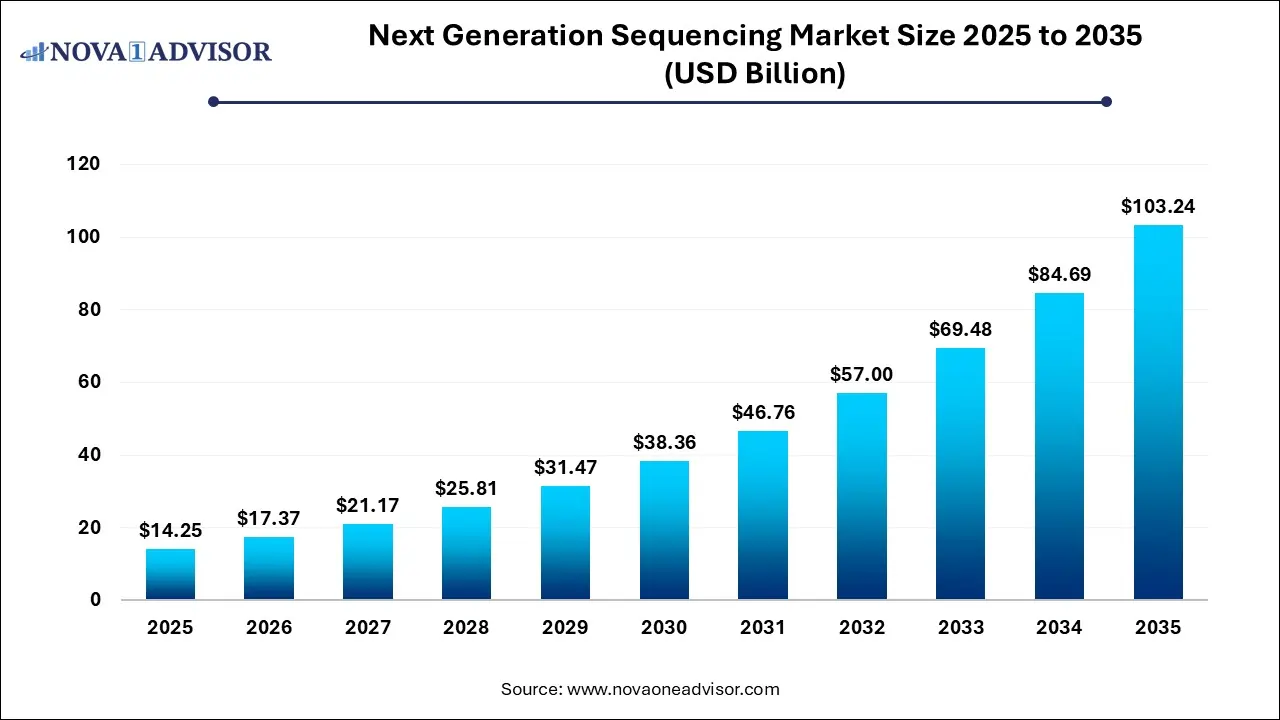

Next Generation Sequencing Market Size and Growth 2026 to 2035

The global next generation sequencing market size was estimated at USD 14.25 billion in 2025 and is projected to hit around USD 103.24 billion by 2035, growing at a CAGR of 21.9% during the forecast period from 2026 to 2035.

Key Takeaways:

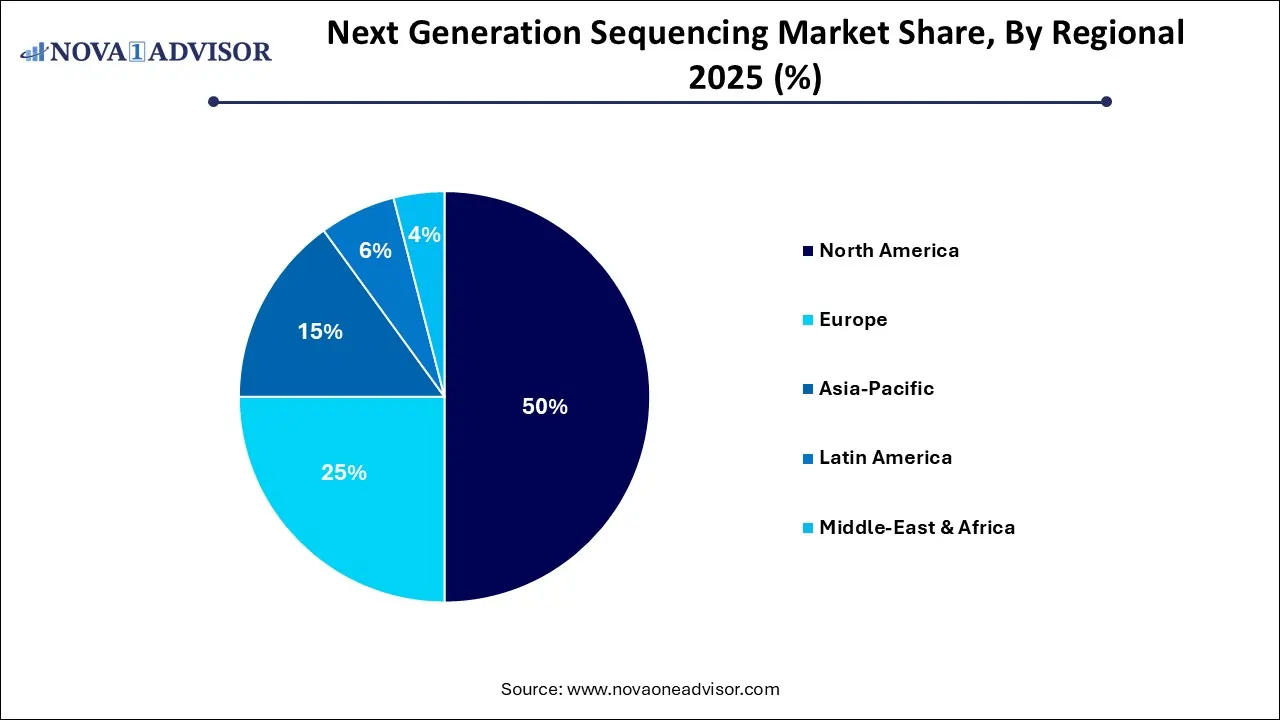

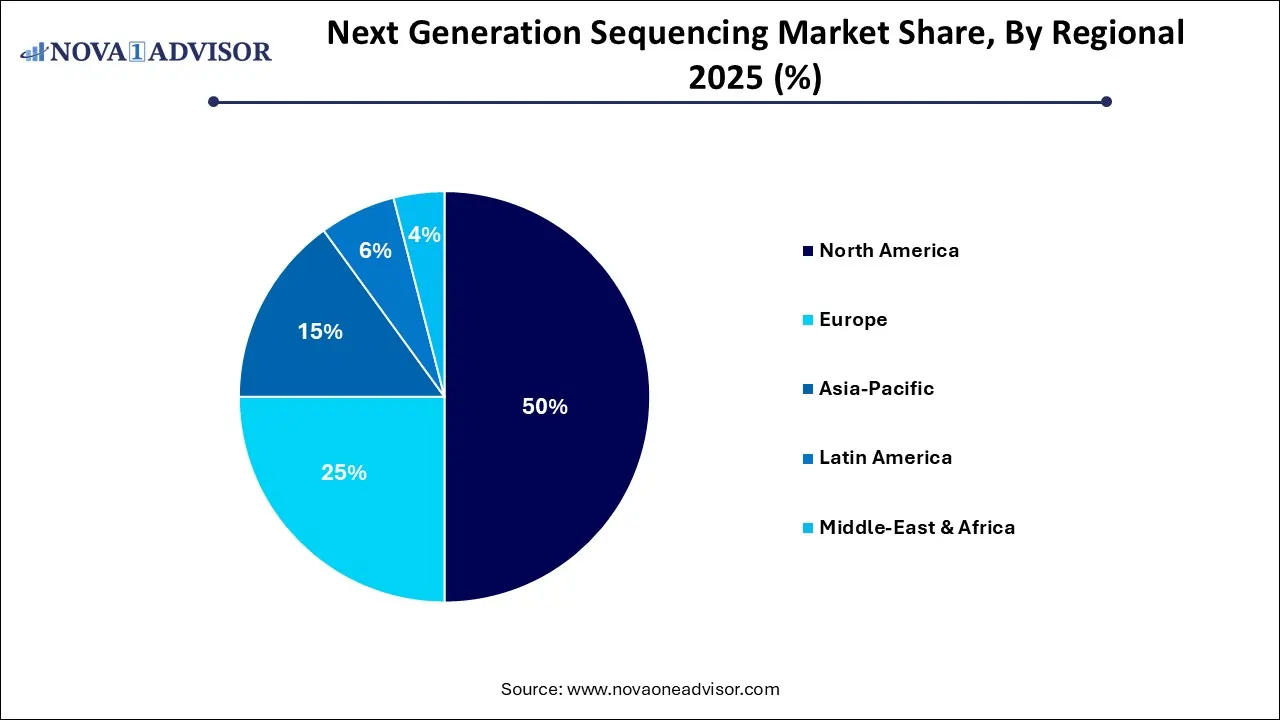

- North America dominated the NGS market with a share of 50% in 2025.

