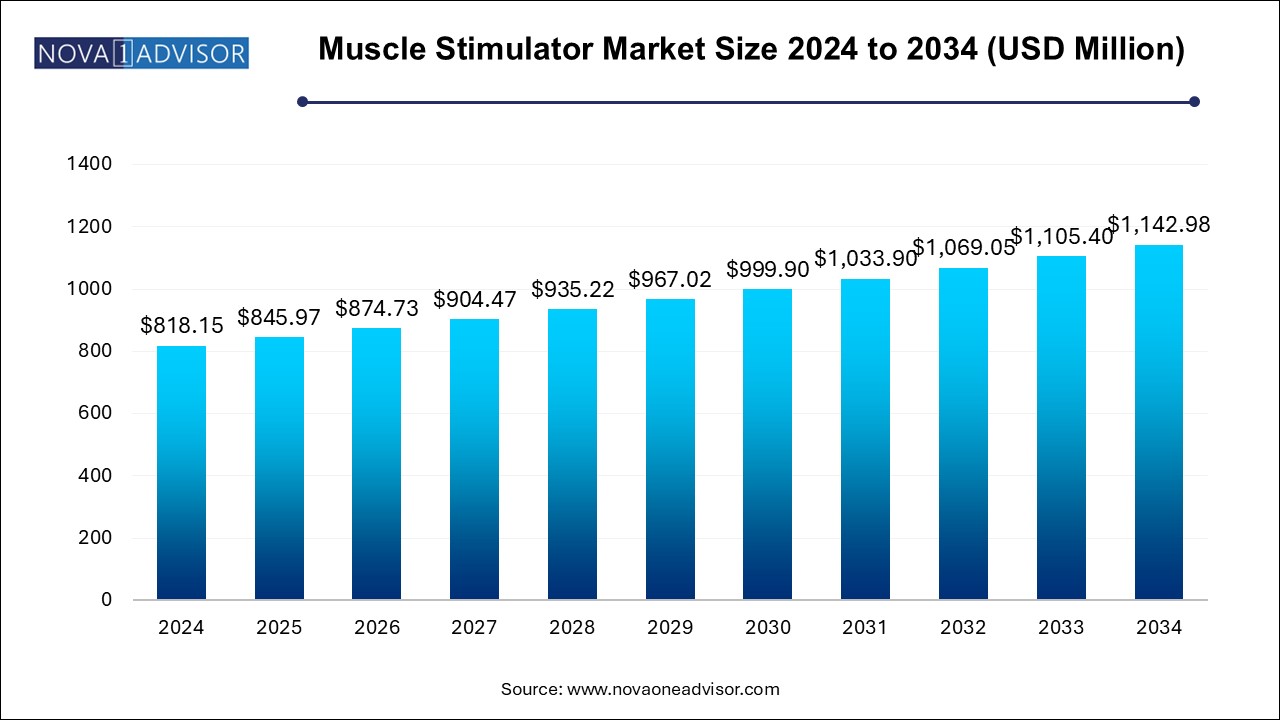

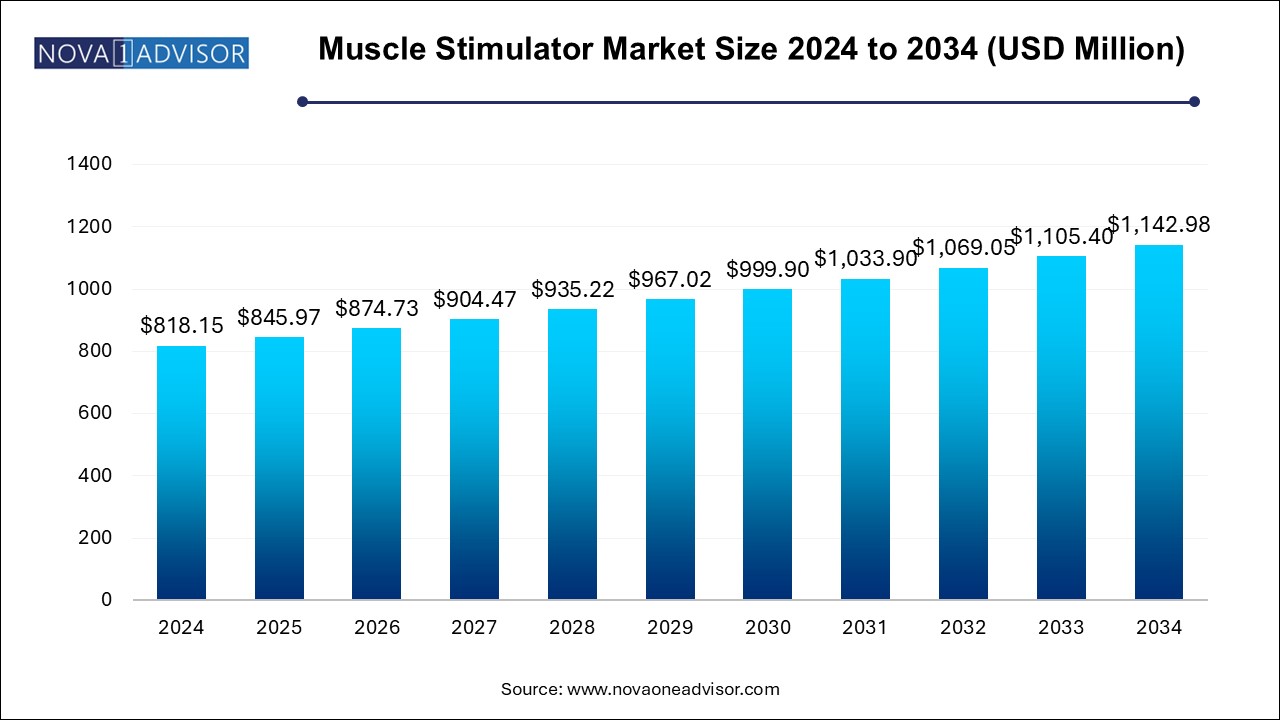

Muscle Stimulator Market Size and Growth

The muscle stimulator market size was exhibited at USD 818.15 million in 2024 and is projected to hit around USD 1,142.98 million by 2034, growing at a CAGR of 3.4% during the forecast period 2024 to 2034.

Muscle Stimulator Market Key Takeaways:

- The transcutaneous electrical nerve stimulation (TENS) segment held the largest market share of 67.4% in 2024.

- The physiotherapy clinics segment dominated the market with the largest revenue share in 2024 and is anticipated to witness the highest CAGR of 4.0% during the forecast period.

- The sports clinics segment held the second-largest revenue share in 2024.

- The portable devices segment dominated the market in 2024 and is estimated to witness the highest CAGR of 3.6% during the forecast period.

- The pain management segment dominated the market in 2024 and is anticipated to grow at a fastest CAGR of 3.6% over the forecast period.

- North America muscle stimulator market dominated the overall global market and accounted for the 41.9% revenue share in 2024.

Market Overview

The global Muscle Stimulator Market has evolved significantly over the last decade, driven by rising awareness regarding physical rehabilitation, increasing sports injuries, and the growing elderly population experiencing muscular disorders. Muscle stimulators, also referred to as Electrical Muscle Stimulation (EMS) devices, employ electric impulses to elicit muscle contraction and have become vital across therapeutic, athletic, and personal healthcare applications.

As sedentary lifestyles, obesity, and chronic pain conditions surge, muscle stimulators have garnered attention not only in medical facilities but also among fitness enthusiasts and home users. The market is experiencing an infusion of innovative technologies, including wireless and wearable muscle stimulators, propelling the accessibility and efficiency of these devices. Moreover, strategic collaborations between healthcare providers and medical device companies are pushing the boundaries for more sophisticated and targeted solutions.

In 2024, the market was estimated to be valued at around USD 820 million and is expected to grow steadily with an anticipated compound annual growth rate (CAGR) of 6.8% through 2034. This expansion is largely fueled by the growing importance of early rehabilitation and non-invasive treatments globally.

