Molecular Diagnostics Market Size and Growth Forecast 2026-2035

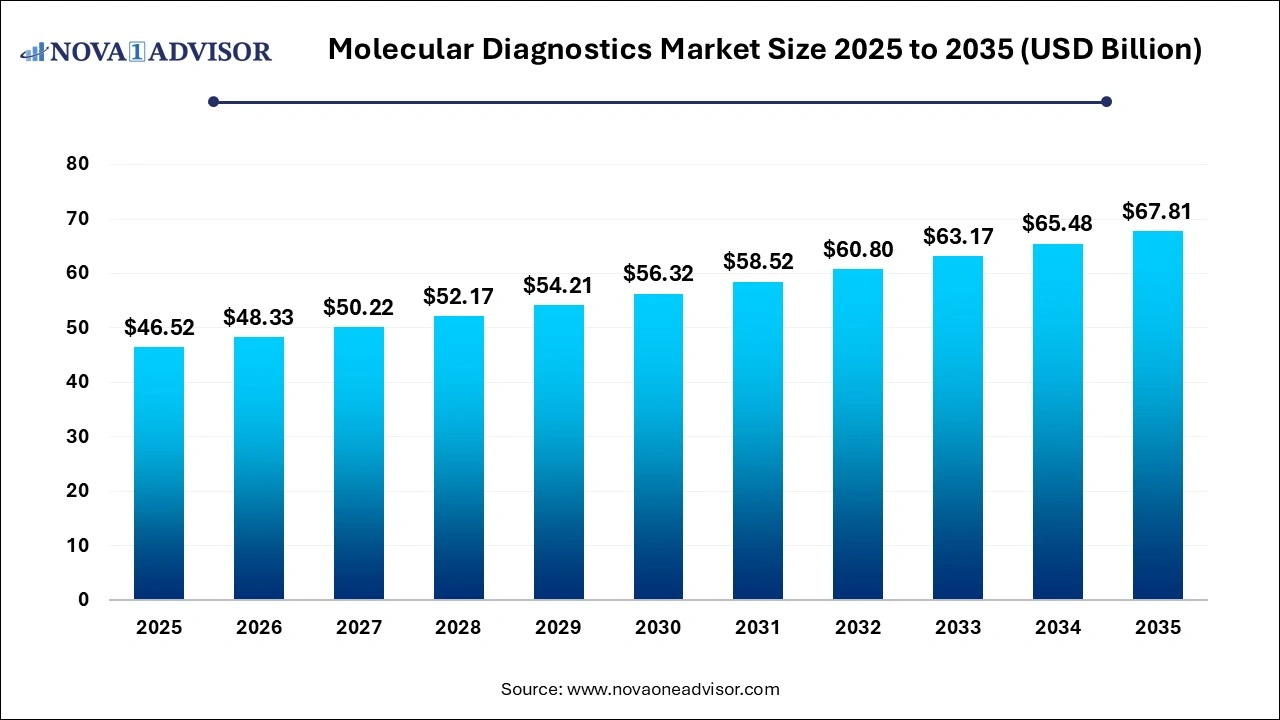

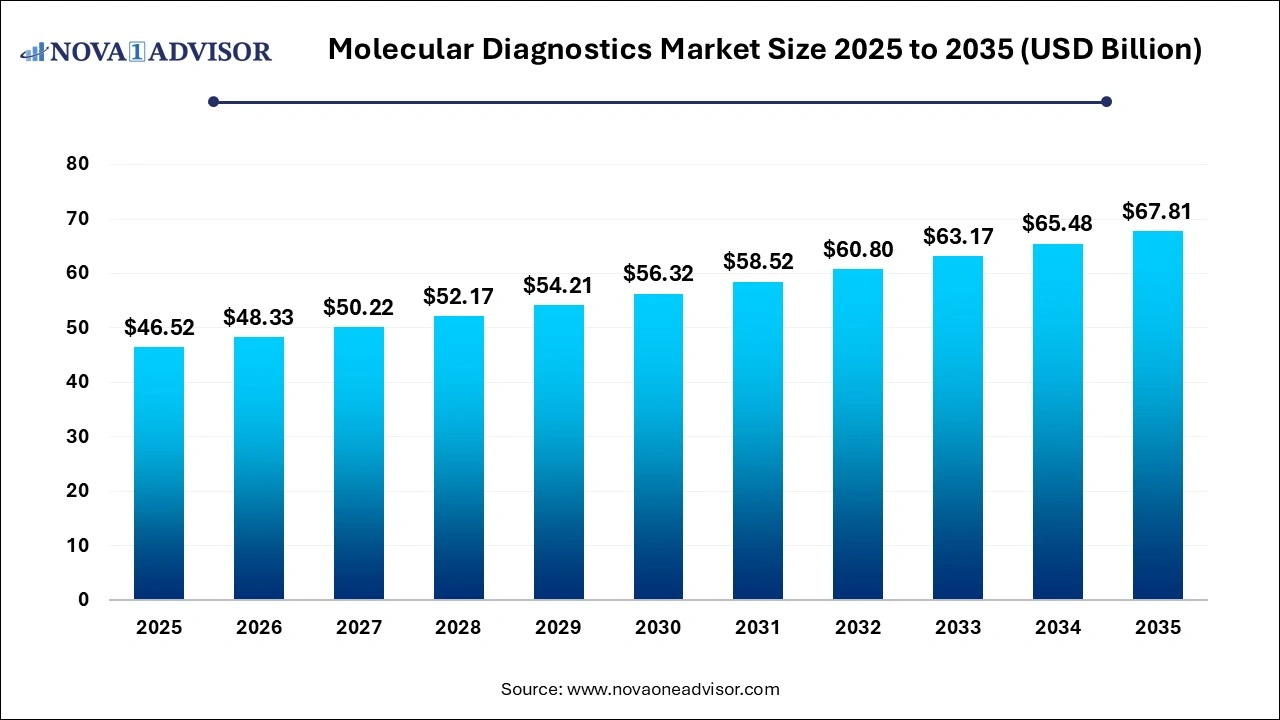

The global molecular diagnostics market size was USD 46.52 billion in 2025, calculated at USD 48.33 billion in 2026 and is expected to reach around USD 67.81 billion by 2035, expanding at a CAGR of 3.84%from 2026 to 2035.

