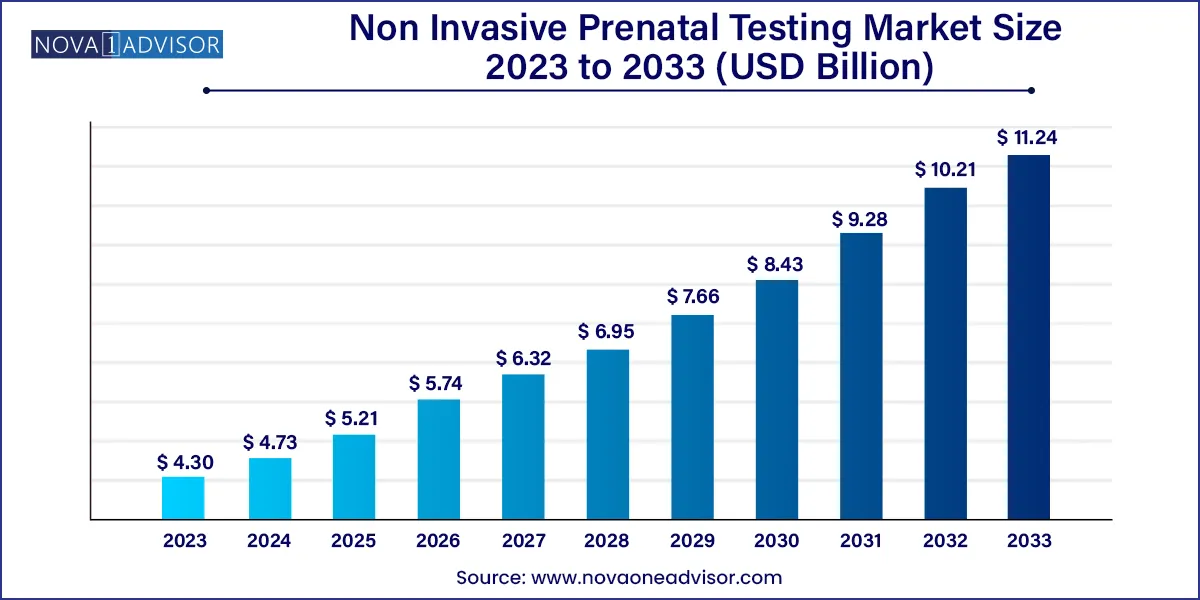

The global non invasive prenatal testing market size was exhibited at USD 4.30 billion in 2023 and is projected to hit around USD 11.24 billion by 2033, growing at a CAGR of 10.09% during the forecast period of 2024–2033.

Key Takeaways:

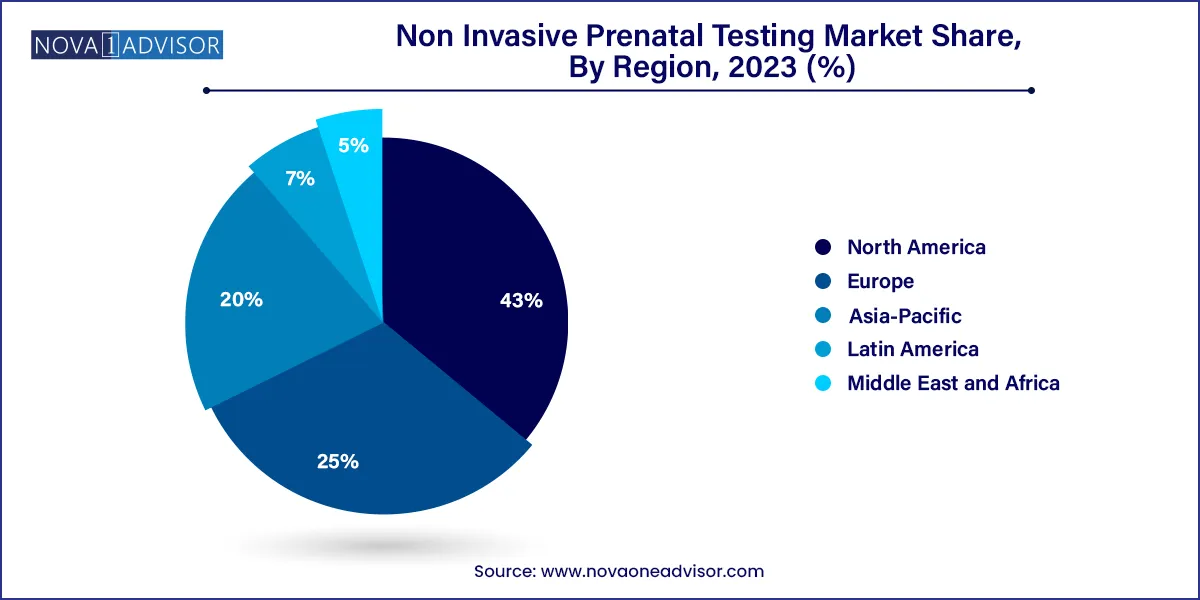

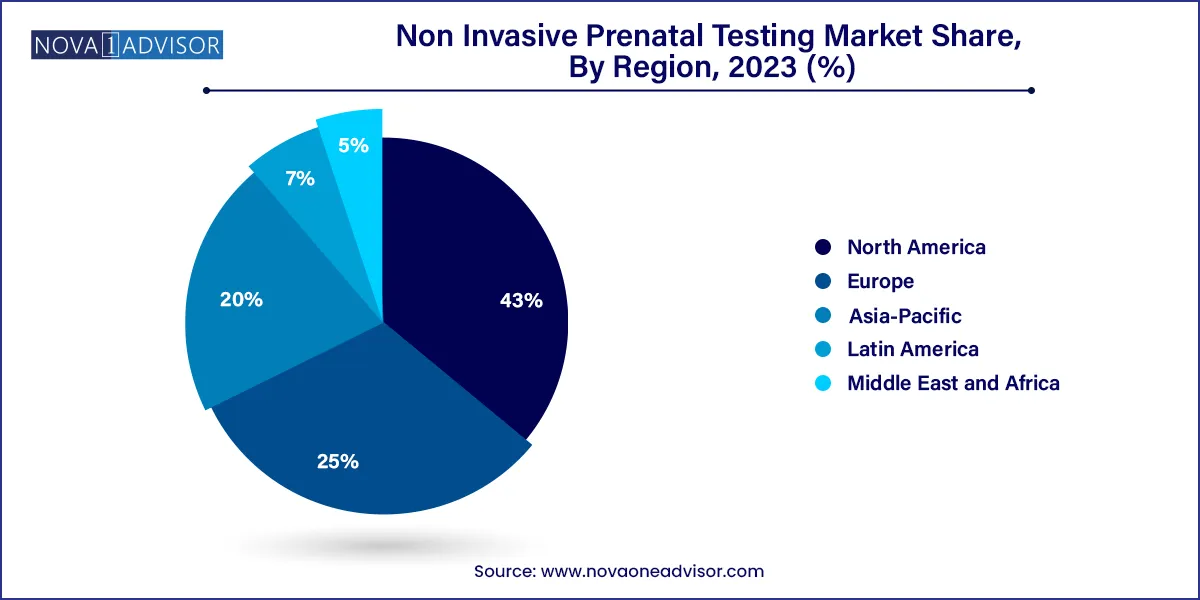

- North America dominated the market with a revenue share of 43.0% in 2023, followed by Europe.

