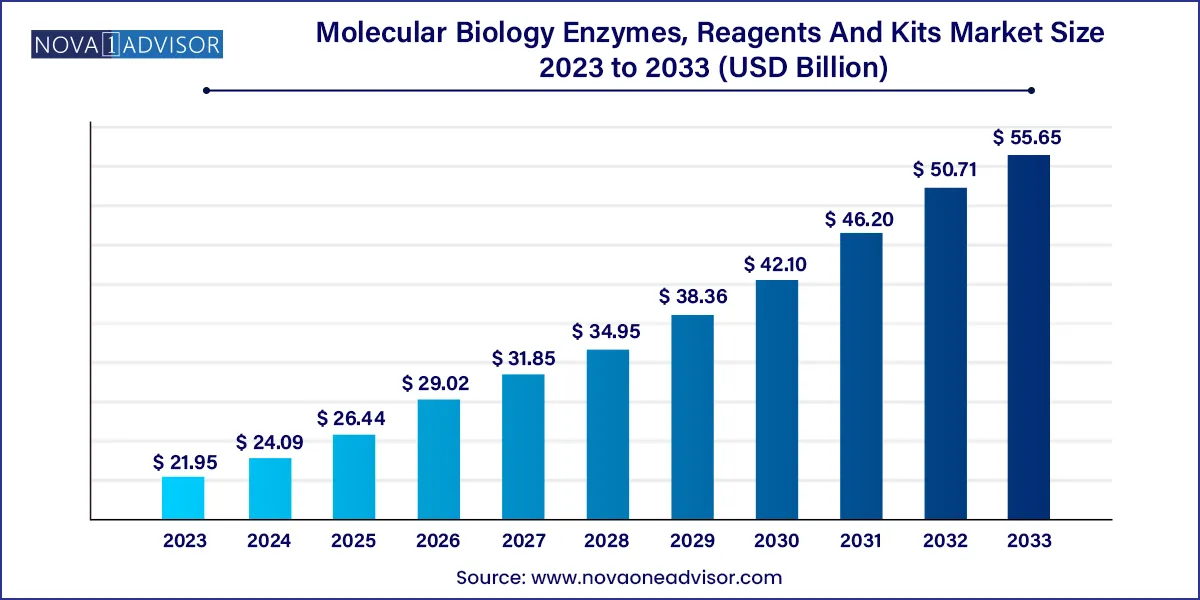

The global molecular biology enzymes, reagents, and kits market size was exhibited at USD 21.95 billion in 2023 and is projected to hit around USD 55.65 billion by 2033, growing at a CAGR of 9.75% during the forecast period 2024 to 2033.

Key Takeaways:

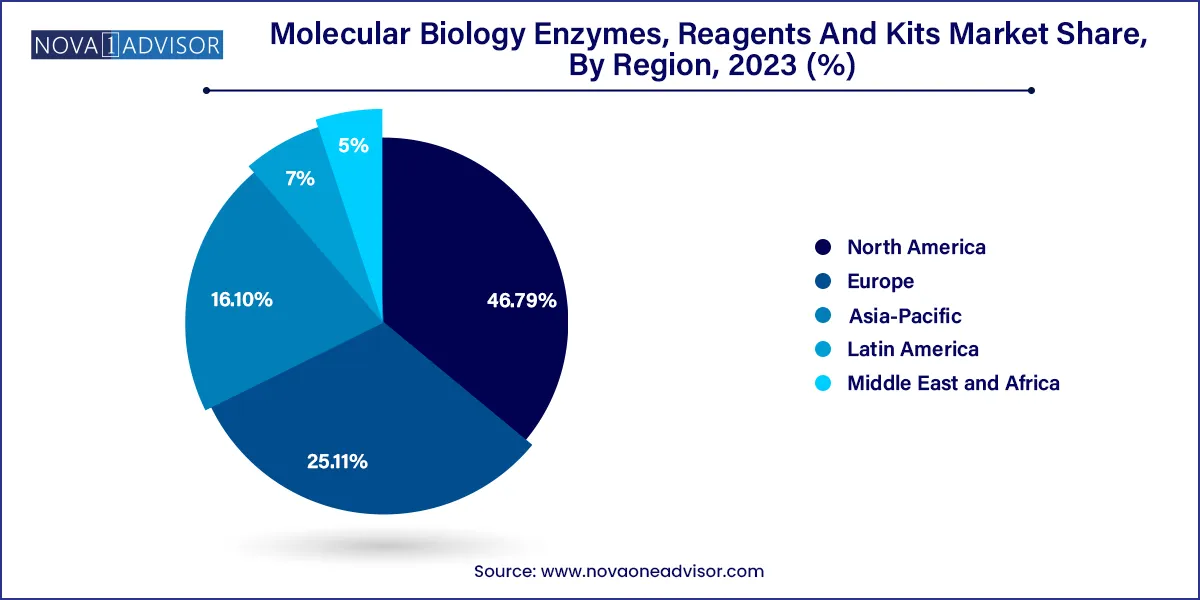

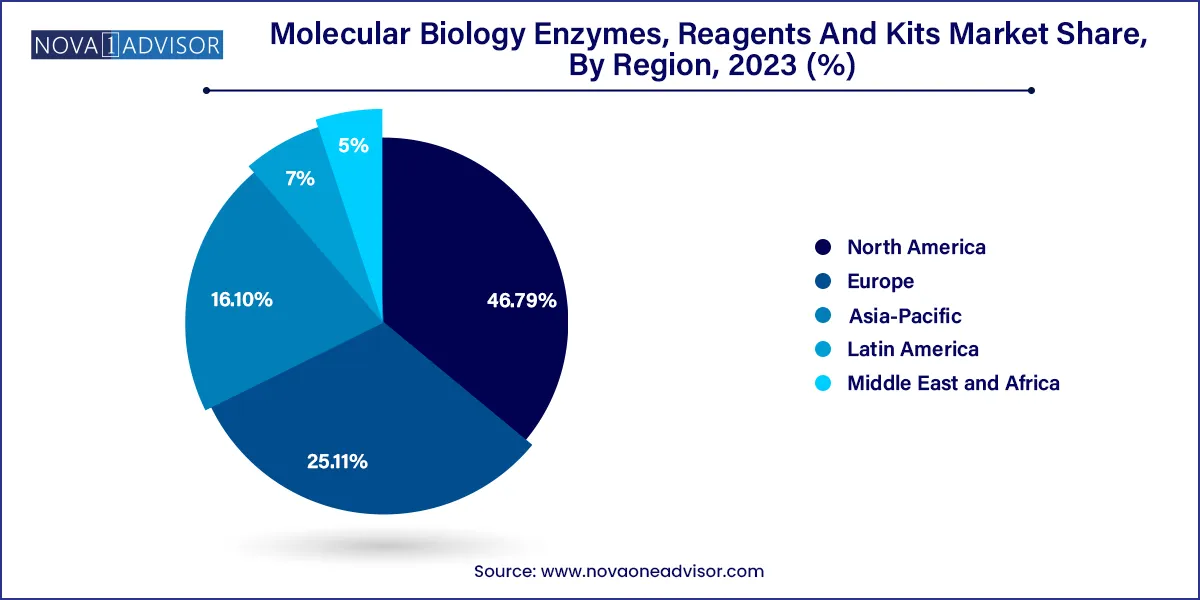

- North America accounted for the largest revenue share of 46.79% in 2023.

- Asia Pacific is expected to register a productive growth rate in the forecast period.

- Kits and reagents held the largest share of over 67.50% in 2023.

- The sequencing segment dominated the market and held a revenue share of over 35.82% in 2023.

