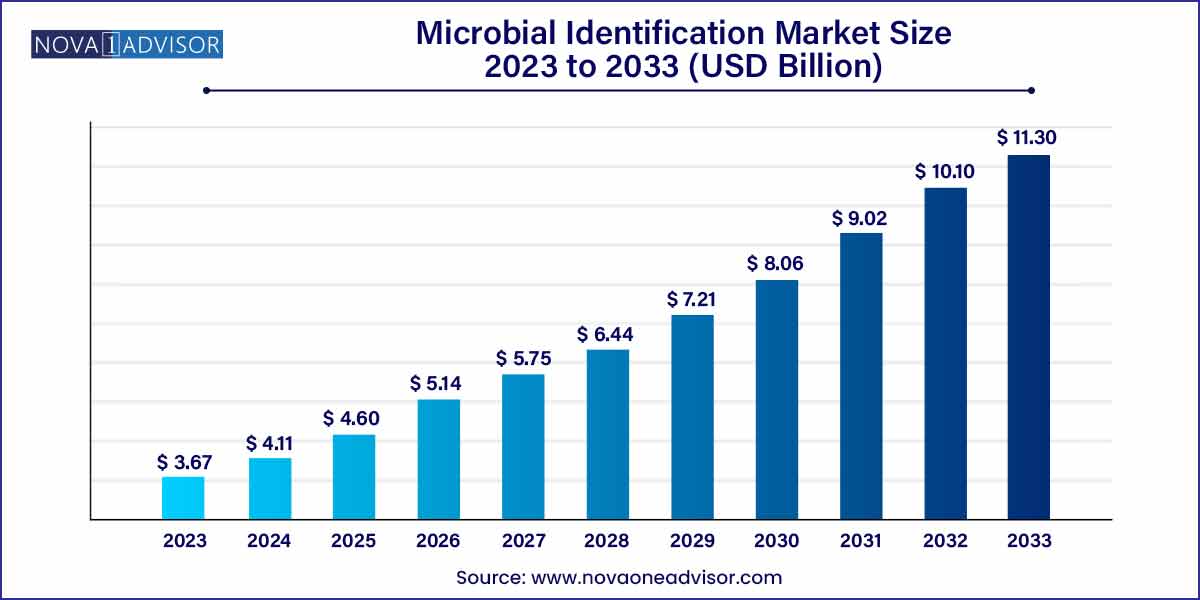

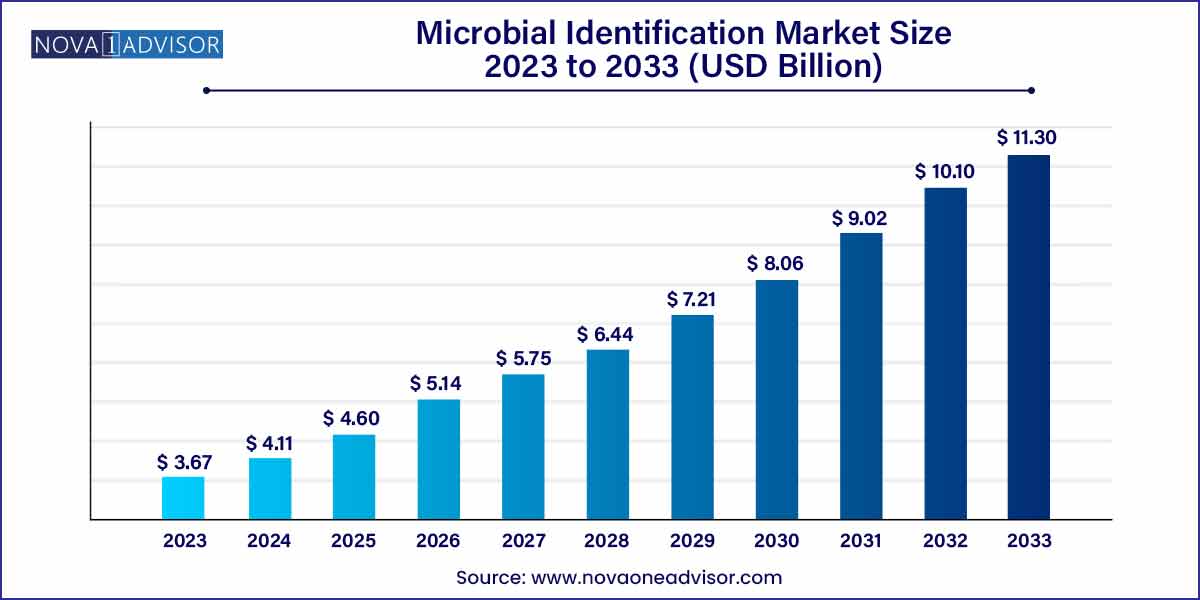

The global microbial identification market size was estimated at USD 3.67 billion in 2023, is expected to surpass around USD 11.30 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 11.9% during the forecast period of 2024–2033.

Key Takeaways:

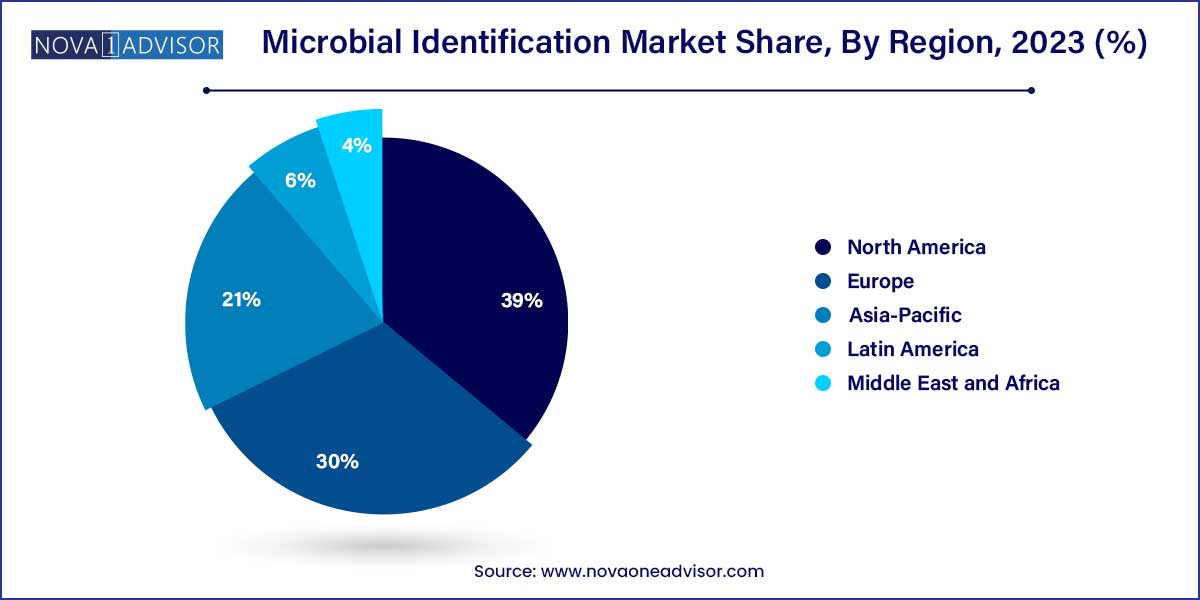

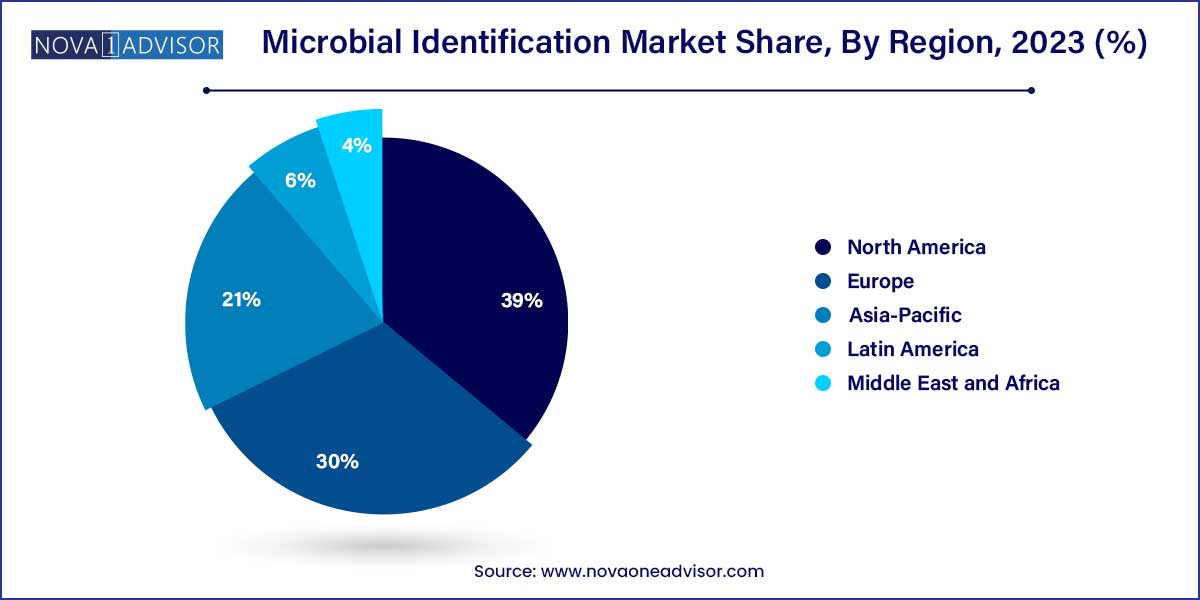

- The North America microbial identification market accounted for the largest market share of 39.0% in 2023.

- The consumables segment held the largest market share of 36.51% in 2023.

- The PCR segment held the largest market share in 2023.

- The genotypic segment held the largest market share of 41.83% in 2023

- The clinical diagnostics segment held the largest market share in 2023.

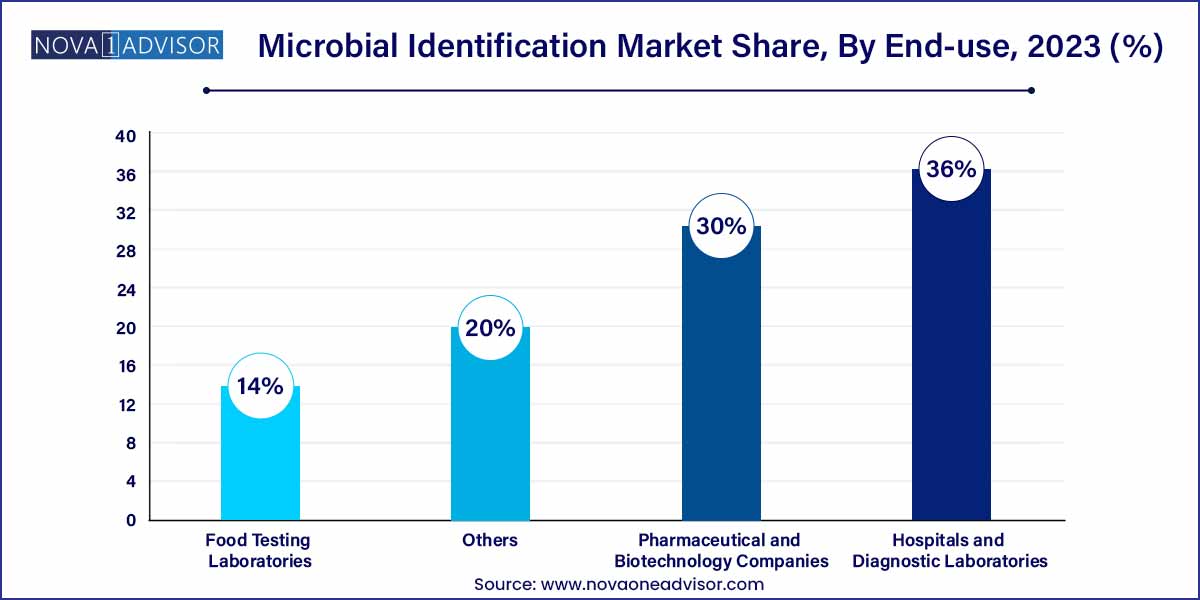

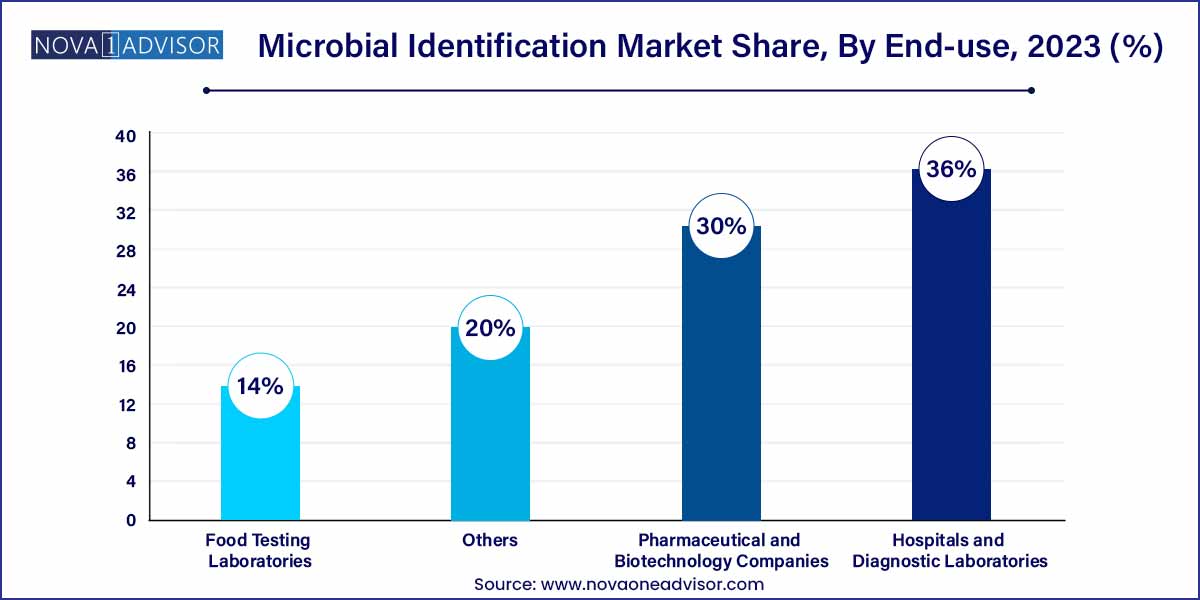

- The hospitals & diagnostic laboratories segment held the largest market share of 36.0% in 2023.

Market Overview

The microbial identification market represents a foundational pillar within clinical diagnostics, pharmaceuticals, environmental monitoring, food safety, and biotechnology. Microbial identification refers to the precise characterization of microorganisms, such as bacteria, fungi, viruses, and parasites, for the purposes of diagnosis, contamination control, and research.

Historically dependent on culture-based and phenotypic methods, the field has witnessed a massive shift toward advanced technologies like mass spectrometry (MALDI-TOF), polymerase chain reaction (PCR), microarrays, and next-generation sequencing (NGS). These innovations have reduced the time to identification from days to mere hours, revolutionizing pathogen detection in healthcare settings and enabling proactive quality assurance in pharmaceutical and food industries.

The growing prevalence of infectious diseases, hospital-acquired infections (HAIs), and the urgent need for biopharmaceutical manufacturing quality control are key factors driving demand. With the COVID-19 pandemic underscoring the importance of fast and accurate microbial detection, the industry is seeing robust investment in R&D, software solutions, and global expansion.

Microbial identification is no longer confined to specialized microbiology labs; it has expanded to decentralized settings, leveraging portable devices, cloud-based analytics, and AI-powered identification tools. This evolution is setting the stage for a more responsive and interconnected global health security system.

Major Trends in the Market

-

Adoption of Mass Spectrometry for Rapid ID: MALDI-TOF platforms becoming a standard in clinical and industrial microbial testing.

-

Rise in Next-Generation Sequencing Applications: NGS is enabling high-throughput, accurate identification of unculturable microorganisms.

-

Automation and High-throughput Workflows: Fully automated systems for sample processing and identification are gaining momentum.

-

Integration of AI and Machine Learning: AI-driven software enhances microbial pattern recognition and reduces human error.

-

Portable and Decentralized Testing Devices: Development of mobile microbial ID solutions for field testing and remote locations.

-

Increased Focus on Antimicrobial Resistance (AMR) Profiling: Integrating susceptibility testing with microbial ID platforms.

-

Expansion into Food and Beverage Industries: Stringent food safety regulations boosting microbial ID adoption in production lines.

-

Growth in Environmental Surveillance: Rising concerns about climate change and pollution driving environmental microbial monitoring.

Microbial Identification Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.67 Billion |

| Market Size by 2033 |

USD 11.30 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product & Services, Technology, Method, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

bioMérieux SA; Becton; Dickinson and Company; Thermo Fisher Scientific Inc.; Bruker Corporation; Danaher Corporation; Qiagen N.V.; Charles River; Wickham Micro Limited; VWR International LLC. (Avantor Inc.); Shimadzu Corporation; Merck KGaA; Eurofins Scientific SE; Biolog Inc. |

Key Market Driver: Rising Incidence of Infectious Diseases and Hospital-Acquired Infections (HAIs)

One of the principal drivers of the microbial identification market is the escalating incidence of infectious diseases and HAIs. According to the Centers for Disease Control and Prevention (CDC), approximately 1 in 31 hospital patients has at least one healthcare-associated infection on any given day in the U.S. alone.

Fast and precise microbial identification is vital in diagnosing infections early, guiding targeted therapies, and curbing the spread of resistant pathogens. With emerging threats like multidrug-resistant tuberculosis (MDR-TB), MRSA (Methicillin-resistant Staphylococcus aureus), and fungal infections like Candida auris, hospitals and healthcare systems are increasingly investing in cutting-edge microbial ID technologies to safeguard patient outcomes and comply with infection control standards.

Key Market Restraint: High Cost of Advanced Identification Systems

While technological advancements have revolutionized microbial identification, the high acquisition and maintenance cost of these sophisticated systems remains a significant restraint. Instruments like MALDI-TOF mass spectrometers or high-throughput NGS platforms require considerable upfront investment, trained personnel, and rigorous quality assurance protocols.

These costs can be prohibitive for small- to mid-sized clinical laboratories, veterinary clinics, food testing labs, or environmental monitoring agencies operating on tight budgets. Additionally, the expenses related to reagent kits, service contracts, and software updates contribute to the total cost of ownership, limiting adoption, particularly in developing countries.

Key Market Opportunity: Expansion of Microbial Surveillance Beyond Healthcare

A substantial opportunity lies in the expansion of microbial identification beyond traditional healthcare into sectors like food safety, environmental monitoring, and bioindustrial applications. With governments worldwide tightening food safety standards and environmental sustainability practices, industries are proactively deploying microbial ID systems to monitor contamination and ensure compliance.

Emerging areas such as microbial monitoring in agriculture (soil microbiomes), aquaculture, and even space missions (NASA’s Planetary Protection program) highlight the expanding relevance of microbial ID technologies. As the applications diversify, vendors offering customizable, rugged, and multi-application platforms will capture emerging market segments.

Segments Insights:

Product & Services Insights

Instruments dominate the microbial identification market, given their central role in accurate and rapid pathogen detection. Mass spectrometers, PCR systems, and microarray platforms form the backbone of clinical microbiology and industrial microbiology laboratories. Among these, MALDI-TOF mass spectrometers are widely acknowledged for their speed, cost-effectiveness per test, and ability to identify a broad range of microbes.

Software and services are the fastest-growing segment, fueled by the shift toward data-driven diagnostics and the need for robust, cloud-based data management systems. Identification services, culture collection repositories, and assay validation support are increasingly being outsourced to specialist providers. Furthermore, AI-enhanced interpretation tools and platforms offering real-time surveillance capabilities are driving growth in this category.

Technology Insights

Mass spectrometry leads the market, largely due to its transformative impact on microbial diagnostics. MALDI-TOF has drastically reduced the time to identification from several days to a few minutes in some cases, fundamentally improving clinical decision-making timelines. Companies like bioMérieux (VITEK MS) and Bruker (MALDI Biotyper) dominate this space.

Next-generation sequencing (NGS) is the fastest-growing technology, particularly for complex, polymicrobial infections and pathogen discovery applications. Metagenomics, an offshoot of NGS, allows for untargeted, unbiased microbial community profiling, ideal for outbreak investigations and rare pathogen detection. The growing affordability and increasing application of NGS beyond research labs into clinical settings are fueling its rapid expansion.

Method Insights

Phenotypic methods continue to dominate, given their long-standing presence, regulatory acceptance, and widespread availability. Culture-based techniques, biochemical assays, and susceptibility testing have been the traditional workhorses of microbial identification, especially in clinical and food industry settings.