Molecular Diagnostics Market Key Takeaways

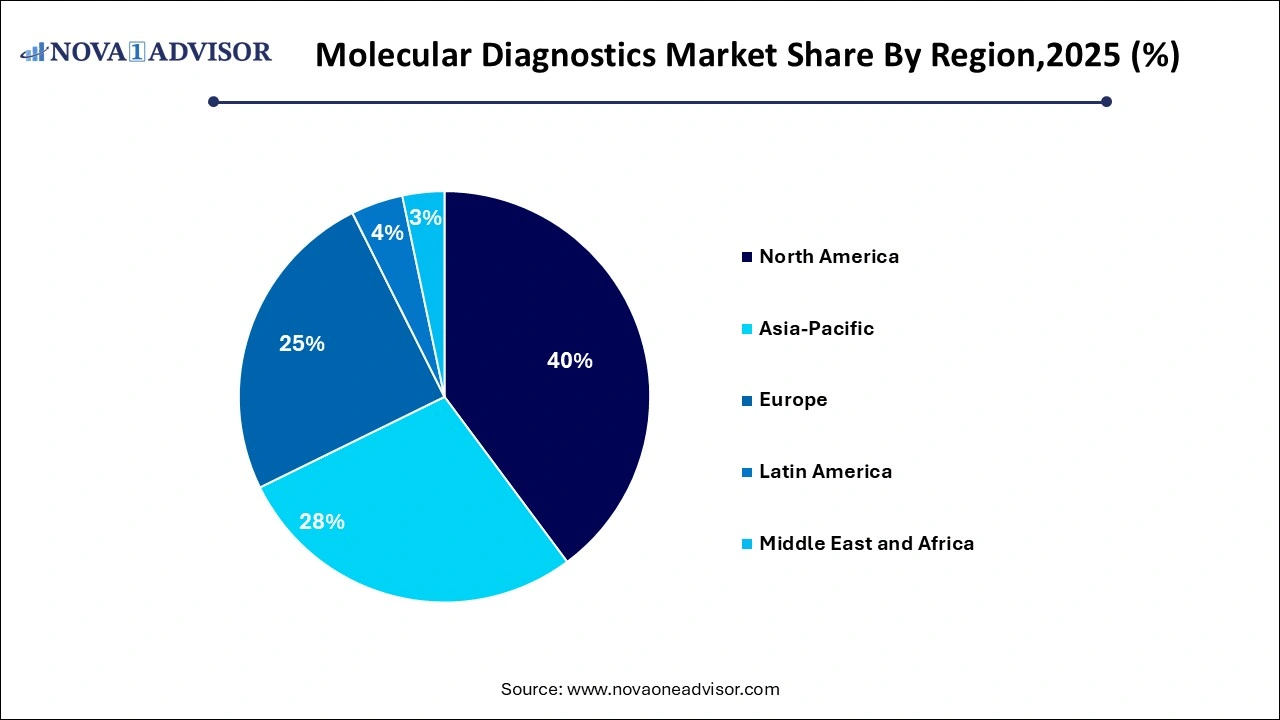

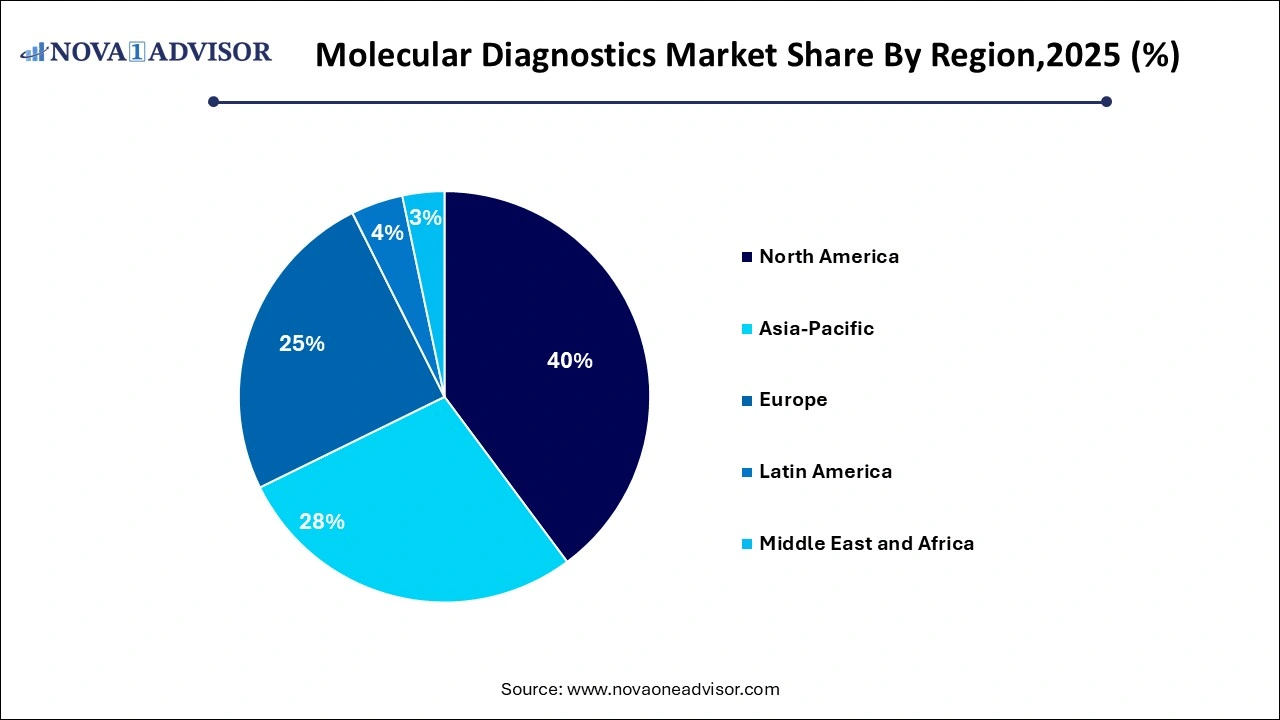

- North America dominated the market and accounted for a 40.22% share in 2025.

- Asia Pacific is anticipated to exhibit significant growth from 2026 to 2035.

