The global next-generation sequencing data analysis market size was exhibited at USD 884.10 million in 2023 and is projected to hit around USD 6,950.57 million by 2033, growing at a CAGR of 22.9% during the forecast period 2024 to 2033.

.jpg)

Key Takeaways:

- The service segment dominated the global industry in 2023 and accounted for the maximum share of more than 54.06% of the overall revenue.

- The NGS tertiary data analysis segment led the global industry in 2023 and captured the highest share of more than 49.18% of the overall revenue.

- The in-house mode segment dominated the global industry in 2023 and accounted for the largest share of more than 65.12% of the overall revenue.

- The short-read sequencing segment dominated the global NGS data analysis industry in 2023 and accounted for the maximum share of 74.14% of the overall revenue.

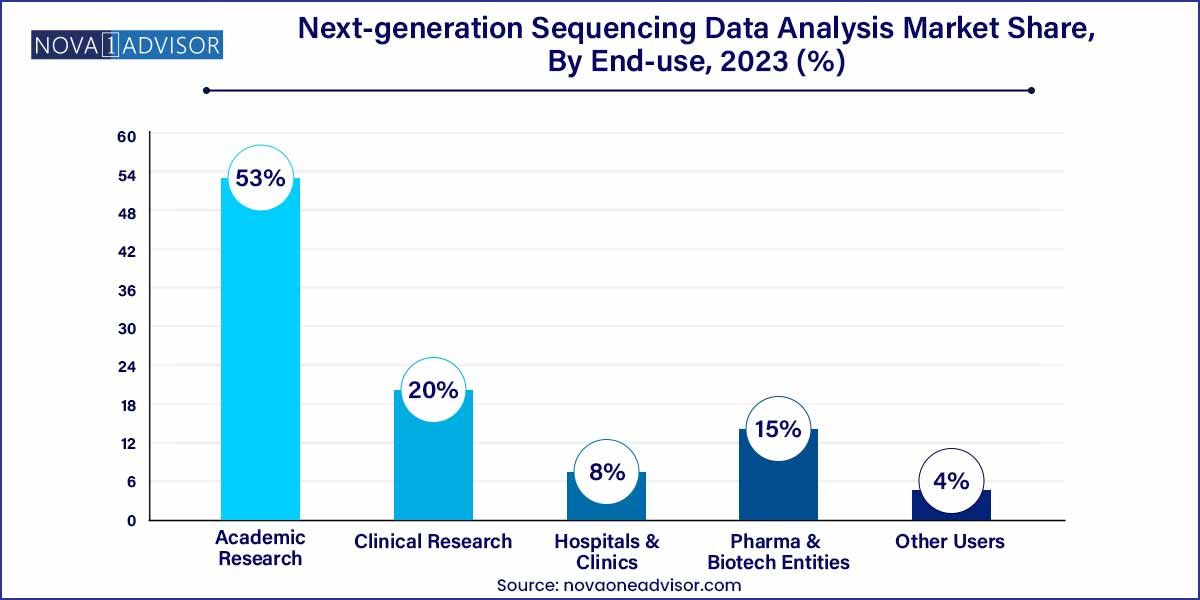

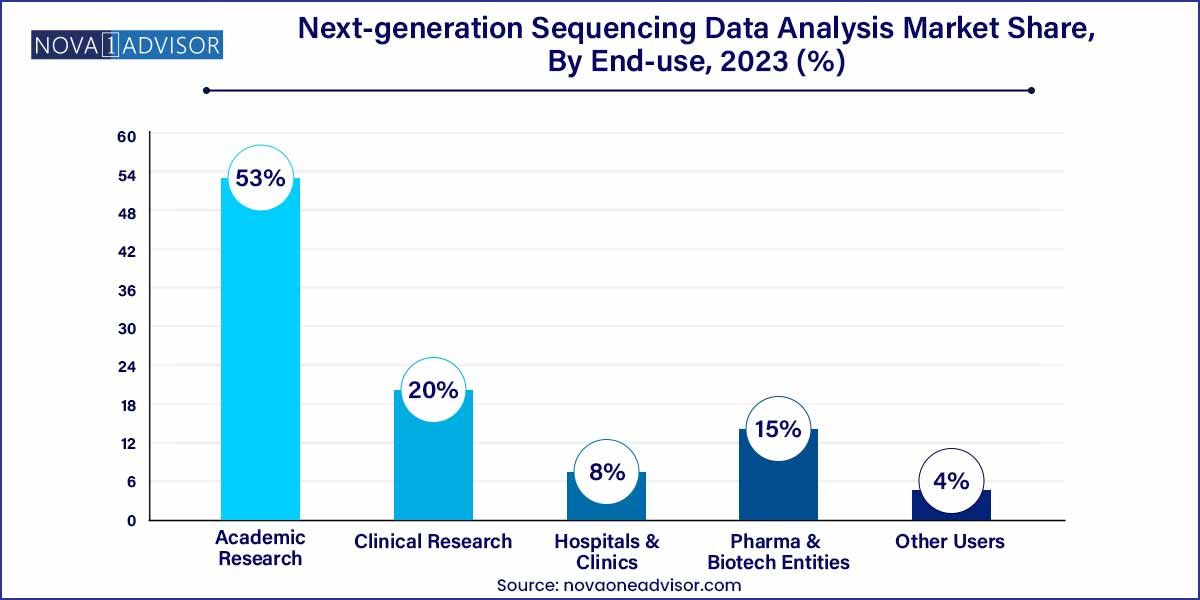

- The academic and research institute segment led the industry in 2023 and accounted for the maximum share of more than 53% of the overall revenue.

