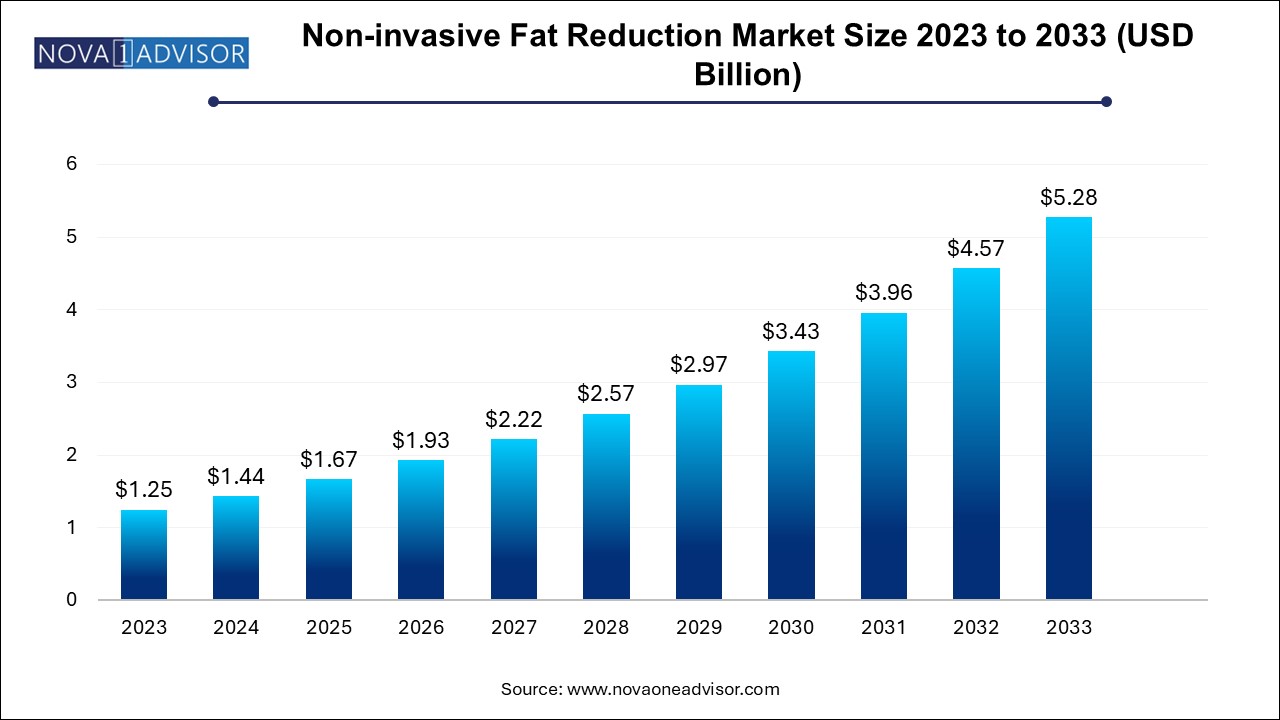

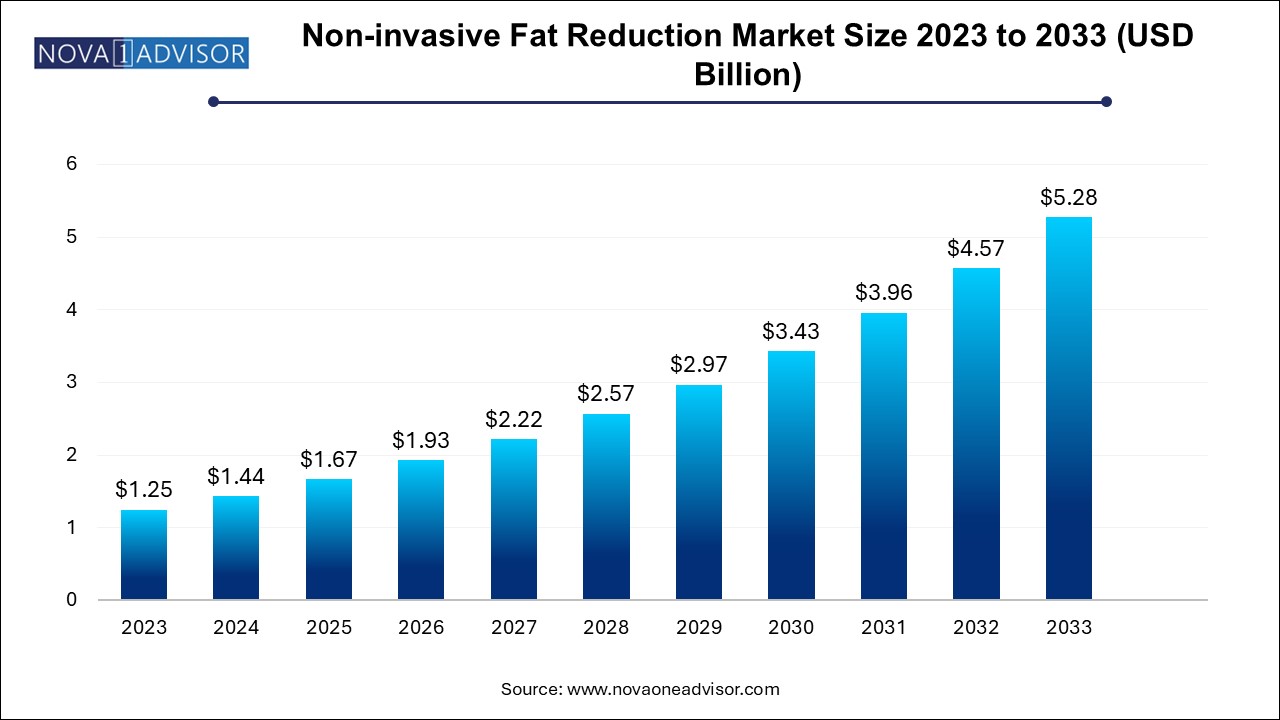

Non-invasive Fat Reduction Market Size and Growth

The global non-invasive fat reduction market size was exhibited at USD 1.25 billion in 2023 and is projected to hit around USD 5.28 billion by 2033, growing at a CAGR of 15.5% during the forecast period 2024 to 2033.

Non-invasive Fat Reduction Market Key Takeaways:

- North America dominated the market and accounted for the largest revenue share of 38.6% in 2023.

- The Asia Pacific market is expected to witness the highest CAGR of 17.4 % over the forecast period.

- The cryolipolysis segment accounted for the largest share of 34.3% of the overall revenue in 2023 and is expected to grow at the fastest CAGR of 16.7% over the forecast period.

- The hospital segment held the largest market share of 52.3% in 2023 and is expected to grow at the fastest CAGR of 16.4% over the forecast period.

Market Overview

The global non-invasive fat reduction market is rapidly evolving as consumers and aesthetic professionals alike seek alternatives to surgical fat removal that offer reduced risk, faster recovery, and minimal downtime. This market encompasses a variety of technologies aimed at reducing stubborn fat deposits through non-surgical methods such as cryolipolysis, ultrasound-based fat disruption, low-level laser therapy, and radiofrequency-based lipolysis.