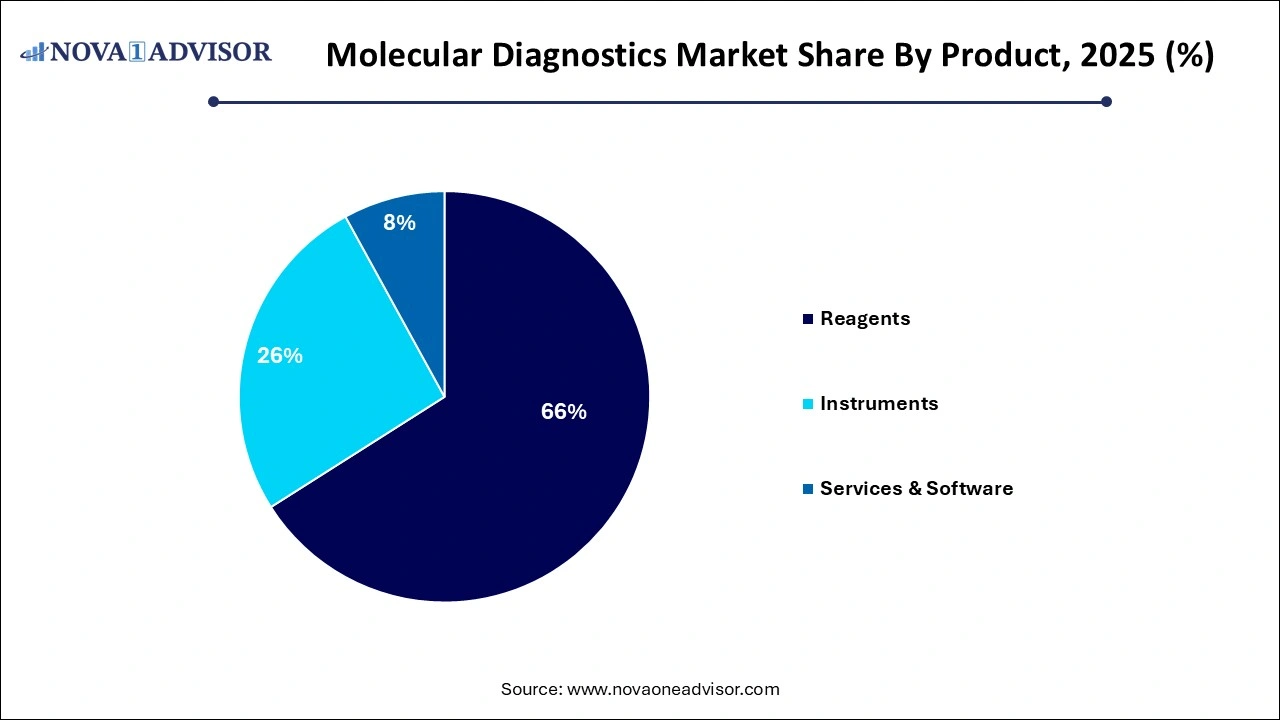

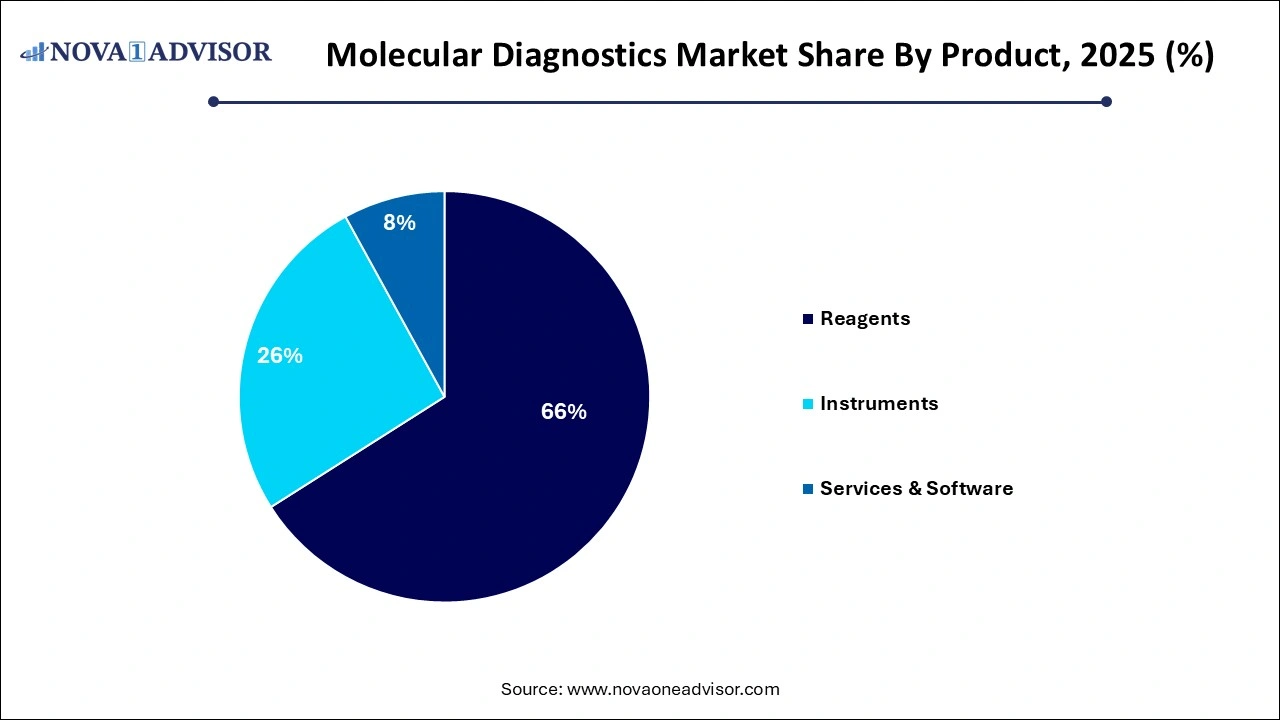

- The reagents segment dominated the market and accounted for a share of 66% of the global revenue in 2025.

- The polymerase chain reaction technology segment accounted for the largest revenue share in 2025.

