Neuroprosthetics Market Size and Growth Report By 2033

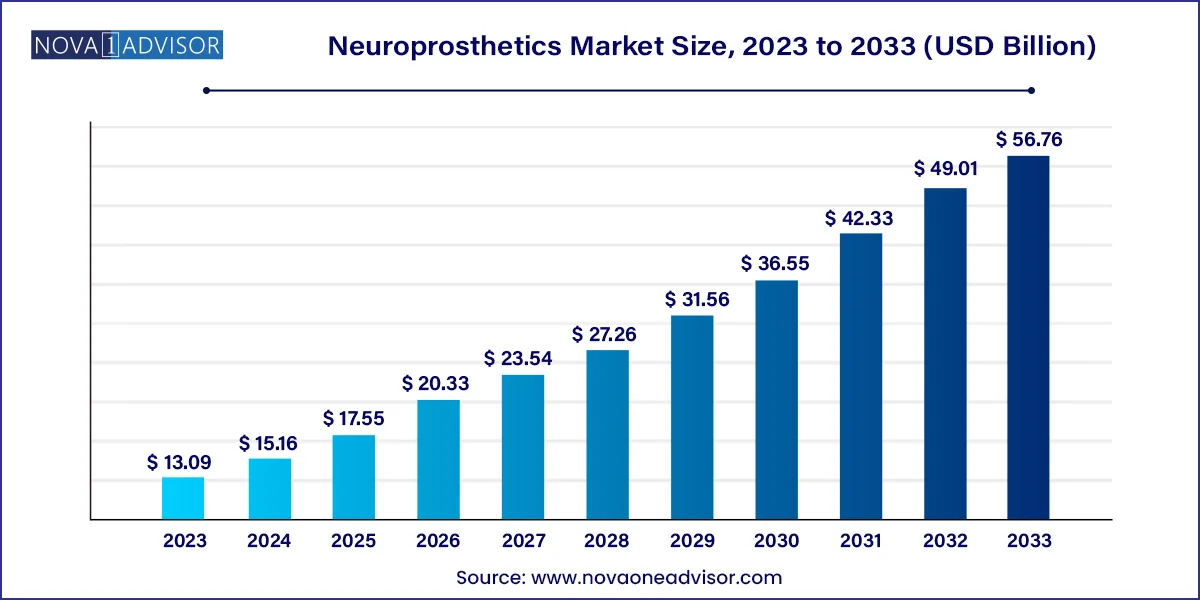

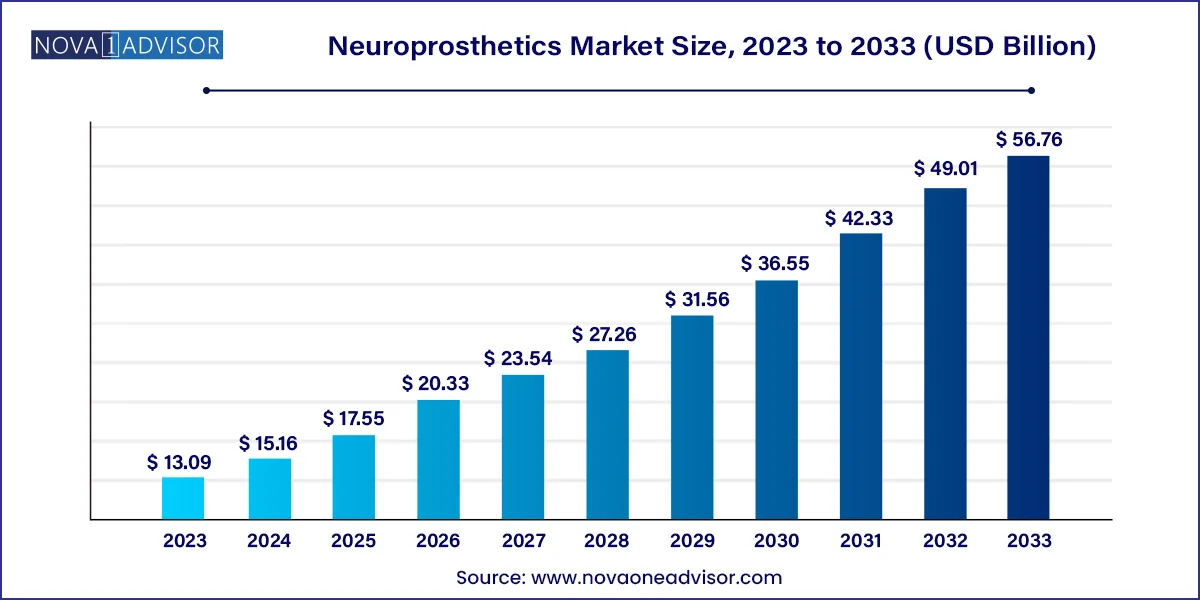

The global neuroprosthetics market size was valued at USD 13.09 billion in 2023 and is anticipated to reach around USD 56.76 billion by 2033, growing at a CAGR of 15.8% from 2024 to 2033.

Neuroprosthetics Market Key Takeaways

- North America neuroproteins market dominated the global market with 42.65% share in 2023

- Asia Pacific neuroproteins market is anticipated to witness a significant CAGR of 16.4% during the forecast period.

- Motor prosthetics accounted for the largest market revenue share of 42.18% in 2023.

- Retinal implants are expected to register a fastest CAGR of 16.4% during the forecast period.

- Spinal Cord Stimulation (SCS) accounted for the largest market share of 49.32% in 2023.

- Sacral Nerve Stimulation (SNS) is expected to register the fastest CAGR of 19.4% during the forecast period.

- Themotor neuron disorders segment dominated the market with 59.15% share in 2023

- The cognitive disorders segment is projected to grow at the fastest CAGR of 16.9% over the forecast period.

Market Overview

The neuroprosthetics market represents one of the most exciting intersections of neuroscience, biomedical engineering, and healthcare innovation. Neuroprosthetics refers to devices that substitute or supplement the input/output of the nervous system, effectively restoring lost sensory or motor functions in individuals suffering from neurological impairments or disorders.

Initially focused on cochlear implants for auditory restoration, the field has expanded rapidly to include motor prosthetics for amputees, cognitive prosthetics for neurodegenerative diseases, and retinal implants for visual impairments. Neuroprosthetic devices leverage technologies such as electrical stimulation, brain-machine interfaces (BMIs), and sophisticated microelectronics to interface directly with the nervous system, offering life-changing possibilities.