Major Trends in the Market

-

Wearable and Wireless Devices: Miniaturization and technological advancements are driving the introduction of compact, wireless, and wearable stimulators.

-

Increased Use in Sports Medicine: Athletes are adopting EMS devices for muscle recovery, performance enhancement, and injury prevention.

-

Integration of AI and IoT: Smart stimulators integrated with IoT platforms and AI-driven monitoring systems are becoming mainstream.

-

Home-based Rehabilitation: The growing trend of at-home physiotherapy solutions is catalyzing portable muscle stimulator sales.

-

Rising Adoption of Micro Current Electrical Neuromuscular Stimulators: Particularly in treating chronic pain and healing soft tissue injuries.

-

Focus on Pain Management: As awareness regarding alternative pain management grows, demand for TENS (Transcutaneous Electrical Nerve Stimulation) devices has soared.

-

Customization and Personalization: Manufacturers are offering customizable programs tailored to users' specific muscular needs.

-

Expansion into Emerging Economies: Companies are expanding into Asia Pacific and Latin America to tap into the burgeoning healthcare sectors.

Report Scope of Muscle Stimulator Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 845.97 Million |

| Market Size by 2034 |

USD 1,142.98 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 3.4% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Modality, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

NeuroMetrix, Inc.; OMRON Corporation; BioMedical Life Systems, Inc.; Zynex, Inc.; EMS Physio Ltd.; DJO Global, Inc.; Beurer GmbH., RS Medical, Inc., OG Wellness Technologies Co., Ltd. |

Driver: Rising Incidence of Musculoskeletal Disorders

The sharp increase in musculoskeletal disorders globally, including back pain, arthritis, and muscular dystrophy, is significantly driving the muscle stimulator market. According to the World Health Organization (WHO), nearly 1.71 billion people globally suffer from musculoskeletal conditions, highlighting an urgent need for effective therapeutic solutions. Muscle stimulators offer a non-invasive and efficient means of managing such conditions by reducing pain, enhancing mobility, and promoting muscle recovery. The devices are especially favored in physiotherapy for post-surgical rehabilitation and injury recovery, thus broadening their application scope across hospitals, physiotherapy clinics, and even home settings.

Restraint: High Cost of Advanced Devices

Despite the promising growth trajectory, the high cost of advanced muscle stimulators remains a significant restraint. Premium products, particularly those integrated with AI and IoT technologies, often come with hefty price tags, limiting their affordability for many potential users. For instance, advanced functional electrical stimulation (FES) systems designed for neurological rehabilitation can cost upwards of $10,000, making them accessible only to specialized medical facilities and affluent consumers. Additionally, in low and middle-income regions, limited reimbursement policies further aggravate this financial burden, hampering widespread adoption.

Opportunity: Expansion of Home-based Healthcare Devices

The COVID-19 pandemic accelerated the trend towards home-based healthcare, creating immense opportunities for portable and handheld muscle stimulators. Consumers are increasingly inclined towards managing minor muscular injuries, post-operative rehabilitation, and pain therapy from the comfort of their homes, avoiding hospital visits. This shift is encouraging manufacturers to innovate user-friendly, affordable, and highly effective devices suitable for personal use. Brands like Compex and PowerDot are already capturing market share by introducing mobile app-controlled muscle stimulators tailored for at-home fitness recovery and pain management.

Muscle Stimulator Market By Product Insights

The "Transcutaneous Electrical Nerve Stimulation (TENS)" segment dominated the muscle stimulator market by product type in 2024.

TENS devices have gained significant traction owing to their versatility in pain management applications, especially for chronic pain conditions like arthritis and lower back pain. Their non-invasive nature, coupled with their affordability compared to other modalities, has made them a preferred choice among both healthcare professionals and personal users. Increasing awareness campaigns about non-drug pain management solutions have also fueled the adoption of TENS devices globally. Companies like Omron and NeuroMetrix are making notable investments to expand their TENS device offerings for broader pain management uses.

However, "Functional Electrical Stimulation (FES)" devices are expected to be the fastest-growing segment over the forecast period.

FES devices are primarily utilized for rehabilitating patients with spinal cord injuries, stroke, and multiple sclerosis. The rising focus on neurological disorder rehabilitation and the technological advancements in FES, such as the introduction of wearable solutions, are accelerating their adoption. The growing incidence of neurological disorders and the increasing number of rehabilitation centers worldwide are further pushing the growth of this segment.

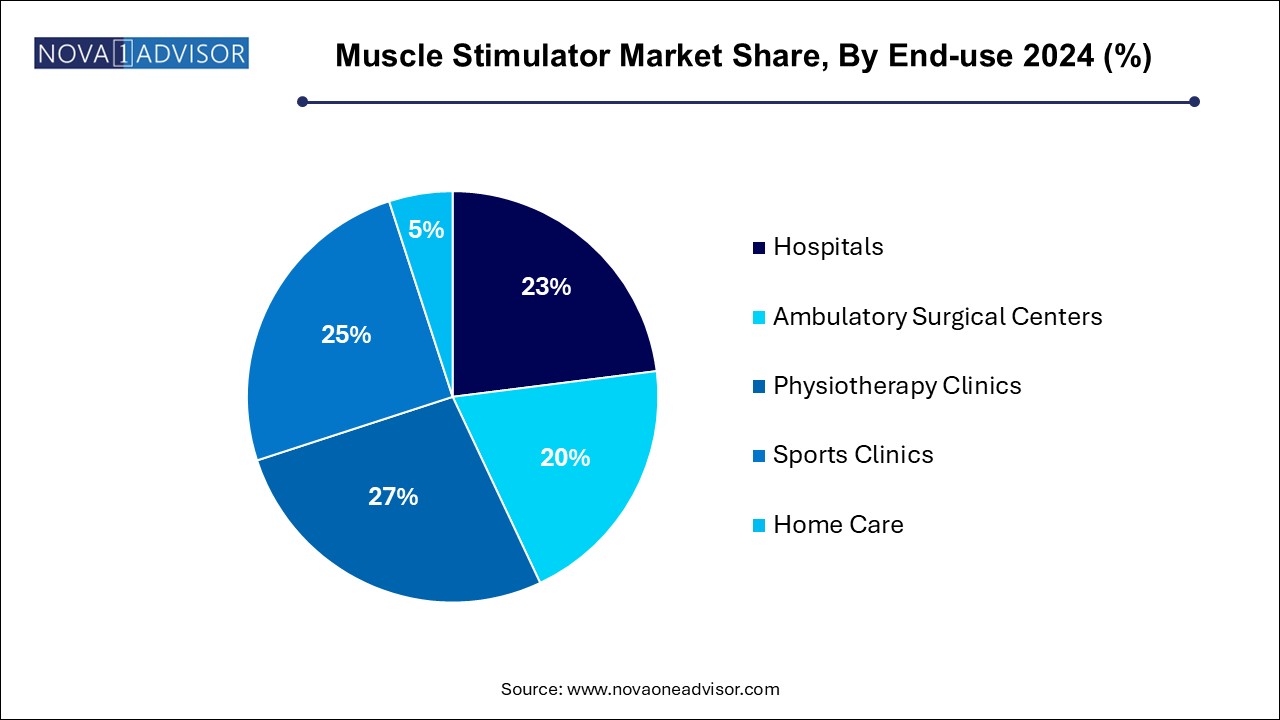

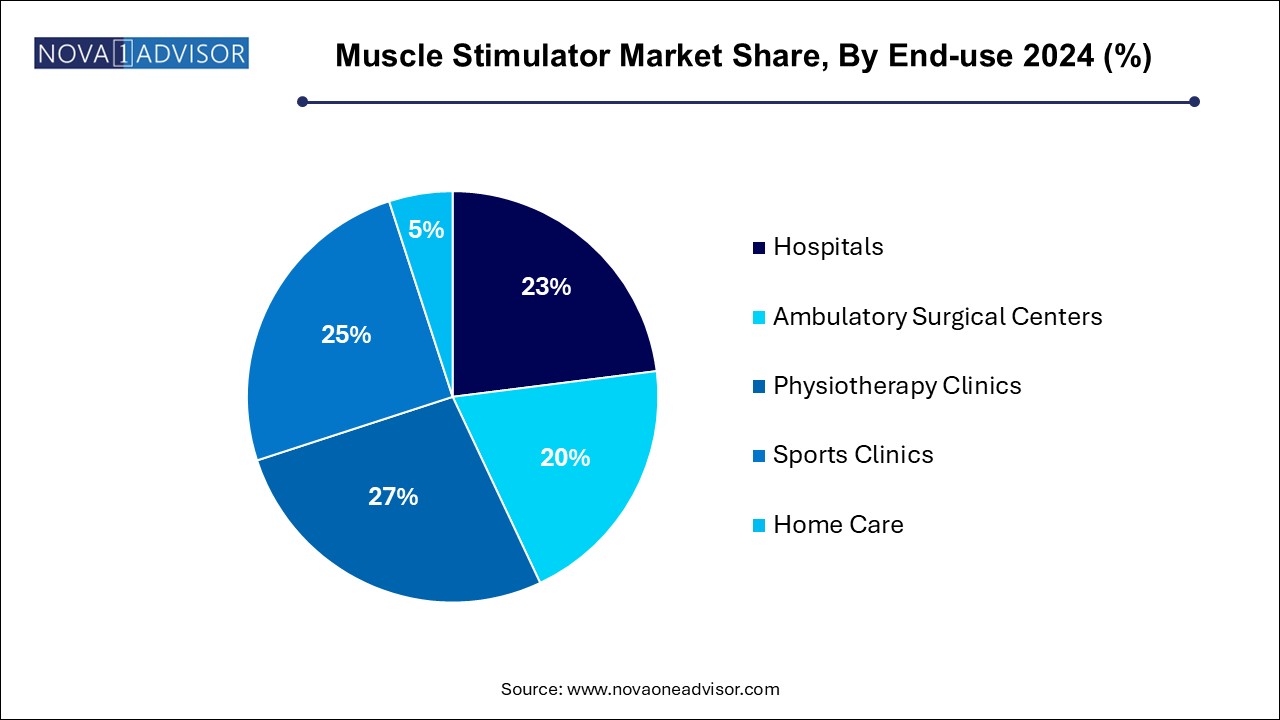

Muscle Stimulator Market By End-use Insights

Hospitals" emerged as the dominant end-use segment of the muscle stimulator market in 2024.

Hospitals remain the primary centers for comprehensive diagnosis, treatment, and rehabilitation of muscular and neurological conditions. The availability of specialized healthcare professionals, sophisticated medical infrastructure, and insurance coverage are key factors contributing to the dominance of hospitals. The increasing prevalence of surgeries requiring post-operative rehabilitation also sustains the demand for muscle stimulators in hospital settings.

"Home Care" is expected to be the fastest-growing end-use segment.

Driven by the rising popularity of home healthcare solutions, the availability of user-friendly portable devices, and a growing elderly population preferring home-based care, the home care segment is witnessing robust growth. Companies are focusing on developing intuitive, affordable, and highly effective stimulators specifically designed for non-clinical environments, thus broadening their accessibility.

Muscle Stimulator Market By Modality Insights

The "Portable" modality segment held the largest share of the muscle stimulator market in 2024.

Portable devices have resonated well with consumers owing to their convenience, affordability, and ease of use. The increase in demand for home healthcare solutions and the proliferation of portable devices tailored for amateur athletes, senior citizens, and individuals with chronic pain have significantly contributed to this segment's dominance. Furthermore, the integration of Bluetooth and mobile applications has enhanced the attractiveness of portable devices among tech-savvy consumers.

Meanwhile, "Handheld" muscle stimulators are projected to grow at the fastest rate.

Handheld stimulators, often battery-operated and highly compact, are ideal for users seeking mobility and on-the-go therapeutic solutions. They are increasingly being adopted in settings like sports clinics, physiotherapy centers, and even corporate wellness programs. Manufacturers are continually innovating to make these devices more ergonomic, multifunctional, and efficient, thus pushing their demand among varied demographics.

Muscle Stimulator Market By Application Insights

The "Pain Management" application segment dominated the muscle stimulator market in 2024.

Chronic pain affects nearly 20% of the global population, and muscle stimulators have emerged as a vital component of non-pharmaceutical pain management regimens. TENS units, in particular, have been effectively used to treat pain stemming from arthritis, fibromyalgia, migraines, and postoperative recovery. The ability to provide immediate relief without the side effects of drugs has made pain management the most prominent application segment.

Conversely, "Neurological Disorder" application is anticipated to exhibit the fastest growth rate during the forecast period.

An increase in incidences of stroke, spinal cord injuries, and multiple sclerosis is driving the demand for electrical stimulators in neurological rehabilitation. Innovations in FES technology, improving muscle strength and motor function among neurological disorder patients, have enhanced adoption. Additionally, support from government initiatives aimed at improving rehabilitation services further fuels the segment’s expansion.

Muscle Stimulator Market By Regional Insights

North America dominated the global muscle stimulator market in 2024.

The region's dominance can be attributed to a combination of factors, including a high prevalence of musculoskeletal and neurological disorders, early adoption of advanced healthcare technologies, and substantial healthcare expenditure. Furthermore, the presence of leading industry players such as DJO Global, Zynex Inc., and Omron Healthcare, combined with favorable reimbursement scenarios and strong consumer awareness regarding pain management therapies, bolstered the regional market.

Asia Pacific is projected to be the fastest-growing region during the forecast period.

Asia Pacific's rapid growth is spurred by rising healthcare infrastructure development, increasing disposable incomes, expanding geriatric population, and growing health consciousness. Countries like China, India, and Japan are witnessing increased demand for affordable and accessible healthcare solutions, including muscle stimulators. Additionally, increasing investments by global players in the region and government initiatives aimed at improving rehabilitation services are further catalyzing growth.

Some of the prominent players in the muscle stimulator market include:

- NeuroMetrix, Inc.

- OMRON Corporation

- BioMedical Life Systems, Inc.

- Zynex, Inc.

- EMS Physio Ltd.

- DJO Global, Inc.

- Zimmer MedizinSysteme GmbH

- Beurer GmbH.

- RS Medical, Inc.

- OG Wellness Technologies Co., Ltd.

Muscle Stimulator Market Recent Developments

-

March 2025 — Zynex, Inc. announced the launch of "NeuroWave Pro," a next-generation wearable muscle stimulator integrating Bluetooth connectivity and real-time monitoring features.

-

February 2025 — Omron Healthcare introduced an upgraded "TENS Premier" model with enhanced mobile app features and customizable therapy modes targeting home users.

-

January 2025 — PowerDot expanded its product line with "PowerDot 3.0," focusing on athletes by offering AI-guided recovery sessions via a smartphone app.

-

December 2024 — Compex collaborated with sports organizations to introduce muscle stimulators customized for professional athlete rehabilitation programs.

-

November 2024 — NeuroMetrix received FDA clearance for its "Quell 2.0," an advanced wearable device designed for chronic pain relief.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the muscle stimulator market

By Product Type

- Neuromuscular Electrical Stimulation

- Functional Electrical Stimulation

- Transcutaneous Electrical Nerve Stimulation

- Interferential

- Burst Mode Alternating Current

- Micro Current Electrical Neuromuscular Stimulator

- Others

By Modality

- Handheld

- Portable

- Tabletop

By Application

- Pain Management

- Neurological Disorder

- Musculoskeletal Disorder

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Physiotherapy Clinics

- Sports Clinics

- Home Care

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)