Nerve Repair And Regeneration Market Size and Trends

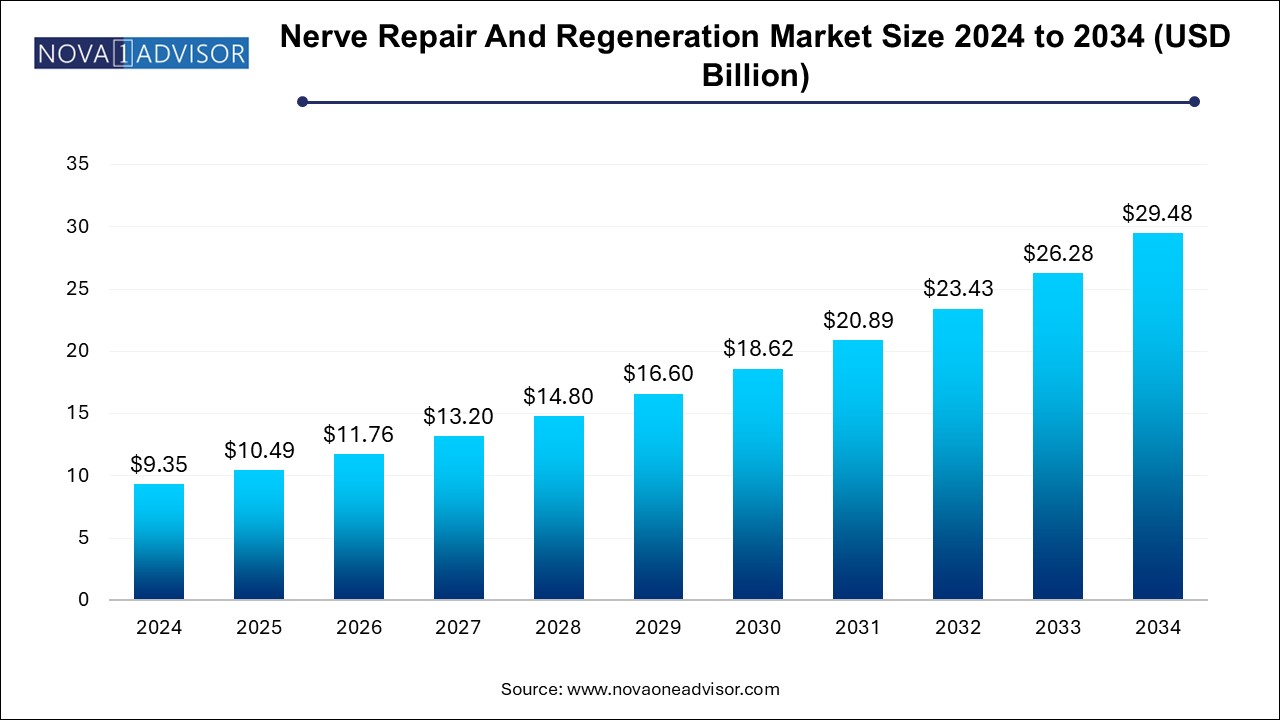

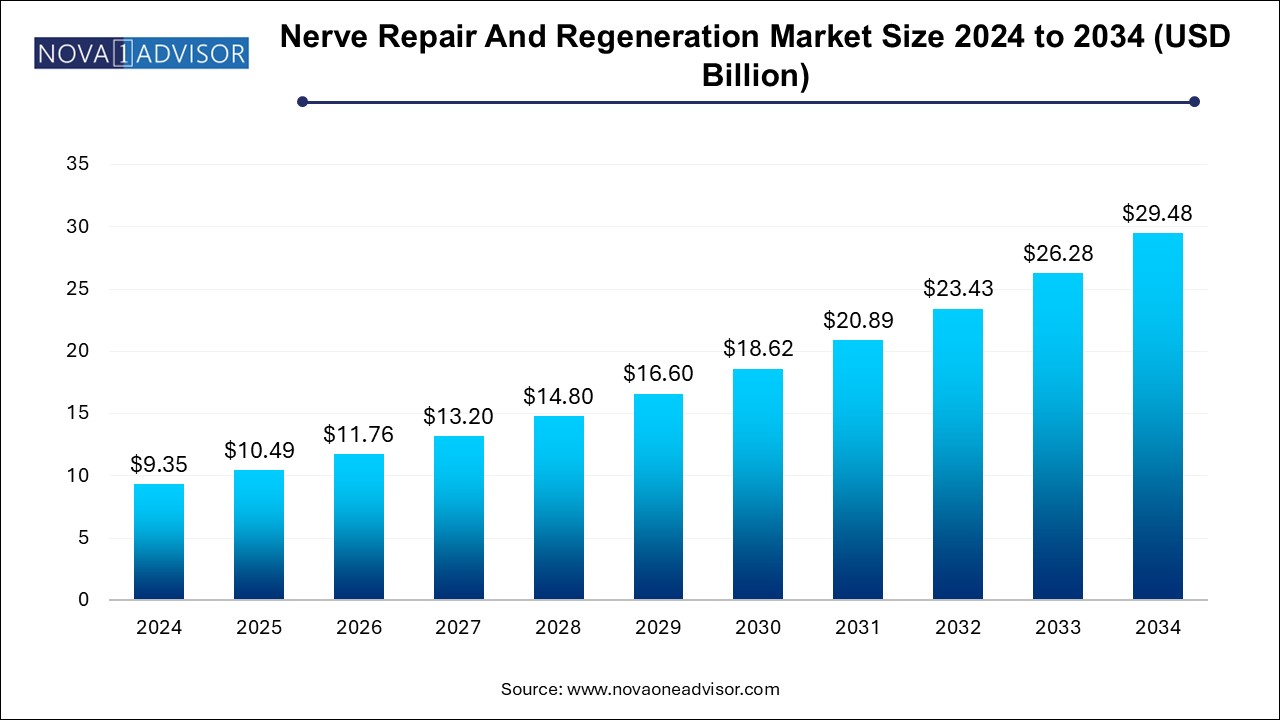

The nerve repair and regeneration market size was exhibited at USD 9.35 billion in 2024 and is projected to hit around USD 29.48 billion by 2034, growing at a CAGR of 12.17% during the forecast period 2024 to 2034.

Nerve Repair And Regeneration Market Key Takeaways:

- The neurostimulation and neuromodulation devices segment emerged as the largest segment with a revenue share of over 66.9% in 2024.

