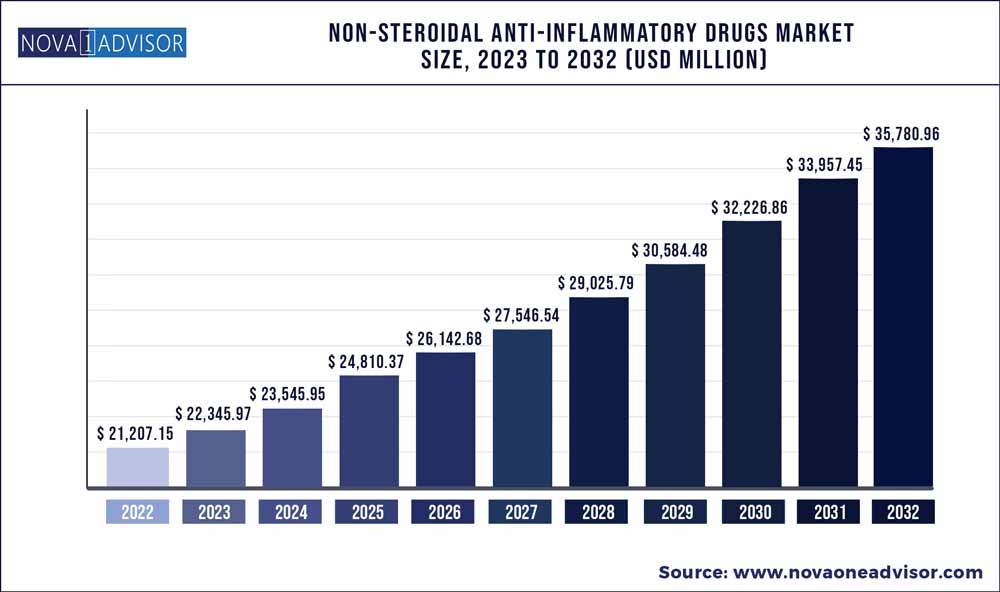

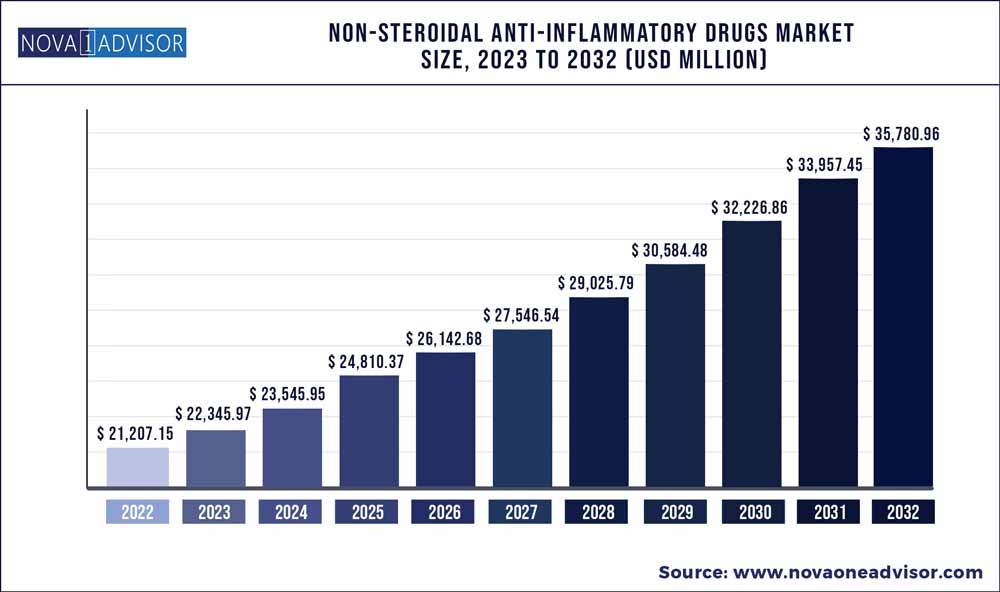

The non-steroidal anti-inflammatory drugs market size was estimated at USD 21,207.15 million in 2022 and is expected to surpass around USD 35,780.96 million by 2032 and poised to grow at a compound annual growth rate (CAGR) of 5.37% during the forecast period 2023 to 2032.

