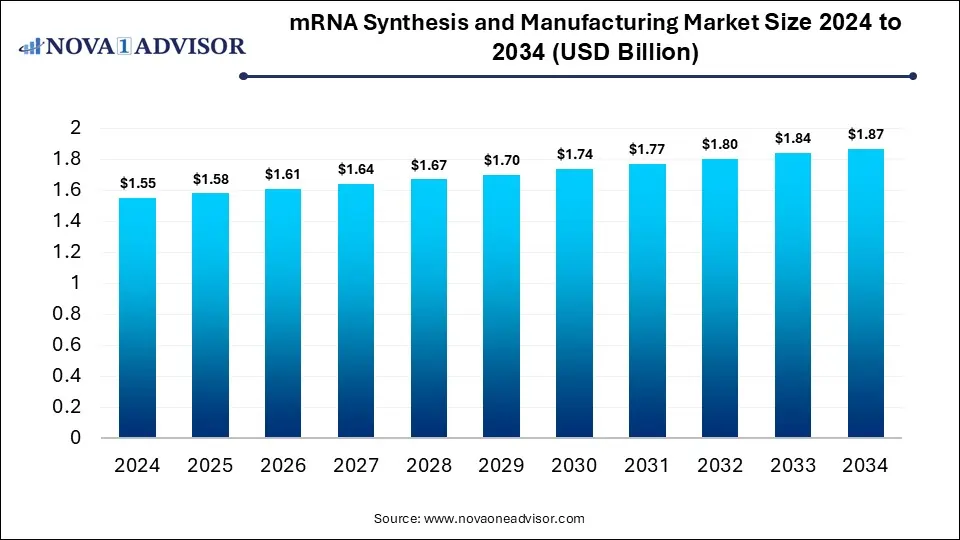

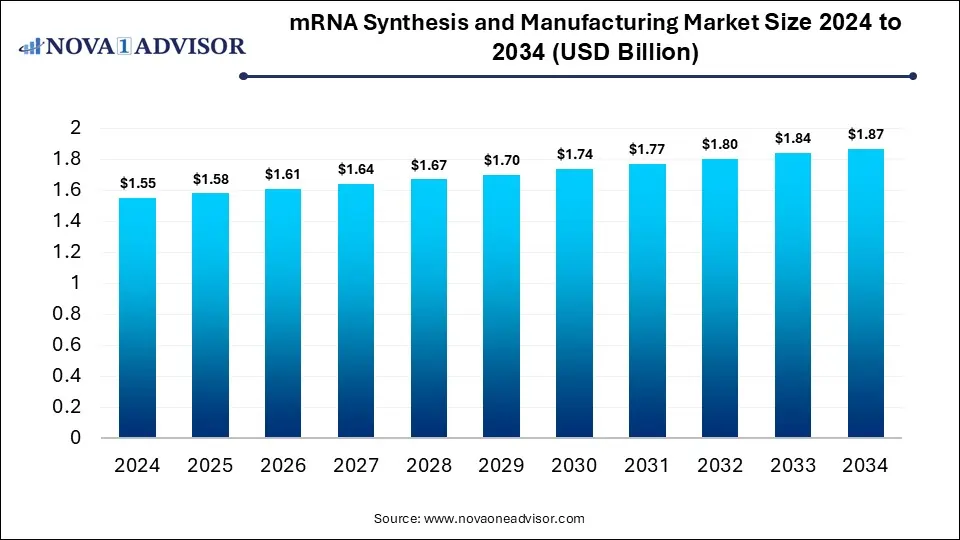

mRNA Synthesis & Manufacturing Market Size and Forecast 2025 to 2034

The global mRNA synthesis & manufacturing market size is calculated at USD 1.55 billion in 2024, grows to USD 1.58 billion in 2025, and is projected to reach around USD 1.87 billion by 2034, growing at a CAGR of 1.9% from 2025 to 2034. The market is growing due to rising demand for mRNA-based vaccines and therapeutics for infectious diseases and cancer. Additionally, advancements in delivery technologies and large-scale production capabilities are accelerating its adoption in biopharma.

Key Takeaways

- North America dominated the mRNA synthesis & manufacturing market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By type of product, the drug substance (APIs) segment dominated the market with a revenue share in 2024.

