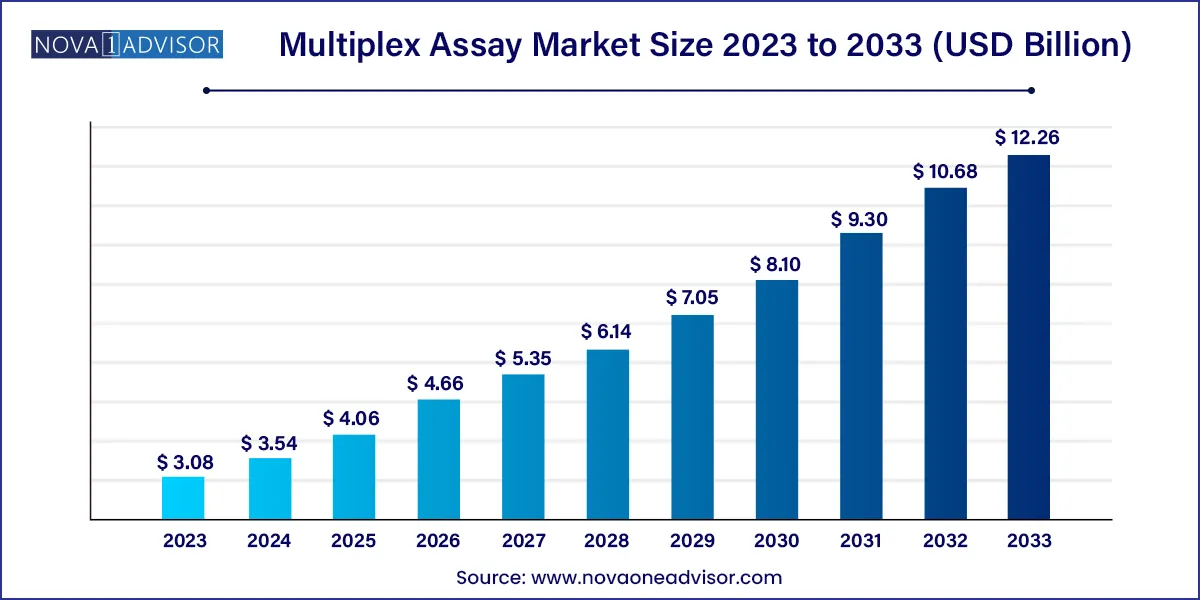

The global multiplex assay market size was exhibited at USD 3.08 billion in 2023 and is projected to hit around USD 12.26 billion by 2033, growing at a CAGR of 14.81% during the forecast period 2024 to 2033.

Key Takeaways:

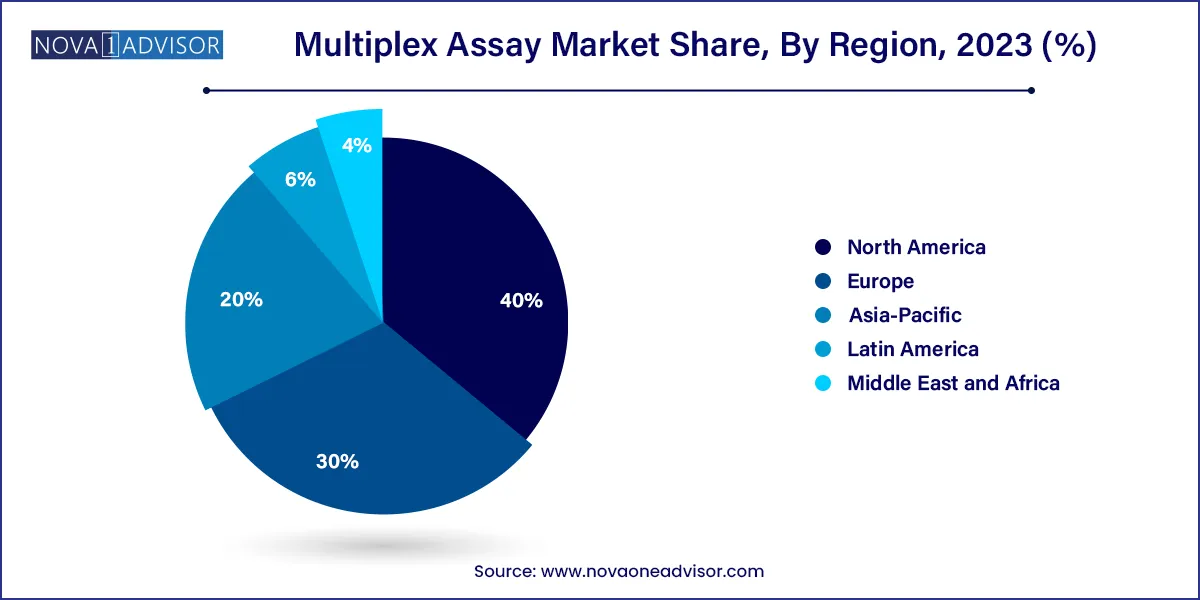

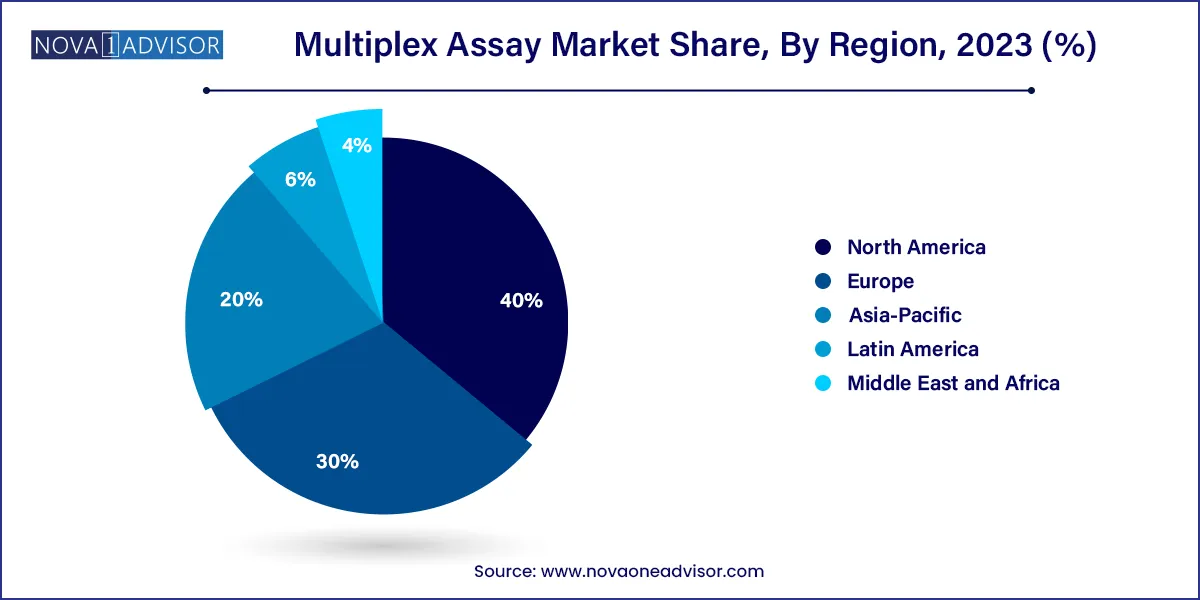

- North America dominated the global industry in 2023 and accounted for the highest share of more than 40.0%.

- The consumables segment captured 74.38% of the market share in 2023,

- The protein multiplex assay segment dominated the global industry in 2023 and accounted for the highest share of more than 52.71% of the overall revenue.

- The flow cytometry technology segment dominated the global industry in 2023 and accounted for the maximum share of more than 34.84% of the overall revenue.

- The pharmaceutical and biotechnology companies segment dominated the global industry in 2023 and accounted for the highest share of more than 40.90% of the overall revenue.