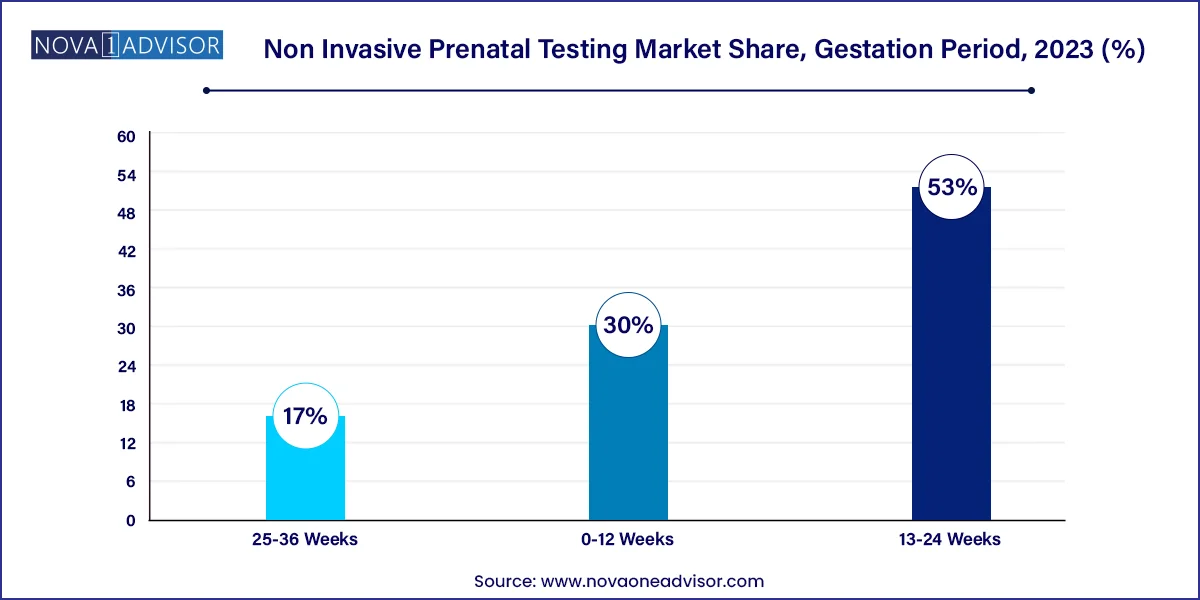

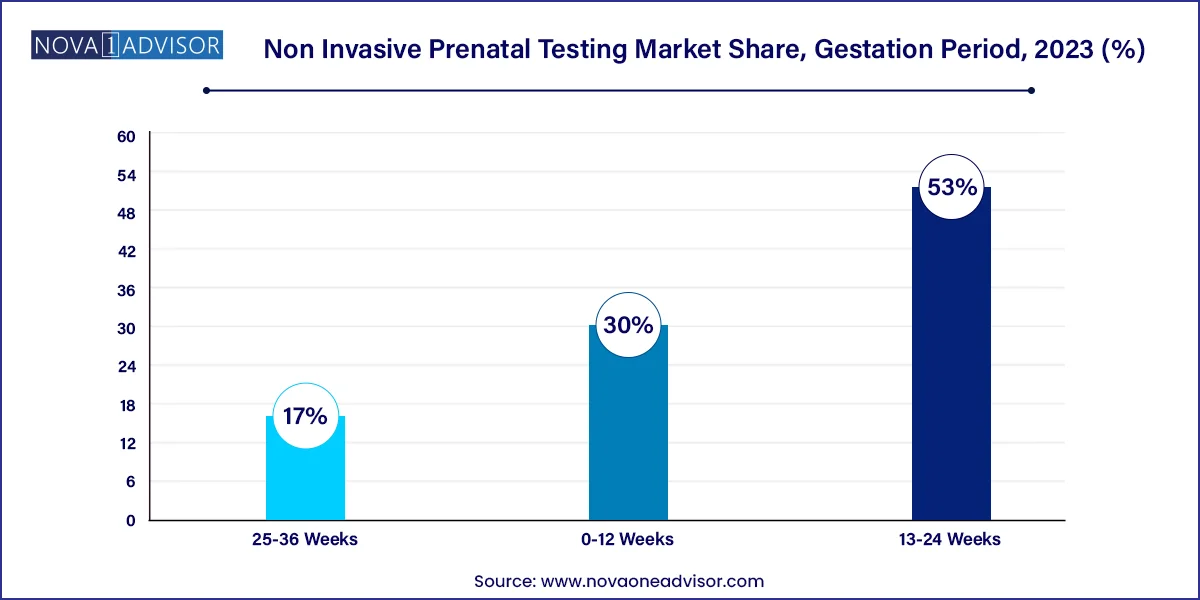

- The 13-24 weeks segment held the largest share of over 53.0% of the non invasive prenatal testing market in 2023.

- Next-generation Sequencing (NGS) accounted for the largest revenue share of market in 2023.

- The high and average risk segment accounted for the largest revenue shareof the market in 2023.

- The cell-free DNA in maternal plasma tests segment accounted for the largest revenue share of the market in 2023.

- Trisomy led the market in 2023 owing to the rising incidence of chromosomal abnormalities.

