Non-Invasive Prenatal Testing Market Size, Share | Forecast- 2034

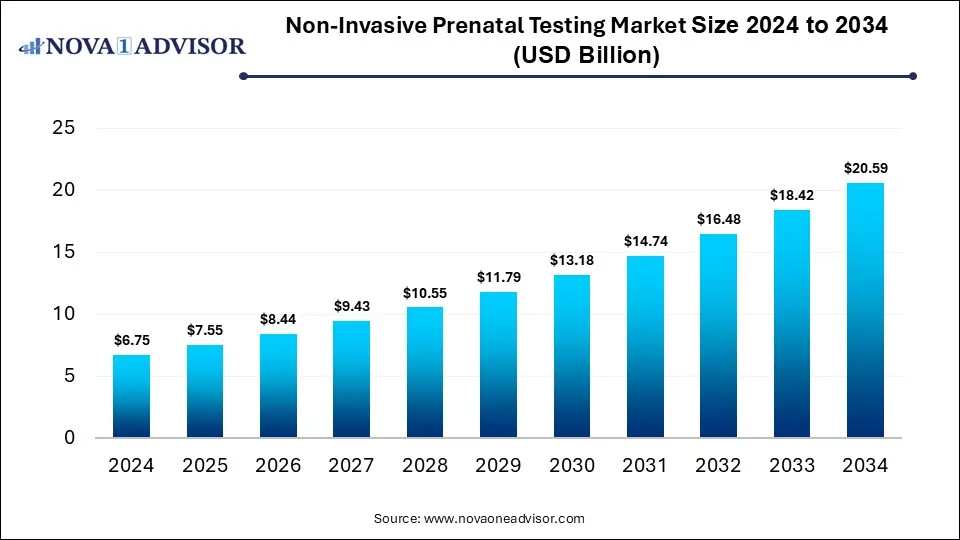

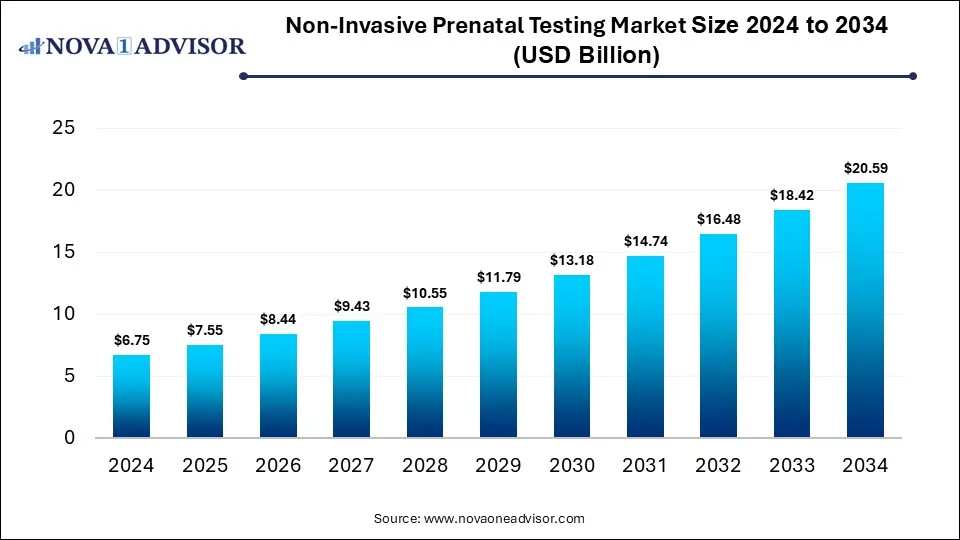

The global non-invasive prenatal testing market size is calculated at USD 6.75 billion in 2024, grows to USD 7.55 billion in 2025, and is projected to reach around USD 20.59 billion by 2034, expanding at a CAGR of 11.8% from 2025 to 2034. The market is growing because it offers a safer, painless alternative to invasive procedures while enabling early detection of genetic abnormalities. Rising maternal age, increasing awareness, and technological advances further drive demand.

Non-Invasive Prenatal Testing Market Key Takeaways

- North America dominated the non-invasive prenatal testing market with a revenue share of approximately 38% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By component, the kits and reagents segment held the largest market share in 2024.

- By component, the instruments segment is expected to grow at a significant CAGR in the market during the forecast period.

- By application, the down syndrome segment led the market with the largest revenue share in 2024.