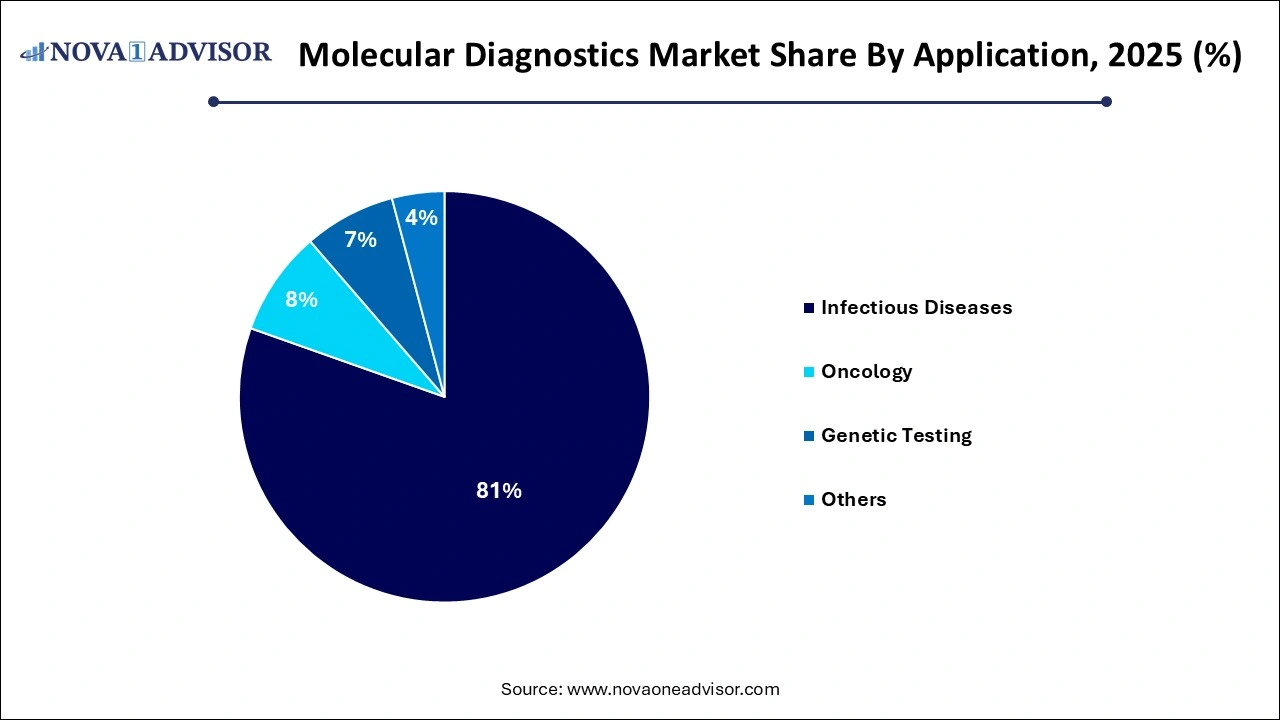

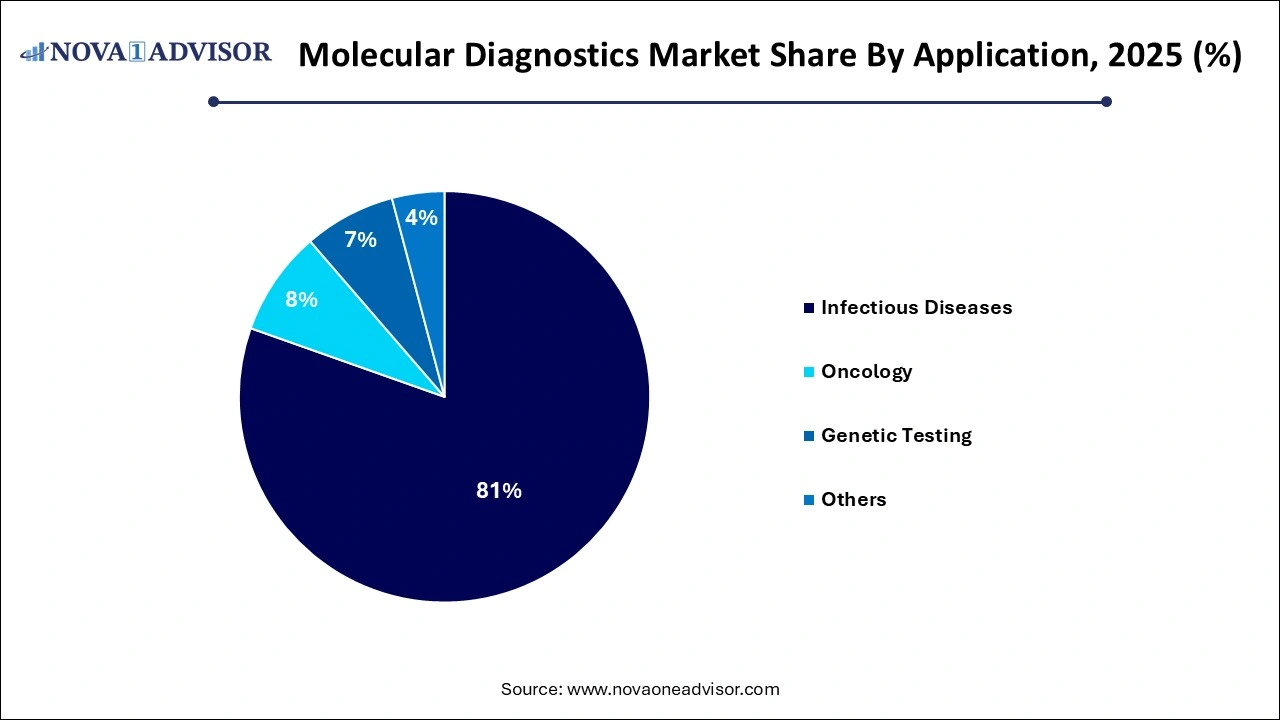

- The infectious diseases segment accounted for the largest revenue share of 78% in 2025.

- The central laboratories segment dominated the industry in 2025.

Molecular Diagnostics Market Overview

The global molecular diagnostics market is undergoing a period of transformative growth, driven by advancements in technology, rising demand for precision medicine, and the increasing prevalence of infectious and chronic diseases. Molecular diagnostics, which involves analyzing biological markers in the genome and proteome, enables early disease detection, prognosis, and therapeutic monitoring with unparalleled specificity and sensitivity.

The market has expanded significantly post the COVID-19 pandemic, with widespread adoption of molecular tests for viral detection bringing new investments and innovations. Beyond infectious diseases, applications in oncology, genetic testing, pharmacogenomics, and microbiology are driving continuous evolution.

Advancements in polymerase chain reaction (PCR), next-generation sequencing (NGS), isothermal amplification technologies, and digital PCR platforms are reshaping diagnostic workflows. Additionally, the shift towards decentralized testing, including point-of-care (POC) molecular diagnostics and self-testing solutions, is revolutionizing healthcare delivery.

As precision medicine initiatives gain momentum and healthcare systems emphasize early diagnosis and prevention, the molecular diagnostics market is poised for robust growth across emerging and developed economies alike.

Molecular Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 48.33 Billion |

| Market Size by 2035 |

USD 67.81 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 3.84% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Test Location, Technology, Application, End User, and Geography |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Siemens Healthineers AG (Germany), Quidel Corporation (US), F. Hoffmann-La Roche Ltd. (Switzerland), Hologic, Inc. (US), Thermo