- By type of product, the drug product (FDFs) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application area, the mRNA-based vaccines segment led the market with the largest revenue share in 2024.

- By application area, the mRNA-based therapeutics segment is expected to grow significantly in the market during the forecast period.

- By therapeutic area, the infectious diseases segment held the highest market share in 2024.

- By therapeutic area, the oncological disorders segment is expected to grow significantly in the market during the forecast period.

How mRNA Synthesis & Manufacturing Market Evolving?

The market refers to the industry focused on producing messenger RNA molecules and developing scalable platforms, technologies, and services for their use in vaccines, therapeutic, and research applications. The mRNA synthesis & manufacturing market is evolving through innovation in cell-free enzymatic synthesis, integration of AI-driven design for optimized sequences, and adoption of modular, flexible facilities to accelerate production timelines. Companies are focusing on thermostable formulation to enhance global distribution, particularly in regions with limited cold-chain infrastructure. Moreover, increasing patent filings, regulatory approvals, and expansion into veterinary medicine and chronic disease management highlight how the market is diversifying beyond infectious diseases.

- For Instance, In April 2024, CureVac partnered with MD Anderson Cancer Center to advance the development of ready-to-use mRNA cancer vaccines targeting both blood-related cancers and solid tumors.

What are the Key trends in the mRNA Synthesis & Manufacturing Market in 2024?

- In April 2024, TriLink BioTechnologies, part of Maravai LifeSciences, signed a license and supply deal with Lonza to integrate its CleanCap mRNA capping technology into Lonza’s worldwide mRNA development and manufacturing operations.

- In April 2024, New England Biolabs (US) introduced the Monarch Mag Viral DNA/RNA Extraction Kit, designed to improve the yield of low-level viral nucleic acids.

How Can AI Affect the mRNA Synthesis & Manufacturing Market?

AI is transforming the market by enabling digital twins of production systems, which allow virtual simulations to optimize workflows and minimize resource waste. It supports predictive maintenance of equipment, reducing downtime and improving efficiency in large-scale facilities. AI algorithms also assist in supply chain management, ensuring the timely availability of raw materials. Furthermore, its role in analyzing real-time process data enhances batch consistency and accelerates regulatory submissions with stronger data-driven validation.

Report Scope of mRNA Synthesis and Manufacturing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.58 Billion |

| Market Size by 2034 |

USD 1.87 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 1.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type of Product, Application Area, Therapeutic Area |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd., Jena Bioscience GmbH, Merck KGaA, Yeasen Biotechnology (Shanghai) Co., Ltd., BOC Sciences, Thermo Fisher Scientific, Inc., Maravai LifeSciences, New England Biolabs, Creative Biogene, HONGENE. |

Market Dynamics

Driver

Growing Demand For Personalized Medicine

The growing demand for personalized medicine drives the mRNA synthesis & manufacturing market as it creates a need for flexible, small-batch production systems capable of generating patient-specific therapies. mRNA platforms can be rapidly adapted to produce individualized doses, supporting niche treatments where conventional large-scale methods are inefficient. This shift pushes manufacturers to adapt modular facilities, advanced analytics, and adaptive regulatory pathways, ultimately fostering innovation and expanding the scope of mRNA application in customized healthcare solutions.

- For Instance, In July 2024, Moderna received USD 176 million from the US government to advance its mRNA influenza vaccine. By 2023, more than 150 clinical trials had been registered for mRNA therapies, reflecting their expanding use across diverse areas such as cancer and infectious diseases.

Restraint

High Production Cost

High production cost restrains the mRNA synthesis & manufacturing market in 2024 because scaling up from laboratory to commercial levels involves significant investment in GMP-compliant facilities and regulatory validation. Frequent process optimization, technology upgrade, and stringent safety testing further raise expenses. Moreover, reliance on limited suppliers for critical components leads to price fluctuations. These financial burdens make it challenging for smaller biotech firms to compete, slowing innovation and restricting broader global deployment of mRNA-based solutions.

Opportunity

Advancements in Drug Delivery Technologies

Advancements in drug delivery technologies is a future opportunity in the mRNA synthesis & manufacturing market because it enables oral, inhalable, or implantable formulations that overcome current limitations of injectable delivery. Such innovations can improve patient compliance, reduce administration costs, and open new therapeutic areas like respiratory and gastrointestinal disorders. By simplifying delivery and expanding treatment routes, these technologies have the potential to make mRNA therapies more practical, scalable, and widely accessible across diverse healthcare settings.

