Nanotechnology Market Size and Research

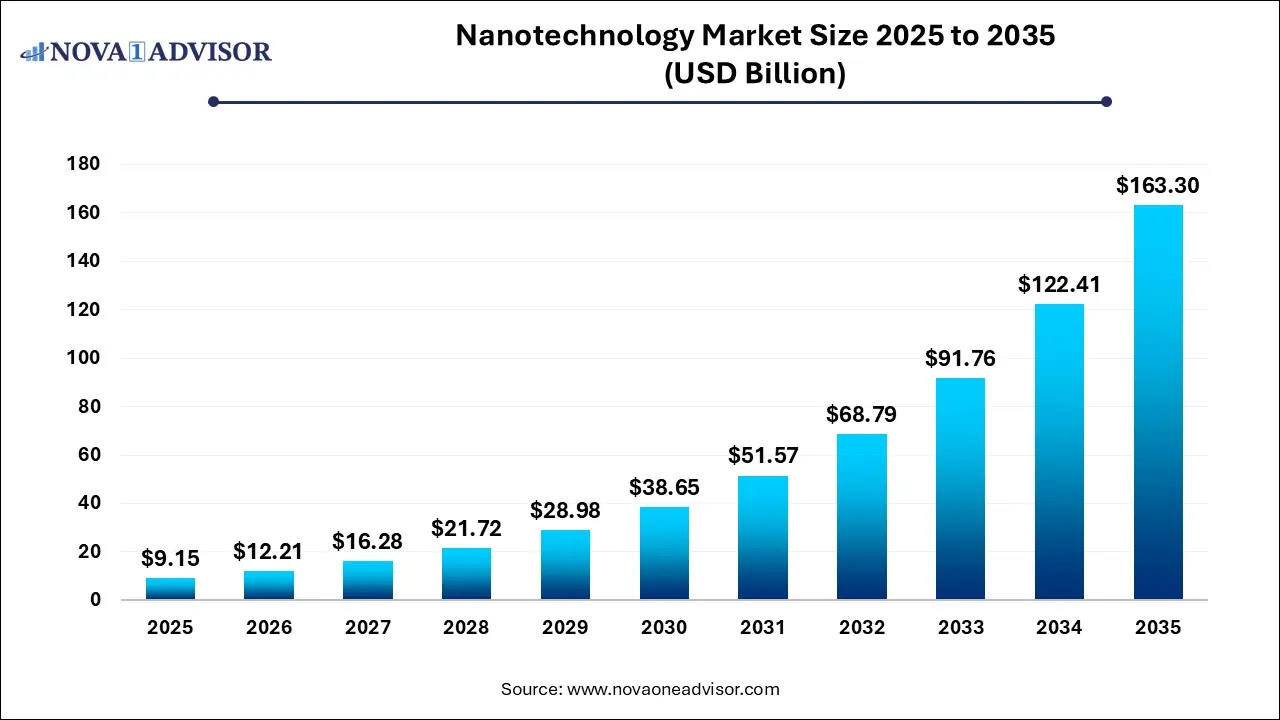

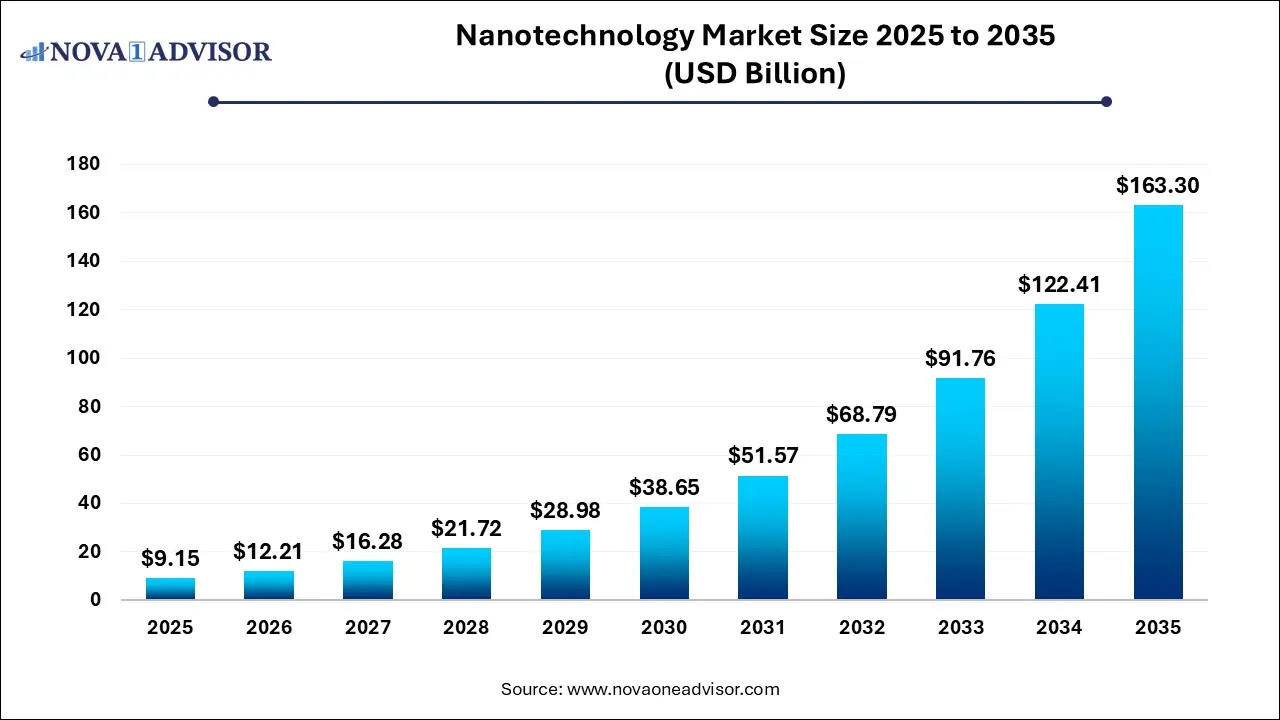

The nanotechnology market size was exhibited at USD 9.15 billion in 2025 and is projected to hit around USD 163.30 billion by 2035, growing at a CAGR of 33.4% during the forecast period 2026 to 2035. The market is growing due to wide application in healthcare, electronics, energy, and materials, offering advanced solutions with higher efficiency. Increasing R&D investment and government support are further accelerating its adoption worldwide.

Nanotechnology Market Key Takeaways:

- North America dominated the nanotechnology market with the revenue shares in 2025.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By type, the nanodevice segment held the largest market share in 2025.

- By type, the nanosensor segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the healthcare & pharmaceuticals segment dominated the market with a major revenue share in 2025.

- By application, the automobile segment is expected to grow at a significant rate in the market during the forecast period.

Which Factors are Driving the Growth of the Nanotechnology Market?

Nanotechnology is the science and engineering of designing, manipulating, and applying materials, devices, and systems at the nanoscale (1-100 nanometers) to exploit unique physical, chemical, and biological properties for use in fields such as medicine, electronics, energy, and materials science. The nanotechnology market is expanding due to rising demand for advanced materials and miniaturized devices across healthcare, electronics, and energy sectors. Increasing use of nanotechnology in drug delivery, diagnostics, and regenerative medicine is fueling growth in healthcare. Additionally, its applications in lightweight materials, renewable energy, and environmental solutions are driving adoption. Strong investments in research and development, along with government and private sector support, are further accelerating innovation and commercialization, making nanotechnology a key driver of future technological advancements.

What are the Key trends in the Nanotechnology Market in 2025?

In February 2024, the NBX initiative was launched to foster collaboration among experts in nanofabrication, nanoelectronics, biotechnology, and data science. The program focuses on advancing innovations in areas such as wearable electronics, neurotechnology, biosensors, organ-on-chip systems, diagnostics, and biophotonics. By breaking traditional research boundaries, it aims to accelerate transformative technologies and drive societal impact through startups and industry partnerships.

- In July 2023, Altair acquired OmniV to enhance integration across simulation, systems, testing, controls, and product development processes. This acquisition aims to provide end-users with an open architecture and a traceable environment that improves monitoring of cost, performance, and scalability.

How Can AI Affect the Nanotechnology Market?

AI is significantly impacting the market by accelerating research, design, and development of nanomaterials and devices. It enables faster simulations, predictive modeling, and data analysis, reducing time and cost in experimentation. AI-driven insights enhance precision in drug delivery systems, diagnostics, and nanorobotics, boosting healthcare applications. In materials science and electronics, AI supports innovation by optimizing performance and scalability. Overall, the integration of AI with nanotechnology is driving breakthroughs, improving efficiency, and expanding commercialization opportunities across industries.

Report Scope of Nanotechnology Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 12.21 Billion |

| Market Size by 2035 |

USD 163.30 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 33.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Nanonics Imaging Ltd.; ANP CORPORATION; Bruker Corporation; Fujitsu Limited; Thermo Fisher Scientific Inc.; Kleindiek Nanotechnik GmbH; eSpin Technologies, Inc.; Altairnano; Bayer AG; Infineon Technologies AG |

Market Dynamics

Driver

Growing Demand for Advanced Drug Delivery and Diagnostics in Healthcare

Rising demand for innovative drug delivery and diagnostic solutions is boosting the nanotechnology market, as nanoscale systems allow medicines to reach specific cells with higher efficiency. In diagnostics, nanotechnology improves sensitivity and speed, enabling earlier detection of diseases. With increasing cases of cancer, diabetes, and infectious disorders, the healthcare industry is shifting towards more precise and personalized approaches. This growing reliance on nanotech-based therapies and diagnostic tools strongly supports its market growth in the medical field.

- For Instance, In May 2025, researchers from Andhra Pradesh, along with teams from Saudi Arabia and the UAE, developed a colon-targeted drug delivery system using mastic gum–based nanoparticles. These nanoparticles effectively released 95.2% of 5-fluorouracil in the colon, improving chemotherapy precision and reducing side effects.

Restraint

High Research and Development Cost

The nanotechnology market faces restraint due to the heavy financial burden of R&D, as developing nanoscale solutions involves costly raw materials, precision instruments, and advanced testing facilities. Continuous experimentation and innovation further add to expenses, making it difficult for smaller firms to compete with large corporations. Moreover, long approval cycles and delayed profitability discourage investors, slowing down commercialization. This high cost barrier limits widespread adoption and prevents many potential players from entering the nanotechnology sector.

Opportunity

Growing Demand for Personalized and Precision Medicine

Personalized and precision medicine is creating strong opportunities for nanotechnology, as it requires highly specialized tools for patient-specific treatments. Nanoscalar carriers can be engineered to adapt to an individual's genetic profile, ensuring medicines act more effectively. In diagnostics, nano-enabled devices allow monitoring of biomarkers unique to each patient, supporting tailored therapies. With rising cases of complex diseases like cancer and neurological disorders, the shift towards customized healthcare makes nanotechnology a critical enabler for future medical advancements.

- For Instance, In May 2025, researchers at IIT Indore introduced a Quantum AI nanotechnology system for early detection of genetic mutations, including cancer-related changes. The system uses nanopore devices to read DNA sequences and AI to decode them with high precision, paving the way for breakthroughs in personalized medicine and cancer diagnostics

Nanotechnology Market By Type Insights

How did Nanodevice dominate the Nanotechnology Market in 2025?

In 2025, the nanodevice segment dominated the nanotechnology market mainly because of its broad applications in medicine, diagnostics, and electronics. Devices like nanosensors and nanoprobes offered superior sensitivity and accuracy, making them valuable in disease monitoring and biomedical research. Their role in developing next-generation semiconductors and high-speed electronics components also fueled demand. Continuous innovations, along with increased adoption in the healthcare and IT sectors, positioned nanodevices as the leading contributor to overall market share during that period.