Fisher Scientific, Inc. (US), Danaher Corporation (US), Illumina, Inc. (US), Becton, Dickinson and Company (US), Grifols, S.A. (Spain), PerkinElmer, Inc. (US), Abbott Laboratories (US), bioMérieux SA (France), QIAGEN N.V. (Netherlands), Myriad Genetics, Inc. (US), Agilent Technologies, Inc. (US), geneOmbio Technologies Pvt. Ltd. (India) |

Molecular Diagnostics Market Dynamics

Drivers

Rising requirement for cancer diagnostics

According to the National Institutes of Health's projection, there will be approximately 1,958,310 cancer cases in the United States in 2023. This number of rising cases of cancer brings demand for early diagnosis of cancer across the globe. Molecular diagnostics plays a crucial role in the early detection of cancer. Molecular diagnostics identify cancer-related biomarkers at an early stage, healthcare providers can diagnose cancer before symptoms arise, leading to earlier treatment initiation. Cancer continues to be a leading cause of morbidity and mortality across the globe, as the cancer cases increase, the demand for accurate and precise diagnostic method also grows. This element is observed to pose a driver for the market.

Development of precision medicine

Precision medicine focuses on tailoring medical treatments and interventions to individual patients based on their unique genetic makeup, lifestyle, and environmental factors. Molecular diagnostics play a crucial role in this approach by enabling the identification of specific biomarkers, genetic mutations, and gene expression patterns that can guide treatment decisions for each patient. Molecular diagnostics have become an essential component of the drug development process. Companion diagnostics are tests used to identify patients who are most likely to respond positively to a particular treatment. By identifying suitable candidates for specific therapies, companion diagnostics help pharmaceutical companies improve the success rates of clinical trials and streamline the drug development process. Thereby, drives the growth of the market.