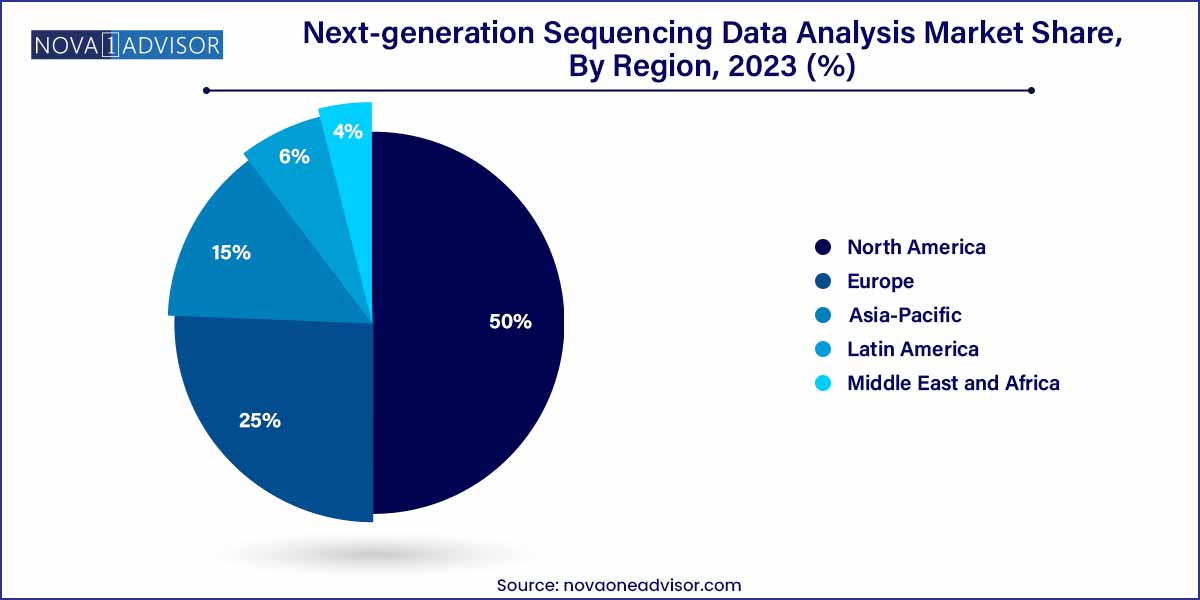

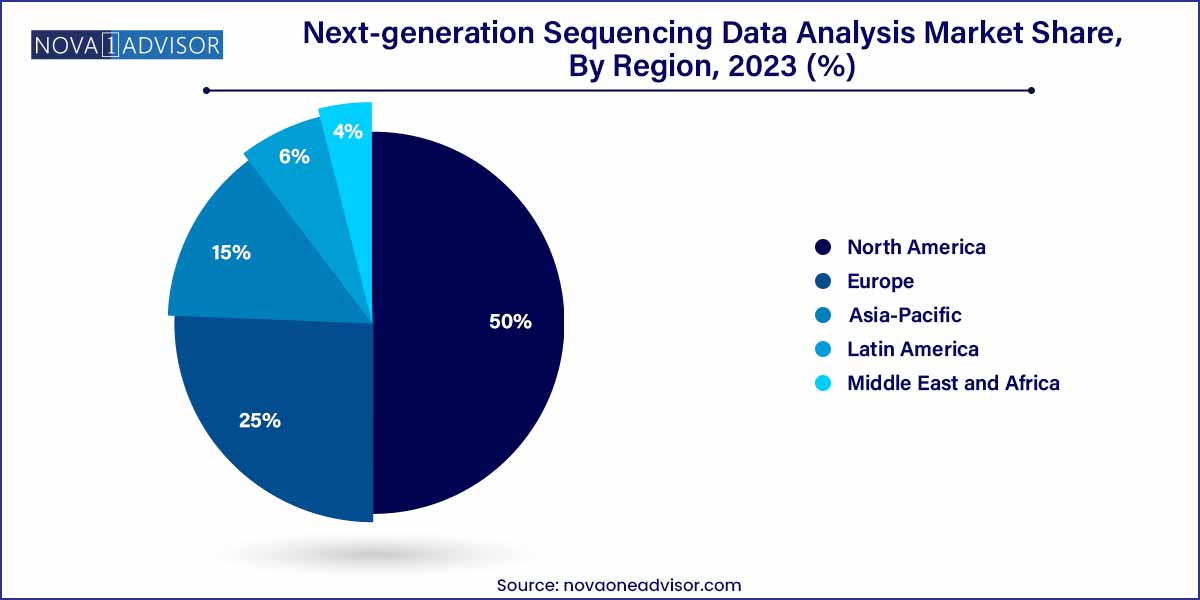

- North America dominated the global industry in 2023 and accounted for the maximum share of more than 50.00% of the global revenue.

Next-generation Sequencing Data Analysis Market Overview

In the ever-evolving landscape of genomics, next-generation sequencing (NGS) has emerged as a revolutionary technology, propelling advancements in personalized medicine, agriculture, and various other scientific domains. At the heart of this innovation lies the critical aspect of data analysis, which plays an indispensable role in deriving meaningful insights from the vast volumes of sequencing data generated. This article delves into the burgeoning market of next-generation sequencing data analysis, providing readers with a comprehensive overview of its dynamics, growth prospects, and key trends.

Next-generation Sequencing Data Analysis Market Growth

The growth trajectory of the next-generation sequencing (NGS) data analysis market is propelled by several pivotal factors that underscore its burgeoning significance in the genomics landscape. Firstly, technological innovations continue to refine NGS platforms, generating vast volumes of sequencing data that necessitate sophisticated analytical tools for interpretation. This influx of data has catalyzed the development of advanced data analysis software and solutions, fostering a conducive environment for market expansion. Additionally, the burgeoning applications of NGS across multifaceted domains, encompassing oncology, agriculture, and personalized medicine, amplify the demand for tailored data analysis platforms adept at deciphering intricate genomic information. Furthermore, collaborative endeavors between academic institutions, pharmaceutical conglomerates, and biotechnology firms are driving research and development initiatives, thereby augmenting the market's growth prospects. Collectively, these intertwined factors converge to create a fertile ecosystem, stimulating innovation, investment, and advancements in the next-generation sequencing data analysis domain.