- The consumables and reagents segment dominated the market in 2023

- The diagnostic laboratories segment held the largest revenue share of the market in 2023.

Market Overview

The Non-Invasive Prenatal Testing (NIPT) market is at the forefront of modern prenatal care, offering a safe, accurate, and advanced screening method for detecting chromosomal abnormalities in fetuses as early as the first trimester of pregnancy. Unlike invasive procedures such as amniocentesis or chorionic villus sampling (CVS), which carry a small risk of miscarriage, NIPT is conducted using a simple blood draw from the pregnant mother, analyzing fragments of fetal DNA (cell-free DNA) circulating in maternal plasma.

Initially developed to screen for common trisomies such as Down syndrome (trisomy 21), Edwards syndrome (trisomy 18), and Patau syndrome (trisomy 13), the scope of NIPT has expanded to include sex chromosome aneuploidies, microdeletion syndromes, and even fetal sex determination. The growing awareness of genetic conditions, a trend toward delayed pregnancies, and technological advancements in sequencing have propelled NIPT from a niche product to a mainstream prenatal screening tool.

NIPT is becoming a standard offering in many healthcare systems, particularly for high-risk pregnancies, while also gaining traction in average- and low-risk cases. The market is witnessing increased integration with next-generation sequencing (NGS), automation of sample analysis, and the development of cost-effective test kits, making NIPT more accessible and scalable than ever before.

Major Trends in the Market

-

Expansion of NIPT for Low-Risk Pregnancies: Once limited to high-risk categories, NIPT is now increasingly recommended for average-risk and even low-risk populations.

-

Widening Scope of Applications Beyond Trisomies: NIPT is expanding to detect microdeletions, single-gene disorders, and fetal RhD status.

-

Integration with Advanced Sequencing Technologies: NGS and digital PCR are driving improvements in accuracy, turnaround time, and cost-effectiveness.

-

Development of Point-of-Care (POC) NIPT Solutions: Rapid diagnostic platforms and sample-to-answer systems are being introduced for decentralized testing.

-

Increasing Regulatory Approvals and Reimbursement Policies: More countries are including NIPT in public healthcare schemes, boosting adoption.

-

Ethical and Privacy Concerns in Genetic Testing: Concerns about fetal sex selection, incidental findings, and genetic data usage are prompting regulatory scrutiny.

-

Rise of Direct-to-Consumer (DTC) Prenatal Testing Kits: Companies are marketing NIPT solutions directly to expectant mothers through telehealth platforms.

Non Invasive Prenatal Testing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.73 Billion |

| Market Size by 2033 |

USD 11.24 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.09% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Gestation Period, Pregnancy Risk, Method, Technology, Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Genesis Genetics (CooperSurgical; Inc.); Natera, Inc.; Centogene N.V.; Illumina, Inc. (Verinata Health, Inc.); Eurofins LifeCodexx GmbH; MedGenome Labs Ltd.; F. Hoffmann-La Roche Ltd.; (Ariosa Diagnostics); Myriad Women’s Health, Inc. (Counsyl; Inc.); QIAGEN; Laboratory Corp. of America Holdings; Progenity, Inc.; Quest Diagnostics, Inc. |

Market Driver: Rising Maternal Age and Associated Genetic Risk

One of the primary drivers for the NIPT market is the increasing average maternal age globally, particularly in developed and urbanizing regions. As more women delay childbirth into their 30s and 40s due to career, lifestyle, or medical factors, the associated risk of chromosomal abnormalities in the fetus rises significantly. The risk of trisomy 21, for example, increases from 1 in 1,250 at age 25 to about 1 in 100 at age 40.

Healthcare providers now routinely offer NIPT as a first-tier screening method for women over 35 or those with previous history of chromosomal abnormalities. The ability of NIPT to provide early, reliable results with minimal risk has made it the preferred choice over traditional serum screening and invasive methods. This demographic trend is projected to continue for the foreseeable future, creating sustained demand for NIPT technologies across global markets.

Market Restraint: High Cost and Unequal Access in Developing Regions

Despite its clinical advantages, cost remains a significant barrier to widespread adoption of NIPT, especially in low- and middle-income countries. While the price of testing has decreased substantially over the past decade often ranging from $350 to $1,200 per test in private clinics it remains unaffordable for large segments of the population without insurance or public healthcare support.

Additionally, infrastructure challenges, lack of trained genetic counselors, and limited awareness in rural or underserved regions further restrict market penetration. In many countries, only urban, private healthcare settings offer NIPT, leading to inequality in access. Addressing this challenge will require collaborations between governments, NGOs, and industry players to subsidize costs and expand access through point-of-care platforms and telemedicine.

Market Opportunity: Expansion of NIPT into Comprehensive Genomic Screening

A key opportunity lies in the expansion of NIPT beyond traditional trisomy screening into comprehensive fetal genomic profiling. Emerging technologies now allow for the detection of microdeletions (e.g., DiGeorge syndrome), duplications, and even single-gene disorders like cystic fibrosis, Duchenne muscular dystrophy, and sickle cell disease. This broader utility enhances the clinical value of NIPT and opens new market segments in prenatal genomics.

Additionally, integration with maternal health screening for infections, preeclampsia, and gestational diabetes through combined NIPT platforms can transform prenatal care into a one-stop diagnostic solution. Companies that can offer comprehensive panels while maintaining cost-effectiveness and regulatory compliance are poised to capture a larger share of this growing market.

Segments Insights:

Gestation Period Insights

The 13–24 weeks segment dominates the NIPT market, largely due to its status as the clinically accepted window for most prenatal screenings. During the second trimester, fetal DNA concentration in maternal blood increases, allowing for more accurate detection of chromosomal anomalies. Many healthcare providers schedule NIPT during this period, often in conjunction with anatomical ultrasound examinations. The synergy between imaging and genetic screening enables clinicians to provide comprehensive risk assessments and guide decisions around further testing or interventions.

The 0–12 weeks segment is the fastest-growing, reflecting a shift toward earlier detection and decision-making. With the push for first-trimester screening, NIPT is increasingly offered as early as 9–10 weeks gestation, enabling parents and clinicians to obtain results before the end of the first trimester. Early testing reduces anxiety, provides more time for genetic counseling, and allows access to a wider range of management options, including early non-invasive interventions or, where legally permitted, pregnancy termination.

Technology Insights

NGS (Next-Generation Sequencing) dominates the technology segment, enabling high-throughput, scalable analysis of cfDNA with high resolution. NGS allows the simultaneous screening of multiple chromosomal targets and microdeletions, offering flexibility and depth of analysis. NGS platforms are widely used in centralized diagnostic labs, academic institutions, and commercial NIPT providers.

PCR-based platforms are the fastest-growing, particularly due to their application in point-of-care and low-resource settings. Innovations in digital PCR and droplet-based systems are making rapid, cost-effective screening feasible without the need for complex sequencing infrastructure. As demand for decentralized and affordable NIPT solutions grows, PCR-based methods are expected to see strong uptake.

Pregnancy Risk Insights

High & average risk pregnancies dominate the market, as NIPT is most widely recommended for women over 35, those with abnormal ultrasound findings, or a family history of genetic disorders. In many countries, public and private healthcare systems provide reimbursement for NIPT in these categories, boosting test volumes. Genetic counselors and OB/GYNs routinely recommend NIPT as a safe alternative to invasive procedures like amniocentesis for these populations.

Low-risk pregnancies are the fastest-growing segment, driven by evolving guidelines and growing public awareness. As technology improves and false-positive rates drop, many health systems are expanding coverage to include all pregnancies regardless of risk level. Direct-to-consumer platforms are also fueling demand among expectant parents who want early, detailed information about their baby’s health.

Method Insights

Cell-free DNA in maternal plasma tests dominate, as they offer the highest accuracy (up to 99% sensitivity for trisomy 21) and are widely adopted in clinical practice. This method has become the cornerstone of NIPT, replacing older biochemical screening methods due to its superior predictive value. Companies such as Natera, Illumina, and Roche Diagnostics have built entire product ecosystems around cfDNA testing, offering integrated lab processing, interpretation software, and patient portals.

Ultrasound detection is the fastest-growing complementary method, especially in integrated screening programs. While not a standalone NIPT method, advanced 3D/4D ultrasound combined with genetic screening enhances the accuracy of fetal anomaly detection. With machine-learning-enabled imaging systems emerging, ultrasound is evolving into a precision diagnostic tool alongside cfDNA assays.