However, genotypic methods are the fastest-growing, offering unparalleled accuracy, speed, and detection of non-culturable organisms. PCR-based assays, nucleic acid sequencing, and microarray-based hybridization techniques are particularly useful for rapid outbreak control, biosecurity, and epidemiological surveillance.

Application Insights

Clinical diagnostics dominate the microbial identification application landscape, driven by the urgent need to diagnose infections promptly and guide targeted antimicrobial therapy. Hospitals, diagnostic laboratories, and specialty clinics account for the majority of microbial ID device and service consumption.

Food and beverage testing is the fastest-growing application, driven by stringent regulatory requirements like the U.S. Food Safety Modernization Act (FSMA) and Europe’s Rapid Alert System for Food and Feed (RASFF). Manufacturers must ensure product safety through routine microbial contamination screening, and advanced ID technologies are critical for detecting spoilage organisms and foodborne pathogens.

End-use Insights

Hospitals and diagnostic laboratories remain the dominant end-users, given their critical role in infectious disease management and outbreak containment. These institutions require continuous microbial identification for infection control, surveillance, and patient treatment optimization.

Food testing laboratories are growing fastest, reflecting the food industry’s heightened vigilance regarding pathogen monitoring. Laboratories specializing in food and beverage testing are rapidly adopting automated, high-throughput microbial ID platforms to meet regulatory demands and maintain product quality assurance.

Regional Insights

North America leads the global microbial identification market, supported by its advanced healthcare infrastructure, strong presence of key market players, and robust investment in biopharmaceutical R&D. The U.S. in particular benefits from a proactive regulatory environment, public health initiatives for infectious disease control, and high adoption rates of cutting-edge technologies like MALDI-TOF and NGS.

Additionally, collaborations between academia, government bodies (e.g., NIH, CDC), and private biotech companies fuel continuous innovation in microbial diagnostics. Presence of leading companies like bioMérieux, Thermo Fisher Scientific, and Bruker further solidifies North America’s dominance.

Asia-Pacific is the fastest-growing region, owing to expanding healthcare infrastructure, increasing incidence of infectious diseases, and growing investment in food safety and biopharmaceutical manufacturing. China, India, Japan, and South Korea are spearheading regional growth with initiatives to modernize diagnostic capabilities and bolster public health systems.

Rising middle-class populations, greater healthcare awareness, and supportive government policies such as India’s National Health Policy 2025 are further enhancing demand for rapid and accurate microbial identification technologies across clinical, food, and environmental sectors.

Recent Developments

-

March 2025: bioMérieux launched the VITEK Reveal™, an advanced AI-powered microbial identification and antimicrobial resistance prediction system.

-

February 2025: Thermo Fisher Scientific expanded its SureTect PCR portfolio for rapid detection and identification of foodborne pathogens.

-

January 2025: Bruker Corporation introduced the MALDI Biotyper sirius system with enhanced sensitivity for fungal and mycobacterial species.

-

December 2024: QIAGEN announced a partnership with an Asian government agency to deploy metagenomic NGS platforms for nationwide infectious disease surveillance.

-

November 2024: Charles River Laboratories acquired a specialist microbial ID laboratory to strengthen its global biopharmaceutical testing services.

Some of the prominent players in the microbial identification market include:

- bioMérieux SA

- Becton, Dickinson and Company

- ThermoFisher Scientific Inc.

- Bruker Corporation

- Danaher Corporation

- Qiagen N.V.

- Charles River Laboratories

- Wickham Micro Limited

- VWR International LLC. (Avantor Inc.)

- Comp10

- Shimadzu Corporation

- Merck KGaA

- Eurofins Scientific SE

- Biolog Inc

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global microbial identification market.

Product & Services

-

- Mass Spectrometers

- PCR Systems

- Microarrays

- Others

-

- Reagents & Kits

- Plates & Media

-

- Identification Services

- Culture Collection Services

- Assay Validation Services

Technology

- Mass Spectrometry

- PCR

- Microarrays

- Next Generation Sequencing

- Others

Method

- Phenotypic Methods

- Genotypic Methods

- Proteotypic Methods

Application

- Clinical Diagnostics

- Pharmaceuticals

- Food & Beverage Testing

- Environmental Application

- Others

End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Food Testing Laboratories

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)