- The Asia Pacific region is estimated to be the fastest growing region

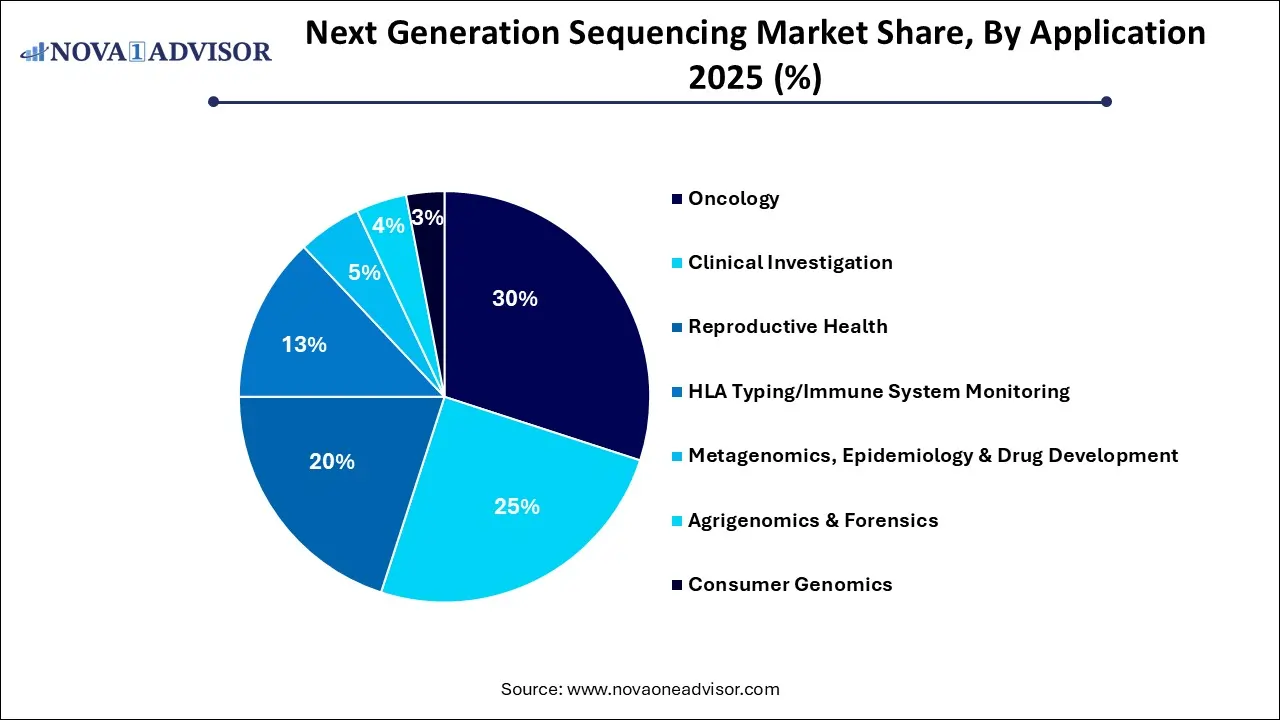

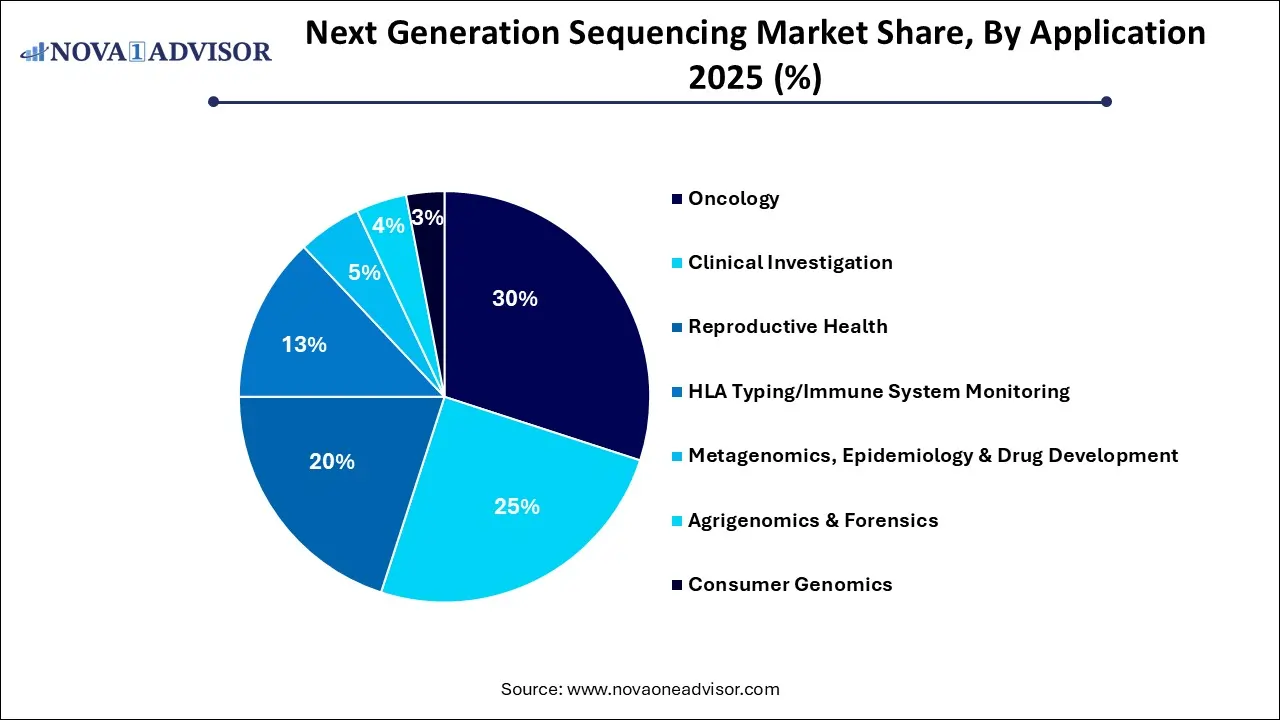

- The oncology segment held the highest market share of 30% in 2025.

- The consumer genomics segment is anticipated to be the fastest-growing segment with a CAGR of 24.84% during the forecast period.

- The consumables segment held the larger market share in 2025 and will continue to grow at a faster CAGR of 22.48% from 2026 to 2035.

- The targeted sequencing & resequencing segment held the highest market share in 2025.

- Thus, this segment is expected to grow in tandem with WGS segment throughout the forecast period.

- The academic research segment held the highest market share in 2025.