With the growing burden of neurological diseases like Parkinson’s disease, epilepsy, Alzheimer’s disease, and sensory impairments, demand for advanced neuroprosthetic solutions is increasing. In addition, ongoing breakthroughs in deep brain stimulation (DBS), vagus nerve stimulation (VNS), and spinal cord stimulation (SCS) are driving both clinical applications and public acceptance of neuroprosthetic interventions.

The market’s evolution is further fueled by advancements in materials science, miniaturization, wireless technology, and artificial intelligence (AI) integration, which are making devices safer, more efficient, and more adaptive to individual patient needs. Strategic collaborations between academia, biotechnology firms, and healthcare providers are accelerating product innovation and clinical validation.

Overall, the neuroprosthetics market is on the cusp of transformative growth, offering hope to millions worldwide while reshaping how chronic neurological conditions are managed.

Major Trends in the Market

-

Expansion of Brain-Computer Interface (BCI) Technologies: Enhancing motor prosthetic control and cognitive restoration.

-

Miniaturization and Wireless Technologies: Development of less invasive, remotely controlled neuroprosthetics.

-

Increased Focus on Cognitive Neuroprosthetics: Efforts to address memory and mood disorders like Alzheimer’s and depression.

-

Rise in Personalized Neuroprosthetic Solutions: Tailoring device settings to individual neural signatures and disorders.

-

Integration of AI and Machine Learning: Smart neuroprosthetics capable of adaptive learning and predictive functioning.

-

Improved Biocompatibility and Material Innovations: Reducing rejection risks and improving long-term device integration.

-

Expansion into Home-based Therapies: Portable, user-friendly devices enabling neuroprosthetic therapies outside hospital settings.

-

Growing Regulatory Support and Fast-tracked Approvals: Especially for breakthrough devices treating severe, refractory conditions.

Neuroprosthetics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 15.16 Billion |

| Market Size by 2033 |

USD 56.76 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.8% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, technology, application, region

|

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Medtronic Plc, LivaNova Cochlear Ltd., Abbott Laboratories, Boston Scientific, NeuroPace, Inc., St. Jude Medical, Inc., Retina Implant AG, Nervo Corp., Sonova, BrainGate. |

Key Market Driver: Rising Prevalence of Neurological Disorders

The primary driver boosting the neuroprosthetics market is the rising prevalence of neurological disorders globally. According to the World Health Organization (WHO), neurological disorders are the leading cause of disability-adjusted life years (DALYs) and the second leading cause of death worldwide.

Conditions such as Parkinson’s disease, epilepsy, Alzheimer’s disease, stroke-related impairments, and sensorineural hearing loss are increasing with aging populations, sedentary lifestyles, and improved diagnostic capabilities. For instance, approximately 10 million people worldwide are living with Parkinson’s disease, a prime target for deep brain stimulation-based neuroprosthetics.

Furthermore, improvements in surgical techniques and patient education are fostering greater acceptance of implantable devices for conditions that were previously managed primarily with medications. This growing clinical need is propelling research investment, product innovation, and expanding adoption of neuroprosthetic technologies.

Key Market Restraint: High Costs and Limited Accessibility

Despite remarkable advances, the high costs associated with neuroprosthetic devices and their implantation procedures act as a significant restraint to market growth.

Procedures involving deep brain stimulation or cochlear implants can cost tens of thousands of dollars, encompassing device costs, surgical expenses, and post-operative rehabilitation. Insurance coverage varies widely across geographies, and out-of-pocket costs can be prohibitive for many patients, especially in low- and middle-income countries.

Moreover, the highly specialized surgical expertise required for implantation, coupled with risks such as infection, device malfunction, and need for reoperation, can limit both provider and patient willingness to adopt neuroprosthetic solutions. These economic and logistical challenges need to be addressed to unlock the market’s full potential.

Key Market Opportunity: Development of Non-invasive Neuroprosthetics

An exciting opportunity lies in the development of non-invasive and minimally invasive neuroprosthetics. Traditional neuroprosthetics often involve surgical implantation, which carries risks and restricts eligible patient pools.

Advances in transcutaneous electrical nerve stimulation (TENS), transcranial magnetic stimulation (TMS), and wearable brain-computer interfaces are opening new avenues for non-invasive neuromodulation. These technologies promise broader accessibility, lower cost, and reduced procedural risks, making neuroprosthetic therapies viable for a much larger population.

Companies that successfully commercialize effective non-invasive neuroprosthetic platforms—particularly for chronic pain management, cognitive enhancement, and motor rehabilitation—are poised for substantial market success.

Neuroprosthetics Market By Type Insights & Trends

Cochlear implants dominate the type segment, as they were among the first successful clinical applications of neuroprosthetic technology. Used to restore hearing in patients with severe-to-profound sensorineural hearing loss, cochlear implants are now widely accepted, with well-established safety and efficacy profiles. Companies like Cochlear Limited and MED-EL continue to lead innovation in this space, with improvements in sound quality, wireless connectivity, and pediatric applications.

Cognitive prosthetics are growing fastest, driven by increasing research into devices aimed at treating Alzheimer's disease, severe depression, and traumatic brain injuries. Neuroprosthetics targeting cognitive function involve complex interfaces with memory circuits and mood regulation networks in the brain. Emerging therapies like deep brain stimulation for depression and hippocampal prostheses for memory restoration are at the forefront of next-generation neuroprosthetic development.

Neuroprosthetics Market By Technology Insights & Trends

Deep brain stimulation (DBS) dominates the technology segment, being the most established and widely used technique for conditions like Parkinson’s disease, dystonia, essential tremor, and refractory epilepsy. DBS involves the implantation of electrodes into specific brain regions to modulate dysfunctional neural circuits. Ongoing refinements, such as directional leads and adaptive stimulation systems, continue to enhance outcomes.

Vagus nerve stimulation (VNS) is growing rapidly, particularly with expanding indications for epilepsy, depression, and inflammatory diseases. The non-invasive and minimally invasive VNS devices are gaining popularity, especially among patients who seek alternatives to pharmacological therapies. Newer VNS applications, including heart failure and migraine treatment, are further boosting this segment's growth.

Neuroprosthetics Market By Application Insights & Trends

Motor neuron disorders dominate the application segment, primarily due to the success of neuroprosthetic interventions like DBS for Parkinson’s disease and epilepsy management. Neuroprosthetic devices aimed at restoring voluntary movement and controlling tremors are crucial for improving quality of life in these patients. Expanded indications and improved surgical techniques continue to bolster this segment.

Cognitive disorders are growing fastest, as the burden of Alzheimer's disease and depression rises globally. Cognitive prosthetics, including devices to stimulate memory formation, mood regulation, and cognitive resilience, are drawing substantial research funding. The integration of AI and neurofeedback in cognitive neuroprosthetics promises even broader future applications.

Neuroprosthetics Market By Regional Insights & Trends

North America dominates the global neuroprosthetics market, driven by its advanced healthcare infrastructure, high adoption rates of new technologies, extensive R&D funding, and the presence of leading neuroprosthetic companies. The U.S. leads in both clinical research and commercial availability of neuroprosthetic solutions, supported by favorable regulatory pathways such as the FDA’s Breakthrough Devices Program.

Prominent academic centers and hospital systems in North America also contribute to the rapid translation of neuroprosthetic innovations from the lab to clinical practice. Moreover, supportive insurance reimbursement policies for cochlear implants, DBS, and other approved neuroprosthetic interventions reinforce strong market penetration.

Asia-Pacific is the fastest-growing region, owing to increasing healthcare investments, rising awareness about advanced neurological treatments, and growing medical tourism industries in countries like India, China, and Thailand.

Government initiatives to improve access to neurological care, combined with rising disposable incomes and aging populations, are fueling demand for neuroprosthetic solutions. Furthermore, multinational corporations are increasingly targeting Asia-Pacific for market expansion through partnerships, local manufacturing, and tailored product offerings, accelerating regional growth.

Neuroprosthetics Market Top Key Companies:

- Medtronic Plc

- LivaNova

- Cochlear Ltd.

- Abbott Laboratories

- Boston Scientific

- NeuroPace, Inc.

- St. Jude Medical, Inc.,

- Retina Implant AG,

- Nervo Corp.,

- Sonova

- BrainGate

Recent Developments

-

March 2025: Cochlear Limited launched the next-generation Cochlear Nucleus 8 Sound Processor, featuring improved connectivity and AI-based sound enhancement.

-

February 2025: Medtronic received expanded FDA approval for its Percept™ PC neurostimulator with BrainSense™ technology for personalized DBS therapy.

-

January 2025: Boston Scientific announced a strategic collaboration with a leading AI startup to enhance adaptive neuromodulation capabilities in its DBS devices.

-

December 2024: NeuroPace, Inc. launched a next-generation responsive neurostimulation system for epilepsy, improving detection accuracy and patient comfort.

-

November 2024: LivaNova PLC initiated a global clinical trial evaluating its latest VNS therapy system for treatment-resistant depression.

Neuroprosthetics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Neuroprosthetics market.

By Type

- Motor Prosthetics

- Cochlear Implants

- Cognitive Prosthetics

- Retinal Implants

By Technology

- Deep Brain Stimulation (DBS)

- Vagus Nerve Stimulation (VNS)

- Spinal Cord Stimulation (SCS)

- Sacral Nerve Stimulation (SNS

By Application

- Motor Neuron Disorders

- Parkinson’s Disease

- Epilepsy

- Physiological Disorders

- Auditory Disorders

- Ophthalmic Disorders

- Cardiac Disorders

- Kidney Disorders

- Cognitive Disorders

- Alzheimer’s Disease

- Severe Depression

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)