Next-generation Sequencing Data Analysis Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 884.10 Million |

| Market Size by 2033 |

USD 6,950.57 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 22.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Workflow, Mode, Read Length, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Golden Helix, Inc.; Bio-Rad Laboratories, Inc.; SciGenom Labs Pvt. Ltd.; DNAnexus Inc.; Genuity Science; Fabric Genomics, Inc.; Congenica Ltd.; QIAGEN; DNASTAR, Inc.; Pacific Biosciences of California, Inc.; Eurofins Scientific; Partek Incorporated; Precigen Bioinformatics Germany GmbH; PierianDx; Agilent Technologies, Inc.; F. Hoffmann-La Roche Ltd.; Illumina, Inc.; Verily Life Science; Thermo Fisher Scientific, Inc. |

Next-generation Sequencing Data Analysis Market Dynamics

- Rapid Technological Advancements: The continuous evolution of NGS technologies has led to an exponential increase in sequencing data output. This surge necessitates sophisticated data analysis tools capable of handling vast datasets efficiently.

- Growing Applications in Precision Medicine: The application of NGS in personalized medicine, oncology, and rare disease diagnostics has expanded significantly. As precision medicine gains momentum, there's an escalating need for robust data analysis platforms to interpret complex genomic data for clinical decision-making.

- Declining Sequencing Costs: The plummeting costs of sequencing have democratized access to genomic data. This cost reduction has amplified the adoption of NGS across various sectors, fueling the demand for advanced data analysis solutions.

Market Restraint

- Data Volume and Complexity:

A primary restraint confronting the Next-Generation Sequencing (NGS) data analysis market is the sheer volume and complexity of data generated through advanced sequencing technologies. As NGS methodologies continue to evolve, they produce exponentially increasing amounts of genomic data, outpacing the capacity of existing computational infrastructures and data storage solutions. This data deluge necessitates sophisticated analytical tools and platforms capable of handling vast datasets while ensuring accuracy, reliability, and efficiency.

The intricate nature of genomic data, characterized by complex patterns, structural variations, and sequence alignments, presents significant challenges in data interpretation, analysis, and visualization. Traditional data analysis methods may prove insufficient in deciphering complex genomic datasets, leading to potential insights being overlooked, misinterpreted, or misaligned.

- Bioinformatics Expertise and Skill Gap:

Another critical restraint impeding the growth of the NGS data analysis market is the persistent gap in bioinformatics expertise and skilled professionals proficient in interpreting and analyzing complex genomic datasets. The rapidly evolving landscape of genomics and bioinformatics necessitates specialized knowledge in computational biology, statistical analysis, data mining, and genomic sequencing technologies.

The shortage of qualified bioinformaticians proficient in NGS data analysis hampers research advancements, slows down data analysis processes, and limits the effective utilization of advanced data analysis tools and technologies. The intricate nature of NGS data requires specialized training, expertise, and domain knowledge to navigate complex data analysis pipelines, interpret genomic variations, and derive meaningful insights from vast datasets.

Market Opportunity

- Advancements in Precision Medicine:

A significant opportunity within the Next-Generation Sequencing (NGS) data analysis market lies in the burgeoning field of precision medicine. Precision medicine aims to tailor healthcare interventions and treatment protocols based on individual genetic profiles, enabling personalized diagnosis, prognosis, and therapeutic strategies. NGS technologies facilitate the generation of comprehensive genomic data, offering insights into genetic variations, disease mechanisms, drug responses, and therapeutic targets.

The integration of NGS data analysis with precision medicine initiatives presents lucrative opportunities for market growth, innovation, and collaboration across the healthcare ecosystem. By leveraging advanced data analysis tools, platforms, and algorithms, researchers, clinicians, and pharmaceutical companies can decipher complex genomic datasets, identify actionable insights, and develop targeted therapies tailored to individual patient profiles.

- Expansion of Genomic Research Initiatives:

Another significant opportunity shaping the Next-Generation Sequencing (NGS) data analysis market is the expanding scope of genomic research initiatives across various sectors, including academic institutions, research organizations, pharmaceutical companies, and biotechnology firms. The increasing interest in understanding genetic variations, disease mechanisms, population genetics, and evolutionary biology drives the demand for advanced NGS technologies and data analysis solutions.