Restraints

Presence of alternative diagnostic methods

Alternative diagnostic methods, such as traditional laboratory tests or imaging techniques, may already be established and widely accepted in the medical community. When molecular diagnostics compete with these existing methods, it can be challenging to gain market share and acceptance, especially if the alternatives are perceived as more cost-effective or easier to implement. Molecular diagnostics often involve sophisticated technologies and specialized equipment, making them more expensive than some conventional diagnostic methods. This cost factor can hinder their adoption, especially in resource-limited settings where healthcare facilities may not have the financial means to invest in expensive molecular diagnostic infrastructure. Thus, the presence of alternative testing methods in the market creates a restraint for the market.

Stringent regulatory policies

Stringent regulatory requirements act as barriers to entry for new entrants in the molecular diagnostics market. As a consequence, established companies with already approved products may have a competitive advantage, making it difficult for newcomers to gain a foothold. Regulatory agencies often work closely with healthcare payers to determine the coverage and reimbursement of molecular diagnostic tests. Uncertain or restrictive reimbursement policies can create financial uncertainties for companies, affecting their willingness to invest in research and development, market expansion, or product improvement. Such policies or guidelines are observed to hamper the market’s expansion.

Opportunity

Rising focus on less-invasive testing methods

Less invasive testing methods can enable earlier detection and continuous monitoring of diseases, leading to better treatment outcomes and overall patient management. Patients often prefer non-invasive or minimally invasive procedures as they are less painful, have shorter recovery times, and reduce the risk of complications. The aging population is more prone to chronic diseases that require frequent monitoring, making less invasive testing methods particularly beneficial for this demographic. Molecular diagnostics has enabled the development of blood tests that can detect specific genetic, or protein markers associated with various diseases. These tests can provide valuable information without the need for invasive procedures, making them more appealing to both patients and healthcare providers. Thus, the rising demand for less invasive testing methods creates significant opportunities for the molecular diagnostics market.

Challenge

Data safety challenges

Molecular diagnostics heavily rely on the analysis and sharing of sensitive genomic information, data privacy and security becomes critical issues. The rise in cyberattack and data breaches to personal health information could deter patients and healthcare providers from embracing molecular diagnostics technologies. Concerns about how companies handle, or store genetic data might also deter users, patients or consumers from adopting such services. All these factors associated with data safety concerns create a significant challenge for the market.

Molecular Diagnostics Market Segment Insights

By Product Insights

Reagents dominated the product segment of the molecular diagnostics market. Reagents are crucial components of molecular assays, including nucleic acid extraction kits, PCR reagents, sequencing reagents, and probes. High consumption rates per test, regular purchasing cycles, and the rise of multiplex assays that require specialized reagents have driven this segment’s dominance. Companies like Roche, Thermo Fisher Scientific, and Qiagen consistently invest in expanding their reagent portfolios to cater to diverse testing needs.

Meanwhile, Services & Software are witnessing the fastest growth within this segment. As molecular diagnostics become more complex, the demand for advanced data analysis, interpretation software, and bioinformatics services is surging. Laboratories seek turnkey solutions encompassing not just instrumentation and consumables but also analytical platforms to manage and interpret massive genomic data, particularly in NGS and personalized medicine applications.

By Technology Used Insights

Polymerase Chain Reaction (PCR) technology dominated the technology segment. PCR remains the backbone of molecular diagnostics due to its unparalleled sensitivity, specificity, and wide applicability in infectious disease testing, oncology, and genetic screening. Multiplex PCR and real-time (qPCR) technologies, in particular, enable rapid and cost-effective detection of multiple targets. Companies like Bio-Rad, Abbott, and Roche Diagnostics lead this space with robust PCR product lines.

However, Sequencing technologies are experiencing the fastest growth. Next-generation sequencing (NGS) has revolutionized molecular diagnostics by enabling comprehensive genomic profiling, uncovering mutations, and identifying novel pathogens. Falling costs, advancements in automation, and growing applications in oncology, rare diseases, and infectious disease surveillance are driving the exponential growth of sequencing technologies.

By Application Insights

Infectious diseases dominated the application segment of the molecular diagnostics market. The COVID-19 pandemic amplified global awareness of the need for rapid molecular diagnostics, while ongoing challenges like antibiotic resistance, TB, HIV, and hepatitis maintain strong testing demand. Multiplex respiratory panels, gastrointestinal panels, and blood-borne pathogen tests exemplify the sector's robustness.

In contrast, Oncology is the fastest-growing application area. Precision oncology, powered by genomic insights, is fueling the demand for molecular diagnostics. Applications such as liquid biopsy for non-invasive tumor detection, companion diagnostics for targeted therapy selection, and MRD (Minimal Residual Disease) monitoring are witnessing robust investment and rapid adoption across healthcare settings.

In contrast, Oncology is the fastest-growing application area. Precision oncology, powered by genomic insights, is fueling the demand for molecular diagnostics. Applications such as liquid biopsy for non-invasive tumor detection, companion diagnostics for targeted therapy selection, and MRD (Minimal Residual Disease) monitoring are witnessing robust investment and rapid adoption across healthcare settings.

By Test Location Insights

Central laboratories dominated the test location segment. Large centralized labs, including reference labs and hospital labs, handle high-volume molecular testing due to their advanced infrastructure, automation capabilities, and skilled personnel. Central labs are critical for complex assays requiring significant processing capabilities, such as NGS and high-throughput PCR testing.

Meanwhile, Point-of-Care (POC) testing is growing fastest. The demand for decentralized, rapid diagnostics at bedside, clinics, and even home settings is expanding, especially after the COVID-19 pandemic showcased the importance of immediate diagnosis. POC molecular tests for respiratory viruses, sexually transmitted infections, and genetic markers are becoming increasingly available, driving the rapid growth of this segment.

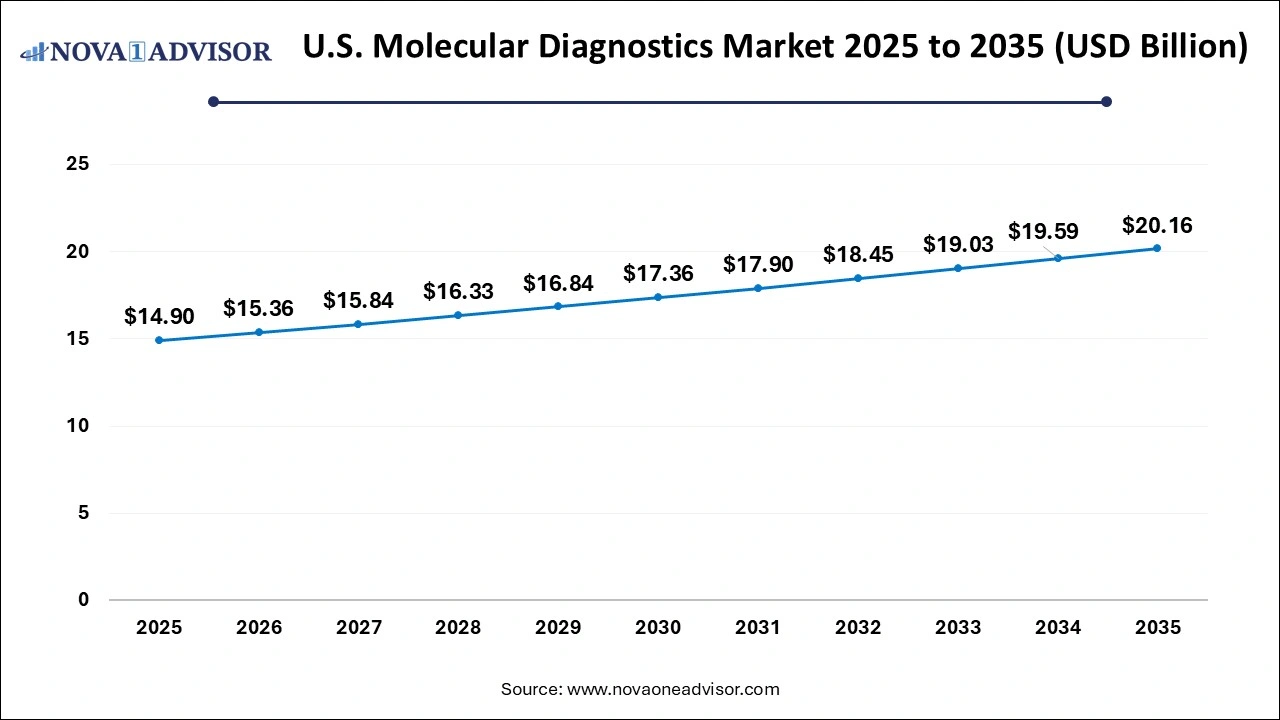

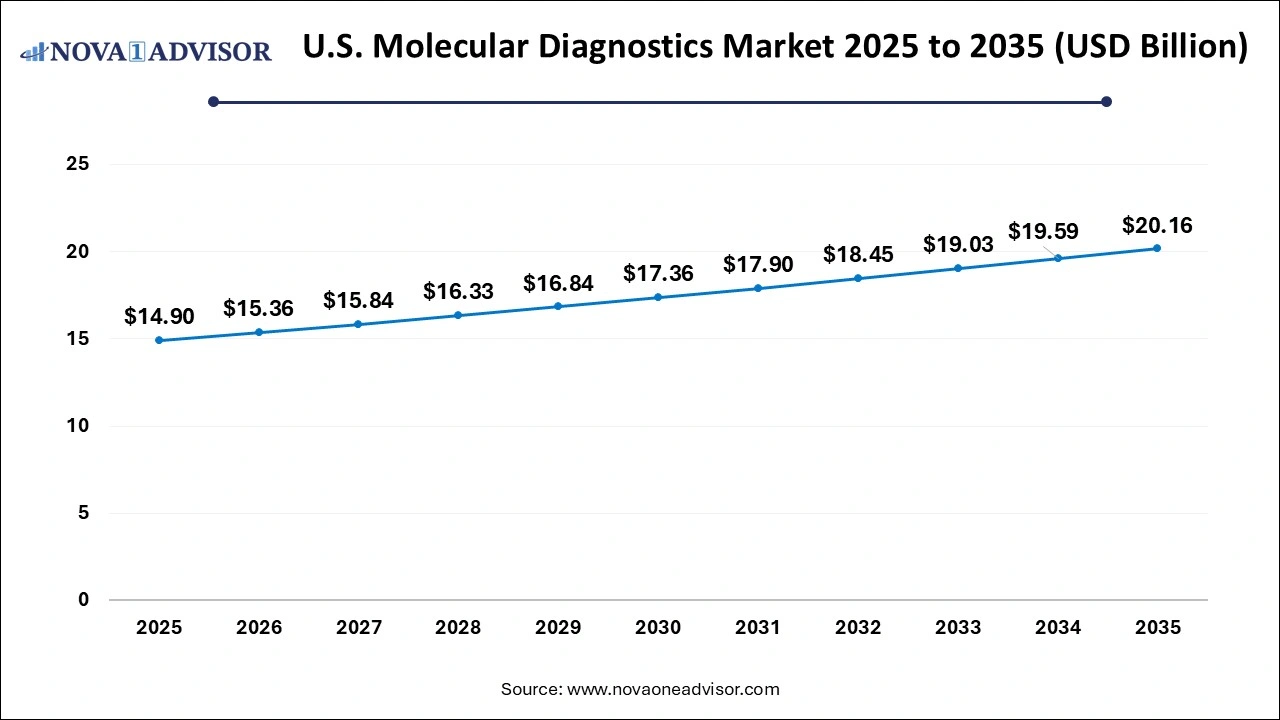

U.S. Molecular Diagnostics Market Size, Industry Report 2026 to 2035

The U.S. molecular diagnostics market size was valued at USD 14.9 billion in 2025 and is anticipated to reach around USD 20.16 billion by 2035, growing at a CAGR of 3.07% from 2026 to 2035.