- By application, the turner syndrome segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the diagnostic laboratories segment held the highest market share.

- By end user, the hospital sector segment is expected to grow at a significant CAGR in the market during the forecast period.

What is the Significance of Non-Invasive Prenatal Testing?

Non-invasive prenatal testing is a screening method that analyzes cell-free fetal DNA in a pregnant woman’s blood to detect genetic abnormalities without the need for invasive procedures. The non-invasive prenatal testing (NIPT) market is important as it transforms prenatal care by offering convenient, risk-free screening for chromosomal and genetic abnormalities early in pregnancy. It empowers healthcare providers and parents with actionable information, improving the planning and management of pregnancies. Additionally, NIPT drives innovation in genomic technologies, expands access to advanced diagnostic solutions, and supports population-level health initiatives. Its role in reducing invasive procedures while increasing screening efficiency underscores its growing impact on global maternal and fetal healthcare.

What are the Key trends in the Non-Invasive Prenatal Testing Market in 2024?

- In June 2024, Illumina introduced DRAGEN v4.3, the newest update to its sequencing analysis software, while Natera expanded its presence in prenatal and carrier screening by acquiring related assets from Invitae. (Source: https://www.illumina.com/)

- In August 2023, Illumina set up a new Solutions Center in Bengaluru, India, while PerkinElmer sold its Applied, Food, and Enterprise Services units to New Mountain Capital and rebranded its Diagnostics and Life Sciences division as Revvity.(Source: https://www.prnewswire.com/)

How Can AI Affect the Non-Invasive Prenatal Testing Market?

AI can impact the market by enabling automation in sample processing, optimizing bioinformatics pipelines, and supporting real-time decision-making for clinicians. It can also enhance predictive modeling for pregnancy outcomes beyond genetic disorders, such as preterm birth risks. Moreover, AI-driven platforms improve scalability for labs, integrate multi-omics data, and facilitate remote testing services. These innovations not only expand test capabilities but also make advanced prenatal screening more accessible in both developed and emerging healthcare markets.

Report Scope of Non-Invasive Prenatal Testing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.55 Billion |

| Market Size by 2034 |

USD 20.59 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Component, By Application, and By End User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Genetics (CooperSurgical, Inc.), Natera, Inc., Centogene N.V., Illumina, Inc. (Verinata Health, Inc.), Eurofins LifeCodexx GmbH, MedGenome Labs Ltd., F. Hoffmann-La Roche Ltd. (Ariosa Diagnostics), Myriad Women’s Health, Inc. (Counsyl, Inc.), Progenity, Inc., Qiagen, Laboratory Corp. of America Holdings, Quest Diagnostics, Inc. |

Market Dynamics

Driver

Rising Awareness and Acceptance of Early Genetic Screening

Rising awareness and awareness of early genetic screening fuel the non-invasive prenatal testing market because educated patients increasingly seek personalized pregnancy care and proactive health management. As more people understand the potential of detecting genetic risks early, demand grows for a convenient, non-invasive option. Additionally, awareness campaigns, digital health platforms, and prenatal counselling promote trust in these tests, encouraging wider adoption across both urban and rural populations, which expands the market significantly.

Restraint

High Cost of Advanced Tests

The high cost of advanced non-invasive prenatal testing market restrains growth because it creates inequality in access, restricting usage mainly to affluent populations or private healthcare settings. Many public hospitals and clinics, especially in developing countries, cannot offer these tests due to budget constraints. Additionally, the expensive equipment and specialized personnel required for accurate analysis increase operational costs for laboratories, limiting the number of providers who can deliver the service and slowing broader market penetration.

Opportunity

Expansion of Test Panel to Detect a wider range of Genetic Disorders

Expanding NIPT panels to cover more genetic disorders offers future opportunities by addressing unmet needs for early detection of rare and complex conditions. This innovation can differentiate providers, attract new patient segments, and open markets in regions with increasing prenatal healthcare awareness. Broader panels also support research and data collection for better population-level insights, improving overall prenatal care. As technology advances and costs decrease, offering comprehensive testing becomes feasible, further boosting adoption and market growth.