The proliferation of collaborative research projects, genome sequencing initiatives, and multi-omics studies underscores the importance of NGS data analysis in facilitating scientific discoveries, innovation, and knowledge generation. By leveraging sophisticated data analysis tools, algorithms, and platforms, researchers can explore complex genomic datasets, uncover novel insights, and elucidate the genetic underpinnings of diseases, traits, and biological processes.

Market Challenges

- Data Volume and Complexity Management:

One of the most prominent challenges facing the Next-Generation Sequencing (NGS) data analysis market is the management of vast volumes of data generated by advanced sequencing technologies. As NGS methodologies continue to evolve and improve in throughput and resolution, the amount of genomic data produced per sequencing run grows exponentially. This massive influx of data presents significant challenges in terms of storage, transfer, processing, and analysis.

The intricate nature of genomic data, characterized by complex sequences, structural variations, and intricate patterns, requires sophisticated computational infrastructures, storage solutions, and analytical tools. Traditional data management and analysis methods may prove inadequate in handling the scale and complexity of NGS datasets, leading to scalability issues, increased processing times, and potential data loss or corruption.

- Bioinformatics Expertise and Skill Gap:

Another critical challenge impeding the growth and adoption of NGS data analysis technologies is the persistent gap in bioinformatics expertise and skilled professionals proficient in interpreting and analyzing complex genomic datasets. The rapidly evolving landscape of genomics, computational biology, and bioinformatics necessitates specialized knowledge, skills, and expertise in data analysis, statistical modeling, algorithm development, and genomic sequencing technologies.

The shortage of qualified bioinformaticians proficient in NGS data analysis hampers research advancements, slows down data analysis processes, and limits the effective utilization of advanced data analysis tools and technologies. The intricate nature of NGS data requires specialized training, domain knowledge, and expertise to navigate complex data analysis pipelines, interpret genomic variations, and derive meaningful insights from vast datasets.

Segmental Analysis

By Product

Services dominate the market, particularly among smaller institutions, startups, and clinics without in-house bioinformatics capacity. These services offer sequencing-to-interpretation pipelines and include read mapping, variant calling, annotation, and reporting. Outsourcing allows organizations to bypass the challenges of setting up and managing a full-stack analysis infrastructure, while ensuring quality and compliance.

However, NGS commercial software is the fastest-growing product category, especially analytical software tools such as alignment and variant calling platforms. Vendors like Illumina, DNAnexus, Qiagen, and Seven Bridges provide robust, customizable software that integrates with lab operations, cloud environments, and reporting systems. With the rise in decentralized genomics research and in-house capabilities, labs are increasingly investing in licensed or open-source software to retain control over their pipelines and data security.

By Workflow

Secondary analysis dominates the workflow segment, covering key steps like read mapping, base calling, alignment, and variant detection. This stage is computationally intensive and determines the accuracy of downstream results. Many clinical and research labs prioritize automating secondary analysis to reduce turnaround time and improve reliability.

Tertiary analysis is the fastest-growing workflow, as the need to interpret variants, classify mutations, and associate findings with clinical phenotypes is central to translational medicine. Tools for variant annotation, visualization, and filtering using knowledge bases such as ClinVar, COSMIC, and gnomAD are in high demand. Application-specific tertiary workflows for oncology panels, RNA-seq, and whole exome sequencing are also expanding, supported by intuitive dashboards and AI-based tools.

By Mode

In-house deployment currently leads the market, particularly among large academic and pharma research institutions that prefer to build and maintain secure, customizable pipelines. This approach offers data ownership, custom workflow optimization, and compliance with data privacy regulations.

Outsourced analysis is growing rapidly, especially among emerging biotech firms and hospitals with budget or expertise constraints. Service providers offer scalable, fast turnaround options and increasingly focus on HIPAA/GDPR compliance, enhancing their attractiveness in clinical applications.