- Clinical research segment is anticipated to be the fastest growing segment with a CAGR of 22.93% during the forecast period.

Market Overview

The Next Generation Sequencing (NGS) market has redefined the landscape of genomic research and clinical diagnostics over the last decade. Emerging as a transformative technology, NGS enables the parallel sequencing of millions of DNA or RNA fragments, providing unprecedented speed, accuracy, and scalability. Compared to traditional Sanger sequencing, NGS offers a high-throughput, cost-efficient, and versatile approach to analyzing complex genetic information ushering in a new era of precision medicine, agricultural genomics, infectious disease monitoring, and population-scale genomics projects.

With widespread applications ranging from oncology and rare disease diagnostics to consumer genomics and reproductive health, the NGS market continues to expand at a remarkable pace. Its value proposition lies not only in its ability to decode the human genome with granular detail but also in its scalability making it suitable for both small-scale clinical settings and large genomic institutions. The rapid integration of AI-powered data analysis tools and cloud computing into sequencing workflows further strengthens the market’s capabilities, making genetic insights more accessible and interpretable.

NGS is no longer confined to high-end laboratories. It is increasingly being adopted in clinical environments, driven by advancements in platforms, consumables, and regulatory support for NGS-based diagnostic tools. Market participants include a mix of established sequencing giants, emerging technology developers, clinical research institutions, and bioinformatics solution providers, all of whom are contributing to this evolving and competitive ecosystem.

Major Trends in the Market

-

Rising Use of NGS in Precision Oncology: The ability of NGS to detect specific mutations is fueling its use in guiding targeted cancer therapies, both in diagnostics and drug development.

-

Growth in Non-Invasive Prenatal Testing (NIPT): NGS is at the core of NIPT services, allowing accurate screening of fetal abnormalities without invasive procedures.

-

Adoption of Portable and Point-of-Care Sequencers: Companies are developing compact NGS devices suitable for field use and clinical point-of-care settings.

-

Integration with AI and Machine Learning: AI is being used to streamline data interpretation in secondary and tertiary analysis workflows, reducing turnaround times and improving diagnostic yield.

-

Expansion into Agriculture and Food Safety: Agrigenomics applications are using NGS to breed disease-resistant crops and improve livestock genetics.

-

Increase in Population-Scale Genomic Projects: Countries such as the U.K., U.S., and China are investing in national genome programs for disease research and public health surveillance.

-

Partnerships Between Pharma and Sequencing Companies: Pharmaceutical companies are leveraging NGS in drug discovery pipelines and clinical trials through strategic collaborations.

Next Generation Sequencing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 17.37 Billion |

| Market Size by 2035 |

USD 103.24 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 21.9% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology, Product, Application, Workflow, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Illumina; QIAGEN; Thermo Fisher Scientific, Inc.; F. Hoffman-La Roche Ltd.; Oxford Nanopore Technologies; Genomatix GmbH; PierianDx; DNASTAR, Inc.; Eurofins GATC Biotech GmbH; Perkin Elmer, Inc.; BGI; Bio-Rad Laboratories, Inc. |

Key Market Driver: Growth in Precision Medicine and Companion Diagnostics

A powerful driver of the NGS market is the growing emphasis on precision medicine and companion diagnostics. NGS allows for comprehensive analysis of genomic variations that can influence individual responses to therapies. In oncology, for example, NGS-based panels help identify mutations like EGFR, BRAF, and ALK, which determine eligibility for targeted treatments.

Regulatory bodies such as the U.S. FDA have approved multiple companion diagnostics built on NGS platforms, including FoundationOne CDx and Oncomine Dx Target Test. These tools are used to select patients for therapies such as osimertinib or pembrolizumab, improving therapeutic outcomes and reducing unnecessary treatment costs. This alignment between NGS diagnostics and targeted therapy approvals is expected to further accelerate adoption across therapeutic areas.

Key Market Restraint: Complexity of Data Interpretation and Standardization

One of the core restraints facing the NGS market is the complexity and cost associated with data analysis and standardization. While sequencing itself has become faster and more affordable, the downstream data processing from primary to tertiary analysis remains computationally intensive and requires advanced bioinformatics expertise.

There is also a lack of uniform standards in data interpretation across platforms and providers, leading to inconsistencies in results. For instance, variant classification and reporting may vary between institutions, complicating clinical decision-making. Additionally, storage and management of large-scale genomic data pose challenges for healthcare systems and research labs, particularly in regions with limited digital infrastructure.

Key Market Opportunity: Rise of Consumer Genomics and Direct-to-Consumer Testing

The rise of consumer genomics and direct-to-consumer (DTC) testing presents a significant opportunity for the NGS market. The growing public interest in ancestry, wellness, fitness, and genetic predispositions has led to the proliferation of consumer-friendly NGS kits. Companies like 23andMe and Ancestry DNA have built strong market presence by making genomic testing accessible to non-specialist consumers.

Additionally, personalized nutrition and fitness genomics startups are beginning to integrate NGS into their platforms, offering tailored recommendations based on individual genetic profiles. As sequencing costs continue to fall and consumer education improves, the demand for at-home, NGS-enabled testing solutions is expected to increase, creating a new revenue stream for sequencing companies and bioinformatics firms alike.

By Technology

Targeted Sequencing and Resequencing dominated the market by technology. These methods are preferred in clinical and diagnostic applications due to their cost-effectiveness, high coverage depth, and ability to focus on known genes of interest. For instance, in oncology diagnostics, panels targeting specific cancer-associated genes allow faster turnaround and reduced sequencing overhead. DNA-based targeted sequencing is widely used for hereditary cancer panels, while RNA-based sequencing is essential for identifying gene fusions or expression profiles.

Whole Genome Sequencing (WGS) is the fastest-growing segment as it offers a comprehensive overview of all coding and non-coding regions of the genome. WGS is becoming more feasible in clinical contexts due to decreasing costs and improving computational tools. It is particularly useful in undiagnosed rare disease cases, pharmacogenomics, and population-scale initiatives. As research transitions into clinical application, WGS will play a critical role in understanding polygenic diseases and complex traits.

By Product

Consumables led the market by product category. This includes reagents, library prep kits, target enrichment kits, and other single-use components essential for sample processing. The high frequency of use, especially in core labs and diagnostic centers, ensures steady revenue from consumables. Products like Illumina’s TruSight and Agilent’s SureSelect are widely adopted due to their reliability and scalability.

Sequencing platforms are the fastest-growing subsegment, driven by the launch of newer, high-throughput systems such as Illumina’s NovaSeq X and Thermo Fisher’s Ion Torrent Genexus. These platforms offer improved processing speeds and are suitable for both research and clinical environments. The integration of data analysis features and modular design further enhances their appeal.

By Application

Oncology remained the dominant application segment. NGS has become indispensable in cancer diagnostics, prognostics, and monitoring. It is used for identifying driver mutations, guiding immunotherapy decisions, and evaluating tumor mutational burden (TMB) and microsatellite instability (MSI). Research studies and companion diagnostics within oncology continue to drive adoption.

Reproductive health is the fastest-growing application segment, particularly in non-invasive prenatal testing (NIPT), preimplantation genetic testing (PGT), and newborn screening. The demand for early and accurate genetic diagnosis has surged among expecting parents and fertility clinics. Products like Verifi and Harmony leverage NGS to detect chromosomal abnormalities with high sensitivity, while PGT applications are being integrated into IVF workflows across the U.S. and Europe.

By Workflow

Pre-sequencing processes dominated the market. This includes library preparation, which is a critical step in determining the quality of sequencing output. Manual, semi-automated, and automated library prep systems cater to labs of different scales. Kits from companies like NEB and Qiagen are commonly used across academic and clinical labs.

NGS Data Analysis is the fastest-growing segment as users demand robust and accurate interpretation tools. Primary analysis (base calling), secondary analysis (alignment and variant calling), and tertiary analysis (annotation and reporting) are being automated using AI-powered pipelines. Companies are also integrating cloud-based solutions to enable remote access and scalability for big data genomics.

