Middle East Digital Health Market Size and Forecast 2025 to 2034

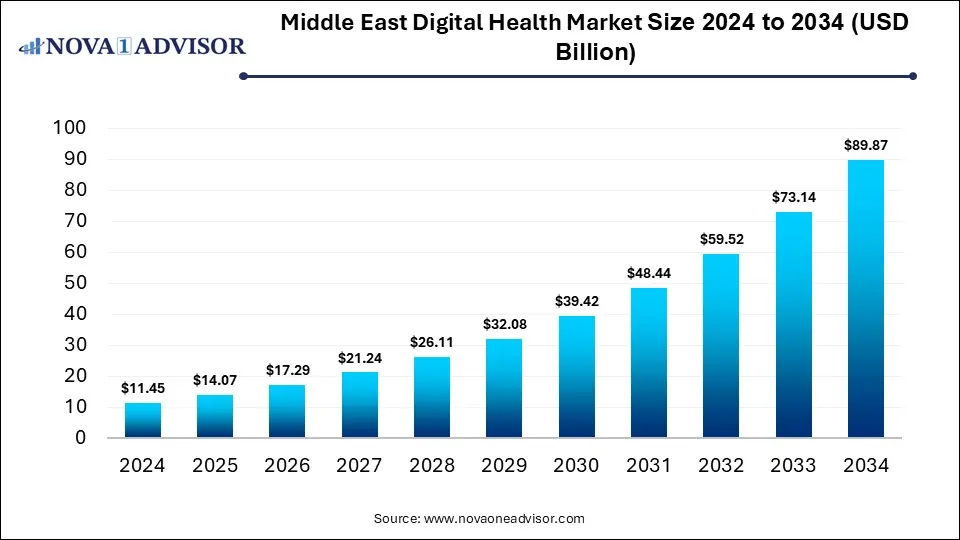

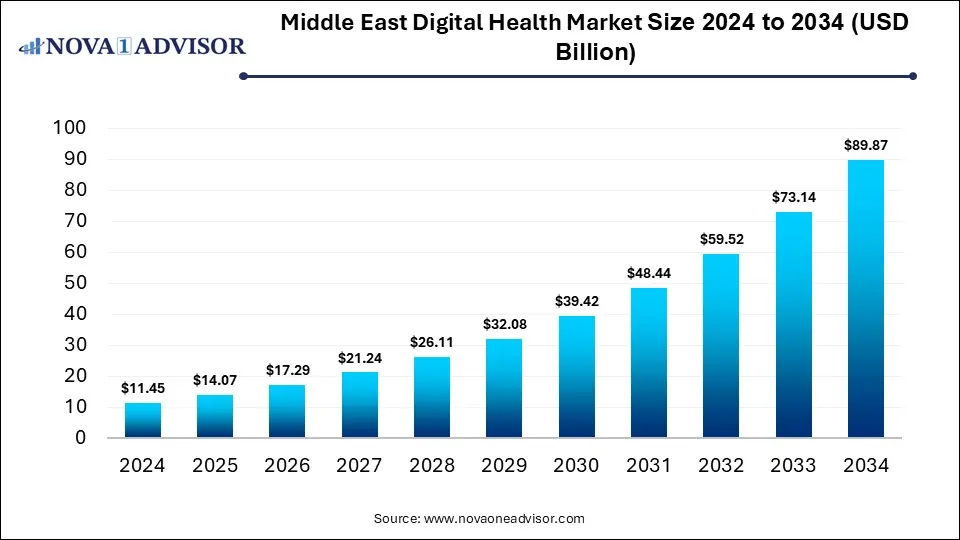

The Middle East digital health market was valued at USD 11.45 billion in 2024 and is projected to hit around USD 89.87 billion by 2034, growing at a CAGR of 22.88% during the forecast period 2025 to 2034. The growth of the market is attributed to the rising burden of chronic diseases, increasing government support, and growing awareness of benefits of digital healthcare solutions.

Middle East Digital Health Market Key Takeaways

- By country, Saudi Arabia dominated the Middle East digital health market in 2024.

- By country, the UAE is expected to experience rapid growth in the coming years.

- By component, the services segment dominated the market in 2024.