By Read Length

Short-read sequencing remains dominant, due to its wide availability, high accuracy, and cost-effectiveness, especially for exome sequencing and gene panels. Tools for Illumina-generated data dominate the analysis software landscape and are well-established in both research and diagnostics.

Long-read sequencing is the fastest-growing segment, driven by the emergence of technologies like Oxford Nanopore and PacBio, which provide richer information on structural variants, isoforms, and epigenetic modifications. Specialized tools for long-read data processing, error correction, and structural variant analysis are being actively developed to support the increasing adoption of these platforms.

By End-use

Academic research institutions lead the end-use segment, as they are major users of NGS for basic genomics, functional genomics, and population studies. Large-scale initiatives like the Human Cell Atlas and the Cancer Genome Atlas rely on extensive bioinformatics support.

Clinical research and hospitals & clinics are the fastest-growing end-use segments, driven by the incorporation of NGS into routine diagnostics. Hospitals increasingly utilize sequencing for tumor profiling, newborn screening, and inherited disease analysis, requiring robust, regulated data analysis platforms to translate genetic findings into clinical decisions.

By Regional Insights

North America dominates the global NGS data analysis market, owing to strong research funding, high adoption of genomics in healthcare, and the presence of key players like Illumina, Thermo Fisher, and DNAnexus. The U.S. leads in personalized medicine programs, AI-in-healthcare investments, and academic-industry collaborations. Institutions such as the Broad Institute and NIH continue to set global benchmarks in sequencing and bioinformatics innovation.

Asia-Pacific is the fastest-growing region, with countries like China, India, South Korea, and Japan investing heavily in genomics infrastructure. China’s “Precision Medicine Initiative” and India’s “GenomeIndia” project are driving demand for sequencing platforms and local data analysis capabilities. With rising disease burden, population-scale genomic projects, and maturing biotech ecosystems, the region is expected to be a key growth engine for the market.

Some of the prominent players in the next-generation sequencing data analysis market include:

- Golden Helix, Inc.

- Bio-Rad Laboratories, Inc.

- SciGenom Labs Pvt. Ltd.

- DNAnexus Inc.

- Genuity Science

- Fabric Genomics, Inc.

- Congenica Ltd.

- QIAGEN

- DNASTAR, Inc.

- Pacific Biosciences of California, Inc.

- Eurofins Scientific

- Partek Incorporated

- Precigen Bioinformatics Germany GmbH

- PierianDx

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd.

- Illumina, Inc.

- Verily Life Science

- Thermo Fisher Scientific, Inc.

Recent Developments

-

March 2025 – Illumina partnered with Google Cloud to enhance its DRAGEN Bio-IT platform, expanding genomic analysis to healthcare providers with integrated AI-based variant interpretation features.

-

January 2025 – DNAnexus launched a new pipeline accelerator for long-read data, offering real-time structural variant analysis for clinical and research clients.

-

December 2024 – Qiagen released updated NGS Secondary Analysis modules for its CLC Genomics Workbench, supporting CRISPR validation and rare variant detection.

-

November 2024 – Seven Bridges Genomics entered a strategic alliance with Roche to develop precision oncology workflows integrating multi-omics datasets.

-

September 2024 – Sentieon announced support for nanopore and PacBio long-read alignments, offering faster processing with clinically validated algorithms.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2024 to 2033. For this study, Nova one advisor, Inc. has segmented the global Next-generation sequencing data analysis market.

Product

- Services

- NGS Commercial Software

-

- Platform OS/UI

- Analytical Software

-

-

- QC/Pre-processing Tools

- Alignment Tools & Software

-

-

-

- DNA Sequencing Alignment

- RNA Sequencing Alignment

- Protein Sequencing Alignment

Workflow

-

- Read Map

- Variant Alignment & Variant Calling

-

- Variant Annotation

- Application Specific

-

-

- Targeted Sequencing/Gene Panel

- Exome

- RNA Sequencing

- Whole Genome

- Chip Sequencing

- Others

Mode

Read Length

- Short Read Sequencing

- Long Read Sequencing

- Very Long Read Sequencing

End-use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)