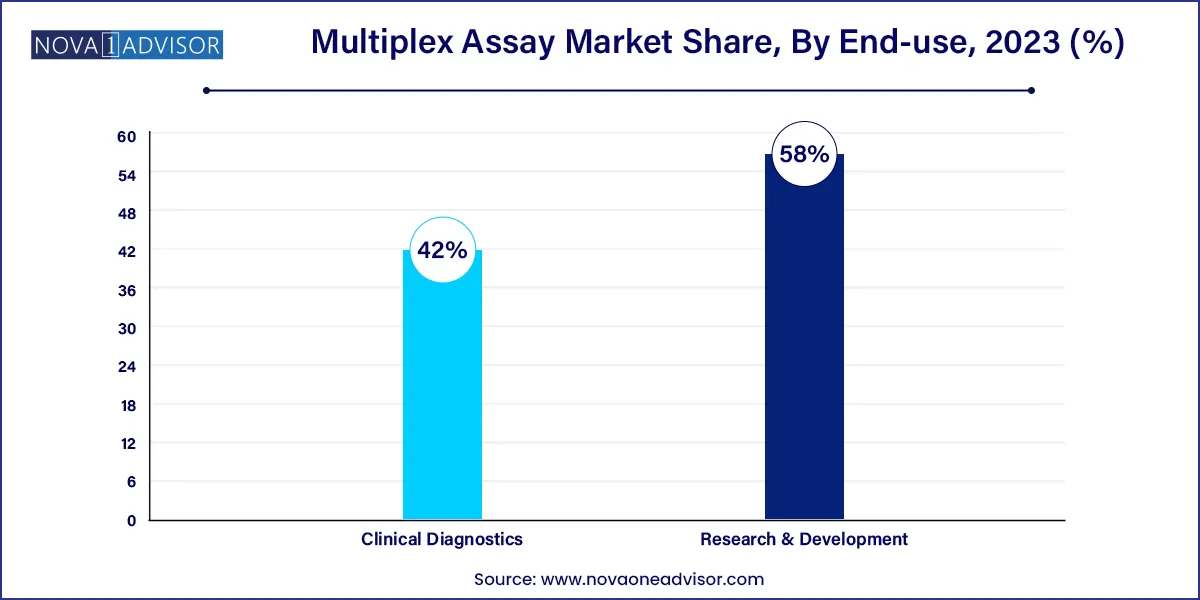

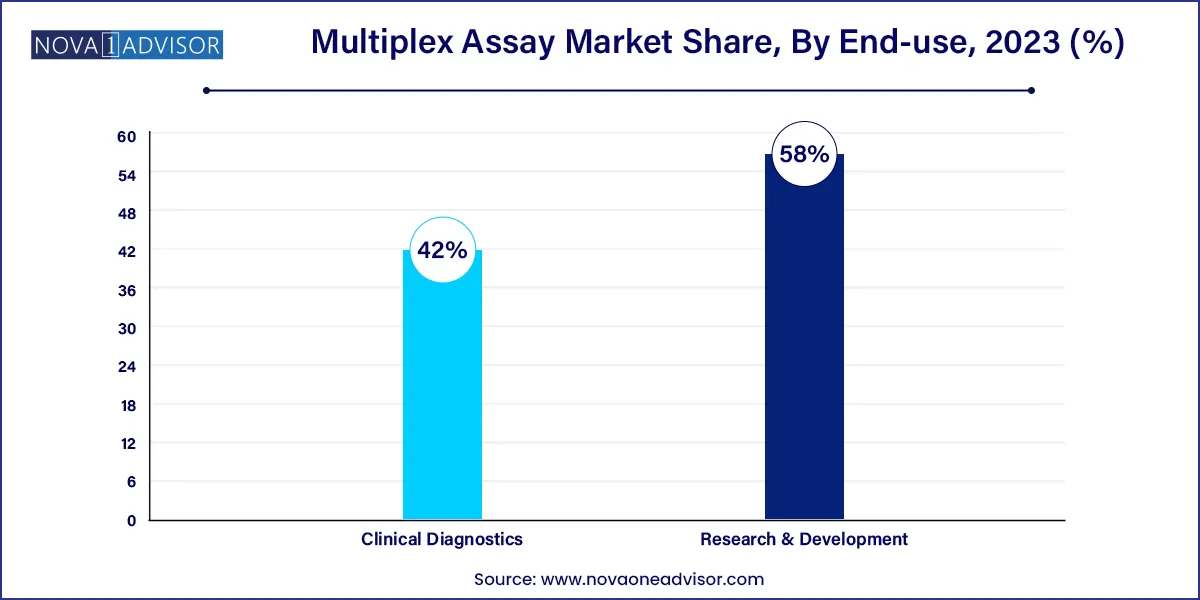

- The research and development application segment dominated the global industry in 2023 and accounted for the maximum share of more than 58.0% of the overall revenue.