- By component, the software segment is expected to grow at the fastest rate between 2025 and 2034.

- By technology, the tele-healthcare segment led the market in 2024.

- By technology, the mHealth segment is expected to expand at the fastest CAGR during the forecast period.

- By application, diabetes segment led the market with the largest share in 2024.

- By application, the obesity segment is expected to expand at the highest CAGR over the projection period.

- By end-use, the patients segment contributed the largest market share in 2024.

- By end-use, the providers segment is expected to experience rapid growth in the coming years.

Impact of AI on the Middle East Digital Health Market

AI is poised to transform the Middle East digital health market by enabling more accurate diagnostics, personalized treatment plans, and efficient patient management. Healthcare providers are leveraging AI-powered tools for predictive analytics, disease detection, and remote monitoring, which improve clinical outcomes and reduce costs. Governments in the region are investing in AI-driven healthcare initiatives as part of their digital transformation agendas. Moreover, AI helps address workforce shortages by automating routine tasks and enhancing decision-making, making healthcare more accessible and efficient across the Middle East.

- In May 2025, Oracle Health, Cleveland Clinic, and G42 announced a strategic partnership to develop an AI-based healthcare platform that leverages nation-scale data analytics and intelligent clinical applications to improve patient care and public health. Combining Oracle’s cloud and AI technologies, Cleveland Clinic’s clinical expertise, and G42’s sovereign AI infrastructure, the platform aims to deliver secure, scalable, and accessible healthcare solutions. Initially targeting the US and UAE, it focuses on enhancing patient outcomes, enabling precision medicine, and shifting healthcare from reactive treatment to proactive wellbeing.

Market Overview

The Middle East digital health market encompasses technologies and solutions that enable the digital delivery, management, and enhancement of healthcare services, including telemedicine, mobile health (mHealth), electronic health records (EHR), and AI-powered diagnostics. Digital health improves patient outcomes by enabling remote monitoring, real-time data access, and personalized care across various applications such as chronic disease management, teleconsultations, and preventive care. Key growth factors driving the market include rising smartphone penetration, increasing government initiatives supporting healthcare digitalization, and growing demand for cost-effective, accessible healthcare solutions. The COVID-19 pandemic accelerated the adoption of digital health technologies. Moreover, Public-private partnerships continue to accelerate development and scaling of digital health infrastructure and services in the region.

- In July 2025, HIMSS partnered with WHX Tech to drive digital health transformation in the Middle East through world-class content and professional development. WHX Tech, a new digital health exhibition in Dubai supported by key UAE health authorities, will host its inaugural event from September 8-10, bringing together global healthcare leaders, innovators, and investors. This partnership with Informa Markets and WHX creates a vital platform for HIMSS to deliver insights, education, and networking for healthcare providers, governments, startups, and health organizations worldwide.

What are the Major Trends in the Middle East Digital Health Market?

- Telehealth Expansion: Telehealth services continue to grow rapidly, driven by increased demand for remote consultations and healthcare access in both urban and remote areas, especially following the COVID-19 pandemic.

- Government Initiatives and Smart Healthcare Infrastructure: Governments in the region are heavily investing in digital transformation initiatives, developing smart hospitals and regulatory frameworks to support digital health innovation and adoption.

- Rise of Mobile Health (mHealth) Solutions: With widespread smartphone use, mHealth apps and wearable devices are increasingly adopted for health monitoring, disease management, and fitness tracking, offering personalized and on-the-go healthcare.

- AI and Data Analytics Integration: Artificial intelligence and advanced data analytics are being integrated into digital health platforms to enhance diagnostics, predictive healthcare, and patient management, improving care quality and efficiency.

- Rising Prevalence of Chronic Diseases: With the rising prevalence of chronic diseases such as diabetes, obesity, and cardiovascular conditions, the demand for digital health solutions that enable continuous monitoring, early intervention, and personalized care is rising. Digital platforms like telemedicine, mHealth apps, and remote patient monitoring help manage these conditions more effectively, reducing hospital visits and improving patient outcomes.

Report Scope of Middle East Digital Health Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 14.07 Billion |

| Market Size by 2034 |

USD 89.87 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 22.88% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Technology, Component, Application, End use, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Growth in Cloud-Based Healthcare Solutions

The growth in cloud-based healthcare solutions is a major driver of the Middle East digital health market, as it enables scalable, secure, and cost-effective data storage and access across healthcare systems. Cloud technology allows healthcare providers to efficiently manage electronic health records (EHRs), support telemedicine platforms, and enable real-time data sharing among professionals and patients. This enhances collaboration, improves decision-making, and ensures continuity of care across facilities and regions. Moreover, cloud-based systems offer greater flexibility and easier integration with AI, IoT, and mobile health applications, aligning with regional efforts to modernize healthcare infrastructure. As more providers and governments adopt cloud technologies, digital health services become more accessible, efficient, and patient-centric.

Government-Led Digital Transformation Initiatives

Government-led digital transformation initiatives are playing a pivotal role in driving the growth of the market. Programs like Saudi Arabia’s Vision 2030 and the UAE’s National Strategy for Artificial Intelligence are heavily focused on modernizing healthcare systems through the adoption of digital technologies such as telemedicine, electronic health records, and AI-powered diagnostics. These initiatives are backed by substantial public funding, regulatory support, and partnerships with private tech firms, creating a favorable environment for innovation and adoption. By prioritizing smart healthcare infrastructure and digital access, governments are not only improving care quality and efficiency but also expanding healthcare reach to underserved populations. This strong policy push is accelerating the region’s shift toward a more connected and technology-driven healthcare ecosystem.

In August 2025, the UAE’s Ministry of Health and Prevention (MoHAP) announced plans to launch a National Unified Digital Platform by Q2 2026 to streamline healthcare professional licensing. The AI-powered system will integrate all federal and local health entities, reducing bureaucracy and enhancing efficiency. Serving over 200,000 professionals annually, it will offer a centralized, intelligent gateway for licensing and registration.

Restraints

Digital Health Literacy and Absence of Legal Frameworks

The growth of the Middle East digital health market is restrained by the lack of digital health literacy among both patients and healthcare professionals, which limits the effective use and acceptance of digital tools. Many users struggle to navigate telehealth platforms, mHealth apps, and remote monitoring technologies, reducing the overall impact and reach of these solutions. Additionally, the absence of comprehensive and standardized regulatory and legal frameworks across the region creates uncertainty for digital health providers, particularly in areas like data privacy, cross-border telemedicine, and AI-driven diagnostics. This regulatory gap slows innovation, deters investment, and makes integration of digital systems more complex. Together, these challenges hinder the widespread adoption and scalability of digital health initiatives in the region.

Data privacy & Security Concerns and Infrastructure Disparities

Data privacy and security concerns significantly restrain the growth of the market, as patients and providers are often hesitant to adopt digital solutions without clear safeguards for sensitive health information. The lack of robust cybersecurity measures and inconsistent data protection laws across the region increases the risk of breaches, undermining trust in digital platforms. Additionally, infrastructure disparities, especially between urban and rural areas, limit access to reliable internet, digital devices, and modern healthcare systems, creating a digital divide. These gaps hinder the seamless implementation of telemedicine, cloud-based platforms, and remote monitoring technologies. As a result, the full potential of digital health cannot be realized uniformly across the region.

Opportunities

Shift Toward Specialized Telehealth & Hybrid Care Models

There is a rapid shift toward specialized telehealth and hybrid care models, which is creating significant opportunities in the Middle East digital health market. These models allow for virtual consultations in areas such as mental health, dermatology, and chronic disease management, reducing the need for in-person visits while maintaining continuity of care. Hybrid care, combining digital and in-clinic services, offers patients greater convenience and providers enhanced efficiency. This approach is especially valuable in a region with geographic disparities in healthcare access, enabling broader reach without compromising quality. As both patients and providers embrace these flexible models, they open new avenues for innovation, partnerships, and scalable digital health solutions.

Rising Adoption of Wearable Devices and Technological Advancements

The rising adoption of wearable devices, combined with rapid technological advancements, is creating immense opportunities in the market by enabling continuous, real-time health monitoring and early detection of medical issues. Innovations in sensors, AI integration, and mobile connectivity have enhanced the accuracy and functionality of wearables, making them valuable tools for both preventive care and chronic disease management. As consumers become more health-conscious and governments promote digital wellness initiatives, demand for smart health devices is accelerating. Additionally, the data generated by these devices supports personalized treatment and remote care models, improving clinical outcomes and healthcare efficiency. This convergence of wearable tech and advanced digital tools is transforming healthcare delivery across the region.

Segment Outlook

Component Insights

What Made Services the Dominant Component of the Middle East Digital Health Market?

The services segment dominated the market with a major revenue share in 2024. This is mainly due to the increased demand for implementation, integration, training, and support services required to adopt digital health technologies effectively. As healthcare providers across the region increasingly invest in telemedicine, electronic health records (EHRs), and AI-driven platforms, they rely heavily on third-party service providers to ensure smooth deployment and ongoing maintenance. Additionally, the complexity of digital systems, combined with a shortage of in-house technical expertise in many healthcare institutions, further boosted demand for specialized services.

The software segment is expected to expand at the fastest CAGR during the upcoming period, owing to increasing adoption of advanced healthcare applications like electronic health records (EHRs), telemedicine platforms, and AI-powered diagnostic tools. As healthcare providers focus on improving patient outcomes and operational efficiency, demand for customized, scalable, and interoperable software solutions is rising. Government initiatives promoting digital transformation and investment in smart healthcare infrastructure further drive software adoption. Additionally, the growing trend of cloud-based solutions offers flexibility and cost-effectiveness, making software an attractive option for both large hospitals and smaller clinics across the region.

Middle East Digital Health Market Size By Component, 2024 to 2034 (USD Billion)

| Segment |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hardware |

2.63 |

3.17 |

3.80 |

4.57 |

5.48 |

6.58 |

7.88 |

9.45 |

11.31 |

13.53 |

16.18 |

| Software |

4.24 |

5.25 |

6.50 |

8.05 |

9.97 |

12.35 |

15.29 |

18.94 |

23.45 |

29.04 |

35.95 |

| Services |

4.58 |

5.66 |

6.98 |

8.63 |

10.65 |

13.15 |

16.24 |

20.05 |

24.76 |

30.57 |

37.75 |

Technology Insights

How Does the Tele-Healthcare Segment Lead the Market in 2024?

The tele-healthcare segment led the Middle East digital health market in 2024 due to its ability to provide remote medical consultations and care, addressing the region’s geographic and accessibility challenges. Increasing patient demand for convenient, timely healthcare services, especially during and after the COVID-19 pandemic, accelerated telehealth adoption across both urban and rural areas. Government support and investment in telemedicine infrastructure further boosted its widespread use. Additionally, tele-healthcare reduces healthcare costs and optimizes resource utilization, making it an attractive solution for providers and patients alike in the Middle East.

The mHealth segment is expected to register the fastest CAGR over the projection period due to the increasing penetration of smartphones and mobile internet across the region. Rising health awareness and the demand for convenient, on-the-go access to healthcare services are driving the adoption of mobile health apps for monitoring, consultation, and disease management. Governments and healthcare providers are also promoting mHealth solutions to extend care to remote and underserved areas. Furthermore, advancements in wearable technology and integration with mobile platforms enhance personalized healthcare, fueling the rapid growth of the mHealth segment.

Middle East Digital Health Market Size By Technology, 2024 to 2034 (USD Billion)

| Segment |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Tele-Healthcare |

3.09 |

3.76 |

4.56 |

5.54 |

6.74 |

8.18 |

9.93 |

12.06 |

14.64 |

17.77 |

21.57 |

| mHealth |

3.78 |

4.67 |

5.77 |

7.14 |

8.82 |

10.91 |

13.48 |

16.66 |

20.59 |

25.45 |

31.45 |

| Healthcare Analytics |

2.29 |

2.86 |

3.56 |

4.44 |

5.53 |

6.90 |

8.59 |

10.70 |

13.33 |

16.60 |

20.67 |

| Digital Health Systems |

2.29 |

2.79 |

3.39 |

4.12 |

5.01 |

6.09 |

7.41 |

9.01 |

10.95 |

13.31 |

16.18 |

Application Insights

Why Did the Diabetes Segment Dominate the Middle East Digital Health Market in 2024?

The diabetes segment dominated the market while capturing the largest share in 2024. This is primarily due to the region’s high prevalence of diabetes, driven by lifestyle changes, urbanization, and genetic factors. This growing patient population has increased demand for digital tools such as remote monitoring, mobile apps, and AI-powered management systems that help improve disease control and patient outcomes. Healthcare providers and governments are focusing on digital solutions to reduce complications and healthcare costs associated with diabetes. Additionally, rising awareness about diabetes management and prevention through digital platforms has further accelerated the adoption of diabetes-focused healthcare technologies.

The obesity segment is expected to expand at the highest CAGR during the forecast period because of the rising prevalence of obesity, driven by sedentary lifestyles, unhealthy diets, and urbanization. Increasing awareness about the health risks associated with obesity is fueling demand for digital health solutions focused on weight management, personalized nutrition, and fitness tracking. Mobile health apps, wearable devices, and AI-driven coaching platforms are gaining popularity as effective tools for prevention and treatment. Additionally, government initiatives aimed at combating obesity and promoting healthier lifestyles are encouraging the adoption of digital interventions in obesity care.

Middle East Digital Health Market Size By Application, 2024 to 2034 (USD Billion)

| Segment |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Obesity |

2.3 |

2.8 |

3.5 |

4.4 |

5.4 |

6.7 |

8.4 |

10.4 |

12.9 |

15.9 |

19.8 |

| Diabetes |

3.4 |

4.2 |

5.1 |

6.2 |

7.6 |

9.3 |

11.4 |

13.9 |

16.9 |

20.6 |

25.2 |

| Cardiovascular |

2.5 |

3.1 |

3.8 |

4.7 |

5.7 |

7.1 |

8.7 |

10.7 |

13.1 |

16.1 |

19.8 |

| Respiratory Diseases |

1.4 |

1.7 |

2.1 |

2.6 |

3.2 |

4.0 |

5.0 |

6.2 |

7.6 |

9.4 |

11.7 |

| Others |

1.8 |

2.2 |

2.7 |

3.3 |

4.1 |

5.0 |

6.1 |

7.4 |

9.0 |

11.0 |

13.5 |

End-Use Insights

How Does Patients Contribute the Largest Market Share in 2024?

The patients segment contributed the largest share of the Middle East digital health market in 2024 due to the heightened demand for accessible, convenient, and personalized healthcare solutions. Increasing smartphone penetration and digital literacy empowered patients to actively engage with mobile health apps, telemedicine, and remote monitoring tools. Additionally, heightened health awareness and chronic disease prevalence encouraged patients to seek continuous care and self-management options through digital platforms. The COVID-19 pandemic further accelerated patient adoption of virtual care, making digital health an integral part of the patient experience in the region.

The providers segment is expected to experience rapid growth in the coming years. This is mainly due to increasing investments by hospitals, clinics, and healthcare facilities in digital solutions to enhance patient care and operational efficiency. Providers are adopting technologies such as electronic health records (EHRs), telehealth platforms, and AI-driven diagnostics to improve clinical workflows and decision-making. Government initiatives promoting healthcare digitalization and the need to manage rising patient volumes also drive this growth. Additionally, providers are focusing on integrated digital systems to ensure better data management, compliance, and improved patient outcomes, fueling segmental growth.

Middle East Digital Health Market Size By End Use, 2024 to 2034 (USD Billion)

| Segment |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Patients |

3.4 |

4.2 |

5.3 |

6.5 |

8.0 |

9.9 |

12.3 |

15.2 |

18.8 |

23.3 |

28.8 |

| Providers |

5.2 |

6.3 |

7.7 |

9.4 |

11.4 |

14.0 |

17.0 |

20.8 |

25.4 |

30.9 |

37.7 |

| Players |

2.1 |

2.5 |

3.1 |

3.9 |

4.8 |

5.9 |

7.3 |

9.1 |

11.2 |

13.8 |

17.1 |

| Other Buyers |

0.8 |

1.0 |

1.2 |

1.5 |

1.8 |

2.2 |

2.8 |

3.4 |

4.2 |

5.1 |

6.3 |

Country Level Analysis

What Made Saudi Arabia the Dominant Marketplace in 2024?

In 2024, Saudi Arabia dominated the Middle East digital healthcare market due to its substantial government investments under Vision 2030, which prioritizes digital transformation and modernization of the healthcare sector. The country has launched numerous large-scale initiatives, including the implementation of nationwide electronic health records (EHRs), telemedicine platforms, and AI-powered health services. Saudi Arabia’s robust healthcare infrastructure, combined with high smartphone penetration and rising demand for remote care, further accelerated digital health adoption. Additionally, strong public-private partnerships and regulatory support created a favorable environment for innovation, making Saudi Arabia the regional leader in digital healthcare.

- In June 2025, Healthtrip launched Healinharam.com, a digital platform connecting international pilgrims to trusted medical, wellness, and chronic care services in Makkah, Madinah, and Jeddah. This initiative supports Saudi Arabia’s Vision 2030 goal to become a global medical and wellness tourism hub while meeting growing healthcare demands during pilgrimage. Pilgrims can now easily book health screenings, therapies, and essential treatments like dialysis and chemotherapy at leading Saudi hospitals.

The UAE is expected to experience the fastest growth in the coming years, driven by its strong focus on innovation, smart city initiatives, and substantial investments in healthcare technology. The UAE government is actively promoting digital health through strategic programs like the Dubai Health Strategy and Abu Dhabi’s Health Data Initiative, which encourage adoption of telemedicine, AI, and blockchain in healthcare. High smartphone penetration, tech-savvy population, and a growing expat community further boost demand for advanced digital health solutions. Additionally, supportive regulatory frameworks and partnerships with global tech firms are accelerating the market growth in the UAE.

Qatar is expected to grow at a notable rate in the Middle East digital health market throughout the forecast period due to its strong national focus on healthcare innovation and digital transformation. The country is heavily investing in smart healthcare infrastructure as part of its National Health Strategy and Vision 2030, emphasizing the integration of advanced technologies such as telemedicine, AI, and electronic health records (EHRs). Qatar’s high internet penetration, tech-savvy population, and government-led initiatives to improve healthcare accessibility and efficiency further support this growth. Additionally, partnerships with global digital health companies and the development of research hubs are positioning Qatar as an emerging leader in the region’s digital health space.

Middle East Digital Health Market Size By Country, 2024 to 2034 (USD Billion)

| Segment |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Saudi Arabia |

5.5 |

6.7 |

8.2 |

10.1 |

12.3 |

15.1 |

18.4 |

22.6 |

27.6 |

33.8 |

41.3 |

| UAE |

3.2 |

4.0 |

4.9 |

6.1 |

7.5 |

9.3 |

11.5 |

14.2 |

17.6 |

21.8 |

27.0 |

| Kuwait |

1.1 |

1.4 |

1.7 |

2.1 |

2.6 |

3.2 |

3.9 |

4.8 |

6.0 |

7.3 |

9.0 |

| Qatar |

0.9 |

1.1 |

1.4 |

1.7 |

2.1 |

2.6 |

3.2 |

3.9 |

4.8 |

5.9 |

7.2 |

| Oman |

0.7 |

0.8 |

1.0 |

1.3 |

1.6 |

1.9 |

2.4 |

2.9 |

3.6 |

4.4 |

5.4 |

Middle East Digital Health Market Value Chain Analysis

- Research & Development (R&D)

This initial stage involves the creation and innovation of digital health technologies such as telehealth platforms, wearable devices, AI algorithms, and health data analytics tools. Key players like IBM Watson Health, Philips Healthcare, and Siemens Healthineers invest heavily in R&D to develop advanced, region-specific solutions that address local healthcare challenges.

- Software & Hardware Manufacturing

At this stage, companies focus on producing the essential digital health software applications and hardware devices such as mobile apps, sensors, and connected medical devices. Players like Medtronic, Samsung Electronics, and Honeywell manufacture wearable devices and IoT-enabled equipment tailored for the Middle Eastern healthcare industry.

This stage involves implementing digital health solutions within healthcare systems, including hospitals, clinics, and government health networks. Companies such as Cerner Corporation, Epic Systems, and regional firms like Healthigo provide integration services, ensuring seamless adoption of electronic health records (EHR), telemedicine platforms, and other digital tools.

After deployment, ongoing support, maintenance, and training are crucial for sustained usage and efficiency of digital health solutions. Firms like IBM, Accenture, and Tata Consultancy Services (TCS) offer consulting, managed services, and technical support to healthcare providers in the Middle East.

The value chain concludes with healthcare providers, patients, and payers utilizing digital health solutions to improve care delivery, health outcomes, and operational efficiency. Leading healthcare systems and insurance companies in Saudi Arabia, UAE, and Qatar are pivotal end-users driving demand and feedback for continuous innovation.

Middle East Digital Health Market Companies

Philips provides advanced telehealth and remote patient monitoring solutions that enhance chronic disease management and critical care services across the region.

Cerner offers electronic health record (EHR) systems and health information technologies that streamline hospital workflows and improve data interoperability in Middle Eastern healthcare facilities.

Siemens delivers a wide range of digital imaging, diagnostics, and AI-powered healthcare software solutions, supporting precision medicine and operational efficiency.

Medtronic contributes through connected medical devices and wearable health technologies that enable real-time monitoring and management of chronic conditions.

IBM integrates AI and data analytics into digital health platforms, enhancing diagnostics, patient management, and personalized treatment strategies.

Honeywell develops IoT-enabled healthcare infrastructure solutions that support smart hospital initiatives and digital health ecosystems.

Epic offers comprehensive EHR platforms widely used by hospitals and clinics in the region, facilitating seamless patient data management.

Healthigo, a regional player, provides telemedicine and healthcare management platforms tailored to Middle Eastern market needs, improving healthcare accessibility.

- Tata Consultancy Services (TCS)

TCS offers IT consulting and digital transformation services that help healthcare providers integrate and optimize digital health technologies.

Accenture supports digital health innovation with strategy consulting, technology implementation, and managed services in the Middle East.

Siemens plays a significant role in supplying advanced healthcare equipment integrated with digital solutions to hospitals in the region.

Allscripts provides healthcare IT solutions including EHR, patient engagement tools, and care coordination software to enhance healthcare delivery.

Samsung contributes through the manufacture of wearable health devices and mobile health technologies used widely for remote monitoring.

GE offers digital imaging and AI-enabled diagnostic tools that aid healthcare providers in improving patient outcomes.

Nextech specializes in cloud-based healthcare software solutions that support telehealth, patient management, and digital workflows for clinics in the Middle East.

Recent Developments

- In April 2025, Dubai Health Authority (DHA) announced the integration of AI into the ‘Nabidh’ system to enhance patient data security and privacy, in partnership with Imprivata. This move underscores DHA’s leadership in digital health transformation and Dubai’s ambition to be a global digital innovation hub.

- In January 2025, Acorn Research launched an AI-driven Healthcare Innovation Lab at Arab Health 2025 to revolutionize care delivery and advance value-based healthcare. Based in Dubai Healthcare City, the initiative empowers both providers and patients through cutting-edge AI solutions. Acorn’s innovations have already gained recognition for their transformative impact.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Middle East Digital Health Market.

By Technology

-

-

- Activity Monitoring

- Remote Medication Management

-

-

- LTC Monitoring

- Video Consultation

-

-

- BP Monitors

- Glucose Meters

- Pulse Oximeters

- Sleep Apnea Monitors

- Neurological Monitors

- Activity Trackers/Actigraphs

-

-

- Medical Apps

- Fitness Apps

-

-

-

-

- Independent Aging Solutions

- Chronic Disease Management & Post-acute Care Services

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Others

-

-

-

- mHealth Services, By Participants

-

-

-

-

- Mobile Operators

- Device Vendors

- Content Players

- Healthcare Providers

- Healthcare Analytics

- Digital Health Systems

-

- EHR

- E-prescribing systems

By Component

- Hardware

- Software

- Services

By Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

By End Use

- Patients

- Providers

- Players

- Other Buyers

By Country

- Saudi Arabia

- UAE

- Kuwait

- Qatar

- Oman