The growing demand for body contouring solutions, fueled by rising aesthetic awareness, social media influence, and increasing disposable income, has created fertile ground for technological innovation. Consumers are becoming increasingly selective about their appearance, prioritizing minimally invasive or non-invasive solutions over traditional liposuction, which involves higher risks, scarring, and prolonged recovery.

Clinics, medispas, and hospitals are investing in advanced body contouring systems to meet consumer expectations for effective, quick, and safe treatments. According to recent trends, multiple-session, walk-in treatments are becoming standard, further enhancing accessibility and convenience. Devices now offer multi-zone targeting, temperature-controlled fat destruction, and real-time progress monitoring, improving both user satisfaction and clinical outcomes.

Furthermore, the demand for non-invasive procedures has surged post-pandemic, with individuals prioritizing wellness, appearance, and minimally disruptive medical interventions. Providers are also integrating AI and imaging diagnostics to personalize treatments and track body transformation over time. These factors, coupled with evolving regulatory clarity and product innovation, point to a robust and expanding non-invasive fat reduction market globally.

Major Trends in the Market

-

Rise in Body Positivity with Targeted Contouring: Consumers are seeking personalized, non-invasive fat reduction in targeted areas such as under the chin, abdomen, and thighs, aligning aesthetics with wellness.

-

Advancements in Cryolipolysis and Ultrasound Technology: New-generation devices now offer faster treatment cycles, increased safety, and more consistent results.