Key Takeaways:

- North America dominated the overall market in terms of revenue in 2022

- Asia-Pacific is expected to be the fastest-growing region during the forecast period.

- The arthritis segment held the largest market share of 40.02% in 2022 and is expected to maintain its dominance over the forecast period.

- The migraine segment is expected to witness lucrative growth opportunities during the forecast period

- The oral segment held the largest market share in 2022 and is expected to maintain its dominance over the forecast period

- The topical segment is expected to experience the fastest growth rate over the forecast period.

- The retail pharmacy segment held the largest market share of 48.39% in 2022.

Non-steroidal Anti-inflammatory Drugs Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 22,345.97 million |

| Market Size by 2032 |

USD 35,780.96 million |

| Growth Rate From 2023 to 2032 |

CAGR of 5.37% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Disease indication, Route of administration, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Pfizer Inc.; Bayer AG; GSK plc; Dr. Reddy’s Laboratories Ltd; Viatris Inc; Teva Pharmaceutical Industries Ltd.; Johnson And Johnson Services; Inc.; Merck & Co., Inc. |

Nonsteroidal anti-inflammatory drugs are drugs that are primarily used to relieve inflammation and pain, as well as to lower elevated body temperature. The high prescription rate of non-steroidal anti-inflammatory drugs (NSAIDs) for relief of symptoms of painful periods, headaches, fever, arthritis, sprains, strains, and other types of chronic pain is expected to drive the market during the forecast period.

The non-steroidal anti-inflammatory drugs market is expected to witness growth opportunities owing to factors such as the rising prevalence of targeted diseases and chronic pain across the globe, coupled with the high prevalence of these diseases in the geriatric population. Moreover, increasing demand for OTC NSAIDs and the rising adoption of NSAIDs for headaches, migraines, and menstrual pain are also expected to boost the growth during the forecast period.

Moreover, the increasing prevalence of arthritis and other pain-related disorders is also expected to support the growth. For instance, the prevalence of osteoarthritis is higher in the UK, France, and Germany compared to other countries in the Europe region. The prevalence of arthritis is seen to be lower in people who are often engaged in physical activities, and its prevalence rises with age. Thus, the rising prevalence of arthritis is also expected to cater to the growth during the forecast period.

Key market players are adopting strategic initiatives such as geographical expansion and the introduction of combination non-steroidal anti-inflammatory drugs to increase their market share across the globe. For instance, Alkem Labs and Dr. Reddy’s Laboratories Ltd have launched their non-steroidal anti-inflammatory drugs in the U.S. Moreover, increasing approval of OTC drugs for pain management and other inflammatory diseases is expected to drive growth during the forecast period. Thus, owing to the various strategies adopted by key players, the market is likely to boost its growth.

Governments in various regions are undertaking favorable initiatives to reduce the burden of migraine, arthritis, and other diseases in their countries. For instance, the National Institutes of Health has initiated HEAL to accelerate research activities to improve the management of pain and inflammatory diseases. Moreover, the Patient-Centered Outcomes Research Institute has undertaken initiatives to introduce non-opioid treatment options for pain. Such initiatives are expected to increase growth during the forecast period.

Disease Indication Insights

The arthritis segment held the largest market share of 40.02% in 2022 and is expected to maintain its dominance over the forecast period. The growth of the segment is owing to factors such as the high prevalence of arthritis and osteoarthritis, the rising geriatric population across the globe, the high prescription of NSAIDs, and a surge in the adoption of topical preparations for subsiding arthritis. According to the Arthritis Society Canada, in 2019, Canada had over 6 million arthritis cases and is expected to be around 9 million by 2040. Moreover, the availability of many approved formulations for the management of arthritis pain is also expected to spur the arthritis segment growth. For instance, Celebrix (Celecoxib Capsule), manufactured by Viatris Inc., is indicated for pain management in rheumatoid arthritis and osteoarthritis.

The migraine segment is expected to witness lucrative growth opportunities during the forecast period owing to the high prevalence of migraines and approved formulations for them. For instance, Advil migraine (Ibuprofen Capsule) manufactured by GSK plc is the only U.S. FDA-approved regime for migraine episodes. Moreover, increasing the adoption of over-the-counter non-steroidal anti-inflammatory drugs is further propelling the segment growth over the forecast period.

Route of Administration Insights

The oral segment held the largest market share in 2022 and is expected to maintain its dominance over the forecast period owing to the availability of a large pool of oral NSAIDs for pain, headache, fever, and migraine and increased sales of OTC NSAIDs. For instance, Johnson & Johnson Consumer Inc. offers its NSAID preparation Motrin (ibuprofen), which is available in dosage forms such as a tablet, capsule, liquid gel, and suspension to treat headaches and migraines. Thus, owing to the higher availability of oral NSAIDs products, the segment is expected to experience robust growth opportunities during the forecast period.

The topical segment is expected to experience the fastest growth rate over the forecast period. The wide availability of topical NSAID preparations and high demand for topical drugs are expected to fuel the growth over the forecast period. For instance, Flector (diclofenac epolamine-Topical system) manufactured by IBSA Pharma Inc., is indicated for pains due to sprains and strains.

Distribution Channel Insights

The retail pharmacy segment held the largest market share of 48.39% in 2022. The high market share of retail pharmacies can be attributed to factors such as the increasing number of NSAIDs prescriptions for pain management and the rising availability of NSAIDs as over-the-counter drugs across the globe. For instance, In August 2021, Dr. Reddy’s Laboratories Ltd re-launched OTC Naproxen Sodium Tablets USP, the store-brand equivalent of Aleve in the United States.

Furthermore, hospital pharmacies held the second largest market share owing to the high adoption rate of non-steroidal anti-inflammatory drugs for pain management in hospitalized patients. However, the online pharmacy segment is expected to grow at the fastest rate during the forecast period, owing to factors, such as increasing adoption of e-commerce and extra discounts on online medicines.

Regional Insights

North America dominated the overall market in terms of revenue in 2022, followed by Europe. Factors such as the presence of a large number of manufacturers and strategic initiatives undertaken by market players are some of the major factors driving the market's growth. Moreover, the increasing prevalence of chronic pain and arthritis is also anticipated to propel the growth forward during the forecast period.

For instance, according to the CDC, it is estimated that the prevalence of arthritis is expected to increase in the upcoming decades. By 2040, it is estimated that over 78.4 million adults will have doctor-diagnosed arthritis. Moreover, the major market players operating in the NSAIDs market have a decent presence across the region, and that is likely to propel market growth forward during the forecast period. For instance, Pfizer Inc., Johnson & Johnson Consumer Inc., and GSK Group of Companies have a decent presence across the United States and Canada.

Asia-Pacific is expected to be the fastest-growing region during the forecast period. The growth of the region is attributed to factors such as the increasing geriatric population, the rising prevalence of chronic pain, migraine, and headaches, along with rising product approvals and launches in the region. For instance, in May 2021, Ono Pharmaceutical Co., Ltd. launched JOYCLU 30mg intra-articular injection, for which Seikagaku received manufacturing and marketing approval in Japan in March 2021.

Some of the prominent players in the Non-steroidal Anti-inflammatory Drugs Market include:

- Pfizer Inc.

- Bayer AG

- GSK plc

- Dr. Reddy’s Laboratories Ltd

- Viatris Inc

- Teva Pharmaceutical Industries Ltd.

- Johnson And Johnson Services, Inc.

- Merck & Co., Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the Non-steroidal Anti-inflammatory Drugs market.

By Disease Indication

- Arthritis

- Migraine

- Ophthalmic Diseases

- Others

By Route of Administration

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)