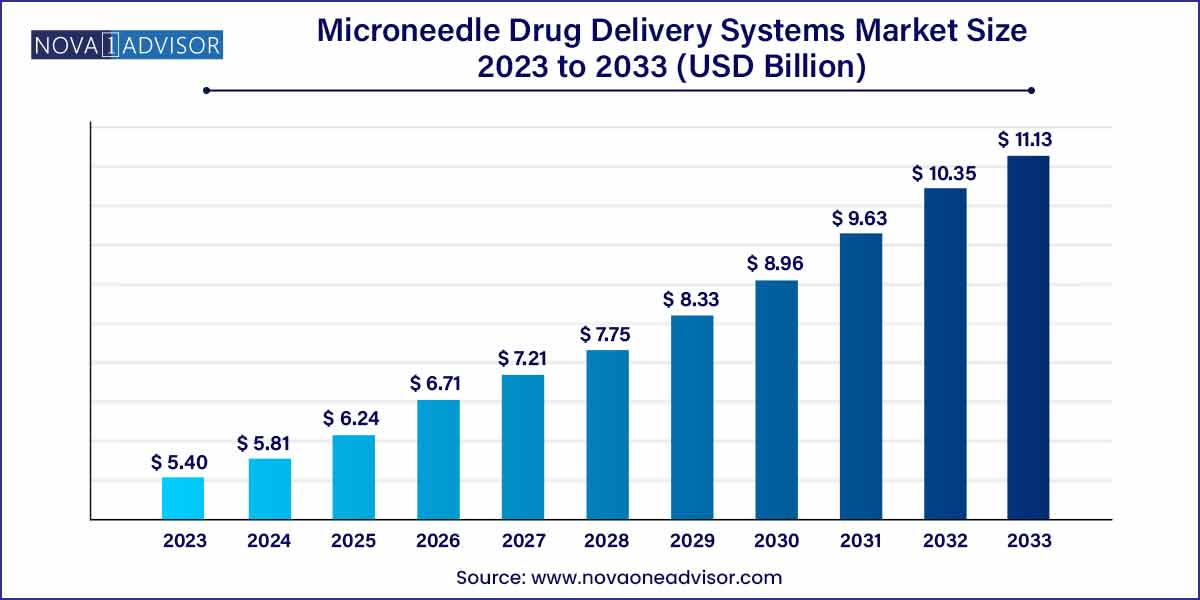

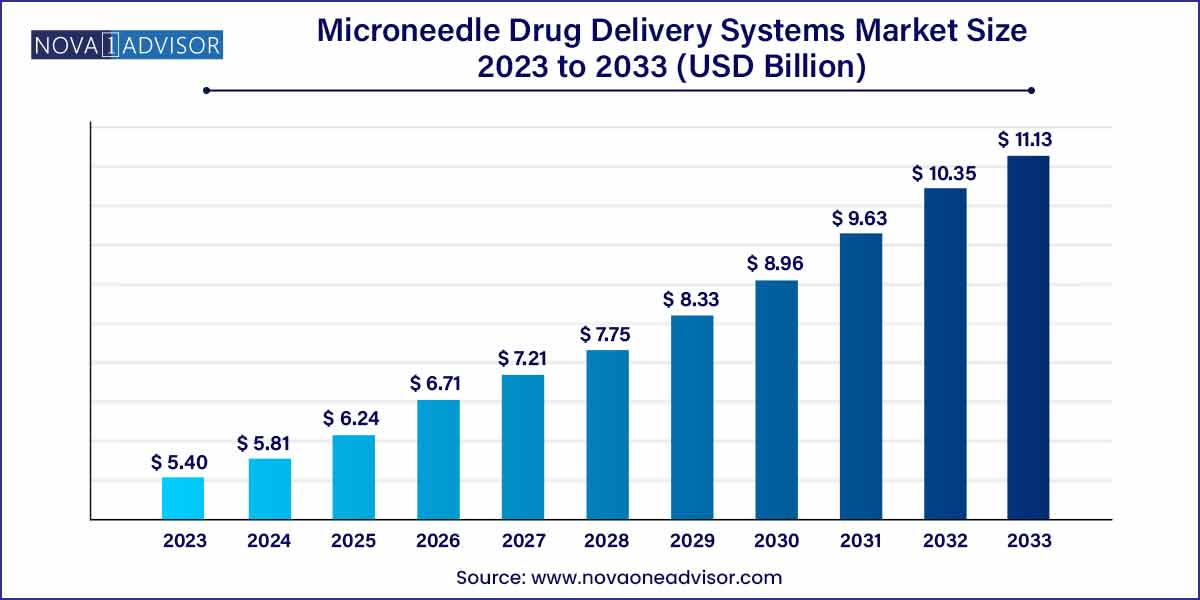

The global microneedle drug delivery systems market size was exhibited at USD 5.40 billion in 2023 and is projected to hit around USD 11.13 billion by 2033, growing at a CAGR of 7.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- The hollow microneedle segment accounted for the largest revenue share of more than 26% in 2023.

- The metal material segment accounted for the highest revenue share of more than 28% in 2023.

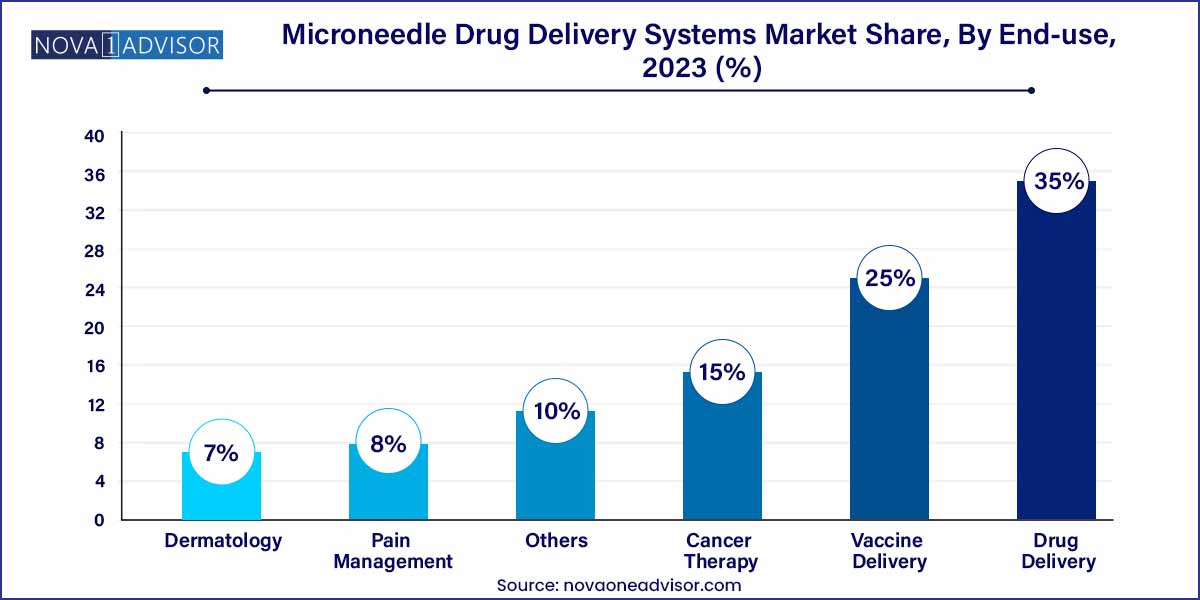

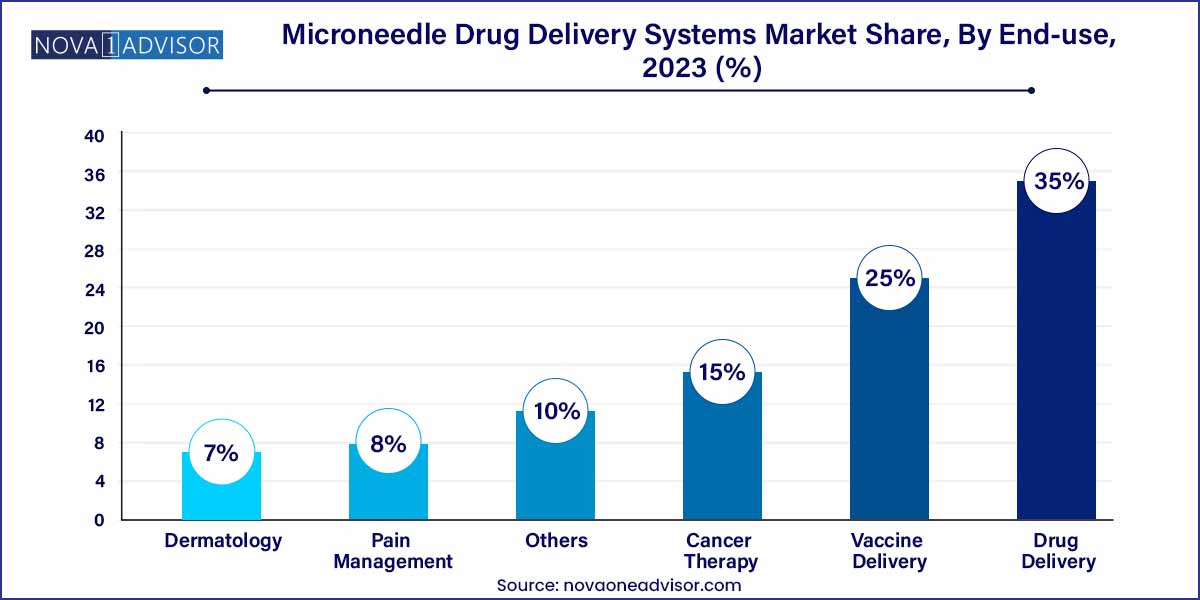

- The drug delivery segment held the largest revenue share of 35.0% in 2023.

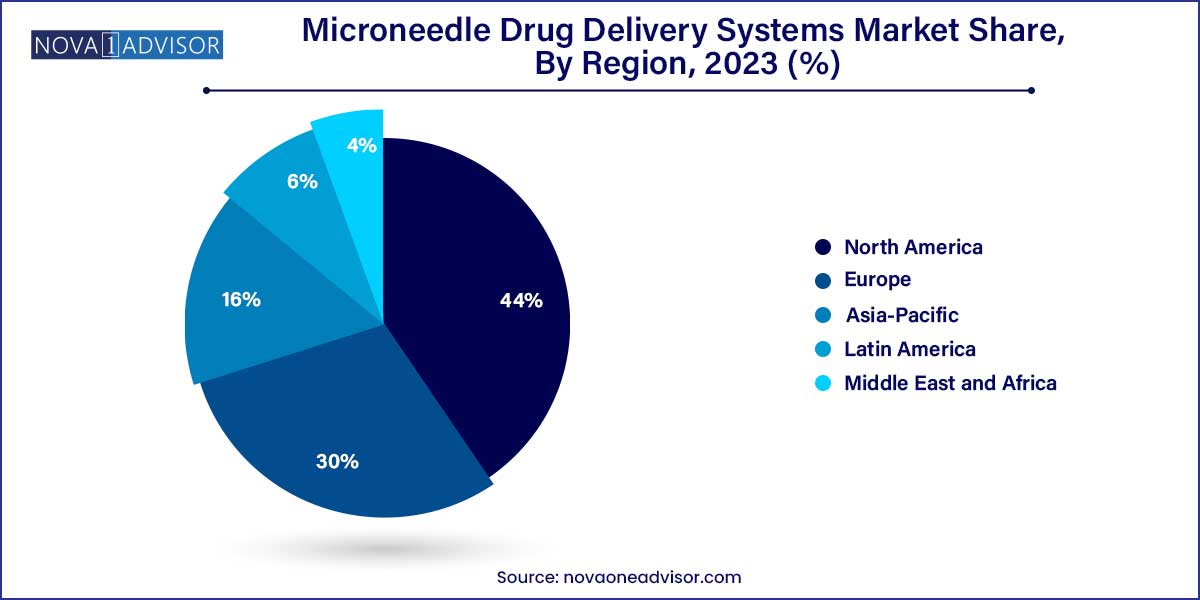

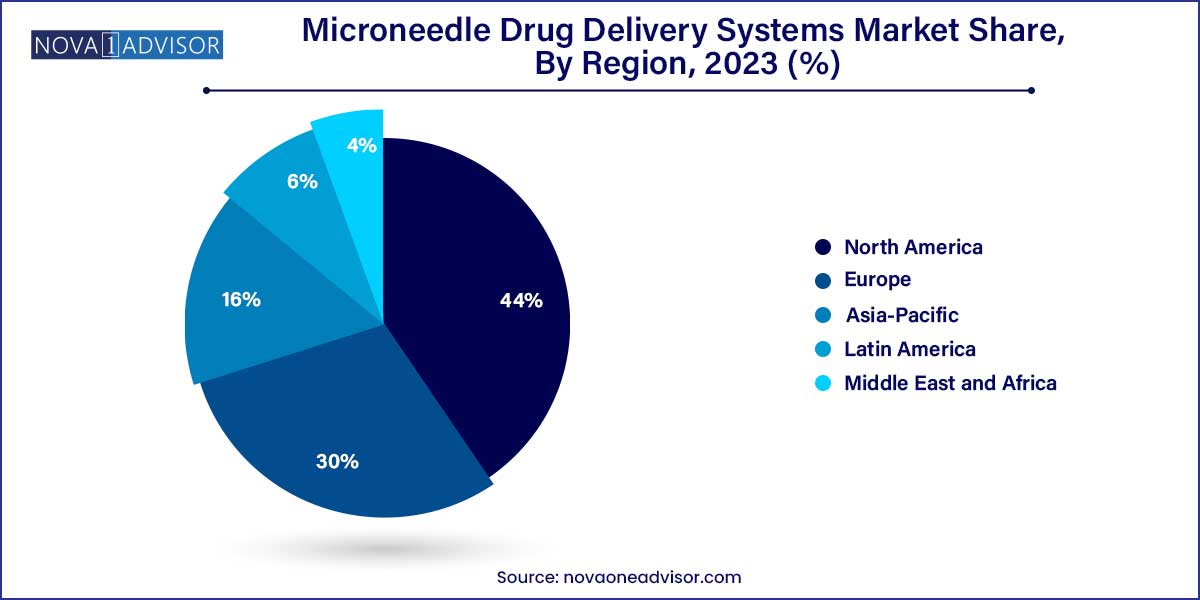

- North America dominated the market and accounted for the largest revenue share of 44% in 2023.

Microneedle Drug Delivery Systems Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.40 Billion |

| Market Size by 2033 |

USD 11.13 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Material, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Raphas; Novartis International AG; Becton Dickinson and Company; B. Braun; NanoPass technologies limited; Termo; Smiths Medical; Cardinal Health; 3M. |

There is a growing demand for microneedle drug delivery systems, owing to the availability of safer alternatives to conventional hypodermic injection, which is minimally invasive and enables pain-free administration. Moreover, the increasing incidence of diabetes is also driving industry demand. The Centers for Disease Control and Prevention (CDC) report that in the U.S., approximately 34.2 million people, or 10.5% of the population, have diabetes. Furthermore, the adoption of smart devices and technological advancements such as the use of AI & data analytics are propelling market growth.

Microneedle drug delivery systems are more beneficial than conventional hypodermal injections because of advantages such as the quicker onset of action, increased permeability and efficacy, better patient compliance, and self-administration. Apart from improving therapeutic benefits, microneedles provide very precise and consistent results with low inter-subject variability in bioavailability.

The market is gaining popularity due to their ability to improve patient compliance with medication regimens, deliver drugs in a painless and non-invasive manner, and reduce patient anxiety and increase adherence to treatment plans. This leads to better patient outcomes and reduced healthcare costs associated with medication non-adherence.

In addition, microneedle drug delivery systems have the potential to increase drug efficacy by improving drug absorption and targeting specific areas of the body. This can reduce the amount of drugs needed to achieve therapeutic effects, potentially reducing healthcare costs and minimizing side effects. Furthermore, government initiatives are also influencing the market growth, for instance, the (FDA) has also approved several microneedle devices for use in clinical trials.

The pandemic has increased interest in the use of microneedles for vaccine delivery. Microneedles can be used to deliver vaccines without the need for a healthcare professional, reducing the risk of exposure to COVID-19 in healthcare settings. The pandemic has generated significant interest in the use of microneedles for vaccine delivery. Microneedle-based vaccine delivery can be done without the need for trained healthcare professionals, which can be particularly helpful in rural or low-resource settings. The pandemic has led to increased funding and research on microneedle-based vaccine delivery, which could have long-term benefits beyond COVID-19.

However, the pandemic has slowed down clinical trials of microneedle drug delivery systems. Many clinical trials have postponed or delayed due to safety concerns and difficulties in recruiting participants during the pandemic.

Type Insights

The hollow microneedle segment accounted for the largest revenue share of more than 26% in 2023. Hollow microneedles are commonly used to deliver vaccines and hormones, which include insulin for diabetic patients. These microneedles are capable of administering a larger dose of the drug as more of the drug can be accommodated into the space inside the needle, making it ideal for the use of vaccine and hormonal therapy patients.

In addition, it is used to deliver drugs or vaccines painlessly, as they do not activate the nerve endings that are responsible for pain. According to the International Diabetes Federation (IDF), the global prevalence of type 2 diabetes in 2021 was 8.5% among adults (ages 20–79), affecting approximately 537 million people worldwide.

The dissolving microneedle segment is expected to grow at the fastest rate during the forecast period. As the dissolving microneedle is a less painful method of delivering active ingredients than the syringe, it only requires one step, as the microneedle needs not to be removed after insertion. For patients who would otherwise require frequent injections, this could potentially improve their quality of life.

Furthermore, there is a rising interest in dissolving microneedles constructed of biodegradable materials, as they enable drug administration without leaving sharp, biocontaminated, or non-degradable waste as the microneedles dissolve into the skin after insertion. All these factors are expected to have a positive impact on market growth.

Material Insights

The metal material segment accounted for the highest revenue share of more than 28% in 2023. Stainless steel and titanium are the most frequently employed metals. Also, other metals used are palladium, nickel, and palladium-cobalt alloys. They have good mechanical and biocompatibility qualities. Metals are better suited for microneedle manufacture than silicon, as they are strong enough to avoid breaking. Stainless steel was the first metal used in the manufacture of microneedles. Thus, the above-mentioned factors are anticipated to augment segment growth.

The silicone material segment is estimated to register the fastest CAGR over the forecast period. Owing to its flexibility, which allows it to produce needles of various sizes and shapes,. It is a versatile material due to its attractive physical features. Furthermore, The Food and Drug Administration (FDA) approved clearance for silicon devices, including silicon microneedles produced by the NanoPass Technologies Ltd, which is expected to boost market growth.

Application Insights

The drug delivery segment held the largest revenue share of 35.0% in 2023. Insulin is a hormone that is made up of peptides. One of the significant drivers of this growth is the increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases. As the global burden of these diseases continues to rise, there is a growing need for effective drug delivery methods that can deliver treatments with greater precision and efficacy.

In addition, advances in drug development have also contributed to the growth of the drug delivery segment. Many of the new drugs being developed are complex, with specific targets and limited bioavailability. This has led to the development of innovative drug delivery methods that can ensure optimal efficacy and minimize side effects.

The cancer therapy segment is expected to grow at a fastest CAGR of 8.3% over the forecast period. The incidence of cancer is increasing globally, and governments are investing more in cancer research and treatment. Cancer is a leading cause of death across the globe, accounting for around 10 million deaths in 2020, or nearly one in six deaths. In addition, advances in cancer research have led to the development of new and innovative cancer therapies, including targeted therapies, immunotherapies, and gene therapies. These therapies offer better outcomes with fewer side effects than traditional chemotherapy, leading to increased demand for the cancer treatment.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 44% in 2023. The region has a strong and well-established pharmaceutical industry, which is a key driver of microneedle drug delivery market. Many leading pharmaceutical companies in the region are investing in the development of microneedle-based drug delivery systems, which is driving the growth of the market.

In addition, the regulatory environment is favorable to the development and commercialization of microneedle-based drug delivery systems. Both the U.S. FDA and Health Canada are supportive of the development of microneedle technology, which has led to increased investment and innovation in the market.

In Asia Pacific, the market for microneedle drug delivery systems is estimated to witness the fastest CAGR of 8.2% during the forecast period. The region has witnessed a significant increase in healthcare expenditure, leading to greater investment in research and development activities related to microneedle drug delivery. This has helped in the development of new and innovative products and technologies, which has boosted market growth.

Furthermore, government support is also driving the demand. For instance, in India, the Digital Health Mission was announced in 2023 with the aim of creating a unified digital health infrastructure for India. It will enable the creation of electronic health records, telemedicine, and e-pharmacies, among other things.

Some of the prominent players in the microneedle drug delivery systems market include:

- Raphas

- Novartis International AG

- Becton Dickinson and Company

- B. Braun

- Nanopass technologies limited

- Termo

- Smiths Medical

- Cardinal Health

- 3M

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global microneedle drug delivery systems market.

Type

- Solid

- Hollow

- Dissolving

- Coated

- Others

Material

- Silicon

- Metal

- Polymer

- Others

Application

- Dermatology

- Drug Delivery

- Pain Management

- Cancer Therapy

- Vaccine Delivery

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)