Application Insights

Trisomy screening remains the dominant application, particularly for Down syndrome (trisomy 21), which accounts for the majority of NIPT test volumes globally. It is the first condition screened in almost all commercial and clinical NIPT protocols, due to its prevalence and clinical impact.

Microdeletion syndrome detection is the fastest-growing application, thanks to increasing awareness of conditions like 22q11.2 deletion (DiGeorge syndrome) and advancements in NGS that allow their reliable detection. While these conditions are rarer than trisomies, their severity and lack of ultrasound visibility make them prime candidates for NIPT expansion.

Product Insights

Consumables & reagents dominate the product segment, reflecting the high volume of routine tests processed in diagnostic laboratories. These include extraction kits, sequencing reagents, and library prep kits required for each patient sample. Consumables offer recurring revenue and are a critical part of the workflow, making them a key focus for OEMs and reagent manufacturers.

Instruments are the fastest-growing, driven by new installations of sequencing platforms, automated extraction systems, and PCR analyzers in emerging markets. As more laboratories and hospitals set up in-house genetic screening capabilities, demand for high-throughput instruments, especially those tailored for prenatal use, is rising rapidly.

End-use Insights

Hospitals and clinics dominate the end-use segment, as they remain the primary point of care for prenatal diagnostics. Most NIPT tests are ordered by obstetricians and processed through hospital-affiliated or reference labs. Integration with EHR systems, in-house genetic counselors, and centralized billing make hospitals an efficient channel for test administration.

Diagnostic laboratories are the fastest-growing, driven by outsourcing trends and the growth of commercial genetic testing providers. Labs specializing in reproductive genomics offer faster turnaround, greater testing depth, and value-added services like AI-driven reporting and mobile result delivery.

Regional Insights

North America leads the NIPT market, supported by high awareness, technological innovation, and favorable reimbursement policies. The United States in particular has a mature market where NIPT is widely available and used across all pregnancy risk categories. Companies like Natera, Labcorp, and Illumina dominate the landscape, and continuous R&D investment ensures a steady pipeline of innovation.

Asia-Pacific is the fastest-growing region, driven by rising maternal age, increasing incidence of genetic disorders, and government initiatives to improve prenatal care. Countries like China and India are seeing rapid growth in NIPT adoption, particularly through public-private partnerships and local manufacturing. Moreover, regional players are emerging with cost-competitive offerings tailored to diverse populations and infrastructure realities.

Recent Developments

-

Natera Inc. (April 2025): Launched a new AI-enhanced version of its Panorama test, improving detection of rare autosomal aneuploidies and microdeletions.

-

Illumina (March 2025): Partnered with South Korea’s Ministry of Health to expand access to low-cost NIPT through regional genomic labs.

-

Roche Diagnostics (February 2025): Received CE approval for its high-throughput NIPT platform using digital PCR and automation-ready reagents.

-

Myriad Genetics (January 2025): Expanded its women's health platform to include NIPT for single-gene disorders using advanced target capture technology.

-

BGI Genomics (December 2024): Opened a new laboratory hub in Brazil to provide localized NIPT services for Latin America, reducing turnaround times.

Some of the prominent players in the non-invasive prenatal testing market include:

- Genesis Genetics (CooperSurgical, Inc.)

- Natera, Inc.

- Eurofins LifeCodexx GmbH

- Illumina, Inc. (Verinata Health, Inc.)

- Centogene N.V.

- MedGenome Labs Ltd.

- Myriad Women’s Health, Inc. (Counsyl, Inc.)

- F. Hoffmann-La Roche Ltd. (Ariosa Diagnostics)

- Qiagen

- Laboratory Corp. of America Holdings

- Progenity, Inc.

- Quest Diagnostics, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global non invasive prenatal testing market.

Gestation Period

- 0-12 Weeks

- 13-24 Weeks

- 25-36 Weeks

Pregnancy Risk

- High & Average Risk

- Low Risk

Method

- Ultrasound Detection

- Biochemical Screening Tests

- Cell-free DNA in Maternal Plasma Tests

Technology

- NGS

- Array Technology

- PCR

- Others

Product

- Consumables & Reagents

- Instruments

Application

- Trisomy

- Microdeletion Syndrome

- Other Applications

End-use

- Hospitals & Clinics

- Diagnostic Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)