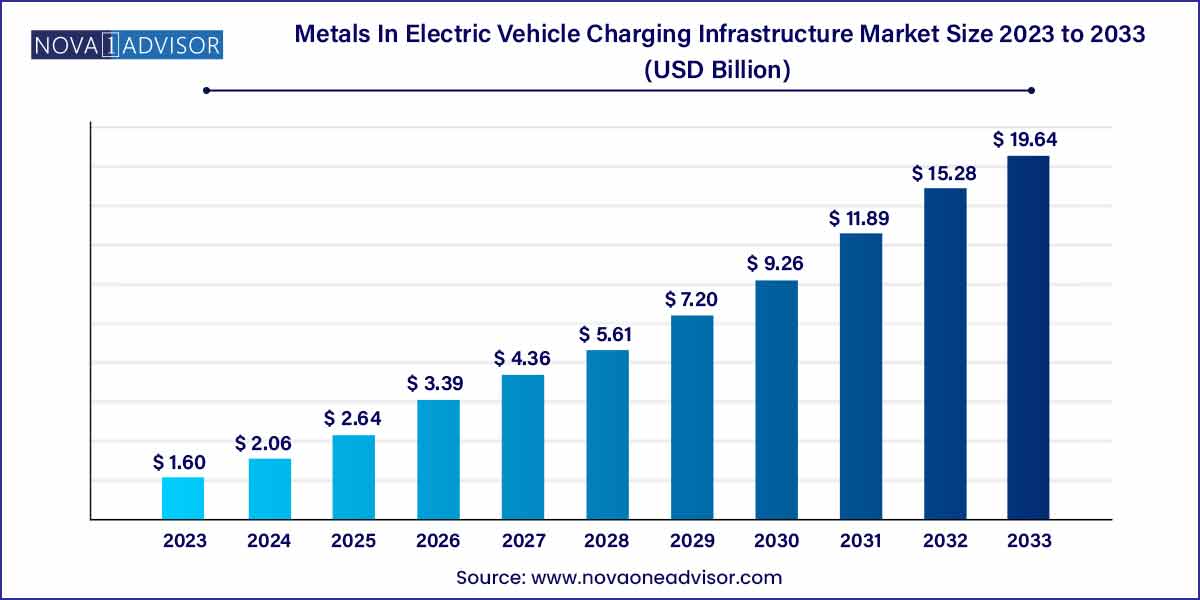

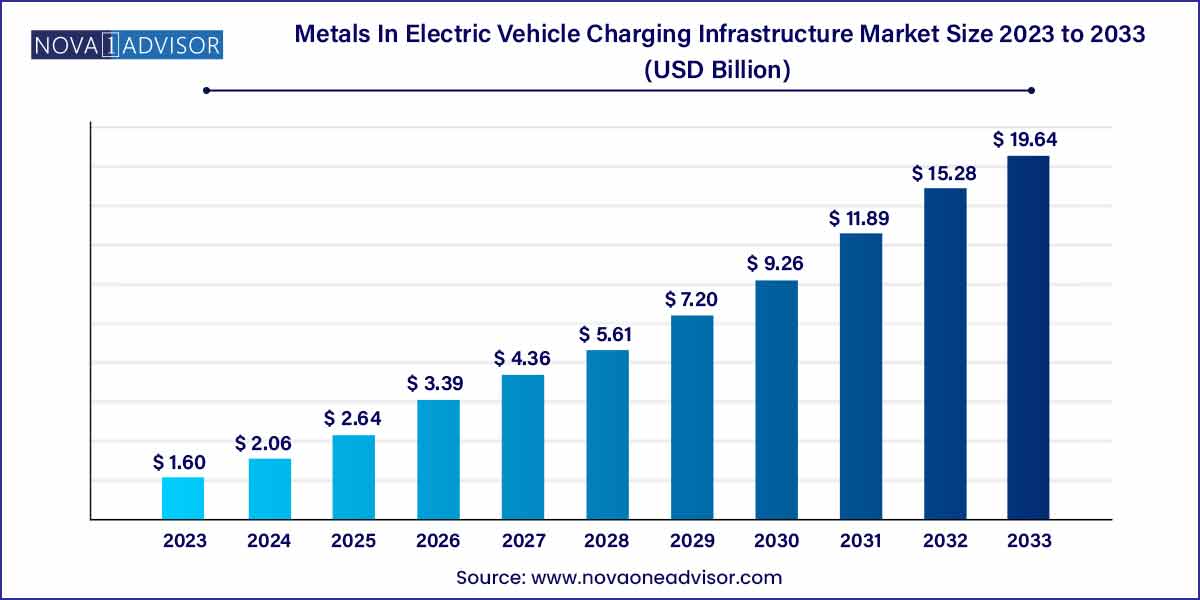

The global metals in electric vehicle charging infrastructure market size was exhibited at USD 1.60 billion in 2023 and is projected to hit around USD 19.64 billion by 2033, growing at a CAGR of 28.5% during the forecast period of 2024 to 2033.

Key Takeaways:

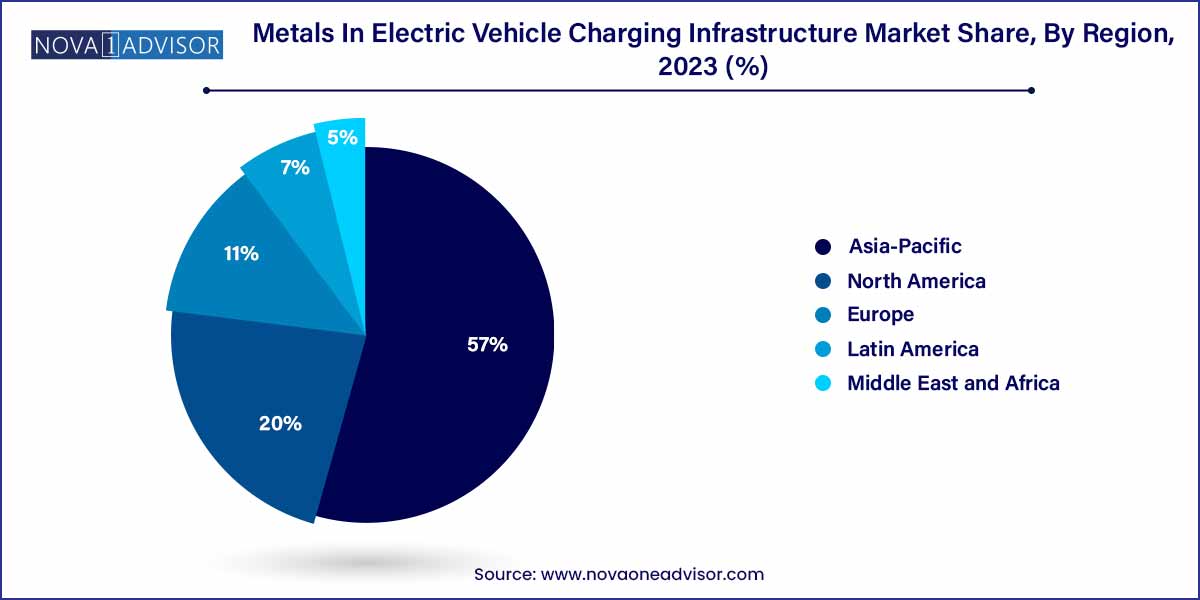

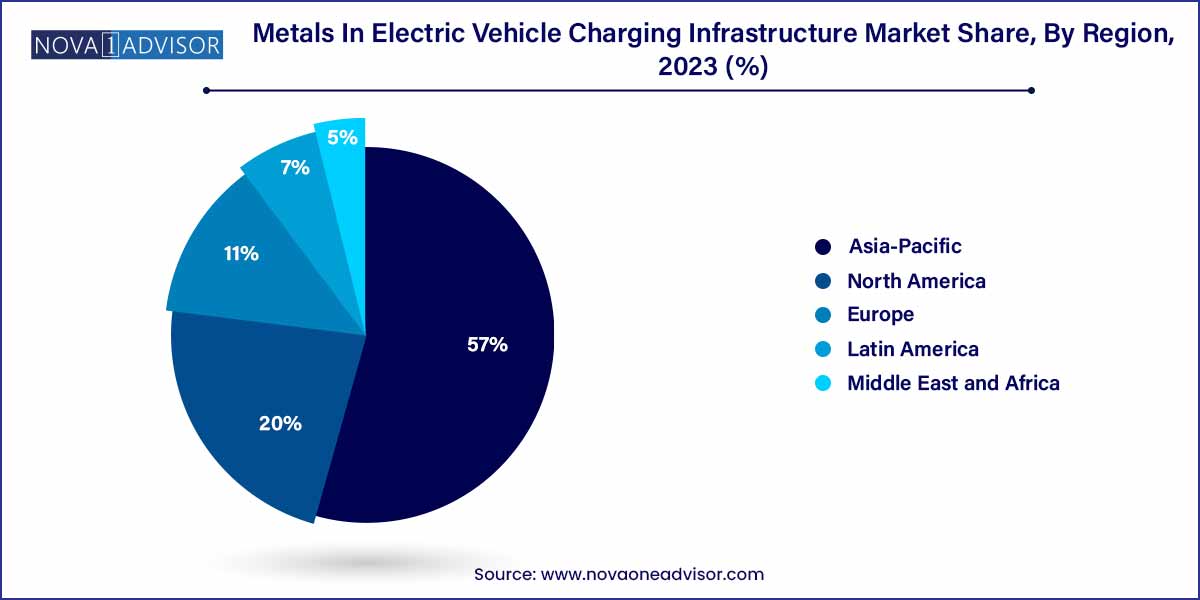

- Asia Pacific dominated the market for metals in electric vehicle charging infrastructure and held the largest revenue share of over 57.0% in 2023.

- Based on metals, the copper segment accounted for the largest revenue share of over 27.0% in 2023

- Based on end-use, the commercial segment accounted for the largest revenue share of over 79.0% in 2023.

- The level 3 segment dominated the metals in the electric vehicle charging infrastructure market and accounted for the largest revenue share of over 80.0% in 2023.

The Metals in Electric Vehicle (EV) Charging Infrastructure Market plays a critical role in supporting the global transition to electric mobility. As the demand for electric vehicles surges, the need for robust, efficient, and durable charging infrastructure becomes paramount. Metals such as copper, steel, and aluminum form the backbone of EV charging systems, providing essential conductivity, structural strength, and corrosion resistance.

Copper is widely used for electrical wiring and connections due to its superior conductivity, while steel offers strength and protection in charger casings and structures. Aluminum's lightweight and corrosion-resistant properties make it ideal for specific charger components. Innovations in material science are further enhancing the performance and cost-efficiency of these metals in charging solutions.

Governments worldwide are prioritizing the development of EV infrastructure by offering grants, tax incentives, and funding public-private partnerships. Companies such as Schneider Electric, ABB, and Siemens are expanding their operations and focusing on sustainable material usage to meet the surging global demand for reliable EV charging networks.

The growth of the metals in the Electric Vehicle (EV) charging infrastructure market is propelled by several key factors. Firstly, the global push towards sustainable transportation solutions, driven by environmental concerns and government initiatives, has significantly increased the adoption of electric vehicles. This surge in EV sales directly translates to a higher demand for charging infrastructure, thereby boosting the market for metals used in its construction. Secondly, technological advancements in charging systems, such as faster charging speeds and increased power outputs, require robust materials with superior conductivity and durability, further driving the need for specialized metals. Additionally, the expansion of charging networks, coupled with advancements in smart charging solutions and renewable energy integration, creates opportunities for innovative materials and designs within the market. Lastly, the growing investment in infrastructure development and the emergence of new players in the EV ecosystem contribute to the overall growth trajectory of the metals in electric vehicle charging infrastructure market.

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.60 Billion |

| Market Size by 2033 |

USD 19.64 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 28.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Metals, Charging Ports, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Alcoa Corporation; CODELCO; Emirates Global Aluminum (EGA); First Quantum Minerals Ltd.; Glencore; JSW; KGHM; Norsk Hydro ASA; Rio Tinto; Rusal. |

- Rising Demand for EV Charging Infrastructure:

The escalating global demand for electric vehicles (EVs) is a primary driver of growth in the metals used within the EV charging infrastructure market. With increasing awareness of environmental sustainability and stringent emissions regulations, consumers and governments alike are transitioning towards electric mobility solutions. This shift necessitates the development of a robust charging infrastructure network to support the growing EV fleet. As a result, there is a significant uptick in the deployment of charging stations across urban centers, highways, and commercial areas. Metals such as copper, aluminum, and steel are essential components in the construction of these charging stations, providing conductivity, structural support, and durability.

- Technological Advancements and Innovation:

Technological advancements play a pivotal role in shaping the dynamics of the metals in electric vehicle charging infrastructure market. As the EV landscape evolves, there is a continuous push towards enhancing charging efficiency, reducing charging times, and improving user experience. This drive for innovation fuels the development of advanced charging technologies, including high-power chargers, wireless charging solutions, and smart charging systems. Metals are integral to the implementation of these cutting-edge technologies, providing the necessary conductivity, thermal management, and structural integrity. Additionally, ongoing research and development efforts focus on optimizing material compositions and manufacturing processes to meet the evolving demands of the market.

- Supply Chain Constraints and Material Shortages:

The metals in electric vehicle charging infrastructure market face significant challenges related to supply chain constraints and material shortages. The rapid expansion of the EV market has led to increased demand for metals such as copper, aluminum, and steel, which are essential components in charging infrastructure. However, fluctuations in raw material prices, geopolitical tensions, and disruptions in global supply chains can lead to shortages and price volatility. This poses a significant challenge for manufacturers and suppliers, impacting production schedules, pricing strategies, and project timelines. Additionally, the reliance on a limited number of suppliers for critical metals raises concerns about supply security and resilience.

- Regulatory and Compliance Challenges:

The metals in electric vehicle charging infrastructure market also face regulatory and compliance challenges that can hinder market growth and innovation. Government regulations and standards governing the design, installation, and operation of charging infrastructure vary across regions, posing complexities for market participants. Compliance with safety, interoperability, and accessibility standards requires careful adherence to regulatory requirements, which can increase project costs and time-to-market. Additionally, evolving regulations related to environmental sustainability and materials usage may necessitate changes in manufacturing processes and material specifications, further adding to compliance burdens.

- Emergence of Advanced Materials and Technologies:

The metals in electric vehicle charging infrastructure market presents significant opportunities for innovation and advancement in materials science and technology. With the rapid evolution of the EV landscape, there is a growing demand for high-performance materials and advanced technologies to enhance the efficiency, reliability, and sustainability of charging infrastructure. This creates opportunities for the development and adoption of novel materials, such as advanced alloys, composites, and coatings, tailored for specific applications in charging stations. Additionally, advancements in manufacturing processes, such as additive manufacturing and nanotechnology, enable the production of complex geometries and customized components, further driving innovation in the mar

- Expansion of Charging Infrastructure Networks:

The ongoing expansion of electric vehicle charging infrastructure networks presents significant growth opportunities for the metals market. As governments worldwide set ambitious targets for electric vehicle adoption and invest in infrastructure development, the demand for charging stations is expected to surge. This includes the deployment of charging stations in urban areas, public spaces, workplaces, and residential complexes, as well as along highways and transportation corridors. Metals such as copper, aluminum, and steel are essential components in the construction of these charging stations, providing conductivity, structural support, and durability. Moreover, the integration of renewable energy sources, energy storage systems, and smart grid technologies into charging infrastructure networks creates opportunities for synergies and optimization.

- High Initial Investment and Infrastructure Costs:

One of the primary challenges facing the metals in electric vehicle charging infrastructure market is the high initial investment and infrastructure costs associated with deploying charging stations. Building a comprehensive charging network requires substantial capital investment in land acquisition, equipment procurement, installation, and grid connection. Additionally, the costs associated with permitting, regulatory compliance, and site preparation add to the financial burden. For metals manufacturers and suppliers, this presents a barrier to entry into the market, particularly for smaller players with limited financial resources. Moreover, the return on investment for charging infrastructure projects may be uncertain or extended over a long period, further complicating financing and investment decisions.

- Interoperability and Standardization Issues:

Interoperability and standardization issues pose significant challenges to the metals in electric vehicle charging infrastructure market. The lack of uniformity in charging protocols, connector types, and communication standards across different regions and charging networks hampers the seamless integration and interoperability of charging infrastructure. This fragmentation not only creates confusion and inconvenience for EV drivers but also increases complexity and costs for infrastructure developers and operators. Moreover, the absence of clear standards and regulations governing interoperability and compatibility can hinder market growth and innovation. Achieving interoperability and standardization requires collaboration among industry stakeholders, including automakers, charging infrastructure providers, utilities, and regulatory authorities, to develop common standards, protocols, and certification schemes.

Segments Insights:

Copper dominated the metals segment in 2024. Thanks to its unparalleled electrical conductivity, copper remains the most critical metal for EV chargers. It is used extensively in internal wiring, busbars, power electronics, and connectors across all types of charging stations. With the rollout of ultra-fast chargers requiring even thicker cables and better heat management, copper's dominance continues to grow.

Aluminum is the fastest-growing metal segment. While copper leads in conductivity, aluminum is increasingly used to reduce charger weight, lower costs, and prevent corrosion. Lightweight aluminum frames, heat sinks, and certain cable applications are becoming more common, especially for Level 2 and DC fast charging stations. Technological improvements in aluminum alloy performance are further boosting its adoption.

End-use Insights

Commercial use dominated the end-use segment. Commercial deployments, including public charging stations, fleet depots, and retail location chargers, require durable, vandal-resistant infrastructure. These facilities heavily rely on steel for protection, copper for connectivity, and aluminum for lightweight yet sturdy housing designs. High visibility and heavy usage patterns necessitate robust material specifications, driving higher demand in this segment.

Private installations are the fastest-growing end-use. Home charging solutions, fueled by rising EV ownership among consumers, are expanding rapidly. Although private chargers generally require less copper and structural metals than commercial ones, their sheer volume is creating a cumulative demand surge. Companies like Tesla, ChargePoint, and Wallbox are increasingly supplying home chargers made with optimized metal designs to enhance affordability and durability.

Charging Port Insights

Level 2 chargers dominated the charging port segment in 2024. Level 2 chargers, offering faster charging than Level 1 while remaining cost-effective, have seen widespread adoption in residential, commercial, and semi-public settings. These chargers use moderate amounts of copper and steel, striking a balance between performance and material cost. Their deployment in workplaces, shopping malls, and multi-unit dwellings continues to drive segment dominance.

DC Fast Chargers (Level 3) are the fastest-growing charging port type. High-capacity DC chargers require significant amounts of copper for thick cabling and power electronics, as well as steel and aluminum for thermal management and structure. The rise of EVs with larger battery packs and the demand for reduced charging times are fueling rapid investments in DC fast charging networks worldwide, making this the most dynamic segment.

Regional Insights

Asia-Pacific dominated the metals in EV charging infrastructure market in 2024. Countries like China, Japan, South Korea, and India are leading the electric mobility revolution, driving massive investments in public and private charging infrastructure. China, in particular, operates the world's largest EV charging network, requiring enormous quantities of copper, steel, and aluminum for construction and operation. The region's robust mining activities and manufacturing base for metals also offer strategic advantages.

Europe is the fastest-growing region. Driven by aggressive climate targets and generous government incentives, European countries are rapidly building extensive EV charging networks. In April 2024, Germany and France announced joint investments in cross-border fast-charging corridors under the "Green Mobility Alliance" initiative. The region's focus on sustainable material sourcing and recycling initiatives is further promoting growth in the metals segment of EV charging infrastructure.

- Alcoa Corporation

- CODELCO

- Emirates Global Aluminum (EGA)

- First Quantum Minerals Ltd.

- Glencore

- JSW

- KGHM

- Norsk Hydro ASA

- Rio Tinto

- Rusal

Recent Developments

-

March 2024: ABB introduced its Terra 360 all-in-one fast charger, utilizing high-conductivity copper cabling and aluminum housings to optimize performance and weight.

-

February 2024: Siemens signed a partnership with Rio Tinto to secure sustainably mined copper for EV charger manufacturing across Europe and North America.

-

April 2024: Schneider Electric launched a modular EV charging platform featuring recycled steel and lightweight aluminum alloy components.

-

January 2024: ChargePoint Holdings announced a new initiative to use 100% recycled aluminum frames in its residential Level 2 chargers by 2025.

-

March 2024: Tesla expanded its Supercharger V4 network in the U.S., integrating enhanced copper cooling systems to support faster charging rates.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global metals in electric vehicle charging infrastructure market.

Metals

- Copper

- Steel

- Aluminum

- Others

Charging Port

- Level 1

- Level 2

- DC Fast Charger (Level 3)

End-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)