Market Overview

The multiplex assay market represents a dynamic and evolving segment within the life sciences and diagnostics industries. At its core, multiplex assays enable the simultaneous detection and quantification of multiple biomarkers or analytes in a single test, offering high-throughput, cost-effective, and time-efficient solutions for clinical diagnostics, drug discovery, and biomarker validation.

Traditional single-analyte methods are being rapidly replaced by multiplexing platforms in response to the growing demand for precision medicine, where detailed biomarker profiling is essential. Multiplex assays offer improved analytical efficiency and reduced sample consumption critical advantages in scenarios with limited sample availability, such as pediatric diagnostics or rare disease research.

These assays span diverse technologies, including protein-based, nucleic acid-based, and cell-based platforms, and employ techniques such as flow cytometry, real-time PCR, fluorescence, and bead-based arrays. Applications are expanding from infectious disease diagnostics to oncology, autoimmune disorders, and cardiovascular diseases, where multiplex data enables clinicians to draw more comprehensive diagnostic conclusions.

With advancements in data integration, automation, and miniaturization, multiplex assays are becoming more accessible to a broader spectrum of end-users, from academic researchers to clinical labs. The synergy of rising disease burden, personalized medicine, and technological sophistication continues to drive growth in the global multiplex assay market.

Major Trends in the Market

-

Shift Toward Personalized Medicine and Precision Diagnostics

Multiplex assays are increasingly used for biomarker panels to tailor therapies and treatment decisions for individual patients.

-

Rise of Companion Diagnostics in Oncology

The co-development of multiplex assays with targeted therapies is accelerating, especially in cancers requiring multi-gene mutation profiling.

-

Automation and Integration with Digital Health Platforms

Advanced software and cloud integration are being incorporated to manage complex data sets, support real-time analytics, and improve laboratory workflow.

-

Expansion of Point-of-Care Multiplex Platforms

Portable, rapid multiplex devices are emerging for infectious diseases and emergency care, especially in resource-limited settings.

-

Growth in Non-Invasive Multiplex Tests

Liquid biopsy technologies, saliva-based assays, and microfluidic platforms are gaining interest for multiplex testing from minimal samples.

Multiplex Assay Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.54 Billion |

| Market Size by 2033 |

USD 12.26 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.81% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, Technology, Application, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Bio-Rad Laboratories, Inc.; Abcam plc.; R&D Systems, Inc.; Merck KGaA; Assay Genie; Promega Connections; QIAGEN N.V.; Thermo Fisher Scientific; Luminex Corp.; Perkin Elmer Inc.; Advanced Cell Diagnostics, Inc.; Seegene Inc. |

Market Driver: Demand for High-Throughput and Cost-Effective Testing

One of the primary drivers of the multiplex assay market is the escalating demand for high-throughput, cost-efficient testing platforms that deliver rich, multidimensional data in a single run. This is particularly important in clinical diagnostics and pharmaceutical R&D, where efficiency and reproducibility are paramount.

In a typical drug development workflow, thousands of samples may need to be analyzed for multiple biomarkers or gene targets. Multiplex assays drastically reduce the reagent costs, time, and labor involved, compared to conducting individual tests for each analyte. In diagnostics, especially during infectious disease outbreaks, rapid multiplex testing enables clinicians to differentiate among pathogens quickly, leading to more effective treatment and containment strategies.

For instance, during the COVID-19 pandemic, multiplex assays were employed to simultaneously test for SARS-CoV-2, influenza A/B, and RSV streamlining public health response while conserving testing capacity.

Market Restraint: Complexity in Standardization and Validation

Despite their efficiency, multiplex assays face challenges related to standardization, validation, and regulatory approval. Unlike single-analyte assays, multiplex systems involve complex interactions among multiple reagents, analytes, and detection platforms, increasing the potential for cross-reactivity and variability.

Developing a robust multiplex assay requires rigorous optimization to ensure specificity, sensitivity, and linearity across all included targets. The interpretation of multiplex data also demands advanced analytical tools and trained personnel, particularly when results must be quantified or normalized across platforms.

Regulatory agencies such as the FDA and EMA have limited precedents for approving highly multiplexed assays, particularly those intended for clinical use, which can extend development timelines and introduce uncertainties for developers.

Market Opportunity: Expanding Applications in Cancer Immunotherapy and Biomarker Discovery

An exciting opportunity in the multiplex assay market lies in the expanding role of immuno-oncology and the need to understand complex tumor microenvironments. Multiplex immunofluorescence, flow cytometry, and RNA-sequencing assays are increasingly used to profile immune checkpoint markers, tumor-infiltrating lymphocytes, and cytokine signatures in parallel.

This is critical for identifying novel therapeutic targets, evaluating immunotherapy responses, and stratifying patients for trials. For instance, multiplex assays allow simultaneous detection of PD-L1 expression, T-cell exhaustion markers, and tumor mutational burden providing a comprehensive view of immunogenicity.

Moreover, advances in single-cell multiplexing and spatial omics are unlocking new frontiers in biomarker discovery, enabling researchers to identify molecular patterns that were previously undetectable using bulk assays. This intersection of multiplex technology with precision oncology represents one of the most significant future growth avenues.

Segments Insights:

Product Insights

Consumables, including reagent kits, beads, antibodies, and assay plates, dominate the product segment as they are frequently used and replenished in both research and clinical workflows. High-throughput laboratories rely on large volumes of standardized, validated reagents to run multiplex assays efficiently and maintain consistency.

The growth of commercial assay panels, particularly disease-specific kits for cancer, inflammation, and metabolic disorders, has further increased the demand for consumables. Customizable multiplex panels tailored to specific research needs also support sustained consumption in academic and pharmaceutical labs.

Software is the fastest-growing product segment, driven by the need to manage, interpret, and integrate large datasets generated by multiplex systems. Modern multiplex assays generate complex multidimensional outputs that require advanced bioinformatics pipelines, visualization tools, and statistical validation software.

As AI and machine learning models become more embedded in diagnostic workflows, software platforms are evolving to offer real-time analytics, predictive insights, and cloud-based collaboration tools. The rise of digital pathology and remote diagnostics further boosts the role of software in multiplex assay ecosystems.

Type Insights

Protein-based multiplex assays dominate due to their application in cytokine profiling, immunoassays, hormone analysis, and autoimmune disease monitoring. Bead-based protein assays, often using xMAP technology or similar platforms, allow simultaneous measurement of up to hundreds of proteins with high sensitivity and minimal sample input.

They are widely used in immunology research, clinical biomarker analysis, and pharmacodynamic studies. The flexibility of protein multiplexing platforms and the broad catalog of validated antibodies make this segment the backbone of most biological multiplex testing.

Nucleic acid multiplex assays are growing rapidly, propelled by the surge in infectious disease testing, oncology genomics, and pharmacogenomics. These assays are used to simultaneously detect multiple gene targets, mutations, or pathogens in a single reaction, often through techniques like multiplex PCR or isothermal amplification.

Their adoption increased significantly during the COVID-19 pandemic and continues to rise with the need for genotyping, antimicrobial resistance profiling, and gene expression analysis in research and clinical environments.

Technology Insights

Flow cytometry remains the dominant technology in multiplex assays due to its ability to analyze multiple parameters of single cells simultaneously. It’s a staple in immunophenotyping, cancer diagnostics, and stem cell research, offering rapid and precise results.

Flow cytometry-based multiplexing can quantify cytokines, phospho-proteins, and cellular activation states across complex cell populations making it a powerful tool in immunology and oncology research.

Multiplex real-time PCR is the fastest-growing segment due to its precision, speed, and utility in clinical diagnostics. With the ability to detect multiple DNA/RNA targets in a single reaction, this technology has become essential in pathogen detection, genetic mutation screening, and viral load quantification.

It is particularly effective for respiratory panels, sexually transmitted infection panels, and oncology mutation panels. The increasing availability of portable PCR systems is further driving adoption in both centralized and point-of-care settings.

End-user Insights

Pharmaceutical and biotech companies dominate the end-user segment, leveraging multiplex assays for target validation, safety profiling, and companion diagnostics. These companies require scalable, regulatory-grade platforms that support high-throughput drug development pipelines.

Additionally, multiplex platforms are instrumental in pharmacokinetic/pharmacodynamic (PK/PD) modeling and clinical trial biomarker stratification, aligning perfectly with the industry’s shift toward personalized medicine.

Hospitals and diagnostic labs are the fastest-growing end-users, as more healthcare systems adopt multiplex diagnostics for comprehensive disease screening. Labs increasingly use multiplex kits for respiratory pathogen detection, sexually transmitted infections, and oncology panels.

Adoption is also being driven by reimbursement improvements, automation, and the need for point-of-care decision-making in emergency care and infectious disease units.

Application Insights

Clinical diagnostics dominate the application segment, fueled by the growing burden of infectious diseases, cancer, and chronic conditions. Multiplex assays enable clinicians to run multiple diagnostic markers from a single patient sample, reducing turnaround time and improving diagnostic accuracy.

Panels for respiratory infections, autoimmune diseases, and cardiovascular risk profiling are widely used in hospital and diagnostic lab settings. Integration with electronic health records and decision support tools further enhances clinical utility.

Biomarker discovery in R&D is the fastest-growing application, driven by pharmaceutical companies and academic institutions seeking to identify predictive and prognostic biomarkers. Multiplex assays accelerate the screening of large biomolecule libraries across multiple biological pathways.

They are also integral to translational research, enabling the validation of target engagement and therapeutic response in preclinical models. The rise of multi-omics and systems biology approaches amplifies this segment’s potential.

Regional Insights

North America leads the global multiplex assay market due to its robust healthcare infrastructure, significant investment in life sciences R&D, and early adoption of precision diagnostic technologies. The U.S. is home to numerous biotechnology giants, well-funded research institutions, and a favorable reimbursement landscape for molecular diagnostics.

The presence of regulatory bodies such as the FDA has also spurred innovation, with many multiplex platforms gaining emergency or full authorization for clinical use. Strategic partnerships between academia and industry further fuel market expansion.

Asia-Pacific is the fastest-growing region, driven by rising healthcare investment, growing biomedical research activity, and increasing awareness of molecular diagnostics. Countries such as China, India, Japan, and South Korea are prioritizing early disease detection and investing in local diagnostics manufacturing.

The region’s large patient population and the need for rapid, scalable diagnostic solutions—especially for infectious diseases—make it a key growth frontier for multiplex assay developers. Local partnerships and favorable policy reforms are further accelerating the adoption of multiplex platforms.

Recent Development

-

March 2025 – A U.S.-based diagnostics company launched a 20-plex respiratory pathogen panel using bead-based flow cytometry for rapid hospital triage during flu season.

-

January 2025 – A leading biotech firm in Germany unveiled a cloud-integrated multiplex data visualization software platform designed for oncology biomarker discovery.

-

February 2025 – A Japanese medical technology startup received regulatory clearance for its portable multiplex PCR platform aimed at field diagnostics in rural clinics.

Some of the prominent players in the Multiplex assay market include:

- Luminex Corp.

- Bio-Rad Laboratories, Inc.

- Abcam plc.

- Seegene Inc.

- Merck KGaA

- Assay Genie

- Promega Connections

- QIAGEN N.V.

- Thermo Fisher Scientific

- Perkin Elmer Inc.

- Advanced Cell Diagnostics, Inc.

- R&D Systems, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global multiplex assay market.

Product

- Consumables

- Instruments

- Software

Type

-

- Planar Protein Assays

- Bead-based Protein Assays

- Nucleic Acid Multiplex Assays

-

- Planar Protein Assays

- Bead-based Protein Assays

- Cell-based Multiplex Assays

Technology

- Flow Cytometry

- Fluorescence Detection

- Luminescence

- Multiplex Real-time PCR

- Other Technologies

Application

-

- Drug Discovery & Development

- Biomarker Discovery & Validation

-

- Infectious Diseases

- Cancer

- Cardiovascular Diseases

- Autoimmune Diseases

- Nervous System Disorders

- Metabolism & Endocrinology Disorders

- Other Diseases

End-user

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic laboratories

- Research & Academic Institutes

- Other End-users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)