Non-alcoholic Steatohepatitis Clinical Trials Market Size and Trends

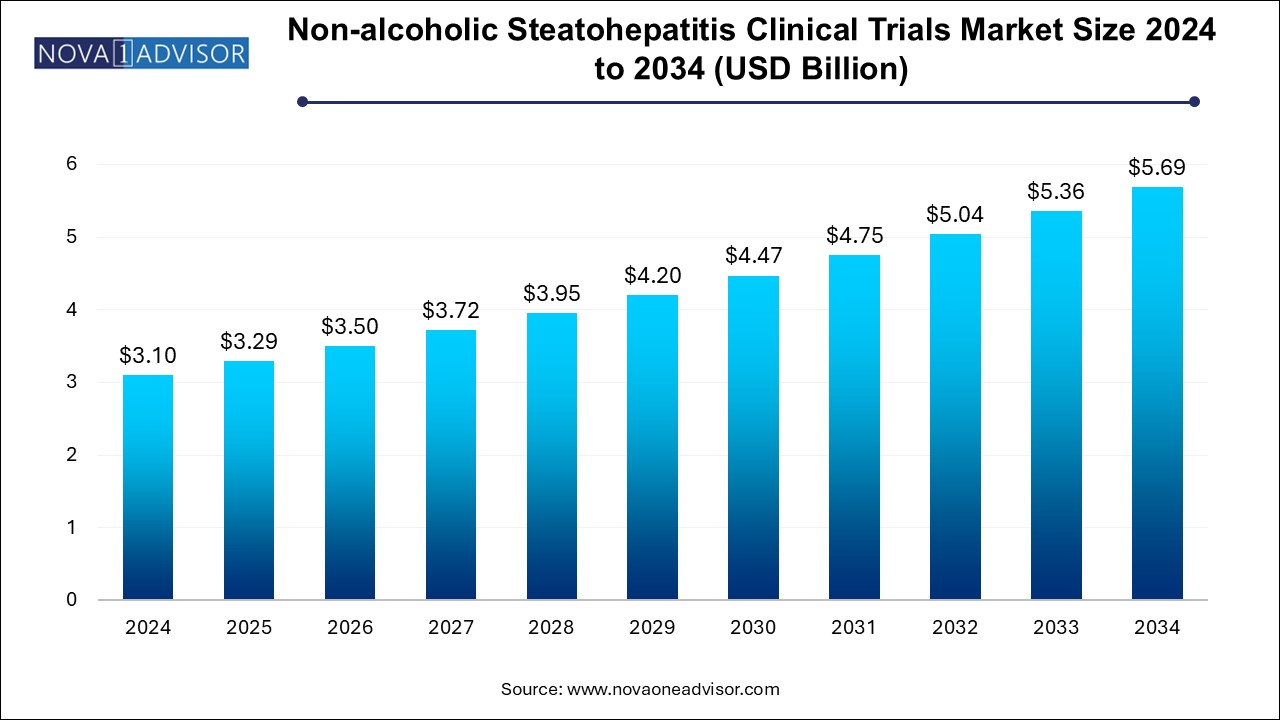

The non-alcoholic steatohepatitis clinical trials market size was exhibited at USD 3.1 billion in 2024 and is projected to hit around USD 5.69 billion by 2034, growing at a CAGR of 6.27% during the forecast period 2024 to 2034.

Non-alcoholic Steatohepatitis Clinical Trials Market Key Takeaways:

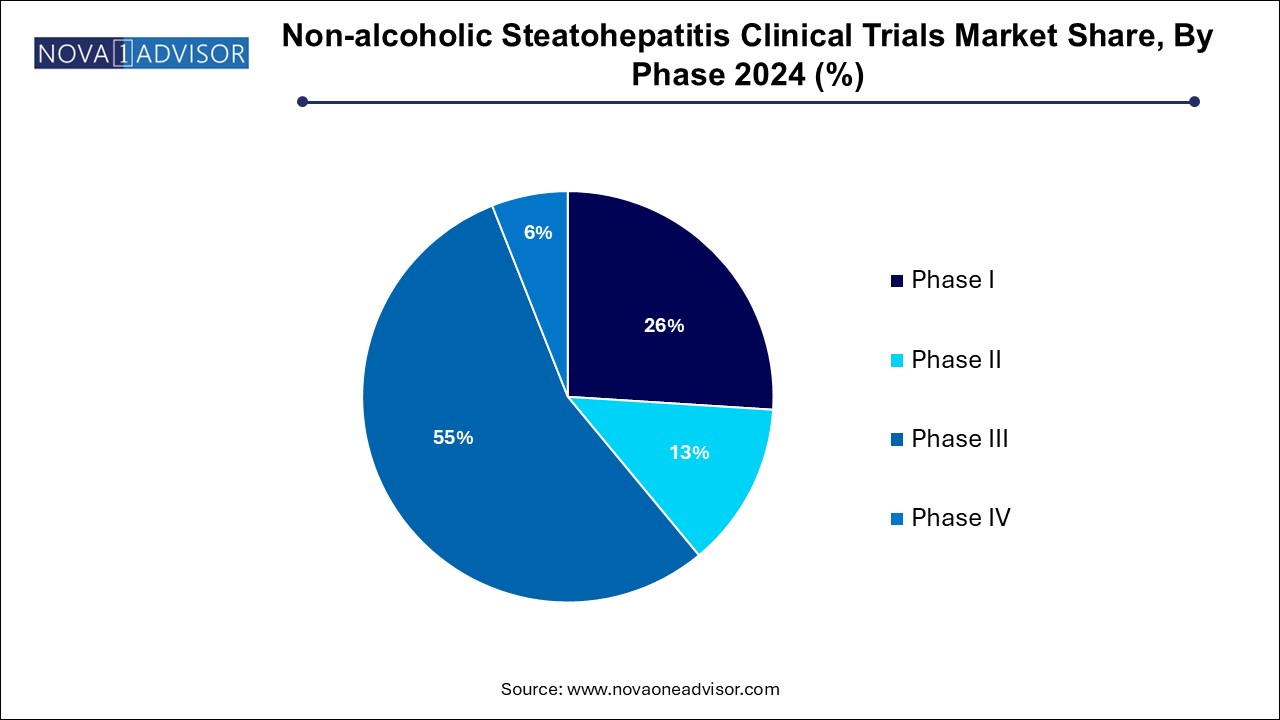

- The phase III segment dominated the market, accounting for 55.0% of the total revenue share in 2024.

- The interventional studies segment dominated the market in 2024.

- North America non-alcoholic steatohepatitis clinical trials market dominated and accounted for a 48.9% share in 2024.

Market Overview

The Non-alcoholic Steatohepatitis (NASH) Clinical Trials Market is becoming increasingly prominent due to the rising global burden of liver diseases associated with lifestyle disorders. NASH, a progressive form of non-alcoholic fatty liver disease (NAFLD), is characterized by liver inflammation and damage due to fat buildup, leading to fibrosis, cirrhosis, and potentially hepatocellular carcinoma.

The increasing prevalence of obesity, type 2 diabetes, and metabolic syndrome globally has made NASH a significant public health concern. As of 2024, an estimated 5%–6% of the world’s population is affected by NASH, with numbers projected to rise. Despite its severity, there are currently no FDA-approved therapies specifically for NASH, fueling robust R&D activity and a growing number of clinical trials. Pharmaceutical giants like Gilead Sciences, Novo Nordisk, and Intercept Pharmaceuticals are actively involved in developing targeted therapeutics.

Additionally, regulatory agencies such as the FDA and EMA have prioritized NASH as an area of unmet medical need, offering fast-track and breakthrough therapy designations to promising drug candidates. The NASH clinical trials landscape is thus witnessing unprecedented momentum, attracting significant investments from biotech firms, CROs, and large pharmaceutical companies alike.

Major Trends in the Market

-

Increase in Combination Therapy Trials: Focus on multi-targeted approaches addressing fibrosis, inflammation, and metabolic dysfunction simultaneously.

-

Rising Adoption of Non-invasive Diagnostic Techniques: Surrogate biomarkers and imaging modalities like FibroScan and MRI-PDFF are increasingly used to assess therapeutic outcomes.

-

Regulatory Push for Accelerated Approval Pathways: Expedited review programs for promising NASH therapies are becoming more common.

-

Growth of Adaptive Clinical Trial Designs: Flexible designs that allow modifications based on interim results are gaining popularity.

-

Focus on Early-stage NASH (F1/F2 Fibrosis): Preventive therapeutic strategies are emerging, aiming to halt progression to cirrhosis.

-

Strategic Collaborations and Licensing Deals: Companies are partnering to leverage complementary expertise and share R&D costs.

-

Artificial Intelligence (AI) in Trial Optimization: AI and machine learning are being utilized to predict patient responses and streamline trial protocols.

Report Scope of Non-alcoholic Steatohepatitis Clinical Trials Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.29 Billion |

| Market Size by 2034 |

USD 5.69 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 6.27% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Phase, Study Design, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Pfizer Inc.; Novartis AG; Icon Plc; Laboratory Corporation of America; AbbVie Inc.; Cadila Healthcare Ltd.; Shire Plc (Takeda Pharmaceuticals); Eli Lilly; Novo Nordisk; Gilead Sciences Inc.; Glaxosmith Kline; Arrowhead Pharmaceuticals |

Key Market Driver

Rising Global Prevalence of Obesity and Metabolic Disorders

One of the strongest drivers of the NASH clinical trials market is the growing incidence of obesity, type 2 diabetes, and metabolic syndrome—key risk factors for NAFLD and NASH. According to the World Obesity Federation, over 1 billion people worldwide will be obese by 2030. This rising prevalence directly correlates with an increased number of individuals at risk for NASH, heightening the urgency for effective therapeutic interventions. In March 2024, the CDC reported a 30% rise in NAFLD-associated hospitalizations in the U.S. over the past five years, underscoring the critical need for accelerated clinical development in this area.

