Netupitant-Palonosetron FDC Market Size and Trends

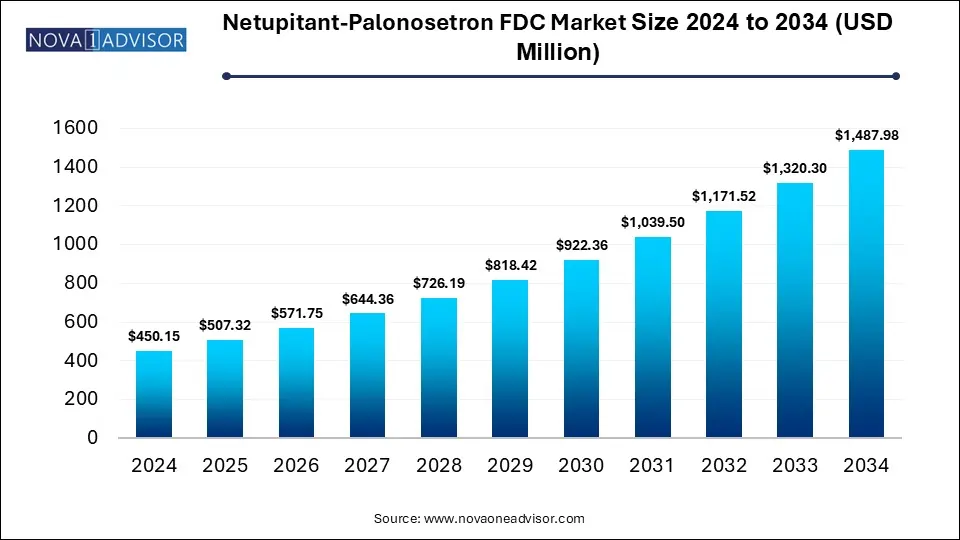

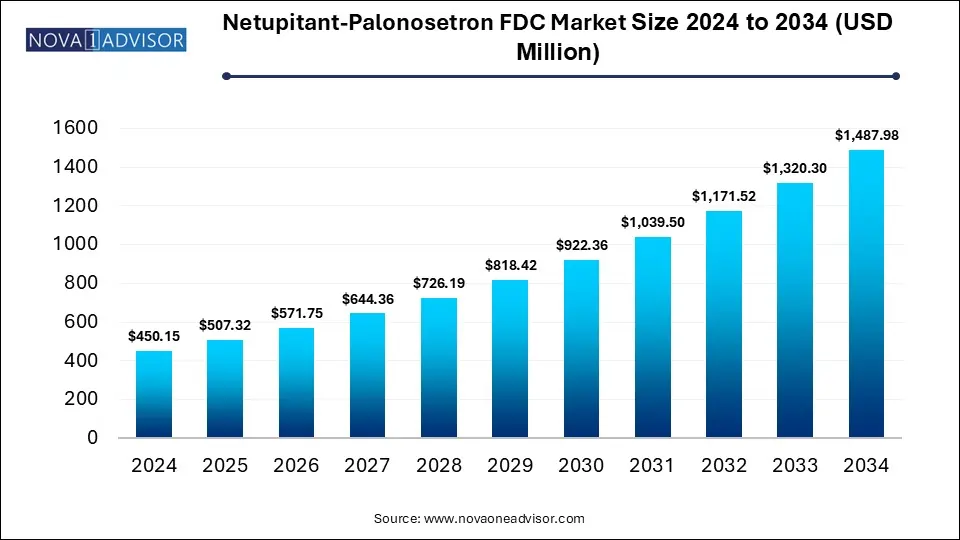

The global netupitant-palonosetron FDC market size is calculated at USD 450.15 million in 2024, grow to USD 507.32 million in 2025, and is projected to reach around USD 1,487.98 million by 2034, exhibiting a CAGR of 12.7% from 2025 to 2034. The market is growing due to its superior effectiveness in preventing both acute and delayed chemotherapy-induced nausea and vomiting. Rising cancer cases and increased chemotherapy use are also driving market demand.

Key Takeaways

- North America dominated the netupitant-palonosetron FDC market in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product type, the netupitant segment held the major market revenue share in 2024.

- By product type, the fixed dose combination (FDC) segment is expected to grow at the fastest CAGR in the market during the studied years.

- By application, the Chemotherapy Induced Nausea and Vomiting (CINV) segment held the largest market share.

- By application, the Postoperative Nausea and Vomiting (PONV) segment is expected to grow at the fastest CAGR in the market during the studied years.

- By route of administration, the oral administration segment led the market in 2024.

- By route of administration, the intravenous segment is expected to grow at the fastest CAGR in the market during the studied years.

- By distribution channel, the hospital pharmacies segment dominated the revenue market share in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR in the market during the studied years.

How Innovation is Impacting Netupitant-Palonosetron FDC Market

Netupitant palonosetron FDC is a fixed-dose oral antiemetic that combines netupitant (NK1 antagonist) and palonosetron, is effectively prevents both acute and delayed chemotherapy-induced nausea and vomiting. Innovation is driving the growth of the netupitant palonosetron FDC market by improving drug delivery methods, such as extended-release formulations and orally disintegrating tablet, which enhances patient convenience and adherence. Advances in formulation technology are also increasing the drug's bioavailability and efficacy. Additionally, the development of ready-to-use injectable forms and digital tools for personalized dosing accessible and efficient for managing chemotherapy-induced nausea and vomiting.

- For Instance, As per the National Cancer Institute, around 1.9 million new cancer cases were projected in the U.S. in 2023, reflecting a rising number of patients needing effective supportive treatments such as Netupitant-Palonosetron FDC to manage chemotherapy-related side effects.

What are the Key Trends in the Netupitant-Palonosetron FDC Market in 2025?

- In 2024, Helsinn launched a patient-friendly packaging design that helped cut medication errors by 20%, as reported through clinical feedback. Partnerships with hospitals also boosted the use of the product by more than 15% in key markets. To keep up with increasing global demand, pharma companies have ramped up production capacity by about 35%.

- In 2023, Heron Therapeutics rolled out an improved version of its anti-emetic treatment, showing better effectiveness and leading to a more than 25% rise in patient satisfaction.

How Can AI Affect the Netupitant-Palonosetron FDC Market?

AI can significantly impact the market by enhancing drug development, optimizing formulation, and improving patient targeting. Through data-driven insights, AI can help identify ideal patient populations, predict treatment responses, and personalize antiemetic regimens. It also aids in streamlining clinical trials, reducing time and cost. Furthermore, AI-powered supply chain management can improve distribution efficiency, while digital health tools can boost patient adherence and monitor real-time outcomes, ultimately driving market growth and improving the overall effectiveness of supportive cancer care.

Report Scope of Netupitant-Palonosetron FDC Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 507.32 Million |

| Market Size by 2034 |

USD 1,487.98 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 12.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product Type, By Application, By Route of Administration, By Distribution Channel, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Helsinn Group, Eisai Co.Ltd., Heron Therapeutics, Inc., Acacia Phama, Tesaro, GlaxoSmithKline plc. |

Market Dynamics

Driver

Rising prevalence of Cancer

The growing prevalence of cancer is a major driver in the Netupitant-Palonosetron FDC market, as chemotherapy remains a common treatment method that often causes nausea and vomiting. This increases the need for reliable antiemetic solutions to improve patient comfort and adherence to therapy. Netupitant-Palonosetron FDC offers effective control of both acute and delayed symptoms, making it a preferred choice among healthcare providers to support patients undergoing cancer treatment.

For Instance, In June 2024, a multinational Phase 2 pediatric PK/PD study evaluated children aged 3 months to 18 years undergoing emetogenic chemotherapy. The trial successfully identified optimized dosing regimens for oral NEPA, ensuring effective pharmacokinetics and efficacy, and confirmed its safe use in the pediatric population.

Restraint

High Treatment Cost

High treatment cost is a major restraint in the Netupitant-Palonosetron FDC market because it limits access for patients, especially in low-and middle-income countries where healthcare budgets are constrained. The premium pricing compared to generic antiemetics makes it less affordable, reducing its widespread adoption. Additionally, a lack of reimbursement coverage in some regions further discourages both patients and healthcare providers from choosing this option, impacting overall market growth despite its clinical effectiveness.

Opportunity

Expansion of Emerging Market

Emerging markets present strong potential for the Netupitant-Palonosetron FDC market as governments invest in better oncology care, and access to advanced treatments improves. With rising healthcare awareness and efforts to include antiemetic therapies in national cancer programs, demand for effective supportive medication is increasing. Pharmaceutical companies can benefit from expanding their presence in these regions by offering cost-effective formulation, localized manufacturing, and partnerships with regional healthcare providers.

For Instance, In November 2023, West China Hospital (Sichuan University) published a study showing that oral NEPA significantly outperformed standard 5-HT₃ antagonists in preventing chemotherapy-induced nausea and vomiting during hematopoietic stem cell transplants. Complete response rates with NEPA were 71.7% overall versus just 32.7% with the comparator, across both acute and delayed phases, confirming its superior efficacy in this high-risk setting.

Segmental Insights

How will the Netupitant Segment Dominate the Netupitant-Palonosetron FDC Market in 2024?

In 2024, the netupitant segment led the market due to its inclusion in widely used oral capsule formulations preferred for their convenience and effectiveness. Netupitant's strong performance in controlling both acute and delayed chemotherapy-induced nausea and vomiting made it a trusted choice among oncologists. Its clinical superiority, along with favorable reimbursement policies and increased adoption and revenue share, solidifies its dominant position in the overall FDC market.

The fixed-dose combination segment is projected to witness the fastest growth in the Netupitant-Palonosetron FDC market as it offers improved treatment efficiency and consistent therapeutic outcomes. Its streamlined dosing approach minimizes the need for multiple medications, reducing the risk of missed doses. Increasing use in both adult and pediatric settings, along with expanding product availability in emerging markets, supports its rapid uptake. Moreover, advancements in formulation technology continue to enhance its critical appeal and market reach.

Why Did the Chemotherapy-Induced Nausea and Vomiting (CINV) Segment Dominate the Netupitant-Palonosetron FDC Market in 2024?

The CINV segment experienced the fastest growth in the market as healthcare providers increasingly prioritized managing treatment-related side effects to improve patient outcomes. With chemotherapy remaining a key cancer treatment, reducing nausea and vomiting became essential to ensure patient comfort and therapy completion. The proven effectiveness of NEPA in controlling these symptoms led to its wider adoption across oncology centers, making it a vital part of supportive care protocols and boosting market expansion in this segment.

The postoperative nausea and vomiting (PONV) segment is projected to grow rapidly in the Netupitant-Palonosetron FDC market due to increasing surgical procedures and heightened focus on improving post-surgical recovery. With healthcare systems aiming to enhance patient comfort and minimize complications, demand for long-acting and reliable antiemetic solutions like NEPA is rising. Its ability to provide extended relief with a single dose makes it well-suited for perioperative care, encouraging broader use across surgical and outpatient settings.

How Does the Oral Administration Segment Dominate the Market?

The oral administration segment dominated the market in 2024 as it allowed greater flexibility in treatment delivery, especially outside hospital settings. Its non-invasive nature and ability to be self-administered made it a preferred option among patients and healthcare providers alike. Moreover, oral formulations helped reduce the burden on healthcare facilities by minimizing the need for IV setups, making them cost-effective and efficient for managing chemotherapy-related side effects across various care environments.

The intravenous segment is expected to grow at the fastest CAGR in the Netupitant-Palonosetron FDC market due to its rapid onset of action and suitability for hospital-based chemotherapy treatments. IV administration ensures accurate dosing, especially for patients who experience severe nausea and cannot tolerate oral medications. With the rising use of high-emetogenic chemotherapy regimens and growing preference for ready-to-use injectable formulations, healthcare providers increasingly opt for IV NEPA to ensure effective and immediate control of nausea and vomiting.

How does the Hospital Pharmacies Segment Dominate the Netupitant-Palonosetron FDC Market in 2024?

In 2024, hospital pharmacies dominated the market revenue as they serve as primary points of care for cancer patients receiving chemotherapy. These settings often require immediate access to supportive medications, making hospitals ideal for dispensing NEPA. Centralized procurement, integration into oncology protocols, and specialist oversight ensure consistent use of antiemetics. Additionally, hospitals handle a higher volume of complex cases, leading to greater reliance on clinically proven therapies like NEPA, thereby strengthening their market share.

The online pharmacy segment is projected to grow rapidly in the Netupitant-Palonosetron FDC market as more patients seek hassle-free access to medications without visiting hospitals or clinics. The rise in e-commerce platforms, along with increasing awareness of digital health services, has made it easier for patients to purchase antiemetic treatments remotely. In addition, improved logistics, subscription-based delivery models, and expanded online availability of oncology drugs are driving the shift toward digital purchasing channels during the studied period.

Regional Insights

How is North America Contributing to the Expansion of Netupitant-Palonosetron FDC Market?

In 2024, North America led the market owing to its well-established cancer care systems and strong emphasis on managing chemotherapy side effects. High patient awareness, early integration of advanced antiemetics into treatment protocols, and strong clinical adoption supported market dominance. The region also benefited from strategic collaborations between drug manufacturers and healthcare providers, along with wide availability through hospital and retail channels, reinforcing its position as the top market for NEPA-based therapies.

How is Asia-Pacific approaching the Netupitant-Palonosetron FDC Market in 2025?

The Asia-Pacific region is projected to witness the fastest growth in the market as countries in the region experience a surge in oncology cases and prioritize better symptom management during chemotherapy. Economic development and expanding insurance coverage are enabling greater patient access to advanced antiemetic treatments. Moreover, increased clinical adoption, regional trials, and pharmaceutical investment in localized production are strengthening the availability and use of NEPA across diverse healthcare settings in the region.

Some of The Prominent Players in The Netupitant-Palonosetron FDC Market Include:

- Helsinn Group

- Eisai Co.Ltd.

- Heron Therapeutics, Inc.

- Acacia Phama

- Tesaro

- GlaxoSmithKline plc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Netupitant-Palonosetron FDC Market.

By Product Type

- Netupitant

- Palonosetron

- Fixed Dose Combination (FDC)

By Application

- Chemotherapy-Induced Nausea and Vomiting (CINV)

- Postoperative Nausea and Vomiting (PONV)

- General Nausea Management

By Route of Administration

- Oral Administration

- Intravenous (IV) Administration

- Sublingual Administration

By Distribution Channel

- Hospitals

- Retail Pharmacies

- Online Pharmacies

- Specialty Clinics

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)