Molecular Biology Enzymes Market Size, Share, Growth, Report 2025 to 2034

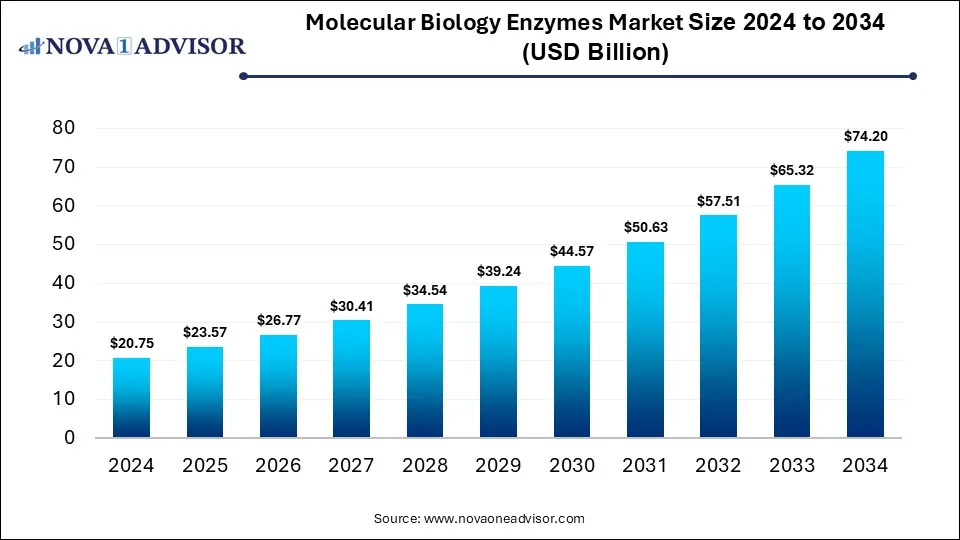

The global molecular biology enzymes market was valued at USD 20.75 billion in 2024 and is projected to hit around USD 74.20 billion by 2034, growing at a CAGR of 13.59% during the forecast period 2025 to 2034. The growth of the market is attributed to the increasing R&D activities, prevalence of genetic diseases, and demand for personalized medicine.

Key Takeaways

- By region, North America dominated the market while holding the largest share in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR during the forecast period of 2025 and 2034.

- By product, the kits & reagents segment held the largest share of the market in 2024.

- By product, the enzyme segment is expected to grow at the highest CAGR between 2025 and 2034.

- By application, the sequencing segment sustained dominance in the market in 2024.

- By application, the PCR segment is expected to expand at the fastest CAGR during the forecast period.

- By end-user, the pharma & biotech companies segment led the market in 2024.

- By end-user, the research institutes segment is expected to grow at the fastest CAGR in the upcoming period.

How is AI Revolutionizing the Molecular Biology Enzymes Market?

AI is significantly transforming the molecular biology enzymes market by accelerating enzyme discovery, design, and optimization. Through machine learning and predictive modeling, AI enables the identification of novel enzymes with improved stability, specificity, and performance for applications like PCR, sequencing, and synthetic biology. It also enhances R&D efficiency by automating data analysis and experimental workflows, reducing time and costs. In manufacturing, AI supports process optimization and quality control, ensuring consistent enzyme production. Additionally, AI-driven tools are aiding in the development of personalized diagnostics and precision medicine by enabling more accurate interpretation of molecular data. As AI technologies advance, their integration is expected to further drive innovation and competitiveness across the market.

- In July 2025, researchers at the University of Illinois Urbana-Champaign, led by Prof. Huimin Zhao, significantly enhanced the performance of two key industrial enzymes by integrating AI, robotics, and synthetic biology. Published in Nature Communications, the study also introduced a rapid, user-friendly method to optimize many more enzymes for industrial use.

Market Overview

The molecular biology enzymes market comprises enzymes used to manipulate DNA, RNA, and proteins in applications such as PCR, sequencing, cloning, and gene editing. These enzymes offer high specificity, efficiency, and versatility, making them essential tools in research, diagnostics, and biopharmaceutical development. Key benefits include enabling accurate genetic analysis, accelerating drug discovery, and supporting advancements in personalized medicine. The market is experiencing strong growth driven by increasing demand for molecular diagnostics, rapid advancements in gene editing and sequencing technologies, and rising investments in life sciences research. As the need for precise and efficient molecular tools grows, the market is expected to expand steadily in the coming years.

What are the Major Trends in the Molecular Biology Enzymes Market?

- Growing Adoption of Next-Generation Sequencing (NGS): Increasing use of NGS in clinical diagnostics, genomics research, and precision medicine is driving demand for high-fidelity enzymes used in sample preparation and sequencing workflows.