- For Instance, In May 2025, BillionToOne launched an expanded UNITY Fetal Risk™ Screen, a non-invasive prenatal test that detects up to 14 genetic conditions, including aneuploidies and X-linked disorders, using maternal blood. This allows accurate early fetal risk assessment from nine weeks of pregnancy without invasive procedures. (Source: https://www.billiontoone.com/)

Segmental Insights

How does the Kits and Reagents Segment dominate the Non-Invasive Prenatal Testing Market in 2024?

In 2024, the kits and reagents segment dominated the NIPT market because manufacturers continuously innovate to offer ready-to-use, standardized solutions that simplify testing workflows. Their reliability and compatibility with advanced sequencing platforms make them indispensable for accurate and high-throughput analysis. Moreover, the rising number of prenatal screening and expansion of testing services in both hospitals and private labs create consistent demand, positioning kits and regents as a key revenue driver and central component of the market ecosystem.

The instruments segment is projected to grow rapidly because laboratories and diagnostic centers are upgrading to integrated, multi-functional platforms that support diverse prenatal tests. Increasing emphasis on precision medicine and the need for faster turnaround times are driving demand for automated and compact instruments. Furthermore, emerging markets are investing in modern laboratory infrastructure, while collaboration between instrument manufacturers and testing providers expands accessibility, making the segment a major contributor to market during the forecast period.

Non-invasive Prenatal Testing Market By Component, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Instruments |

1.49 |

1.63 |

1.79 |

1.96 |

2.15 |

2.36 |

2.58 |

2.83 |

3.10 |

3.39 |

3.71 |

| Kits and Reagents |

2.43 |

2.69 |

2.99 |

3.31 |

3.67 |

4.07 |

4.51 |

5.00 |

5.54 |

6.13 |

6.80 |

| Services |

2.84 |

3.22 |

3.66 |

4.16 |

4.72 |

5.36 |

6.09 |

6.91 |

7.84 |

8.90 |

10.09 |

Why Did the Down Syndrome Segment Dominate the Non-Invasive Prenatal Testing Market in 2024?

The Down syndrome segment dominated the NIPT market in 2024 because it is widely recognized as one of the most common and clinically significant chromosomal abnormalities. Strong demand from expectant parents for early reassurance and informed pregnancy management, combined with support from public health programs and insurance coverage in several regions, fueled testing uptake. Additionally, ongoing innovations in assay sensitivity and quicker turnaround times made NIPT for Down syndrome more accessible and reliable, reinforcing its position as the highest-revenue-generating application.

The Turner syndrome segment is projected to grow rapidly because healthcare providers are increasingly recommending early screening to identify potential chromosomal abnormalities that affect female fetal development. Technological improvements in NPTL have enhanced sensitivity for detecting monosomy X, making tests more reliable. Additionally, rising prenatal preference for non-invasive, risk-free testing and increasing government initiatives promoting prenatal health are expanding the use of NIPT for Turner syndrome, driving the segment's high growth during the forecast period.

Non-invasive Prenatal Testing Market By Application, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Down Syndrome (trisomy 21) |

3.24 |

3.56 |

3.91 |

4.30 |

4.72 |

5.19 |

5.69 |

6.25 |

6.85 |

7.51 |

8.24 |

| Edwards Syndrome (trisomy 18) |

1.08 |

1.20 |

1.33 |

1.48 |

1.65 |

1.83 |

2.03 |

2.26 |

2.50 |

2.78 |

3.09 |

| Patau Syndrome (trisomy 13) |

0.81 |

0.90 |

1.00 |

1.10 |

1.22 |

1.36 |

1.50 |

1.67 |

1.85 |

2.05 |

2.27 |

| Turner Syndrome |

0.61 |

0.68 |

0.76 |

0.85 |

0.95 |

1.06 |

1.19 |

1.33 |

1.48 |

1.66 |

1.85 |

| Other Applications |

1.01 |

1.21 |

1.43 |

1.70 |

2.00 |

2.36 |

2.77 |

3.24 |

3.79 |

4.42 |

5.15 |

How does the Diagnostic Laboratories Segment Dominate the Non-Invasive Prenatal Testing Market?

The diagnostic laboratories segment captured the largest market share in 2024 because it provides specialized services that smaller clinics or hospitals cannot easily offer. Their infrastructure supports high-throughput testing, quality control, and advanced data analysis, making them essential for accurate NIPT results. Additionally, increasing outsourcing by healthcare providers to central labs, along with their capability to adopt new technologies rapidly, ensures wider accessibility and faster turnaround times, reinforcing their leadership in the non-invasive prenatal testing market.

