

Medical writers are now collaborating with UX designers, digital strategists, and AI engineers to create chatbot scripts, app content, remote monitoring instructions, and adaptive learning modules for patients. Furthermore, advanced analytics enables writers to generate personalized messages based on audience behavior and medical history, especially in medico-marketing.

This shift allows writers to go beyond static PDFs and embrace multimedia, interactive formats, offering higher engagement across stakeholders. Companies that embrace this convergence of science, storytelling, and technology stand to create differentiated experiences and improved outcomes.

Medical Writing Market By Type Insights

Regulatory Writing dominated the market in 2024. Regulatory writing, which includes Investigational New Drug (IND) applications, Clinical Study Reports (CSRs), and Common Technical Documents (CTDs), remains the backbone of the medical writing domain. It is mission-critical to achieving timely approvals and maintaining compliance with agencies like FDA, EMA, and Health Canada. Due to stringent documentation requirements, especially for new molecular entities (NMEs) and biologics, regulatory writing has become a high-demand, high-stakes function within pharmaceutical operations.

Scientific Writing is expected to be the fastest-growing segment. With increased focus on scientific publications, white papers, and post-marketing research, the demand for high-quality scientific manuscripts is growing. Companies use scientific writing to communicate drug efficacy, safety profiles, and mechanism of action through peer-reviewed journals, medical congresses, and continuing medical education (CME) programs. Scientific credibility is crucial for brand positioning, especially in competitive therapy areas such as oncology and rare diseases.

Medical Writing Market By Application Insights

Medico Marketing applications dominated the market. Medical writing plays an integral role in crafting scientifically accurate, compliant content for sales teams, Key Opinion Leaders (KOLs), and healthcare professionals. This includes slide decks, brand monographs, brochures, infographics, and patient information leaflets. The expansion of omnichannel marketing has further embedded writing into digital campaigns, content portals, and email strategies.

Medical Education is the fastest-growing segment. Medical writing for education includes development of CME materials, training modules for healthcare staff, patient education brochures, and e-learning modules. With the evolution of healthcare delivery and remote learning platforms, demand for engaging, evidence-based educational content has soared—particularly for chronic diseases, post-pandemic recovery care, and preventive health.

Medical Writing Market By End-Use Insights

Pharmaceutical & Biotechnology Companies accounted for the largest market share in 2024. These companies rely heavily on medical writing across the drug development lifecycle, from preclinical data summarization to regulatory submission, and post-marketing safety reporting. With pipeline expansion in areas like immuno-oncology and CNS disorders, the need for specialist writing has intensified. Internal medical affairs and regulatory departments are supported by a hybrid model of in-house teams and outsourced vendors.

Contract Research Organizations (CROs) are growing at the fastest rate. As outsourcing becomes the preferred model for cost control and expertise access, CROs are scaling their medical writing capabilities. Many now offer full-spectrum writing services as part of integrated clinical development packages. Global CROs like Parexel, ICON, and IQVIA are expanding their writing teams in low-cost talent hubs, further accelerating growth.

Medical Writing Market By Regional Insights

North America, particularly the United States, leads the medical writing market. The region’s dominance is driven by the high concentration of pharmaceutical R&D activity, strong regulatory frameworks, and early adoption of digital health technologies. The U.S. Food and Drug Administration (FDA) requires extensive and highly structured documentation for new drug applications, ensuring steady demand for regulatory and clinical writing.

The presence of industry giants like Pfizer, Merck, Johnson & Johnson, and Amgen supports consistent demand. Additionally, a robust network of professional organizations such as the American Medical Writers Association (AMWA) supports continuous education and certification, reinforcing quality standards and talent development.

Asia Pacific is witnessing the fastest growth, fueled by the expansion of clinical trial activity, pharmaceutical manufacturing, and contract research operations in countries such as India, China, and Singapore. Cost advantages, growing English-speaking medical graduate pools, and government incentives for local pharma sectors are attracting global clients to outsource medical writing services.

India, in particular, has emerged as a hub for regulatory and clinical writing due to its strong IT infrastructure and competitive labor costs. China’s push to reform its regulatory landscape and support local innovation in biologics and vaccines is creating demand for specialized writing talent fluent in both scientific and regulatory language.

Some of the prominent players in the medical writing market include:

- Parexel International Corporation

- Trilogy Writing & Consulting GmBH

- Freyr

- Cactus Communications

- Labcorp Drug Development

- IQVIA Holdings Inc.

- Omics International

- Synchrogenix

- Siro Clinpharm Private Limited

- Quanticate

- Inclin, Inc.

Recent Developments

-

March 2025 – Parexel International expanded its medical writing team in Bengaluru, India, by opening a new center focused on oncology and gene therapy documentation, aiming to shorten regulatory submission timelines.

-

January 2025 – IQVIA launched an AI-powered writing assistant to support its medical affairs division, combining NLP and data mining to accelerate content generation for CSRs and safety narratives.

-

November 2024 – ICON plc acquired a regional medical communication agency in Japan to strengthen its APAC operations and meet growing client demand for Japanese-language regulatory documentation.

-

August 2024 – Certara integrated its medical writing services into its regulatory sciences division, enabling clients to access a single platform for clinical strategy and documentation.

-

May 2024 – Synchrogenix (a Certara company) announced the launch of “Smart Author,” a cloud-based authoring platform to streamline collaboration between regulatory writers, medical reviewers, and statisticians.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the medical writing market

Type

- Clinical Writing

- Regulatory Writing

- Scientific Writing

- Others

Application

- Medical Journalism

- Medical Education

- Medico Marketing

- Others

End-use

- Medical Device/Pharmaceutical & Biotechnology Companies

- Contract Research Organizations & Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)