The nanosensor segment is projected to record the fastest CAGR as it plays a vital role in enhancing precision across diverse industries. In healthcare, they enable non-invasive monitoring and early disease detection, while in agriculture and food, they ensure safety and quality control. Their ability to detect extremely small changes at the molecular level makes them essential for environmental applications such as water and air quality assessment. Growing integration with smart devices and IoT further fuels rapid market expansion.

Nanotechnology Market By Application Insights

What made the Healthcare & Pharmaceuticals Segment Dominant in the Nanotechnology Market in 2025?

The healthcare & pharmaceuticals segment led the nanotechnology market in 2025 because of its extensive use in innovative treatment and disease management. Nanotechnology improved drug solubility, bioavailability, and targeted delivery, making therapies more effective. It also advanced imaging and diagnostics methods, allowing earlier and more accurate detection of illness. With the growing focus on precision medicine and rising prevalence of cancer, nano-based solutions surged, securing this market the highest revenue contribution.

The automobile segment is set to witness strong growth in the nanotechnology market as manufacturers increasingly adopt nano-based solutions to enhance vehicle performance and sustainability. Applications such s scratch-resistant coatings, UV-protective paints, and high-strength composites are improving durability and aesthetics. At the same time, nanotechnology is contributing to longer-lasting batteries, better fuel efficiency, and reduced emissions. With the rising shift toward electric and smart vehicles, the integration of nanotech-based innovation is expected to accelerate rapidly in the automotive industry.

Nanotechnology Market By Regional Insights

How is North America Contributing to the Expansion of the Nanotechnology Market?

North America dominated the market in 2025 due to strong government funding, advanced research infrastructure, and the presence of leading nanotech companies and universities. High adoption of nanotechnology in healthcare, electronics, and energy sectors further boosted market growth. The region also benefited from significant investments in personalized medicine, drug delivery, and nano-enabled diagnostics. Additionally, collaborations between research institutes and industry players, along with favorable regulatory frameworks, positioned North America as the leading contributor to global nanotechnology revenue.

How is Asia-Pacific Accelerating the Market?

Asia Pacific is projected to register the fastest CAGR in the nanotechnology market as the region experiences strong growth in sectors such as electronics, automotive, and healthcare. Increasing investments in advanced manufacturing and nanomaterial production are fueling adoption across industries. Supportive government initiatives, rising R&D activities, and a rapidly expanding consumer base are further strengthening the market. Moreover, the push for innovative solutions in energy storage, diagnostics, and sustainable technologies is positioning the Asia Pacific as a key hub for nanotech expansion.

Some of the prominent players in the nanotechnology market include:

- Nanonics Imaging Ltd.

- ANP CORPORATION

- Fujitsu Limited

- Bruker Corporation

- Thermo Fisher Scientific Inc.

- Kleindiek Nanotechnik GmbH

- eSpin Technologies, Inc.

- Altairnano

- Bayer AG

- Infineon Technologies AG

Recent Developments

- In September 2025, researchers at NIAB created an innovative diagnostic kit to identify antibiotic residues in animal food, marking a key step in improving food safety and tackling antimicrobial resistance. They also developed a nano-mineral biocapsule designed for precise delivery of nutrients, drugs, antibiotics, and other bioactive compounds, supporting advancements in targeted and personalized treatments.

- In September 2025, NanoSyrinx, a biotech company, secured £10 million (USD 12.2 million) in funding to advance its nano-syringe delivery technology. This platform uses engineered natural nano-syringes to accurately deliver peptide and protein payloads into the cytosol of specific target cells, enabling more precise therapeutic applications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the nanotechnology market

By Type

-

- Optical Nanosensor

- Chemical Nanosensor

- Physical Nanosensor

- Biosensors

- Others

-

- Nanomanipulator

- Nanomechanical Test Instruments

- Nanoscale Infrared Spectrometers

By Application

- Electronics & Semiconductor

- Healthcare & Pharmaceuticals

- Biotechnology

- Textile

- Chemicals and Advanced materials

- Automobiles

- IT & Telecom

- Aerospace

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)