- For Instance, In February 2024, researchers at Columbia University developed an innovative inhalable therapy using exosome-based nanobubbles to deliver interleukin-12 (IL-12) mRNA directly to the lungs in mice. This method enabled targeted pulmonary delivery of mRNA for lung cancer treatment, bypassing traditional injection approaches and potentially reducing systemic side effects.

Segmental Insights

How will the Drug Substance (APIs) Segment dominate the mRNA Synthesis & Manufacturing Market in 2024?

The drug substance (APIs) segment led the market in 2024 as companies increasingly prioritized proprietary mRNA sequences and optimized constructs, which are central to product differentiation and intellectual property value. Unlike consumables or services, ADPs represent the core innovation driving regulatory approvals and clinical progress. The surge in clinical trials for diverse disease areas further emphasized the need for robust API development, making it the largest contributor to revenue within the mRNA it largest contributor to revenue within the mRNA synthesis & manufacturing market.

The drug product (FDFs) segment is estimated to grow at the fastest CAGR as manufacturers shift towards integrating large-scale fill-finish capabilities to meet surging global demand. Growth is further supported by advancements in formulation techniques that extend shelf life and reduce cold-chain dependency, improving distribution efficiency. Strategic collaborations between biotech firms and CMOs are also fueling innovation in packaging and delivery formats, positioning FDFs as a critical area for scaling mRNA therapies in diverse healthcare markets.

MRNA Synthesis & Manufacturing Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Drug Substance (APIs) |

0.85 |

0.87 |

0.89 |

0.91 |

0.93 |

0.95 |

0.98 |

1 |

1.02 |

1.04 |

1.07 |

| Drug Product (FDFs) |

0.7 |

0.71 |

0.72 |

0.73 |

0.74 |

0.75 |

0.76 |

0.77 |

0.78 |

0.8 |

0.8 |

Why Did the mRNA-based Vaccines Segment Dominate the Market in 2024?

The mRNA-based vaccines segment held the largest revenue share in 2024 as companies expanded commercial supply agreements and secured long-term contracts with governments and global health agencies. Growing acceptance of mRNA vaccines in routine immunization programs, such as seasonal flu and pediatric use, further strengthened market dominance. In addition, continuous clinical progress in developing multivalent and pan-variant vaccines supports wider adoption, positioning this segment as the leading contributor to revenue within the mRNA synthesis & manufacturing market.

The mRNA-based therapeutic segment is set to grow rapidly as healthcare systems increasingly seek personalized and regenerative treatments that traditional drugs cannot address. Expansion into combination therapies, where mRNA is used alongside cell or gene-based platforms, is creating new clinical possibilities. Moreover, partnerships between biotech firms and academic institutions are driving breakthroughs in chronic disease management, such as cardiovascular and metabolic disorders, further propelling the segment growth during the forecast period.

MRNA Synthesis & Manufacturing Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| mRNA-based Vaccines |

1.08 |

1.08 |

1.08 |

1.07 |

1.07 |

1.06 |

1.06 |

1.05 |

1.04 |

1.04 |

1.03 |

| mRNA-based Therapeutics |

0.47 |

0.5 |

0.53 |

0.57 |

0.6 |

0.64 |

0.68 |

0.72 |

0.76 |

0.8 |

0.84 |

How does the Infectious Diseases Segment Dominate the mRNA Synthesis & Manufacturing Market?

In 2024, the infectious diseases segment dominated the market as pharmaceutical companies expanded pipelines beyond COVID-19 to include next-generation vaccines for tuberculosis, malaria, and Zika. The rising prevalence of antimicrobial resistance also accelerates the need for innovative mRNA-based solutions. Furthermore, international collaboration and funding from organizations like CEPI and Gavi strengthened large-scale development programs, ensuring infectious diseases remained the top therapeutic area within the mRNA synthesis & manufacturing market.

The oncological disorders segment is projected to expand rapidly as researchers explore mRNA for encoding tumor-specific antigens and delivering oncolytic proteins that directly disrupt cancer cells. Advancements in intratumoral and localized delivery approaches are enhancing treatment precision while minimizing systemic side effects. Moreover, pharmaceutical collaboration with cancer research institutes are fostering novel pipelines, particularly for hard-to-treat cancer, positioning oncology as a key growth driver for the market during the forecast period.