Key Market Restraint

Challenges in NASH Diagnosis and Patient Recruitment

One of the primary restraints hampering clinical trial progress is the difficulty in diagnosing NASH. Liver biopsy, the current gold standard, is invasive, costly, and prone to sampling variability, deterring patient participation. Moreover, asymptomatic early-stage NASH makes patient identification challenging, leading to prolonged recruitment timelines and high dropout rates. As of early 2024, many Phase II and III NASH trials reported slower-than-expected enrollment, pushing back projected drug approval timelines.

Key Market Opportunity

Emergence of Non-invasive Biomarkers and Digital Health Solutions

The development of non-invasive biomarkers and digital diagnostic platforms offers significant opportunities to overcome traditional hurdles in NASH clinical trials. Technologies such as magnetic resonance elastography (MRE), serum-based fibrosis biomarkers, and AI-driven imaging analysis are improving patient stratification and monitoring while reducing trial costs and complexity. In February 2024, a partnership between Perspectum Diagnostics and Novo Nordisk to incorporate non-invasive liver imaging biomarkers into ongoing NASH trials showcased the transformative potential of these innovations.

Non-alcoholic Steatohepatitis Clinical Trials Market By Phase Insights

Phase III trials dominated the phase segment in 2024. Phase III trials are pivotal studies aimed at evaluating the efficacy and safety of new therapeutic agents in large patient populations. Given the high unmet need for approved therapies, multiple companies are pushing their leading candidates through late-stage development. Drugs such as resmetirom (Madrigal Pharmaceuticals) and obeticholic acid (Intercept Pharmaceuticals) are undergoing large multicenter Phase III trials, driving heavy investments in this phase.

Phase II trials are the fastest-growing phase segment. Many companies are advancing early-stage candidates with novel mechanisms, such as GLP-1 receptor agonists, THR-beta agonists, and antifibrotic agents. Phase II trials, focusing on dose-finding and preliminary efficacy, are crucial for de-risking future late-stage studies. In March 2024, Akero Therapeutics expanded its Phase IIb HARMONY study for its Efruxifermin candidate, reflecting the vibrancy of this segment.

Non-alcoholic Steatohepatitis Clinical Trials Market By Study Design Insights

Interventional studies dominated the study design segment. Interventional trials testing new pharmacological therapies, lifestyle interventions, or combination approaches represent the bulk of NASH clinical research. Companies and researchers aim to directly assess the impact of therapeutic candidates on histological liver outcomes and fibrosis progression.

Observational studies are witnessing rapid growth. Observational studies, particularly longitudinal cohort studies, are gaining importance in understanding the natural history of NASH, patient heterogeneity, and biomarker validation. In January 2024, a European consortium launched a multi-year observational study involving over 5,000 patients to track NASH progression and identify new therapeutic targets.

Non-alcoholic Steatohepatitis Clinical Trials Market By Regional Insights

North America dominated the global NASH clinical trials market in 2024. The U.S., in particular, benefits from a high prevalence of NASH risk factors, robust R&D infrastructure, strong regulatory support, and a concentration of biopharmaceutical companies. According to ClinicalTrials.gov data, over 60% of all active NASH trials are based in North America. In April 2024, the FDA granted accelerated review status to multiple NASH drug candidates, reinforcing North America's leadership.

Asia-Pacific is the fastest-growing region. Rising rates of diabetes and obesity, coupled with improving healthcare infrastructure and government support for clinical research, are making Asia-Pacific an attractive destination for NASH trials. Countries like China, Japan, and Australia are seeing increased trial activity. In February 2024, China's National Medical Products Administration (NMPA) announced new guidelines to facilitate faster NASH drug trial approvals, boosting regional momentum.

Some of the prominent players in the non-alcoholic steatohepatitis clinical trials market include:

- Pfizer Inc.

- Novartis AG

- Icon Plc

- Laboratory Corporation of America

- AbbVie Inc.

- Cadila Healthcare Ltd.

- Shire Plc (Takeda Pharmaceuticals)

- Eli Lilly

- Novo Nordisk

- Gilead Sciences Inc.

- Glaxosmith Kline

- Arrowhead Pharmaceuticals

Non-alcoholic Steatohepatitis Clinical Trials Market Recent Developments

-

April 2024: Madrigal Pharmaceuticals announced positive Phase III results for Resmetirom, showing significant reduction in liver fat and fibrosis reversal.

-

March 2024: Akero Therapeutics expanded its Phase IIb HARMONY study for Efruxifermin to additional international sites.

-

February 2024: Novo Nordisk entered a strategic collaboration with Perspectum Diagnostics to integrate AI-driven liver imaging biomarkers into its NASH trial portfolio.

-

January 2024: Intercept Pharmaceuticals resubmitted its NDA for obeticholic acid to the FDA, targeting approval for NASH-associated fibrosis.

-

March 2024: Genfit announced a new Phase II trial launch for its dual PPAR agonist elafibranor in combination with an FXR agonist for NASH patients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the non-alcoholic steatohepatitis clinical trials market

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional Studies

- Observational Studies

- Expanded Access Studies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)