- Rising Demand for Custom and Engineered Enzymes: Researchers and biotech firms are increasingly seeking customized enzymes tailored for specific applications in synthetic biology, CRISPR-based editing, and industrial biotechnology.

- Expansion of Point-of-Care and Molecular Diagnostics: Growth in decentralized testing and home-based diagnostics is fueling demand for enzyme-based kits that are stable, easy to use, and suitable for rapid molecular assays.

Report Scope of Molecular Biology Enzymes Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 23.57 Billion |

| Market Size by 2034 |

USD 74.20 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.59% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, and End-User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Demand for Molecular Diagnostics and Prevalence of Genetic Diseases

The rising demand for molecular diagnostics and the increasing prevalence of genetic disorders are major factors driving the growth of the molecular biology enzymes market. Molecular diagnostics rely heavily on enzymes such as polymerases, ligases, and nucleases for accurate detection of genetic material in diseases like cancer, infectious diseases, and inherited conditions. As awareness and availability of genetic testing grows, more patients are being screened and diagnosed using enzyme-based technologies. This has led to a surge in demand for high-performance enzymes that offer precision, speed, and reliability in clinical applications. Additionally, the growing burden of genetic disorders has intensified the need for advanced research and personalized treatment approaches, further boosting enzyme usage in both research and diagnostic labs.

Increasing Investments in Genomic Research

Increasing investments in genomic research are significantly driving the growth of the market. These investments, from both public and private sectors, are enabling large-scale projects in areas such as genome sequencing, gene editing, and personalized medicine, all of which require specialized enzymes for DNA/RNA manipulation. As research becomes more advanced, there is growing demand for high-quality, efficient enzymes that can support complex and high-throughput workflows. Funding also supports the development of novel enzyme formulations tailored for emerging technologies like CRISPR and synthetic biology. Additionally, enhanced research infrastructure and collaborations between academia and industry are accelerating the discovery and commercialization of enzyme-based tools. This surge in genomic research activity continues to expand the applications and market potential of molecular biology enzymes globally.

- In July 2025, MedGenome announced it raised $47.5 million in a Series E round co-led by Maj Invest and Novo Holdings, with participation from Sofina. The funding will support the expansion of MedGenome’s genomic and integrated diagnostics solutions across India and emerging markets, reinforcing its mission to reduce disease burden through affordable early detection and targeted disease management.

Restraints

High Costs of Enzymes and Storage and Stability Issues

High costs of molecular biology enzymes and challenges related to their storage and stability are significant factors restraining the growth of the market. Many of these enzymes, especially high-fidelity or custom-engineered types, are expensive to produce and purchase, limiting accessibility for smaller research labs and institutions in low- and middle-income regions. Additionally, most enzymes require strict cold-chain storage conditions to maintain their activity and shelf life, increasing logistics and handling costs. Any deviation in temperature can compromise enzyme functionality, leading to failed experiments and financial losses. These issues can deter widespread adoption, particularly in resource-constrained environments or field-based applications.

Stringent Regulatory Requirements

Enzymes used in clinical diagnostics, therapeutic development, and genetic testing must comply with strict quality, safety, and efficacy standards set by regulatory bodies such as the FDA and EMA. Meeting these standards involves extensive documentation, validation studies, and costly, time-consuming approval processes, which can delay product launches and limit innovation. Smaller companies and startups often face significant challenges navigating these complex regulations, hindering their ability to compete or expand. Additionally, evolving regulatory frameworks for advanced applications like gene editing and personalized medicine add uncertainty and compliance burdens. These regulatory hurdles can slow down market entry and limit the availability of new enzyme technologies across regions.

Opportunities

Growth in Metagenomics and Microbiome Research

The rapid growth in metagenomics and microbiome research is creating immense opportunities in the molecular biology enzymes market. These fields rely heavily on enzymes for DNA extraction, amplification, sequencing, and analysis of complex microbial communities from various environments, including the human gut, soil, and water. As researchers explore the role of the microbiomes in health, disease, and ecosystem functions, the demand for high-performance and specialized enzymes continues to rise. Enzymes with enhanced sensitivity and specificity are particularly valuable for detecting low-abundance microbial DNA and processing large volumes of diverse samples. Additionally, microbiome research is driving innovation in personalized medicine, probiotics, and biotherapeutics, all of which require reliable molecular tools.

Increasing Demand for Personalized Medicine

The increasing demand for personalized medicine is also creating significant opportunities in the market. Personalized medicine relies on precise genetic and molecular profiling of individuals to tailor treatments, which require advanced molecular techniques such as PCR, sequencing, and gene editing, all dependent on high-quality enzymes. These enzymes enable accurate analysis of DNA and RNA, detection of mutations, and targeted therapeutic development. As healthcare shifts toward more individualized approaches, the need for reliable, efficient enzymes to support diagnostic and therapeutic applications is rapidly growing. Moreover, enzymes play a crucial role in developing companion diagnostics and pharmacogenomic tests, essential components of personalized care. This trend is driving greater investment and innovation in enzyme technologies, expanding their role in modern healthcare solutions.

Segment Outlook

By Product

What Made Kits & Reagents the Dominant Segment in the Molecular Biology Enzymes Market?

The kits & reagents segment dominated the market while holding the largest share in 2024 due to their convenience, standardization, and broad applicability across research and clinical settings. These ready-to-use products simplify complex workflows, reduce the risk of errors, and save time for researchers and lab technicians. They are widely used in applications such as PCR, sequencing, cloning, and gene expression analysis, making them essential tools in both academic and commercial laboratories. The growing demand for molecular diagnostics and rapid testing solutions, especially during public health crises like the COVID-19 pandemic, further boosted their adoption. Additionally, advancements in kit formulations have enhanced their sensitivity, stability, and ease of use, making them the preferred choice over standalone enzymes. This widespread utility and efficiency have solidified their leading position in the market.

The enzyme segment is expected to expand at the fastest CAGR in the coming years due to the rising demand for high-performance, specialized enzymes in advanced applications like next-generation sequencing (NGS), gene editing, and synthetic biology. As research becomes more targeted and complex, there is a growing need for enzymes with enhanced specificity, stability, and efficiency. Innovations in enzyme engineering and recombinant technology are enabling the development of tailored enzymes for specific tasks, boosting their adoption across pharma, biotech, and academic research. Additionally, the increasing use of enzymes in therapeutic development and molecular diagnostics is expanding their market scope. As precision medicine and genetic research gain momentum, the need for robust enzyme solutions continues to surge, supporting segmental growth.

By Application

Why Did the Sequencing Segment Dominate the Market in 2024?

The sequencing segment dominated the molecular biology enzymes market in 2024 due to the growing adoption of next-generation sequencing (NGS) technologies across research, clinical diagnostics, and precision medicine. Increased demand for whole genome, exome, and targeted sequencing drove the need for high-performance enzymes used in library preparation, amplification, and sample processing. Additionally, expanding applications in oncology, infectious disease surveillance, and personalized therapies further boosted enzyme consumption in sequencing workflows. The continued investment in genomics research and declining sequencing costs also played a significant role in this segment's market leadership.

The PCR segment is likely to grow at the fastest rate in the upcoming years due to its widespread use in research, diagnostics, and clinical testing. PCR is a fundamental technique for amplifying DNA and RNA, making it essential in disease detection, genetic analysis, forensic science, and infectious disease testing. The surge in demand for rapid and accurate diagnostic tools, particularly during the COVID-19 pandemic, further accelerated the adoption of PCR-based methods. Enzymes like DNA polymerases are central to the PCR process, driving consistent demand in both academic and commercial settings. Additionally, ongoing advancements in qPCR and digital PCR technologies have expanded the range and sensitivity of PCR applications.

The synthetic biology segment is expected to grow at a significant CAGR over the projection period, owing to the rising demand for engineered biological systems in healthcare, agriculture, and industrial biotechnology. This field heavily relies on enzymes for tasks such as DNA assembly, gene synthesis, and pathway engineering, driving the need for high-efficiency and customizable enzyme solutions. Advances in enzyme engineering and automation are enabling more complex and scalable synthetic biology applications, from biofuel production to the development of novel therapeutics. Additionally, increased funding and collaborations between biotech firms and academic institutions are accelerating innovation in this space. As synthetic biology becomes a cornerstone of next-generation biomanufacturing and personalized medicine, the demand for specialized enzymes is expected to surge.

- In October 2024, a research team at UC Irvine engineered a new enzyme capable of efficiently producing threose nucleic acid (TNA), a synthetic, more stable alternative to DNA. This breakthrough could pave the way for advanced, more precise therapies for cancer, autoimmune, metabolic, and infectious diseases.

By End-User

How Does Pharma & Biotech Companies Contribute the Largest Market Share in 2024?

Pharma & biotech companies contributed the largest market share in 2024 due to their extensive use of molecular biology enzymes in drug discovery, development, and production processes. These companies invest heavily in advanced research involving gene editing, next-generation sequencing, and biologics manufacturing, all of which rely on high-quality enzymes. The growing focus on personalized medicine and targeted therapies has further increased enzyme demand in this sector. Additionally, pharma and biotech firms require reliable and scalable enzyme supplies for clinical trials and regulatory-compliant manufacturing. Their substantial R&D budgets and continuous innovation efforts drive sustained growth and dominance in the molecular biology enzymes market.

The research institutes segment is expected to expand at the fastest CAGR in the coming years. This is mainly due to increased funding and focus on cutting-edge life sciences research globally. These institutes are driving innovations in genomics, gene editing, synthetic biology, and molecular diagnostics, all of which require a wide range of specialized enzymes. The rising number of academic publications and collaborations with industry partners is expanding enzyme usage in experimental workflows. Additionally, government initiatives supporting basic and translational research are boosting enzyme demand in public and private research organizations. As new technologies and methodologies emerge, research institutes are early adopters, fueling rapid market growth.

By Regional Insights

What Made North America the Dominant Region in the Molecular Biology Enzymes Market in 2024?

North America dominated the molecular biology enzymes market by holding the largest share in 2024 due to its well-established life sciences infrastructure, robust funding for research and development, and presence of leading pharmaceutical and biotechnology companies. The region benefits from strong government support, extensive academic research, and widespread adoption of advanced molecular technologies such as next-generation sequencing and CRISPR gene editing. Additionally, North America has a large number of clinical trials and molecular diagnostics initiatives that drive enzyme demand. The presence of key market players and efficient regulatory frameworks further contribute to the region’s leadership. High awareness of personalized medicine and increasing investments in genomics also fuel market growth.

The U.S. is a major contributor to the North American molecular biology enzymes market due to its strong life sciences ecosystem, including world-leading research institutions, biotech companies, and pharmaceutical firms. Substantial government funding and private investments drive innovation in genomics, gene editing, and molecular diagnostics, increasing enzyme demand. The U.S. also benefits from early adoption of cutting-edge technologies like next-generation sequencing and CRISPR. Additionally, well-established regulatory frameworks and a large number of clinical trials support the development and commercialization of enzyme-based products.

What Factors Make Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to experience the fastest-growth in the market in the upcoming period due to increasing investments in biotechnology research, expanding healthcare infrastructure, and rising adoption of advanced molecular techniques. Rapid growth in genomics research, government initiatives supporting life sciences, and a large pool of skilled researchers are driving enzyme demand. Additionally, the region’s expanding pharmaceutical and biotech sectors are fueling the need for molecular biology tools. Growing awareness of personalized medicine and increasing collaborations with global companies further accelerate market growth in Asia Pacific.

China is a leading player in the molecular biology enzymes market in Asia Pacific due to its rapidly expanding biotechnology and pharmaceutical sectors. The country has made significant investments in genomic research, precision medicine, and synthetic biology, supported by strong government initiatives and funding programs. China also hosts a a large number of research institutions and biotech startups that actively use molecular biology enzymes in advanced applications. Additionally, increased collaboration with global biotech firms and rising demand for molecular diagnostics are accelerating the adoption of enzyme-based technologies.

India is considered an emerging player in the market due to its rapidly expanding biotechnology sector, increasing government investment in life sciences research, and growing focus on genomics and personalized medicine. The presence of a large pool of skilled scientists and expanding research infrastructure is driving local innovation and enzyme demand. Additionally, rising collaborations with global biotech firms, the growth of molecular diagnostics, and launch of enzyme-based products are boosting the country's role in the market.

- In April 2025, NOVUS launched its CIBENZA XCEL Xylanase Enzyme Feed Additive in India at a three-day event in Kovalam, Kerala. Designed to enhance nutrient utilization in poultry diets, the product reflects NOVUS’ commitment to precision enzyme technology backed by global science and regional validation. The launch marks the regional debut of a globally trusted solution, supported by NOVUS' full-service technical expertise.

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 8.6 Bn |

~6.54% |

Strong biotech/pharma R&D, cutting-edge infrastructure, high adoption of molecular diagnostics |

High production costs, supply chain issues for high purity enzymes |

Mature, dominant, continued steady growth |

| Asia Pacific |

USD 6.1 Bn |

~7.69% |

Rising biotech investments, large patient populations, rapid adoption in China, India, Japan |

Infrastructure gaps, uneven standardization, cost sensitivity |

Fastest-growing region with high potential |

| Europe |

USD 4.8 Bn |

~11.06% |

Academic research strength, supportive regulatory environment, personalized medicine drive |

Reimbursement limits, relatively slower tech adoption |

Stable and innovation-focused |

| Latin America |

USD 1.7 Bn |

~5.12% |

Improving healthcare systems, growing R&D funding, awareness of molecular diagnostics |

Political instability, limited lab infrastructure |

Emerging with promising upside |

| MEA |

USD 1.1 Bn |

~3.15% |

Healthcare infrastructure investments, increasing diagnostics demand, expanding research capabilities |

Skilled workforce shortages, raw material supply fluctuations |

Gradual uptake; emerging and underpenetrated |

Molecular Biology Enzymes Market Values Chain Analysis

.webp)

Competitive Landscape

1. Thermo Fisher Scientific

Thermo Fisher offers a comprehensive range of molecular biology enzymes, including polymerases and ligases, essential for PCR, cloning, and NGS workflows. Its global distribution and integration with advanced genomic platforms make it a dominant supplier for both research and clinical applications.

2. Merck KGaA (MilliporeSigma)

Merck supplies high-purity enzymes used in DNA amplification, gene expression, and molecular diagnostics. The company’s strong R&D and quality assurance make its products reliable for critical applications in pharmaceuticals and life sciences.

3. New England Biolabs (NEB)

NEB is widely recognized for its innovation in enzyme development, especially restriction enzymes and high-fidelity polymerases. Its focus on academic research and open-access resources supports broad scientific advancement globally.

4. Promega Corporation

Promega provides enzyme-based solutions for PCR, RT-PCR, and nucleic acid purification, with strong applications in genomics, forensics, and diagnostics. Its flexible product formats and automation compatibility enhance usability across research labs.

5. Takara Bio Inc.

Takara Bio offers robust enzymes for high-performance PCR and gene editing, widely used in academic and commercial biotech sectors. The company is particularly strong in Asia and continues to expand its global footprint.

6. Agilent Technologies

Agilent supplies enzymes for NGS, qPCR, and molecular cloning through its genomics and life sciences divisions. It supports precision medicine and clinical genomics with high-throughput, reliable tools.

7. QIAGEN N.V.

QIAGEN’s enzyme kits power DNA/RNA purification and amplification processes, commonly used in infectious disease testing and cancer diagnostics. Its integrated workflow systems streamline molecular lab operations worldwide.

8. Illumina, Inc.

Illumina incorporates proprietary enzyme technologies within its sequencing platforms to improve speed, accuracy, and sample throughput. While known for NGS, its enzyme innovations support custom genomics and clinical pipelines.

9. F. Hoffmann-La Roche Ltd.

Roche develops enzyme kits for molecular diagnostics, particularly in oncology and virology. Its extensive diagnostic portfolio integrates enzymes into point-of-care and laboratory testing systems.

10. Bio-Rad Laboratories, Inc.

Bio-Rad provides enzyme products for PCR and gene expression analysis, widely used in life science research and education. Its instruments and consumables ensure consistency and scalability in molecular workflows.

These companies are adopting various business development strategies, including launching advanced enzyme kits, investing in synthetic biology and gene editing technologies, and forming partnerships with research institutions and biotech startups. Companies are also expanding their presence in emerging markets like Asia Pacific through localized manufacturing and distribution. To further grow, these players can enhance digital platforms, develop eco-friendly enzyme production methods, and tailor products for personalized medicine and high-throughput genomic applications.

- For instance, in February 2024, New England Biolabs (NEB) launched the NEBNext Enzymatic 5hmC-seq Kit (E5hmC-seq), an enzyme-based method for accurate detection of 5hmC sites. The kit offers high-quality data with input as low as 100 pg, supporting research into the potential role of 5hmC in gene regulation and tissue-specific biological processes.

Recent Developments

- In November 2024, VTR Biotech hosted its New Product Launch and Sustainable Biotechnology Seminar in Zhuhai, showcasing its commitment to innovation and sustainability in enzyme technology. The company unveiled two new products: Yiduozyme, a next-generation xylanase, and the Yibeijia Com Series, a versatile detergent enzyme solution. The event marked a key milestone in advancing high-efficiency, sustainable solutions for the agricultural, livestock, and industrial enzyme sectors.

- In May 2024, Fermbox Bio launched EN3ZYME, an advanced enzyme cocktail that boosts the efficiency and cost-effectiveness of converting pre-treated agri-residues into fermentable cellulosic sugars. These sugars enable the production of second-generation (2G) ethanol and serve as alternative carbon sources in precision fermentation for bio-ingredients and biomaterials, supporting a circular economy.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the molecular biology enzymes market.

By Product

By Application

- PCR

- Sequencing

- Epigenetic

- Synthetic Biology

- Others

By End-User

- Research Institutes

- Pharma & Biotech Companies

- Hospitals

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

.webp)