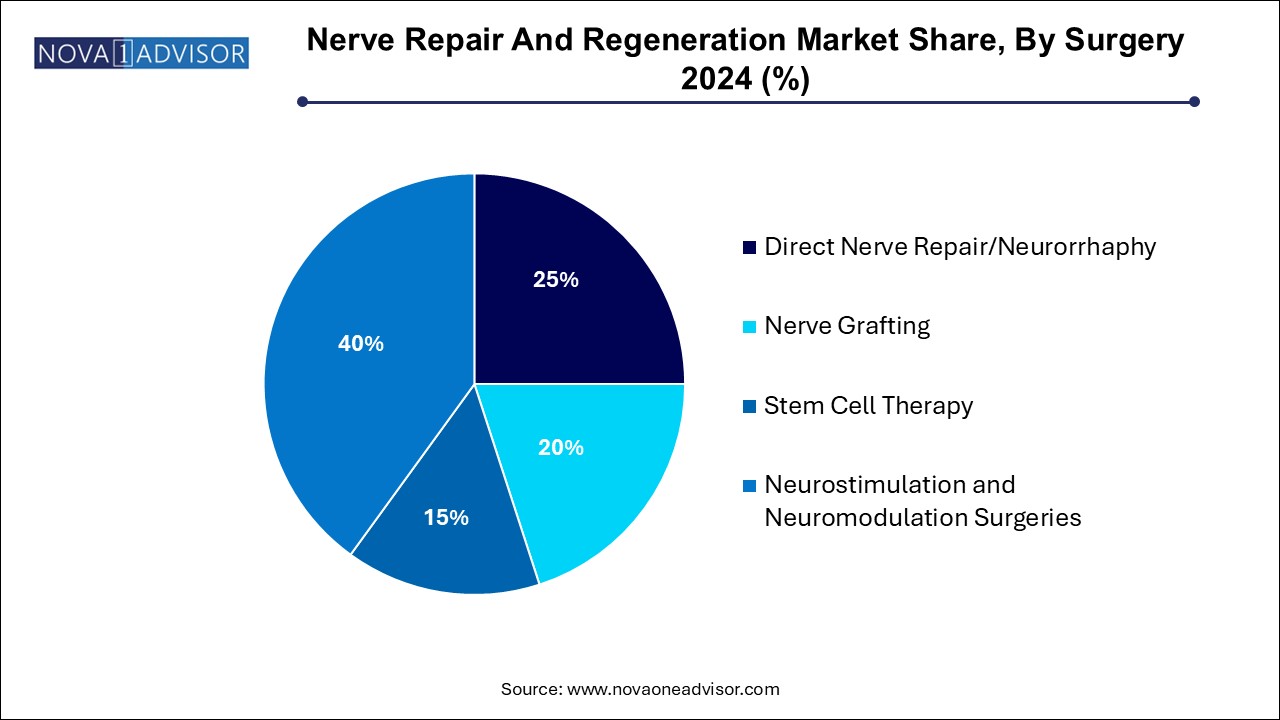

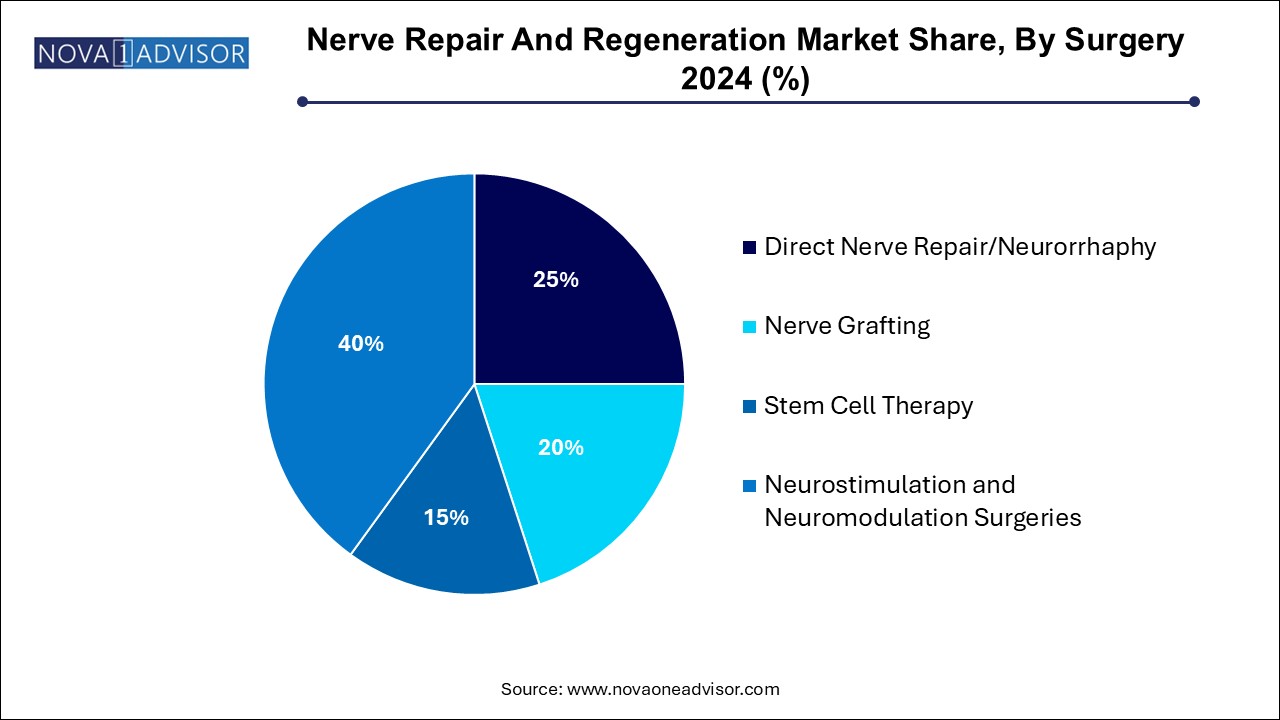

- Neurostimulation and neuromodulation surgeries held the largest revenue share of over 40.0% in 2024.

- In 2024, North America dominated the market with over 30.8% share owing to the increased incidence of neural disorders and supportive health insurance coverage scenario in the region.

- The Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period.

Market Overview

The nerve repair and regeneration market represents a critical segment of modern medical innovation, focused on restoring nerve function lost due to injury, trauma, or degenerative conditions. Damage to the peripheral or central nervous systems can result in debilitating consequences such as paralysis, chronic pain, sensory deficits, or cognitive impairments. Given the increasing incidence of nerve injuries stemming from accidents, surgical procedures, and neurological diseases effective nerve repair solutions are a growing necessity.

This market encompasses a diverse array of products and procedures, including biomaterials (such as nerve conduits and wraps), neurostimulation and neuromodulation devices, and surgical techniques like direct nerve repair, nerve grafting, and emerging stem cell therapies. With advancements in bioengineering, material science, and electrical stimulation technologies, the field is witnessing groundbreaking innovations that significantly improve patient outcomes.

Factors such as an aging population (prone to neurological disorders), rising prevalence of lifestyle diseases like diabetes (leading to neuropathy), and greater awareness of treatment options are contributing to market expansion. Additionally, the increasing number of approvals for novel devices by regulatory agencies, along with strategic collaborations between biotech firms and research institutions, are accelerating development in this high-potential field.

Major Trends in the Market

-

Advances in Bioengineered Nerve Conduits: Development of synthetic and natural biomaterial-based conduits mimicking native nerve tissues.

-

Growth in Neuromodulation Applications: Expanded use of neurostimulation devices for conditions beyond chronic pain, including epilepsy and depression.

-

Integration of Stem Cell Therapy: Increasing adoption of stem cell-based approaches for complex nerve regeneration.

-

Miniaturization of Neurostimulation Devices: Development of less invasive, rechargeable, and wearable neurostimulators.

-

Expansion of Target Indications: Nerve repair solutions being extended to treat Parkinson’s disease, Alzheimer's, and gastrointestinal motility disorders.

-

Rise in Clinical Research Funding: Surge in grants and investments from public and private sectors to advance nerve regeneration technologies.

-

Personalized Medicine Approach: Tailoring nerve repair techniques based on patient-specific injuries and genetic profiles.

-

Robotic Assistance in Microsurgical Procedures: Improving precision and outcomes in nerve repair surgeries through robotic technology.

Report Scope of Nerve Repair And Regeneration Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 10.49 Billion |

| Market Size by 2034 |

USD 29.48 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 12.17% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Surgery, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

AxoGen, Inc.; Stryker Corporation; St. Jude Medical, Inc.; Baxter International, Inc.; Polyganics B.V.; Boston Scientific, Inc.; Integra Lifesciences Corporation; Cyberonics, Inc.; Medtronic plc. |

Key Market Driver: Rising Incidence of Nerve Injuries and Neurological Disorders

The foremost driver boosting the nerve repair and regeneration market is the increasing incidence of nerve injuries and chronic neurological disorders globally. Motor vehicle accidents, falls, sports injuries, and surgical trauma are common causes of peripheral nerve injuries. Additionally, central nervous system (CNS) disorders such as Parkinson’s disease, Alzheimer’s disease, epilepsy, and multiple sclerosis are becoming more prevalent with aging populations.

According to the World Health Organization (WHO), neurological disorders are the second leading cause of death globally, further emphasizing the urgent need for effective nerve repair solutions. Nerve damage resulting from diabetes, which affects more than 460 million people worldwide, also contributes significantly to the demand for nerve regeneration therapies. The unmet need for restoring functional recovery in these patient populations is fueling consistent investment and innovation in the market.

Key Market Restraint: High Cost of Advanced Treatments and Devices

Despite promising growth, the high cost associated with nerve repair and regeneration treatments and devices acts as a significant market restraint. Advanced neurostimulation devices, bioengineered nerve grafts, and stem cell therapies entail substantial manufacturing, maintenance, and surgical costs.

In countries with limited healthcare reimbursement frameworks, affordability becomes a barrier to adoption. Even in developed markets, insurers often require extensive documentation and justification for covering expensive procedures like spinal cord stimulation or deep brain stimulation, causing delays and access issues. Cost-containment pressures within healthcare systems further complicate the commercial viability of innovative but expensive nerve repair technologies.

Key Market Opportunity: Expansion of Stem Cell-Based Therapies

One of the most exciting opportunities lies in the expansion of stem cell-based therapies for nerve regeneration. Stem cells offer the potential to differentiate into various types of nerve cells, repair damaged neural circuits, and modulate the inflammatory environment that hinders natural recovery.

Research into mesenchymal stem cells (MSCs), induced pluripotent stem cells (iPSCs), and neural progenitor cells is progressing rapidly, with several preclinical and clinical trials demonstrating promising results. Companies that successfully develop scalable, safe, and effective stem cell therapies could revolutionize the treatment of spinal cord injuries, peripheral nerve defects, and neurodegenerative diseases. This segment represents a transformative opportunity to move beyond symptom management toward actual restoration of nerve function.

Nerve Repair And Regeneration Market By Product Insights

Neurostimulation and neuromodulation devices dominate the market, serving as the primary therapeutic modality for chronic nerve pain, epilepsy, depression, and bladder dysfunction. Spinal cord stimulation devices, in particular, have gained widespread adoption for managing intractable back and limb pain. Companies like Medtronic, Abbott, and Boston Scientific have introduced increasingly sophisticated devices featuring rechargeable batteries, closed-loop feedback systems, and wireless control options.

Biomaterials are growing fastest, driven by rising demand for nerve conduits, wraps, and scaffolds made from synthetic polymers or natural materials like collagen. These materials provide a supportive environment for axonal regrowth across nerve gaps, reducing the need for autografts. Innovation in biodegradable and drug-eluting biomaterials is further enhancing healing outcomes, positioning this segment for rapid expansion.

Nerve Repair And Regeneration Market By Surgery Insights

Direct nerve repair/neurorrhaphy dominates the surgical segment, especially for acute, clean-cut injuries where the nerve ends can be sutured directly. Microsurgical techniques have advanced significantly, reducing tension at the repair site and improving functional recovery.

Stem cell therapy is the fastest-expanding surgical segment, reflecting growing interest in regenerative approaches. Clinical trials using stem cells to promote axonal regeneration, remyelination, and functional synaptic reformation are demonstrating encouraging outcomes. Stem cell-based therapies hold the promise of repairing both peripheral and central nervous system injuries that were previously considered irreversible, making this the most dynamic and transformative surgical approach under development.

Nerve Repair And Regeneration Market By Regional Insights

North America dominates the global nerve repair and regeneration market, driven by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading medical device and biotechnology companies. The U.S., in particular, benefits from a large pool of trained neurosurgeons, early adoption of innovative technologies, and robust investment in neurological research through agencies like the National Institutes of Health (NIH).

Favorable reimbursement policies for neurostimulation procedures, coupled with aggressive marketing efforts by device manufacturers, support high market penetration. Furthermore, the region’s active clinical trial ecosystem accelerates the introduction of novel therapies.

Asia-Pacific is the fastest-growing region, fueled by improving healthcare infrastructure, rising incidence of road traffic accidents and neurological disorders, and expanding middle-class populations with access to advanced treatments. Countries like China, India, Japan, and South Korea are investing heavily in healthcare modernization, including neurorehabilitation services.

The increasing number of academic collaborations, government funding for medical innovation, and growing interest from global device manufacturers entering these markets are expected to sustain strong growth in Asia-Pacific over the next decade.

Some of the prominent players in the nerve repair and regeneration market include:

- AxoGen, Inc.

- Stryker Corporation

- St. Jude Medical, Inc.

- Baxter International, Inc.

- Polyganics B.V.

- Boston Scientific, Inc.

- Integra Lifesciences Corporation

- Cyberonics, Inc.

- Medtronic plc.

Recent Developments

-

March 2025: Medtronic received FDA approval for its Senza Omnia spinal cord stimulation system designed to treat chronic intractable pain with multiple waveform delivery.

-

February 2025: Axogen, Inc. announced positive Phase III trial results for its Avance Nerve Graft, supporting its application for broader regulatory indications.

-

January 2025: Boston Scientific Corporation launched the Vercise Genus deep brain stimulation system with enhanced precision for managing Parkinson’s disease symptoms.

-

December 2024: Neuronetics, Inc. expanded its TMS (transcranial magnetic stimulation) therapy system for treatment-resistant depression to select Asian markets.

-

November 2024: Checkpoint Surgical, Inc. introduced the Checkpoint Edge Nerve Cutting Kit, enhancing precision during nerve-sparing surgeries.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the nerve repair and regeneration market

By Product

- Biomaterials

- Neurostimulation and Neuromodulation Devices

-

- Spinal Cord Stimulation Devices

- Deep Brain Stimulation Devices

- Sacral Nerve Stimulation Devices

- Vagus Nerve Stimulation Devices

- Gastric Electric Stimulation Devices

By Surgery

- Direct Nerve Repair/Neurorrhaphy

- Nerve Grafting

- Stem Cell Therapy

- Neurostimulation and Neuromodulation Surgeries

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)