MRNA Synthesis & Manufacturing Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Infectious Diseases |

1.05 |

1.05 |

1.04 |

1.03 |

1.02 |

1 |

0.99 |

0.98 |

0.96 |

0.95 |

0.94 |

| Oncological Disorders |

0.31 |

0.34 |

0.37 |

0.4 |

0.43 |

0.47 |

0.51 |

0.54 |

0.58 |

0.62 |

0.65 |

| Other Diseases |

0.19 |

0.19 |

0.2 |

0.21 |

0.22 |

0.23 |

0.24 |

0.25 |

0.26 |

0.27 |

0.28 |

Regional Insights

How is North America contributing to the Expansion of the mRNA Synthesis & Manufacturing Market?

North America led the market in 2024 as regional players invested heavily in expanding GMP-certified facilities and integrating cutting-edge automation for large-scale production. Strong venture capital funding and active collaborations between biotech firms and academic institutions further accelerated innovation. Additionally, the region’s focus on building strategic stockpiles of mRNA vaccines and therapeutics for future health emergencies boosted demand, securing North America’s dominant revenue share in the global market.

How is Asia-Pacific Accelerating the mRNA Synthesis & Manufacturing Market?

Asia Pacific is projected to grow at the fastest CAGR as regional companies focus on developing cost-efficient manufacturing platforms and leveraging large patient populations for rapid clinical trial enrollment. Rising interest from multinational firms to establish R&D hubs in countries like Singapore and Japan is further boosting innovation. Additionally, increasing academic-industry collaborations and technology transfer agreements are accelerating the development of homegrown mRNA solutions, positioning the region as a global leader in future market expansion.

- For Instance, In November 2024, Singapore launched the NATi mRNA BioFoundry, the first automated mRNA manufacturing facility in Asia. This non-GMP center aims to accelerate nucleic acid therapeutics development by leveraging automation, machine learning, and its collaboration with the Wellcome Leap R3 Program.

MRNA Synthesis & Manufacturing Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

0.59 |

0.59 |

0.6 |

0.6 |

0.61 |

0.61 |

0.62 |

0.62 |

0.63 |

0.63 |

0.64 |

| Europe |

0.47 |

0.47 |

0.47 |

0.48 |

0.48 |

0.49 |

0.49 |

0.49 |

0.5 |

0.5 |

0.5 |

| Asia Pacific |

0.37 |

0.39 |

0.41 |

0.43 |

0.45 |

0.47 |

0.49 |

0.51 |

0.53 |

0.56 |

0.58 |

| Latin America |

0.06 |

0.07 |

0.07 |

0.07 |

0.07 |

0.07 |

0.08 |

0.08 |

0.08 |

0.08 |

0.08 |

| Middle East and Africa (MEA) |

0.06 |

0.06 |

0.06 |

0.06 |

0.06 |

0.06 |

0.06 |

0.07 |

0.06 |

0.07 |

0.07 |

Top Companies in the mRNA Synthesis & Manufacturing Market

- F. Hoffmann-La Roche Ltd.

- Jena Bioscience GmbH

- Merck KGaA

- Yeasen Biotechnology (Shanghai) Co., Ltd.

- BOC Sciences

- Thermo Fisher Scientific, Inc.

- Maravai LifeSciences

- New England Biolabs

- Creative Biogene

- HONGENE.

Recent Developments in the mRNA Synthesis & Manufacturing Market

- In November 2024, Cytiva, a Danaher Corporation subsidiary, established Poland’s first mRNA FlexFactory to support the development of mRNA-based therapies for cancer and COVID-19.

- In May 2024, GenScript introduced a self-amplifying RNA synthesis service aimed at boosting the effectiveness of vaccines, immunotherapies, and gene therapies by improving their potency and therapeutic impact.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the mRNA Synthesis & Manufacturing Market.

Type of Product

- Drug Substance (APIs)

- Drug Product (FDFs)

Application Area

- mRNA-based Vaccines

- mRNA-based Therapeutics

Therapeutic Area

- Infectious Diseases

- Oncological Disorders

- Other Diseases

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)