-

Multi-application Platforms: Devices that combine skin tightening, cellulite reduction, and fat destruction in one system are gaining popularity among providers.

-

Increased Popularity of Home-based Aesthetic Devices: At-home fat-reduction devices are entering the market for consumers preferring DIY treatments.

-

Integration of AI and Imaging Tools: Clinics are using 3D imaging and AI to visualize treatment outcomes and personalize treatment plans.

-

Men Entering the Aesthetic Market: There's growing adoption of non-invasive fat reduction among male consumers, particularly in the 30–50 age group.

-

Flexible Financing Options: Clinics are partnering with fintech platforms to offer EMI and subscription-based body sculpting packages.

-

Growing Influence of Social Media and Celebrity Endorsements: Treatments like CoolSculpting and truSculpt have gained visibility via influencer-driven marketing.

Report Scope of Non-invasive Fat Reduction Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.44 Billion |

| Market Size by 2033 |

USD 5.28 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Cynosure; Fosun Pharmaceuticals Co. Ltd.; Cutera Inc.; Zeltiq Aesthetics; Candela Corp.; BTL Industries; Venus Concept; Lynton Lasers Ltd.; AbbVie Inc.; Hologic, Inc. |

Market Driver: Rising Demand for Non-Surgical Aesthetic Procedures

The primary driver of the global non-invasive fat reduction market is the increasing global demand for non-surgical aesthetic treatments. With rising awareness of physical appearance and a cultural shift toward self-care and cosmetic enhancement, consumers are now actively seeking solutions that are effective but do not involve surgery or significant downtime.

This trend is especially prevalent in urban centers where busy lifestyles deter invasive procedures. Non-invasive treatments like cryolipolysis, ultrasound, and laser lipolysis offer a compelling alternative, allowing individuals to return to their daily routines immediately after sessions. The ability to address localized fat deposits without scarring, general anesthesia, or prolonged recovery times has widened the appeal to younger and older demographics alike.

The pandemic also reinforced this preference, as consumers avoided surgical interventions and sought procedures that minimized contact and recovery time. The increased availability of FDA-approved technologies, coupled with patient satisfaction and clinic endorsements, is pushing these solutions toward mainstream adoption.

Market Restraint: High Cost of Treatment and Limited Insurance Coverage

Despite strong consumer interest, one of the key restraints for the non-invasive fat reduction market is the high cost of procedures and the lack of reimbursement through health insurance. A single treatment session of cryolipolysis or ultrasound lipolysis can cost between $600 and $1,500 per area, and multiple sessions are often required for optimal results.

For many potential patients, these costs are prohibitive, especially when treatments are not considered medically necessary. This has limited market penetration in lower- and middle-income regions and among cost-sensitive demographics. Moreover, the rise of budget-oriented and sometimes unregulated devices may lead consumers to choose cheaper, less effective options, impacting overall industry credibility.

To counter this, some providers are offering financing plans or bundled packages, but the cost remains a barrier to widespread accessibility. Innovation in affordable technologies and more inclusive pricing models could help overcome this restraint.

Market Opportunity: Expansion in Emerging Economies and Tier-2 Cities

A major market opportunity lies in the expansion of non-invasive fat reduction services into emerging economies and tier-2 cities across Asia, Latin America, and Africa. Rapid urbanization, rising disposable incomes, improved access to aesthetic services, and increased awareness of body image are driving demand in these markets.

In countries like India, Brazil, and Indonesia, younger consumers are becoming key adopters of aesthetic enhancements, particularly those involving minimal recovery and no surgical risks. Clinics in these regions are actively expanding their portfolios to include cryolipolysis, radiofrequency lipolysis, and ultrasound fat removal to attract a growing customer base. Franchised medispa chains and dermatologist-led aesthetic centers are also contributing to the infrastructure growth in these markets.

Furthermore, partnerships between international device manufacturers and regional distributors are facilitating the entry of cutting-edge fat reduction systems. Offering affordable treatment plans, EMI options, and local-language digital campaigns are helping providers tap into previously untapped populations, making this an exciting and scalable market opportunity.

Non-invasive Fat Reduction Market By Technology Insights

Cryolipolysis dominates the global market for non-invasive fat reduction due to its proven efficacy, safety profile, and strong consumer awareness. Popularized under brand names like CoolSculpting, this technique involves controlled cooling of subcutaneous fat cells, which are then metabolized by the body over time. Cryolipolysis has become the standard offering in medispas and dermatology clinics worldwide due to its non-invasive nature and visible results, often in a single session. Its FDA approval and multiple applicator options for various body zones make it a staple for aesthetic practices.