The hospital segment is projected to grow rapidly because hospitals are expanding prenatal care programs and offering in-house NIPT services to meet rising patient demand. Increased trust in hospital-based testing, coupled with the ability to provide integrated services like maternal monitoring and genetic counseling, encourages more expectant parents to opt for NIPT. Additionally, government initiatives supporting hospital-based prenatal diagnostics and growing healthcare infrastructure in emerging regions contribute to the faster adoption and high CAGR of this segment during the forecast period.

Non-invasive Prenatal Testing Market By End User, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospitals |

3.0 |

3.3 |

3.7 |

4.1 |

4.6 |

5.1 |

5.6 |

6.3 |

7.0 |

7.8 |

8.6 |

| Diagnostic Labs |

3.8 |

4.2 |

4.8 |

5.3 |

6.0 |

6.7 |

7.5 |

8.5 |

9.5 |

10.6 |

11.9 |

Regional Insights

How is North America contributing to the Expansion of the Non-Invasive Prenatal Testing Market?

North America led the NIPT market in 2024 because of early adoption of innovative prenatal screening solutions and strong investment in precision medicine. High consumer awareness, availability of specialized testing centers, and regulatory support for non-invasive diagnostics encouraged widespread use. Moreover, collaborations between biotechnology companies and healthcare providers, along with growing demand for personalized prenatal care, ensured broader accessibility of NIPT, enabling North America to secure the largest revenue share in the market during that year.

How is Asia-Pacific Accelerating the Non-Invasive Prenatal Testing Market?

The Asia Pacific market is expected to register the fastest CAGR because of rising investments in diagnostic facilities and growing private healthcare networks. Increased focus on early prenatal care, expanding middle-class populations, and greater availability of advanced testing technologies are fueling demand. Moreover, collaborations between local and international companies to provide cost-effective and high-quality NIPT solutions are accelerating adoption, while government programs promoting maternal health in countries like China and India further support rapid market growth in the region.

Non-invasive Prenatal Testing Market By Region, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

2.50 |

2.76 |

3.05 |

3.38 |

3.73 |

4.13 |

4.56 |

5.04 |

5.57 |

6.15 |

6.80 |

| Europe |

1.89 |

2.10 |

2.33 |

2.59 |

2.87 |

3.18 |

3.53 |

3.92 |

4.35 |

4.83 |

5.35 |

| Asia-Pacific |

1.69 |

1.93 |

2.21 |

2.53 |

2.89 |

3.30 |

3.77 |

4.30 |

4.91 |

5.60 |

6.38 |

| Latin America |

0.41 |

0.45 |

0.51 |

0.57 |

0.63 |

0.71 |

0.79 |

0.88 |

0.99 |

1.11 |

1.24 |

| Middle East and Africa |

0.27 |

0.30 |

0.34 |

0.38 |

0.42 |

0.47 |

0.53 |

0.59 |

0.66 |

0.74 |

0.82 |

Top Companies in the Non-Invasive Prenatal Testing Market

- Genetics (CooperSurgical, Inc.)

- Natera, Inc.

- Centogene N.V.

- Illumina, Inc. (Verinata Health, Inc.)

- Eurofins LifeCodexx GmbH

- MedGenome Labs Ltd.

- F. Hoffmann-La Roche Ltd. (Ariosa Diagnostics)

- Myriad Women’s Health, Inc. (Counsyl, Inc.)

- Progenity, Inc.

- Qiagen

- Laboratory Corp. of America Holdings

- Quest Diagnostics, Inc.

Recent Developments in the Non-Invasive Prenatal Testing Market

- In May 2025, Roche partnered with Broad Clinical Labs to promote the use of SBX sequencing technology for critically ill newborns, aiming to integrate whole-genome sequencing into standard clinical care. (Source: https://www.roche.com/)

- In April 2025, UnitedHealthcare removed prior authorization for non-invasive prenatal testing, including cell-free fetal DNA tests, across various commercial and community plans to streamline access for both patients and providers. (Source: https://www.caplinehealthcaremanagement.com/)

Segments Covered in the Report:

By Component

- Instruments

- Kits and Reagents

- Services

By Application

- Down Syndrome (trisomy 21)

- Edwards Syndrome (trisomy 18)

- Patau Syndrome (trisomy 13)

- Turner Syndrome

- Other Applications

By End User

- Hospitals

- Diagnostic Labs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa