Microarray Market Size and Trends

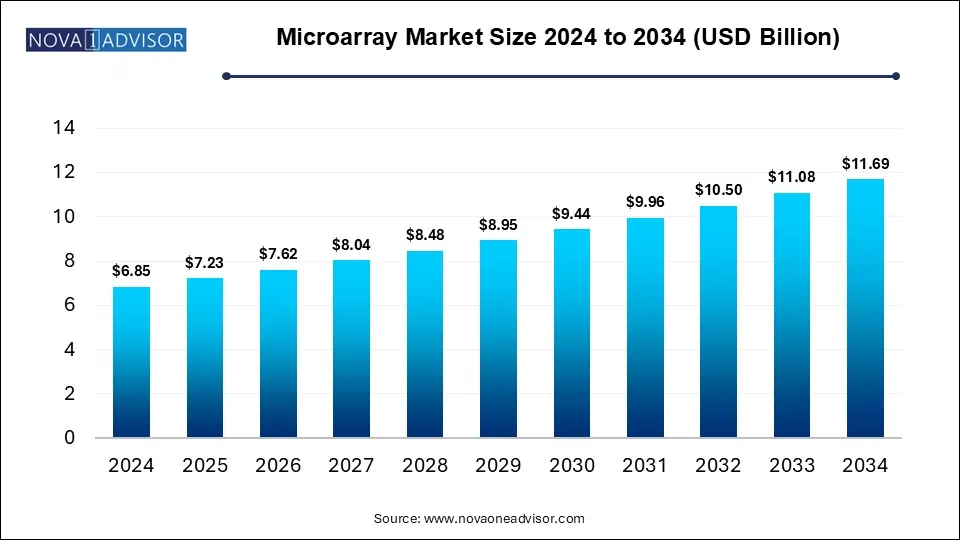

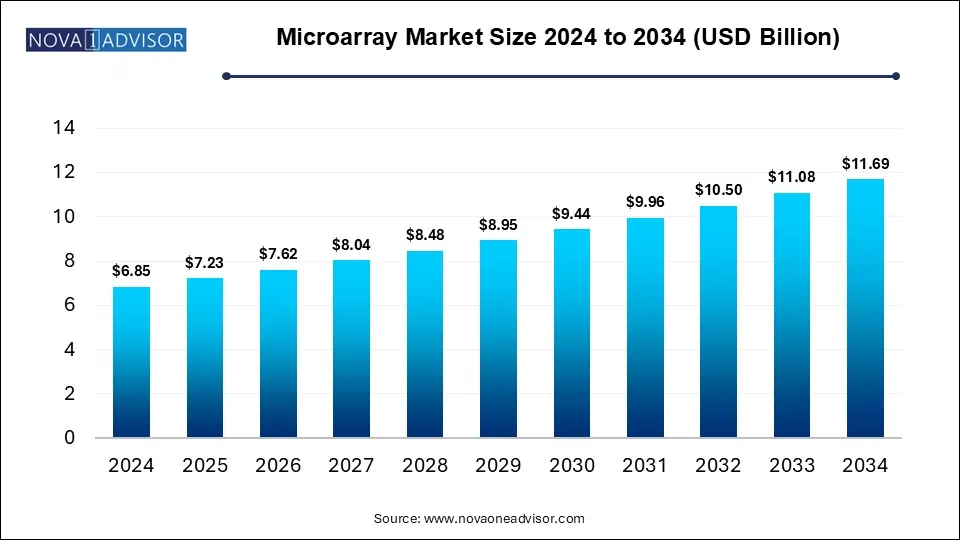

The microarray market size was exhibited at USD 6.85 billion in 2024 and is projected to hit around USD 11.69 billion by 2034, growing at a CAGR of 5.49% during the forecast period 2025 to 2034.

Key Takeaways:

- Consumables held the largest market share of 50% in 2024.

- DNA microarrays accounted for the largest revenue share in 2024.

- The research applications segment dominated the microarray market in 2024

- Research and academic institutes accounted for the largest revenue share of the market in 2024.

- North America microarray market dominated the global industry and accounted for a 49% share in 2024.

Market Overview

The global Microarray Market is a dynamic and evolving sector within the biotechnology and diagnostics industry, recognized for its critical role in high-throughput gene expression analysis, genotyping, biomarker discovery, and disease diagnostics. Microarrays are microscopic platforms, often glass slides or chips, that contain a grid of probes used to detect the presence of specific DNA, RNA, or protein sequences. By enabling the simultaneous examination of thousands of genetic sequences or protein interactions, microarrays have revolutionized the field of molecular biology and translational research.

In recent years, the market has grown significantly due to rising demand for personalized medicine, increasing R&D investments, and the expansion of genetic testing services. Microarrays are widely utilized in academic research, clinical diagnostics, and drug discovery, providing essential data on gene expression, single nucleotide polymorphisms (SNPs), and epigenetic modifications. The growing prevalence of chronic diseases, such as cancer and autoimmune disorders, along with the need for companion diagnostics, has accelerated adoption in clinical settings.

Moreover, technological advancements have enhanced the precision, throughput, and cost-effectiveness of microarray platforms. The integration of microarray technology with bioinformatics tools and artificial intelligence is further optimizing data interpretation and research workflows. As global healthcare systems shift toward preventive and precision medicine, the microarray market is expected to witness robust expansion through 2034.

Major Trends in the Market

-

Adoption of AI-Based Bioinformatics Tools

Integration of AI and machine learning in microarray data analysis is improving the accuracy and efficiency of genetic interpretation.

-

Shift Toward Personalized and Precision Medicine

Microarrays are instrumental in tailoring treatments based on individual genetic profiles, especially in oncology and rare disease management.

-

Miniaturization and Automation of Microarray Platforms

Development of lab-on-a-chip technologies is driving the trend toward portable and automated microarray systems for point-of-care diagnostics.

-

Expanding Use in Epigenomics and Transcriptomics

Microarrays are being increasingly used to study DNA methylation and non-coding RNA expression in various diseases.

-

Growth in Companion Diagnostics

Pharmaceutical companies are leveraging microarrays for companion diagnostic development to support targeted therapies.

-

Rise in Direct-to-Consumer Genetic Testing

Consumer interest in ancestry and health-related genetic insights is boosting demand for microarray-based home testing kits.

Report Scope of Microarray Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.23 Billion |

| Market Size by 2034 |

USD 11.69 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.49% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product & Services, Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc. (Applied Biosystems); Agilent Technologies, Inc.; Illumina, Inc.; PerkinElmer; Merck KGaA; Schott (Applied Microarrays); Danaher Corporation; Arrayit Corporation; Bio-Rad Laboratories; Inc.; and Microarrays Inc. |

Market Driver: Increasing Demand for Genetic Testing

A key driver propelling the microarray market is the rising demand for genetic testing in both clinical and consumer settings. Genetic testing has become central to modern diagnostics, risk assessment, and personalized treatment planning. Microarrays enable rapid, high-throughput analysis of genetic variations, allowing healthcare providers to identify mutations associated with hereditary diseases, cancer predisposition, and pharmacogenomics.

For instance, companies like 23andMe and AncestryDNA have popularized consumer-facing genetic testing kits based on microarray technology. In clinical applications, microarrays are used for chromosomal microarray analysis (CMA) to diagnose developmental delays, autism spectrum disorders, and congenital anomalies. The growing awareness and affordability of these tests, coupled with their increasing integration into routine medical care, is fueling sustained market growth.

Market Restraint: Limited Sensitivity Compared to NGS

One of the primary restraints limiting the microarray market is its comparatively lower sensitivity and specificity than next-generation sequencing (NGS) technologies. While microarrays offer high-throughput capabilities, they are limited to detecting known genetic sequences and are less effective in discovering novel variants or rare mutations. This restricts their utility in comprehensive genomic analysis and deep sequencing applications.

NGS technologies, which allow for full genome and exome sequencing, have rapidly advanced in terms of accuracy, cost-efficiency, and versatility. As a result, certain research and clinical laboratories are transitioning from microarray platforms to NGS for more detailed genomic analysis. This competition poses a challenge to market expansion, especially in well-funded academic and hospital settings.

Market Opportunity: Expanding Applications in Cancer Diagnostics

An emerging opportunity in the microarray market lies in its growing application in cancer diagnostics and profiling. Microarrays allow for the detection of gene expression patterns, mutations, and epigenetic changes that are characteristic of various cancer types. These insights are critical for early diagnosis, risk stratification, and personalized therapy selection.

Several commercial platforms, such as Affymetrix and Agilent microarrays, are already used in oncology to identify gene signatures associated with breast, colorectal, and lung cancers. With the global burden of cancer expected to rise significantly, demand for cost-effective, high-throughput diagnostic tools will increase. The ability of microarrays to provide rapid and comprehensive cancer profiles positions them well for greater adoption in both research and clinical oncology labs.

Product & Services Outlook

Consumables dominated the product and services segment in 2024 due to their indispensable role in every microarray experiment. Reagents, assay kits, and microarray chips are required for sample preparation, hybridization, washing, and signal detection. The recurring nature of consumable usage—unlike instruments that are purchased once—ensures a steady revenue stream. The increasing volume of academic research, diagnostics, and pharmaceutical studies using microarrays has significantly fueled demand for consumables.

Software and services are expected to be the fastest growing segment during the forecast period. The complexity of microarray data necessitates robust software platforms for data normalization, statistical analysis, and visualization. Additionally, bioinformatics services and cloud-based platforms are being increasingly used to outsource data interpretation, especially in diagnostics and personalized genomics. As multi-omics studies grow in popularity, this segment is likely to witness accelerated adoption.

Type Outlook

DNA microarrays lead the type segment due to their wide adoption in gene expression profiling, SNP genotyping, and comparative genomic hybridization (CGH). These arrays are extensively used in academic research, drug development, and diagnostic applications. DNA microarrays offer high throughput and can screen thousands of genes in a single assay, making them a preferred choice for large-scale genomic studies.

Protein microarrays are anticipated to grow at the fastest rate, driven by their expanding use in proteomics, biomarker discovery, and immune response profiling. These arrays allow for the simultaneous detection of multiple proteins and are instrumental in identifying disease-specific antigens, especially in autoimmune diseases and cancer. As proteomics becomes a central focus of biomedical research, this segment is set for robust expansion.

Application Outlook

Research applications dominated the application segment, accounting for the largest revenue share in 2024. Microarrays are core tools in academic and commercial research settings for studying gene expression, gene regulation, and genetic variation. With strong support from government and private sector grants, researchers continue to leverage microarrays for both fundamental and translational research. The scalability and relative affordability of microarrays make them ideal for large population studies.

Disease diagnostics are projected to be the fastest growing application, propelled by the increasing prevalence of genetic disorders, infectious diseases, and cancer. Diagnostic labs and hospitals are integrating microarray-based tests for conditions such as cystic fibrosis, leukemia, and prenatal anomalies. As regulatory approvals expand and microarray platforms become CLIA-certified, their diagnostic utility will continue to rise.

End-use Outlook

Research and academic institutes held the largest market share in 2024, due to widespread adoption of microarrays in life sciences and biomedical research. Universities and genomic research centers utilize microarrays for hypothesis-driven investigations into gene function, genetic pathways, and disease mechanisms. These institutions are supported by funding agencies like NIH, Horizon Europe, and India’s DBT, ensuring sustained use of microarray technologies.

Pharmaceutical and biotechnology companies are expected to grow the fastest over the forecast period. These organizations use microarrays to identify drug targets, assess toxicity, and monitor gene expression in response to therapeutic compounds. The integration of microarrays into drug development pipelines enhances screening efficiency and reduces time-to-market, making them valuable assets in commercial R&D.

Regional Analysis

North America remains the dominant region in the global microarray market, driven by the presence of established biotechnology firms, strong research funding, and advanced healthcare infrastructure. The United States accounts for the majority of the regional share, supported by initiatives like the Cancer Moonshot, the All of Us Research Program, and personalized medicine campaigns. Major companies such as Thermo Fisher Scientific, Agilent Technologies, and Illumina operate from this region, reinforcing its leadership in microarray adoption and innovation.

Asia Pacific is poised to be the fastest growing region, owing to expanding research activities, increasing healthcare expenditure, and rising awareness of genetic testing. Countries like China, India, and Japan are investing heavily in genomics and biotechnology through national programs and international collaborations. Additionally, the rise of contract research organizations (CROs) and the availability of a skilled workforce are fostering rapid adoption of microarrays in clinical and research settings.

Some of The Prominent Players in The Microarray Market Include:

- Thermo Fisher Scientific Inc (Applied Biosystems)

- Agilent Technologies, Inc

- Illumina, Inc

- PerkinElmer Inc.

- Merck KGaA

- Schott (Applied Microarrays)

- Danaher Corporation

- Arryait Corporation (ARYC)

- Bio-Rad Laboratories, Inc

- Microarrays Inc

Recent Developments

-

March 2025 – Agilent Technologies launched a new high-density customizable microarray chip designed to support large-scale epigenetic studies, improving data output and cost-efficiency for research labs.

-

February 2025 – Illumina Inc. announced the expansion of its microarray manufacturing facility in San Diego to meet increasing global demand for genetic screening and research tools.

-

December 2024 – Thermo Fisher Scientific introduced a new cloud-based software solution for real-time microarray data interpretation, aiming to enhance diagnostic decision-making in clinical labs.

-

October 2024 – Arrayit Corporation partnered with a South Korean diagnostics company to co-develop protein microarrays for early cancer detection, targeting the Asian diagnostics market.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Microarray Market

Product & services

- Consumables

- Software and Services

- Instruments

Type

- DNA Microarrays

- Protein Microarrays

- Other Microarrays

Application

- Research Applications

- Drug Discovery

- Disease Diagnostics

- Other Applications

End-use

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Other End Users

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)