However, ultrasound-based fat reduction is the fastest growing segment, primarily because of its non-thermal, focused mechanical disruption of fat cells, which provides an alternative for patients with sensitivity to cold or contraindications for cryolipolysis. Devices like UltraShape and Liposonix are gaining popularity for their ability to target deeper fat layers with minimal discomfort and rapid recovery. Ultrasound offers unique benefits such as skin-tightening effects and adaptability for different body types, making it especially appealing in clinics that offer personalized contouring solutions.

Non-invasive Fat Reduction Market By End-use Insights

Standalone aesthetic practices, including medispas and cosmetic dermatology clinics, currently dominate the end-use segment. These facilities specialize in aesthetic treatments and body contouring, often offering non-invasive fat reduction as a core service. Their ability to personalize treatment packages, invest in state-of-the-art devices, and leverage experienced professionals positions them well to meet rising demand. Consumers often prefer standalone practices for their aesthetic expertise, short appointment wait times, and premium service quality.

On the other hand, multispecialty clinics are the fastest growing end-use segment. These clinics combine multiple medical disciplines, such as dermatology, endocrinology, and cosmetic surgery, and are increasingly incorporating non-invasive aesthetic offerings to cater to patients seeking holistic care. With greater trust in medical oversight and diversified service portfolios, these clinics attract patients who prioritize safety and comprehensive care. The inclusion of fat reduction within general wellness or post-bariatric programs is also accelerating growth in this segment.

Non-invasive Fat Reduction Market By Regional Insights

North America dominates the global non-invasive fat reduction market, accounting for the largest revenue share, driven by high consumer awareness, strong purchasing power, and the widespread presence of advanced aesthetic clinics. The U.S. leads in both the number of procedures performed and technology development, with brands like CoolSculpting (Allergan) and truSculpt (Cutera) achieving household recognition.

The region benefits from a favorable regulatory environment, a culture of aesthetic enhancement, and a robust insurance industry that, while not covering cosmetic procedures, supports elective financing through partnerships. The rise of men’s aesthetic clinics and body contouring programs further drives demand, while teleconsultation services help providers expand reach in suburban and rural markets.

Asia Pacific is witnessing the fastest growth, driven by a combination of population size, economic growth, and cultural shifts toward personal wellness and aesthetics. China, Japan, South Korea, and India are leading contributors to regional demand, each with a growing middle class that is increasingly spending on cosmetic enhancements.

South Korea’s global leadership in cosmetic procedures, coupled with its status as a medical tourism hub, is setting benchmarks for non-invasive fat reduction practices. Meanwhile, India’s tier-2 and tier-3 cities are opening up to medispas and aesthetic clinics, expanding the addressable market. Local and international device manufacturers are aggressively marketing in the region, and government support for medical device innovation is fostering technological advancements tailored for regional preferences.

Some of the prominent players in the global non-invasive fat reduction market include:

Recent Developments

-

February 2024 – Cutera Inc. launched its next-generation truSculpt platform, featuring improved fat reduction and muscle toning capabilities. The device includes AI-enhanced temperature regulation and faster treatment times for larger body areas, targeting both standalone clinics and high-end medical spas. [Source: GlobeNewswire]

-

October 2023 – Allergan Aesthetics (AbbVie) announced a strategic revamp of its CoolSculpting Elite system, introducing new applicators for smaller treatment areas like the jawline and knees, as well as updated user-interface features for better clinician control.

-

September 2023 – BTL Aesthetics unveiled a global expansion strategy for Emsculpt Neo, combining radiofrequency and high-intensity focused electromagnetic energy (HIFEM) for simultaneous fat loss and muscle building. The device is now approved in over 50 countries.

-

June 2023 – Lumenis Ltd. launched NuEra Tight 2.0, a multi-functional platform offering both fat reduction and skin tightening, aimed at clinics seeking versatile, cost-effective equipment.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global non-invasive fat reduction market

Technology

- Cryolopolysis

- Lower-level Lasers

- Ultra-sound

- Others

End-use

- Hospitals

- Standalone Practices

- Multispecialty Clinics

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa