Non-small Cell Lung Cancer Therapeutics Market Size, Report 2026 to 2035

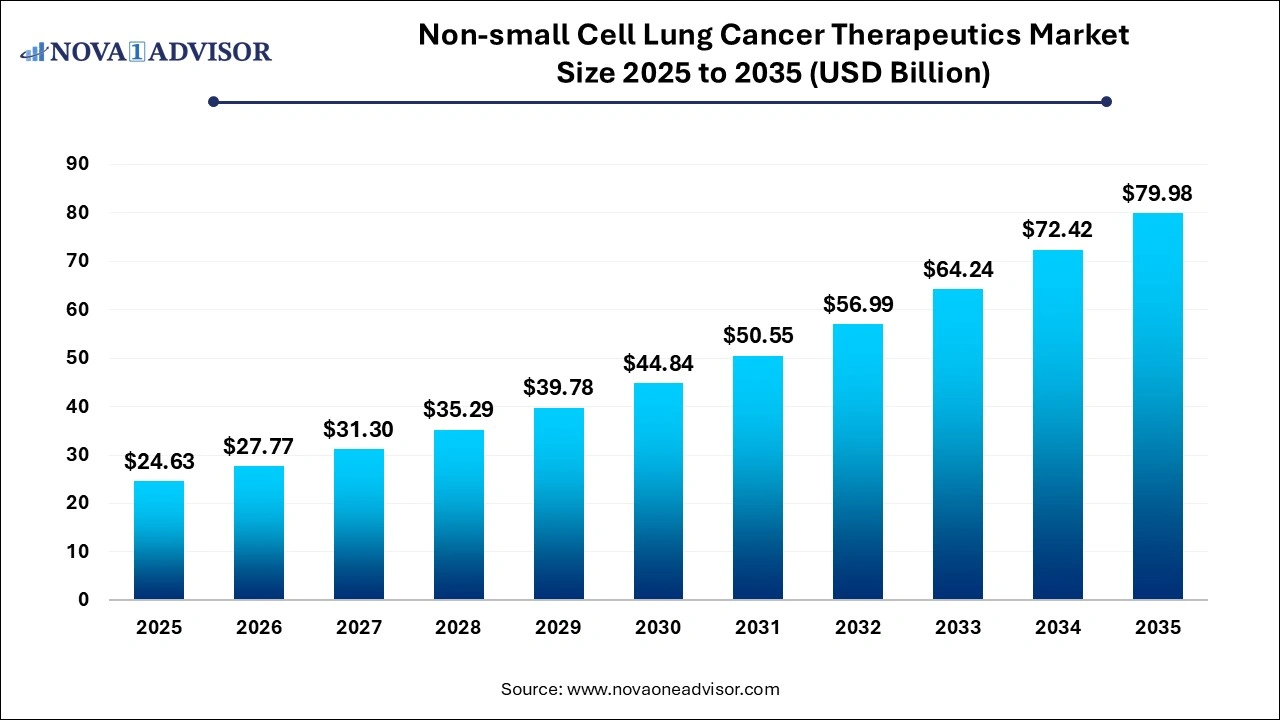

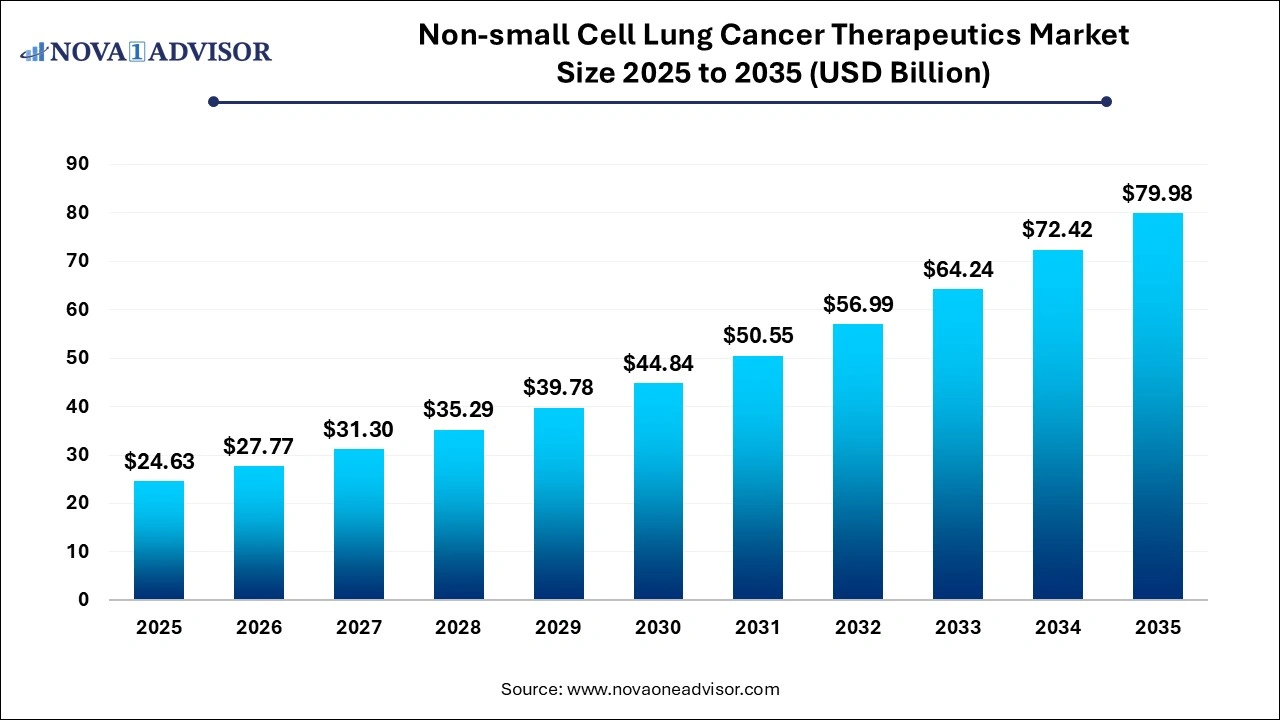

The global non-small cell lung cancer therapeutics market size was valued at USD 24.63 billion in 2025 and is anticipated to reach around USD 79.98 billion by 2035, growing at a CAGR of 12.5% from 2026 to 2035. The growth of the non-small cell lung cancer (NSCLC) therapeutics market can be linked to the rising cases of NSCLC, ongoing advancements in targeted therapies, increased awareness and focus on early diagnosis, and a strong product pipeline.

Non-small Cell Lung Cancer Therapeutics Market Key Takeaways

- The adenocarcinoma segment dominated the market in 2024 with a share of 44% in 2025

- The targeted therapy segment dominated the market in 2024 with a share of 51% in 2025.

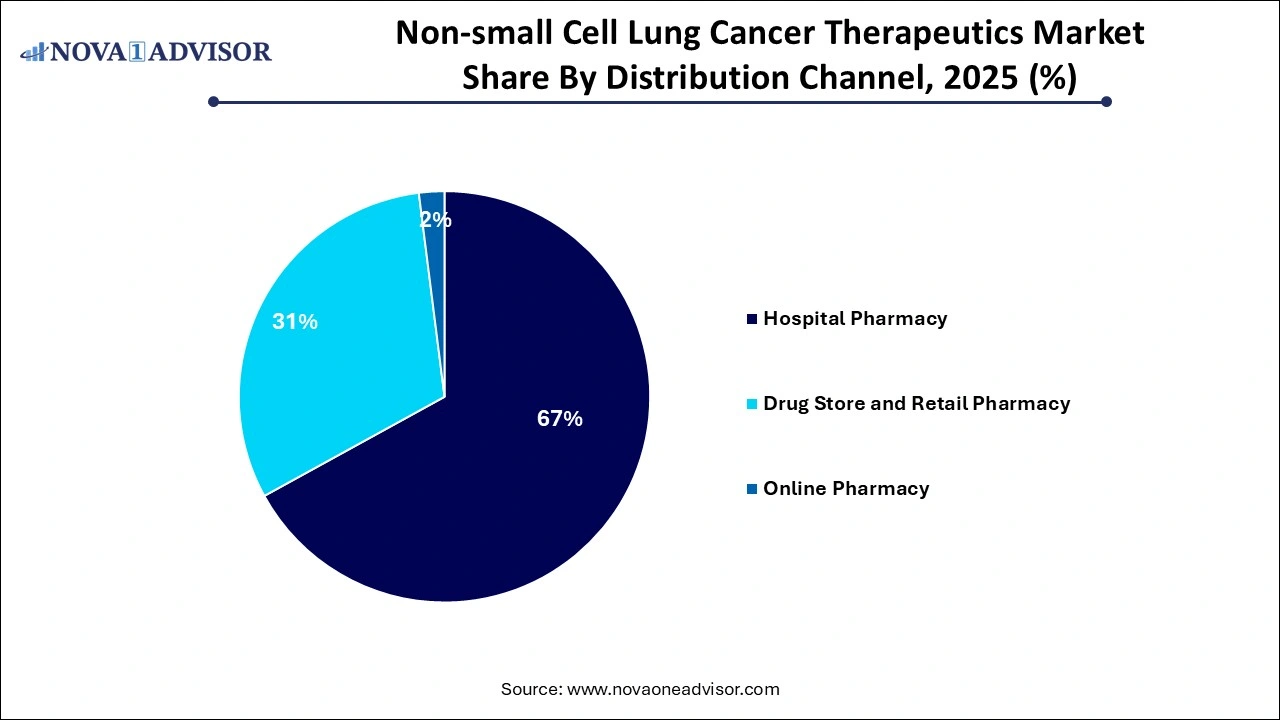

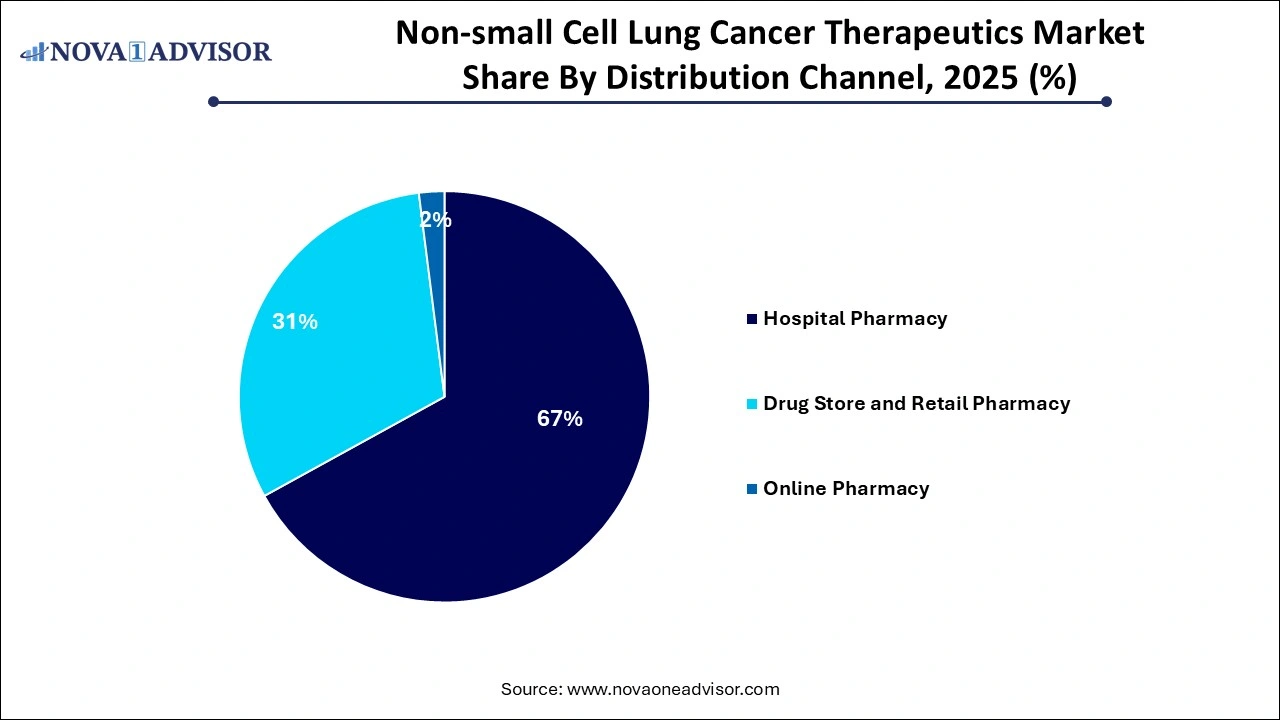

- The hospital pharmacy segment dominated the market with a share of 67% in 2025.

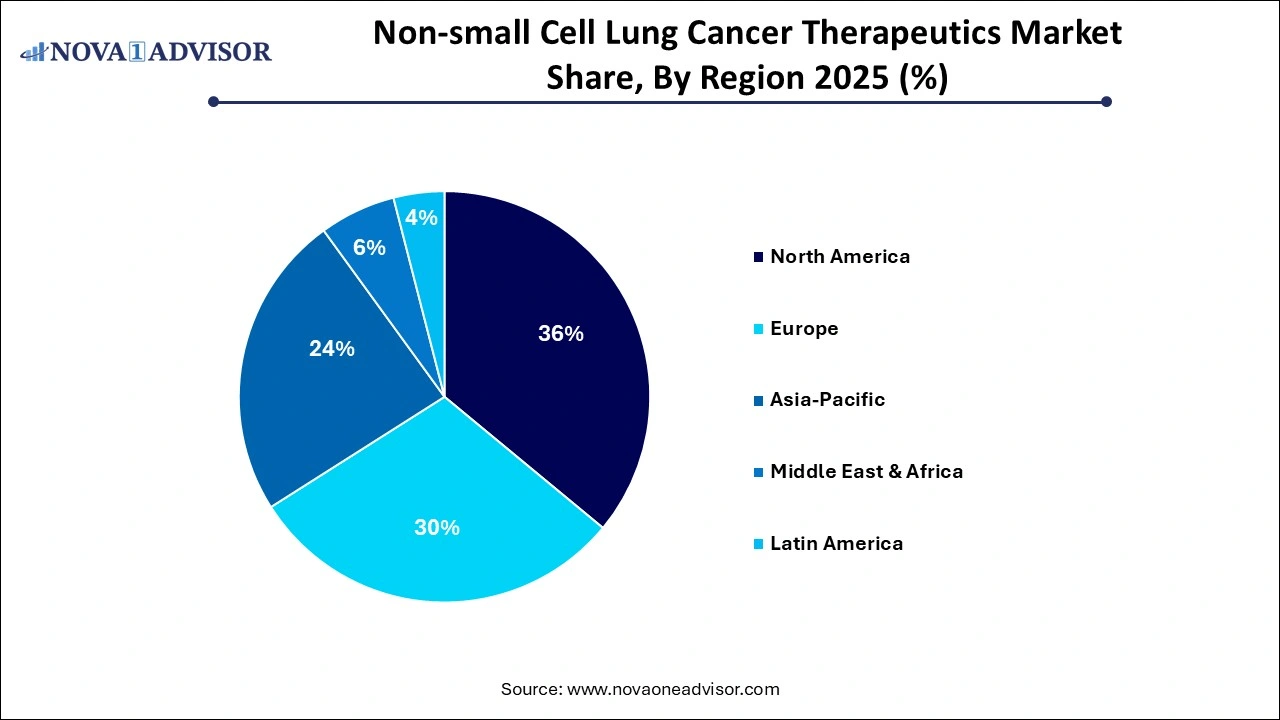

- North America Non-small Cell Lung Cancer (NSCLC) therapeutics industry dominated globally with a market share of 36% in 2025.

Non-small Cell Lung Cancer Therapeutics Market Overview

The global Non-small Cell Lung Cancer (NSCLC) therapeutics market represents one of the most dynamic and high-investment areas in oncology, driven by increasing disease prevalence, rapid advances in targeted and immuno-oncology therapies, and expanding diagnostics enabling biomarker-driven treatment. NSCLC accounts for approximately 85% of all lung cancer cases, making it the most common form of lung malignancy globally. As smoking-related and environmental lung cancer risk factors persist, coupled with aging populations and improved screening techniques, incidence rates continue to rise, thereby fueling therapeutic demand.

Historically dominated by platinum-based chemotherapies, the NSCLC treatment paradigm has undergone a radical transformation over the past decade. Precision medicine approaches where treatment is guided by the genetic profile of the tumor—have taken center stage. Targeted therapies, especially tyrosine kinase inhibitors (TKIs) directed at EGFR, ALK, ROS1, and KRAS mutations, have demonstrated superior efficacy in subsets of patients. Moreover, immunotherapy has become a foundational treatment in advanced NSCLC, with PD-1 and PD-L1 inhibitors like pembrolizumab and nivolumab revolutionizing outcomes.

The NSCLC therapeutics market is characterized by continuous R&D activity, strategic partnerships between pharmaceutical companies and diagnostics developers, and a robust regulatory pipeline. The combination of personalized therapeutics, combination regimens, and expanding access to treatment especially in emerging markets is expected to drive long-term market growth. However, high treatment costs, resistance development, and regional disparities in healthcare infrastructure present ongoing challenges.

Major Trends in the Non-small Cell Lung Cancer Therapeutics Market

-

Shift Toward Biomarker-Based Treatment: EGFR, ALK, BRAF, KRAS, and MET mutations are increasingly guiding therapy choices, leading to more personalized regimens.

-

Combination Regimens Becoming Standard: Immunotherapy combined with chemotherapy or other checkpoint inhibitors is now a preferred first-line approach in advanced NSCLC.

-

Emergence of KRAS-Targeted Therapies: New approvals targeting the KRAS G12C mutation, once considered “undruggable,” are changing treatment for previously hard-to-treat patients.

-

Growth of Liquid Biopsy in Patient Stratification: Non-invasive diagnostic tools are helping in mutation detection, monitoring resistance, and guiding second-line treatments.

-

Rise of Biosimilars and Generic Oncology Drugs: Patent expirations of first-generation biologics are opening the door for biosimilars, especially in developing markets.

-

Digital and AI-Driven Clinical Trial Platforms: AI is being used to accelerate drug discovery, predict patient response, and optimize trial recruitment for NSCLC drugs.

-

Global Expansion of Immuno-oncology Trials: Companies are conducting NSCLC immunotherapy trials across diverse populations, including Asia and Latin America, to expand indications.

Non-small Cell Lung Cancer Therapeutics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 27.77 Billion |

| Market Size by 2035 |

USD 79.98 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 12.5% |

| Base Year |

2025 |

| Forecast Period |

2026to 2035 |

| Segments Covered |

By Type, By treatment, By distribution channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd., Mylan N.V., Teva, Pharmaceutical Industries Ltd. , Sanofi , Pfizer Inc.,GSK plc , Novartis AG , Bayer AG , Eli Lilly and Company, Merck & Co., Inc. |

Non-small Cell Lung Cancer Therapeutics Market Dynamics

Driver: Advancements in Immunotherapy and Targeted Therapy

A major force propelling the NSCLC therapeutics market is the breakthrough success of immunotherapy and targeted therapies. For decades, NSCLC was treated primarily with surgery, radiation, and chemotherapy, often yielding limited survival benefits. However, the approval of immune checkpoint inhibitors such as nivolumab (Opdivo), pembrolizumab (Keytruda), atezolizumab (Tecentriq), and durvalumab (Imfinzi) has drastically altered patient outcomes. These agents enable the immune system to recognize and attack cancer cells by inhibiting PD-1/PD-L1 or CTLA-4 pathways.

Similarly, targeted therapies have improved progression-free survival and quality of life for patients with actionable mutations. The availability of drugs like osimertinib (Tagrisso) for EGFR mutations, alectinib (Alecensa) for ALK-positive tumors, and sotorasib (Lumakras) for KRAS G12C mutations highlights the precision medicine revolution. These treatments not only improve clinical efficacy but also reduce unnecessary toxicity by targeting tumor-specific pathways. As companion diagnostics become more widely available, the adoption of these treatments continues to rise globally.

Restraint: High Cost and Access Disparities

One of the most pressing challenges in the NSCLC therapeutics market is the high cost of novel therapies and associated disparities in patient access. Targeted therapies and immuno-oncology drugs often come with premium pricing. For instance, a full course of pembrolizumab can exceed $150,000 annually. While many developed countries provide insurance coverage or public reimbursement, access remains a significant issue in low- and middle-income countries.

Additionally, even in developed nations, discrepancies in access to molecular testing and diagnostics prevent timely initiation of optimal therapy. The cost burden extends beyond the drug itself to include frequent imaging, biomarker testing, and management of immune-related adverse events. These barriers can delay treatment, reduce adherence, or exclude entire patient populations from cutting-edge therapies, thereby hindering overall market penetration.

Opportunity: Expansion into Early-Stage and Adjuvant Therapy

A significant growth opportunity in the NSCLC therapeutics market lies in the expansion of novel agents into early-stage and adjuvant treatment settings. Traditionally, immunotherapies and targeted treatments were reserved for advanced or metastatic NSCLC cases. However, recent trials have demonstrated their efficacy in early-stage disease, both pre- and post-surgery.

For example, the IMpower010 trial led to the FDA approval of atezolizumab as adjuvant treatment following chemotherapy in resected stage II–IIIA NSCLC. Similarly, neoadjuvant use of nivolumab (in combination with chemotherapy) before surgical resection has shown promise in reducing tumor size and recurrence. These paradigm shifts allow companies to expand their market to patients who were previously treated with surgery alone. As biomarker testing becomes routine even in early-stage lung cancer, pharmaceutical developers have the opportunity to broaden their revenue streams by targeting a larger population.

Non-small Cell Lung Cancer Therapeutics Market Segmental Insights

By Type Insights

Adenocarcinoma dominates the NSCLC market, accounting for the majority of diagnosed cases globally. This subtype is most commonly found in non-smokers and women and is frequently associated with identifiable driver mutations such as EGFR, ALK, and KRAS. These genetic alterations make adenocarcinoma more amenable to targeted therapies, thereby driving higher treatment penetration. The success of drugs like osimertinib, lorlatinib, and sotorasib can be largely attributed to the molecular characteristics of adenocarcinoma tumors. Furthermore, early detection programs and biomarker screening are more frequently deployed in adenocarcinoma, reinforcing its dominant market position.

Large cell carcinoma, while less prevalent, is experiencing faster growth due to increasing recognition and molecular profiling. This subtype tends to be more aggressive and has historically been underrepresented in clinical trials. However, with broader immunotherapy indications and evolving insights into genetic drivers, patients with large cell carcinoma are now benefitting from checkpoint inhibitors and broader-spectrum targeted agents. As diagnostic accuracy improves, the identification of large cell carcinoma cases is expected to rise, supporting rapid expansion in treatment uptake.

By Treatment Insights

The targeted therapy segment dominated the market in 2023 with a share of 50.87% in 2025. Therapies targeting EGFR, ALK, ROS1, BRAF, and more recently, MET and RET mutations, have been highly successful in extending survival and delaying disease progression. These therapies are often administered orally and are generally better tolerated than chemotherapy, increasing patient preference. The ability to re-sequence or switch to second-line targeted agents in the face of resistance mutations further solidifies their place in the treatment landscape.

Immunotherapy, on the other hand, is the fastest-growing segment due to expanding indications and favorable long-term survival data. Initially approved for metastatic NSCLC, checkpoint inhibitors are now being adopted in adjuvant, neoadjuvant, and combination regimens. Immuno-oncology agents are showing promise even in biomarker-negative populations when combined with chemotherapy. Recent breakthroughs in T-cell engagers, cancer vaccines, and bispecific antibodies further diversify the immunotherapy pipeline. As long-term survivors of NSCLC increase, maintenance therapies and new checkpoint combinations are expected to drive exponential growth in this segment.

By Distribution Channel Insights

Hospital pharmacies dominate the NSCLC therapeutics distribution landscape, especially for intravenous immunotherapies and supportive oncology care. These settings provide the infrastructure necessary for administering complex biologics, monitoring immune-related adverse effects, and conducting molecular diagnostics on-site. Additionally, large academic hospitals and cancer treatment centers serve as central hubs for clinical trials, where cutting-edge therapies are first introduced and later adopted into standard practice.

Online pharmacies are gaining traction as patients, particularly those on oral targeted therapies, seek convenience, cost transparency, and delivery efficiency. Telemedicine platforms and patient-assistance programs are facilitating home delivery of prescription drugs, including tyrosine kinase inhibitors. The pandemic accelerated this trend, and regulations are evolving to support the safe delivery of oncology medications through licensed online platforms. As digital health ecosystems mature, online pharmacies are expected to capture an increasing share of NSCLC drug dispensing, particularly for maintenance therapy and supportive care.

Non-small Cell Lung Cancer Therapeutics Market Regional Insights

North America held the largest market share in the NSCLC therapeutics industry in 2024, driven by strong healthcare infrastructure, high awareness, and rapid adoption of novel therapies. The U.S. accounts for the largest share, thanks to early access to FDA-approved immunotherapies and targeted agents. Insurance coverage, routine biomarker testing, and access to advanced oncology centers contribute to high treatment rates. Key pharmaceutical players like Merck, Bristol Myers Squibb, and Amgen have established dominant commercial operations in the region, reinforcing North America’s market leadership.

U.S. Non-small Cell Lung Cancer Therapeutics Market

U.S. Non-small Cell Lung Cancer Therapeutics Market

The U.S. is major contributor to the market in North America. The market growth is driven by the rising awareness of early lung cancer diagnosis, well-established healthcare infrastructure with state-of-the-art oncology centers, adoption of advanced diagnostic tools, availability of new and efficient targeted therapies for NSCLC. The rising investments by pharmaceutical companies, research organizations as well as by the government through institutes like the National Institutes of Health (NIH) in lung cancer R&D is bolstering the market growth. Furthermore, the U.S. government through agencies such as the Food and Drug Administration (FDA) regulates the conduction of clinical trials, approves new therapies and funds research. According to the American Lung Association’s “State of Lung Cancer” 2024 Report, approximately 235,000 people will be diagnosed with lung cancer in 2024.

- For instance, in March 2025, Zenocutuzumab, marketed as Bizengri, received an accelerated approval from the U.S. FDA. The approval makes it the first drug targeting tumors with a very rare genetic alteration called an NRG1 fusion and be used to treat people with pancreatic or non-small cell lung cancer (NSCLC).

Asia Pacific is expected to witness the fastest growth, driven by a large population, rising smoking-related lung cancer burden, and improving access to cancer care. Countries like China and India are making major investments in oncology infrastructure, while South Korea and Japan are at the forefront of precision medicine. Regulatory authorities in the region are increasingly approving targeted therapies and biosimilars at faster rates. Partnerships between multinational drug developers and regional players are also facilitating local manufacturing and distribution, accelerating market penetration.

China Non-small Cell Lung Cancer Therapeutics Market Trends

China is leading the market in Asia Pacific, driven by the factors such as rising incidences in the large population, increased expenditure for advancing healthcare infrastructure, robust research infrastructure, and adoption of advanced diagnostic technologies. Continuous advancements in targeted therapies such as ALK and EGFR mutations as well as immunotherapies like checkpoint inhibitors are improving patient outcomes in China. Initiatives like the National Reimbursement Drug List (NRDL) which includes some of the key NSCLC therapies is improving patient access and affordability to these therapies. Additionally, the rising number of clinical trials, focus on personalized medicine, early screening programs and increased healthcare spending are contributing to the market growth.

- For instance, in July 2025, Akeso, Inc. received the approval of supplementary New Drug Application (sNDA) from the National Medical Products Administration (NMPA) for ivonescimab (PD-1/VEGF bispecific antibody) in combination with chemotherapy as a first-line treatment for advanced squamous non-small cell lung cancer (sq-NSCLC).

Non-small Cell Lung Cancer Therapeutics Market Top Key Companies:

- F. Hoffmann-La Roche Ltd.

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Pfizer Inc.

- GSK plc

- Novartis AG

- Bayer AG

- Eli Lilly and Company

- Merck & Co., Inc.

Non-small Cell Lung Cancer Therapeutics Market Recent Developments

- In May 2025, NeoGenomics, Inc., a prominent provider of oncology testing services, commercially introduced their c-MET companion diagnostic immunohistochemistry (IHC) assay, c-MET CDx for NSCLC. The assay offering a 48-hour turnaround time will support treatment selection for patients with advanced non-small cell lung cancer (NSCLC).

- In December 2024, Merck declared that sacituzumab tirumotecan (sac-TMT) was granted the Breakthrough Therapy Designation by the U.S. Food and Drug Administration (FDA) for the treatment of patients with advanced or metastatic nonsquamous non-small cell lung cancer (NSCLC) with epidermal growth factor receptor (EGFR) mutations (exon 19 deletion [19del] or exon 21 L858R) whose disease progressed on or after tyrosine kinase inhibitor (TKI) and platinum-based chemotherapy.

- In September 2024, AstraZeneca’s TAGRISSO (osimertinib) used for treatment of adult patients with unresectable, Stage III epidermal growth factor receptor-mutated (EGFRm) non-small cell lung cancer (NSCLC) was approved in the U.S. As detected by a FDA-approved test, TAGRISSO is indicated for patients with exon 19 deletions or exon 21 (L858R) mutations and whose disease has not progressed during or following concurrent or sequential platinum-based chemoradiation therapy (CRT).

Non-small Cell Lung Cancer Therapeutics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the Non-small Cell Lung Cancer Therapeutics market.

By Type

- Squamous Cell Carcinoma

- Large Cell Carcinoma

- Adenocarcinoma

- Others

By Treatment

- Chemotherapy

- Targeted Therapy

- Immunotherapy

By Distribution Channel

- Hospital Pharmacy

- Drug Store and Retail Pharmacy

- Online Pharmacy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Online pharmacies are gaining traction as patients, particularly those on oral targeted therapies, seek convenience, cost transparency, and delivery efficiency. Telemedicine platforms and patient-assistance programs are facilitating home delivery of prescription drugs, including tyrosine kinase inhibitors. The pandemic accelerated this trend, and regulations are evolving to support the safe delivery of oncology medications through licensed online platforms. As digital health ecosystems mature, online pharmacies are expected to capture an increasing share of NSCLC drug dispensing, particularly for maintenance therapy and supportive care.

Online pharmacies are gaining traction as patients, particularly those on oral targeted therapies, seek convenience, cost transparency, and delivery efficiency. Telemedicine platforms and patient-assistance programs are facilitating home delivery of prescription drugs, including tyrosine kinase inhibitors. The pandemic accelerated this trend, and regulations are evolving to support the safe delivery of oncology medications through licensed online platforms. As digital health ecosystems mature, online pharmacies are expected to capture an increasing share of NSCLC drug dispensing, particularly for maintenance therapy and supportive care.