North America dominated the global molecular diagnostics market. The region benefits from a strong healthcare infrastructure, high per capita healthcare expenditure, technological advancements, and a proactive regulatory environment. Companies like Abbott Laboratories, Thermo Fisher Scientific, and Cepheid (Danaher) are headquartered in North America, reinforcing regional leadership. The rapid adoption of companion diagnostics in oncology, widespread infectious disease testing, and high public awareness contribute significantly to North America's dominance.

Asia-Pacific is the fastest-growing region in the molecular diagnostics market. Rapid urbanization, rising chronic and infectious disease burdens, improving access to healthcare, and government initiatives promoting diagnostic infrastructure are driving regional growth. Additionally, local companies and global players are increasingly targeting Asia-Pacific for clinical trials, product launches, and partnerships, fueling vibrant market expansion across China, India, Japan, South Korea, and Southeast Asia.

Asia-Pacific is the fastest-growing region in the molecular diagnostics market. Rapid urbanization, rising chronic and infectious disease burdens, improving access to healthcare, and government initiatives promoting diagnostic infrastructure are driving regional growth. Additionally, local companies and global players are increasingly targeting Asia-Pacific for clinical trials, product launches, and partnerships, fueling vibrant market expansion across China, India, Japan, South Korea, and Southeast Asia.

Molecular Diagnostics Market Top Key Companies:

- BD

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Abbott

- Agilent Technologies, Inc.

- Danaher

- Hologic Inc. (Gen Probe)

- Illumina, Inc.

- Grifols, S.A.

- QIAGEN

- F. Hoffmann-La Roche, Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

Molecular Diagnostics Market Recent Developments

-

April 2025: Roche Diagnostics launched its "cobas omni Utility Channel" in Europe, enabling laboratories to consolidate molecular assays on a single high-throughput platform.

-

March 2025: Illumina Inc. introduced "NovaSeq X Series," its next-generation sequencing platforms, designed to double data output while reducing sequencing costs.

-

February 2025: Abbott received FDA clearance for its "Alinity m Respiratory Panel 2" assay for multiplex detection of COVID-19, influenza A/B, and RSV.

-

January 2025: Qiagen announced a strategic partnership with BioNTech to develop companion diagnostics for mRNA-based immunotherapies.

Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 20353. For this study, Nova one advisor, Inc. has segmented the Molecular Diagnostics market.

By Product

- Instruments

- Reagents

- Services & Software

By Technology

- Polymerase chain reaction (PCR)

- By Type

- By Product

- Instruments

- Reagents

- Others

- In Situ Hybridization (ISH)

- Instruments

- Reagents

- Others

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Instruments

- Reagents

- Others

- Chips and Microarrays

- Instruments

- Reagents

- Others

- Mass Spectrometry

- Instruments

- Reagents

- Others

- Sequencing

- Instruments

- Reagents

- Others

- Transcription Mediated Amplification (TMA)

- Instruments

- Reagents

- Others

- Others

- Instruments

- Reagents

- Others

By Application

- Oncology

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Cervical Cancer

- Kidney Cancer

- Liver Cancer

- Blood Cancer

- Lung Cancer

- Other Cancer

- Pharmacogenomics

- Infectious Diseases

- Methicillin-resistant Staphylococcus Aureus (MRSA)

- Clostridium Difficile

- Vancomycin-resistant Enterococci (VRE)

- Carbapenem-resistant Bacteria

- Flu

- Respiratory Syncytial Virus (RSV)

- Candida

- Tuberculosis and Drug-resistant TBA

- Meningitis

- Gastrointestinal Panel Testing

- Chlamydia

- Gonorrhea

- HIV

- Hepatitis C

- Hepatitis B

- Other Infectious Diseases

- Genetic Testing

- Newborn Screening

- Predictive and Presymptomatic Testing

- Other Genetic Testing

- Neurological Disease

- Cardiovascular Disease

- Microbiology

- Others

By Test Location

- Point of Care

- Self-test or OTC

- Central Laboratories

By End User

- Diagnostic Laboratories

- Hospitals & Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

In contrast, Oncology is the fastest-growing application area.

In contrast, Oncology is the fastest-growing application area.

Asia-Pacific is the fastest-growing region in the molecular diagnostics market. Rapid urbanization, rising chronic and infectious disease burdens, improving access to healthcare, and government initiatives promoting diagnostic infrastructure are driving regional growth. Additionally, local companies and global players are increasingly targeting Asia-Pacific for clinical trials, product launches, and partnerships, fueling vibrant market expansion across China, India, Japan, South Korea, and Southeast Asia.

Asia-Pacific is the fastest-growing region in the molecular diagnostics market. Rapid urbanization, rising chronic and infectious disease burdens, improving access to healthcare, and government initiatives promoting diagnostic infrastructure are driving regional growth. Additionally, local companies and global players are increasingly targeting Asia-Pacific for clinical trials, product launches, and partnerships, fueling vibrant market expansion across China, India, Japan, South Korea, and Southeast Asia.