By End-use

Academic research institutions lead in end-use adoption. These centers often pioneer genomic discovery, conduct population-based research, and develop novel diagnostic methods using NGS. They frequently collaborate with government agencies, sequencing companies, and pharmaceutical firms, contributing to a majority of published studies and datasets.

Hospitals and clinics are the fastest-growing end-user segment. With the transition of NGS into clinical workflows, many hospitals are setting up in-house genomics labs or partnering with external labs. NGS is being used in cancer diagnostics, rare disease screening, and infectious disease testing. Clinical integration is expected to further expand with electronic medical record (EMR) integration and decision support systems.

By Regional Insights

North America, particularly the United States, has led the NGS market for over a decade due to a confluence of factors including advanced healthcare infrastructure, strong research funding, and presence of key market players such as Illumina, Thermo Fisher Scientific, and Pacific Biosciences. The U.S. government has actively supported genomic research through initiatives like the Precision Medicine Initiative and All of Us Research Program, generating huge repositories of genomic data.

Private insurers and Medicare in the U.S. have also started to reimburse for NGS-based diagnostics in oncology and rare diseases, encouraging clinical adoption. Moreover, North American institutions continue to set the benchmark in bioinformatics, automation, and regulatory compliance making this region central to both innovation and commercialization.

Asia-Pacific is the fastest-growing region.

Asia-Pacific has witnessed rapid adoption of NGS due to rising healthcare investments, increased awareness, and expanding access to molecular diagnostics. Countries like China, India, Japan, and South Korea are actively participating in national genome sequencing efforts. For instance, China’s Genomics Institute (BGI) is playing a pivotal role in large-scale sequencing and affordable test development.

Asia-Pacific’s growing burden of infectious and hereditary diseases, coupled with rising middle-class income, is boosting demand for NGS-based diagnostics and personalized treatment. Additionally, regional startups and academic institutions are developing local sequencing platforms and pipelines, contributing to market growth and democratization of genomic services.

Recent Developments

-

April 2025: Illumina launched the NovaSeq X Plus, a high-throughput platform offering reduced run times and improved scalability for large research and clinical labs.

-

March 2025: Thermo Fisher Scientific expanded its Ion Torrent Genexus System with new oncology panels for lung and colorectal cancers, aiming for comprehensive in-clinic genomic profiling.

-

February 2025: BGI Genomics announced a partnership with India’s Apollo Hospitals to deploy population-scale genetic screening programs across urban and rural areas.

-

January 2025: Roche Diagnostics introduced AVENIO Edge System, a fully automated sample-to-insight NGS platform targeted at molecular pathology labs.

-

December 2024: 10x Genomics acquired Spatial Transcriptomics AB, enhancing its capabilities in RNA-based targeted sequencing and spatial genomics integration.

Some of the prominent players in the Next Generation Sequencing Market include:

- Illumina

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH

- BGI

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the next generation sequencing market.

By Technology

- WGS

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

- Others

By Product

- Platform

- Consumables

- Sample Preparation

- Target Enrichment

- Others

By Application

- Oncology

- Diagnostics and Screening

- Oncology Screening

- Sporadic Cancer

- Inherited Cancer

- Companion Diagnostics

- Other Diagnostics

- Research Studies

- Clinical Investigation

- Infectious Diseases

- Inherited Diseases

- Idiopathic Diseases

- Non-Communicable/Other Diseases

- Reproductive Health

- NIPT

- Aneuploidy

- Microdeletions

- PGT

- Newborn Genetic Screening

- Single Gene Analysis

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Agrigenomics & Forensics

- Consumer Genomics

By Workflow

- Pre-Sequencing

- NGS Library Preparation Kits

- Semi-automated Library Preparation

- Automated Library Preparation

- Sequencing

- NGS Data Analysis

- NGS Primary Data Analysis

- NGS Secondary Data Analysis

- NGS Tertiary Data Analysis

By End-use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)