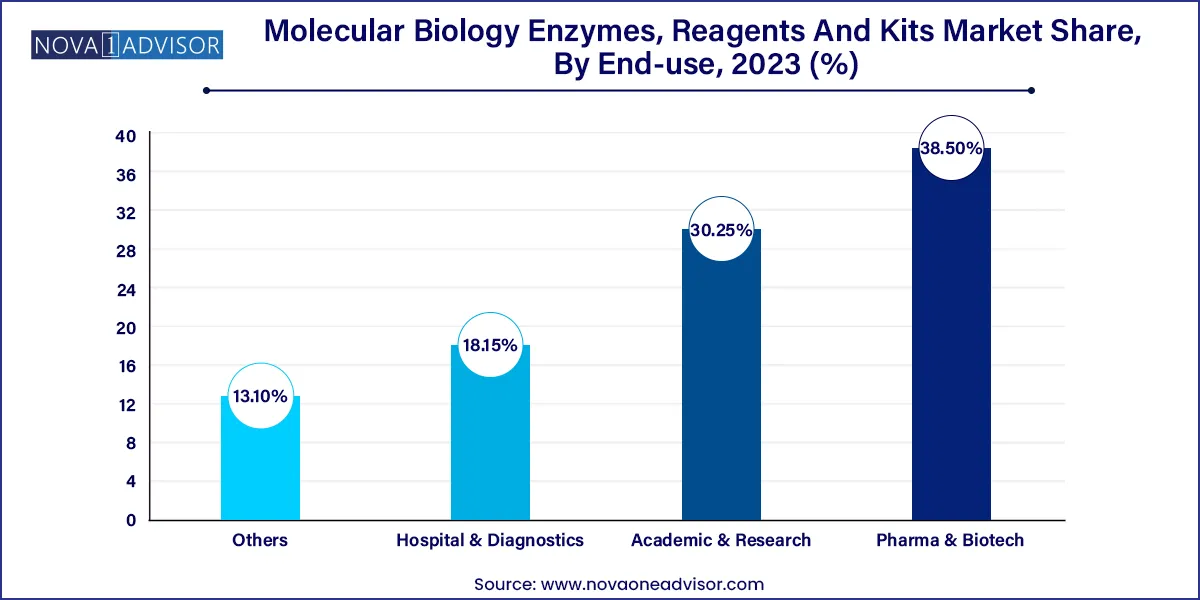

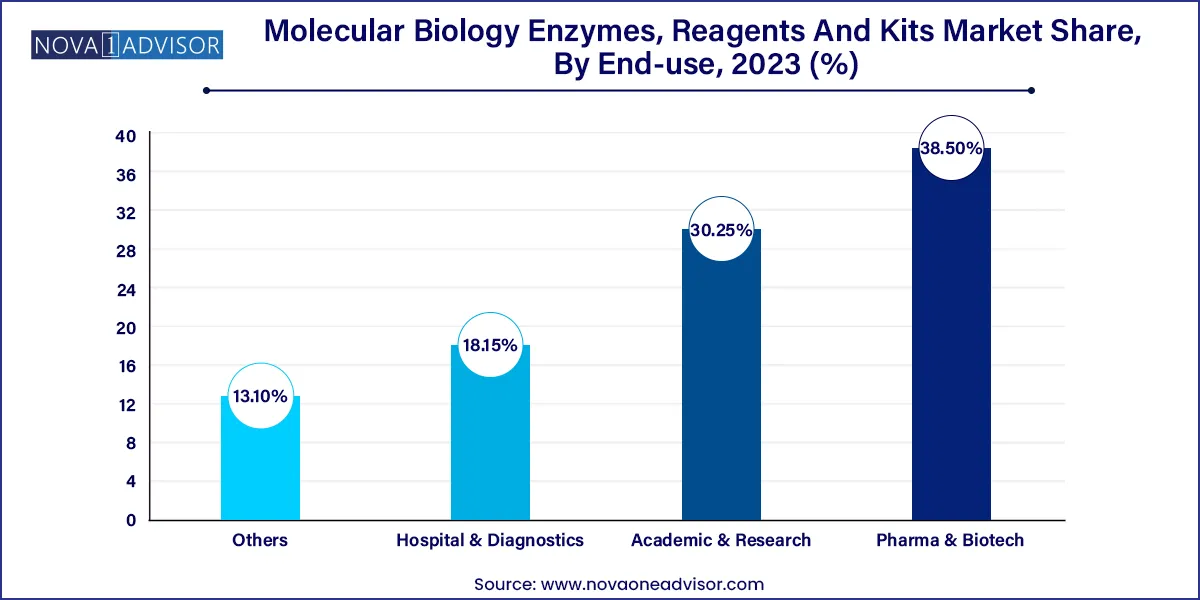

- The pharma and biotech segment held the largest share of around 38.50% in 2023.

- The academic and research segments held a prominent share in 2023.

Market Overview

The molecular biology enzymes, reagents, and kits market represents a foundational pillar of modern life sciences, enabling groundbreaking advances in genomics, proteomics, and personalized medicine. These components are essential in laboratories across pharmaceutical, biotechnology, clinical diagnostics, forensic science, and academic institutions. The market has expanded rapidly in recent years, underpinned by increased global investment in research and development, the growing prevalence of genetic disorders, and the widespread adoption of next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies.

Molecular biology tools are indispensable in applications ranging from cloning and gene editing to cancer diagnostics and infectious disease testing. For example, the COVID-19 pandemic spotlighted the role of PCR kits, viral RNA extraction reagents, and reverse transcriptase enzymes in enabling mass diagnostics. This incident not only expanded short-term demand but also triggered long-term investment in molecular diagnostics infrastructure. Additionally, the rise of CRISPR-Cas9 technology for genome editing, RNA-based therapeutics, and gene therapies is driving demand for specialized reagents and enzymes.

Moreover, governmental and private sector support for biotechnology research, especially in fields such as epigenetics, synthetic biology, and agricultural genomics, is fueling market growth. Academic institutions, startups, and multinational corporations are increasingly collaborating on research projects, further expanding the scope and scale of this market. With product innovation, automation in labs, and digital transformation reshaping workflows, the molecular biology enzymes, reagents, and kits market is set to remain a core component of the global biomedical research and diagnostics ecosystem.

Major Trends in the Market

-

Expansion of CRISPR and Gene Editing Applications: The increasing use of CRISPR-Cas systems in therapeutic research is boosting the demand for high-purity enzymes and reagents tailored for genome editing.

-

Rising Automation in Laboratories: Automated liquid handling systems and integrated molecular diagnostics platforms are driving the need for pre-validated kits that ensure consistency and reduce hands-on time.

-

Increased Investment in Cancer Genomics: The rising incidence of cancer and demand for early detection tools are propelling the use of sequencing and epigenetic analysis kits.

-

Miniaturization and Point-of-Care (POC) Testing: Compact PCR and sequencing devices are gaining popularity in clinical and field settings, pushing demand for versatile and stable reagents.

-

Sustainability in Reagent Manufacturing: Manufacturers are adopting eco-friendly production methods and recyclable packaging to reduce environmental impact.

-

Academic-Industrial Collaborations: Partnerships between universities and biotech firms are fostering innovation in reagent formulation and enzyme specificity.

-

Cloud-Based Data Analysis Integration: Kits now often come with associated software tools or cloud-based platforms for immediate interpretation of molecular biology results.

Molecular Biology Enzymes, Reagents And Kits Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 24.09 Billion |

| Market Size by 2033 |

USD 55.65 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.75% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; QIAGEN, Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; New England Biolabs; Merck KGaA; Promega Corporation; Takara Bio, Inc.; LGC Limited; Bausch Health Companies Inc. |

Market Driver: Growing Prevalence of Genetic Disorders and Chronic Diseases

One of the most compelling drivers in the molecular biology enzymes, reagents, and kits market is the surge in genetic and chronic diseases, which require precise molecular-level diagnostics and treatment planning. Conditions like cystic fibrosis, various cancers, and inherited cardiovascular diseases are increasingly being diagnosed using molecular techniques that rely on high-quality enzymes and reagents for DNA/RNA analysis. The global burden of cancer alone is a major factor, with organizations such as the WHO forecasting over 28 million new cancer cases annually by 2040. This surge fuels demand for sequencing and PCR-based diagnostics, all of which require reliable reagents and enzymes for sample preparation, amplification, and analysis.

Market Restraint: High Cost of Advanced Molecular Biology Kits and Reagents

Despite the market’s upward trajectory, the high cost of specialized kits and reagents remains a significant barrier, especially in resource-limited settings. Many advanced enzymes like high-fidelity DNA polymerases or modified reverse transcriptases are expensive due to the complexity of their production and purification processes. Furthermore, certain applications—like next-generation sequencing or epigenetic profiling require extensive reagent libraries and sophisticated instruments, raising the cost per sample and limiting accessibility in developing countries. Budget constraints in academic institutions and small-scale research labs often restrict the adoption of premium molecular biology solutions, thereby slowing market penetration.

Market Opportunity: Expanding Applications in Personalized Medicine and Companion Diagnostics

A major opportunity lies in the integration of molecular biology reagents into personalized medicine strategies, particularly for companion diagnostics. As treatment regimens become more tailored to individual genetic profiles, there is a growing need for molecular assays that can stratify patients, predict drug response, and monitor treatment efficacy. For example, sequencing kits and PCR panels are now used to identify EGFR, BRAF, and KRAS mutations in cancer patients, guiding targeted therapy. Similarly, epigenetic kits are used in studies linking methylation patterns to drug resistance. The evolution of personalized healthcare supported by regulatory agencies and healthcare payers—is expected to propel long-term growth in this space.

Segments Insights:

Molecular Biology Enzymes, Reagents And Kits Market By Product Insights

Kits & reagents dominate the product segment, accounting for the largest share due to their wide applicability across both research and diagnostics. These products offer convenience, consistency, and accuracy, enabling faster workflows in both high-throughput and small-scale lab environments. Ready-to-use kits are preferred for applications like PCR, sequencing, and cloning, reducing the need for manual buffer preparation and decreasing error rates. For example, qPCR kits bundled with fluorescent dyes and internal controls are staples in clinical diagnostics and academic research, especially when working under strict regulatory conditions.

Enzymes represent the fastest-growing product segment, driven by innovation in protein engineering and increased demand for customized enzymes. High-performance enzymes like proofreading DNA polymerases, reverse transcriptases with reduced RNase H activity, and thermostable ligases are gaining traction in complex applications like long-read sequencing and single-cell genomics. Companies are investing in recombinant enzyme production and enzyme stability under ambient conditions to meet emerging demands in field diagnostics and decentralized testing environments.

Molecular Biology Enzymes, Reagents And Kits Market By Application Insights

PCR continues to dominate the application segment, largely due to its widespread use in disease diagnostics, forensic testing, environmental monitoring, and food safety. PCR reagents are vital for the amplification of DNA/RNA sequences, and variants like real-time PCR and digital PCR have enhanced sensitivity and quantification accuracy. The COVID-19 pandemic reaffirmed the centrality of PCR in global health responses, and its applications have only expanded post-pandemic, especially in viral load quantification and pathogen detection.

Sequencing is the fastest-growing application segment, as next-generation sequencing becomes more affordable and clinically relevant. Whole genome sequencing (WGS), exome sequencing, and targeted gene panels require a wide array of specialized reagents from library prep kits to barcoded adaptors and magnetic bead clean-up systems. Clinical applications, such as cancer mutation profiling and neonatal genetic screening, are boosting demand. Moreover, advancements in nanopore and single-molecule sequencing are opening doors for new reagent formulations that ensure higher accuracy and throughput.

Molecular Biology Enzymes, Reagents And Kits Market By End-use Insights

Pharma & biotech companies dominate the end-use segment, with their extensive need for molecular biology products in drug development, genetic engineering, and clinical trials. These organizations heavily invest in kits and enzymes for applications like cloning therapeutic genes, producing recombinant proteins, or evaluating biomarkers. The rigorous quality control and compliance requirements in the pharma sector further boost demand for high-fidelity, batch-consistent products.

Academic & research institutes represent the fastest-growing end-use segment, fueled by increased funding from governmental bodies and non-profit organizations. Initiatives like the Human Cell Atlas and international genome consortiums have encouraged academic participation in large-scale molecular research. These institutions are focusing on emerging fields like synthetic biology, transcriptomics, and epigenetics—all of which demand high volumes of reagents and enzymes. The ease of online ordering and increased educational training in molecular techniques are also contributing to adoption growth.

Molecular Biology Enzymes, Reagents And Kits Market By Regional Insights

North America leads the global molecular biology enzymes, reagents, and kits market, driven by the U.S. biotechnology and pharmaceutical industries, which are among the most mature globally. The presence of leading market players such as Thermo Fisher Scientific, Bio-Rad, and NEB, combined with a high concentration of academic research institutions like Harvard and MIT, fuels continuous innovation. The NIH and NSF provide consistent grant support, encouraging basic and applied molecular research. In addition, regulatory clarity from the FDA regarding molecular diagnostics ensures streamlined product deployment in the clinical setting.

Asia-Pacific is the fastest-growing region, propelled by increasing research funding, improving healthcare infrastructure, and expanding biotech industries in countries like China, India, South Korea, and Japan. China’s massive investment in genomics—exemplified by the Beijing Genomics Institute (BGI)—has catalyzed local production and demand for molecular biology kits. India’s biotech sector, bolstered by government support through the DBT and BIRAC initiatives, is also experiencing a surge in R&D activity. Rising awareness of molecular diagnostics in clinical settings and the spread of academic research institutions contribute to rapid regional growth.

Some of the prominent players in the Molecular biology enzymes, reagents, and kits market include:

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Agilent Technologies, Inc.

- QIAGEN

- Promega Corporation

- New England Biolabs

- Merck KGaA

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Takara Bio, Inc.

- LGC Limited

- Bausch Health Companies Inc.

Recent Developments

-

Thermo Fisher Scientific (March 2025): Announced the launch of a high-throughput library prep kit for nanopore sequencing, tailored for clinical genomic labs requiring faster turnaround times.

-

New England Biolabs (NEB) (February 2025): Introduced a thermostable reverse transcriptase designed for challenging RNA samples, enhancing accuracy in single-cell applications.

-

QIAGEN (January 2025): Partnered with Illumina to co-market NGS reagent kits with integrated bioinformatics solutions for cancer diagnostics.

-

Takara Bio (December 2024): Launched a new epigenetics kit optimized for low-input DNA methylation analysis, targeting neuroscience and oncology researchers.

-

Agilent Technologies (November 2024): Expanded its automation-compatible PCR kit line with lyophilized reagents for enhanced shelf-life in remote laboratory conditions.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global molecular biology enzymes, reagents, and kits market.

Product

Application

- Cloning

- Sequencing

- PCR

- Epigenetics

- Restriction Digestion

- Other Applications

End-use

- Pharma & Biotech

- Academic & Research

- Hospital & Diagnostics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)